DoorDash Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

DoorDash Bundle

Curious about DoorDash's strategic positioning? This glimpse into their BCG Matrix reveals how their various services might be categorized as Stars, Cash Cows, Dogs, or Question Marks. Understand which segments are driving growth and which require careful consideration.

Unlock the full potential of this analysis by purchasing the complete DoorDash BCG Matrix report. Gain a comprehensive understanding of their product portfolio's market share and growth rate, enabling you to make informed strategic decisions and optimize resource allocation.

Stars

DoorDash solidified its position as the leader in the U.S. restaurant food delivery market, capturing an impressive 60.7% market share by the close of 2024. This dominance is expected to grow, with projections indicating a 67% share by 2025.

This strong market presence in a sector still experiencing significant growth firmly places DoorDash in the "Star" category of the BCG Matrix. The company consistently demonstrates robust order volume increases and a growing base of monthly active users within its primary restaurant delivery service.

DashPass and Wolt+ are DoorDash's key subscription services, acting as significant growth drivers. By the end of 2024, these programs boasted over 22 million members, a figure projected to reach 26 million by 2025.

These subscription models are instrumental in boosting customer loyalty and transaction frequency. The enhanced benefits, such as the recent Lyft partnership for DashPass, further solidify their value proposition and contribute to sustained user engagement.

DoorDash is making significant strides beyond its core restaurant delivery, pushing into grocery, convenience, and general retail. These newer areas are actually expanding at a quicker pace than its established restaurant segment.

By December 2024, a substantial portion of DoorDash's active users, over 25%, were engaging with these non-restaurant categories. This demonstrates a clear demand and points to a considerable market opportunity for further expansion.

Key strategic alliances, including those with major players like Home Depot and numerous regional grocery chains, are crucial in cementing DoorDash's presence and competitive edge in these developing markets.

Advertising Platform Growth

DoorDash's advertising platform, encompassing services like Wolt Ads, has experienced remarkable expansion. By 2024, its annualized advertising revenue run-rate surpassed $1 billion, a testament to its rapid scaling. This burgeoning segment is anticipated to continue its upward trajectory, with projections suggesting it could reach $2.59 billion by 2027, thereby becoming a crucial contributor to DoorDash's overall revenue and enhancing its profitability.

The strategic investment in advanced AI-powered advertising tools, coupled with the acquisition of the ad tech platform Symbiosys, highlights the company's commitment to unlocking the full potential of this high-growth area. These initiatives are designed to further optimize ad performance and expand the platform's reach.

- Advertising Revenue Run-Rate: Exceeded $1 billion in 2024.

- Projected Growth: Expected to reach $2.59 billion by 2027.

- Strategic Investments: AI tools and Symbiosys acquisition underscore growth focus.

International Market Share Gains via Acquisitions

DoorDash's aggressive international expansion, significantly bolstered by its acquisition of Wolt and the more recent $3.85 billion purchase of Deliveroo in May 2025, is a key driver of its global market share growth. This strategic move has extended its reach into over 40 countries, positioning the company for substantial gains in diverse markets.

The international segment is already demonstrating robust financial health, achieving gross profit positivity. Furthermore, its growth rate surpasses that of its competitors, signaling a strong trajectory for these markets to evolve into significant cash-generating assets for DoorDash if this momentum is maintained.

- International Expansion: DoorDash acquired Wolt and Deliveroo, expanding its presence to over 40 countries.

- Market Share Growth: These acquisitions are directly contributing to increased global market share.

- Profitability: The international portfolio is already gross profit positive.

- Growth Trajectory: International operations are growing faster than industry peers, indicating strong future potential.

DoorDash's advertising platform, including Wolt Ads, is a clear "Star" with its impressive growth. By 2024, its annualized advertising revenue run-rate surpassed $1 billion, and it's projected to reach $2.59 billion by 2027. This segment is rapidly scaling and becoming a significant profit contributor.

The company's strategic investments in AI-powered advertising tools and the acquisition of Symbiosys further underscore its commitment to this high-growth area, optimizing performance and expanding reach.

