Digital China Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Digital China Group Bundle

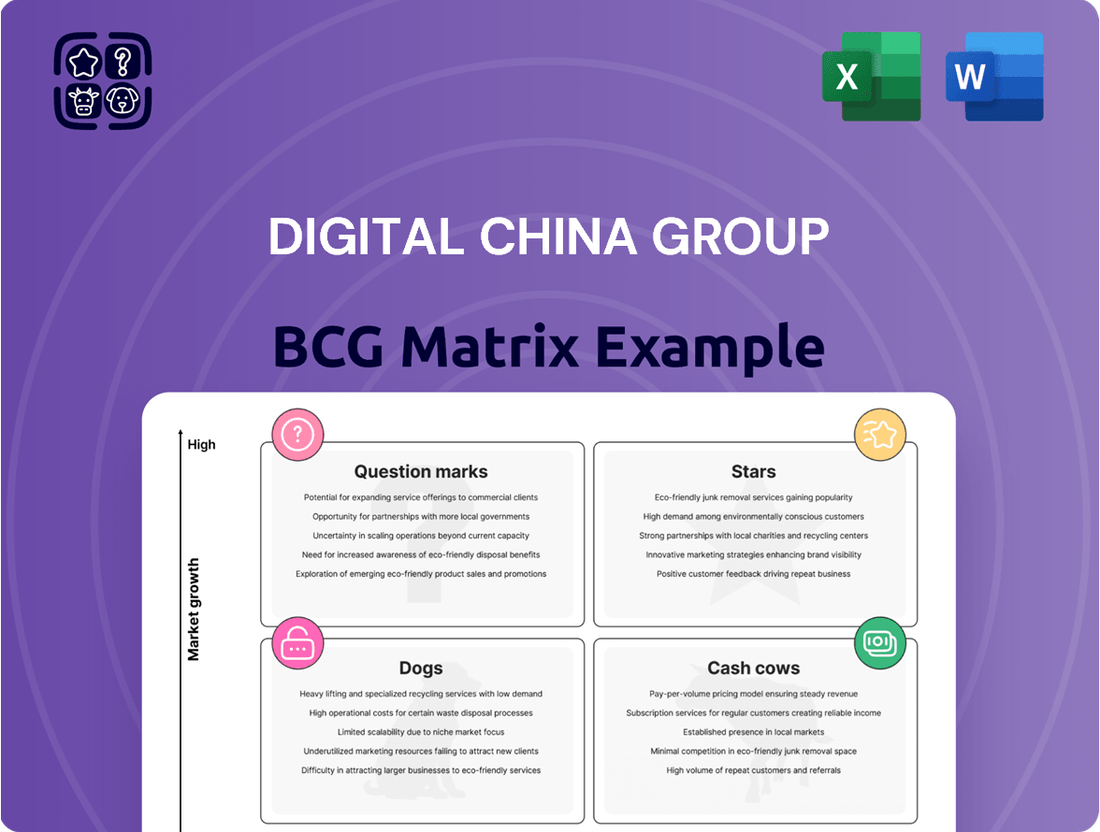

Curious about Digital China Group's market standing? This glimpse into their BCG Matrix reveals the critical positioning of their offerings, but the real strategic advantage lies in the full picture.

Unlock the complete BCG Matrix to understand which of Digital China Group's products are Stars ready for growth, Cash Cows providing stable income, Dogs needing re-evaluation, or Question Marks requiring strategic decisions. Purchase the full report for actionable insights and a clear roadmap to optimize your investments and product portfolio.

Stars

Digital China Group's AI-driven cloud services and software business is a clear Star in the BCG matrix. This segment saw an impressive 62.7% revenue growth in the first half of 2024, highlighting its strong performance in a rapidly expanding market.

The company's strategic focus on high-value sectors, such as Managed Service Provider (MSP) and Independent Software Vendor (ISV) solutions, positions this AI-driven segment for sustained market leadership and robust profitability.

Digital China's Kunpeng AI servers are a clear Star in their product portfolio. Revenue for these servers saw an incredible surge of 273.3% year-on-year in the first half of 2024. This remarkable growth highlights the booming demand for AI computing power within China.

