Dollar Tree PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dollar Tree Bundle

Political shifts, economic volatility, and evolving social trends are critical factors impacting Dollar Tree's business model. Understanding these external forces is key to unlocking strategic advantages and mitigating potential risks. Dive deeper into these dynamics and equip yourself with actionable intelligence by downloading our comprehensive PESTLE analysis.

Political factors

Dollar Tree navigates a complex web of government regulations impacting product safety, labor practices, and consumer rights. For instance, the Consumer Product Safety Improvement Act (CPSIA) mandates stringent testing and labeling for children's products, a category Dollar Tree serves. Failure to comply can result in significant fines and product recalls, directly affecting profitability and brand reputation.

Shifts in regulatory landscapes, such as proposed increases in the federal minimum wage or new environmental standards for packaging, present ongoing challenges. These changes can necessitate investments in new compliance procedures, potentially increasing operating expenses. For example, a rise in the minimum wage to $15 per hour, a topic of frequent discussion in 2024, would directly impact Dollar Tree's substantial hourly workforce.

Adhering to a patchwork of state and local laws adds another layer of complexity. These can range from specific zoning ordinances affecting store locations to varying sales tax regulations and unique product restrictions in different jurisdictions. This decentralized regulatory environment requires constant vigilance and adaptability from Dollar Tree's legal and operational teams to ensure company-wide compliance.

Global trade policies and tariffs are a significant concern for Dollar Tree. As a retailer heavily reliant on sourcing a vast array of products, often at very low price points, changes in import duties can directly impact their cost of goods sold. For instance, in late 2023 and early 2024, ongoing discussions and potential adjustments to tariffs on goods imported from Asia, a major sourcing region for many discount retailers, could necessitate price adjustments or a review of their product mix.

These fluctuations in trade agreements and tariffs directly affect Dollar Tree's ability to maintain its core value proposition. A sudden increase in tariffs on imported seasonal decor or party supplies, for example, could force the company to either absorb the cost, impacting margins, or pass it on to consumers, potentially alienating their price-sensitive customer base. This highlights the need for robust supply chain management and strategic sourcing to navigate these political and economic shifts effectively.

Dollar Tree's reliance on a large hourly workforce means that rising minimum wage laws in states like California, which saw its minimum wage reach $16 per hour for all employers in 2024, directly impact labor expenses. This trend, coupled with wage inflation, has been cited as a pressure point on the company's operating margins, potentially affecting profitability.

Political Stability and Geopolitical Tensions

Political instability and geopolitical tensions in countries where Dollar Tree sources its products can significantly disrupt its supply chain. For instance, ongoing trade disputes or regional conflicts can lead to shipping delays, higher freight costs, and even shortages of popular items. This was evident in late 2023 and early 2024, where several key sourcing regions faced localized unrest, impacting inventory levels for various consumer goods. Retailers like Dollar Tree must remain agile, potentially diversifying suppliers or adjusting product assortments to mitigate these risks.

These external political factors inject considerable uncertainty into global markets, directly affecting both the availability and pricing of merchandise for retailers. Dollar Tree, with its extensive international sourcing network, is particularly exposed to these fluctuations. The company's ability to navigate these challenging environments is crucial for maintaining competitive pricing and consistent product availability for its customers.

- Supply Chain Disruption: Geopolitical events can halt or slow down the movement of goods, impacting Dollar Tree's ability to stock shelves.

- Increased Costs: Tariffs, sanctions, or increased insurance premiums due to political instability directly translate to higher operational expenses.

- Market Volatility: Fluctuating exchange rates and commodity prices, often driven by political events, can affect Dollar Tree's cost of goods sold.

Consumer Protection and Data Privacy Legislation

The evolving landscape of consumer protection and data privacy laws, both federally and at the state level, directly influences how Dollar Tree manages customer information. Compliance with regulations such as the California Privacy Rights Act (CPRA) and other emerging state-level privacy laws expected to be in full effect by 2025 necessitates considerable investment in data governance and cybersecurity infrastructure. This regulatory environment impacts Dollar Tree's marketing approaches and the foundational trust it builds with its customer base.

Key considerations for Dollar Tree include:

- Data Collection and Usage: Adhering to strict guidelines on what customer data can be collected and how it can be utilized for marketing and operational purposes.

- Security Measures: Implementing robust security protocols to safeguard sensitive customer data against breaches, a critical factor in maintaining consumer confidence.

- Consumer Rights: Ensuring customers have clear rights regarding their data, including access, deletion, and opt-out options, as mandated by laws like CPRA.

