Dollar Tree Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dollar Tree Bundle

Curious about Dollar Tree's strategic positioning? This glimpse into their BCG Matrix highlights key product categories, but the full report unveils the complete picture. Understand which items are driving growth, which are sustaining profits, and where potential challenges lie.

Unlock the full strategic potential of Dollar Tree's business by purchasing the complete BCG Matrix. Gain a detailed, quadrant-by-quadrant analysis that reveals actionable insights for optimizing your investment and product development strategies.

Stars

The Dollar Tree banner, anchored by its core $1.25 price point, continues to be a powerful draw for consumers, especially when economic conditions are less predictable. This segment consistently sees robust customer traffic, underscoring its strong value proposition and its foundational role in the Dollar Tree brand. In fact, for the fiscal year 2023, Dollar Tree reported a 7.0% increase in comparable store sales for the Dollar Tree segment, a testament to its enduring appeal.

Dollar Tree's consumables, encompassing food, health, and beauty, are a booming segment, showing robust demand. Consumers are increasingly focused on essential items, a trend amplified by ongoing inflation. This strategic focus has propelled Dollar Tree to achieve notable market share increases within the consumables sector, with its dollar growth outperforming the general market. For instance, in the first quarter of 2024, Dollar Tree reported a 1.2% increase in same-store sales for the consumables category, a testament to its resilience and appeal.

Dollar Tree's new 3.0 store format, featuring a wider range of price points including $3, $5, and up to $7 items, is demonstrating strong performance. This evolution is directly contributing to higher sales and a more engaged customer base.

These revamped stores are not only drawing in more shoppers but are also seeing an increase in the average amount each customer spends. This suggests Dollar Tree's strategy to diversify its product offerings beyond the traditional $1 price point is resonating well with consumers, attracting a broader audience and encouraging larger purchases.

New Store Openings and Lease Acquisitions

Dollar Tree is aggressively pursuing market share growth through a robust expansion strategy. This includes the strategic acquisition of leases from bankrupt competitors, such as the recent deal involving 99 Cents Only Stores, which will facilitate numerous new store openings.

This real estate expansion is a key component of Dollar Tree's plan to enter new geographic markets and fortify its presence in established ones. The company aims to capitalize on these opportunities for rapid growth and increased market penetration.

- Aggressive Lease Acquisitions: Dollar Tree secured approximately 170 leases from 99 Cents Only Stores following its bankruptcy filing in 2024.

- New Store Opening Targets: The company plans to open around 600 new stores in fiscal year 2024, with a long-term goal of reaching 10,000 stores across the U.S.

- Market Share Expansion: This expansion is designed to capture market share from competitors and solidify Dollar Tree's position as a leading discount retailer.

Strategic Portfolio Optimization (Post-Family Dollar Divestiture)

The strategic decision to divest the underperforming Family Dollar business allows Dollar Tree to sharpen its focus and allocate capital more effectively towards its core Dollar Tree banner. This move is designed to streamline operations and boost efficiency, paving the way for increased investment in high-growth, high-return opportunities within the Dollar Tree brand.

This strategic realignment is anticipated to unlock significant value by concentrating resources on the more robust Dollar Tree segment. For instance, Dollar Tree reported a net sales increase of 1.2% to $7.71 billion for the first quarter of fiscal year 2024, with same-store sales at the Dollar Tree banner growing by 3.0%. This demonstrates the underlying strength and potential of the core business post-divestiture.

- Focus on Core Growth: Divesting Family Dollar allows Dollar Tree to concentrate on expanding and improving its successful Dollar Tree brand.

- Capital Reallocation: Freed-up capital can be reinvested in initiatives expected to yield higher returns for the core business.

- Operational Efficiency: Streamlining operations by shedding a struggling segment can lead to improved overall efficiency and profitability.

- Enhanced Profitability Potential: By focusing on its stronger banner, Dollar Tree aims to improve its overall financial performance and shareholder value.