DoorDash's international expansion, significantly boosted by the Wolt acquisition and the May 2025 Deliveroo purchase, is also a strong indicator of "Star" status. Operating in over 40 countries, these markets are already gross profit positive and growing faster than competitors.

This global reach positions DoorDash for substantial gains, with these diverse markets showing potential to become significant cash-generating assets.

| Category | 2024 Status | Growth Driver | Future Potential |

| Advertising Platform | Revenue run-rate > $1B | AI tools, Symbiosys acquisition | Projected $2.59B by 2027 |

| International Operations | Gross profit positive | Wolt, Deliveroo acquisitions | Faster growth than peers |

What is included in the product

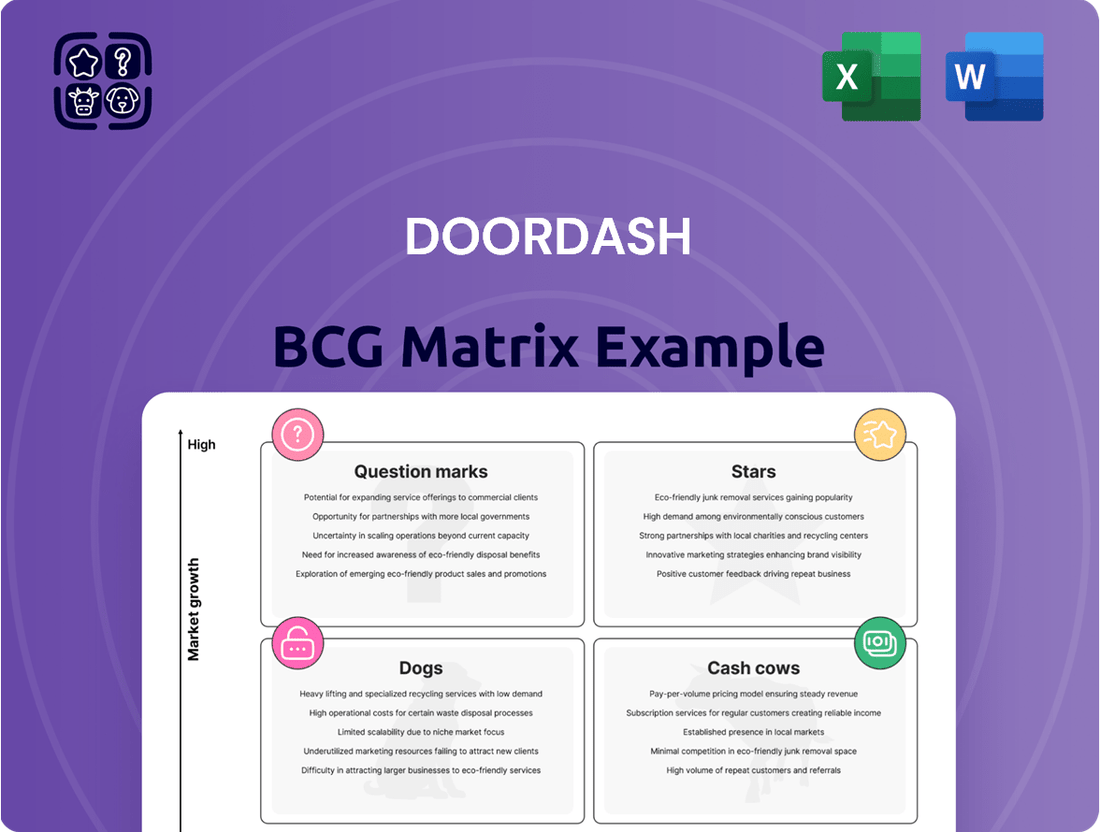

The DoorDash BCG Matrix analyzes its offerings, categorizing them into Stars, Cash Cows, Question Marks, and Dogs.

It offers strategic insights on which services to invest in, maintain, or divest to optimize its portfolio.

The DoorDash BCG Matrix offers a clear, one-page overview of its business units, alleviating the pain of strategic uncertainty.

Cash Cows

DoorDash's core U.S. restaurant delivery operations are its Cash Cows. This segment, while still experiencing growth, is a major generator of consistent cash flow for the company. Its dominance in the U.S. market, supported by a vast network of restaurants and delivery personnel, ensures reliable order volume and revenue.

