Dominion Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dominion Energy Bundle

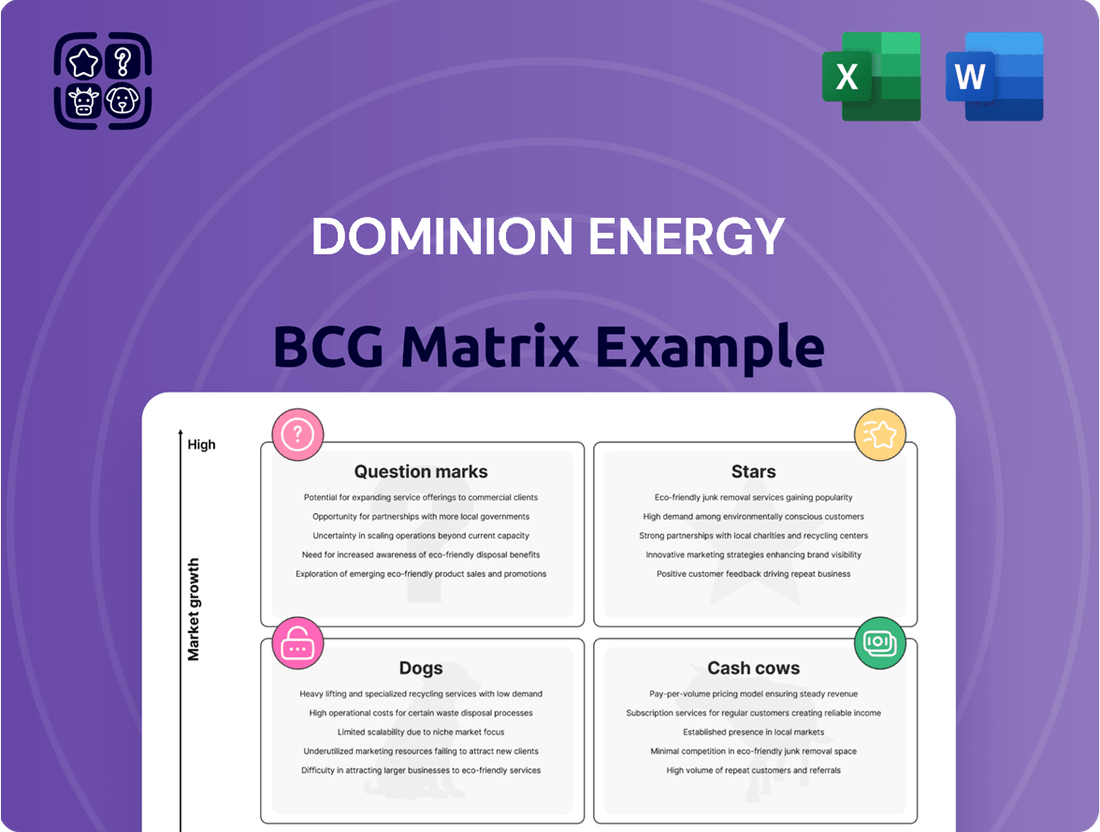

Curious about Dominion Energy's strategic positioning? Our preview offers a glimpse into how their diverse portfolio might be segmented across the BCG Matrix. Understand which segments are driving growth and which might require a closer look.

Unlock the full potential of this analysis by purchasing the complete Dominion Energy BCG Matrix report. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with actionable insights to guide your investment and strategic decisions.

Don't miss out on the detailed quadrant placements and data-backed recommendations that only the full report can provide. Invest in clarity and make informed choices about Dominion Energy's future market performance.

Stars

The Coastal Virginia Offshore Wind (CVOW) project, a monumental undertaking by Dominion Energy, features 176 turbines and a 2.6 gigawatt capacity, positioning it as the largest offshore wind project currently under construction in the United States. This ambitious venture is slated for completion by late 2026, aligning with Dominion Energy's aggressive clean energy transition objectives.