The Dollar Tree banner, with its core $1.25 price point, is a strong performer, consistently attracting customers seeking value. Its consumables segment, in particular, is experiencing robust demand, with Dollar Tree outperforming the general market in this category. The company's strategic expansion, including acquiring leases from competitors like 99 Cents Only Stores in 2024, further solidifies its position.

| Metric | Fiscal Year 2023 | Fiscal Year 2024 (Q1) |

|---|---|---|

| Dollar Tree Segment Comp. Sales Growth | 7.0% | 3.0% |

| Consumables Comp. Sales Growth | N/A (Category focus) | 1.2% |

| New Stores Opened (FY24 Target) | N/A | ~600 |

| Leases Acquired (2024) | N/A | ~170 (from 99 Cents Only Stores) |

What is included in the product

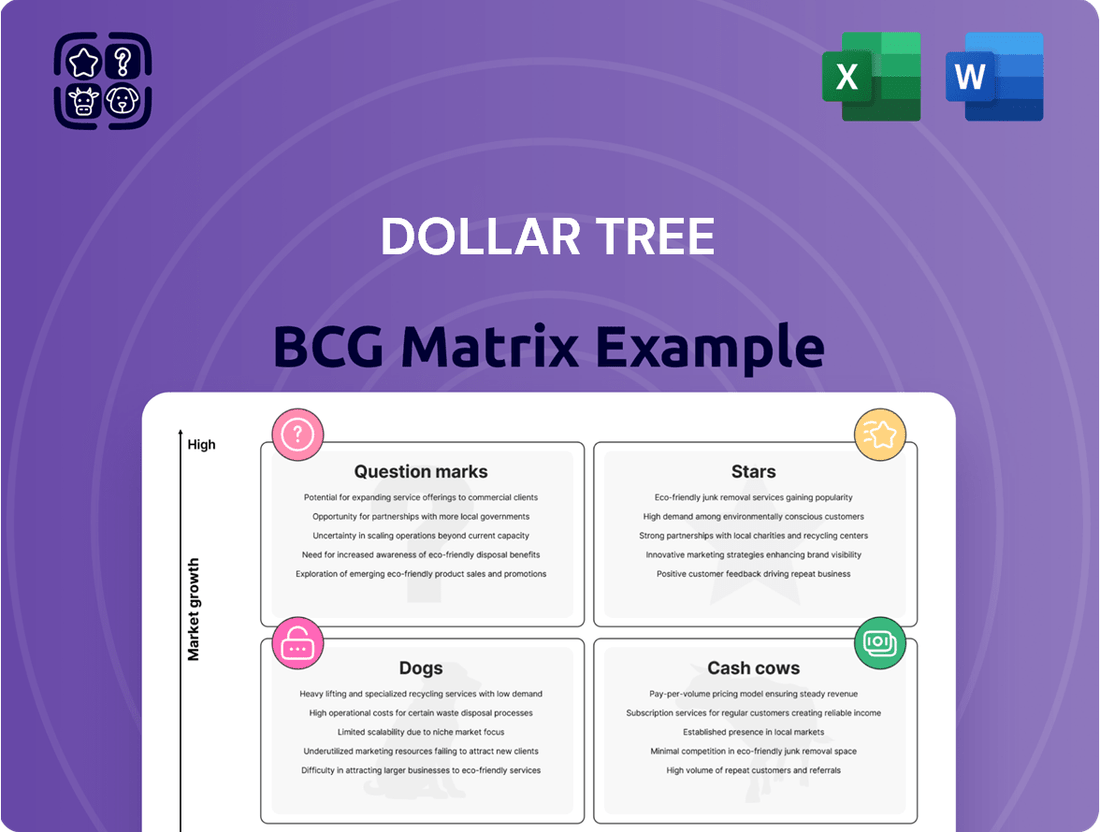

Dollar Tree's BCG Matrix would analyze its diverse product categories, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

A clear visualization of Dollar Tree's business units in the BCG matrix, simplifying complex portfolio analysis.

Cash Cows

Dollar Tree Canada, though smaller than its U.S. counterpart, functions as a reliable Cash Cow within the broader Dollar Tree portfolio. Its strategy mirrors the U.S. model, emphasizing affordability and everyday essentials, which fosters consistent consumer demand and predictable revenue streams.

