Dollar Tree Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dollar Tree Bundle

Unlock the full strategic blueprint behind Dollar Tree's business model. This in-depth Business Model Canvas reveals how the company drives value through its unique "everything's a dollar" proposition, its vast store network, and efficient supply chain. It's an essential tool for anyone seeking to understand the core mechanics of a successful discount retailer.

Dive deeper into Dollar Tree’s real-world strategy with the complete Business Model Canvas. From its distinct customer segments and value propositions to its cost structure and revenue streams, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie for future growth.

See how the pieces fit together in Dollar Tree’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more, providing a comprehensive view of its operational success. Download the full version to accelerate your own business thinking and gain actionable insights.

Partnerships

Dollar Tree's success hinges on its extensive network of suppliers and vendors, who provide a wide array of products, from everyday consumables to seasonal decor, all typically priced at $1.25. In 2024, the company continued to emphasize robust supplier relationships to guarantee a steady flow of merchandise and secure competitive pricing, a critical factor for its value proposition.

Maintaining these partnerships is paramount for Dollar Tree to offer its signature broad assortment of goods. The company actively works to manage its supply chain, a strategy that became even more vital in 2024 with ongoing global trade dynamics, to mitigate risks such as tariffs and ensure that the final cost of goods remains favorable for its customers.

Dollar Tree relies heavily on its logistics and distribution partners to keep its vast network of over 9,000 stores stocked efficiently. These partnerships are crucial for managing the flow of goods from suppliers to its 18 strategically located distribution centers across the contiguous U.S. and Canada.

In 2024, the company continued to optimize these relationships to ensure cost-effective and timely deliveries, a key component in maintaining its value proposition. For example, by leveraging the expertise of specialized transportation providers, Dollar Tree can manage the complexities of replenishing diverse product assortments across its numerous locations.

Dollar Tree's strategic investments in its digital infrastructure and evolving store formats necessitate strong alliances with technology and IT service providers. These partnerships are crucial for upgrading inventory management systems, modernizing point-of-sale (POS) technology, and bolstering e-commerce capabilities, all of which drive operational efficiency and enhance customer engagement.

For instance, in 2023, Dollar Tree continued its rollout of new store formats and technology upgrades, aiming to streamline operations and improve the shopping experience. Collaborations with providers for cloud services, data analytics, and cybersecurity are vital to supporting these initiatives and ensuring seamless integration across their vast network of stores.

Financial Institutions

Dollar Tree actively cultivates relationships with financial institutions to secure essential funding. These partnerships are crucial for supporting day-to-day operations, enabling significant capital expenditures, and facilitating shareholder returns through share repurchase programs.

The company's reliance on these financial allies is evident in recent financial maneuvers. For instance, Dollar Tree announced a new $1.5 billion revolving credit facility, demonstrating a robust commitment to maintaining liquidity and financial flexibility.

- Financing Operations: Access to credit lines and loans to manage working capital and inventory needs.

- Capital Expenditures: Funding for store expansions, renovations, and supply chain infrastructure.

- Share Repurchases: Securing funds to execute authorized share buyback programs, enhancing shareholder value.

- Debt Management: Establishing credit facilities for efficient debt issuance and management.

Further underscoring the importance of these relationships, Dollar Tree recently completed a substantial $2.5 billion share repurchase authorization, a move that typically requires strong backing from financial partners to manage cash flows effectively.

Real Estate Developers and Landlords

Dollar Tree's extensive store footprint and ambitious expansion plans necessitate strong relationships with real estate developers and landlords. These partnerships are crucial for securing prime locations for new store openings and for managing its vast portfolio of existing retail spaces, including renovations. In 2024, Dollar Tree continued its aggressive growth strategy, aiming to open approximately 300 new stores.

Furthermore, the company is actively converting a significant portion of its existing store base to its enhanced 3.0 store model. This initiative involves upgrading approximately 2,000 stores by the end of 2025, requiring close collaboration with landlords on lease agreements and store build-outs. These strategic real estate partnerships are fundamental to Dollar Tree's operational efficiency and market penetration.

- New Store Openings: Securing favorable lease terms and prime retail space for new Dollar Tree locations.

- Store Renovations and Upgrades: Collaborating on the modernization of existing stores to the 3.0 model.

- Portfolio Management: Working with landlords to manage and optimize the company's extensive network of retail properties.

- Expansion Support: Leveraging developer and landlord expertise to facilitate rapid store growth.

Dollar Tree's strategic alliances with suppliers and vendors are foundational, ensuring a consistent supply of diverse merchandise at its signature price point. In 2024, the company continued to prioritize these relationships to maintain competitive costs amidst evolving global trade conditions.

Logistics and distribution partners are vital for efficiently stocking Dollar Tree's vast store network. These collaborations enable the seamless movement of goods from suppliers to its numerous distribution centers, a critical function for operational success.

Technology and IT service providers are key partners in Dollar Tree's ongoing digital transformation and store modernization efforts. These relationships support upgrades to inventory management, POS systems, and e-commerce capabilities, enhancing efficiency and customer experience.

Financial institutions provide essential capital for operations, expansion, and shareholder returns. Dollar Tree's access to credit facilities, such as its $1.5 billion revolving credit facility, underscores the importance of these partnerships for financial flexibility.

Real estate developers and landlords are crucial for Dollar Tree's aggressive growth strategy, facilitating new store openings and the renovation of existing locations. The company's plan to open approximately 300 new stores in 2024 highlights the significance of these real estate collaborations.

What is included in the product

Dollar Tree's business model focuses on offering a wide variety of discretionary and essential consumer goods at a fixed price point, primarily targeting value-conscious shoppers across diverse demographics.

This model leverages high-volume sales, efficient supply chain management, and strategically located stores to deliver its core value proposition of affordability and convenience.

Dollar Tree's Business Model Canvas provides a high-level, editable view of their strategy, allowing for quick identification of core components that relieve the pain point of budget-conscious consumers seeking value.

