Designer Brands PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Designer Brands Bundle

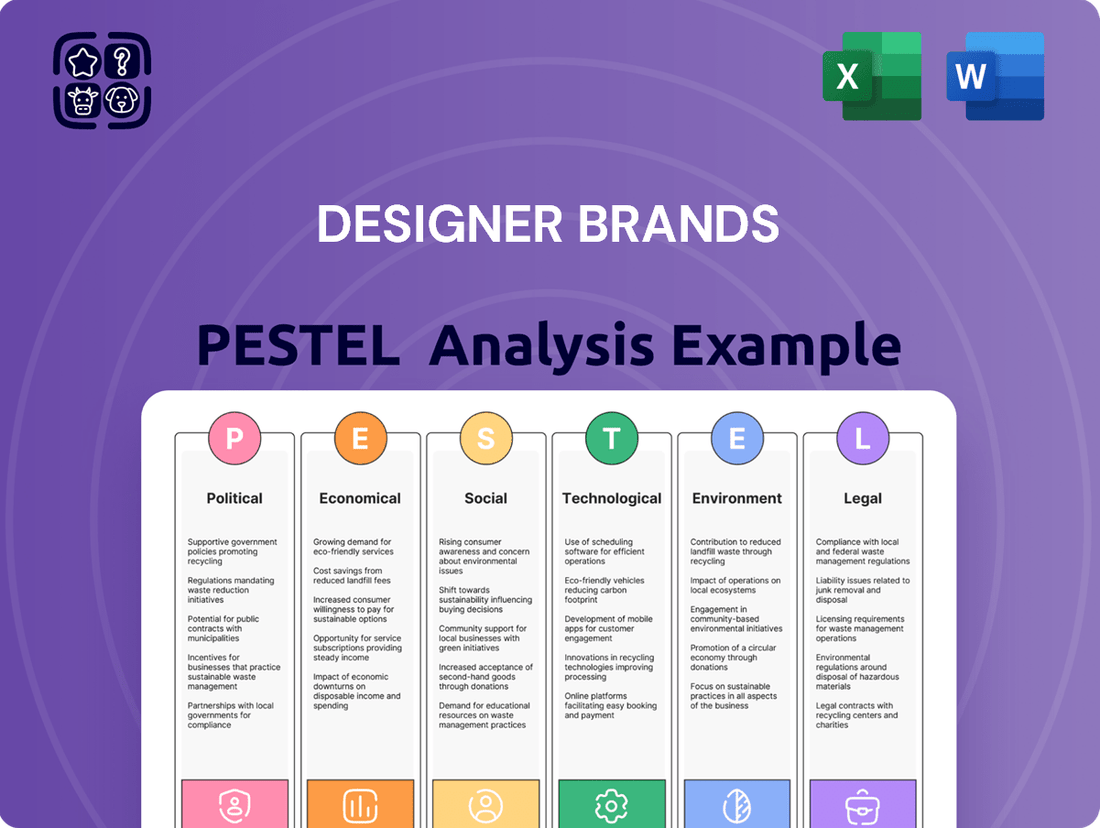

Unlock the strategic landscape impacting Designer Brands with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and evolving social trends are shaping the luxury market. This expert-crafted report offers actionable intelligence to inform your investment and business strategies. Download the full PESTLE analysis now and gain a critical competitive edge.

Political factors

Shifting global trade policies and the implementation of new tariffs directly influence the cost of raw materials and finished products for designer brands. For instance, the United States' imposition of tariffs on goods from China in recent years, such as those enacted during the Trump administration, led to an average increase of 19.3% on imported apparel and accessories, impacting both production costs and consumer prices.

Government regulations significantly shape Designer Brands Inc.'s operational landscape. Labor laws, such as minimum wage requirements and working condition standards, directly impact staffing costs and human resource management. For instance, in 2024, many regions saw increases in minimum wages, adding to operational expenses.

Consumer protection regulations, covering product safety, advertising accuracy, and data privacy, are paramount for maintaining brand trust and avoiding legal repercussions. Designer Brands must ensure its marketing claims are substantiated and that customer data is handled with utmost care, especially with evolving data privacy laws like GDPR and CCPA.

