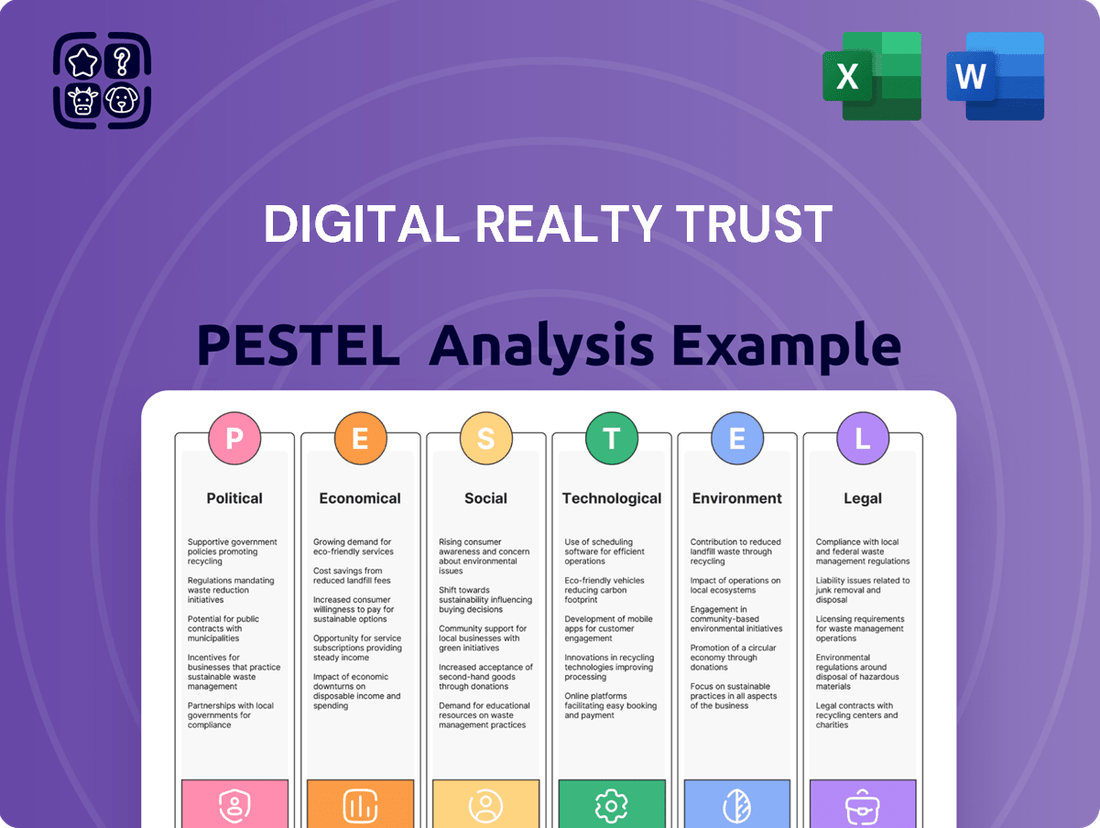

Digital Realty Trust PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital Realty Trust Bundle

Navigate the complex external forces impacting Digital Realty Trust with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are shaping the data center industry, and how these factors directly influence Digital Realty's strategic decisions and future growth potential.

Unlock critical insights into the technological advancements and environmental regulations that are redefining the digital infrastructure landscape. Our analysis provides a clear roadmap of the opportunities and challenges Digital Realty Trust faces, empowering you to make informed investment and strategic planning decisions.

Don't get left behind in the rapidly changing digital world. Purchase the full PESTLE analysis of Digital Realty Trust today to gain a decisive competitive advantage and ensure your strategies are aligned with the prevailing market dynamics.

Political factors

Government policies and regulations significantly shape Digital Realty Trust's operations worldwide. For instance, data sovereignty laws, which mandate data storage within specific national borders, directly influence where Digital Realty can build and operate its facilities, impacting expansion plans and requiring tailored infrastructure investments in compliance with local mandates.

Political stability is another key consideration. Regions experiencing political unrest or uncertainty can pose risks to Digital Realty's existing data center infrastructure and future investment opportunities. For example, geopolitical tensions in Eastern Europe in early 2024 highlighted the potential for disruptions to critical infrastructure and supply chains, underscoring the importance of careful site selection and risk mitigation strategies.

