Digital China Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital China Group Bundle

Navigate the complex external forces impacting Digital China Group with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are creating both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategy and gain a competitive edge. Download the full PESTLE analysis now for immediate insights.

Political factors

The Chinese government's commitment to digital transformation remains a significant political driver, with the nation investing heavily in areas like 5G, AI, and cloud computing. This strategic push is designed to bolster economic growth and enhance global competitiveness. For instance, China's State Council has outlined plans to accelerate the integration of digital technologies into various industries, aiming for a substantial increase in the digital economy's share of GDP by 2025.

Digital China Group is positioned to capitalize on this governmental focus. As a leading IT service provider, the company benefits directly from policies that encourage digital infrastructure development and the adoption of new technologies. This includes potential access to government grants and preferential treatment for projects aligned with national digital strategies, creating a supportive ecosystem for its business expansion and innovation efforts.

Ongoing geopolitical tensions, especially with the United States, continue to shape Digital China Group's operational landscape. These tensions can restrict access to critical foreign technologies and components, prompting a strategic pivot towards strengthening domestic supply chain resilience and fostering indigenous innovation. For instance, the US Commerce Department's export controls on advanced semiconductors, which intensified in 2023 and are expected to continue influencing the market through 2024, directly impact companies reliant on such technologies.

China's increasing emphasis on national security and technological self-reliance presents both hurdles and avenues for local IT service providers like Digital China Group. The drive for indigenous capabilities creates opportunities for the company to step in and fill technological gaps, thereby bolstering domestic capacity. This national strategy is reflected in government initiatives like the Made in China 2025 plan, which targets significant advancements in key sectors, including information technology, aiming to reduce reliance on foreign suppliers.

China's 'Digital China' national strategy, a comprehensive plan to foster a digitally empowered society and economy, directly benefits companies like Digital China Group. This strategy prioritizes advancements in areas where Digital China Group excels, such as cloud computing and big data solutions.

The company's core business in digital transformation services is perfectly aligned with the objectives of the 'Digital China' initiative. This strategic alignment is expected to translate into significant opportunities for government contracts and participation in major national digital infrastructure projects, ensuring a robust demand for their expertise through 2025 and beyond.

Cybersecurity and Data Sovereignty Policies

China's cybersecurity and data sovereignty laws, such as the Cybersecurity Law and the Data Security Law, compel critical information infrastructure operators and data handlers to store specific data within China's borders. This regulatory landscape directly benefits Digital China Group by increasing the demand for its domestic data center and cloud services, as companies must comply with these mandates. Furthermore, the company's expertise in cybersecurity and data compliance solutions becomes essential for businesses navigating these complex requirements, bolstering its market position.

The imperative to comply with these stringent regulations underscores the importance of Digital China Group's robust domestic infrastructure and its ability to offer compliant solutions. Failure to adhere to these policies can lead to significant penalties and reputational damage, making adherence a critical factor for operational legitimacy and client trust. For instance, in 2023, China continued to enhance its enforcement of data localization rules, with reports indicating increased scrutiny on cross-border data transfers by multinational corporations operating within the country.

- Data Localization Mandates: Policies require certain data to be stored within China, boosting demand for local data centers.

- Cybersecurity Focus: Increased government emphasis on cybersecurity creates opportunities for Digital China Group's security solutions.

- Compliance as a Differentiator: Adherence to evolving data regulations is key for maintaining operational legitimacy and client confidence.

State-Owned Enterprise (SOE) Reform and Competition

While Digital China Group operates as a private entity, the Chinese IT landscape is significantly shaped by state-owned enterprises (SOEs). Government-led reforms targeting SOEs in 2024 and 2025 are focused on enhancing their operational efficiency and market responsiveness. This could intensify competition for Digital China Group.

Despite the potential for increased competition from reformed SOEs, Digital China Group's strong existing ties with government agencies and SOE clients provide a competitive advantage. Its position as a market leader with advanced solutions enables it to effectively manage this dynamic environment.

- SOE Reform Focus: Initiatives in 2024-2025 aim to make SOEs more market-driven, potentially altering competitive dynamics.

- Digital China's Advantage: Established government and SOE relationships and leading solutions mitigate competitive pressures.

- Market Positioning: Digital China Group's solutions are integral to many government and SOE digital transformation projects.

China's national digital strategy continues to be a primary political driver, with substantial government investment funneling into 5G, AI, and cloud computing infrastructure through 2025. This focus aims to boost economic growth and solidify China's global tech standing, as evidenced by plans to significantly increase the digital economy's GDP contribution by 2025.

Digital China Group is well-positioned to benefit from these government initiatives, particularly those encouraging digital infrastructure development and technology adoption. Policies supporting domestic innovation and supply chain resilience, especially in response to geopolitical tensions impacting access to foreign technologies, create opportunities for the company to provide indigenous solutions.