The substantial and expanding subscriber base for DashPass and Wolt+ acts as a significant cash cow for DoorDash. This existing membership provides a consistent, recurring revenue stream primarily from membership fees. In the first quarter of 2024, DoorDash reported that its subscription services continued to grow, contributing to a more predictable revenue model.

These loyal, frequent users are invaluable as they lower customer acquisition costs and ensure a steady, predictable cash flow. DoorDash can effectively leverage these established relationships, treating them as a reliable income source. The value proposition of these programs encourages continued engagement, solidifying their role as a dependable revenue generator.

DoorDash's standard delivery fees and merchant commissions are its primary cash cows. This established revenue model, built on millions of daily orders, generates consistent, high-volume transactions. The efficiency of this system ensures a steady influx of operational cash, underpinning its market position.

Established Logistics Network Efficiency

DoorDash's established logistics network is a significant cash cow, leveraging its mature and optimized backbone in key markets. This efficiency translates into lower operational costs and higher profit margins on each delivery, a direct result of years of scaling and experience.

This operational strength is a primary driver of DoorDash's strong cash generation, particularly from its high-volume delivery services. For instance, by Q1 2024, DoorDash reported a Gross Order Value (GOV) of $7.1 billion, showcasing the immense scale of its operations.

- Optimized delivery routes and driver utilization minimize fuel and time costs.

- High order volume allows for economies of scale in operational management.

- Years of data analytics refine fulfillment processes, boosting profitability.

Brand Recognition and Customer Retention

DoorDash's robust brand recognition, particularly in its established markets, significantly contributes to its Cash Cow status. This strong brand presence, cultivated through consistent service and market penetration, means less capital is needed for customer acquisition. For instance, in 2023, DoorDash reported a substantial portion of its orders came from repeat customers, a testament to its retention efforts.

Effective customer retention strategies further solidify DoorDash's Cash Cow position. Programs like DashPass, which offers benefits for frequent users, foster loyalty and encourage repeat business. This reduces the churn rate and the associated marketing costs of replacing lost customers. The company's ability to keep users engaged translates directly into predictable revenue streams with lower operational expenditure.

- DoorDash's brand recognition minimizes the need for costly customer acquisition efforts.

- Customer retention strategies, such as DashPass, generate consistent revenue with reduced marketing spend.

- Repeat business from loyal customers forms a stable and profitable ecosystem for DoorDash.

- In 2023, DoorDash's focus on retention contributed to a significant percentage of its total order volume originating from existing users.

DoorDash's core U.S. restaurant delivery operations, along with its subscription services like DashPass and Wolt+, represent significant cash cows. These segments generate consistent, predictable revenue streams due to high order volumes and a loyal customer base. The efficiency of its logistics network and strong brand recognition further bolster these cash-generating capabilities, minimizing acquisition costs and maximizing profitability from established user relationships.

| Segment | Revenue Driver | Key Metric (Q1 2024) | Contribution to Cash Flow |

|---|---|---|---|

| U.S. Restaurant Delivery | Standard delivery fees, merchant commissions | Gross Order Value (GOV) of $7.1 billion | Primary driver of operational cash |

| Subscription Services (DashPass, Wolt+) | Membership fees | Continued subscriber growth | Consistent, recurring revenue |

| Logistics Network | Operational efficiency, economies of scale | Optimized routes, high driver utilization | Lower operational costs, higher profit margins |

| Brand & Customer Retention | Repeat business, reduced marketing spend | High percentage of orders from repeat customers (2023) | Stable and profitable ecosystem |

Delivered as Shown

DoorDash BCG Matrix

The DoorDash BCG Matrix preview you see is the exact, fully formatted document you'll receive after purchase, containing no watermarks or demo content. This comprehensive analysis is ready for immediate use in your strategic planning and presentations. You'll gain access to a professionally designed, market-backed report that requires no further editing or revisions. This is the complete strategic tool you need to understand DoorDash's product portfolio and make informed business decisions.