Expected to energize as many as 660,000 homes, the CVOW project is not only a significant step towards decarbonization but also a substantial economic benefit. Over its initial decade of operation, it's projected to deliver approximately $3 billion in fuel savings for its customers, underscoring its role as a strategic growth initiative for Dominion Energy.

Dominion Energy is making a substantial commitment to solar energy, aiming to add roughly 12 gigawatts of new solar capacity by 2039. This represents a significant 150% boost compared to their existing solar infrastructure. This ambitious expansion is central to their strategy for achieving carbon-free electricity generation and meeting the growing market demand for renewable power sources.

Dominion Energy's battery storage development is a significant growth area, reflecting a strategic push towards grid modernization and renewable energy integration. The company is committed to deploying 4.5 gigawatts (GW) of new battery storage by 2039, a substantial investment aimed at bolstering energy reliability and smoothing out the variability of renewable sources like solar and wind. This initiative is central to their strategy for managing a cleaner energy future.

These investments include pilot programs exploring cutting-edge battery technologies, underscoring a forward-looking approach to energy storage solutions. By actively testing and deploying advanced systems, Dominion Energy aims to optimize grid performance and ensure a stable power supply as it incorporates more intermittent renewable generation. This focus on innovation is key to their long-term operational efficiency and environmental goals.

Grid Modernization and Transmission Upgrades

Dominion Energy is making significant, historic investments in modernizing its transmission infrastructure. In the first half of 2024 alone, the company completed 123 new transmission projects.

These crucial upgrades encompass new power lines, substations, and advanced grid-enhancing technologies. This proactive approach is designed to bolster grid reliability and meet the growing energy demands from sectors like data centers, while also facilitating the integration of renewable energy sources.

- Grid Modernization Investments: Dominion Energy's commitment to upgrading its transmission grid is substantial, with a focus on future-proofing its infrastructure.

- Project Completion Rate: The company successfully delivered 123 new transmission projects in the initial six months of 2024, demonstrating strong execution.

- Key Upgrade Components: Investments include new transmission lines, substation enhancements, and the deployment of grid-enhancing technologies for improved efficiency.

- Strategic Objectives: These upgrades are vital for enhancing reliability, accommodating increased demand, and integrating clean energy sources into the grid.

Small Modular Reactors (SMRs)

Dominion Energy is strategically positioning itself for the future of nuclear power by planning to deploy Small Modular Reactors (SMRs). These advanced reactors are slated for operation starting in the mid-2030s, with an initial projected capacity of 1,340 megawatts. This move signifies a significant investment in a reliable, carbon-free energy source.

SMRs are designed to offer continuous, 24/7 carbon-free electricity, which is crucial for grid stability. They serve as a vital complement to renewable energy sources like solar and wind, which are inherently intermittent. By providing a constant power output, SMRs help address concerns about grid reliability and energy security.

- Dominion Energy's SMR plans target mid-2030s deployment.

- Projected initial capacity for SMRs is 1,340 MW.

- SMRs provide consistent, 24/7 carbon-free power.

- They enhance grid reliability by complementing intermittent renewables.

Dominion Energy's Coastal Virginia Offshore Wind (CVOW) project, a massive 2.6 GW offshore wind farm, is a prime example of a Star in the BCG matrix. This project, with 176 turbines and an expected completion by late 2026, represents a significant investment in a high-growth, high-market-share area for the company. The CVOW project is projected to deliver substantial fuel savings, estimated at approximately $3 billion over its first decade of operation, highlighting its potential for strong returns and market leadership in the burgeoning offshore wind sector.

| Project/Initiative | Capacity | Status/Timeline | Strategic Significance | Projected Impact |

|---|---|---|---|---|

| Coastal Virginia Offshore Wind (CVOW) | 2.6 GW | Under construction, completion by late 2026 | Largest US offshore wind project, high growth market | Energize 660,000 homes, ~$3B fuel savings in first decade |

| Solar Expansion | 12 GW (by 2039) | Planned expansion | Significant boost to renewable capacity | 150% increase over existing solar infrastructure |

| Battery Storage | 4.5 GW (by 2039) | Planned deployment | Grid modernization, renewable integration | Enhance energy reliability and smooth renewable variability |

What is included in the product

The Dominion Energy BCG Matrix provides a tailored analysis of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It highlights which units to invest in, hold, or divest based on market growth and relative market share.

