Dominion Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dominion Energy Bundle

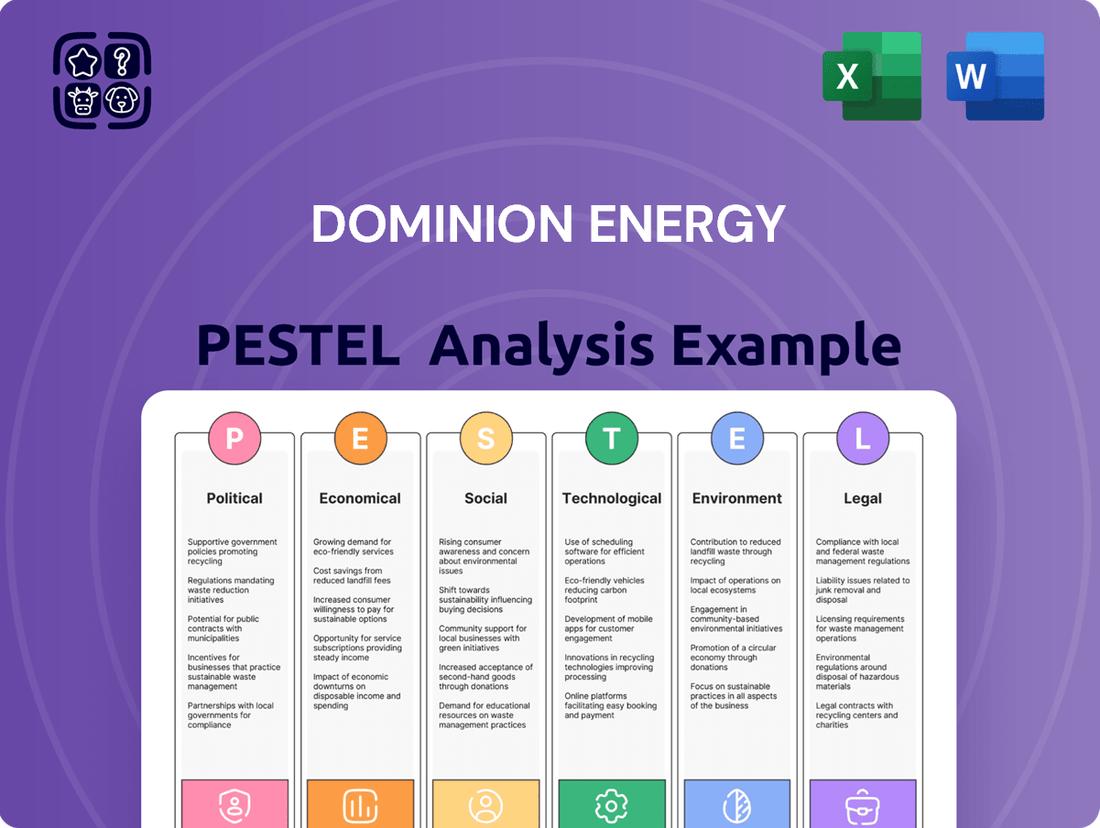

Dominion Energy operates within a dynamic landscape shaped by evolving political mandates, economic fluctuations, and technological advancements. Our PESTLE analysis delves into these critical external factors, revealing how they present both challenges and opportunities for the company. Gain a competitive edge by understanding the complete picture. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Dominion Energy navigates a complex web of government regulations and energy policies that shape its business. The Virginia Clean Economy Act (VCEA) is a prime example, setting a firm deadline of 2045 for achieving 100% carbon-free electricity. This mandate directly influences Dominion's strategic investments in renewable energy sources and the retirement of fossil fuel assets.

The company's Integrated Resource Plans (IRPs), submitted to regulatory bodies like the Virginia State Corporation Commission (SCC) and the North Carolina Utilities Commission (NCUC), are crucial documents detailing how Dominion plans to meet future energy needs while complying with these evolving policies. For instance, Dominion's 2023 IRP projected significant investments in offshore wind and solar power to meet the VCEA's carbon reduction goals.

Dominion Energy actively participates in the political arena by employing lobbyists and making political contributions. This engagement is crucial for shaping legislation and regulations that impact its operations and strategic objectives, ensuring its business interests are represented in policy discussions.

The company transparently discloses its political activities, regularly filing detailed lobbying reports with both the U.S. Congress and various state-level agencies. For instance, in 2023, Dominion Energy reported significant lobbying expenditures, reflecting its commitment to influencing public policy and maintaining strong government relations.

