Digital Realty Trust Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital Realty Trust Bundle

Curious about Digital Realty Trust's strategic positioning? Our BCG Matrix analysis reveals which of their assets are market leaders (Stars), consistent revenue generators (Cash Cows), underperforming (Dogs), or potential growth opportunities (Question Marks). Don't miss out on the crucial insights needed to navigate the dynamic data center market.

Unlock the full potential of your investment strategy by purchasing the complete Digital Realty Trust BCG Matrix. This comprehensive report provides a detailed quadrant breakdown, actionable recommendations, and a clear roadmap for optimizing your capital allocation. Gain a competitive edge with data-driven decision-making.

Stars

Digital Realty Trust is strategically positioning itself to capitalize on the burgeoning AI revolution by heavily investing in data center infrastructure specifically designed for Artificial Intelligence (AI) and high-performance computing (HPC) workloads. This forward-thinking approach includes developing facilities capable of handling high power density requirements and incorporating advanced cooling technologies such as liquid cooling.

The company clearly views AI as a pivotal growth engine for its future. Evidence of this commitment is seen in their Q1 2025 leasing activity, where over two-thirds of their total leases were directly attributed to AI-related projects, underscoring the immense demand and Digital Realty's proactive response to it.

Digital Realty's Hyperscale Data Center Fund is a strong contender in the BCG matrix, likely positioned as a star. Its successful launch, securing over $3 billion in LP equity commitments, demonstrates significant investor confidence and the fund's capacity to fuel substantial growth. This financial backing is earmarked to support approximately $10 billion in hyperscale investments, underscoring its potential for high returns and market leadership.

Digital Realty's aggressive global platform expansion is a key driver of its market position. The company launched new data centers in India in early 2024, with further expansions planned for Indonesia and Crete in Q1 2025. This strategic growth in emerging digital hubs underscores their commitment to meeting escalating global demand and diverse data sovereignty needs.

Interconnection Services

Digital Realty Trust's Interconnection Services are a significant component of its growth strategy, fitting into the Stars category of a BCG Matrix analysis due to their high market share and high growth potential. The company's commitment to enhancing its interconnection capabilities, including its specialized 'zero to one megawatt plus interconnection' offerings, has directly translated into impressive financial performance.

These services are vital for enabling direct and secure data exchange, a fundamental requirement in today's data-driven landscape. This strategic focus has proven to be a powerful engine for expansion and revenue generation for Digital Realty.

- Record Bookings: Digital Realty achieved $90 million in interconnection services bookings in Q2 2025, highlighting strong demand.

- Strategic Importance: The 'zero to one megawatt plus interconnection' product set is a key growth driver, catering to evolving data needs.

- Market Position: High growth and market share in interconnection services place this segment firmly in the Stars quadrant of the BCG Matrix.

- Data Economy Enabler: These services are critical for secure data exchange, underpinning the growth of the digital economy.

Strong Leasing Backlog and Pipeline

Digital Realty's strong leasing backlog provides excellent visibility into future revenue streams. As of Q1 2025, the company reported a record $919 million in signed leases, followed by $826 million at the close of Q2 2025. This substantial backlog ensures predictable income growth extending through 2026 and beyond.

Furthermore, Digital Realty's development pipeline has expanded significantly, reaching $9.3 billion. A notable aspect of this pipeline is the substantial pre-leasing already secured, underscoring robust market demand for its data center solutions.

- Record Leasing Backlog: $919 million (Q1 2025) and $826 million (Q2 2025).

- Future Revenue Visibility: Strong projections through 2026 and beyond.

- Development Pipeline Growth: Reached $9.3 billion.

- Pre-Leasing Success: Significant portion of the pipeline is already secured, indicating high demand.

Digital Realty's hyperscale data center fund is a clear Star in the BCG matrix, reflecting its high market share and rapid growth. The fund's successful launch, securing over $3 billion in equity, fuels approximately $10 billion in hyperscale investments, indicating strong investor confidence and future revenue potential.

The company's interconnection services also shine as Stars. With record bookings of $90 million in Q2 2025 and a strategic focus on high-demand offerings, this segment demonstrates both high growth and a dominant market position.