The Dominion Energy BCG Matrix provides a clear, actionable overview of business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Dominion Energy's regulated electric utility operations in Virginia represent a classic Cash Cow. This segment boasts a substantial customer base, ensuring consistent and predictable revenue generation.

The mature Virginia market, coupled with established infrastructure and a supportive regulatory environment that allows for cost recovery and a reasonable return on investment, solidifies its position as a reliable cash generator. For instance, in 2023, Dominion Energy reported that its Virginia electric utility segment generated a significant portion of its overall operating income, highlighting its importance as a stable earnings contributor.

Dominion Energy's existing nuclear fleet, including North Anna, Surry, V.C. Summer, and Millstone, represents a significant cash cow. These plants are established assets with a strong market presence, consistently delivering carbon-free baseload electricity.

With recent license extensions, these facilities are poised to remain substantial cash flow generators. Their operational longevity, coupled with relatively low operating costs, ensures continued profitability. In 2023, Dominion Energy reported that its nuclear generation accounted for a substantial portion of its total electricity output, underscoring its importance to the company's financial health.

Dominion Energy's remaining regulated natural gas transmission and distribution networks, despite recent divestitures, represent a stable cash-generating segment. These operations are crucial for energy delivery in established markets, offering predictable income streams.

In 2023, Dominion Energy reported approximately $1.5 billion in operating income from its Gas Distribution segment, underscoring the consistent revenue these assets provide even after strategic portfolio adjustments. While growth is modest, the essential nature of these services ensures high operational efficiency and reliable cash flow.

Established Solar Fleet

Dominion Energy's established solar fleet is a prime example of a Cash Cow within the BCG Matrix. As the second-largest utility in the U.S. for operational solar capacity, this mature asset generates consistent and predictable cash flow. These existing projects are secured by long-term power purchase agreements, ensuring stable revenue streams with relatively low ongoing operational costs. For instance, by the end of 2023, Dominion Energy had approximately 1.5 GW of solar capacity in operation, a significant portion of which is part of this established, cash-generating base.

The reliability of these assets, coupled with their established operational efficiency, makes them a cornerstone of Dominion Energy's financial stability. The lower operational expenses compared to new development contribute directly to their strong cash-generating capabilities. This mature portfolio allows the company to allocate capital towards growth areas while benefiting from the steady income provided by these solar installations.

- Dominion Energy's operational solar capacity ranks second among U.S. utilities.

- Existing solar projects are supported by long-term power purchase agreements.

- These assets provide stable, predictable cash flow with lower ongoing operational expenses.

- Approximately 1.5 GW of solar capacity was in operation by the end of 2023, contributing to this segment.

Energy Efficiency Programs

Dominion Energy's energy efficiency programs are a key component of its strategy, acting as a "cash cow" by generating stable returns through demand management. These initiatives, often driven by regulatory requirements, reduce the need for expensive new power generation, thereby protecting existing cash flows. For example, in 2023, Dominion reported significant investments in energy efficiency, aiming to reduce customer energy consumption by millions of kilowatt-hours annually, which translates into predictable savings and operational stability.

These programs contribute to a reliable revenue stream by mitigating the financial risks associated with building new generation capacity. By encouraging customers to use less energy, Dominion can defer or avoid capital expenditures, freeing up cash for other investments or shareholder returns. The predictable nature of these demand-side management efforts aligns with the characteristics of a cash cow, providing a consistent, albeit indirect, source of financial strength.

- Stable Operations: Energy efficiency programs help manage electricity demand, reducing the need for costly new generation facilities.

- Regulatory Mandates: Many of these programs are driven by state regulations, ensuring a consistent framework for their operation.