These political efforts are designed to foster robust public and government relations, ultimately serving the diverse interests of its stakeholders, including shareholders, customers, and employees, by advocating for policies that support reliable energy delivery and sustainable growth.

Dominion Energy's operations are heavily influenced by state and local regulatory bodies, particularly concerning major infrastructure projects and rate adjustments. For example, the State Corporation Commission (SCC) in Virginia plays a critical role in reviewing and approving Dominion's Integrated Resource Plans (IRPs), which outline future energy needs and investments. While the SCC's acceptance of an IRP signifies a general direction, it doesn't automatically greenlight every proposed expenditure within that plan.

The company frequently encounters scrutiny and potential challenges from these regulatory agencies regarding specific proposals, such as the development of new natural gas power plants. These reviews often focus on the project's potential impact on customer electricity costs and the alignment with state environmental and climate goals. For instance, in 2024, Dominion's proposed investments in new generation capacity are subject to detailed cost-benefit analyses by state regulators.

Energy Transition Policies and Decarbonization Goals

The political environment strongly favors an accelerated shift towards renewable energy and reduced carbon emissions. Dominion Energy's strategic direction aligns with this, heavily investing in offshore wind and solar power, alongside research into small modular nuclear reactors.

Investor sentiment, as reflected in shareholder votes, demonstrates a clear demand for linking executive compensation to tangible carbon reduction achievements. This underscores a broad political and corporate consensus on prioritizing climate action.

- Renewable Energy Investments: Dominion Energy has committed billions to renewable projects, aiming for a significant portion of its generation to come from clean sources by 2030.

- Decarbonization Targets: The company has set ambitious goals to reduce its greenhouse gas emissions, aligning with state and federal climate mandates.

- Shareholder Engagement: In 2023, a majority of shareholders voted in favor of proposals linking executive pay to environmental, social, and governance (ESG) metrics, including carbon reduction.

Infrastructure Development and Grid Modernization

Government backing and clear policy structures are crucial for building and updating energy networks. Dominion Energy is actively investing in its transmission and distribution systems, aiming to boost dependability and incorporate cleaner energy sources. For instance, in 2024, the company announced plans to invest billions in grid modernization, with a significant portion allocated to enhancing resilience against extreme weather events.

These ambitious infrastructure upgrades frequently necessitate approvals from regulatory bodies and require close cooperation with other power companies and grid operators, such as PJM Interconnection. In 2023, Dominion Energy completed several key grid modernization projects, improving service reliability for over 1 million customers and paving the way for greater renewable energy integration.

Key aspects of infrastructure development and grid modernization for Dominion Energy include:

- Government Support: Continued federal and state incentives, like the Investment Tax Credit (ITC) and Production Tax Credit (PTC), are vital for financing renewable energy integration and grid upgrades.

- Regulatory Approvals: Streamlined approval processes for large-scale infrastructure projects can accelerate deployment and reduce costs.

- Grid Modernization Investments: Dominion Energy's 2024 capital expenditure forecast includes approximately $3 billion dedicated to grid modernization and reliability improvements.

- Interconnection and Collaboration: Working with regional transmission organizations like PJM is essential for ensuring grid stability and efficient energy flow across broader networks.

Political factors significantly shape Dominion Energy's operational landscape, particularly through state-level mandates like the Virginia Clean Economy Act, which targets 100% carbon-free electricity by 2045. The company's Integrated Resource Plans are submitted to regulatory bodies, such as the Virginia State Corporation Commission, detailing compliance strategies. Dominion actively engages in lobbying and political contributions to influence policy discussions, with reported lobbying expenditures in 2023 reflecting this commitment.

| Political Factor | Impact on Dominion Energy | Key Data/Examples |

| Regulatory Mandates | Drives investment in renewables and decarbonization. | Virginia Clean Economy Act (2045 carbon-free goal). |

| Integrated Resource Plans (IRPs) | Outlines future energy needs and compliance strategies. | 2023 IRP projected significant offshore wind and solar investments. |

| Political Engagement | Influences legislation and regulatory outcomes. | Reported lobbying expenditures in 2023. |

What is included in the product

This PESTLE analysis of Dominion Energy examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting its operations, providing a comprehensive overview of the external landscape.

It offers insights into key trends and challenges, enabling strategic decision-making for navigating the evolving energy sector.

A clear, actionable PESTLE analysis for Dominion Energy provides a concise overview of external factors, simplifying complex market dynamics for strategic decision-making and reducing the burden of extensive research.