Dogs

DoorDash's 'Dogs' category would encompass any nascent international markets or specialized ventures that aren't gaining momentum. Imagine a scenario where DoorDash enters a smaller European country, expecting rapid growth, but local competitors with strong brand loyalty and established delivery networks dominate. In such a case, DoorDash might find itself with a very low market share and little prospect of significant expansion.

These struggling niche international ventures represent investments that aren't paying off. For instance, if DoorDash invested heavily in launching its services in a particular South American city known for its complex logistics and a few dominant local players, and after a year, their market penetration remained in the single digits with minimal revenue growth, that specific market would likely be classified as a 'Dog.'

Such segments drain capital and management attention without contributing meaningfully to DoorDash's overall success. As of late 2024, while DoorDash has seen robust growth in core markets like the US and Canada, any new, smaller international expansions that haven't yet achieved critical mass or are facing intense local competition would fall into this category. For example, if a new market launch in a country with a GDP per capita significantly lower than its core markets fails to attract a substantial user base or merchant partners, it could quickly become a 'Dog.'

Certain small-scale or niche retail partnerships under DoorDash's 'new verticals' push may struggle to gain traction. These might include highly specialized product categories or individual merchants with limited customer appeal, leading to low order volumes. For instance, if a partnership with a boutique artisanal cheese shop in a small town only generates an average of 5 orders per week, it's unlikely to justify the operational investment.

When these partnerships consistently show low order volume and disproportionately high operational expenses, they can be categorized as dogs in the DoorDash BCG Matrix. Such ventures fail to capture significant market share or contribute meaningfully to the company's overall growth trajectory. For example, a partnership with a local bookstore that, despite DoorDash's efforts, only sees 1% of its sales through the platform, would fit this description.

DoorDash's legacy internal technologies, such as older dispatch systems or outdated data warehousing, could be categorized as dogs. These systems often require substantial maintenance budgets, diverting funds that could be invested in more innovative areas. For instance, in 2023, DoorDash reported that technology and development expenses increased by 16% year-over-year to $1.5 billion, partly due to ongoing investments in platform infrastructure and modernization.

These less efficient systems can directly impact operational efficiency, leading to slower order fulfillment or increased error rates. Such inefficiencies create a drag on the company's ability to scale and compete effectively. Modernization projects, aimed at replacing these legacy systems, are crucial for streamlining operations and reducing long-term costs.

Highly Competitive, Low-Margin Local Micro-Markets

In densely packed urban centers or niche local areas, DoorDash often encounters fierce rivalry from smaller, agile competitors. This intense competition, coupled with aggressive pricing strategies from these local players, can significantly squeeze DoorDash's profit margins. In 2024, DoorDash reported facing particularly challenging conditions in several such micro-markets, where its market share growth was minimal, leading to a low return on investment for those specific operational areas.

When DoorDash operates in these highly competitive, low-margin micro-markets and struggles to gain substantial market share or achieve meaningful growth, these segments can be categorized as dogs within the BCG matrix. This classification highlights areas that are not contributing significantly to the company's overall profitability or strategic advantage. For instance, reports from late 2023 and early 2024 indicated that in certain densely populated neighborhoods, DoorDash's operational costs in acquiring and retaining customers outpaced the revenue generated, signaling a dog-like performance in those specific pockets.

- Intense Competition: DoorDash faces numerous local competitors in saturated urban areas, driving down prices and margins.

- Low Market Share & Growth: In these micro-markets, DoorDash often has a small percentage of the customer base and minimal expansion.

- Profitability Constraints: The combination of high competition and low market share makes it difficult to generate substantial profits from these specific locations.

- Strategic Re-evaluation: Such underperforming segments may require DoorDash to either invest heavily to gain traction or consider divesting resources.

Unsuccessful Pilot Programs or Experimental Services

DoorDash's "Dogs" in the BCG Matrix would encompass pilot programs or experimental services that haven't proven their worth. Think of initiatives that required significant upfront investment but failed to gain traction or show a clear path to profitability. These are the ventures that consume resources without generating substantial returns or market share.