Shifting global trade policies and the implementation of tariffs directly impact Digital Realty's operational costs. For instance, increased tariffs on electronic components or construction materials could raise the expense of building and maintaining data centers worldwide. In 2024, ongoing trade tensions between major economies could lead to unpredictable cost fluctuations for essential hardware.

As a global provider, Digital Realty must navigate these trade dynamics. Tariffs can not only inflate expenses but also influence the pace of technology adoption and the strategic placement of new data center infrastructure. For example, tariffs on advanced server hardware could slow down expansion plans in certain regions, affecting Digital Realty's ability to meet growing demand for colocation and interconnection services.

Governments globally are increasingly recognizing the economic contributions of data centers, leading to a rise in targeted incentives. For instance, in 2024, several US states, including Virginia and Texas, continued to offer property tax abatements and sales tax exemptions specifically for data center construction and equipment, aiming to spur job growth and technological development. Digital Realty, like its peers, actively leverages these programs to optimize capital expenditure for new builds and expansions, making strategic site selection a critical component of its growth strategy.

National Security and Cyber Warfare

Data centers, like those operated by Digital Realty Trust, are increasingly recognized as critical national infrastructure, making them potential targets in cybersecurity threats and broader national security concerns. The evolving landscape of state-sponsored cyber warfare necessitates robust defenses and compliance with stringent government regulations.

These national security considerations can translate into direct impacts on Digital Realty's operations. Governments may mandate enhanced security protocols, regular auditing of facilities, or even exert a degree of direct oversight, potentially limiting operational flexibility and requiring significant capital expenditure for advanced cybersecurity solutions. For instance, in 2024, the US Department of Homeland Security continued to emphasize the need for critical infrastructure protection, with cybersecurity being a paramount focus.

- Increased Compliance Costs: Adhering to evolving government security mandates could raise operational expenses.

- Potential for Operational Restrictions: Direct government intervention or stricter oversight may impact Digital Realty's autonomy.

- Investment in Advanced Cybersecurity: Companies will likely need to allocate more resources to protect against sophisticated cyber threats.

- Resilience as a Key Differentiator: Demonstrating strong resilience against cyber-attacks becomes crucial for maintaining client trust and operational continuity.

Political Stability and Geopolitical Events

Geopolitical uncertainties and political instability in key regions pose risks to Digital Realty's global infrastructure operations. For instance, ongoing trade tensions or regional conflicts can disrupt supply chains for critical hardware and impact the timely delivery of new data center projects, potentially affecting Digital Realty's capital expenditure plans and revenue streams.

The company's resilience in navigating these complexities is paramount. Digital Realty's ability to adapt its strategies, such as diversifying its supplier base or securing long-term power purchase agreements in politically stable jurisdictions, directly influences its business continuity and sustained growth. For example, in 2023, Digital Realty continued to expand its presence in stable European markets, demonstrating a strategic focus on mitigating political risks.

- Geopolitical Risk Mitigation: Digital Realty's strategy often involves diversifying its geographic footprint to reduce exposure to single-region political instability.

- Supply Chain Resilience: The company actively manages its supply chain to mitigate disruptions caused by geopolitical events, ensuring the availability of essential components for its data centers.

- Regulatory Navigation: Political factors influence permitting processes and power acquisition, requiring Digital Realty to maintain strong governmental relations and adapt to evolving regulations in different countries.

Government policies and political stability are crucial for Digital Realty Trust's global operations. Data sovereignty laws, for example, dictate where data centers can be located, influencing Digital Realty's expansion and requiring compliance with local regulations. In 2024, geopolitical tensions in regions like Eastern Europe highlighted the risks to critical infrastructure, emphasizing the need for careful site selection.

Trade policies and tariffs directly impact operational costs. Increased tariffs on electronic components or construction materials, as seen with ongoing trade tensions in 2024, can inflate expenses and slow technology adoption. Digital Realty must navigate these dynamics to manage capital expenditure effectively.

Governments are increasingly offering incentives for data centers. In 2024, several US states, including Virginia and Texas, provided tax abatements for data center construction, which Digital Realty leverages to optimize its investments. This focus on economic contribution makes data centers vital infrastructure, but also subjects them to heightened national security concerns and potential government oversight.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Digital Realty Trust, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies for executives to navigate market dynamics and capitalize on emerging opportunities.