- Compliance Costs: Allocating resources for legal counsel, technology upgrades, and personnel training to meet the complex requirements of these privacy regulations.

Political factors significantly shape Dollar Tree's operational environment, particularly concerning trade policies and labor laws. For instance, the ongoing discussions around import tariffs in 2024, especially on goods from Asia, directly impact Dollar Tree's cost of goods sold, potentially affecting their ability to maintain low price points. Furthermore, the trend towards higher minimum wages, with states like California already at $16 per hour for all employers in 2024, increases labor expenses for the company's substantial hourly workforce.

Regulatory compliance remains a critical political consideration. Laws such as the Consumer Product Safety Improvement Act (CPSIA) necessitate adherence to product safety standards, particularly for items sold to children. Non-compliance can lead to costly fines and recalls, impacting profitability. Additionally, evolving data privacy laws, with comprehensive regulations like the California Privacy Rights Act (CPRA) coming into full effect, require significant investment in data governance and cybersecurity to protect customer information.

Geopolitical instability and trade relations also pose risks. Disruptions in key sourcing regions due to political tensions in late 2023 and early 2024 can lead to supply chain delays and increased freight costs. This necessitates agile supply chain management and supplier diversification to ensure product availability and manage the financial implications of market volatility driven by political events.

What is included in the product

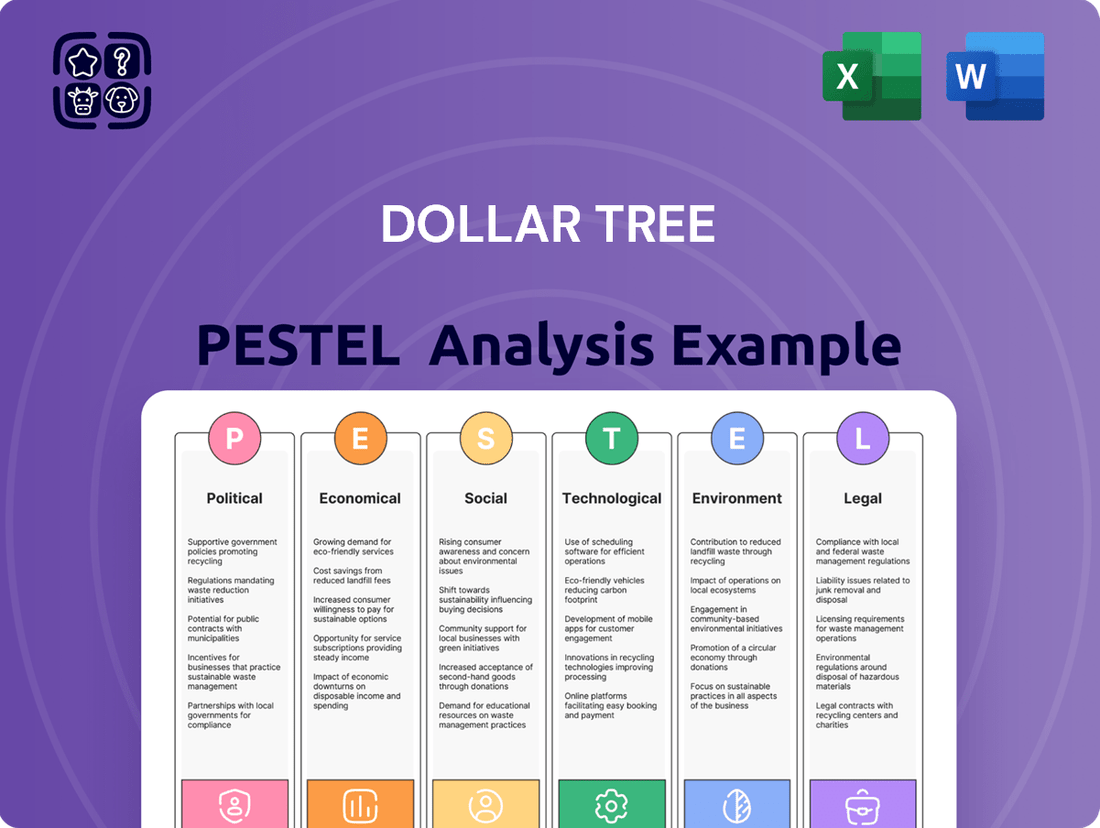

This PESTLE analysis examines the external macro-environmental factors influencing Dollar Tree's operations across political, economic, social, technological, environmental, and legal dimensions.