Furthermore, business conduct regulations, including anti-corruption laws and fair trade practices, dictate ethical operations and supply chain management. Non-compliance can lead to substantial fines and reputational damage, as seen in past cases where companies faced penalties for violating these statutes.

Political instability in key sourcing regions, such as Southeast Asia and parts of Eastern Europe, poses a significant risk to designer brands. For instance, ongoing geopolitical tensions in 2024 in regions vital for textile manufacturing could lead to unpredictable supply chain disruptions. Designer Brands Inc. must actively monitor these situations, as a sudden escalation can halt production and increase shipping costs, impacting product availability and profitability.

To counter these risks, a strategic diversification of sourcing locations is paramount. By spreading manufacturing across multiple countries, the company can reduce its reliance on any single politically volatile region. This approach, which was increasingly adopted by apparel manufacturers in 2024, helps ensure continuity of operations even if one sourcing country faces unforeseen political challenges or trade restrictions.

Consumer Protection Legislation

New and evolving consumer protection laws are compelling Designer Brands Inc. to adjust its marketing and sales strategies. For example, legislation focusing on price transparency and product safety necessitates careful review of all customer-facing communications and product development pipelines.

The Digital Markets, Competition and Consumers Act 2024, enacted in the UK, is a significant development. This act introduces the potential for substantial financial penalties for violations of consumer law, underscoring the need for strict compliance. This could impact Designer Brands' digital advertising campaigns and sales platforms.

- Increased Compliance Costs: Adapting to new regulations may require investment in new systems or training, potentially increasing operational expenses for Designer Brands.

- Reputational Risk Mitigation: Proactive adherence to consumer protection laws helps safeguard the brand's reputation and customer trust.

- Market Access Implications: Non-compliance could lead to restrictions or bans in certain markets, impacting sales channels.

Fiscal Policies and Taxation

Changes in corporate tax rates and other fiscal policies directly influence Designer Brands Inc.'s profitability and strategic investment choices. For instance, a reduction in corporate tax rates, such as the potential for further adjustments following the 2017 Tax Cuts and Jobs Act, could boost net income and free up capital for expansion or research and development. Conversely, an increase in taxes would likely reduce earnings and potentially deter new investments.

The National Retail Federation actively lobbies for policies that maintain competitive corporate tax rates. Their advocacy aims to foster an environment conducive to business investment and job creation within the retail sector. This focus on competitive taxation is crucial for companies like Designer Brands to remain agile and invest in areas such as e-commerce infrastructure and sustainable sourcing, which are increasingly important in the 2024-2025 landscape.

- Corporate Tax Impact: Fluctuations in corporate tax rates, like those seen in recent years, directly affect Designer Brands' bottom line and capital allocation strategies.

- Investment Incentives: Favorable fiscal policies, including competitive tax rates, encourage companies to invest in growth initiatives and employment.

- Industry Advocacy: Organizations like the National Retail Federation champion tax policies that support the retail industry's health and competitiveness.

- Strategic Financial Planning: Understanding and anticipating changes in fiscal policy is a critical component of Designer Brands' long-term financial planning and operational decision-making.

Political stability and government policies significantly impact global trade, influencing sourcing costs and market access for designer brands. For example, trade agreements or disputes between major economies in 2024-2025 can alter import duties on textiles and finished luxury goods, directly affecting pricing and supply chain reliability.

Regulatory environments, from labor laws to consumer protection standards, dictate operational compliance and brand reputation. The enforcement of new data privacy regulations in 2024, for instance, requires designer brands to invest in secure data management, impacting digital marketing strategies and customer engagement.

Government stability in key manufacturing hubs is crucial for uninterrupted production. Geopolitical events in 2024 have highlighted the risks of relying on single sourcing locations, prompting brands to diversify to mitigate potential supply chain disruptions and associated cost increases.

Fiscal policies, including corporate tax rates and investment incentives, directly shape profitability and strategic investment decisions. The National Retail Federation's advocacy for competitive tax rates in 2024-2025 aims to foster an environment that encourages brands like Designer Brands to invest in e-commerce and sustainable practices.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external forces impacting Designer Brands across political, economic, social, technological, environmental, and legal landscapes.

It offers actionable insights for strategic decision-making, identifying key opportunities and threats within the dynamic luxury market.