This one-page snapshot of Dollar Tree's business model is perfect for brainstorming how their value proposition addresses consumer pain points related to affordability.

Activities

Dollar Tree's core activity revolves around the strategic sourcing and procurement of a vast range of merchandise. This involves identifying emerging consumer trends and negotiating favorable pricing with a global network of suppliers to maintain their distinctive value proposition.

The company actively seeks a diverse and rapidly rotating inventory, encompassing consumables, seasonal decorations, and various home goods. This dynamic product mix is crucial for fostering the 'thrill-of-the-hunt' shopping experience that attracts and retains customers.

In 2024, Dollar Tree continued to leverage its scale to secure competitive pricing. For instance, the company reported net sales of $31.7 billion for the fiscal year ending February 3, 2024, demonstrating the significant volume of goods procured to meet demand across its expansive store base.

Managing the day-to-day operations across more than 9,000 Dollar Tree and Dollar Tree Canada locations is a core activity. This involves ensuring efficient store staffing, meticulous inventory control at each site, and delivering excellent customer service.

Maintaining a clean, well-organized, and easily accessible shopping environment is paramount to the customer experience. This operational focus directly impacts sales and customer loyalty.

In 2024, Dollar Tree continued to refine its store operations, aiming to optimize labor costs and improve inventory turnover. The company's strategy relies heavily on the effective execution of these in-store processes to drive profitability.

Dollar Tree's key activities heavily involve managing its extensive supply chain and logistics network. This encompasses the operation of 18 strategically located distribution centers across the U.S. and Canada, ensuring timely and cost-effective product flow to over 17,000 stores.

The company focuses on efficient transportation, inventory control, and master data management to maintain product availability and minimize costs. In 2024, Dollar Tree continued to navigate the complexities of global sourcing and potential tariff impacts, emphasizing resilience and cost optimization within its logistics operations.

Pricing Strategy Implementation

Dollar Tree's pricing strategy implementation has evolved significantly, moving beyond its iconic $1 price point. The company has strategically introduced a multi-price point model, offering items ranging from $1.25 up to $7. This shift is a crucial activity in their business model, requiring meticulous planning to re-merchandise store layouts and effectively communicate the expanded value to their customer base.

This implementation involves careful cost management to ensure profitability across the new price tiers. For instance, in early 2024, Dollar Tree reported that its "Dollar Tree Plus" initiative, featuring items at $3 and $5, was a key driver of growth, with these price points contributing to a notable increase in average transaction value.

- Expanded Price Points: Offering items at $1.25, $3, $5, and $7 alongside the traditional $1 price.

- Store Re-merchandising: Adjusting store layouts and product placement to accommodate the new price tiers and highlight value.

- Customer Communication: Marketing efforts to inform customers about the broader selection and value proposition.

- Cost Management: Ensuring profitability by carefully managing the sourcing and pricing of a wider range of products.

Store Development and Optimization

Dollar Tree's key activities heavily involve its physical store network. This includes the ongoing process of developing new locations to expand its reach and optimizing existing ones. A significant part of this strategy is the conversion of stores to their '3.0 model,' which features a broader product selection and enhanced store layouts designed to improve the customer experience and drive sales. In 2024, the company continued this expansion, aiming to add approximately 600 new stores, while also focusing on optimizing its existing footprint by renovating and expanding certain locations.

The company also strategically manages its store portfolio by closing underperforming locations. This ensures that capital and resources are directed towards the most profitable and promising sites, maintaining the overall health and relevance of its retail presence. This dynamic approach to store development and optimization is crucial for Dollar Tree's continued growth and profitability in a competitive retail landscape.

Key Store Development and Optimization Activities:

- New Store Openings: Continuously expanding the store count to capture new markets and customer bases.

- Store Renovations and Model Conversions: Upgrading existing stores to the '3.0 model' to enhance product variety and customer experience.

- Strategic Store Closures: Identifying and closing underperforming locations to optimize the overall retail footprint and profitability.

Dollar Tree's key activities center on its extensive sourcing and procurement operations. The company actively seeks a diverse and rapidly rotating inventory across consumables, seasonal items, and home goods. In 2024, Dollar Tree leveraged its scale, reporting net sales of $31.7 billion for the fiscal year ending February 3, 2024, underscoring the volume of goods managed.

Managing over 9,000 Dollar Tree and Dollar Tree Canada locations is a critical activity, focusing on efficient staffing, inventory control, and customer service. The company continued to refine store operations in 2024 to optimize labor costs and inventory turnover, vital for profitability.

Logistics and supply chain management are paramount, with 18 distribution centers supporting over 17,000 stores. In 2024, Dollar Tree navigated global sourcing complexities and potential tariff impacts, prioritizing resilience and cost optimization in its logistics.

The implementation of expanded price points, from $1.25 to $7, is a significant activity. The Dollar Tree Plus initiative, featuring $3 and $5 items, was a key growth driver in early 2024, contributing to increased average transaction values.

Store development and optimization, including new openings and renovations to the '3.0 model,' are core activities. In 2024, the company aimed to add approximately 600 new stores while optimizing its existing footprint through renovations and strategic closures of underperforming locations.

| Key Activity | Description | 2024 Data/Focus |

| Merchandise Sourcing & Procurement | Identifying trends, negotiating with suppliers for value. | Net sales of $31.7 billion (FYE Feb 3, 2024) reflect massive procurement volume. |

| Store Operations Management | Efficient staffing, inventory control, customer service. | Focus on optimizing labor costs and inventory turnover in 2024. |

| Supply Chain & Logistics | Operating 18 distribution centers, managing product flow. | Navigating global sourcing complexities and cost optimization in 2024. |

| Pricing Strategy Implementation | Introducing multi-price points ($1.25-$7). | Dollar Tree Plus ($3, $5 items) a key growth driver in early 2024. |

| Store Development & Optimization | Opening new stores, renovating to '3.0 model', closing underperformers. | Targeted ~600 new stores in 2024, with ongoing renovations and strategic closures. |