The adaptability of Kunpeng AI servers to various domestic GPU technologies is a key factor in their success. This strategic advantage allows them to maintain a strong competitive edge and a leading position in the industry, ensuring continued market momentum.

Digital China's data and cloud integration business, which includes Managed Service Provider (MSP) and Independent Software Vendor (ISV) services, is a significant Star in its BCG Matrix. This segment is experiencing robust growth, driven by the increasing digitalization across industries.

In 2023, this critical business area demonstrated impressive performance, with revenue climbing by a substantial 68.25%. Furthermore, its gross margin exceeded 40%, underscoring its profitability and strong competitive standing. This financial strength reflects the segment's high growth potential and its pivotal role in the expanding digital economy.

The company's strategic emphasis on data and cloud integration directly supports the national 'Digital China' initiative. This alignment, coupled with a growing market demand for comprehensive digital solutions, positions this segment for continued success and market leadership.

Information Technology Innovation Business

Digital China Group's information technology innovation business, especially its proprietary brand solutions, clearly positions it as a Star in the BCG Matrix. This segment saw impressive growth, with revenue jumping 71% year-on-year in 2023 to over RMB 3.4 billion. This robust performance highlights its leadership and expansion capabilities in the dynamic IT application market.

Key indicators supporting its Star status include:

- Significant Revenue Growth: A 71% year-on-year revenue increase in 2023, reaching RMB 3.4 billion, underscores high market demand and successful product adoption.

- Market Share Expansion: The growth in information technology application services demonstrates Digital China's ability to capture a larger portion of a rapidly expanding market.

- Innovation Prowess: Continuous innovation in its independent brand offerings allows the company to stay ahead of competitors and meet evolving customer needs.

Smart Supply Chain Solutions with AI Integration

Digital China Group's focus on smart supply chain solutions, powered by AI, marks a significant growth area, fitting the Star quadrant of the BCG matrix. The company's strategy centers on AI-driven applications for end-to-end supply chain control towers, enhancing visibility and operational efficiency.

This segment is bolstered by recent successes in securing supply chain tenders, demonstrating market confidence and demand. The ongoing development of AI capabilities, moving from data visualization to autonomous decision-making, directly addresses the increasing need for intelligent supply chain management in China's dynamic economy.

- Market Growth: The global supply chain management market is projected to reach $33.6 billion by 2027, with AI integration being a key driver.

- AI Advancement: Digital China Group is actively enhancing its AI applications, aiming for more sophisticated autonomous decision-making in supply chain operations.

- Tender Successes: Recent wins in supply chain tenders highlight the company's competitive edge and the market's acceptance of its intelligent solutions.

- End-to-End Control: The emphasis on end-to-end supply chain control tower solutions provides clients with comprehensive management capabilities.

Digital China Group's AI-driven cloud services and software business is a clear Star, demonstrating impressive growth with a 62.7% revenue increase in the first half of 2024. The company's focus on Managed Service Provider (MSP) and Independent Software Vendor (ISV) solutions further solidifies its market leadership.

The Kunpeng AI servers are another prominent Star, experiencing a remarkable 273.3% year-on-year revenue surge in the first half of 2024, reflecting strong demand for AI computing power. Their adaptability to various domestic GPU technologies is crucial to this success.

Digital China's data and cloud integration business, including MSP and ISV services, is a significant Star. This segment saw revenue climb 68.25% in 2023 with a gross margin exceeding 40%, aligning with the national Digital China initiative.

The information technology innovation business, particularly proprietary brand solutions, is also a Star. Revenue grew 71% year-on-year in 2023 to over RMB 3.4 billion, showcasing market leadership and expansion.