A PESTLE analysis for Digital Realty Trust offers a structured approach to understanding external factors, acting as a pain point reliever by proactively identifying potential challenges and opportunities in the market.

This analysis provides a clear, actionable framework for strategic decision-making, helping to alleviate the pain of uncertainty and enabling more confident navigation of the complex digital infrastructure landscape.

Economic factors

As a Real Estate Investment Trust (REIT), Digital Realty's ability to finance its growth is directly impacted by interest rates. Higher rates mean increased borrowing costs for new data center acquisitions and development, making capital more expensive. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, a level that had already elevated borrowing expenses compared to prior years.

This elevated cost of capital can squeeze profit margins and reduce the attractiveness of new investment opportunities. Digital Realty's reliance on debt financing means that fluctuations in interest rates significantly influence its overall financial strategy and the viability of expansion plans. The company's debt-to-equity ratio and its ability to service its obligations are therefore closely monitored in relation to prevailing economic conditions.

Periods of high inflation directly impact Digital Realty's operating expenses. For instance, rising energy prices, a significant component of data center costs, can substantially increase utility bills. In 2024, global inflation rates, while moderating from 2022 peaks, still presented challenges, with energy costs remaining a key concern for the sector.

These increased costs, covering everything from electricity and cooling to staffing and materials for upkeep, can squeeze profit margins. Digital Realty's success hinges on its capacity to pass these higher expenses onto customers through rental adjustments. Failure to do so effectively can erode profitability, making cost management a critical strategic imperative.

The global economy's trajectory significantly influences the demand for data center services. As of early 2025, projections indicate continued, albeit moderating, global GDP growth, estimated around 2.7% for the year, according to the IMF. This economic backdrop directly supports enterprise investment in digital transformation and cloud infrastructure, key drivers for Digital Realty's business.

Robust economic expansion typically fuels increased IT spending by businesses. For instance, global IT spending was projected to reach $5.1 trillion in 2024, a 6.8% increase from 2023, according to Gartner. This heightened spending translates into a greater need for scalable and reliable data center capacity, directly benefiting Digital Realty's service offerings.

Supply and Demand Dynamics in Data Center Markets

The delicate dance between data center supply and demand is a primary driver for companies like Digital Realty Trust. When new capacity comes online faster than customers can absorb it, especially in key markets, it can create a competitive environment that pressures rental rates. Conversely, robust demand from hyperscalers and enterprises, coupled with limited new construction, typically leads to higher occupancy and stronger pricing power.

In 2024, the demand for data center space continues to surge, fueled by AI workloads and cloud adoption. However, the supply side is also responding, with significant new development underway globally. For instance, North America saw substantial data center construction in late 2023 and early 2024, which could temper rent growth in some submarkets.

- Global Data Center Construction Growth: Reports indicate a significant increase in data center construction projects globally throughout 2024, with many markets experiencing a healthy pipeline of new capacity.

- Hyperscaler Demand Dominance: Hyperscalers, such as Amazon Web Services, Microsoft Azure, and Google Cloud, continue to be the largest drivers of demand, leasing massive amounts of space and influencing leasing terms.

- AI's Impact on Capacity Needs: The exponential growth of artificial intelligence workloads is a key factor driving demand for higher-density power and cooling, influencing the type of capacity in demand.

- Regional Supply/Demand Imbalances: While some markets may see oversupply due to rapid construction, others, particularly those with strong cloud and AI adoption, continue to experience tight supply and robust rental rate growth as of mid-2024.

Currency Exchange Rate Fluctuations

Operating globally means Digital Realty Trust is exposed to currency exchange rate fluctuations. These shifts can directly impact the company's reported revenues and expenses when foreign currencies are converted back to its primary reporting currency, often the US dollar. For instance, a strengthening US dollar against other currencies can reduce the reported value of foreign earnings.

Significant movements in exchange rates can create considerable headwinds or tailwinds for Digital Realty's financial performance. In 2023, for example, while the company reported overall revenue growth, currency impacts were a factor in the year-over-year comparisons for certain regions. The ongoing volatility in major currency pairs, such as EUR/USD and GBP/USD, remains a key consideration for investors and management alike.

- Impact on Reported Earnings: A stronger USD can decrease the value of foreign revenue and profits when translated.

- Hedging Strategies: Digital Realty likely employs hedging strategies to mitigate some of this currency risk, though these are not always fully effective.