Designer Brands' PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, helping to alleviate the pain of information overload.

Economic factors

Economic conditions, particularly inflation, significantly shape how consumers allocate their budgets for non-essential items like designer footwear and accessories. When inflation is high, consumers often find their purchasing power diminished, leaving less disposable income for discretionary purchases.

Designer Brands Inc. has publicly acknowledged that persistent inflation and a general tightening of consumer budgets are impacting discretionary spending. This economic pressure is causing consumers to prioritize value and seek out more affordable options within the premium footwear and accessories market.

For instance, in early 2024, inflation rates remained a concern for many economies, with reports indicating that a significant portion of consumers were scaling back on non-essential spending to manage household budgets. This trend directly translates to a more cautious approach to purchasing higher-priced designer goods.

Designer Brands Inc. faces significant headwinds from rising inflation and escalating costs for essential inputs. The cost of merchandise, particularly raw materials like leather and textiles, is a primary challenge for the entire footwear industry, impacting profitability directly. For instance, in early 2024, reports indicated continued upward pressure on commodity prices, a trend that is expected to persist through 2025, squeezing margins for companies like Designer Brands.

Furthermore, increased logistics and transportation expenses, driven by higher fuel prices and supply chain disruptions, add another layer of cost pressure. These rising operational costs can directly translate into reduced profit margins for Designer Brands if they cannot effectively pass these increases onto consumers without impacting demand.

Designer Brands Inc. faces significant exposure to volatile foreign currency exchange rates. For instance, a stronger US dollar can make imported raw materials and finished goods more expensive, directly impacting cost of goods sold and potentially squeezing profit margins. Conversely, a weaker dollar can boost the profitability of international sales when converted back to US dollars.

In 2024, the US dollar's performance against major currencies like the Euro and British Pound has been a key consideration for global retailers. Fluctuations here directly influence the landed cost of products sourced from Europe and affect the revenue recognized from sales in those regions. For example, if the Euro strengthens against the dollar, Designer Brands' European manufacturing costs increase in dollar terms.

E-commerce Growth and Digital Sales

The ongoing surge in e-commerce is fundamentally altering how footwear is bought and sold. Online sales are expected to climb steadily, making digital channels crucial for reaching consumers.

Designer Brands Inc. is well-positioned to capitalize on this trend, with its established billion-dollar digital commerce operations enabling it to cater to a wide array of customer preferences and demands.

By 2025, global e-commerce sales are projected to surpass $7 trillion, underscoring the immense opportunity within the digital retail space for brands like Designer Brands.

- Digital Sales Momentum: E-commerce continues its rapid expansion, significantly impacting traditional retail models in the footwear sector.

- Designer Brands' Digital Strength: The company's substantial digital commerce business, valued in the billions, is a key asset for market reach.

- Projected Growth: Analysts anticipate continued robust growth in online footwear sales through 2025 and beyond.

Market Growth and Competition

The global footwear market is expected to see continued expansion, with projections indicating a compound annual growth rate (CAGR) of approximately 4.5% through 2028, reaching an estimated value of $425 billion. This growth presents significant opportunities, but Designer Brands Inc. faces a highly competitive landscape. Numerous established and emerging brands vie for consumer attention, necessitating a strong focus on product differentiation and brand loyalty to secure and expand market share.

Designer Brands Inc. has outlined a strategic objective for profitable growth in 2025, a goal that will be tested by this competitive environment. Success will hinge on the company's ability to innovate in design, marketing, and distribution channels to stand out from competitors like Nike, Adidas, and Puma, which collectively hold a substantial portion of the market.

- Projected Global Footwear Market Growth: Expected to reach $425 billion by 2028, with a CAGR of around 4.5%.

- Intense Competition: Major players like Nike, Adidas, and Puma dominate, requiring strong differentiation strategies.

- Designer Brands' 2025 Goal: Focus on achieving profitable growth amidst market pressures.

- Key Success Factors: Innovation in design, marketing, and distribution are crucial for maintaining market share.

Economic factors, particularly inflation and consumer spending habits, directly influence demand for designer footwear. As of early 2024, persistent inflation continued to pressure household budgets, leading consumers to re-evaluate discretionary purchases. This economic climate means Designer Brands Inc. must navigate a landscape where value and affordability are increasingly important considerations for shoppers.