These Star segments are crucial for Digital Realty's overall strategy, driving significant revenue and reinforcing its leadership in the digital infrastructure space. Their performance in 2024 and early 2025 highlights their role as key growth engines.

| Segment | BCG Category | Key Metrics (2024-2025) | Growth Potential |

| Hyperscale Data Center Fund | Star | $3B+ LP equity, $10B+ investment capacity | High |

| Interconnection Services | Star | $90M Q2 2025 bookings, high market share | High |

What is included in the product

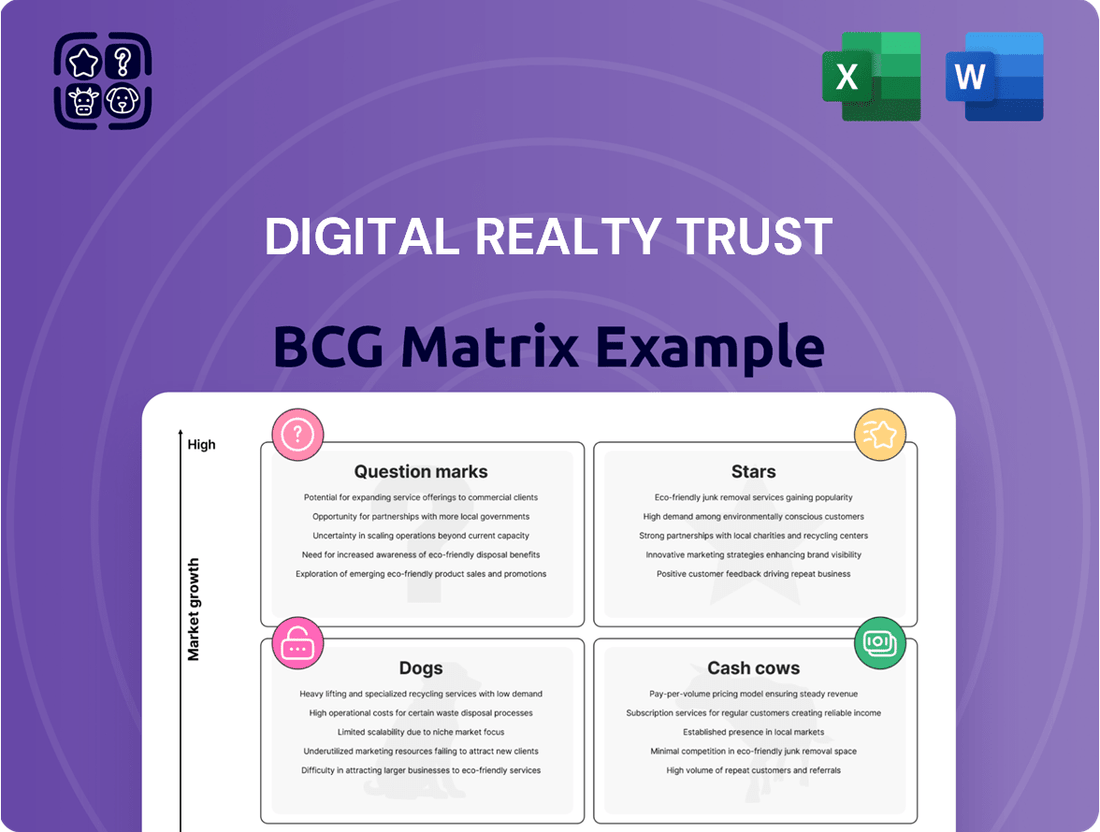

This BCG Matrix overview for Digital Realty Trust details strategic actions for each quadrant, guiding investment decisions.

A Digital Realty Trust BCG Matrix offers a clear, visual pain point reliever by quickly identifying which business units are stars, cash cows, question marks, or dogs.

This allows for strategic resource allocation, alleviating the pain of uncertain investment decisions.

Cash Cows

Digital Realty's established Tier 1 market portfolio, primarily in North America and Europe, functions as a classic Cash Cow within its BCG Matrix. This segment boasts significant market share in mature, high-demand regions.

These prime locations benefit from robust existing infrastructure and a deeply entrenched customer base, ensuring consistent demand for colocation and interconnection services. This stability translates into predictable and reliable cash flow generation for Digital Realty.

As of early 2024, Digital Realty's data center portfolio in these key Tier 1 markets continues to be a significant contributor to its overall revenue, underscoring its role as a dependable income generator.

Digital Realty Trust cultivates robust, long-term customer relationships across a diverse base, including major cloud providers, large enterprises, and financial institutions. These relationships are often cemented through multi-year lease agreements, which are crucial for generating reliable and predictable revenue streams for the company.