Preview Before You Purchase

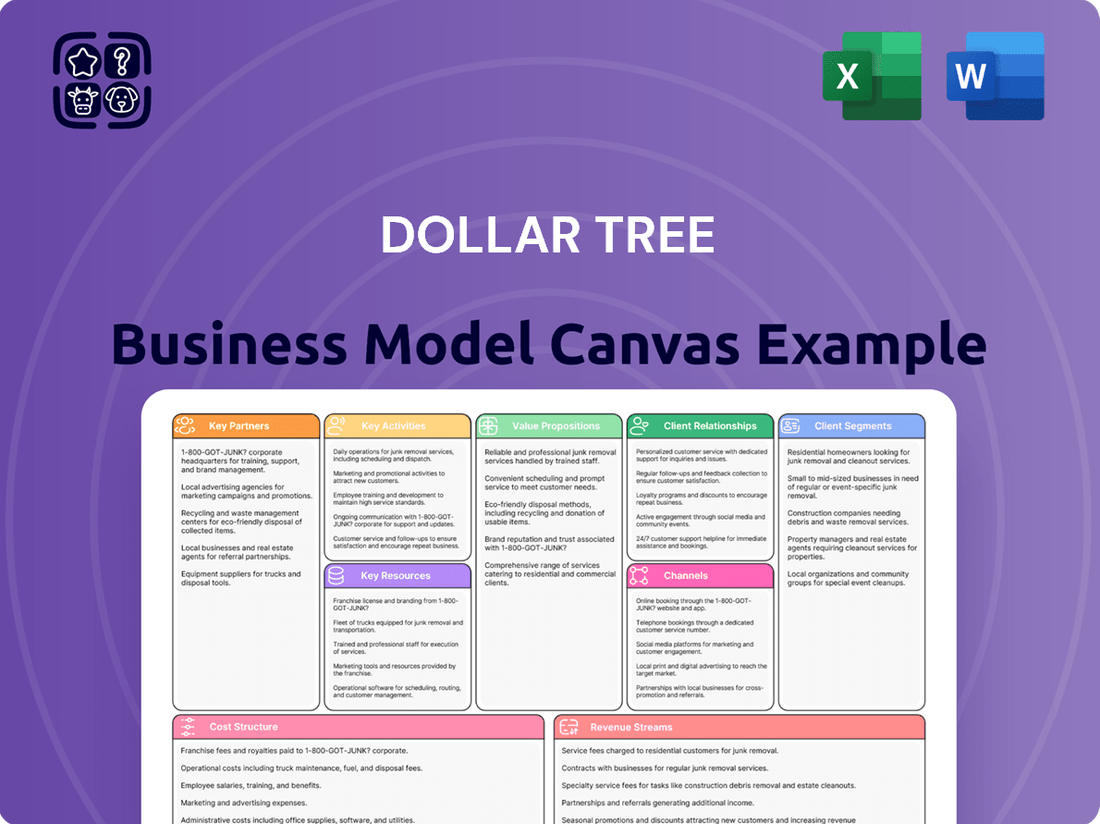

Business Model Canvas

The preview you are viewing is a direct representation of the Dollar Tree Business Model Canvas you will receive upon purchase. This is not a sample or mockup; it is an exact snapshot of the comprehensive document that will be delivered to you. Once your order is complete, you will gain full access to this same professionally structured and ready-to-use Business Model Canvas.

Resources

Dollar Tree's extensive store network, boasting over 9,000 locations across 48 contiguous U.S. states and five Canadian provinces, is a cornerstone of its business model. This vast physical presence ensures remarkable market penetration and unparalleled convenience for its diverse customer base, making it a significant competitive differentiator.

Dollar Tree's operational backbone relies on a robust global supply chain, a key resource that ensures a steady flow of goods. This network is supported by 18 strategically located distribution centers across North America. These centers are vital for efficiently moving products from manufacturers to over 17,000 stores, enabling the company to maintain its value proposition.

The company's extensive distribution network is critical for its business model, allowing for cost-effective management of a vast and diverse product assortment. In 2024, Dollar Tree continued to optimize this infrastructure to meet growing demand and ensure timely replenishment of its stores, a significant factor in its ability to consistently offer low-priced items.

Dollar Tree's merchandise inventory is its lifeblood, a vast and ever-changing collection that includes everything from everyday consumables to seasonal decorations and home essentials. This diverse stock is crucial for attracting a wide customer base seeking value.

The company's success hinges on its capacity to efficiently source, distribute, and manage this inventory. For instance, in fiscal year 2023, Dollar Tree reported a net sales increase of 5.1% to $30.09 billion, demonstrating the strong demand for its product assortment.

Brand Recognition and Customer Loyalty

Dollar Tree's strong brand recognition is a cornerstone resource, built on its consistent promise of extreme value. This recognition fosters customer loyalty, as shoppers trust the brand to deliver affordable everyday items. The company cultivates this loyalty through a unique shopping experience, often described as a "thrill-of-the-hunt," where customers enjoy discovering new and unexpected products at low price points.

This loyalty translates into consistent foot traffic and sales. For instance, Dollar Tree reported net sales of $7.63 billion for the first quarter of 2024, a 5.7% increase year-over-year, demonstrating the enduring appeal of its value proposition. Their ability to maintain this appeal is directly linked to their established brand and the trust it has cultivated.

- Brand Recognition: Dollar Tree is a household name synonymous with low prices and accessible shopping.

- Customer Loyalty: Repeat customers are drawn to the consistent value and the engaging shopping experience.

- Value Proposition: The core offering of deeply discounted products drives consistent demand.

- Shopping Experience: The "thrill-of-the-hunt" aspect encourages exploration and repeat visits.