For instance, if DoorDash launched a niche delivery service for a specific product category, like gourmet pet food, and it failed to attract a critical mass of users or merchants, it would likely fall into the dog category. Such services, especially those diverging from the core food delivery model, often struggle with scalability and require continuous funding without a clear return on investment.

- Unsuccessful experimental services: Ventures that don't demonstrate viability or scalability after initial investment.

- Resource consumption: These initiatives consume development and testing resources without showing potential for high growth.

- Low market share: They typically fail to capture significant market share or generate substantial revenue.

- Strategic re-evaluation: Such programs often require a strategic decision to either divest, pivot, or discontinue to reallocate resources to more promising areas.

DoorDash's "Dogs" represent business units or ventures with low market share and low growth potential. These are often costly to maintain and offer little prospect of future returns. For example, a niche international market where DoorDash has minimal penetration and faces entrenched local competition would fit this description. Similarly, experimental services that fail to gain traction or specific legacy internal technologies requiring significant upkeep without clear benefits also fall into this category.

These segments drain capital and management focus without contributing meaningfully to DoorDash's overall success. As of late 2024, while DoorDash has seen robust growth in core markets, any new, smaller international expansions that haven't achieved critical mass or are facing intense local competition could be classified as dogs. For instance, if a new market launch in a country with lower GDP per capita fails to attract a substantial user base, it could quickly become a dog.

DoorDash's "Dogs" are essentially underperforming assets that consume resources without generating significant returns. These could include pilot programs that didn't prove viable, niche retail partnerships with low order volumes, or even older internal systems that are expensive to maintain. The key characteristic is their inability to capture market share or contribute to overall growth, necessitating a strategic decision on whether to divest, pivot, or discontinue them.

In 2023, DoorDash's technology and development expenses rose 16% year-over-year to $1.5 billion, partly due to platform modernization. However, legacy systems within this spend could be considered dogs if they require substantial maintenance budgets without offering a clear competitive advantage or efficiency gains. Similarly, in densely packed urban centers, intense local competition in 2024 led to minimal market share growth in some micro-markets, resulting in a low return on investment for those specific operational areas.

| BCG Category | DoorDash Example | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|---|

| Dogs | Nascent, low-penetration international markets facing strong local competition. | Low | Low | Consider divestment or significant strategic shift. |

| Dogs | Experimental services or niche product delivery pilots that fail to gain traction. | Low | Low | Discontinue to reallocate resources to more promising ventures. |

| Dogs | Legacy internal technologies with high maintenance costs and low operational benefit. | N/A (Internal) | N/A (Internal) | Prioritize modernization or replacement. |

| Dogs | Micro-markets with intense competition leading to minimal market share growth and low ROI (as seen in some urban areas in 2024). | Low | Low | Re-evaluate investment or exit strategy for specific micro-markets. |

Question Marks

DoorDash's foray into new international territories like Luxembourg, following its 2023 entries into Austria and Iceland, places these operations squarely in the Question Marks quadrant of the BCG Matrix. These markets offer substantial growth prospects, as evidenced by the burgeoning food delivery sector across Europe, but DoorDash's current market share is negligible.

Significant investment is necessary to establish brand recognition, build robust delivery networks, and onboard local merchants in these nascent markets. For instance, DoorDash invested heavily in marketing and operational setup during its Austrian launch in early 2023, aiming to capture a share of a market already served by established players.

The success of these ventures remains uncertain, hinging on DoorDash's ability to adapt its model to local consumer preferences and competitive landscapes. The high cost of entry and the need for sustained capital expenditure to gain traction make these Question Marks high-risk, high-reward propositions for the company's future growth.

DoorDash is investing heavily in advanced delivery technologies such as drones and autonomous vehicles. These are currently in their nascent stages, representing significant research and development expenditure without immediate market share or revenue generation.

While these technologies hold considerable future potential for logistics innovation, their commercial feasibility and broad market acceptance remain uncertain, placing them in the question mark category of the BCG matrix.

DoorDash's acquisition of SevenRooms for $1.2 billion in May 2025 significantly expands its hospitality technology offerings beyond delivery. This move targets the high-growth adjacent market of restaurant reservations and guest management, areas where DoorDash currently holds a minimal market share.