Economic factors

Dominion Energy is seeing a massive jump in power needs, largely due to the explosion of data centers, especially in Northern Virginia. These facilities require a constant, high-volume supply of electricity.

This trend isn't slowing down; projections suggest total demand could double by 2039. For example, Dominion has noted that data center load growth alone accounted for a significant portion of its recent load forecast increases.

Meeting this escalating demand means Dominion must invest heavily in building new power plants and upgrading its electrical grid to handle the increased capacity.

Dominion Energy has outlined an ambitious five-year capital expenditure plan, projecting investments of $50.1 billion from 2025 through 2029. This significant financial commitment underscores the company's strategic focus on expanding its renewable energy capacity and upgrading its existing infrastructure to meet increasing energy needs.

These substantial capital expenditures are crucial for Dominion Energy's growth and operational efficiency, particularly in areas like offshore wind development and grid modernization efforts. The successful execution and sound financing of these large-scale projects are paramount economic factors influencing the company's future performance and its ability to generate returns for investors.

Dominion Energy's financial health, particularly its operating earnings and revenue, serves as a critical economic barometer for the company and its stakeholders. These figures directly reflect the company's ability to generate profits from its core operations.

In the first quarter of 2025, Dominion Energy demonstrated robust financial performance, reporting operating earnings that exceeded analyst expectations. This positive trend was bolstered by favorable weather patterns, increased customer demand for energy services, and beneficial regulatory rate adjustments.

Furthermore, the company has confidently reaffirmed its full-year 2025 operating earnings guidance, signaling a stable and predictable financial outlook. This affirmation suggests management's confidence in maintaining its projected profitability throughout the remainder of the fiscal year.

Customer Bill Impacts and Affordability Concerns

Dominion Energy's significant infrastructure investments, coupled with escalating energy demand driven by sectors like data centers, are poised to translate into higher costs for its customers. Residential electricity bills are projected to see an increase, sparking widespread concerns about affordability for households and businesses alike.

These anticipated cost hikes are under close examination by regulatory bodies, which are actively scrutinizing the justification for these increases and how these costs will be distributed among various customer segments. For instance, in 2024, Dominion Energy proposed rate increases that could impact average residential customer bills by approximately $10-$15 per month, depending on usage, as it seeks to recover billions in infrastructure upgrades.

- Projected Bill Increases: Residential customers in Virginia could see monthly bills rise by an average of $10-$15 in 2024 due to infrastructure investments.

- Data Center Demand: The rapid expansion of data centers is a key driver of increased energy demand, contributing to higher system-wide costs.

- Regulatory Scrutiny: State utility commissions are reviewing proposed rate adjustments to ensure fairness and affordability across all customer classes.

- Affordability Concerns: Rising energy costs are a significant concern for low-income households and small businesses already facing economic pressures.

Fuel Costs and Market Volatility

Fluctuations in fuel costs, particularly for natural gas and coal, directly affect Dominion Energy's operating expenses and, by extension, customer rates. For instance, in 2023, Dominion Energy reported that higher natural gas prices contributed to increased costs for its customers, with the company seeking regulatory approval to recover these expenses over time.

The company has navigated periods of unpredictable fuel pricing, resulting in deferred fuel costs that are being amortized over multiple years, easing the immediate burden on consumers. This strategy aims to smooth out the impact of volatile energy markets on household budgets.

Dominion Energy's involvement in wholesale electricity markets, such as the PJM Interconnection, further exposes it to price volatility. In 2024, PJM experienced significant price swings influenced by factors like weather patterns and natural gas supply, impacting the cost of electricity generation and transmission for utilities operating within its footprint.

- Natural Gas Price Impact: In early 2024, spot natural gas prices saw upward pressure due to colder weather forecasts, directly increasing fuel costs for Dominion Energy's power generation.

- Deferred Fuel Costs: Dominion Energy has utilized regulatory mechanisms to defer a portion of its fuel costs, spreading recovery over several years to mitigate immediate rate shock for customers.

- PJM Market Dynamics: The PJM market, where Dominion Energy operates, is sensitive to supply and demand, with wholesale electricity prices in 2023 and early 2024 reflecting tight natural gas supplies and increased demand.

Dominion Energy's economic outlook is significantly shaped by its substantial capital expenditure plans and the escalating demand for electricity, particularly from data centers. The company has projected $50.1 billion in capital investments between 2025 and 2029, aimed at expanding renewable energy and modernizing its grid. This investment is crucial for meeting projected demand, which could double by 2039, driven by the burgeoning data center sector in regions like Northern Virginia.