Human Capital (Associates)

Dollar Tree's approximately 150,000 associates are the bedrock of its daily operations. These individuals are directly responsible for everything from stocking shelves to assisting customers, ensuring a positive shopping experience. Their engagement is vital for maintaining the company's value proposition of affordability and accessibility.

The effectiveness of these associates directly impacts customer satisfaction and operational efficiency. In 2023, Dollar Tree reported total operating expenses of $6.2 billion, a significant portion of which is attributed to its workforce. This highlights the substantial investment in human capital required to manage its vast retail footprint.

- Workforce Size: Approximately 150,000 associates.

- Key Responsibilities: Daily store operations, customer service, and enhancing the shopping experience.

- Financial Impact: A significant component of the company's operating expenses, reflecting the importance of human capital.

Dollar Tree's intellectual property, including its proprietary sourcing methods and merchandising strategies, is a critical intangible asset. These elements allow the company to consistently secure products at prices that support its value proposition. The company's ability to innovate in product selection and presentation, while maintaining extreme affordability, is a key differentiator in the discount retail sector.

The company's financial resources, including its access to capital and credit, are essential for funding its vast operations, inventory purchases, and expansion initiatives. Robust financial management allows Dollar Tree to navigate market fluctuations and maintain its competitive pricing. In the first quarter of 2024, Dollar Tree reported a strong balance sheet, enabling continued investment in its store base and supply chain infrastructure.

| Resource Category | Key Components | Fiscal Year 2023/Q1 2024 Data |

|---|---|---|

| Intellectual Property | Sourcing Strategies, Merchandising Techniques | Proprietary methods drive consistent low pricing. |

| Financial Resources | Capital Access, Credit Lines, Cash Flow | Net sales of $7.63 billion in Q1 2024 reflect strong financial health. |

Value Propositions

Dollar Tree's core promise is unbeatable affordability, with the vast majority of its products priced at a mere $1.25. This extreme value proposition is a powerful draw for shoppers actively seeking to stretch their budgets. In 2024, this focus on low price points continues to resonate, attracting a broad customer base.

Beyond the deeply budget-conscious, Dollar Tree's pricing strategy also appeals to a wider demographic, including middle and higher-income consumers looking for deals on everyday items and discretionary purchases. This broad appeal allows them to capture market share across various economic segments.

The company has also strategically expanded its price points to include items up to $7, offering a wider assortment while maintaining the perception of overall affordability. This allows them to cater to more diverse needs without alienating their core value-driven customer.

Dollar Tree cultivates a 'thrill-of-the-hunt' shopping experience, drawing customers in with the allure of discovering unexpected treasures and exceptional deals. This element of surprise is a key driver of customer engagement.

The constant rotation of their merchandise, with new items appearing frequently, incentivizes repeat visits. In 2023, Dollar Tree reported a net sales increase of 5.7% to $30.3 billion, demonstrating the effectiveness of their customer acquisition and retention strategies.

Dollar Tree's extensive store network, boasting over 17,000 locations as of early 2024, is a cornerstone of its convenience and accessibility value proposition. This widespread presence ensures that customers, even in rural or underserved areas, have a Dollar Tree nearby for their shopping needs.

The sheer density of its store footprint makes Dollar Tree a readily available option for a broad customer base seeking both everyday essentials and impulse buys. This accessibility directly translates into customer loyalty and frequent visits, as the brand is often the most convenient choice.

In 2023, Dollar Tree reported a net sales increase of 8.7% to $30.2 billion, underscoring the effectiveness of its accessible store model in driving revenue and reaching a vast customer segment. This growth highlights how convenience fuels customer engagement and purchasing behavior.

Broad Assortment of Merchandise

Dollar Tree's value proposition centers on its broad assortment of merchandise, providing customers with a wide variety of goods. This includes everyday essentials, seasonal decorations, and home goods, all at accessible price points.

The company's strategic move to include multi-price points, such as $1.25 and $5 items, significantly broadens this assortment. This allows Dollar Tree to offer larger sizes and even national brand products, meeting a wider range of consumer demands and preferences.

- Diverse Categories: From consumables and party supplies to home décor and seasonal items, Dollar Tree stocks a vast array of products.

- Expanded Price Points: The introduction of $1.25 and $5 price points allows for a more varied selection, including bigger ticket items and national brands.

- Value Perception: This wide assortment, coupled with the affordability, creates a strong perception of value for shoppers seeking variety and savings.

- Customer Reach: The broad merchandise offering appeals to a diverse customer base with differing needs and shopping missions.

Everyday Essentials and Seasonal Goods

Dollar Tree serves as a dependable provider of everyday necessities, stocking items like household paper, food, health, and personal care products. This consistent availability caters to the regular needs of consumers.

The company also excels in offering a wide array of seasonal merchandise, perfectly timed for holidays and special events. This strategic offering ensures Dollar Tree remains relevant for both routine purchases and celebratory shopping occasions.

- Everyday Consumables: Household paper, food, health, and personal care items form a core part of Dollar Tree's value proposition, ensuring consistent customer traffic.

- Seasonal Merchandise: A robust selection of seasonal goods for holidays and events drives incremental sales and attracts customers looking for timely, affordable decorations and gifts.

- Dual Focus: The combination of everyday essentials and seasonal items provides a broad appeal, making Dollar Tree a go-to destination for a variety of consumer needs throughout the year.

Dollar Tree's value proposition is built on extreme affordability, with most items priced at $1.25, a core tenet that continues to attract budget-conscious shoppers in 2024. This low-price strategy broadens its appeal beyond the deeply frugal, drawing in middle and higher-income consumers seeking deals on everyday and discretionary items, thereby capturing market share across various economic segments.

The company has strategically expanded its price points to include items up to $7, offering a wider assortment without sacrificing its core affordability image. This allows Dollar Tree to cater to more diverse needs, including national brands and larger items, enhancing its appeal and driving repeat business.