It provides actionable insights for strategic decision-making by identifying key opportunities and threats within Dollar Tree's operating landscape.

Dollar Tree's PESTLE analysis provides a concise version that can be dropped into PowerPoints or used in group planning sessions, highlighting how understanding political, economic, social, technological, legal, and environmental factors can alleviate the pain of strategic uncertainty.

Economic factors

Inflationary pressures remain a critical economic challenge, directly affecting Dollar Tree's cost of goods sold and overall operating expenses. The persistent rise in manufacturing, transportation, and labor costs makes it increasingly difficult for the company to uphold its traditional low-price strategy.

To counter these rising costs, Dollar Tree has strategically implemented a multi-price point model, moving beyond its single dollar price point. For instance, in the first quarter of 2024, the company reported a 5.7% increase in its cost of goods sold, underscoring the impact of these inflationary trends.

Consumer spending trends, especially for low-to-middle-income households, are a direct driver of Dollar Tree's revenue. When economic conditions tighten and disposable income shrinks, consumers tend to prioritize essential purchases, which can affect sales of non-essential discretionary goods.

In the first quarter of 2024, Dollar Tree reported a 1.1% increase in same-store sales, indicating resilience. However, shifts in consumer behavior, such as a greater focus on value and necessity, are crucial for the company to monitor as disposable income levels fluctuate throughout 2024 and into 2025.

Changes in interest rates directly impact Dollar Tree's operational costs, influencing borrowing expenses for crucial activities like store expansion, managing inventory, and general business operations. For instance, if interest rates climb, the cost of financing new store openings or maintaining higher inventory levels to meet demand will increase, potentially squeezing profit margins.

Looking ahead to 2025, the economic landscape suggests a nuanced environment for interest rates. While a moderate rise in inflation might prompt central banks to delay aggressive rate cuts, the overall economic trajectory indicates a potential deceleration in inflation. This could lead to some central banks beginning to ease monetary policy, which would be beneficial for companies like Dollar Tree by lowering their cost of capital.

Competition in the Discount Retail Sector

The discount retail sector is intensely competitive, with giants like Dollar General and emerging players such as Five Below continuously refining their approaches. These competitors are known for their aggressive pricing and innovative product assortments, forcing established players to adapt to maintain market share.

Dollar Tree's strategic pivot, including its multi-price point expansion beyond the traditional $1.25 price and the significant divestiture of its Family Dollar banner, directly addresses this fierce competition. These moves are designed to streamline operations, improve profitability, and better resonate with a wider spectrum of value-conscious consumers.

- Dollar General's Market Presence: As of early 2024, Dollar General operates over 19,000 stores, significantly outnumbering Dollar Tree's approximately 17,000 locations, highlighting its broader reach.

- Five Below's Growth Trajectory: Five Below reported strong sales growth in its fiscal year 2023, indicating a successful strategy in attracting younger demographics with its trend-driven, fixed-price point model.

- Dollar Tree's Financial Adjustments: In late 2023, Dollar Tree announced plans to close approximately 1,000 underperforming Family Dollar stores, a move aimed at bolstering overall company performance and focusing resources on its core Dollar Tree banner.

Economic Growth and Recessionary Concerns

The broader economic outlook, particularly the persistent concerns about a potential recession, directly impacts consumer confidence and their willingness to spend. While some economic indicators have shown resilience, consumer sentiment has remained somewhat cautious throughout late 2024 and into early 2025, prompting more deliberate spending habits.

Dollar Tree's core business model, centered on providing deeply discounted everyday items, positions it favorably when consumers are more budget-conscious. This value proposition becomes a significant advantage during periods of economic uncertainty or when recessionary fears are elevated.

- Consumer Confidence: The Conference Board Consumer Confidence Index, while fluctuating, has generally remained below pre-pandemic highs, indicating ongoing consumer caution. For example, in Q4 2024, the index averaged around 105, down from peaks near 120 earlier in the year.

- Inflationary Pressures: Persistent, albeit moderating, inflation throughout 2024 continued to squeeze household budgets, making value retailers like Dollar Tree more attractive to a wider consumer base.

- Recessionary Indicators: While a widespread recession was not definitively declared by mid-2025, several leading economic indicators, such as inverted yield curves and slowing manufacturing output in certain sectors during 2024, fueled recessionary concerns.

Persistent inflation throughout 2024 and into early 2025 has significantly impacted Dollar Tree's cost of goods sold, with a 5.7% increase reported in Q1 2024. This necessitates strategic pricing adjustments beyond the traditional $1.25 model to maintain profitability.