Rising input costs for raw materials like leather and textiles, coupled with elevated logistics expenses due to fuel prices, present significant margin challenges for the footwear industry. For instance, reports in early 2024 indicated continued upward pressure on commodity prices, a trend expected to persist into 2025, directly impacting profitability for companies like Designer Brands if these costs cannot be absorbed or passed on effectively.

The company also faces exposure to volatile foreign currency exchange rates, impacting the cost of imported goods and the value of international sales. For example, a stronger US dollar in 2024 increased the cost of sourcing materials from Europe, directly affecting Designer Brands' cost of goods sold.

What You See Is What You Get

Designer Brands PESTLE Analysis

The file you’re seeing now is the final version of the Designer Brands PESTLE Analysis—ready to download right after purchase.

This preview accurately reflects the comprehensive PESTLE analysis of Designer Brands you will receive, ensuring you know exactly what you're acquiring.

What you’re previewing here is the actual file, a fully formatted and professionally structured PESTLE analysis for Designer Brands, ready for immediate use.

Sociological factors

Consumer preferences are in constant flux, with a notable surge in demand for athletic, casual, and comfortable footwear. Designer Brands Inc. is actively realigning its product offerings to capture these evolving tastes, evidenced by a strategic expansion into the athleisure segment.

Consumers increasingly prioritize eco-friendly and ethically sourced products, with a significant portion of Gen Z and Millennial shoppers willing to pay a premium for sustainable fashion. This growing demand is reshaping the footwear industry, pushing designer brands to invest in recycled materials and transparent supply chains.

The increasing focus on health and wellness is significantly impacting consumer choices, particularly in footwear. Globally, participation in sports and fitness activities has seen a notable rise. For instance, the global sports apparel and footwear market was valued at approximately $333.7 billion in 2023 and is projected to reach over $467 billion by 2028, indicating strong growth driven by these trends.

This heightened awareness of health and fitness directly fuels demand for performance-oriented and comfortable footwear. Consumers are actively seeking shoes that support their active lifestyles, whether for running, training, or everyday wear. This trend is particularly beneficial for the athletic footwear segment within designer brands, as it encourages investment in innovative materials and designs that offer both functionality and style.

Generational Differences in Shopping Behavior

Generational differences significantly shape how consumers interact with designer brands. Younger demographics, particularly Gen Z and Millennials, often prioritize value and digital engagement, frequently comparing prices and seeking peer reviews before purchasing. For instance, a 2024 report indicated that over 60% of Gen Z consumers consider online reviews a critical factor in their purchasing decisions for fashion items.

This contrasts with older generations who might place more emphasis on brand heritage, quality, and in-store experiences. Understanding these nuances is vital for designer brands to tailor their marketing strategies effectively. For example, while older consumers might respond well to traditional advertising, younger audiences are more receptive to influencer collaborations and social media campaigns highlighting authenticity and sustainability.

- Gen Z (born 1997-2012): Highly influenced by social media and peer recommendations; often price-conscious but willing to invest in brands aligning with their values, such as sustainability.

- Millennials (born 1981-1996): Seek experiences and personalization; value online research and are responsive to digital marketing and loyalty programs.

- Gen X (born 1965-1980): Appreciate quality and brand reputation; may be less swayed by trends and more by established brand loyalty and tangible benefits.

- Baby Boomers (born 1946-1964): Often prefer established brands and traditional retail channels; value customer service and product longevity.

Social Responsibility and Ethical Sourcing

Consumers are increasingly scrutinizing designer brands for their social responsibility, demanding ethical sourcing and fair labor practices throughout the supply chain. This shift significantly impacts brand perception and purchasing decisions, with transparency becoming a key differentiator. For instance, a 2024 survey indicated that over 70% of Gen Z consumers consider a brand's ethical stance when making purchasing choices.

Brands demonstrating genuine commitments to fair wages, safe working conditions, and the use of cruelty-free materials are gaining a competitive edge. Companies that proactively address these concerns often see improved customer loyalty and a stronger brand reputation. In 2025, luxury fashion houses are investing more in supply chain audits and public reporting on their social impact initiatives, recognizing this as a crucial element for long-term success.