Stringent cybersecurity and data sovereignty laws, like the Data Security Law, mandate local data storage, directly increasing demand for Digital China Group's domestic data center and cloud services. Compliance with these evolving regulations, with enhanced enforcement observed in 2023 and continuing into 2024, becomes a critical differentiator for the company.

| Policy Area | Impact on Digital China Group | Key Data/Timeline |

| Digital China Strategy | Increased demand for cloud, big data, and digital transformation services. | Aiming for significant digital economy GDP share increase by 2025. |

| Data Localization & Cybersecurity Laws | Boosts demand for domestic data centers and compliance solutions. | Enhanced enforcement of data localization in 2023-2024. |

| Geopolitical Tensions & Tech Self-Reliance | Opportunities in developing domestic alternatives to foreign tech. | Continued US export controls on semiconductors impacting 2024. |

What is included in the product

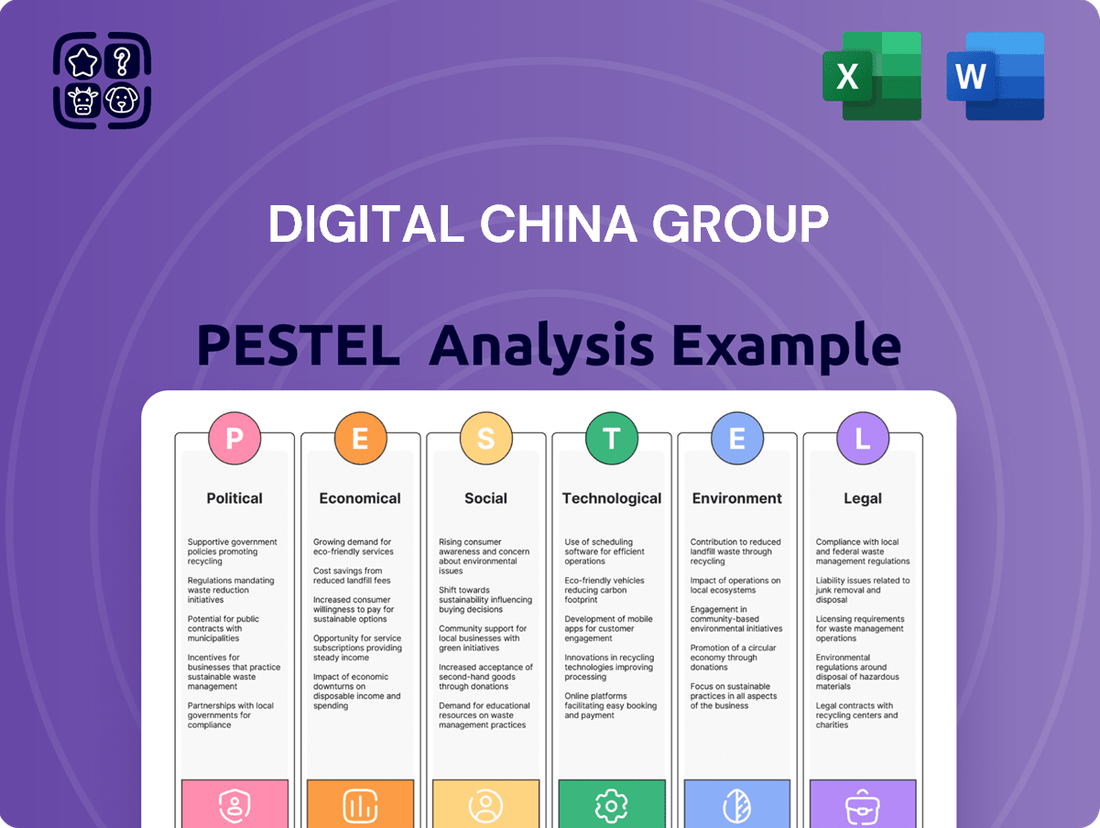

This PESTLE analysis of Digital China Group examines the influence of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic direction.

It provides a comprehensive overview of the external forces shaping Digital China Group's market, offering insights for strategic decision-making and risk management.

A concise PESTLE analysis of Digital China Group that highlights key external factors, serving as a pain point reliever by providing clear insights for strategic decision-making.

Economic factors

Despite a moderation in its growth rate, China's economy remains a powerful engine for IT spending. In 2023, China's GDP grew by 5.2%, demonstrating continued economic expansion that fuels investment in digital transformation across sectors like finance, manufacturing, and government. This sustained economic activity directly translates into increased demand for IT services, benefiting companies like Digital China Group.