The integration of SevenRooms' advanced tools presents a strategic opportunity for DoorDash to become a more comprehensive platform for restaurants. However, achieving success in this new vertical will necessitate substantial investment and careful execution to leverage the acquired technology effectively.

Offsite Advertising Capabilities (Symbiosys Acquisition)

DoorDash's acquisition of Symbiosys in 2025 significantly bolsters its offsite advertising capabilities, allowing it to leverage its extensive merchant and consumer data across search, social, and display networks. This move positions DoorDash to tap into the rapidly growing digital advertising market, a key strategy for diversifying revenue streams beyond its core delivery services.

While DoorDash's ad tech expansion is a strategic play for future growth, its current market share within the vast digital advertising ecosystem remains nascent. Established giants like Google and Meta dominate this space, highlighting the competitive landscape DoorDash is entering. For instance, the global digital advertising market was projected to reach over $600 billion in 2024, underscoring the scale of the opportunity and the challenge.

- Expansion into Offsite Channels: DoorDash's 2025 acquisition of Symbiosys enables advertising on platforms like Google Search, Meta social media, and display networks, extending its reach beyond its own app.

- Data Monetization Strategy: This acquisition is a critical step in monetizing DoorDash's rich first-party data and strong merchant relationships, creating new revenue avenues.

- Market Position: Despite the strategic importance, DoorDash's share in the broader digital advertising market is currently minimal compared to entrenched players.

- Future Revenue Diversification: The move represents a significant bet on diversifying DoorDash's revenue streams and capturing a larger share of the digital ad spend directed towards restaurants and local businesses.

Specific, Early-Stage Non-Food Categories

DoorDash is actively expanding beyond its food delivery roots into diverse non-food retail sectors. For instance, their collaboration with Home Depot signifies a push into home improvement, a category with significant growth potential.

While the broader non-food segment is considered a star in DoorDash's portfolio, many of these nascent categories are still in their infancy. They may exhibit low current market share and necessitate substantial investment to achieve scale and widespread consumer adoption.

- Home Improvement: Partnerships like the one with Home Depot are key, aiming to capture a share of the growing demand for convenient access to home goods.

- Pharmacy and Health: Expansion into delivering prescriptions and over-the-counter medications represents another high-potential, albeit early-stage, category.

- Retail Goods: Beyond groceries, DoorDash is integrating with various general merchandise retailers, broadening its appeal and revenue streams.

The ultimate success of these early-stage non-food categories hinges on several factors, including the platform's ability to seamlessly integrate with a wider array of merchants and the evolving preferences of consumers who increasingly expect on-demand delivery for a broader range of products.

DoorDash's ventures into new international markets, such as Luxembourg, and its investments in emerging technologies like drone delivery, represent classic Question Marks. These areas offer high growth potential but currently have low market share for DoorDash, requiring significant investment to gain traction.

The company's recent acquisitions, like SevenRooms for $1.2 billion in May 2025, and Symbiosys, also fall into this category. While these moves aim to diversify revenue and leverage data, their success in established markets like digital advertising, where giants like Google and Meta dominate, is not guaranteed.

Similarly, DoorDash's expansion into non-food retail, including partnerships with companies like Home Depot, is in its early stages. These new verticals, while promising, require substantial capital and strategic execution to build market share against established players.

The success of these Question Marks is uncertain, with high investment needs and the potential for significant returns if DoorDash can effectively capture market share and adapt to local conditions.

| Initiative | Market Potential | Current Market Share | Investment Required | Risk Level |

| International Expansion (e.g., Luxembourg) | High | Low | High | High |

| Drone/Autonomous Delivery Tech | High | Negligible | Very High (R&D) | Very High |

| SevenRooms Acquisition (Hospitality Tech) | High | Low (in this vertical) | High | High |

| Symbiosys Acquisition (Digital Advertising) | High | Low | High | High |

| Non-Food Retail Expansion (e.g., Home Depot) | High | Low (in specific categories) | Medium to High | Medium to High |

BCG Matrix Data Sources

DoorDash's BCG Matrix is informed by a blend of internal financial data, market share reports, and industry growth projections to accurately assess each business segment's performance.