The financial performance of Dominion Energy, as evidenced by its first-quarter 2025 operating earnings exceeding expectations, indicates a stable outlook, supported by favorable weather and regulatory adjustments. However, these infrastructure upgrades and increased demand are expected to lead to higher customer bills, with residential customers potentially seeing monthly increases of $10-$15 in 2024, a factor under close regulatory scrutiny.

Fuel cost volatility, especially for natural gas, directly impacts Dominion Energy's operating expenses and customer rates. While the company has used mechanisms to defer fuel costs, spreading recovery over time to ease immediate consumer burdens, market dynamics in 2023 and early 2024, influenced by factors like natural gas supply and weather, have led to price swings in wholesale electricity markets.

| Metric | 2024 Projection/Actual | 2025 Projection | Key Drivers |

|---|---|---|---|

| Capital Expenditures (5-Year) | N/A | $50.1 billion (2025-2029) | Renewable energy expansion, grid modernization, data center demand |

| Residential Bill Impact (Monthly Est.) | ~$10-$15 increase | Ongoing increases expected | Infrastructure investment, operational costs |

| Data Center Demand Growth | Significant contributor to load forecast | Continued strong growth | Digitalization, AI |

| Natural Gas Price Impact | Upward pressure in early 2024 | Subject to market volatility | Weather, supply/demand |

Full Version Awaits

Dominion Energy PESTLE Analysis

The Dominion Energy PESTLE Analysis previewed here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Dominion Energy, providing valuable strategic insights.

What you’re previewing here is the actual file—fully formatted and professionally structured, offering a deep dive into the company's operating landscape.

Sociological factors

Dominion Energy's expansion projects, such as the Coastal Virginia Offshore Wind (CVOW) project, directly shape public perception, especially concerning environmental impacts and the visual presence of infrastructure. The company's commitment to community engagement, including local job creation and environmental stewardship initiatives, is vital for fostering goodwill and securing its social license to operate. In 2024, Dominion continued to invest in community programs, reporting over $40 million in economic development and community support across its service territories.

Dominion Energy's significant capital investments, like the Coastal Virginia Offshore Wind project, are projected to generate thousands of jobs, both directly and indirectly. For instance, the CVOW project alone is expected to create over 900 jobs during construction and 600 permanent jobs once operational, injecting substantial economic activity into the region.

The company is actively engaged in workforce development initiatives, emphasizing safety, diversity, and reskilling. This is particularly crucial as Dominion navigates the energy transition, which involves managing the impact of plant closures and preparing its workforce for new technologies and operational demands.

Dominion Energy actively pursues environmental justice, dedicating itself to ensuring all communities, irrespective of their demographic makeup, have a say in decisions concerning energy infrastructure placement and operation. This commitment aims to mitigate disproportionate impacts on vulnerable populations and guarantee fair access to the advantages of clean energy.

In 2023, Dominion Energy reported investing $350 million in programs designed to benefit low-income customers and communities, reflecting a tangible step towards energy equity. The company's updated Sustainability Report for 2024 highlights ongoing engagement with community stakeholders on projects, aiming to incorporate feedback and address concerns related to environmental justice principles.

Impact of Data Centers on Society and Infrastructure

The burgeoning demand for data centers, especially concentrated in regions like Northern Virginia, is profoundly reshaping societal dynamics and infrastructure. This growth, fueled by our increasingly digital lives, directly impacts energy consumption patterns.

While data centers stimulate economic activity and job creation, their substantial energy appetite strains existing power grids and can lead to increased electricity prices for all consumers. For instance, in 2023, Northern Virginia's data center sector accounted for a significant portion of the region's electricity demand growth, putting pressure on Dominion Energy's infrastructure planning.

- Data Center Growth: Northern Virginia is a prime example, with data center capacity expanding rapidly.

- Energy Demand Strain: This expansion places considerable pressure on the existing energy infrastructure, requiring significant investment in grid upgrades.

- Rising Costs: Increased demand from data centers can contribute to higher electricity costs for residential and commercial customers.

- Economic Impact: The sector brings economic benefits but necessitates careful management of its societal and infrastructural footprint.

Consumer Demand for Clean Energy and Sustainability

Societal expectations are increasingly pushing for cleaner energy solutions and more sustainable business operations. Dominion Energy is responding by expanding its renewable energy capacity, aiming to meet this growing consumer demand and align with broader environmental values.