The company's success in consistently attracting new customer logos, coupled with remarkably low churn rates, underscores the strength and stability of these client partnerships. This ongoing customer acquisition and retention directly translates into a steady and dependable cash flow generation, a hallmark of a cash cow business unit.

Digital Realty Trust consistently boasts high occupancy rates, a key indicator of its strong market position. For instance, in Q1 2024, their portfolio occupancy remained robust, demonstrating consistent demand for their data center solutions.

Furthermore, the company achieves healthy renewal spreads on expiring leases. This means they are able to re-lease space to existing clients at higher rates than the previous contracts, showcasing their pricing power and the sticky nature of their customer relationships.

These favorable renewal spreads, coupled with high occupancy, directly translate to sustained profitability and predictable cash flow. This stability is a hallmark of a cash cow, providing a reliable income stream for the business.

Sustainable Operations and Efficiency Gains

Digital Realty Trust's focus on sustainable operations is a key driver for its cash cow segment. By achieving 75% renewable energy coverage across its global portfolio, the company is not only reducing its environmental impact but also securing long-term cost stability. This strategic commitment translates directly into improved profit margins for its mature, well-established data center assets.

Further demonstrating this commitment, Digital Realty has achieved significant reductions in water usage intensity, a critical factor for operational efficiency, especially in water-scarce regions. These sustainability efforts aren't just about corporate responsibility; they are integral to enhancing the long-term viability and profitability of its existing, high-performing infrastructure.

- Renewable Energy Adoption: Digital Realty's global portfolio is powered by 75% renewable energy sources, a substantial figure that mitigates energy cost volatility.

- Water Efficiency: The company has made notable strides in reducing water usage intensity, contributing to lower operational expenses and environmental stewardship.

- Profit Margin Enhancement: These efficiency gains directly bolster the profit margins of Digital Realty's established, cash-generating data center assets.

- Long-Term Viability: The strategic integration of sustainability practices ensures the continued financial health and resilience of its mature business lines.

Recurring Revenue from Colocation and Interconnection

Digital Realty Trust's colocation and interconnection services form the bedrock of its business, generating highly predictable, recurring revenue. These services are fundamental to the operations of businesses reliant on digital infrastructure, offering a stable cash flow even during economic downturns.

The consistent demand for these essential services positions them as a significant cash cow within Digital Realty's portfolio. This stability allows for reliable financial planning and investment in growth areas.

- Recurring Revenue: Colocation and interconnection services provide a steady stream of income due to their essential nature for businesses.

- Market Stability: Demand for these services is less sensitive to economic cycles, ensuring consistent cash generation.

- Operational Necessity: Businesses depend on these facilities for their digital operations, making the services indispensable.

Digital Realty's established Tier 1 markets, particularly in North America and Europe, act as its primary Cash Cows. These mature regions offer substantial market share and consistent demand for colocation and interconnection services, driven by robust existing infrastructure and a strong customer base. This stability translates into predictable, reliable cash flow for the company.

As of Q1 2024, Digital Realty reported a portfolio occupancy rate of 81.4%, highlighting the sustained demand for its services in these key markets. The company's ability to secure favorable renewal spreads on expiring leases further solidifies its Cash Cow status, demonstrating pricing power and customer loyalty.

| Metric | Q1 2024 Value | Significance for Cash Cow Status |

| Portfolio Occupancy | 81.4% | Indicates strong demand and efficient asset utilization. |

| Renewable Energy Coverage | 75% | Mitigates energy cost volatility, enhancing profit margins. |

| Recurring Revenue Streams | High (from colocation/interconnection) | Provides predictable and stable cash flow. |

Delivered as Shown

Digital Realty Trust BCG Matrix

The Digital Realty Trust BCG Matrix preview you're seeing is the complete, unwatermarked document you'll receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be immediately available for your use without any alterations. You're getting the exact same professionally designed report, ready for immediate integration into your business planning and competitive strategy discussions.

Dogs

Legacy, low-density facilities within Digital Realty Trust's portfolio represent assets that are becoming increasingly challenged by the evolving demands of modern computing. These older data centers, often built for less power-intensive workloads, may not be easily retrofitted to support the high power and cooling requirements essential for today's AI and high-density applications. This limitation can hinder their ability to attract and retain high-value customers seeking cutting-edge infrastructure.