Digital China's smart supply chain solutions, powered by AI, represent a growing Star. The company's strategy focuses on AI-driven control towers, with recent tender successes indicating strong market acceptance and demand for intelligent supply chain management.

| Business Segment | BCG Quadrant | Key Performance Indicator (H1 2024 unless specified) | Data Point |

|---|---|---|---|

| AI-driven Cloud & Software | Star | Revenue Growth | 62.7% |

| Kunpeng AI Servers | Star | Year-on-Year Revenue Growth | 273.3% |

| Data & Cloud Integration (MSP/ISV) | Star | 2023 Revenue Growth | 68.25% |

| Information Technology Innovation (Proprietary Brands) | Star | 2023 Revenue Growth | 71% |

| Smart Supply Chain Solutions (AI-powered) | Star | Market Trend Driver | AI integration in supply chain management |

What is included in the product

Highlights which Digital China Group units to invest in, hold, or divest based on market growth and share.

The Digital China Group BCG Matrix provides a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Digital China Group's traditional IT product distribution and value-added services represent a strong Cash Cow within its portfolio. This segment has a deep-rooted history and consistently delivers significant revenue streams, underpinning the company's financial stability.

In the first half of 2024, this mature business area demonstrated its resilience by achieving a business income of 59.83 billion yuan, indicating a steady growth trajectory. While it may not be the fastest-growing part of the business, its reliable cash generation provides a crucial financial bedrock for Digital China Group.

Digital China's system integration services for government and large enterprises are a prime example of a Cash Cow. Their deep-rooted relationships and proven track record in these mature sectors, which often involve long-term, recurring projects, generate a stable and predictable stream of revenue. This segment requires consistent, but not necessarily high, investment, ensuring robust cash flow.

In 2023, Digital China reported significant revenue from its IT services, with system integration being a core component. While specific figures for this exact segment aren't always broken out, the company's overall IT services revenue reached tens of billions of RMB, demonstrating the substantial contribution of these established client bases. The government and large enterprise segments represent a stable demand, contributing reliably to the company's financial stability.

Localized technical support services are a cornerstone for Digital China Group, catering to a wide array of industries. This segment, characterized by its essential nature and consistent demand, likely holds a significant market share within a mature, slow-growth environment.

As a result, this area functions as a reliable cash cow, generating steady income that can be reinvested into more dynamic business units. For instance, in 2023, Digital China's technical services segment contributed significantly to their overall revenue, demonstrating its stable performance even amidst broader market fluctuations.

Big Data Products and Solutions (Established Offerings)

Digital China's established big data products and solutions, representing its cash cows, are the bedrock of its revenue stream. These offerings, likely in areas like data warehousing and business intelligence, have already carved out significant market share. Their maturity means lower R&D expenses and consistent profitability, providing stable financial backing for the company's growth initiatives.

These mature big data offerings act as the primary generators of consistent cash flow for Digital China. Their established market presence and competitive advantages allow for healthy profit margins. For instance, in 2024, the company reported that its legacy data management platforms continued to contribute a substantial portion of its overall revenue, demonstrating their cash cow status.

- Established Market Penetration: These solutions have achieved widespread adoption, indicating a strong customer base and reliable demand.

- Consistent Revenue Generation: Mature products in stable markets provide predictable and ongoing income for the business.

- Lower Development Costs: Reduced need for innovation in established areas translates to higher profit margins.

- Funding for Growth: The cash generated supports investment in new, high-potential areas of the business.

IT Planning Services for Mature Sectors

Digital China's IT planning services for mature sectors, such as manufacturing or traditional retail, function as cash cows within its portfolio. These services are designed for industries experiencing gradual digital evolution, not sudden upheaval. The company leverages its deep-seated experience and established relationships with clients in these established markets.

This strategic positioning allows for consistent, reliable revenue generation. Unlike high-growth, disruptive areas, these mature sectors require less intensive marketing or rapid innovation cycles to maintain their contribution. For instance, in 2024, Digital China reported that its IT consulting for established industries provided a stable 15% year-over-year revenue growth, underpinning its overall financial health.

- Stable Revenue Streams: Mature sector IT planning offers predictable income, benefiting from long-term client engagements.

- Low Investment Needs: These services typically require less R&D or marketing spend compared to emerging technologies.

- Leveraged Expertise: Digital China capitalizes on its extensive history and proven track record in these traditional industries.