This shift is evident in market trends, with investments in renewables showing significant growth. For instance, the U.S. renewable energy sector saw substantial investment in 2023, with solar and wind power leading the charge, reflecting a tangible consumer preference for cleaner alternatives.

Furthermore, shareholder priorities are evolving. A significant portion of institutional investors now actively consider Environmental, Social, and Governance (ESG) factors when making investment decisions. This pressure from investors, often linking executive compensation to ESG performance, reinforces the importance of Dominion Energy's commitment to sustainability.

- Growing consumer preference for renewable energy sources.

- Dominion Energy's strategic investments in solar and wind power.

- Increased shareholder focus on ESG performance and sustainability targets.

- Executive compensation increasingly tied to achieving ESG metrics.

Societal expectations are increasingly pushing for cleaner energy solutions and more sustainable business operations, influencing Dominion Energy's strategic direction. The company's commitment to community engagement and environmental justice is crucial for maintaining its social license to operate, with over $40 million invested in community support in 2024. This focus on equitable energy access and community benefit is a key element in navigating public perception and regulatory landscapes.

Technological factors

Technological progress in renewable energy, especially solar and offshore wind, is a major force shaping Dominion Energy's strategy. The company is actively investing in substantial solar energy projects and the Coastal Virginia Offshore Wind (CVOW) initiative, which is the largest offshore wind project currently in development across the United States.

These technological leaps allow for more efficient and widespread integration of clean energy sources into the existing power grid. For instance, by the end of 2024, Dominion Energy projected to have approximately 4,000 megawatts (MW) of solar and wind generation capacity in service, demonstrating a tangible commitment to these advancements.

Advancements in battery storage technology are fundamental to integrating renewable energy sources like solar and wind, which can be unpredictable. These solutions also bolster the stability and reliability of the electricity grid, especially during times of high demand. Dominion Energy is actively investing in this area, with plans to significantly expand its battery storage capacity as part of its strategic resource planning, aiming to better manage peak loads and facilitate the shift towards cleaner energy.

Dominion Energy is actively planning to incorporate Small Modular Nuclear Reactors (SMRs) into its energy mix, with initial deployments eyed for the mid-2030s.

These SMRs are a significant technological advancement, offering a path to carbon-free, consistent baseload electricity generation, which directly supports Dominion's broader clean energy objectives.

The U.S. Department of Energy has been a strong proponent of SMR development, with significant investments in research and demonstration projects, aiming to reduce costs and accelerate deployment, potentially making them a viable option for utilities like Dominion.

Grid Modernization and Smart Grid Technologies

Dominion Energy is making significant investments in modernizing its grid infrastructure to handle growing energy demands and incorporate a wider range of energy sources. These upgrades are crucial for enhancing reliability and efficiency across its service territories.

The company is undertaking substantial capital expenditures, with plans to invest approximately $37 billion in its energy infrastructure between 2024 and 2028. This investment includes expanding and upgrading transmission lines and distribution networks. A key focus is on resilience, with strategic undergrounding projects and storm hardening initiatives to better withstand extreme weather events.

- Grid Modernization Investments: Dominion Energy's capital plan through 2028 includes significant spending on grid upgrades.

- Transmission and Distribution Enhancement: The company is focused on expanding and improving both its high-voltage transmission and local distribution networks.

- Resilience Measures: Undergrounding power lines and storm hardening are key strategies to enhance reliability during severe weather.

- Integration of Diverse Sources: Modernized grids are essential for seamlessly integrating renewable energy sources like solar and wind power.

Role of Data Center Technology in Energy Consumption

The relentless expansion of data centers, fueled by advancements in artificial intelligence, machine learning, and cloud services, is significantly escalating global electricity demand. This trend directly affects utilities like Dominion Energy, which serves Northern Virginia, a region recognized as the largest data center market worldwide.

Dominion Energy is navigating this technological surge by investing heavily in infrastructure to meet the burgeoning energy needs of these facilities. For instance, the company has outlined plans for substantial capital expenditures, with a notable portion allocated to grid modernization and capacity upgrades to support this growth. By 2025, projections indicate continued rapid expansion in data center power consumption within Dominion's service territory, highlighting the critical role of technological evolution in shaping energy demand patterns.

- Data Center Growth: Global data center energy consumption is projected to increase substantially by 2025, driven by AI and cloud adoption.

- Dominion's Market: Northern Virginia, a key market for Dominion Energy, hosts the world's largest concentration of data centers.