The Canadian market's consumer habits, closely aligned with those in the United States, further bolster Dollar Tree Canada's stability. This segment likely contributes steady cash flow, allowing the parent company to invest in other growth areas.

Many existing Dollar Tree stores, especially those not yet converted to the 3.0 model, are mature assets. They benefit from established customer loyalty and dependable sales figures.

These locations, anchored by the consistent $1.25 price point, are significant cash generators. They require minimal ongoing investment for marketing or inventory placement, solidifying their cash cow status.

For instance, in fiscal year 2023, Dollar Tree reported total sales of $30.59 billion. A substantial portion of this revenue likely stems from these well-established, non-converted locations.

Seasonal and home product categories at Dollar Tree, while influenced by trends, typically boast higher profit margins than consumables. These items are crucial cash generators, especially during peak holiday seasons, contributing significantly to the banner's overall financial health.

In 2024, Dollar Tree continued to leverage these categories to drive profitability. For instance, their Q1 2024 earnings report highlighted strong performance in discretionary segments, which often include seasonal and home decor items, demonstrating their consistent ability to capture consumer spending during key periods.

Efficient Supply Chain and Logistics Network

Dollar Tree's extensive nationwide logistics network is a significant asset, directly contributing to its status as a cash cow. This established infrastructure allows for efficient distribution, which in turn fuels strong cash flow generation.

The company's ongoing investments in supply chain optimization, including initiatives like RotaCart delivery, are designed to further enhance operational efficiency. These improvements not only reduce costs but also accelerate product availability, directly bolstering profitability and reinforcing its cash cow position.

- Efficient Distribution: Dollar Tree operates a vast network of distribution centers strategically located across the United States, ensuring timely and cost-effective delivery of goods to its numerous stores.

- Cost Reduction through Logistics: Investments in supply chain technology and processes, such as RotaCart, aim to lower per-unit transportation and handling costs, directly increasing profit margins.

- Speed to Market: Optimizing the logistics network allows Dollar Tree to get products from suppliers to store shelves faster, enabling quicker response to consumer demand and maximizing sales opportunities.

- Strong Cash Flow Generation: The efficiency derived from its logistics network allows Dollar Tree to maintain healthy profit margins and convert sales into robust cash flow, characteristic of a cash cow business.

Loyal Customer Base Seeking Value

Dollar Tree benefits from a robust and loyal customer base, especially those value-seeking consumers who regularly shop for everyday necessities. This consistent demand translates into a stable and predictable revenue stream, enabling the company to generate significant cash flow from repeat business. For instance, in the first quarter of 2024, Dollar Tree reported a comparable store sales increase of 1.1% for its Dollar Tree banner, underscoring the ongoing customer traffic and purchasing behavior.

This loyal following is a key driver for Dollar Tree's "Cash Cow" status within the BCG Matrix. The predictable revenue generation allows for substantial cash flow, which can then be reinvested in other business segments or used for operational improvements. The company's ability to maintain customer loyalty, particularly in an environment where consumers are increasingly price-conscious, is a testament to its value proposition.

- Loyal Customer Base: Dollar Tree's success is built on a foundation of repeat customers who rely on the brand for affordable everyday items.

- Stable Revenue Stream: The consistent demand from this customer segment ensures a predictable and reliable flow of income.

- Value Proposition: The company's focus on offering products at low price points, like the $1.25 price point for many items, attracts and retains a broad consumer base.

- Cash Flow Generation: This stable demand directly contributes to strong cash flow, a hallmark of a Cash Cow business.

Dollar Tree's established store base, particularly those not yet upgraded to the newer store models, represents mature, high-performing assets. These locations benefit from ingrained customer loyalty and consistent sales performance, acting as reliable cash generators with minimal need for extensive reinvestment in marketing or product assortment changes.

The company's strategic focus on seasonal and home decor items, which often carry higher profit margins, further solidifies their cash cow status. These categories are particularly strong during peak shopping periods, contributing significantly to the overall financial health of the Dollar Tree banner.