- Consumer Demand: A significant majority of consumers, particularly younger demographics, now factor a brand's social responsibility into their buying decisions.

- Supply Chain Transparency: Brands are under pressure to provide clear information about their manufacturing processes and labor conditions.

- Ethical Sourcing: The use of fair labor, sustainable materials, and cruelty-free practices are becoming non-negotiable for many shoppers.

- Brand Reputation: Companies that prioritize ethical conduct often enjoy enhanced brand loyalty and a more positive public image.

Societal values are increasingly emphasizing inclusivity and diversity, influencing how consumers perceive and interact with brands. Designer Brands Inc. is responding by ensuring its marketing campaigns and product lines reflect a broader range of ethnicities, body types, and gender identities. This aligns with a growing consumer expectation for representation, with a 2024 study showing that 75% of consumers feel more connected to brands that showcase diversity.

The rise of conscious consumerism means shoppers are more informed and critical, demanding ethical practices and transparency from designer brands. This includes scrutiny of labor conditions and environmental impact, pushing companies to adopt more sustainable and socially responsible operations. For instance, a 2025 survey revealed that 68% of consumers consider a brand's commitment to sustainability when making a purchase.

Generational shifts continue to shape purchasing power and preferences, with younger consumers like Gen Z and Millennials prioritizing authenticity and digital engagement. These demographics are highly influenced by social media trends and peer reviews, often seeking brands that align with their personal values. A 2024 report highlighted that over 60% of Gen Z consumers consider online reviews crucial for fashion purchases.

| Sociological Factor | Impact on Designer Brands | Consumer Behavior Trend (2024-2025) |

|---|---|---|

| Inclusivity & Diversity | Need for representative marketing and product lines. | 75% of consumers feel more connected to diverse brands. |

| Conscious Consumerism | Demand for ethical sourcing, fair labor, and sustainability. | 68% of consumers consider sustainability in purchases. |

| Generational Preferences | Emphasis on authenticity, digital engagement, and values. | 60%+ of Gen Z consider online reviews for fashion. |

Technological factors

Technological advancements are revolutionizing how consumers interact with brands, particularly in the fashion industry. Features like augmented reality (AR) try-ons, powered by sophisticated AI, allow customers to visualize products virtually, bridging the gap between online browsing and in-store fitting. This enhances the online shopping experience significantly.

Designer Brands Inc. is actively investing in its digital infrastructure to create a seamless omnichannel journey. For instance, in fiscal year 2024, the company reported a 7% increase in digital net sales, reaching $1.3 billion. This growth underscores the importance of technology in meeting customer expectations for integrated shopping experiences across all touchpoints.

3D printing is transforming how designer brands develop products, paving the way for true mass customization. This means shoes can be designed and produced to fit individual foot shapes and personal style preferences, offering a unique selling proposition.

Beyond personalization, 3D printing also offers significant environmental benefits by reducing material waste during production. For example, in 2023, the additive manufacturing industry generated an estimated $20 billion in revenue globally, with a growing focus on sustainable practices and on-demand manufacturing, which directly supports waste reduction efforts.

AI is revolutionizing product development for brands like Designer Brands Inc. by analyzing vast datasets to identify emerging trends and consumer preferences, leading to more targeted and successful product launches. For example, in 2024, companies leveraging AI in their design process reported a 15% increase in product adoption rates compared to those relying on traditional methods.

AI-powered personalization is also a game-changer in marketing, enabling Designer Brands to offer tailored recommendations and experiences to individual customers, thereby boosting engagement and sales. Studies from late 2024 indicate that personalized marketing campaigns can improve conversion rates by up to 20%.

Designer Brands Inc. is actively investing in data analytics to refine its product strategy, aiming to leverage AI insights to better understand its customer base and enhance its product portfolio. This strategic focus on data is crucial for staying competitive in the rapidly evolving fashion industry.

Supply Chain Innovation and Automation

Technological advancements are revolutionizing designer brand supply chains. Agile manufacturing and automation are key, enabling faster production cycles and quicker adaptation to shifting consumer preferences. For instance, by 2024, the global supply chain management market is projected to reach over $34 billion, with a significant portion driven by technology investments aimed at efficiency.