Consequently, these legacy sites could face difficulties in remaining competitive in the market, potentially requiring substantial and economically unviable investments to upgrade. While specific underperforming assets aren't detailed, it's a common challenge for companies managing extensive and varied portfolios like Digital Realty's to identify and address such aging infrastructure. For instance, in 2024, the increasing demand for AI-driven computing power has put a premium on facilities capable of delivering over 20 kilowatts per cabinet, a benchmark many older sites struggle to meet.

Digital Realty Trust's non-strategic or divested assets, fitting into the 'Dogs' quadrant of a BCG matrix, would represent properties or business segments that are not central to its core data center operations. These might include older facilities in less desirable locations or those in markets with limited growth potential and intense competition, making them less attractive for future investment.

The company's active capital recycling initiatives, a common strategy in real estate investment trusts, underscore this. For instance, in 2023, Digital Realty completed approximately $1.3 billion in asset dispositions. These sales are typically of properties that no longer align with the company's strategic focus on hyperscale and colocation solutions, indicating a deliberate move away from underperforming or non-core assets.

Underperforming regional markets for Digital Realty Trust, like any global REIT, would be areas facing significant headwinds. These could include intense local competition, restrictive zoning laws, or a slower pace of digital infrastructure build-out compared to more developed markets. For instance, a region with a nascent cloud adoption rate would naturally see lower demand for data center space, impacting Digital Realty's growth there.

Assets with High Operational Costs

Digital Realty Trust's portfolio might include data centers with high operational costs. These are facilities where expenses for power, cooling, and maintenance significantly outweigh the revenue they generate, potentially due to outdated technology or inefficient design. For instance, older facilities requiring substantial upgrades to meet modern energy efficiency standards could fall into this category.

These underperforming assets can negatively impact the company's overall financial health. While Digital Realty actively invests in sustainability initiatives, such as improving power usage effectiveness (PUE), some legacy sites may still present cost challenges. As of early 2024, the company's focus on upgrading its infrastructure aims to address these inefficiencies across its global footprint.

- Aging Infrastructure: Data centers with outdated cooling systems or power distribution units often lead to higher energy consumption and increased maintenance needs.

- Inefficient Energy Consumption: Facilities with poor PUE ratios, meaning a larger proportion of energy is used for non-computing functions, contribute to elevated operational expenses.

- Challenging Maintenance: Older buildings or those in remote locations might incur higher costs for repairs and upkeep, impacting profitability.

Highly Commoditized Services

Highly commoditized services within the data center market, characterized by intense price competition and limited differentiation, could be considered a potential 'Dogs' category for Digital Realty Trust. These might include basic colocation offerings where the primary selling point is price rather than advanced features or tailored solutions. While Digital Realty aims to provide a comprehensive suite of services, any segment lacking a distinct competitive edge or operating on thin margins could fit this description.

The company's strategic focus, as evidenced by its investor presentations and financial reports, tends to highlight growth-oriented segments like hyperscale colocation, interconnection, and cloud services. These areas typically offer higher margins and greater opportunities for differentiation. For instance, Digital Realty's expansion into emerging markets and its focus on sustainability initiatives are geared towards capturing higher-value segments of the market, rather than competing solely on price in commoditized spaces.

- Commoditization Risk: Basic colocation services with minimal value-added features face significant price pressure.

- Low Margin Potential: Services lacking differentiation often yield lower profit margins, impacting overall profitability.

- Strategic Focus: Digital Realty prioritizes high-growth, high-margin areas like hyperscale and interconnection.

- Competitive Landscape: Intense competition in commoditized segments can erode market share and pricing power.

Assets fitting the 'Dogs' quadrant in Digital Realty Trust's BCG matrix would likely include legacy data centers with low density and high operational costs, particularly those struggling to meet modern power and cooling demands. These facilities may also represent older, less strategic locations or commoditized service offerings facing intense price competition. For example, in 2024, the increasing demand for AI infrastructure, requiring power densities exceeding 20 kW per cabinet, highlights the challenge for older sites. Digital Realty's active capital recycling, including $1.3 billion in dispositions in 2023, demonstrates a strategy to divest from such non-core or underperforming assets.