Digital China Group is well-positioned to capitalize on this trend. As businesses and public sector organizations across China invest heavily in upgrading their IT infrastructure and adopting new digital solutions to boost productivity and gain a competitive edge, the company sees a substantial opportunity. The sheer size of the Chinese market, with its millions of enterprises and government bodies, offers a vast and growing customer base for Digital China Group's comprehensive IT offerings.

Chinese businesses are heavily investing in digital transformation to stay ahead. This trend is directly benefiting companies like Digital China Group, which provides essential digital solutions. In 2024, IT spending in China was projected to reach $316 billion, with a significant portion directed towards cloud computing and data analytics.

This heightened corporate investment in digital infrastructure, including cloud services and big data, signifies a strong and expanding market for Digital China Group's core offerings. The company's position as a provider of these critical digital transformation tools ensures a consistent and growing revenue stream as more enterprises digitize their operations.

Global and domestic inflationary pressures present a significant economic challenge for Digital China Group, directly impacting operational costs. For instance, the cost of semiconductors, a key component in many of their hardware offerings, saw significant price increases throughout 2024, with some components experiencing rises of over 15% year-on-year. Similarly, energy prices for their data centers, crucial for cloud services, have remained volatile, with average electricity costs in key Asian markets increasing by an estimated 8% in early 2025 compared to the previous year.

Managing these escalating costs while striving to maintain competitive pricing in the digital services market is a critical balancing act. Digital China Group must focus on implementing robust cost management strategies, such as optimizing supply chain logistics and exploring more energy-efficient data center solutions. Leveraging economies of scale in procurement and operations will be essential to absorb some of these inflationary impacts and maintain profitability.

Intense Market Competition

The Chinese IT services market is characterized by fierce competition, with a multitude of domestic and international companies actively seeking to capture market share. Digital China Group navigates this landscape alongside established technology leaders, focused cloud service providers, and agile new entrants.

This highly competitive environment can exert downward pressure on pricing and profit margins. Consequently, Digital China Group must prioritize ongoing innovation and cultivate strong differentiation in its service portfolio and client engagement strategies to maintain its competitive edge.

- Market Share Dynamics: In 2024, the Chinese IT services market is projected to reach over $200 billion, with numerous players contributing to this growth.

- Key Competitors: Digital China Group competes with giants like Huawei, Tencent, and Alibaba, as well as specialized firms in areas like AI and cybersecurity.

- Pricing Pressures: Reports from 2024 indicate that intense competition has led to an average price reduction of 5-10% for standard IT services in China.

- Innovation Imperative: Companies like Digital China Group are investing heavily in R&D, with IT service spending on new technologies like cloud and AI expected to grow by 15-20% annually through 2025.

Investment Climate and Access to Capital

The broader investment climate in China, particularly policies affecting foreign direct investment (FDI) and the growth of domestic capital markets, directly impacts Digital China Group's capacity to finance its growth. For instance, China's efforts to liberalize its financial markets and attract foreign capital, as seen in the continued expansion of the Stock Connect programs, aim to create a more robust funding environment. This favorable climate is crucial for Digital China Group to secure capital for ambitious expansion plans, critical technology upgrades, and deeper market penetration, especially as the digital economy continues its rapid ascent.

A supportive investment environment is a cornerstone for Digital China Group's strategic objectives. In 2024, China's State Council continued to emphasize measures to attract foreign investment, including further opening up sectors like value-added telecommunications services, which are core to Digital China Group's operations. This policy direction is designed to ensure companies like Digital China Group have ready access to the capital needed for strategic acquisitions, significant technology investments, and aggressive market expansion initiatives.

Digital China Group's ability to attract further investment hinges significantly on its own financial health and its strategic alliances. The company's demonstrated financial performance, including revenue growth and profitability, coupled with successful partnerships, builds investor confidence. For example, its reported revenue for the fiscal year ending March 2024, which saw a notable increase in its cloud services segment, signals a strong operational footing that is attractive to both domestic and international investors looking to capitalize on China's digital transformation.

Key factors influencing Digital China Group's access to capital include:

- Government policies on foreign investment: Continued liberalization and sector-specific opening up directly benefit companies operating in technology and digital services.

- Domestic capital market development: The deepening of China's stock markets and bond markets provides alternative and often more accessible funding avenues.

- Company financial performance: Strong revenue growth, profitability, and efficient capital allocation are critical for attracting and retaining investor interest.

- Strategic partnerships and alliances: Collaborations with major tech firms or government entities can enhance credibility and unlock new investment opportunities.

China's economic trajectory presents a robust backdrop for IT spending, with GDP growth consistently fueling digital transformation initiatives. This sustained economic expansion directly translates into increased demand for IT services, benefiting companies like Digital China Group.