Nearshoring, facilitated by these technologies, allows brands to bring production closer to home markets. This not only reduces lead times but also enhances visibility and control over the entire production process. In 2023, several luxury brands explored nearshoring options to mitigate geopolitical risks and improve delivery speed, with some reporting up to a 20% reduction in transit times.

These innovations also bolster sustainability efforts. Technologies like AI-powered inventory management minimize waste, while advanced logistics software optimizes shipping routes, cutting carbon emissions. By 2025, it's estimated that the fashion industry could see a 15% reduction in its environmental footprint through widespread adoption of these digital supply chain solutions.

- Agile Manufacturing: Enables rapid product iteration and customization, a critical factor for designer brands to respond to fast-changing trends.

- Automation in Warehousing and Logistics: Increases efficiency, reduces errors, and speeds up order fulfillment, especially important for online sales channels.

- Nearshoring: Reduces transportation costs and lead times, improving responsiveness to demand and potentially lowering carbon emissions.

- Data Analytics and AI: Optimizes inventory, predicts demand, and identifies supply chain disruptions, leading to more resilient and efficient operations.

Smart Footwear and Wearable Technology Integration

The increasing integration of smart technology into footwear is a significant technological factor for designer brands. These innovations, offering features like advanced fitness tracking, real-time gait analysis, and even posture correction, appeal directly to the growing segment of tech-savvy consumers. This fusion of fashion and function not only enhances the user's experience but also opens new avenues for product development and data collection, allowing brands to offer personalized insights and services.

The wearable technology market continues its robust expansion, with smart footwear playing an increasingly prominent role. For instance, the global smart footwear market was valued at approximately $1.2 billion in 2023 and is projected to reach over $3.5 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 17%. This growth is driven by consumer demand for connected devices that seamlessly blend into their lifestyles.

This trend presents designer brands with opportunities to:

- Innovate product offerings: Incorporate sensors and connectivity to provide added value beyond traditional aesthetics.

- Enhance customer engagement: Utilize data from smart footwear to offer personalized recommendations and improve user experience.

- Create new revenue streams: Explore subscription services for advanced analytics or premium app features.

- Differentiate from competitors: Lead in adopting and integrating cutting-edge technology into luxury fashion items.

Technological advancements are rapidly reshaping the designer brand landscape, from product creation to customer engagement. AI and 3D printing are enabling unprecedented levels of customization and reducing waste, while digital infrastructure investments are crucial for seamless omnichannel experiences, as evidenced by Designer Brands Inc.'s 7% digital sales growth in fiscal year 2024.

The integration of smart technology into footwear, with the global smart footwear market valued at $1.2 billion in 2023 and projected to reach over $3.5 billion by 2030, offers new avenues for product innovation and customer engagement.

Supply chain modernization through agile manufacturing and nearshoring, supported by technologies like AI-powered inventory management, enhances efficiency and responsiveness, with the global supply chain management market expected to exceed $34 billion by 2024.

| Technology Area | Impact on Designer Brands | Key Data/Trends (2023-2025) |

| AI & Machine Learning | Personalized marketing, trend prediction, optimized design | 15% increase in product adoption for AI-leveraging companies (2024); Personalized marketing improves conversion by up to 20% (late 2024) |

| 3D Printing | Mass customization, reduced material waste | Additive manufacturing revenue reached $20 billion globally (2023); Focus on sustainability and on-demand production |

| Augmented Reality (AR) | Enhanced online shopping experience, virtual try-ons | Bridging gap between online browsing and in-store fitting |

| Smart Footwear & Wearables | Innovative product features, data collection, new revenue streams | Global smart footwear market valued at $1.2 billion (2023); projected to reach $3.5 billion by 2030 (17% CAGR) |

| Supply Chain Tech (Agile Mfg, Nearshoring, AI) | Faster production, reduced lead times, improved efficiency, sustainability | Global supply chain management market >$34 billion (2024 projection); Nearshoring can reduce transit times by up to 20% (2023 luxury brand exploration); Potential 15% reduction in fashion industry environmental footprint by 2025 |

Legal factors

Designer Brands Inc., like all retailers, faces increasing scrutiny over customer data. Compliance with regulations such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) is paramount. These laws mandate how companies collect, store, and use personal information, with significant fines for violations. For instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

To navigate this complex legal landscape, Designer Brands must implement robust data security measures. This includes strong encryption protocols and clear, transparent privacy policies to safeguard consumer information. The company's ability to maintain customer trust hinges on its commitment to data protection, especially as digital sales and personalized marketing efforts continue to grow. In 2023, data breaches cost companies an average of $4.35 million globally, highlighting the financial imperative for strong security.