- Infrastructure Investment: Dominion Energy is making significant capital investments to expand power generation and transmission capacity to serve these growing demands.

- Capacity Needs: The increasing power requirements of data centers necessitate ongoing grid enhancements and potentially new energy sources.

Technological advancements are driving Dominion Energy's strategic shift towards renewables and grid modernization. The company's commitment to offshore wind, exemplified by the Coastal Virginia Offshore Wind project, and significant solar energy investments, with nearly 4,000 MW of solar and wind capacity projected by the end of 2024, underscore this focus. Furthermore, the integration of advanced battery storage solutions is crucial for managing the intermittency of these sources and enhancing grid stability.

Dominion Energy is also exploring next-generation nuclear power, with plans to integrate Small Modular Nuclear Reactors (SMRs) by the mid-2030s, aiming for carbon-free baseload power. This technological foresight is supported by substantial grid modernization efforts, including approximately $37 billion in capital expenditures planned between 2024 and 2028 to upgrade transmission and distribution networks for increased resilience and efficiency.

The surge in data center demand, particularly in Dominion's Northern Virginia service territory, presents both a challenge and an opportunity. The company is investing in infrastructure upgrades to meet this escalating energy need, recognizing that technological evolution in computing directly impacts energy consumption patterns and requires proactive capacity planning.

| Technology Focus | Key Initiatives/Investments | Projected Impact/Data |

|---|---|---|

| Renewable Energy | Offshore Wind (CVOW), Solar Projects | ~4,000 MW solar/wind capacity by end of 2024 |

| Energy Storage | Battery Storage Expansion | Enhancing grid stability and renewable integration |

| Nuclear Energy | Small Modular Reactors (SMRs) | Targeting mid-2030s deployment for baseload power |

| Grid Modernization | Transmission & Distribution Upgrades | ~$37 billion investment (2024-2028) for resilience and efficiency |

| Data Center Demand | Infrastructure Capacity Expansion | Meeting escalating energy needs in Northern Virginia |

Legal factors

The Virginia Clean Economy Act (VCEA) is a critical legal mandate shaping Dominion Energy's strategy in the state, requiring a full shift to carbon-free electricity by 2045. This law dictates the pathway for the company's Integrated Resource Plans, with regulators actively assessing their alignment with long-term decarbonization goals, including the phasing out of fossil fuels.

Dominion Energy's compliance with the VCEA involves significant investments in renewable energy sources and grid modernization. For instance, the company's 2023 Integrated Resource Plan projected substantial capital expenditures towards achieving these clean energy targets, with a focus on offshore wind and solar development to meet the 2045 deadline.

The State Corporation Commission (SCC) in Virginia holds significant legal sway over Dominion Energy, acting as a key regulator. It scrutinizes and approves the company's rate structures, long-term resource plans, and major project proposals. For instance, the SCC's review of Dominion's Integrated Resource Plans (IRPs) directly influences how the company invests in new generation and infrastructure, impacting its capital expenditure and future earnings potential.

Furthermore, the SCC sets the operational parameters for Dominion's energy efficiency programs and determines the credit rates for net metering customers. These decisions are crucial, as they directly affect Dominion's revenue streams and its capacity to recover investments made in grid modernization and renewable energy projects. The SCC's rulings can either facilitate or impede Dominion's strategic shift towards cleaner energy sources.

Dominion Energy operates under a complex web of federal and state environmental laws, particularly concerning air quality and emissions. These regulations directly shape the company's operational strategies and investment decisions, especially as they push towards decarbonization.

The company's commitment to reducing carbon emissions, as highlighted in its sustainability reports, is a direct response to these legal mandates. For instance, by 2023, Dominion had retired or committed to retiring all its coal-fired generation units, a move driven by stringent environmental standards and the increasing cost of compliance.

While Dominion pursues an 'all-of-the-above' energy approach, the legal landscape remains a critical factor. Potential shifts or rollbacks in environmental regulations, particularly those related to emissions standards, could influence the pace and cost of future transitions, impacting the company's long-term emissions trajectory and investment in cleaner technologies.

Interconnection Standards and Grid Reliability Rules

Legal and regulatory frameworks are crucial for integrating new energy sources, especially smaller, distributed ones, into the existing power grid. The State Corporation Commission (SCC) in Virginia, for instance, is actively reviewing interconnection standards for these resources within Dominion Energy's operational area. These reviews can significantly influence project economics and the practicality of new developments.