The Chinese IT services market is projected to reach over $200 billion in 2024, underscoring the significant investment in digital solutions. Companies are prioritizing cloud computing and data analytics, areas where Digital China Group holds a strong market position.

While economic growth is a tailwind, inflationary pressures, particularly in component costs like semiconductors, present a challenge. For instance, semiconductor prices saw increases of over 15% year-on-year in 2024, impacting hardware margins.

| Economic Factor | 2023 Data | 2024 Projection/Estimate | Impact on Digital China Group | Key Considerations |

|---|---|---|---|---|

| GDP Growth (China) | 5.2% | ~5.0% | Sustains IT spending, driving demand for digital solutions. | Continued economic stability is crucial for investment in digital transformation. |

| IT Services Market Size (China) | ~$190 billion | ~$200+ billion | Expands the addressable market for Digital China Group's offerings. | Intense competition within this growing market. |

| Semiconductor Costs | Increasing | Up >15% YoY (2024 estimate) | Increases operational costs for hardware-centric solutions. | Need for efficient supply chain management and potential price adjustments. |

| Electricity Costs (Asia) | Stable to Moderate Increase | Up ~8% (early 2025 estimate) | Impacts data center operational expenses for cloud services. | Focus on energy efficiency and cost optimization in data centers. |

Preview the Actual Deliverable

Digital China Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Digital China Group covers all key external factors impacting its operations and strategy. You'll gain immediate access to this detailed report upon completing your purchase.

Sociological factors

China's digital literacy is soaring, with the Cyberspace Administration of China reporting over 1.07 billion internet users by the end of 2023. This widespread adoption fuels demand for Digital China Group's cloud, big data, and digital transformation services, as more individuals and businesses embrace digital tools.

The increasing comfort with digital technologies across all demographics creates a strong foundation for growth in the IT services sector. This societal trend directly translates into greater market opportunities for companies like Digital China Group, which are at the forefront of providing these essential digital solutions.

The increasing reliance on digital services for everyday tasks, like online shopping and mobile banking, sets a high bar for business efficiency. This societal shift fuels a robust demand for digital transformation, pushing companies to adopt solutions that improve customer interactions and operational workflows.

Enterprises are actively seeking digital tools to elevate customer experiences and streamline internal processes, directly aligning with Digital China Group's core business. For instance, in 2023, China's digital economy reached approximately 53 trillion yuan, highlighting the immense market opportunity for companies like Digital China Group that facilitate this transition.

China boasts a vast labor force, but a significant shortage persists in advanced IT domains like artificial intelligence, cloud computing, and cybersecurity. This presents a challenge for Digital China Group as it navigates the need for specialized expertise.

To counter this, Digital China Group must prioritize strategic investments in talent. This includes robust recruitment efforts, comprehensive upskilling and reskilling programs, and initiatives to retain top performers. For instance, by mid-2024, the demand for AI specialists in China was reported to be over 5 million, far exceeding the available supply.

Effectively bridging these skill gaps is not merely beneficial but essential for Digital China Group to maintain its leadership and deliver innovative, high-demand digital solutions in a rapidly evolving market.

Data Privacy Concerns Among Citizens and Businesses

As China's digital economy expands, citizens and businesses are increasingly vocal about data privacy. A 2024 survey indicated that over 70% of Chinese internet users express significant concern about how their personal data is collected and used. This societal shift directly influences the market for IT solutions, pushing for greater transparency and security in data handling.

This heightened awareness creates a strong demand for services that ensure data protection and regulatory compliance. Companies like Digital China Group can leverage this by providing advanced cybersecurity measures and data governance frameworks.

- Growing Public Demand: Over 70% of Chinese internet users in 2024 reported concerns about personal data privacy.

- Market Opportunity: This concern fuels demand for secure IT infrastructure and data protection services.

- Competitive Advantage: Digital China Group can build trust by offering robust, compliant data solutions.

- Regulatory Landscape: Evolving data protection laws, like the Personal Information Protection Law (PIPL), underscore the importance of these concerns.

Urbanization Driving Smart City Solutions

China's rapid urbanization remains a powerful driver for smart city development, creating a substantial demand for sophisticated digital infrastructure and integrated IT solutions. As of 2024, over 65% of China's population resides in urban areas, a figure projected to reach 70% by 2025, highlighting the scale of this ongoing transformation.

Digital China Group is strategically positioned to capitalize on this trend. Its core strengths in system integration and IT planning are directly applicable to the complex needs of large-scale urban development projects. The company's involvement in smart city initiatives is expected to see continued growth, mirroring the national investment in these areas.

The demand for smart city solutions presents a significant growth opportunity for Digital China Group, with market research indicating the Chinese smart city market is expected to reach over $30 billion by 2025. This growth is fueled by government initiatives and the increasing need for efficient urban management.