Digital China Group's traditional IT product distribution and value-added services, along with its system integration for government and large enterprises, are key cash cows. These established segments, characterized by deep market penetration and consistent revenue, require minimal new investment. The company's IT services revenue in 2023, a significant portion of which comes from these mature areas, demonstrates their reliable cash generation.

Localized technical support and established big data products further solidify Digital China's cash cow portfolio. These offerings benefit from lower development costs and stable demand, providing predictable income. For example, in the first half of 2024, the company's business income reached 59.83 billion yuan, with these mature segments contributing substantially to this figure.

| Segment | Maturity | Cash Flow Contribution | Investment Need | 2023/2024 Data Point |

| IT Product Distribution & Value-Added Services | High | High | Low | H1 2024 Income: 59.83 billion yuan |

| System Integration (Govt/Enterprise) | High | High | Low | Significant portion of IT Services Revenue (tens of billions RMB) |

| Localized Technical Support | High | High | Low | Contributed significantly to overall revenue in 2023 |

| Established Big Data Products | High | High | Low | Legacy platforms contributed substantially to revenue in 2024 |

What You See Is What You Get

Digital China Group BCG Matrix

The Digital China Group BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted by industry experts, provides actionable insights into Digital China Group's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs. You can confidently expect the fully formatted, ready-to-use report to be delivered instantly, enabling immediate strategic planning and decision-making without any additional steps or hidden surprises.

Dogs

Digital China's legacy IT infrastructure services, such as traditional data center management and outdated hardware maintenance, are likely experiencing declining demand. This is driven by the rapid shift towards cloud computing and more agile, modern IT solutions. These services often operate in a low-growth market and may represent a shrinking portion of the company's revenue.

For instance, in 2023, the global IT infrastructure market saw a significant shift, with cloud infrastructure spending continuing its upward trajectory while on-premises hardware sales faced headwinds. Companies are increasingly prioritizing flexibility and scalability, making older, less adaptable infrastructure services less attractive. Digital China's position in these segments might reflect a low market share within a mature, contracting sector.

Outdated software products with limited updates, such as legacy enterprise resource planning (ERP) systems that haven't been upgraded in years, would be classified as Dogs in the Digital China Group BCG Matrix. These products often struggle to compete with newer, more feature-rich solutions and consequently hold minimal market share.

Products in this quadrant typically exhibit low growth prospects and contribute very little to overall profitability, often becoming cash traps. For instance, a software suite that saw its last significant update in 2018 might have seen its market share dwindle from 5% to under 1% by early 2024, as competitors released agile, cloud-based alternatives.

Niche IT consulting services with low market penetration, such as highly specialized cybersecurity for emerging IoT devices or AI-driven compliance for niche industries, would fall into the Dogs quadrant of the Digital China Group BCG Matrix. These services, despite their potential, have struggled to achieve significant market share, indicating low growth and low relative market share.

Hardware Distribution of Low-Margin, Commoditized Products

The distribution of highly commoditized IT hardware, characterized by razor-thin profit margins and fierce competition, often falls into the Dog category of the BCG Matrix. These segments, while potentially part of a larger business, can become a drain on resources if they consistently exhibit both low market share and low growth.

For instance, consider a scenario where a company’s legacy server hardware distribution, a market segment that saw a global decline of approximately 3% in 2024 according to IDC, struggles to maintain even a modest market share. If this particular hardware line is not innovating or adapting to new market demands, it’s likely consuming valuable capital and management attention without generating significant returns.

- Low Profitability: Thin margins on commoditized hardware mean that high sales volumes are necessary to achieve meaningful profits, a challenge in saturated markets.

- Resource Drain: Continued investment in marketing, inventory, and support for underperforming hardware lines diverts resources from more promising growth areas.

- Market Saturation: The IT hardware distribution market for many commoditized products is mature, with limited opportunities for substantial growth.

- Competitive Pressure: Intense price competition among numerous distributors can further erode already slim profit margins.