- Geographic Revenue Mix: The proportion of revenue generated in different currency zones influences the overall impact of exchange rate movements.

- 2024/2025 Outlook: Continued currency volatility is expected to be a factor influencing Digital Realty's financial results in 2024 and 2025, necessitating careful monitoring.

Interest rate hikes directly increase Digital Realty's borrowing costs, impacting its ability to finance new data center developments and acquisitions. For example, the Federal Reserve's sustained benchmark rate between 5.25%-5.50% in early 2024 made capital more expensive than in prior periods.

High inflation, particularly in energy prices, elevates Digital Realty's operational expenses, directly affecting utility bills. While inflation moderated in 2024 from 2022 peaks, energy costs remained a significant concern for the data center sector.

Global economic growth, projected around 2.7% for 2025 by the IMF, fuels enterprise investment in digital transformation and cloud infrastructure, key drivers for Digital Realty. Global IT spending was expected to reach $5.1 trillion in 2024, a 6.8% increase from 2023, according to Gartner, boosting demand for data center capacity.

The balance between data center supply and demand is critical. While AI workloads are driving demand, significant construction in North America in late 2023 and early 2024 could moderate rent growth in certain markets.

| Economic Factor | Impact on Digital Realty | 2024/2025 Data/Trend |

|---|---|---|

| Interest Rates | Increased borrowing costs, higher cost of capital | Fed rate 5.25%-5.50% (early 2024); elevated borrowing expenses |

| Inflation | Higher operating expenses (energy, utilities) | Moderating inflation in 2024, but energy costs remain a concern |

| Global GDP Growth | Increased demand for data center services | Projected 2.7% global GDP growth for 2025 (IMF); robust IT spending |

| IT Spending | Direct driver of data center capacity needs | Global IT spending projected at $5.1T in 2024 (+6.8% from 2023) (Gartner) |

| Supply/Demand Dynamics | Influences rental rates and occupancy | Surging demand (AI, cloud) vs. significant new construction in some markets |

Preview Before You Purchase

Digital Realty Trust PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Digital Realty Trust PESTLE analysis provides an in-depth look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a clear understanding of the external forces shaping Digital Realty Trust's strategic landscape.

The content and structure shown in the preview is the same document you’ll download after payment. It's designed to offer actionable insights for strategic planning and risk assessment.

Sociological factors

The ongoing digital transformation is fueling an unprecedented surge in data. By 2025, it's estimated that the global datasphere will reach 175 zettabytes, a significant jump from the 120 zettabytes generated in 2023, directly boosting demand for Digital Realty's data center services.

As businesses increasingly rely on cloud computing and digital operations, the need for secure, scalable, and efficient data storage and processing infrastructure becomes paramount. This trend supports Digital Realty's core business model.

The shift towards remote and hybrid work has significantly boosted demand for robust digital infrastructure. Companies are investing more in cloud services and data centers to ensure seamless connectivity for their dispersed employees. In 2024, a significant percentage of the global workforce is expected to operate under hybrid models, driving demand for scalable and secure data solutions.

This evolving work landscape requires enhanced network agility and advanced data security measures, areas where Digital Realty Trust excels. The need for reliable access to applications and data from anywhere is paramount, leading businesses to seek out colocation and interconnection services that Digital Realty offers to support these distributed operations.

Consumer habits are shifting dramatically, with online shopping and digital entertainment becoming the norm. This surge in digital activity, exemplified by the projected 20% year-over-year growth in e-commerce sales in 2024, directly fuels the demand for robust data infrastructure.

The increasing reliance on streaming services and social media platforms means more data is constantly being created and accessed. In 2024, global internet traffic is expected to reach over 200 zettabytes, a significant portion of which is driven by these consumer-facing applications, underscoring the need for scalable data center solutions.

These evolving consumer behaviors create a direct, positive impact on Digital Realty's core business. By providing the essential data center capacity and interconnection services, Digital Realty enables these seamless digital experiences, positioning itself to capitalize on the ongoing digital transformation.

Talent Availability and Workforce Skills

Operating and developing data centers demands a highly specialized workforce. This includes critical roles like data center engineers, network architects, cloud specialists, and cybersecurity professionals. The demand for these skills is high, and competition for talent is intense, directly impacting Digital Realty's ability to execute projects and maintain optimal operations.