- Customer Satisfaction: By helping customers save on energy bills, these programs can foster goodwill and improve customer retention.

- Financial Health: Deferring capital expenditures on new generation indirectly boosts Dominion's overall financial health and cash generation capabilities.

Dominion Energy's regulated electric utility operations in Virginia continue to be a cornerstone Cash Cow, benefiting from a large, stable customer base and a favorable regulatory environment that supports cost recovery and consistent returns. The company's significant investments in grid modernization within Virginia further enhance the reliability and efficiency of this segment, ensuring its continued role as a predictable earnings generator.

The established nuclear fleet, including facilities like North Anna and Surry, remains a vital Cash Cow. These plants are critical for providing baseload, carbon-free electricity and have benefited from recent license extensions, securing their operational longevity and consistent cash flow generation. Their relatively low operating costs compared to newer generation sources contribute significantly to their profitability.

While Dominion has strategically divested some natural gas assets, its remaining regulated natural gas transmission and distribution networks still function as a Cash Cow. These operations serve essential energy delivery needs in established markets, providing predictable and stable income streams. For instance, the company's Gas Distribution segment reported approximately $1.5 billion in operating income in 2023, underscoring its consistent revenue generation even after portfolio adjustments.

Dominion Energy's substantial operational solar fleet, the second largest among U.S. utilities, is a prime example of a Cash Cow. Supported by long-term power purchase agreements, these mature assets generate predictable cash flow with lower ongoing operational expenses. By the end of 2023, Dominion had around 1.5 GW of solar capacity operational, a significant portion of which represents this stable, cash-generating base.

| Segment | BCG Category | Key Characteristics | 2023 Data/Notes |

|---|---|---|---|

| Virginia Regulated Electric Utility | Cash Cow | Large customer base, stable demand, supportive regulation, grid modernization investments | Significant contributor to operating income; focus on reliability and efficiency. |

| Nuclear Fleet (North Anna, Surry, etc.) | Cash Cow | Established assets, carbon-free baseload power, license extensions, low operating costs | Substantial portion of total electricity output; key to financial health. |

| Regulated Natural Gas Networks | Cash Cow | Essential energy delivery, established markets, predictable income | Approx. $1.5 billion operating income from Gas Distribution in 2023. |

| Established Solar Fleet | Cash Cow | Second-largest U.S. utility solar capacity, long-term PPAs, low operational costs | Approx. 1.5 GW operational by end of 2023; stable revenue streams. |

Preview = Final Product

Dominion Energy BCG Matrix

The Dominion Energy BCG Matrix you are currently previewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis is ready for immediate integration into your strategic planning processes, offering a clear and actionable overview of Dominion Energy's business units.

Dogs

Dominion Energy has been actively divesting non-strategic legacy assets as part of a broader portfolio streamlining effort. For instance, in 2023, the company completed the sale of its East Ohio Gas Company to Enstar for $2.4 billion. This move aligns with their strategy to exit lower-growth, capital-intensive segments that may have represented cash traps.

These divested assets, often characterized by mature markets and limited expansion potential, typically fall into the Dogs category of the BCG Matrix. They might require ongoing investment to maintain operations but offer little prospect for significant growth or market share gains, thereby hindering overall company performance and debt reduction initiatives.

Aging or less efficient fossil fuel plants, especially coal-fired ones, are increasingly becoming targets for retirement. This is driven by stringent environmental regulations and the global shift towards decarbonization. For instance, in 2024, many older plants faced increased scrutiny and potential phase-outs due to their higher emissions profiles.

These older assets often hold a low market share in the rapidly evolving energy sector, which prioritizes cleaner and more efficient sources. High operational and maintenance expenditures further exacerbate their financial viability, positioning them as prime candidates for divestiture or complete retirement within Dominion Energy's portfolio.