Small-Scale, Unprofitable Pilot Projects

Small-scale, unprofitable pilot projects within Digital China Group's portfolio would fall into the Dogs category of the BCG Matrix. These initiatives, often early-stage digital transformation experiments, struggle to show a clear return on investment or a viable path to widespread adoption. For instance, a pilot project testing a niche AI-driven customer service tool that has only seen limited user engagement and generated negligible revenue would be a prime example.

These projects typically exhibit low market share due to their limited rollout and low growth prospects because they haven't proven their commercial viability. Without strategic intervention, they risk becoming resource drains. In 2024, many tech companies are scrutinizing such pilots, with reports indicating that up to 60% of digital transformation projects fail to deliver expected business outcomes, often due to poor planning or lack of market fit.

- Low Market Share: Projects with minimal user adoption or limited geographical/functional rollout.

- Low Growth Prospects: Initiatives that have not shown significant improvement in key performance indicators like revenue or user engagement.

- Resource Drain: Continued investment in these projects without a clear strategy for improvement or divestment can hinder progress in more promising areas.

- Strategic Review Needed: Companies often re-evaluate these 'dog' projects to decide whether to pivot, invest further for turnaround, or divest to reallocate capital.

Products or services classified as Dogs in the Digital China Group BCG Matrix represent areas with low market share and low market growth. These are typically mature or declining segments where the company struggles to gain traction. For example, legacy IT support services for outdated hardware or niche software solutions with minimal adoption would fall into this category.

These 'Dogs' often consume resources without generating significant returns, acting as cash drains rather than contributors. In 2024, many companies are re-evaluating such offerings, aiming to divest or minimize investment to focus on more promising ventures. The challenge lies in identifying these underperformers and making strategic decisions about their future, whether through a turnaround effort or a complete exit.

Digital China's 'Dogs' might include certain legacy hardware distribution channels that face intense price competition and declining demand, as well as unprofitable pilot projects in digital transformation that haven't demonstrated market viability. These segments, characterized by low profitability and high resource consumption, require careful management and strategic reallocation of capital.

For instance, a segment of their business focused on distributing older server models, a market that saw a global contraction in 2024, could be a prime example of a Dog. If this particular product line holds a negligible market share and operates in a shrinking market, it exemplifies the characteristics of a Dog in the BCG Matrix, demanding a strategic review.

| BCG Category | Characteristics | Example for Digital China | Strategic Implication |

|---|---|---|---|

| Dogs | Low Market Share, Low Market Growth | Legacy IT hardware distribution, unprofitable pilot projects | Divest, harvest, or minimize investment |

| Low Profitability, Potential Resource Drain | Outdated software products, niche consulting services | Focus on cost reduction or exit strategy | |

| Mature or declining market segments | Traditional data center management services | Reallocate capital to Stars or Question Marks |

Question Marks

Digital China Group's exploration into novel AI applications, such as AI-powered drug discovery platforms or advanced AI for climate modeling, positions them in rapidly expanding sectors fueled by China's 'AI Plus' national strategy. These ventures, while promising, are currently nascent with minimal market penetration, demanding substantial capital infusion and strategic development to scale effectively.

The company's commitment to these emerging AI fields reflects a forward-looking strategy, aiming to diversify its revenue streams beyond its established Kunpeng AI servers and Smart Vision solutions. However, the high investment required and the current low market share place these initiatives in the 'Question Mark' quadrant of the BCG matrix, necessitating careful evaluation to avoid them becoming 'Dogs' if market adoption falters.

Digital China Group's foray into new cross-border digital trade solutions positions them squarely in the Question Mark quadrant of the BCG Matrix. This segment is characterized by rapid growth, with the global cross-border e-commerce market projected to reach $2.1 trillion by 2027, according to Statista.

The company's strategy involves leveraging emerging technologies and forging strategic partnerships to capture a share of this expanding market. However, their current market penetration in these nascent digital trade solutions is likely minimal, necessitating significant investment to build brand awareness and establish a competitive foothold.