- Urban Population Growth: Over 65% of China's population lived in urban areas in 2024, projected to hit 70% by 2025.

- Market Size: The Chinese smart city market is anticipated to exceed $30 billion by 2025.

- Digital China's Role: The company's expertise in system integration and IT planning aligns perfectly with smart city infrastructure needs.

China's burgeoning digital economy, valued at approximately 53 trillion yuan in 2023, underscores a societal embrace of digital services for everything from shopping to banking. This widespread adoption creates a fertile ground for Digital China Group's offerings, as citizens and businesses alike increasingly rely on digital solutions for efficiency and enhanced customer experiences.

However, a significant IT talent gap, particularly in AI and cloud computing, poses a challenge, with demand for AI specialists exceeding supply by over 5 million in mid-2024. Digital China Group must invest in talent development to meet this demand and maintain its competitive edge.

Furthermore, heightened public concern over data privacy, with over 70% of internet users expressing worries in 2024, drives demand for secure IT solutions. Digital China Group can leverage this by providing robust data protection and compliance services, aligning with evolving regulations like PIPL.

The rapid urbanization trend, with over 65% of the population living in urban areas in 2024 and projected to reach 70% by 2025, fuels smart city development. This presents a substantial market opportunity, estimated to exceed $30 billion by 2025, for Digital China Group's system integration and IT planning expertise.

| Sociological Factor | 2023/2024 Data Point | Implication for Digital China Group |

|---|---|---|

| Digital Adoption | 1.07 billion internet users (end of 2023) | Increased demand for cloud, big data, and digital transformation services. |

| Talent Shortage | Over 5 million AI specialist demand gap (mid-2024) | Need for strategic investment in talent acquisition and development. |

| Data Privacy Concerns | Over 70% of users concerned (2024) | Opportunity for cybersecurity and data governance solutions. |

| Urbanization | 65% urban population (2024), projected 70% by 2025 | Growth opportunities in smart city infrastructure and integrated IT solutions. |

Technological factors

The relentless pace of cloud computing, embracing hybrid and multi-cloud strategies, alongside the rapid maturation of artificial intelligence, are fundamental technological forces shaping Digital China Group's landscape. These advancements are not just trends; they are the bedrock upon which new digital services are built and existing ones are redefined.

Digital China Group's ability to pivot and embed these sophisticated technologies into its portfolio is critical for maintaining its competitive edge. For instance, by leveraging AI in data analytics, the company can offer more predictive insights to its clients, a key differentiator in a crowded market. Staying ahead means not just adopting these technologies but actively integrating them to deliver superior client value.

The global cloud computing market, projected to reach over $1.3 trillion by 2025, underscores the immense opportunity. Similarly, AI adoption is accelerating, with businesses increasingly relying on AI-powered solutions for efficiency and innovation, areas where Digital China Group is strategically positioned.

The rapid rollout of 5G infrastructure across China presents significant growth avenues for Digital China Group. By the end of 2024, China had already established over 3.3 million 5G base stations, a testament to the nation's commitment to this advanced technology.

This widespread 5G deployment fuels demand for sophisticated digital solutions. Faster speeds and reduced latency are critical enablers for the Internet of Things (IoT), edge computing, and big data analytics, all core areas where Digital China Group can expand its service portfolio.

Digital China Group is well-positioned to capitalize on these trends by integrating 5G capabilities into its existing offerings and developing innovative digital applications. This strategic alignment with 5G advancement is expected to drive new revenue streams and enhance client digital transformation initiatives.

The sheer volume and complexity of data businesses now handle are exploding, making advanced big data analytics essential. This trend is a significant technological driver for companies like Digital China Group.

Digital China Group leverages its big data capabilities to assist clients in uncovering valuable insights, streamlining operations, and improving decision-making processes. This directly addresses the market's growing need for sophisticated data processing and analysis tools.

For instance, the global big data analytics market was projected to reach $274.3 billion by 2022 and is expected to continue its robust growth through 2025, highlighting the persistent demand for these advanced technological solutions.

Evolving Cybersecurity Threats and Solutions

The cybersecurity landscape is in constant flux, with increasingly sophisticated threats emerging annually. This dynamic challenge fuels a persistent need for advanced security solutions, a core offering for Digital China Group. For instance, in 2024, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the immense market opportunity.

Digital China Group must prioritize research and development to stay ahead, creating cutting-edge security services. These services are crucial for safeguarding client digital assets and ensuring adherence to evolving data protection regulations, such as China's Personal Information Protection Law (PIPL).

- Evolving Threat Landscape: New malware variants and advanced persistent threats (APTs) are continuously developed by malicious actors.