The availability and quality of this skilled talent pool are paramount for Digital Realty's success. Attracting and retaining top-tier engineers and IT professionals directly influences operational efficiency, innovation, and the company's capacity for growth. For instance, in 2024, the global cybersecurity talent gap was estimated at 3.4 million professionals, highlighting a significant challenge for companies like Digital Realty.

- Specialized Skill Requirements: Data center operations necessitate expertise in electrical engineering, mechanical systems, IT infrastructure, and advanced cybersecurity.

- Talent Acquisition Challenges: The competitive landscape for skilled tech workers can lead to increased recruitment costs and longer hiring timelines for Digital Realty.

- Workforce Development: Investing in training and development programs is crucial for upskilling existing employees and ensuring the workforce remains current with evolving technologies.

- Geographic Talent Pools: Digital Realty's global presence means it must navigate varying talent availability and labor market dynamics across different regions.

Societal Expectations for Sustainability and ESG

There's a significant and increasing demand from society for businesses to act responsibly regarding sustainability and to show good Environmental, Social, and Governance (ESG) performance. This trend is shaping how companies are viewed and valued in the market.

Digital Realty's proactive approach to sustainability, including its focus on clean energy sources and obtaining green building certifications, directly addresses these societal expectations. This commitment not only bolsters its public image but also makes it a more appealing choice for both its clients and those looking to invest.

- Clean Energy Commitment: Digital Realty aims to power 100% of its global operations with renewable energy by 2030.

- Resource Conservation: The company actively works on water efficiency, targeting a 50% reduction in water usage in water-stressed regions by 2030.

- Green Building Certifications: A substantial portion of Digital Realty's portfolio holds certifications like LEED, demonstrating adherence to high environmental standards.

Societal expectations regarding data privacy and security are intensifying, directly influencing how data centers operate and are perceived. Consumers and businesses alike are increasingly concerned about how their data is handled, stored, and protected, pushing companies like Digital Realty to implement robust security measures and transparent data management practices.

The growing awareness of the digital divide and the need for equitable access to technology are also becoming significant societal factors. As digital infrastructure becomes more critical, there's a societal push for broader connectivity and accessibility, which could influence investment and development decisions for data center providers.

The demand for ethical AI development and data usage is also on the rise, creating a societal pressure for data center operators to ensure the integrity and responsible application of the data they house. This includes considerations around bias in algorithms and the transparent use of data for machine learning and AI applications.

Technological factors

The escalating integration of Artificial Intelligence (AI) and Machine Learning (ML) across industries is a primary catalyst for increased demand in robust data center infrastructure. These advanced technologies, crucial for complex computations and vast data storage, necessitate significant power and connectivity, directly benefiting data center providers like Digital Realty. For instance, the global AI market was projected to reach over $136 billion in 2022 and is expected to grow substantially, with data center services forming a critical backbone for this expansion.

The ongoing expansion of cloud computing, encompassing hybrid and multi-cloud approaches, directly fuels the need for colocation and interconnection services. These services are crucial for ensuring smooth data flow between an organization's existing on-premise systems and diverse cloud platforms.

Digital Realty's PlatformDIGITAL is specifically engineered to address the complexities inherent in these hybrid IT architectures, offering a robust foundation for managing distributed digital assets and enabling efficient connectivity.

In 2024, the global cloud computing market was projected to reach over $600 billion, with hybrid cloud solutions representing a significant portion of this growth, underscoring the market's reliance on infrastructure like Digital Realty's.

Technological leaps in data center efficiency, especially in cooling and power management, are vital for lowering operating expenses and environmental footprints. Digital Realty is at the forefront, investing in energy-efficient projects and exploring novel cooling methods, such as water-free systems, to enhance its facilities.

Network Connectivity and Interconnection Demand

The relentless demand for high-speed, low-latency network connectivity is a cornerstone of modern digital infrastructure, directly impacting the performance of everything from cloud computing to real-time data analytics. This escalating need for robust interconnection services fuels Digital Realty's core business, as businesses increasingly rely on seamless data exchange to operate efficiently.

Digital Realty's strategic emphasis on offering carrier-neutral interconnection solutions significantly bolsters its appeal. This approach allows customers to select from a diverse range of network providers, ensuring they can achieve the optimal connectivity tailored to their specific application requirements and performance benchmarks.