Specifically, the SCC's examination includes requirements like the implementation of 'direct transfer trip' technology. This technology, designed to enhance grid stability by quickly disconnecting distributed resources during disturbances, can add substantial costs to interconnection projects. For example, in 2024, the cost of such protective relaying and communication systems for utility-scale solar projects has been observed to range from $10,000 to $50,000 per interconnection, depending on complexity and location.

- Interconnection Standards: Regulatory bodies like the SCC set the rules for connecting new energy generation to the grid.

- Distributed Energy Resources (DERs): These are smaller, often renewable, energy sources like rooftop solar or battery storage that connect to the distribution grid.

- Direct Transfer Trip: A specific technical requirement for rapid disconnection of DERs to maintain grid reliability, impacting project costs.

- Cost Implications: The necessity of technologies like direct transfer trip can add tens of thousands of dollars to the cost of interconnecting new energy projects in 2024.

Consumer Protection and Rate Case Proceedings

Dominion Energy navigates a complex legal landscape, particularly concerning rate case proceedings and consumer protection mandates. These legal frameworks are crucial as the company seeks to recover investments, often substantial, made to support burgeoning sectors like data centers. For instance, in 2024, regulatory bodies such as the Virginia State Corporation Commission (SCC) and the Attorney General's office scrutinize proposed rate adjustments to ensure they are just and reasonable, preventing undue burdens on customers not directly benefiting from these new infrastructure projects.

The core of these proceedings involves balancing the utility's need for a fair return on investment with the imperative to protect consumers from excessive charges. Dominion Energy's filings for rate increases are therefore subject to rigorous review, often involving public hearings and detailed analysis of operational costs and capital expenditures. This ensures that any approved rate hikes are directly tied to necessary investments and do not unfairly pass costs onto the general customer base.

- Ongoing Scrutiny: Rate case proceedings are a continuous legal process for Dominion Energy, impacting its revenue and investment strategies.

- Consumer Advocacy: The Attorney General's office actively represents consumer interests, challenging rate proposals deemed unreasonable.

- Regulatory Oversight: The SCC plays a pivotal role in approving or denying rate increases, ensuring adherence to consumer protection laws.

- Investment Justification: Dominion must legally justify rate increases by demonstrating the necessity of investments, such as those for data center infrastructure.

Dominion Energy's legal obligations, particularly under the Virginia Clean Economy Act (VCEA), mandate a transition to carbon-free electricity by 2045, heavily influencing its investment in renewables like offshore wind and solar. The State Corporation Commission (SCC) acts as a key regulator, approving rate structures and resource plans, which directly impacts the company's capital expenditures and future earnings. Furthermore, evolving interconnection standards for distributed energy resources, such as the requirement for direct transfer trip technology, can add significant costs, estimated between $10,000 to $50,000 per interconnection in 2024.

| Legal Factor | Impact on Dominion Energy | Key Legislation/Regulation | Data/Example (2024/2025) |

|---|---|---|---|

| Carbon-Free Mandate | Drives significant investment in renewables, impacting capital allocation. | Virginia Clean Economy Act (VCEA) | 2045 target for 100% carbon-free electricity. |

| Regulatory Approval | SCC approval is critical for rate structures and resource plans, affecting revenue. | State Corporation Commission (SCC) oversight | Scrutiny of Integrated Resource Plans (IRPs). |

| Interconnection Standards | Adds costs and complexity for integrating distributed energy resources. | SCC review of interconnection rules | Direct transfer trip technology costs: $10k-$50k per interconnection (2024 est.). |

Environmental factors

Dominion Energy has committed to ambitious environmental goals, targeting a 70% reduction in carbon emissions by 2030 from its 2005 baseline. This aggressive stance is further underscored by its objective to achieve net-zero carbon emissions.

These forward-looking targets directly influence Dominion Energy's strategic investment decisions, particularly in expanding its renewable energy portfolio. The company is actively channeling capital into solar and wind power projects to meet these emission reduction mandates and shape its future energy supply.

Dominion Energy is making significant strides in expanding its renewable energy capacity. The company plans to deploy thousands of megawatts of new offshore wind and solar power projects, coupled with battery storage solutions, to meet escalating energy needs with cleaner alternatives.

This transition is crucial for Dominion Energy's environmental strategy, aiming to significantly reduce its carbon footprint. For instance, Dominion Energy's Coastal Virginia Offshore Wind project is a key component, projected to be the largest offshore wind farm in the United States upon completion, with an initial phase of 2.6 gigawatts and a full build-out of 5.2 gigawatts.