- Demand for Robust Solutions: The increasing frequency and severity of cyberattacks create a strong market demand for comprehensive cybersecurity services.

- Regulatory Compliance: Strict data privacy laws necessitate advanced security measures to protect sensitive information and avoid significant penalties.

- R&D Investment: Digital China Group's commitment to innovation in security technologies is paramount for maintaining a competitive edge and client trust.

Emergence of New Technologies (Blockchain, IoT, etc.)

The rapid evolution of technologies like blockchain and the Internet of Things (IoT) is reshaping industries, and Digital China Group must stay ahead of these trends. For instance, the global IoT market is projected to reach $1.1 trillion by 2025, indicating a massive opportunity for companies leveraging connected devices and data analytics. Digital China Group can harness these advancements to offer innovative solutions to its clients.

The integration of advanced technologies like digital twins, which create virtual replicas of physical assets, offers new avenues for optimization and predictive maintenance. By 2026, the digital twin market is expected to grow to $15.6 billion, demonstrating its increasing importance in industrial applications. Digital China Group’s strategic focus on these emerging tech areas will be crucial for maintaining its competitive edge and expanding its service offerings.

- Blockchain Adoption: China is actively promoting blockchain technology, with a significant number of blockchain patents filed in 2023, highlighting its strategic importance.

- IoT Growth: The number of connected IoT devices in China is expected to surpass 50 billion by 2025, presenting substantial opportunities for data management and analysis services.

- Digital Twin Potential: Early investment in digital twin capabilities can position Digital China Group to capture a significant share of a market anticipated to reach $15.6 billion globally by 2026.

The technological landscape is defined by the pervasive growth of cloud computing, artificial intelligence, and 5G infrastructure. Digital China Group's strategic integration of these technologies, including big data analytics and advanced cybersecurity solutions, is crucial for its market positioning and client value proposition. Emerging technologies like blockchain and digital twins also present significant future growth opportunities.

| Technology Area | 2024/2025 Projection/Data | Impact on Digital China Group |

|---|---|---|

| Cloud Computing Market | Projected to exceed $1.3 trillion by 2025 | Drives demand for cloud-based services and infrastructure management. |

| 5G Infrastructure (China) | Over 3.3 million 5G base stations by end of 2024 | Enables faster data transmission, supporting IoT, edge computing, and big data. |

| Big Data Analytics Market | Projected robust growth through 2025 (reached $274.3 billion in 2022) | Enhances insights and operational efficiency for clients. |

| Cybercrime Cost | Projected to reach $10.5 trillion annually by 2025 | Increases demand for robust cybersecurity services. |

| IoT Market | Projected to reach $1.1 trillion by 2025 | Creates opportunities in connected device data management. |

| Digital Twin Market | Expected to reach $15.6 billion globally by 2026 | Offers potential for industrial optimization and predictive maintenance solutions. |

Legal factors

China's Cybersecurity Law (CSL), enacted in 2017, mandates stringent data protection and localization for network operators and critical information infrastructure (CII) providers. Digital China Group, operating within this landscape as an IT service provider, must meticulously align its internal processes and client-facing solutions with CSL mandates. This regulatory environment, while posing compliance challenges, simultaneously fuels demand for specialized cybersecurity and data compliance services, a segment where Digital China Group can leverage its expertise.

China's Personal Information Protection Law (PIPL), enacted in November 2021, presents a significant legal framework for data handling, akin to Europe's GDPR. Digital China Group must navigate these regulations, which impose strict requirements on how personal data is collected, processed, and transferred, impacting its cloud and data services.

The group's ability to guide clients through PIPL compliance and ensure its own operations meet these stringent standards is paramount. Non-compliance risks substantial fines, with penalties potentially reaching up to 5% of annual turnover or ¥5 million RMB, as stipulated by the law, undermining customer trust and operational continuity.

China's Data Security Law (DSL), enacted in September 2021, classifies data into different levels of importance, imposing significant obligations on data handlers. This includes stringent requirements for transferring data outside of China, impacting companies like Digital China Group. For instance, the DSL mandates security assessments for data transfers exceeding certain thresholds, aiming to protect national security and public interest.

Digital China Group must meticulously navigate these evolving regulations when offering services that involve cross-border data flows. Failure to comply can result in substantial penalties, including fines up to 50 million yuan or even business suspension, as stipulated by the DSL. Therefore, a robust understanding and implementation of DSL requirements are critical for both the company and its international clientele.

Anti-Monopoly Regulations in the Tech Sector

China's intensified focus on anti-monopoly measures within its technology industry, exemplified by significant fines levied against major players like Alibaba (which faced a $2.8 billion fine in 2021) and Tencent, underscores a commitment to cultivating a more equitable market. While Digital China Group may not directly face these large-scale investigations, these regulatory shifts create a ripple effect. This means potential impacts on its strategic alliances and acquisition opportunities, as well as the overall competitive dynamics within the sectors it operates. Navigating these evolving legal frameworks is paramount for Digital China Group's long-term viability and expansion.