Consumer spending is closely tied to disposable income, and cautious sentiment, reflected in a Q4 2024 average Consumer Confidence Index of around 105, favors value retailers like Dollar Tree. This trend is amplified by ongoing recessionary concerns, despite a lack of definitive declaration by mid-2025.

Interest rate fluctuations directly affect Dollar Tree's financing costs for expansion and inventory. While potential inflation moderation in 2025 might lead to eased monetary policy, higher rates in 2024 increased borrowing expenses.

The competitive landscape, featuring over 19,000 Dollar General stores and Five Below's strong growth, pressures Dollar Tree. Its strategic move to close ~1,000 Family Dollar stores in late 2023 aims to enhance focus and performance.

| Economic Factor | Impact on Dollar Tree | Data/Trend (2024-2025) |

| Inflation | Increased Cost of Goods Sold (COGS), pressure on low-price strategy | COGS up 5.7% (Q1 2024); persistent but moderating inflation |

| Consumer Spending/Confidence | Increased demand for value, cautious spending due to recession fears | Consumer Confidence Index ~105 (Q4 2024); focus on essentials |

| Interest Rates | Higher financing costs for operations and expansion | Potential for rate cuts in 2025, but rates remained elevated in 2024 |

| Competition | Need for strategic differentiation and operational efficiency | Dollar General >19,000 stores; Five Below strong growth; Dollar Tree closing ~1,000 Family Dollar stores |

Full Version Awaits

Dollar Tree PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Dollar Tree PESTLE analysis provides a comprehensive look at the external factors influencing the company's operations and strategic decisions. You'll gain insights into the political, economic, social, technological, legal, and environmental aspects impacting this prominent discount retailer.

Sociological factors

Consumers today are a savvy bunch, demanding more bang for their buck and a broader selection of goods. This shift puts pressure on retailers like Dollar Tree, which built its success on a strict $1.25 price point. The need to cater to evolving tastes means a simple, low price isn't always enough.

Dollar Tree's strategic pivot to a multi-price point model, with items now ranging from $1.50 to $7, directly addresses this evolving consumer preference. This move allows them to offer a wider variety of merchandise, from everyday essentials to slightly more premium items, thereby broadening their appeal and potentially capturing a larger share of the market. For instance, in their fiscal year 2023 earnings reports, the company highlighted the positive impact of these new price points on sales growth.

Dollar Tree's customer base is diverse, but a significant portion of its sales, estimated to be around 60% in recent years, comes from households with incomes below $50,000 annually. This reliance means that changes in income levels for this demographic directly impact the company's performance.

However, economic pressures are not limited to lower-income brackets. Data from the U.S. Bureau of Labor Statistics in late 2024 indicated that inflation and stagnant wage growth have put pressure on middle and upper-middle-income households, leading to increased interest in value shopping. This trend benefits Dollar Tree as more consumers seek affordable alternatives for everyday goods.

The social perception of discount retailers is shifting, with consumers increasingly viewing them as primary sources for everyday necessities rather than solely for opportunistic bargains. This evolution is particularly evident as shoppers seek value in response to persistent inflation, driving higher customer engagement.

In 2024, data suggests a significant portion of consumers actively sought out discount chains to manage household budgets. For instance, reports indicate that discount retailers have seen a notable uptick in visit frequency, with many customers now making these stores a regular part of their shopping routine for groceries and household goods.

Evolving Shopping Habits and Omnichannel Expectations

Consumers increasingly demand a fluid shopping journey, expecting to transition effortlessly between physical stores and digital platforms. This omnichannel expectation means a customer might research online, visit a store to see a product, and then purchase it via a mobile app, all within the same shopping trip. Retailers are investing in technology to bridge these gaps.

Dollar Tree, like many in the retail sector, is responding to these evolving habits. While a significant portion of their sales still originate from brick-and-mortar locations, the company is exploring ways to enhance its digital presence and operational efficiency to cater to this demand. For instance, by mid-2024, a substantial percentage of discount retailers were reporting increased investment in e-commerce capabilities and in-store technology to improve customer interaction and inventory management, aiming to meet these blended shopping preferences.

- Omnichannel Integration: Consumers expect seamless transitions between online browsing, mobile app usage, and in-store purchasing.

- Digital Investment: Retailers are allocating capital towards improving their e-commerce platforms and digital customer service.