Dollar Tree's extensive store network, exceeding 17,000 locations by early 2024, provides unparalleled convenience and accessibility. This widespread presence ensures easy access for a broad customer base, including those in underserved areas, making it a readily available option for essentials and impulse purchases.

The constant rotation of merchandise, featuring new items regularly, incentivizes repeat visits, a strategy that proved effective with net sales increasing by 5.7% to $30.3 billion in 2023. This dynamic inventory keeps the shopping experience fresh and encourages customers to return frequently to discover new treasures.

| Value Proposition Component | Description | Key Differentiator | 2023/2024 Data Point |

|---|---|---|---|

| Extreme Affordability | Majority of items priced at $1.25. | Unbeatable price point for a wide range of goods. | Continued focus in 2024. |

| Broad Assortment | Everyday essentials, seasonal items, home goods, party supplies. | One-stop shop for diverse needs at low prices. | Expanded to include multi-price points ($1.25, $5). |

| Convenience & Accessibility | Extensive store network. | Easy access for a wide demographic, even in rural areas. | Over 17,000 locations by early 2024. |

| Shopping Experience | 'Thrill-of-the-hunt' with rotating merchandise. | Encourages repeat visits and impulse buys through discovery. | Net sales increased 5.7% to $30.3 billion in 2023. |

Customer Relationships

Dollar Tree's customer relationships are largely transactional, a natural outcome of its deeply ingrained low-price strategy. Shoppers visit for immediate needs, expecting a quick and efficient experience rather than personalized engagement.

The self-service model is paramount, with customers browsing, selecting, and checking out with minimal staff interaction. This focus on convenience and speed is key to managing the high volume of transactions, especially during peak times. In 2023, Dollar Tree reported net sales of $30.2 billion, reflecting the success of this high-volume, low-touch approach.

Dollar Tree cultivates customer relationships by consistently offering a wide array of products at a fixed, low price point, fostering a sense of dependable value. This strategy encourages repeat visits from budget-conscious shoppers who appreciate the ability to stretch their dollars further.

The loyalty of Dollar Tree customers is largely built on the perceived savings and the satisfaction derived from making their money go further. In 2024, Dollar Tree reported strong performance, with net sales increasing by 5.7% to $32.9 billion for the fiscal year, indicating that this value-driven approach resonates with a broad customer base.

Dollar Tree's in-store experience, though largely transactional, significantly shapes customer relationships. The company focuses on maintaining organized stores and a consistent shopping environment, fostering a sense of reliability for its shoppers.

The unique 'thrill-of-the-hunt' element is a key driver of customer engagement. This aspect encourages repeat visits as customers anticipate discovering new, unexpected value items at the fixed price point.

In 2024, Dollar Tree continued to invest in store presentation and operational efficiency to enhance this in-store experience. This commitment aims to reinforce customer loyalty amidst a competitive retail landscape.

Limited Direct Personalization

Dollar Tree's business model, centered on high volume and a consistent low price point, means direct, personalized customer relationships are minimal. The company prioritizes efficient operations and broad appeal over individual customer tailoring.

- Broad Customer Segments: The focus is on attracting a wide range of shoppers by offering a consistent value proposition across all stores.

- Product Assortment and Pricing: Customer engagement is primarily driven by the extensive variety of products available at the $1.25 price point, rather than personalized interactions.

- Limited Direct Engagement: In 2023, Dollar Tree reported serving millions of customers weekly, highlighting the scale of their operations which naturally limits individualized customer service.

- In-Store Experience: The primary customer interaction occurs within the store environment, emphasizing product discovery and value.

Community Integration

Dollar Tree actively seeks to integrate into the communities where it operates, positioning itself as a dependable and convenient retail choice. This approach aims to build a positive customer relationship by being a consistent presence in diverse neighborhoods.

By offering affordable products, Dollar Tree can become a valued resource, particularly in areas where budget-conscious shopping is a priority. This accessibility fosters a sense of reliance and goodwill among local shoppers.

- Community Presence: Dollar Tree operates over 17,000 stores across North America as of early 2024, demonstrating a significant commitment to serving local communities.

- Affordability as a Pillar: The company's core value proposition of offering items at a fixed price point of $1.25 (as of recent adjustments) makes it an accessible option for a broad customer base.

- Local Economic Impact: By providing employment opportunities and a convenient shopping destination, Dollar Tree contributes to the local economic fabric, indirectly strengthening customer ties.

Dollar Tree's customer relationships are primarily transactional, built on consistent value and convenience. The company fosters loyalty through its dependable low-price strategy and the engaging in-store experience of product discovery. By maintaining a strong community presence and offering accessible, affordable goods, Dollar Tree cultivates a sense of reliability and goodwill among its broad customer base.

| Aspect | Description | Supporting Data (2023/2024) |

|---|---|---|

| Relationship Type | Largely transactional, self-service oriented. | Net sales reached $30.2 billion in 2023, indicating high transaction volume. |

| Key Drivers | Consistent low prices ($1.25 price point), product variety, 'thrill-of-the-hunt'. | Fiscal year 2024 net sales grew 5.7% to $32.9 billion, showing sustained customer appeal. |

| Customer Engagement | In-store experience, community presence, perceived savings. | Operates over 17,000 stores as of early 2024, serving millions weekly. |

Channels

Dollar Tree's primary channel is its vast network of physical retail stores. As of early 2024, the company operated over 16,000 stores across the United States and Canada under banners like Dollar Tree and Family Dollar. These locations are crucial for delivering products directly to customers and offering a distinctive in-store shopping experience.

Dollar Tree utilizes a limited e-commerce strategy focused on in-store pickup, allowing customers to conveniently order online and collect their purchases at a physical store. This approach bridges the gap between online browsing and immediate, tangible access to merchandise.

In 2023, Dollar Tree reported a net sales increase of 5.7% to $30.09 billion, with their omnichannel initiatives, including e-commerce and curbside pickup, contributing to this growth. This indicates a positive customer response to their efforts to integrate digital and physical shopping experiences.