Dollar Tree's robust logistics network is a key enabler of its cash cow operations. This efficient infrastructure ensures timely and cost-effective product distribution, directly contributing to strong profit margins and consistent cash flow generation.

The company's loyal customer base, drawn to its consistent value proposition, provides a stable and predictable revenue stream. This consistent demand, exemplified by a 1.1% comparable store sales increase for the Dollar Tree banner in Q1 2024, directly fuels the strong cash flow characteristic of a cash cow.

| Segment | BCG Category | Key Characteristics | Financial Impact |

| Established Dollar Tree Stores (Non-3.0) | Cash Cow | Mature, loyal customer base, consistent sales, minimal investment needed | Steady, predictable cash flow |

| Seasonal & Home Decor Categories | Cash Cow | Higher profit margins, strong performance during peak seasons | Significant contribution to banner profitability |

What You See Is What You Get

Dollar Tree BCG Matrix

The Dollar Tree BCG Matrix preview you are currently viewing is the exact, fully functional document you will receive upon purchase, offering a complete strategic analysis without any alterations or watermarks. This comprehensive report is meticulously designed to provide actionable insights into Dollar Tree's product portfolio, categorizing each offering into Stars, Cash Cows, Question Marks, and Dogs for informed decision-making. You can confidently rely on this preview as it represents the final deliverable, ready for immediate integration into your business strategy and presentations. Rest assured, what you see is precisely what you get – a professionally formatted and analysis-ready BCG Matrix for Dollar Tree.

Dogs

Family Dollar stores, particularly those marked for closure, are positioned as Dogs in the BCG Matrix. These locations represent a low market share within a stagnant or declining retail segment.

In 2023, Dollar Tree announced plans to close approximately 1,000 underperforming Family Dollar stores, a significant move reflecting their ongoing struggles with profitability and cash generation.

These underperforming units have historically consumed more capital than they returned, negatively impacting Dollar Tree's overall financial health and requiring substantial investment for minimal returns.

Family Dollar's discretionary merchandise, such as seasonal decor and basic apparel, falls into the 'dog' category of the BCG Matrix. These items have seen weak demand and declining sales, especially from their core lower-income customer base. For instance, in the first quarter of 2024, Family Dollar reported a 5.7% decrease in same-store sales, with discretionary categories being a significant drag.

Family Dollar stores with outdated formats or those in less-than-ideal locations have faced challenges in drawing and keeping customers, resulting in a diminished market share and slow growth. For instance, Dollar Tree, the parent company, has been actively addressing these underperforming stores.

These locations often necessitate substantial capital for renovations or even relocation, with no certainty of a positive return on investment. This makes them prime candidates for divestiture as part of a broader strategic realignment.

In 2023, Dollar Tree announced plans to close approximately 1,000 underperforming Family Dollar stores, a significant move reflecting the struggles of these outdated formats. This action aims to streamline operations and focus resources on more promising locations.

Certain Low-Margin $1.25 Items Being Phased Out

Certain traditional $1.25 items, especially those with consistently low margins or slow sales due to escalating supply chain and production costs, are being strategically phased out by Dollar Tree. This move is a direct response to the evolving economic landscape, where the fixed price point of $1.25 for some goods has become unsustainable for maintaining profitability. For instance, in late 2023 and early 2024, the company has been transparent about these adjustments, aiming to optimize its product mix.

The company is actively reducing the presence of these less profitable items to boost overall store profitability and create more space for higher-margin products. This strategic shift is crucial for Dollar Tree's financial health, allowing them to better absorb rising costs and reinvest in their business. By streamlining the product assortment, Dollar Tree can focus on items that contribute more significantly to their bottom line.

- Focus on Margin Improvement: Phasing out low-margin $1.25 items directly addresses the challenge of maintaining profitability when costs increase.

- Product Assortment Optimization: This strategy allows Dollar Tree to curate a product selection that better aligns with current economic realities and consumer demand for value.

- Increased Store Profitability: By removing items that are no longer financially viable at the $1.25 price point, the company aims to improve the overall financial performance of its stores.