- In-Store Experience: Enhancements in store layout, checkout processes, and product availability are crucial for meeting evolving expectations.

Impact of Social Media and Public Opinion

Social media significantly influences public perception of Dollar Tree's pricing and product assortment. Platforms like TikTok and X (formerly Twitter) are crucial for shaping consumer sentiment, especially concerning the company's value proposition. For instance, viral videos highlighting price increases or the removal of the $1 price point can quickly generate widespread customer dissatisfaction, impacting brand image.

Negative online commentary, particularly regarding the perceived shift away from a true fixed-price model and the persistence of non-removable price tags, can erode customer trust and loyalty. This sentiment can directly affect sales volumes as consumers seek alternatives that better align with their expectations of value. In 2024, Dollar Tree faced continued scrutiny on social media regarding its pricing adjustments, with many consumers expressing disappointment online.

- Social Media Influence: Platforms like TikTok and X are key in shaping consumer views on Dollar Tree's pricing and product strategies.

- Customer Sentiment: Negative feedback, such as frustration over price changes or the $1.25 price point, can quickly spread online and impact brand perception.

- Brand Loyalty: Perceived abandonment of the fixed-price model and issues like non-removable price tags can lead to decreased customer loyalty and a search for alternative retailers.

Consumer demand for value is a primary driver for Dollar Tree, especially as economic conditions in 2024 and early 2025 continue to impact household budgets. A significant portion of their customer base, historically around 60% from households earning under $50,000 annually, is particularly sensitive to inflation and income fluctuations. This demographic's spending power directly correlates with Dollar Tree's performance, making economic stability for lower-income families crucial.

The evolving perception of discount retailers as essential shopping destinations, rather than just for bargains, is a key sociological trend benefiting Dollar Tree. As inflation persisted through late 2024, data showed a notable increase in consumers actively seeking out discount chains for everyday necessities, leading to higher visit frequencies and a more integrated role in regular shopping routines.

Social media's influence is undeniable, with platforms like TikTok and X shaping consumer sentiment regarding Dollar Tree's pricing and product assortment. For instance, viral discussions in 2024 around the shift from the strict $1.25 price point to a multi-price model, with items now ranging up to $7, generated significant customer feedback, impacting brand perception and loyalty.

The expectation for omnichannel shopping experiences, seamlessly blending online research, mobile app interaction, and in-store purchases, is another critical sociological factor. By mid-2024, many discount retailers, including Dollar Tree, were increasing investments in e-commerce and in-store technology to meet these evolving consumer habits.

Technological factors

Dollar Tree's future hinges on strengthening its digital footprint. While its core strength remains its vast physical store network, the company is exploring e-commerce, recognizing the need to meet evolving consumer shopping habits. This digital expansion is crucial for reaching new customer segments and providing convenient online purchasing options.

Dollar Tree's commitment to its low-price model hinges on optimizing its supply chain through technology. By integrating advanced forecasting models and robust data analytics for inventory management, the company can better predict demand and reduce excess stock, a critical factor in maintaining profitability at a dollar price point.

Investments in logistics are also paramount. For instance, the company has been expanding its distribution network, with plans for new facilities that enhance efficiency. In 2023, Dollar Tree reported capital expenditures of $1.3 billion, a portion of which is allocated to supply chain and logistics improvements, aiming to streamline the movement of goods from suppliers to its over 16,000 stores.

Data analytics is fundamentally changing how retailers operate. By analyzing vast amounts of data, companies like Dollar Tree can gain deep insights into what customers want, predict demand more accurately, and manage their stock levels much more efficiently. This allows for smarter, more informed decisions across the entire business.

For Dollar Tree, harnessing big data means they can move beyond guesswork. They can tailor marketing campaigns to specific customer segments, ensuring their promotions resonate better. In 2023, for example, retailers leveraging advanced analytics saw an average of a 10-15% improvement in inventory turnover, directly impacting profitability.

This technological shift also boosts operational efficiency. From optimizing store layouts based on purchasing patterns to streamlining distribution routes, data analytics provides the foundation for cost savings and improved customer experiences. Dollar Tree's ability to adapt to these data-driven trends will be crucial for maintaining its competitive edge in the evolving retail landscape.

In-Store Technology and Customer Experience

Technology plays a crucial role in shaping the in-store shopping journey. Dollar Tree is enhancing its customer experience through upgraded point-of-sale (POS) systems and the implementation of in-store analytics. These tools help monitor customer flow and product engagement, aiming to create a more efficient and enjoyable shopping environment.