Dollar Tree's distribution centers are the backbone of its operations, acting as crucial internal channels that ensure products reach over 17,000 stores efficiently. These facilities manage the flow of goods from manufacturers to the retail floor, a complex logistical undertaking supporting the company's value proposition of low-priced, accessible merchandise.

In fiscal year 2023, Dollar Tree operated 26 distribution centers strategically located across the United States and Canada. The company continues to invest in expanding and modernizing this network, with plans for new facilities to accommodate growth and improve delivery times, underscoring their importance in the business model.

Advertising and Promotional Circulars

Dollar Tree leverages advertising and promotional circulars as a key channel to communicate value. These materials highlight new arrivals, seasonal collections, and compelling price points, effectively drawing shoppers into their physical locations. For instance, their weekly ad circulars are a cornerstone of their customer outreach, detailing the latest discounts and product assortments designed to encourage impulse buys and repeat visits.

In-store signage complements these circulars, reinforcing promotions and guiding customer purchasing decisions at the point of sale. This dual approach ensures consistent brand messaging and maximizes the impact of their low-price strategy. In 2023, Dollar Tree continued to invest in these traditional advertising methods, recognizing their effectiveness in reaching their broad customer base.

The effectiveness of these channels is evident in their ability to drive foot traffic and sales, especially during key shopping periods. Dollar Tree's commitment to this advertising strategy underscores its importance in maintaining customer engagement and promoting its unique value proposition.

- Traditional Advertising: Circulars and in-store signage are vital for announcing new products, seasonal items, and deals.

- Driving Traffic: These promotional tools are designed to bring customers into Dollar Tree stores.

- Customer Communication: They serve as a primary method for informing the customer base about current offerings.

- Value Proposition: Advertising reinforces Dollar Tree's core strategy of providing everyday low prices.

Digital Presence (Website and Social Media)

Dollar Tree leverages its website and social media platforms to establish a robust digital presence. These channels serve as key informational hubs, allowing customers to easily discover product offerings, locate nearby stores, and stay updated on promotions. As of Q1 2024, Dollar Tree reported over 17,000 stores across North America, underscoring the need for accessible digital information for its vast customer base.

- Website Functionality: The Dollar Tree website provides essential details including store hours, addresses, and a store locator feature.

- Social Media Engagement: Active social media profiles on platforms like Facebook and Instagram are used for brand building and customer interaction.

- Promotional Dissemination: Digital channels are crucial for communicating sales events and new product arrivals to a wide audience.

Dollar Tree's channels are a blend of extensive physical retail presence and growing digital engagement. Their core strategy relies on over 17,000 physical stores across North America, serving as the primary point of customer interaction and purchase. This vast footprint is supported by a robust distribution network, ensuring efficient product flow. While e-commerce is limited, it complements the physical stores through options like in-store pickup, enhancing customer convenience and contributing to sales growth, with net sales reaching $30.09 billion in 2023.

| Channel Type | Description | Key Data/Impact |

|---|---|---|

| Physical Stores | Vast network of Dollar Tree and Family Dollar locations. | Over 17,000 stores across North America as of early 2024. |

| E-commerce/Digital | Website and social media for information and limited online ordering. | Supports in-store pickup, contributing to 5.7% net sales increase in 2023. |

| Distribution Centers | Internal logistics network for product delivery. | 26 centers in fiscal year 2023, with ongoing investment for expansion. |

| Advertising/Promotions | Circulars, in-store signage, and digital marketing. | Drives foot traffic and reinforces value proposition of low prices. |

Customer Segments

Budget-Conscious Shoppers represent Dollar Tree's bedrock customer base. They are driven by the pursuit of exceptional value, actively seeking out the most affordable options for a wide array of goods. This segment is particularly sensitive to price points, making Dollar Tree's consistent $1.25 price per item a significant draw for their everyday needs and impulse buys.

Dollar Tree's appeal is broadening, drawing in customers from all income brackets who are prioritizing savings due to persistent inflation. This trend is particularly evident as consumers across the spectrum actively seek ways to stretch their budgets on everyday items.

In 2024, this value-seeking behavior is a significant driver for Dollar Tree. For instance, reports indicate that discount retailers, including those like Dollar Tree, have seen an uptick in traffic from consumers who might not have traditionally shopped there, demonstrating a widespread desire to cut costs.

Everyday shoppers for consumables represent a core customer segment for Dollar Tree, seeking value and convenience for their routine purchases. This group includes individuals and families who regularly buy items like groceries, personal care products, and cleaning supplies, making Dollar Tree a go-to destination for their everyday needs.

In 2024, Dollar Tree continued to focus on this segment by expanding its assortment of essential consumables, aiming to capture a larger share of household spending on these frequently bought items. The company's strategy often involves offering a wide variety of national brand products alongside its private label offerings, catering to diverse preferences and budgets.

Seasonal and Event Shoppers

Dollar Tree’s customer base significantly includes seasonal and event shoppers who are drawn to the retailer’s vast array of holiday and occasion-specific merchandise. This segment actively seeks out decorations, party favors, and themed items for events like Halloween, Christmas, Easter, and birthdays. The company’s ability to stock relevant, affordable products for these periods is a major draw.

The appeal to this segment is amplified by Dollar Tree's consistent introduction of new seasonal collections throughout the year. For instance, during the 2023 holiday season, Dollar Tree reported strong sales performance, with comparable store sales increasing by 3.7%, indicating robust demand for seasonal items. This trend is expected to continue into 2024 as consumers look for budget-friendly ways to celebrate and decorate.

- Seasonal Demand: Customers purchase decorations and supplies for holidays like Christmas, Halloween, and Easter.

- Event Focus: This segment also buys party supplies for birthdays, anniversaries, and other celebrations.

- Value Proposition: Dollar Tree’s low price point makes it an attractive destination for disposable event and seasonal goods.