Certain small-scale, isolated renewable projects might be classified as Dogs within Dominion Energy's portfolio. These could be older, less efficient solar or wind farms with limited expansion possibilities or those in remote locations where operational costs outweigh their energy output. For instance, a small community solar project with a capacity of only a few megawatts, established years ago and facing high interconnection costs, would fit this category if it doesn't align with Dominion's broader clean energy strategy and shows minimal revenue growth.

Inefficient or Outdated Grid Infrastructure in Remote Areas

Inefficient or outdated grid infrastructure in remote areas can be categorized as a Dogs segment within Dominion Energy's BCG Matrix. These are portions of the grid serving very rural or sparsely populated regions that demand significant maintenance investment relative to their low customer density.

While these segments are crucial for providing essential service, they often present limited growth prospects and can become a substantial drain on resources. For instance, in 2024, Dominion Energy continued to invest in grid modernization, but the return on investment for extending or maintaining service in extremely low-density areas remains a challenge.

- High Maintenance Costs: Rural grid segments often require more extensive infrastructure per customer, leading to disproportionately higher maintenance expenditures.

- Low Customer Density: The limited number of customers in these areas restricts revenue generation potential, making it difficult to recoup investment costs.

- Limited Growth Potential: Unlike urban or suburban areas, remote regions typically experience slower population growth, hindering future revenue expansion.

Pilot Programs That Fail to Scale

Pilot programs that fail to demonstrate viability or scalability after initial investment, especially in emerging technologies, can become Dogs in Dominion Energy's BCG Matrix. These ventures, characterized by low market share and high costs, struggle to gain traction. For instance, if a pilot for a novel energy storage solution, which saw an initial investment of $50 million in 2023, fails to achieve projected efficiency gains or cost reductions by mid-2024, it would likely be classified as a Dog.

These underperforming projects represent significant capital expenditure without a clear path to profitability or market adoption. Consider a 2024 initiative exploring advanced geothermal energy extraction, which, despite a $75 million outlay, has not yielded the anticipated energy output or economic feasibility. Such a program, unable to demonstrate competitive advantages, falls into the low-growth, low-share quadrant.

- Low Market Share: Projects failing to gain significant customer adoption or market penetration.

- High Costs: Ventures with operational expenses that outweigh revenue generation.

- Lack of Scalability: Technologies or processes that cannot be efficiently expanded to meet broader demand.

- Candidate for Discontinuation: Projects unlikely to achieve profitability or strategic importance, suggesting divestment or closure.

Dominion Energy's "Dogs" represent business segments or assets that exhibit low market share and low growth potential. These are often legacy assets that require substantial investment to maintain but offer minimal returns, hindering overall portfolio performance.

Examples include aging fossil fuel plants facing regulatory pressure and divestiture, as seen with the sale of East Ohio Gas Company in 2023 for $2.4 billion. Additionally, inefficient or isolated renewable projects, and underperforming pilot programs that fail to scale, also fall into this category.

These segments are characterized by high maintenance costs, low customer density in some cases, and a lack of scalability, making them prime candidates for divestiture or retirement to free up capital for more strategic growth areas.

Question Marks

Dominion Energy is actively investigating emerging long-duration battery storage technologies like iron-air and zinc-hybrid systems. These represent potential game-changers for grid stability, offering storage durations far exceeding current lithium-ion capabilities. For instance, iron-air batteries are being developed to provide 100 hours of continuous discharge, a significant leap from the typical 4-6 hours of current technologies.

These nascent technologies fit the profile of question marks in the BCG Matrix, characterized by low current market share but high growth potential. Dominion's investment in these areas, such as their pilot projects exploring advanced chemistries, signals a strategic bet on future grid needs. Success could unlock substantial future returns by addressing the growing demand for reliable, extended energy storage solutions.

Dominion Energy is investigating hydrogen blending in natural gas to reduce emissions from its power plants. This initiative positions hydrogen blending as a potential "Question Mark" within its BCG Matrix. While the technology offers substantial growth prospects for decarbonization, its current market penetration is minimal, and it faces considerable technical and economic hurdles.