Dollar Tree's strategic investments in store renovations and technology upgrades are directly tied to improving customer satisfaction. For instance, the company has been rolling out new POS systems across its banners, which can streamline checkout processes. In 2023, Dollar Tree reported capital expenditures of $1.2 billion, a significant portion of which is allocated to store improvements and technology, reflecting a commitment to modernizing its physical retail spaces.

- POS System Upgrades: Facilitating faster and more reliable transactions for customers.

- In-Store Analytics: Providing insights into shopper behavior to optimize store layout and product placement.

- Customer Experience Focus: Enhancing overall satisfaction to drive repeat business and loyalty.

- Capital Investment: Allocating substantial funds towards technological advancements and store modernization.

Automation and Operational Efficiency

Automation is a key technological factor for Dollar Tree, impacting everything from how they manage their vast inventory to how quickly they can get products onto shelves. By automating processes like inventory tracking and order fulfillment, the company can significantly boost its operational efficiency. This not only speeds things up but also helps to control and potentially reduce labor costs, which is crucial in a high-volume, low-margin retail environment.

Dollar Tree is increasingly leveraging advanced analytics and artificial intelligence (AI) to streamline operations. These technologies can automate critical tasks such as reordering popular items and ensuring optimal stock levels across its numerous stores. For instance, AI can predict demand more accurately, preventing stockouts of high-demand products and minimizing overstock of slower-moving goods. This data-driven approach to inventory management is vital for maintaining profitability and customer satisfaction.

The potential for in-store automation also presents opportunities. While Dollar Tree has historically relied on a more hands-on approach, exploring self-checkout options or automated task management for store associates could further enhance efficiency. This technological integration is not just about cost savings; it’s about creating a more responsive and agile supply chain and retail experience.

- Improved Inventory Management: Automation reduces manual errors and provides real-time stock visibility, crucial for a retailer with over 16,000 stores as of early 2024.

- Optimized Order Fulfillment: Streamlined processes in distribution centers lead to faster and more accurate order processing for store replenishment.

- Reduced Labor Costs: Automating repetitive tasks frees up staff for customer-facing roles and lowers overall operational expenses.

- Enhanced Demand Forecasting: AI and analytics enable more precise predictions of customer demand, leading to better stock planning and reduced waste.

Technological advancements are reshaping retail, and Dollar Tree is investing in digital capabilities to enhance customer reach and convenience. The company is actively exploring e-commerce solutions to complement its extensive physical store network, acknowledging the shift in consumer behavior towards online shopping. This digital push is vital for attracting new demographics and offering accessible purchasing options.

Optimizing its supply chain through technology is fundamental to Dollar Tree's low-price strategy. By implementing advanced forecasting and data analytics for inventory management, the company can better anticipate demand and minimize excess stock, a critical element for maintaining profitability at its price point. For example, in 2023, Dollar Tree's capital expenditures reached $1.3 billion, with a portion dedicated to supply chain enhancements aimed at improving efficiency.

Data analytics provides deep insights into customer preferences and allows for more accurate demand prediction and efficient stock management. Retailers utilizing advanced analytics saw an average of 10-15% improvement in inventory turnover in 2023, directly boosting profitability. Dollar Tree’s adoption of these data-driven approaches is key to its ongoing competitiveness.

The company is also upgrading its in-store technology, including point-of-sale (POS) systems and in-store analytics, to improve the customer journey. These investments, part of its 2023 capital expenditures of $1.2 billion for store improvements and technology, aim to streamline operations and enhance customer satisfaction. As of early 2024, Dollar Tree operates over 16,000 stores, making technological integration crucial for efficiency.

Legal factors

Dollar Tree navigates a dense landscape of labor laws, encompassing minimum wage, overtime, and crucial workplace safety mandates. These regulations, which differ significantly across states and municipalities, are vital for maintaining ethical employment practices and sidestepping costly legal penalties. For instance, in 2024, the federal minimum wage remains $7.25 per hour, but many states and cities have enacted much higher rates, impacting Dollar Tree's operational costs in those areas.

Dollar Tree, as a retailer, must adhere to stringent product safety and consumer protection regulations. This involves ensuring all merchandise, from toys to cleaning supplies, meets established safety standards and is accurately labeled. Failure to comply can result in significant fines and damage to brand reputation.

In 2024, the Consumer Product Safety Commission (CPSC) continued its focus on enforcing safety standards across various retail sectors. For Dollar Tree, this means rigorous checks on imported goods and domestic products to prevent hazardous items from reaching consumers. For instance, recalls due to lead paint or small parts in toys are common concerns that retailers must actively manage.