- Sales Impact: Seasonal merchandise often drives significant comparable store sales increases, as seen in past holiday quarters.

Rural and Underserved Community Residents

Dollar Tree recognizes the vital role it plays in rural and underserved areas, often being the primary source for everyday necessities. In 2024, the company continued its strategic store expansion, with a significant portion of new locations targeting these communities where access to affordable retail is limited. This approach directly addresses the needs of residents who may otherwise face long travel distances to access essential goods.

The affordability of Dollar Tree's product assortment is particularly impactful for these customer segments. By offering a wide range of items at a fixed price point, the company provides a predictable and manageable way for individuals and families to stretch their budgets. This is crucial in areas where disposable income may be lower, making every dollar count.

- Primary Retailer: In many rural and underserved areas, Dollar Tree is the sole or primary provider of affordable household goods, groceries, and seasonal items.

- Economic Impact: The presence of a Dollar Tree store can stimulate local economies by providing jobs and making essential shopping more convenient for residents.

- Accessibility Focus: As of early 2024, Dollar Tree reported operating thousands of stores across the nation, with a deliberate strategy to increase penetration in smaller towns and less populated regions.

Dollar Tree's customer base is broad, encompassing value-driven shoppers across all income levels, particularly those seeking savings amidst economic pressures. This includes everyday shoppers who rely on the retailer for consumables and seasonal shoppers looking for affordable decorations and party supplies.

Furthermore, Dollar Tree serves as a critical retail option in rural and underserved communities, often acting as the primary source for essential goods. The company's expansion strategy in 2024 specifically targets these areas, acknowledging the significant need for accessible, low-cost merchandise.

In 2023, Dollar Tree reported a 4.0% increase in total revenue, reaching $34.18 billion, reflecting the strong demand from these diverse customer segments. The company's consistent ability to offer products at a fixed price point, such as the $1.25 price for most items, remains a key attraction.

| Customer Segment | Key Motivations | 2023/2024 Relevance |

|---|---|---|

| Value-Conscious Shoppers | Price sensitivity, seeking discounts | Core demographic; inflation drives increased traffic from all income levels. |

| Everyday Shoppers (Consumables) | Convenience, affordability for routine purchases | Steady demand for groceries, cleaning, and personal care items; expanded assortment in 2024. |

| Seasonal/Event Shoppers | Affordable decorations, party supplies for holidays/events | Strong sales driver, particularly during Q4; new seasonal collections introduced regularly. |

| Rural/Underserved Communities | Limited retail options, need for affordable necessities | Strategic growth area; increased store openings in smaller towns and less populated regions in 2024. |

Cost Structure

The cost of goods sold is a significant part of Dollar Tree's expenses, representing the direct costs of the products they sell. This includes everything from buying merchandise from manufacturers to getting it to their stores. For instance, in fiscal year 2023, Dollar Tree reported a Cost of Goods Sold of $25.09 billion.

Their ability to manage these costs hinges on their considerable purchasing power, strong negotiations with suppliers, and their global sourcing strategies. Tariffs and import duties also play a role in these direct costs, impacting the final price of goods.

Selling, General, and Administrative (SG&A) expenses are a major cost driver for Dollar Tree, covering essential operational elements like store staff wages, utility costs, advertising campaigns, and the salaries of corporate management. In 2023, Dollar Tree's SG&A expenses amounted to approximately $3.5 billion, highlighting their substantial impact on the company's bottom line.

Efficiently controlling these SG&A costs is paramount for maintaining profitability, particularly as the company navigates increasing labor costs due to wage adjustments and invests in store renovations and technology upgrades. For instance, the company's commitment to improving the customer experience and store infrastructure in 2024 will likely see continued investment in store payroll and operational support, directly impacting SG&A.

Dollar Tree's extensive supply chain and distribution network represent a significant cost. Operating and maintaining these facilities, which include numerous distribution centers, requires substantial investment in infrastructure, technology, and personnel. In fiscal year 2023, the company reported total operating expenses of $7.34 billion, a portion of which is directly attributable to these supply chain operations.

Transportation costs, a key component of distribution, are heavily influenced by fluctuating fuel prices and the overall efficiency of logistics. In 2023, Dollar Tree's cost of goods sold was $6.77 billion, with transportation being a major factor within that figure. The company's ability to manage these expenses hinges on optimizing routes, negotiating favorable carrier contracts, and leveraging economies of scale.

Inventory management also contributes significantly to the cost structure. Holding vast amounts of merchandise across its distribution centers and stores incurs costs related to warehousing, insurance, and potential obsolescence. Efficient inventory turnover and precise demand forecasting are crucial for mitigating these expenses and ensuring product availability without excessive carrying costs.

Store Occupancy Costs

Store occupancy costs are a major component of Dollar Tree's expenses. These include rent, property taxes, and maintenance for its extensive store base. In fiscal year 2023, Dollar Tree operated over 16,000 stores, each requiring dedicated space and ongoing upkeep, making these costs a substantial fixed overhead.

The variability of these costs is significant, influenced by prime retail locations and store size. Leases are negotiated for each property, meaning terms, rent amounts, and escalation clauses differ widely. This decentralized approach to real estate management necessitates careful budgeting for each store's operational footprint.

- Rent Expenses: A primary driver, directly tied to lease agreements for each of its over 16,000 locations as of fiscal year 2023.

- Lease Terms: Varying by location and store size, impacting the long-term financial commitment for each property.

- Property Taxes and Insurance: Additional occupancy-related expenses that fluctuate based on property assessments and coverage needs.

- Maintenance and Utilities: Costs associated with keeping each store operational and presentable to customers.

Capital Expenditures (CapEx)

Dollar Tree's cost structure is heavily influenced by significant capital expenditures (CapEx). These investments are primarily directed towards expanding its store footprint through new openings, enhancing existing locations via renovations, particularly the conversion to the more efficient 3.0 store model, and implementing crucial technological upgrades across its operations.