- Strategic Pricing Adjustments: This is part of a broader strategy that may include introducing items at price points above $1.25 to better reflect product costs and ensure sustainable margins.

Family Dollar E-commerce Efforts (Limited)

Family Dollar's e-commerce efforts are notably limited, primarily focusing on Instacart delivery for SNAP-eligible items. This positions them with a low market share within the rapidly expanding online retail sector.

In 2024, Family Dollar's digital strategy has not kept pace with competitors who boast comprehensive e-commerce platforms. This digital lag means their online presence has not been a significant driver of growth or market share expansion.

- Limited Online Presence: Family Dollar's digital footprint is minimal, primarily relying on third-party delivery services for a narrow range of products.

- Low Market Share in E-commerce: Their share of the online retail market is negligible compared to major players.

- Competitor Disadvantage: Rivals with established online sales channels and broader digital offerings significantly outperform Family Dollar in the e-commerce space.

- Impact on Growth: The lack of a robust online strategy hinders Family Dollar's ability to capture growth in the increasingly digital consumer landscape.

Family Dollar stores, particularly those slated for closure, are firmly in the Dogs quadrant of the BCG Matrix. These locations exhibit a low market share within a retail segment that is either stagnant or declining, meaning they aren't attracting many customers and the overall market isn't growing. This situation is exacerbated by their limited online presence, which further constrains their ability to compete in the modern retail landscape.

The company's decision to close around 1,000 underperforming Family Dollar stores in 2023 highlights the challenges these units face. These stores have historically required more investment than they generated, impacting Dollar Tree's overall financial performance. For instance, in the first quarter of 2024, Family Dollar saw a 5.7% drop in same-store sales, with discretionary items being a major contributor to this decline.

These underperforming stores often need significant capital for upgrades or even relocation, with no guarantee of a profitable outcome. This makes them prime candidates for divestiture as part of a strategic realignment. The company is also phasing out certain traditional $1.25 items that have become unsustainable due to rising costs, aiming to boost profitability and streamline its product mix.

Family Dollar's digital efforts are minimal, mainly involving Instacart for specific items, resulting in a negligible market share in the growing e-commerce sector. This digital lag means their online presence hasn't been a growth engine, putting them at a disadvantage against competitors with robust online platforms.

| Category | Market Share | Market Growth | Strategic Implication |

|---|---|---|---|

| Family Dollar Stores (Underperforming) | Low | Stagnant/Declining | Divestiture, Closure, or Significant Restructuring |

| Discretionary Merchandise (Family Dollar) | Low | Declining | Phasing Out, Reduce Inventory |

| Family Dollar E-commerce Presence | Very Low | High (Industry Trend) | Invest or Divest from Digital Operations |

| Certain $1.25 Items (Low Margin) | N/A (Product Level) | N/A (Product Level) | Product Mix Optimization, Price Point Adjustment |

Question Marks

Dollar Tree's expansion into price points above $1.25, reaching $3, $5, and even $7, places these offerings in a growing segment of the discount retail market. While this strategy aims to attract a wider customer base and increase the average transaction value, these higher-priced items represent a relatively small portion of Dollar Tree's total sales mix as of early 2024.

The success of these multi-price items is still under evaluation, with the company focusing on expanding their assortment and assessing customer adoption. This initiative is crucial for Dollar Tree to capture a larger share within the broader discount retail landscape, which has shown resilience and growth.

The Dollar Tree Plus concept stores represent an expansion for Dollar Tree, introducing items priced at $3 and $5 alongside their traditional $1.25 offerings. This strategy aims to broaden the appeal and capture a larger share of the value retail market by offering a wider assortment of goods. As of early 2024, Dollar Tree was actively rolling out these enhanced stores, with plans to convert a significant portion of its existing footprint.

While the Dollar Tree Plus initiative is designed to boost sales and profitability by catering to consumers seeking a slightly higher value proposition, its long-term market penetration and financial impact are still being evaluated. The company's 2023 fiscal year saw continued investment in this concept, signaling a strategic shift towards a more diversified price point model.