Consumer protection laws also mandate transparent pricing and fair advertising practices. Dollar Tree's business model relies on its low price point, making it crucial to ensure advertised prices are accurate and that no deceptive practices are employed. The Federal Trade Commission (FTC) actively monitors for such violations, which can lead to penalties and consumer lawsuits.

The expanding landscape of data privacy laws, including California's CPRA and emerging state regulations set to take effect in 2025, places substantial responsibilities on Dollar Tree for managing customer data. This necessitates rigorous data security protocols and clear, accessible privacy statements to ensure compliance and maintain customer trust.

Lease Agreements and Real Estate Regulations

Dollar Tree's vast network of stores necessitates meticulous management of lease agreements and compliance with diverse real estate laws. The company's strategic moves, such as the closure of approximately 1,000 underperforming Family Dollar stores announced in early 2024, directly impact these legal obligations, requiring careful negotiation of lease terminations and adherence to property disposition regulations.

Navigating these legal complexities is crucial for optimizing real estate portfolios and mitigating potential liabilities. For instance, understanding specific lease clauses regarding early termination penalties or landlord consent for store closures can significantly affect the financial outcome of such decisions. In 2023, Dollar Tree reported having over 16,000 locations across its banners, highlighting the sheer scale of its real estate commitments and the importance of robust legal oversight.

- Lease Compliance: Ensuring all store leases, estimated to be in the thousands, adhere to local, state, and federal real estate regulations.

- Lease Termination: Managing the legal processes and costs associated with closing approximately 1,000 Family Dollar stores, impacting lease agreements.

- Property Law: Adhering to property laws for any new store acquisitions or dispositions, ensuring legal ownership and operational compliance.

- Regulatory Changes: Staying abreast of evolving zoning laws, environmental regulations, and building codes that could affect store operations or new site development.

Advertising and Marketing Regulations

Dollar Tree's advertising and marketing efforts must strictly adhere to consumer protection legislation, which forbids deceptive or misleading claims. For instance, in 2023, the Federal Trade Commission (FTC) continued its focus on ensuring truthfulness in advertising, a trend expected to persist through 2024 and 2025.

Given Dollar Tree's core business model centered on affordability, maintaining absolute clarity in pricing and promotional offers is paramount. This transparency is vital for preserving customer confidence and sidestepping potential regulatory investigations or penalties.

- Consumer Protection Laws: Adherence to regulations like the FTC Act is mandatory.

- Transparency in Pricing: Clear communication of prices and discounts builds trust.

- Avoiding Misleading Claims: Marketing must accurately reflect product value and availability.

- Regulatory Scrutiny: Non-compliance can lead to fines and reputational damage.

Dollar Tree faces significant legal obligations concerning labor, including minimum wage laws that vary by state, impacting operational costs. The company must also comply with product safety regulations, ensuring merchandise meets standards to avoid fines and reputational harm, a focus for agencies like the CPSC in 2024.

Data privacy laws are increasingly critical, with new state regulations emerging in 2025 requiring robust data security and transparent privacy policies. Furthermore, Dollar Tree's extensive real estate footprint necessitates strict adherence to property and lease laws, as highlighted by the 2024 announcement of closing approximately 1,000 Family Dollar stores, impacting lease agreements and property dispositions.

| Legal Factor | Relevance to Dollar Tree | Key Considerations/Data Points |

| Labor Laws | Minimum wage, overtime, workplace safety | Federal minimum wage $7.25/hr (2024); many states/cities have higher rates. |

| Product Safety & Consumer Protection | Merchandise safety standards, accurate labeling, fair advertising | CPSC focus on imports; FTC oversight on pricing and promotions. |

| Data Privacy | Customer data management, security protocols | Emerging state regulations (e.g., CPRA) effective 2025. |

| Real Estate & Lease Law | Lease compliance, store closures, property law | 1,000 Family Dollar store closures announced (2024); over 16,000 total locations (2023). |

Environmental factors

Dollar Tree is actively pursuing waste reduction and recycling initiatives to lessen its environmental impact. This involves optimizing packaging to use less material and boosting recycling efforts throughout its operations. For instance, in 2023, Dollar Tree reported a 5% increase in the recycling rate of its cardboard waste across distribution centers.