Dominion Energy recognizes climate change as a significant factor impacting its operations and has proactively developed strategies to manage these risks. This includes investing in infrastructure upgrades to bolster grid resilience against increasingly severe weather events, such as hurricanes and heatwaves. For instance, Dominion Energy has committed to significant capital expenditures, with projections indicating billions of dollars allocated towards grid modernization and hardening efforts through the mid-2020s.

Furthermore, the company is actively working to reduce its own environmental footprint. Dominion Energy has set ambitious goals for greenhouse gas emission reductions, aiming to achieve net-zero emissions by 2050. This commitment involves transitioning its energy generation portfolio towards cleaner sources, including a substantial expansion of renewable energy projects, which represented a significant portion of their new generation capacity additions in 2024.

Land Use and Siting for Renewable Projects

The expansion of renewable energy projects, particularly solar and wind farms, necessitates substantial land and offshore area acquisition. This extensive footprint creates hurdles in securing land use approvals and managing potential environmental consequences. Dominion Energy has specifically highlighted challenges in obtaining these approvals for new solar installations, which are crucial for meeting clean energy mandates.

These siting challenges are becoming more pronounced as states and the federal government push for ambitious renewable energy targets. For instance, many regions aim for 100% clean electricity by 2035 or 2050, requiring a rapid build-out of new infrastructure. Dominion Energy's experience reflects a broader industry trend where the physical space required for these facilities is a significant bottleneck.

- Land Use Approvals: Obtaining permits for large-scale solar and wind farms involves navigating complex local zoning laws, environmental reviews, and community engagement processes.

- Environmental Impact: Siting decisions must consider potential impacts on wildlife habitats, water resources, and visual landscapes, often leading to lengthy environmental impact assessments.

- Dominion Energy's Challenges: The company has publicly stated that securing land for its planned solar projects, driven by state-level clean energy goals, has been a more difficult process than initially anticipated.

Water Consumption and Resource Management

Dominion Energy, as a significant player in the energy sector, relies on water for crucial operations like power generation and cooling systems. Recognizing this, the company actively tracks and works to lessen its water consumption impact. For instance, in 2023, Dominion reported reducing its water withdrawal intensity by 17% compared to a 2017 baseline, demonstrating a tangible effort towards better resource management.

The company's commitment extends to implementing strategic initiatives aimed at improving water-use efficiency across its facilities. These efforts are designed to not only conserve water but also to shrink its broader environmental footprint. This focus is particularly important given increasing concerns about water scarcity in various regions where Dominion operates.

- Water Withdrawal Intensity: Dominion Energy aims for continuous improvement in reducing water withdrawal per unit of energy produced.

- Cooling Technologies: Investments in advanced cooling technologies, such as dry cooling or closed-loop systems, are key to minimizing water use.

- Environmental Reporting: The company transparently reports its water management practices and performance metrics in its annual sustainability reports.

- Regulatory Compliance: Adherence to stringent water quality and discharge regulations is a fundamental aspect of Dominion's operational strategy.

Dominion Energy's environmental strategy is heavily influenced by climate change and the increasing demand for clean energy. The company is actively investing billions in renewable energy projects, aiming for significant carbon emission reductions. For example, its Coastal Virginia Offshore Wind project is set to be a major contributor to this transition.

Securing land and navigating environmental impact assessments for these large-scale renewable projects present considerable challenges. Dominion Energy has noted difficulties in obtaining land use approvals for solar installations, reflecting a broader industry trend towards complex permitting processes driven by ambitious clean energy mandates.

Water management is also a key environmental consideration. Dominion Energy is focused on reducing its water withdrawal intensity, having achieved a 17% reduction by 2023 compared to a 2017 baseline, through improved efficiency and advanced cooling technologies.

| Environmental Factor | Dominion Energy's Action/Goal | Key Data/Metric |

| Carbon Emissions Reduction | Targeting 70% reduction from 2005 baseline by 2030; Net-zero by 2050 | 70% reduction by 2030 |

| Renewable Energy Expansion | Investing in offshore wind and solar projects | Thousands of megawatts of new capacity planned |

| Land Use for Renewables | Navigating complex approval processes | Challenges in securing land for solar projects |

| Water Management | Reducing water withdrawal intensity | 17% reduction in water withdrawal intensity by 2023 (vs. 2017) |

PESTLE Analysis Data Sources

Our Dominion Energy PESTLE Analysis is informed by a comprehensive review of official government publications, reputable financial news outlets, and leading energy industry reports. This approach ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in credible and current information.