Dollar Tree's acquisition of 99 Cents Only Stores' leases, announced in April 2024, positions it to potentially fill gaps in its geographic footprint and secure prime retail locations. This move, involving approximately 170 leases, could accelerate Dollar Tree's market penetration. However, the operational and financial success of converting these stores and establishing a strong presence in these new markets is uncertain, classifying this initiative as a Question Mark in the BCG matrix.

Increased Focus on Frozen and Refrigerated Goods

Dollar Tree is significantly increasing its frozen and refrigerated food selections, a move aimed at capturing growing consumer interest in budget-friendly grocery options. This expansion, which includes items at higher price points than the traditional dollar, broadens their appeal and taps into a new customer base.

The company’s strategy to offer more frozen and refrigerated items is a direct response to market trends showing increased demand for convenient, affordable meal solutions. For instance, by late 2023, Dollar Tree had expanded its "fresh" offerings to over 3,000 stores, indicating a substantial commitment to this category.

- Expanding Product Assortment: Dollar Tree is actively increasing the variety of frozen and refrigerated goods available in its stores.

- Targeting Consumer Demand: This strategy caters to a growing consumer need for affordable, convenient grocery options.

- Developing Profitability: While the expanded category broadens appeal, its long-term profitability and market share are still being established.

- Strategic Expansion: By the end of 2023, over 3,000 Dollar Tree locations featured enhanced fresh offerings, demonstrating a significant investment in this area.

Digital and Omni-channel Initiatives for Dollar Tree

Dollar Tree's digital and omni-channel efforts are currently in their early stages, operating within a rapidly expanding online retail landscape. While the company has historically prioritized its brick-and-mortar presence, initiatives like buy-online-pickup-in-store (BOPIS) represent a crucial entry point into this high-growth market.

Despite these efforts, Dollar Tree holds a comparatively small share of the online retail market when stacked against major players. The ultimate impact of these nascent digital strategies on substantial growth is yet to be fully realized, making their performance a key area to monitor.

- Nascent Digital Presence: Dollar Tree's investment in omni-channel, including in-store pickup, targets a growing online market.

- Low Online Market Share: The company faces significant competition in the digital space, holding a smaller slice of the online retail pie.

- Growth Potential Uncertain: The effectiveness of current digital initiatives in driving substantial future growth is still under evaluation.

Dollar Tree's expansion into multi-price point items, like those in Dollar Tree Plus stores, and its acquisition of 99 Cents Only Stores leases represent significant strategic moves. These initiatives aim to broaden market reach and capture new customer segments, but their ultimate success and market penetration remain uncertain as of early 2024. The company's growing presence in frozen and refrigerated foods, with over 3,000 stores offering these items by late 2023, also falls into this category, as its long-term profitability is still being established.

The company's nascent digital and omni-channel efforts, such as buy-online-pickup-in-store, are also considered Question Marks. Despite investments, Dollar Tree holds a small share of the online retail market, and the effectiveness of these strategies in driving substantial future growth is yet to be fully realized.

| Initiative | Description | Status/Uncertainty | Data Point |

| Dollar Tree Plus Stores | Introduction of $3 and $5 items alongside $1.25 offerings. | Broadening appeal, but long-term market penetration and financial impact are being evaluated. | Active rollout in early 2024. |

| 99 Cents Only Stores Acquisition | Acquisition of ~170 leases to fill geographic gaps and secure locations. | Operational and financial success of conversion and market presence is uncertain. | Announced April 2024. |

| Expanded Frozen/Refrigerated Foods | Increasing selections of fresh and frozen grocery items. | Broadens appeal, but long-term profitability and market share are still being established. | Over 3,000 stores by late 2023. |

| Digital/Omni-channel Efforts | Implementing BOPIS and other online initiatives. | Low online market share and uncertain effectiveness in driving substantial growth. | Early stages of development. |

BCG Matrix Data Sources

Our Dollar Tree BCG Matrix is informed by a blend of financial disclosures, market growth data, and industry publications. This ensures a robust analysis of each business segment's performance and potential.