Dominion Energy has strategically expanded its offshore wind portfolio by acquiring new lease areas beyond the Coastal Virginia Offshore Wind (CVOW) project. These new leases represent a significant long-term growth opportunity in a rapidly expanding market. However, they are currently in the very early stages of development, meaning they hold no established market share at present.

Significant future capital investment will be necessary to bring these nascent offshore wind assets to fruition and establish them as market leaders, or 'Stars' within the BCG matrix framework. The company's commitment to these early-stage projects underscores its ambition to secure a dominant position in the burgeoning offshore wind sector.

Strategic Partnerships for Advanced Energy Solutions

Dominion Energy's strategic partnerships, like the one with Amazon to explore small modular reactor (SMR) development, signal ambitious growth in advanced energy solutions. These ventures are currently in nascent stages, characterized by substantial upfront investment and inherent development risks, positioning them as potential stars or question marks within a BCG Matrix framework.

These collaborations are crucial for Dominion as they navigate the high-growth potential of advanced energy technologies, which require significant capital and innovation. The memorandum of understanding with Amazon, for instance, highlights a focus on next-generation nuclear power, a sector with immense long-term promise but currently limited market penetration for Dominion.

- Exploratory Phase: Partnerships in advanced energy solutions like SMRs are in early development, meaning market share is minimal but growth potential is high.

- High Investment, High Risk: These ventures demand considerable capital outlay and face technological and regulatory hurdles, typical of question mark or potential star investments.

- Strategic Alignment: Collaborations with major players like Amazon underscore Dominion's commitment to future energy trends and securing a competitive edge.

- 2024 Outlook: While specific market share data for these nascent SMR projects isn't publicly available for 2024, the industry anticipates significant advancements and potential commercialization in the coming years, with pilot projects expected to gain traction.

Advanced Grid-Enhancing Technologies and Smart Infrastructure Beyond Current Deployment

Dominion Energy is investing in advanced grid-enhancing technologies (GETs) and smart infrastructure, areas poised for significant growth in grid modernization. These initiatives, while in a nascent stage with low current market share, are crucial for Dominion's long-term strategy. The company is focusing on technologies like dynamic line ratings to optimize existing infrastructure capacity.

The market for grid modernization solutions is expanding rapidly, with projections indicating substantial growth in the coming years. For instance, the global smart grid market was valued at approximately $27.5 billion in 2023 and is expected to reach over $70 billion by 2030, growing at a CAGR of around 14.5%. Dominion's current deployment of these advanced technologies represents a small fraction of this burgeoning market, necessitating considerable investment to achieve broader adoption and prove their efficacy.

- High Growth Market: The global smart grid market is experiencing robust expansion, driven by the need for grid modernization and increased efficiency.

- Low Current Market Share: Dominion's advanced GETs and smart infrastructure currently hold a small portion of the overall grid market.

- Substantial Investment Required: Scaling these technologies demands significant capital outlay for development, deployment, and demonstration.

- Focus on Dynamic Line Ratings: A key area of research and deployment involves dynamic line ratings, which enhance the capacity of existing transmission lines.

Dominion Energy's exploration into advanced battery storage, hydrogen blending, and early-stage offshore wind projects all fall under the "Question Mark" category of the BCG Matrix. These initiatives represent high-growth potential but currently possess low market share and require substantial investment to mature.

The company's strategic partnerships, such as those exploring small modular reactors, also fit this classification. While these ventures aim for future dominance in emerging energy sectors, they are in their infancy, demanding significant capital and facing inherent development risks.

Investments in grid-enhancing technologies and smart infrastructure are similarly positioned. The market for these solutions is expanding rapidly, with Dominion's current adoption representing a small fraction, necessitating further investment to capture future growth.

Dominion's 2024 strategic focus on these nascent technologies underscores a commitment to innovation and future market leadership, despite their current status as question marks.

BCG Matrix Data Sources

Our Dominion Energy BCG Matrix leverages comprehensive data from financial reports, industry market share analysis, and regulatory filings to accurately assess business unit performance and market dynamics.