Intellectual Property Rights (IPR) Protection

The protection of intellectual property rights (IPR) is a critical legal consideration for Digital China Group, particularly within China's rapidly evolving technology landscape. The company's success hinges on its proprietary software, innovative solutions, and unique methodologies. Ensuring strong IPR protection not only safeguards these assets but also fosters an environment conducive to further innovation and the secure licensing of its technological advancements.

China has been actively strengthening its legal frameworks for IPR protection. For instance, in 2023, the Supreme People's Court reported a significant increase in IP-related cases, indicating a more robust enforcement environment. This trend is expected to continue, offering greater security for companies like Digital China Group that invest heavily in research and development.

- Increased IP Enforcement: China's commitment to IP protection is demonstrated by rising numbers of IP infringement cases handled by courts, signaling a more stringent legal environment.

- Impact on Innovation: Stronger IPR frameworks directly encourage Digital China Group to invest in developing and patenting new technologies and services.

- Licensing Opportunities: Enhanced legal safeguards for intellectual property make it more attractive for Digital China Group to license its technologies and solutions to other entities.

- Mitigating Risk: Adhering to and benefiting from robust IPR laws helps Digital China Group mitigate the risks associated with unauthorized use or replication of its digital assets.

China's robust legal framework for data governance, including the Cybersecurity Law (CSL), Personal Information Protection Law (PIPL), and Data Security Law (DSL), imposes strict requirements on data handling and cross-border transfers. Digital China Group must ensure compliance with these regulations, which carry significant penalties for violations, such as fines up to 5% of annual turnover or ¥5 million RMB for PIPL breaches. The group's ability to navigate these complex laws is crucial for its IT services and cloud offerings.

The intensified anti-monopoly enforcement in China's tech sector, evidenced by substantial fines on major companies, indirectly influences Digital China Group's strategic partnerships and market positioning. Furthermore, China's strengthening of intellectual property rights (IPR) protection, with a notable increase in IP-related cases handled by courts in 2023, provides a more secure environment for Digital China Group's innovation and potential technology licensing activities.

Environmental factors

The Chinese government is strongly advocating for green IT and enhanced energy efficiency, particularly targeting energy-intensive industries such as data centers. This governmental focus translates into a significant regulatory and market impetus for companies like Digital China Group to integrate sustainable practices into their operations and provide energy-saving solutions to their clientele.

For instance, China's 14th Five-Year Plan (2021-2025) emphasizes reducing energy consumption per unit of GDP, a directive that directly impacts IT infrastructure. By 2025, the plan aims for a 13.5% reduction in energy intensity compared to 2020 levels. This creates a clear expectation for Digital China Group to demonstrate its commitment to these goals.

Adherence to these environmental mandates is increasingly becoming a crucial differentiator and a key driver of competitive advantage within the market. Companies that proactively embrace and implement green IT strategies are likely to gain favor with both regulators and environmentally conscious customers.

China's commitment to achieving carbon neutrality by 2060 places significant pressure on energy-intensive sectors like data centers, directly impacting Digital China Group. The IT industry, a major electricity consumer, must align with these national objectives.

Digital China Group's strategy must incorporate substantial investments in renewable energy sources to power its data centers. Optimizing operational efficiency for reduced emissions and developing cloud solutions with a lower carbon footprint are also crucial steps. For instance, by 2023, China's renewable energy capacity reached 1.52 billion kilowatts, a 29.5% increase year-on-year, showcasing the growing availability of green power.

Beyond regulatory compliance, actively reducing its carbon footprint is a core corporate responsibility for Digital China Group. This proactive approach can enhance brand reputation and appeal to environmentally conscious clients and investors, especially as global ESG (Environmental, Social, and Governance) considerations become more prominent in investment decisions.

Digital China Group, as a significant player in IT product distribution and services, faces increasing scrutiny under China's evolving e-waste management regulations. These rules mandate responsible disposal and recycling of electronic equipment, directly impacting the company's operational footprint.

In 2023, China's Ministry of Ecology and Environment reported a substantial increase in e-waste generation, underscoring the urgency for compliance. Digital China Group must therefore prioritize sustainable lifecycle management for its IT assets, ensuring adherence to national environmental policies and promoting a circular economy for electronics.

Sustainable Supply Chain Practices

Digital China Group faces growing pressure to ensure its supply chains are environmentally sound. As a major IT service provider and product distributor, the company is increasingly expected to verify that its partners meet environmental standards.