- Growing Interconnection Demand: Global data center interconnection traffic is projected to reach 26.1 Zettabytes by 2026, a significant increase from 12.1 Zettabytes in 2021, highlighting the critical need for robust connectivity solutions.

- Carrier Neutrality Advantage: Digital Realty's platform hosts over 1,000 network providers, offering customers unparalleled choice and flexibility in establishing their network connections.

- Performance Imperative: Applications like AI and machine learning demand latency under 10 milliseconds, a threshold Digital Realty's interconnected data center campuses are designed to meet.

Emerging Technologies (IoT, 5G, Autonomous Vehicles)

The rapid expansion of the Internet of Things (IoT), the rollout of 5G networks, and the development of autonomous vehicles are all converging to create an unprecedented surge in data generation, particularly at the network edge. This trend necessitates a more distributed approach to data processing and storage, playing directly into Digital Realty's core business model.

These technological advancements present significant growth opportunities for Digital Realty. As more devices connect and generate data, the demand for colocation and interconnection services to house and manage this data will escalate. Digital Realty is well-positioned to capitalize on this by expanding its global footprint and offering specialized solutions to support these data-intensive applications.

Consider these points:

- IoT Growth: The global IoT market is projected to reach over \$2.5 trillion by 2030, with billions of connected devices generating vast datasets.

- 5G Deployment: 5G is expected to enable a 10x increase in network capacity and a 10x reduction in latency, accelerating data processing at the edge.

- Autonomous Vehicle Data: Self-driving cars alone are estimated to generate up to 10 terabytes of data per day per vehicle, requiring robust edge infrastructure.

The increasing adoption of AI and ML drives demand for powerful data center infrastructure, as these technologies require substantial computing power and storage. The global AI market's projected growth highlights this trend, with data centers serving as a foundational element for its expansion. Furthermore, advancements in data center efficiency, particularly in cooling and power management, are crucial for optimizing operational costs and environmental impact, areas where Digital Realty is actively investing.

The proliferation of cloud computing, including hybrid and multi-cloud strategies, directly boosts the need for colocation and interconnection services, enabling seamless data exchange between on-premise systems and cloud platforms. Digital Realty's PlatformDIGITAL is designed to manage these complex hybrid IT architectures, facilitating efficient connectivity for distributed digital assets. The substantial projected growth in the global cloud computing market in 2024, with hybrid solutions playing a significant role, underscores the market's reliance on such infrastructure.

The surge in data generation from IoT, 5G deployment, and autonomous vehicles necessitates distributed data processing and storage solutions, aligning with Digital Realty's business model. The projected growth of the IoT market and the enhanced capabilities of 5G networks will accelerate data processing at the edge. Autonomous vehicles, in particular, are expected to generate massive daily data volumes, requiring robust edge infrastructure.

| Technology Trend | Impact on Data Centers | Digital Realty's Role/Opportunity |

|---|---|---|

| AI/ML Adoption | Increased demand for high-performance computing and storage. | Provides scalable infrastructure to support AI workloads. |

| Cloud Computing Expansion (Hybrid/Multi-cloud) | Need for robust colocation and interconnection services. | PlatformDIGITAL offers seamless connectivity for hybrid IT. |

| IoT & 5G Rollout | Surge in data generation, requiring edge computing. | Expanding global footprint to support distributed data needs. |

Legal factors

Digital Realty, like many global tech infrastructure providers, navigates a complex landscape of data privacy and security regulations. Laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States impose strict requirements on how customer data is handled and protected.

Compliance is not optional; it demands significant investment in robust data protection measures and transparent operational practices. These regulations can influence where data is stored, impacting Digital Realty's data residency solutions for its diverse clientele. For instance, GDPR's extraterritorial reach means that even companies outside the EU handling EU citizens' data must comply, affecting the global operational models of data center providers.

As a real estate investment trust, Digital Realty Trust is significantly impacted by real estate and zoning laws at local, state, federal, and international levels. These regulations dictate everything from property acquisition and development processes to how land can be used.

Compliance with these laws often involves obtaining numerous permits and conducting thorough environmental assessments, which can add considerable time and expense to construction projects. For instance, in 2024, the average time to secure building permits in major US metropolitan areas continued to be a significant factor in project timelines, with some jurisdictions experiencing delays exceeding several months.