Governments are increasingly tightening environmental rules, particularly concerning carbon emissions and waste management. For instance, the European Union's Green Deal aims for climate neutrality by 2050, impacting supply chains and material sourcing for fashion brands.

This regulatory pressure compels footwear manufacturers to invest in sustainable materials, such as recycled plastics and bio-based leathers, and to optimize production processes to minimize environmental impact. Companies failing to comply risk significant fines and reputational damage.

By 2024, many fashion retailers are facing scrutiny over their environmental claims, with bodies like the UK's Advertising Standards Authority cracking down on greenwashing, underscoring the need for verifiable sustainable practices.

Retailers must stay vigilant regarding evolving labor laws, particularly concerning minimum wage adjustments and overtime regulations. For instance, in 2024, several US states saw increases in their minimum wages, impacting payroll costs for many designer brands. Compliance with these changes, alongside updated rules on paid sick leave and scheduling predictability, necessitates ongoing policy reviews to avoid penalties and ensure fair treatment of employees.

Product Safety and Quality Standards

Retailers of designer brands face stringent legal obligations regarding product safety and quality. These standards are not static; they frequently evolve, necessitating ongoing vigilance and adaptation to ensure compliance. For instance, the UK's Product Regulation and Metrology Act 2025 is designed to modernize and reinforce the existing product regulation landscape, directly impacting how designer goods are brought to market and maintained.

Failure to meet these evolving legal benchmarks can result in significant penalties, including fines, product recalls, and reputational damage. In 2024, the European Union reported a 15% increase in product safety alerts related to apparel and accessories, underscoring the critical importance of robust quality control measures for designer brands. This trend suggests a heightened regulatory focus and increased enforcement across major markets.

Key areas of compliance for designer brands include:

- Material Safety: Ensuring all materials used, from textiles to embellishments, meet chemical and physical safety regulations, such as restrictions on certain dyes or heavy metals.

- Durability and Performance: Adhering to standards that guarantee the product's intended lifespan and performance under normal use, preventing premature wear or failure.

- Labeling and Information: Providing accurate and comprehensive labeling, including care instructions, origin, and composition, in compliance with consumer protection laws.

- Intellectual Property: While not strictly product safety, ensuring all designs and branding are legally protected and do not infringe on existing patents or trademarks is paramount.

Anti-Competitive Practices and Trade Regulations

Laws governing competition and trade significantly influence how designer brands operate, affecting everything from market access to pricing. Regulations designed to prevent anti-competitive practices can reshape market dynamics, potentially leading to increased competition and downward pressure on prices. For example, the Credit Card Competition Act of 2022, enacted in the US, aims to foster greater competition in credit card network routing, which could indirectly impact transaction costs for retailers and, by extension, consumer-facing pricing strategies for brands.

These trade regulations can also manifest as tariffs or import/export restrictions, directly impacting the cost of goods and the feasibility of global supply chains. For a company like Designer Brands Inc., navigating these legal frameworks is crucial for maintaining competitive pricing and efficient operations. The ongoing evolution of trade policies globally means continuous monitoring is essential to adapt strategies effectively.

- Impact of Credit Card Competition Act: This legislation could lead to lower processing fees for merchants, potentially improving profit margins or allowing for more competitive pricing.

- Tariff Fluctuations: Changes in tariffs on imported materials or finished goods can directly affect the cost of production and the final retail price of footwear and accessories.

- Anti-Monopoly Enforcement: Increased scrutiny of market dominance and anti-competitive behaviors by regulatory bodies can influence M&A strategies and market entry approaches.