Question Marks

Digital Realty's recent ventures into markets like India and Indonesia exemplify "Question Marks" in the BCG matrix. These early-stage international entries demand significant capital for infrastructure development and market penetration, with future profitability and market dominance still uncertain.

Digital Realty Trust's development projects under construction represent a significant investment, with a substantial pipeline of 734 MW in Q2 2025 and a total development pipeline valued at $9 billion. These capital-intensive projects are not yet contributing to revenue, positioning them as potential future Stars within the BCG framework. Successful completion and leasing of these data centers will be crucial for their transition to revenue-generating assets.

New AI-specific infrastructure deployments, especially those requiring cutting-edge power and cooling solutions, are emerging as potential 'Question Marks' within Digital Realty Trust's BCG Matrix. These advanced facilities demand substantial initial capital for technologies that are still maturing, meaning their long-term market acceptance and profitability are not yet fully established.

Investments in Emerging Technologies (e.g., Private AI)

Digital Realty's focus on enabling private AI infrastructure positions them to capitalize on a nascent but rapidly growing market. Their customer wins in this area highlight a strategic push into emerging technologies, even if the market is still developing. This segment likely falls into the "Question Marks" category of the BCG matrix, demanding significant investment to foster growth and market share.

- Market Potential: The global AI market is projected to reach $1.8 trillion by 2030, with private AI solutions representing a significant portion of this growth, driven by data privacy and security concerns.

- Investment Needs: Developing and marketing private AI solutions requires substantial capital expenditure for specialized infrastructure and ongoing research and development.

- Risk Profile: As a developing market, private AI faces uncertainties regarding widespread adoption, technological evolution, and competitive landscape shifts.

- Strategic Importance: Early investment in private AI infrastructure allows Digital Realty to establish a strong foothold and influence the direction of this critical technological trend.

Strategic Partnerships for New Growth Areas

Strategic partnerships, like the significant $7 billion venture with Blackstone for hyperscale data center projects, are crucial for Digital Realty Trust to tap into new growth areas. These collaborations are essentially investments in future market share, but their true impact is contingent on successful execution and how well the market embraces the resulting offerings. For instance, in 2024, Digital Realty continued to expand its global footprint through strategic capital deployments, aiming to capture demand in emerging digital economies.

These alliances are designed to accelerate Digital Realty's expansion into promising segments, thereby enhancing its position within the BCG matrix. However, they inherently involve a sharing of both the potential upside and the inherent risks. The success of these ventures directly influences Digital Realty's ability to move its offerings into the Stars or Cash Cows quadrants.

- Accelerated Expansion: Partnerships like the one with Blackstone provide substantial capital to fund large-scale hyperscale developments, crucial for meeting the rapidly growing demand from cloud providers.

- Risk Mitigation: Sharing investment burdens with partners like Blackstone distributes financial risk, making ambitious projects more feasible and less burdensome for Digital Realty alone.

- Market Penetration: These collaborations can open doors to new geographic markets or customer segments that might be challenging to access independently, boosting market share potential.

- Execution Dependency: The ultimate success of these partnerships hinges on Digital Realty's operational capabilities and the market's reception of the data center capacity developed, directly impacting their BCG matrix positioning.

Digital Realty's strategic push into emerging markets like India and Indonesia, alongside investments in new AI-specific infrastructure, places these initiatives firmly in the Question Mark category of the BCG matrix. These ventures require significant capital investment for development and market penetration, with their future profitability and market dominance yet to be solidified.

The company's substantial development pipeline, including 734 MW under construction as of Q2 2025, valued at $9 billion, represents a significant investment in potential future Stars. However, these projects are capital-intensive and not yet revenue-generating, making their successful completion and leasing critical for their transition within the BCG framework.

| Initiative | BCG Category | Key Considerations | Data Point (Q2 2025) |

|---|---|---|---|

| Emerging Market Expansion (India, Indonesia) | Question Mark | High capital needs, uncertain market adoption | N/A (Specific market entry data not provided) |

| AI-Specific Infrastructure | Question Mark | Nascent market, evolving technology, high initial costs | N/A (Specific AI deployment data not provided) |

| Development Pipeline | Potential Star (currently Question Mark) | Significant capital investment, future revenue potential | 734 MW under construction, $9 billion total development pipeline |

BCG Matrix Data Sources

Digital Realty Trust's BCG Matrix is informed by comprehensive financial disclosures, including annual reports and SEC filings, alongside detailed market research and industry growth projections.