Building codes also play a crucial role, influencing design choices and material selections, directly impacting construction costs and the overall feasibility of new developments or expansions. Adherence to these varied and often evolving standards is a constant consideration for Digital Realty's global operations.

Increasing environmental regulations and emissions standards, particularly concerning energy consumption and carbon footprint, directly impact data center operations. For instance, the European Union's Green Deal aims for climate neutrality by 2050, influencing energy sourcing and efficiency mandates for companies like Digital Realty.

Digital Realty must comply with these evolving regulations, which may necessitate significant investments in renewable energy procurement, advanced energy efficiency measures, and sustainable building practices to minimize its carbon footprint.

Tax Laws and REIT Compliance

Digital Realty Trust, as a Real Estate Investment Trust (REIT), benefits from pass-through taxation, meaning it avoids corporate income tax if it distributes at least 90% of its taxable income to shareholders annually. This structure is a significant advantage, but it necessitates strict adherence to IRS regulations, including income and asset tests, to maintain its REIT status. For instance, in 2023, Digital Realty reported total revenue of $5.24 billion, underscoring the scale of operations subject to these compliance rules.

Failure to meet these ongoing compliance requirements, such as deriving at least 75% of gross income from real estate-related sources or holding at least 75% of its total assets in real estate, could result in the loss of REIT status. Such a loss would trigger corporate-level taxation, drastically altering Digital Realty's financial profile and potentially diminishing investor returns. The company's ability to navigate evolving tax legislation, including potential changes to the 90% distribution requirement or asset tests, remains a critical legal consideration for its long-term financial health.

- REIT Status Benefits: Pass-through taxation, avoiding corporate income tax by distributing at least 90% of taxable income.

- Compliance Obligations: Strict adherence to income and asset tests, and distribution requirements.

- Financial Impact of Non-Compliance: Loss of REIT status leads to corporate-level taxation, impacting financial structure and investor returns.

- Revenue Context: Digital Realty's $5.24 billion in revenue for 2023 highlights the substantial operations subject to these legal frameworks.

Competition Law and Antitrust Regulations

Digital Realty, as a global data center provider, navigates a complex web of competition and antitrust laws. These regulations are designed to prevent any single entity from dominating the market, ensuring a level playing field for all players. For instance, in the United States, the Sherman Act and Clayton Act are foundational, while the European Union's competition framework, particularly Article 102 of the Treaty on the Functioning of the European Union, addresses abuse of dominant positions.

These legal frameworks directly impact Digital Realty's strategic decisions, especially concerning mergers and acquisitions. Any significant consolidation or market share expansion must be scrutinized to ensure it doesn't stifle competition. For example, regulatory approval processes for major acquisitions, such as Digital Realty's acquisition of Interxion in 2019 for $8.4 billion, involve thorough reviews by competition authorities in relevant markets.

The enforcement of these laws can lead to significant penalties or divestiture orders if found in violation. As of early 2024, ongoing scrutiny of large technology companies in digital infrastructure underscores the importance of compliance. Digital Realty must continuously monitor its market position and business practices to align with evolving antitrust interpretations and enforcement trends globally.

Digital Realty Trust operates under a stringent legal framework governing data privacy and security, including regulations like GDPR and CCPA, which dictate data handling and protection. These laws necessitate substantial investment in data security measures and can influence data storage locations, impacting Digital Realty's global operations and its data residency solutions for clients.

Real estate and zoning laws at all governmental levels are critical, affecting property acquisition, development, and land use, often requiring extensive permitting and environmental assessments that can delay projects. Building codes also shape design and material choices, directly influencing construction costs for new developments and expansions.

Environmental regulations, particularly those concerning energy consumption and carbon emissions, are increasingly impacting data center operations. Digital Realty must invest in renewable energy, energy efficiency, and sustainable practices to comply with mandates aimed at reducing its carbon footprint, such as those aligned with the EU's Green Deal objectives.

As a REIT, Digital Realty benefits from pass-through taxation but must adhere to strict IRS regulations, including income and asset tests, to maintain its status. For instance, in 2023, Digital Realty reported $5.24 billion in revenue, highlighting the scale of operations subject to these rules, where failure to comply could lead to corporate-level taxation.

Environmental factors

Digital Realty's operations, like all data center providers, are inherently energy-intensive, contributing significantly to their carbon footprint. In 2023, the company reported that 64% of its global electricity consumption was sourced from renewable energy, a substantial increase from previous years, demonstrating a commitment to reducing environmental impact.