Dollar Tree is increasingly focusing on sustainable sourcing and ethical supply chains to meet growing consumer and regulatory demands. The company aims to boost its use of recycled and recyclable packaging materials, a move that aligns with broader industry trends toward circular economy principles. In 2024, Dollar Tree continued to evaluate its supplier base against environmental and social responsibility benchmarks, including fair labor practices and efforts to lower carbon emissions in production processes.

Dollar Tree is actively working to lower its energy footprint. They are implementing efficiency upgrades across their retail stores and distribution centers, aiming to reduce overall energy use.

The company is also making strides in adopting renewable energy sources. This initiative is a key part of their broader commitment to reach science-based net-zero emissions by the year 2050.

Climate Change Impact and Carbon Footprint Reduction

Dollar Tree is increasingly recognizing the significant impact of climate change on its operations and supply chain. The company is actively developing a decarbonization roadmap aimed at reducing its overall carbon footprint. This strategy encompasses efforts across its extensive retail network and broader value chain.

As part of its commitment, Dollar Tree is establishing ambitious emissions reduction targets. These goals are designed to drive meaningful progress in mitigating its environmental impact. The company is also enhancing its climate risk disclosures to provide greater transparency on its ongoing efforts and performance.

- Emissions Reduction Goals: Dollar Tree is setting specific, measurable targets for reducing greenhouse gas emissions across its Scope 1, 2, and 3 emissions.

- Decarbonization Roadmap: The company is outlining key initiatives and investments to achieve its emissions reduction objectives, focusing on energy efficiency, renewable energy sourcing, and sustainable logistics.

- Climate Risk Disclosure: Dollar Tree is updating its reporting to reflect a more comprehensive understanding of climate-related risks and the strategies being implemented to manage them, aligning with evolving regulatory and investor expectations.

Environmental Regulations and Reporting

Dollar Tree, like all retailers, navigates a complex web of environmental regulations concerning waste management, emissions, and the sourcing of its products. These rules impact everything from packaging materials to transportation logistics.

The company is increasingly focused on environmental, social, and governance (ESG) reporting, a trend driven by heightened regulatory scrutiny and investor demand for transparency. This includes updating its climate risk disclosures, a growing area of focus for businesses globally.

- Waste Management: Compliance with local and federal regulations on landfill disposal and recycling programs is essential for Dollar Tree's operations.

- Emissions Control: Regulations on greenhouse gas emissions from transportation and store operations necessitate strategies for reducing the company's carbon footprint.

- Sustainable Sourcing: Growing expectations and potential regulations around ethical and sustainable product sourcing require Dollar Tree to monitor its supply chain closely.

- Climate Risk Disclosure: As of 2024, companies are increasingly expected to report on how climate change could impact their business, including supply chain disruptions and operational costs.

Dollar Tree is actively enhancing its waste reduction and recycling programs, aiming to minimize its environmental footprint. The company reported a 5% increase in cardboard waste recycling rates across its distribution centers in 2023, demonstrating a tangible step towards more sustainable operations.

The company is also prioritizing sustainable sourcing and the use of recycled and recyclable packaging materials, aligning with circular economy principles. By 2024, Dollar Tree continued to assess its suppliers against environmental and social responsibility standards, including carbon emission reduction efforts in production.

Dollar Tree is committed to reducing its energy consumption through efficiency upgrades in stores and distribution centers and is exploring renewable energy sources as part of its strategy to achieve net-zero emissions by 2050.

The company is developing a decarbonization roadmap to lower its carbon footprint, setting ambitious emissions reduction targets and improving climate risk disclosures to enhance transparency. In 2024, regulatory scrutiny and investor demand for ESG reporting continued to influence Dollar Tree's approach to environmental stewardship.

| Environmental Factor | Dollar Tree's Initiatives | Data/Targets |

|---|---|---|

| Waste Reduction & Recycling | Optimizing packaging, increasing recycling efforts | 5% increase in cardboard recycling (2023) |

| Sustainable Sourcing & Packaging | Evaluating suppliers, increasing recycled/recyclable materials | Ongoing supplier assessments (2024) |

| Energy Efficiency & Renewables | Store/distribution center upgrades, renewable energy adoption | Net-zero emissions goal by 2050 |

| Emissions Reduction & Climate Risk | Decarbonization roadmap, setting emissions targets, climate risk disclosure | Enhanced climate risk disclosures (2024) |

PESTLE Analysis Data Sources

Our PESTLE analysis for Dollar Tree is built upon a foundation of reliable data from government economic reports, industry-specific market research, and consumer behavior studies. We also incorporate insights from regulatory updates and technological trend analyses.