The company anticipates its capital expenditures to reach a high point in 2025, reflecting the ongoing multi-year investment cycle aimed at modernizing its store base and driving future growth. For instance, in the first quarter of 2024, Dollar Tree reported CapEx of $317.5 million, a substantial increase from $213.4 million in the same period of the prior year, underscoring the ramp-up in these investments.

- New Store Openings: Continued investment in expanding the store network to reach new customer bases.

- Store Renovations: Significant spending on upgrading existing stores, with a focus on the 3.0 model for improved efficiency and customer experience.

- Technological Upgrades: Investments in IT infrastructure and systems to support operational improvements and data analytics.

- 2025 CapEx Peak: The company has guided for substantial CapEx in 2025, indicative of the ongoing strategic investments.

Dollar Tree's cost structure is dominated by the cost of goods sold, which was $25.09 billion in fiscal year 2023, reflecting their massive purchasing power and global sourcing. Selling, General, and Administrative (SG&A) expenses, totaling approximately $3.5 billion in 2023, cover operational necessities like labor and marketing, with ongoing investments in store improvements expected to impact this category further in 2024. Significant capital expenditures are also a key cost, with $317.5 million spent in Q1 2024 alone, primarily for store expansion and renovations, and a projected peak in 2025.

| Cost Category | FY 2023 (Approx.) | Key Drivers |

| Cost of Goods Sold | $25.09 billion | Merchandise procurement, supplier negotiations, tariffs |

| SG&A Expenses | $3.5 billion | Store labor, utilities, marketing, corporate salaries |

| Capital Expenditures (Q1 2024) | $317.5 million | New stores, renovations (3.0 model), technology upgrades |

Revenue Streams

Dollar Tree's main way of making money is by selling stuff in its stores. For a long time, everything was a dollar, but now they have a lot of items priced higher, like $3, $5, and even $7. This multi-price strategy is a key part of their business model.

In the first quarter of 2024, Dollar Tree reported net sales of $7.09 billion, showing the significant volume of merchandise sold. The introduction of multi-price point items, particularly at Family Dollar, is a strategic move to capture a wider range of consumer spending and improve overall profitability.

Dollar Tree's revenue heavily relies on selling everyday consumables like food, cleaning supplies, and personal care items. These products encourage customers to visit frequently, leading to steady sales. In 2023, consumable products were a major contributor to their overall financial performance, reflecting the demand for value-priced necessities.

Dollar Tree's revenue gets a significant boost from seasonal and discretionary product sales. Think holiday decorations, party supplies, toys, and craft items. These items tap into what customers call the thrill-of-the-hunt, making shopping an engaging experience and often encouraging shoppers to buy more than they initially planned, increasing the average basket size.

In the first quarter of 2024, Dollar Tree reported a net sales increase of 5.7% to $7.09 billion. While not broken down by specific product categories, this overall growth indicates the continued importance of their diverse product mix, including these popular seasonal and discretionary offerings, in driving top-line performance.

Dollar Tree Canada Sales

Dollar Tree Canada's sales are a significant component of the company's overall revenue, demonstrating its reach and performance within the Canadian retail landscape. These operations directly contribute to the top line, reflecting consumer demand for the value-oriented products offered under the Dollar Tree banner in Canada.

For the fiscal year 2023, Dollar Tree Canada reported a notable contribution to the company's financial results. While specific segment reporting can vary, the company's consolidated financial statements provide insight into the performance of its international segments, which include Canada.

- Dollar Tree Canada Sales Contribution: Reflects the revenue generated from all Dollar Tree branded stores operating within Canada.

- Market Presence: Indicates the company's established footprint and sales volume in the Canadian market.

- Fiscal Year 2023 Performance: The Canadian segment played a role in the company's overall financial performance, with specific figures detailed in their annual reports.

Potential Future E-commerce Sales

While Dollar Tree's primary sales channel remains its brick-and-mortar stores, the company is exploring avenues to enhance its digital presence. Any future expansion into direct-to-consumer e-commerce, beyond current in-store pickup options, could unlock a significant new revenue stream.

This digital channel would complement existing sales, potentially attracting a broader customer base and increasing overall transaction volume. For instance, in 2024, Dollar Tree reported a net sales increase of 5.7% to $30.06 billion for the fiscal year ending January 28, 2024, indicating a strong foundation for digital growth.

- E-commerce Expansion: Developing a robust direct-to-consumer platform could tap into online shopping trends.

- Customer Reach: Online sales can extend the company's reach beyond its physical store locations.

- Sales Complementarity: E-commerce can offer an additional purchasing option, boosting overall revenue.

Dollar Tree's revenue streams are primarily driven by its extensive network of physical retail stores. The company's strategic shift to a multi-price point model, with items now commonly priced at $1.25, $3, $5, and $7, broadens its appeal and allows for greater margin potential on a wider variety of goods.

Consumable products, including food and household essentials, form a core revenue driver due to their frequent purchase cycle and consistent demand. Seasonal and discretionary items, such as decorations and party supplies, also contribute significantly by creating shopping excitement and encouraging impulse buys.

Dollar Tree Canada represents another key revenue stream, reflecting the brand's international presence and success in attracting Canadian consumers to its value-oriented offerings.

The company also generates revenue from its Family Dollar segment, which operates under a different brand and often targets a slightly different customer demographic, though it also focuses on value.

| Segment | Q1 2024 Net Sales (Billions) | Year-over-Year Growth (Approx.) |

|---|---|---|

| Dollar Tree | $3.44 | +7.0% |

| Family Dollar | $3.65 | +4.4% |

| Total Company | $7.09 | +5.7% |

Business Model Canvas Data Sources

The Dollar Tree Business Model Canvas is built using extensive market research, competitor analysis, and internal financial data. This ensures each component, from value proposition to cost structure, is informed by current industry realities and operational efficiency.