This involves careful consideration of where components are sourced and actively encouraging suppliers to adopt greener manufacturing methods. For instance, in 2024, the company continued to emphasize its commitment to reducing carbon emissions across its operations, aiming for a significant reduction by 2030, aligning with national targets.

- Responsible Sourcing: Digital China Group is expected to prioritize suppliers who demonstrate ethical and environmentally conscious sourcing of raw materials and components.

- Eco-Friendly Manufacturing: Encouraging and verifying that manufacturing processes used by suppliers minimize waste, pollution, and energy consumption is crucial.

- Carbon Footprint Reduction: A key focus for 2024 and beyond is the reduction of the overall carbon footprint associated with the entire supply chain, from production to distribution.

- Circular Economy Principles: The company is exploring ways to integrate circular economy principles, promoting repair, refurbishment, and recycling of IT products within its distribution network.

Corporate Social Responsibility (CSR) in Environmental Protection

Digital China Group faces increasing pressure to go beyond mere regulatory compliance and actively engage in environmental protection through robust Corporate Social Responsibility (CSR). Stakeholders, including investors and consumers, now expect transparent reporting on environmental performance and tangible investments in green technologies. For instance, the company's commitment to reducing carbon emissions aligns with China's national goals, which aim for peak carbon emissions before 2030 and carbon neutrality by 2060.

A proactive stance on environmental CSR can significantly bolster Digital China Group's brand reputation and foster deeper trust among its diverse stakeholder base. This proactive approach often translates into competitive advantages, as seen in the growing market demand for sustainable products and services. The company's participation in initiatives aimed at ecological sustainability, such as reforestation projects or waste reduction programs, can further solidify its image as an environmentally conscious entity.

Key aspects of Digital China Group's environmental CSR strategy might include:

- Transparent Reporting: Publishing annual sustainability reports detailing energy consumption, waste management, and carbon footprint reduction efforts, aligning with global standards like the Global Reporting Initiative (GRI).

- Green Technology Investment: Allocating capital towards developing and adopting eco-friendly technologies within its operations and product offerings, potentially targeting a specific percentage of R&D budget for green initiatives.

- Ecological Initiatives: Engaging in partnerships with environmental organizations or launching internal programs focused on biodiversity conservation, water resource management, or circular economy principles.

- Supply Chain Sustainability: Working with suppliers to ensure they also adhere to environmental standards, thereby extending the positive impact beyond the company's direct operations.

China's push for green IT and energy efficiency, particularly in data centers, directly impacts Digital China Group. The 14th Five-Year Plan targets a 13.5% reduction in energy intensity by 2025, creating a clear mandate for the company to adopt sustainable practices and offer energy-saving solutions.

Digital China Group must invest in renewable energy, optimize operational efficiency, and develop low-carbon cloud solutions to align with China's 2060 carbon neutrality goal. By 2023, China's renewable energy capacity reached 1.52 billion kilowatts, a 29.5% year-on-year increase, indicating growing green power availability.

The company faces increasing scrutiny under evolving e-waste management regulations, necessitating responsible disposal and recycling of IT equipment. In 2023, e-waste generation saw a substantial increase, highlighting the need for Digital China Group to prioritize sustainable lifecycle management and circular economy principles for electronics.

Digital China Group is also under pressure to ensure its supply chains are environmentally sound, encouraging suppliers to adopt greener manufacturing methods. For instance, in 2024, the company continued its commitment to reducing carbon emissions across its operations, aiming for significant reductions by 2030.

| Environmental Factor | Government Mandate/Target | Digital China Group's Implication | Relevant Data Point |

|---|---|---|---|

| Green IT & Energy Efficiency | 14th Five-Year Plan: 13.5% reduction in energy intensity by 2025 | Integrate sustainable practices, offer energy-saving solutions | China's total energy consumption in 2023 was approximately 5.03 billion tons of standard coal equivalent. |

| Carbon Neutrality Goals | Carbon neutrality by 2060 | Invest in renewables, reduce operational carbon footprint | China's renewable energy capacity reached 1.52 billion kilowatts in 2023, up 29.5% YoY. |

| E-Waste Management | Stricter e-waste regulations | Prioritize responsible disposal, recycling, and circular economy principles | China's Ministry of Ecology and Environment reported a substantial increase in e-waste generation in 2023. |

| Supply Chain Sustainability | Emphasis on greener manufacturing | Verify supplier environmental standards, promote eco-friendly sourcing | Digital China Group aims for significant carbon emission reduction across its operations by 2030. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Digital China Group is meticulously constructed using data from official Chinese government publications, reports from international financial institutions, and leading technology industry research firms. This comprehensive approach ensures that our insights into political stability, economic growth, technological advancements, and societal trends are grounded in credible, current information.