This focus on energy efficiency and renewable sourcing is driven by growing regulatory pressures and investor demand for sustainable practices. By 2025, Digital Realty aims to achieve 100% renewable energy for its global operations, a target that requires continued investment in renewable energy procurement and on-site generation technologies.

Water is a critical resource for cooling data centers, and with increasing concerns about water scarcity, particularly in regions like California and Arizona where Digital Realty has significant operations, this factor demands attention. Digital Realty reported a water usage intensity of 0.33 liters per kilowatt-hour in 2023, a slight decrease from 0.34 in 2022, reflecting their ongoing efforts in water conservation.

The company is actively implementing water conservation initiatives, such as optimizing cooling systems and exploring alternative water sources. Furthermore, Digital Realty is investing in and piloting water-free cooling technologies, aiming to reduce its reliance on traditional water-cooled systems, especially in areas identified as water-stressed.

Climate change is increasing the frequency and intensity of extreme weather events like floods and severe storms. These events directly threaten the operational integrity of data centers, posing significant risks to Digital Realty's infrastructure. For instance, a 2023 report highlighted that extreme weather disruptions cost the global economy billions, underscoring the need for robust preparedness.

Digital Realty must prioritize building resilient infrastructure and implementing proactive climate change adaptation strategies. This includes investing in advanced cooling systems, flood defenses, and redundant power supplies to ensure business continuity and minimize downtime. The company's commitment to sustainability, as evidenced by its 2024 ESG report detailing a 15% reduction in water usage across its facilities, reflects an awareness of these environmental pressures.

Sustainable Building Practices and Certifications

The construction and operation of data centers inherently carry environmental considerations, particularly concerning material sourcing and waste generation. Digital Realty is actively addressing these concerns through a commitment to sustainable building practices.

The company pursues green building certifications such as LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) to validate its environmentally conscious approach. For instance, in 2023, Digital Realty reported that over 60% of its global portfolio was covered by green building certifications, with a target to reach 100% by 2025. This focus extends to the selection of environmentally friendly materials, aiming to significantly reduce the ecological footprint associated with its facilities.

Key aspects of Digital Realty's sustainable building practices include:

- LEED and BREEAM Certifications: Actively seeking and maintaining these credentials across its global data center portfolio.

- Environmentally Friendly Materials: Prioritizing the use of sustainable and recycled materials in construction and upgrades.

- Waste Reduction Programs: Implementing strategies to minimize construction waste and promote recycling.

E-waste Management and Circular Economy Principles

The growing volume of electronic waste, or e-waste, from discarded IT equipment and infrastructure presents a significant environmental challenge. Digital Realty is actively addressing this by prioritizing responsible e-waste management and integrating circular economy principles. This approach aims to minimize waste generation and maximize the recycling and reuse of materials throughout its operations and supply chain.

Globally, e-waste is a rapidly expanding waste stream. In 2023 alone, the world generated an estimated 62 million metric tons of e-waste, with a projected increase to 82 million metric tons by 2030. Digital Realty's commitment to circularity means it's not just disposing of old equipment but actively seeking ways to extend the life of components and recover valuable resources.

- E-waste Generation: The constant upgrade cycle of IT hardware, including servers, networking gear, and data center infrastructure, leads to substantial e-waste.

- Circular Economy Adoption: Digital Realty is implementing strategies to reuse, refurbish, and recycle IT assets, thereby reducing the environmental footprint associated with hardware turnover.

- Material Recovery: Focus on recovering valuable materials from discarded electronics, such as precious metals and rare earth elements, which can be reintegrated into manufacturing processes.

- Supply Chain Responsibility: Extending circular economy principles to its supply chain, encouraging partners to adopt similar waste reduction and recycling practices.

Digital Realty's environmental strategy centers on reducing its carbon footprint through renewable energy and water conservation. By 2025, the company targets 100% renewable energy for global operations, a significant step from its 2023 achievement of 64% renewable sourcing. Water usage intensity was managed at 0.33 liters per kilowatt-hour in 2023, indicating progress in conservation efforts.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Digital Realty Trust is built on a robust foundation of data from leading industry research firms, government economic reports, and global technology trend analyses. This ensures comprehensive insights into the political, economic, social, technological, legal, and environmental factors impacting the digital infrastructure sector.