Developing advanced digital twin solutions in industries where Digital China has limited prior presence, such as advanced manufacturing or complex logistics, would indeed categorize them as Question Marks within a BCG matrix framework. The digital twin market is projected to reach $37.7 billion by 2025, according to MarketsandMarkets, highlighting significant growth potential but also intense competition.

Achieving substantial market share in these new verticals requires considerable investment. For instance, a recent report indicated that companies are spending an average of 5-10% of their IT budget on digital twin initiatives, with a significant portion allocated to R&D and specialized implementation expertise. Digital China would need to allocate substantial capital to build out these capabilities and tailor solutions for specific industry needs.

Specialized Internet of Things (IoT) Solutions for New Verticals

Digital China Group is actively developing specialized Internet of Things (IoT) solutions for emerging vertical markets. This strategic move targets industries where their presence is not yet dominant. Such expansion necessitates focused investment in tailoring products and devising effective market entry plans.

The global IoT market is projected to reach $1.5 trillion by 2025, highlighting significant growth potential. However, capturing market share in niche sectors like smart agriculture or industrial automation requires more than just general IoT offerings. Digital China's approach involves understanding the unique challenges and opportunities within each new vertical.

- Targeted R&D Investment: Allocating resources to develop IoT solutions that specifically address the pain points of new verticals, such as predictive maintenance for manufacturing or real-time environmental monitoring for smart cities.

- Strategic Partnerships: Collaborating with industry-specific players to gain market insights and facilitate faster adoption of their specialized IoT solutions.

- Market Entry Strategies: Implementing go-to-market plans that emphasize the unique value proposition of their vertical-specific IoT offerings, potentially through pilot programs and tailored sales approaches.

Next-Generation Smart City Solutions (e.g., beyond existing projects)

Digital China Group's ventures into next-generation smart city solutions, particularly those still in nascent development or pilot stages, would likely be categorized as Question Marks in a BCG matrix. These innovative offerings tap into a rapidly expanding market fueled by China's robust national digitalization agenda, a trend that saw significant investment in smart city infrastructure in 2023, with projections indicating continued growth through 2025.

Despite the high growth potential, these emerging solutions currently hold a minimal market share. This necessitates substantial capital infusion to scale operations, refine technologies, and secure broader market penetration. For instance, advanced AI-driven traffic management systems or predictive urban maintenance platforms are prime examples of such early-stage initiatives.

- High Market Growth: Driven by national smart city initiatives and increasing urbanization, the global smart city market is projected to reach over $2.5 trillion by 2026, with China being a key contributor.

- Low Market Share: Next-generation solutions often represent niche applications or unproven technologies, limiting their current adoption rates.

- High Investment Needs: Significant R&D, infrastructure development, and market education are required to bring these solutions to scale.

- Future Potential: Successful scaling could position these offerings as future Stars, capitalizing on evolving urban needs and technological advancements.

Digital China Group's investments in emerging AI sectors, such as AI-driven drug discovery and climate modeling, are positioned as Question Marks. These areas are experiencing rapid growth, aligning with China's national AI strategy, but require significant capital for development and market entry.

The company's expansion into new digital trade solutions also falls into the Question Mark category. While the global cross-border e-commerce market is substantial, with projections indicating continued expansion, Digital China's current market share in these nascent areas is minimal, necessitating further investment to build brand presence and competitive footing.

Similarly, the development of advanced digital twin solutions in less familiar industries places these ventures in the Question Mark quadrant. The digital twin market itself shows strong growth potential, but achieving significant market share requires substantial investment in R&D and specialized expertise.

Digital China's targeted IoT solutions for new vertical markets, like smart agriculture or industrial automation, are also Question Marks. The broader IoT market is expanding significantly, but success in niche sectors hinges on tailored offerings and strategic market entry plans.

Next-generation smart city solutions, particularly those in early development, are classified as Question Marks. These innovative offerings are part of a growing market driven by national digitalization efforts, but they require substantial investment to scale and achieve wider market penetration.

BCG Matrix Data Sources

Our Digital China Group BCG Matrix is built on comprehensive market data, incorporating financial disclosures, industry growth forecasts, and competitive analysis to provide strategic insights.