Designer Brands must adhere to evolving product safety and quality regulations, which are increasingly stringent. For instance, the UK's Product Regulation and Metrology Act 2025 aims to bolster existing product regulations, impacting market entry and maintenance of goods. In 2024, the EU saw a 15% rise in product safety alerts for apparel and accessories, highlighting the need for robust quality control.

Compliance extends to material safety, ensuring chemicals used are within legal limits, and product durability meets set performance standards. Accurate labeling regarding origin and care is also a legal requirement, with intellectual property protection being crucial to avoid infringement. These legal mandates are critical for avoiding fines, recalls, and reputational harm.

| Regulatory Area | Key Compliance Aspects | Example/Impact |

|---|---|---|

| Product Safety & Quality | Material safety, durability, accurate labeling | UK Product Regulation and Metrology Act 2025; EU safety alerts up 15% in 2024 |

| Data Protection | GDPR, CCPA compliance, data security | GDPR fines up to 4% global revenue; 2023 data breaches cost $4.35M globally |

| Environmental Regulations | Carbon emissions, waste management, sustainable materials | EU Green Deal; UK ASA cracking down on greenwashing in 2024 |

| Labor Laws | Minimum wage, overtime, paid sick leave | US state minimum wage increases in 2024 impacting payroll |

| Trade & Competition | Tariffs, import/export, anti-monopoly practices | US Credit Card Competition Act 2022 impacting transaction costs |

Environmental factors

Consumers are increasingly prioritizing footwear crafted from recycled, organic, or plant-based materials. This shift directly influences designer brands to integrate more eco-friendly options into their collections.

For instance, in 2024, the global market for sustainable footwear was projected to reach approximately $11.7 billion, with an anticipated compound annual growth rate of 9.5% through 2030. This demonstrates a clear and growing demand for environmentally conscious choices.

The footwear industry is under significant pressure to curb its carbon footprint, with brands actively seeking ways to reduce emissions across their entire value chain. This includes everything from sourcing raw materials to the final delivery of products.

Innovative solutions are emerging, such as the adoption of waterless dyeing techniques, which drastically cut down on water consumption and the associated energy needed for heating and treatment. Many manufacturers are also investing in energy-efficient machinery and renewable energy sources for their factories, aiming to make production processes greener.

For example, in 2023, the global apparel and footwear industry's greenhouse gas emissions were estimated to be around 7.3 billion tonnes of CO2 equivalent, highlighting the scale of the challenge. Brands are setting ambitious targets; by 2025, many are committed to achieving significant reductions, with some aiming for 30% less carbon intensity compared to 2019 levels.

Designer brands are increasingly focusing on waste reduction, with initiatives like take-back programs and the development of fully recyclable or biodegradable footwear gaining traction. For example, in 2024, several major luxury brands launched pilot programs for shoe recycling, aiming to divert significant tonnage from landfills.

These efforts are reshaping industry norms around waste management and corporate responsibility, pushing for a more circular economy model. By 2025, it's projected that up to 20% of new shoe collections from leading designers will incorporate recycled or bio-based materials, a substantial increase from less than 5% in 2023.

Ethical Sourcing and Supply Chain Transparency

Environmental factors are increasingly shaping consumer preferences, with ethical sourcing and supply chain transparency becoming paramount for designer brands. Consumers are actively seeking out brands that can demonstrate responsible material procurement and open communication about their production processes. This trend is underscored by growing awareness of labor practices and environmental impact throughout the fashion industry.

Brands that prioritize these ethical considerations are not only mitigating reputational risks but also building stronger customer loyalty. For instance, a 2024 survey revealed that 65% of luxury consumers consider a brand's sustainability efforts when making purchasing decisions. This highlights a tangible shift towards valuing integrity alongside product quality.

- Consumer Demand: A significant majority of consumers, upwards of 60% in recent studies, now expect brands to be transparent about their supply chains and ethical sourcing practices.

- Regulatory Scrutiny: Governments worldwide are introducing stricter regulations concerning supply chain due diligence and environmental impact reporting, pushing companies towards greater accountability.

- Brand Reputation: Negative publicity stemming from unethical sourcing or opaque supply chains can severely damage a designer brand's image and financial performance, with recovery being a long and costly process.

- Investment in Transparency: Brands are investing in technologies like blockchain to track materials from origin to finished product, aiming to provide verifiable proof of ethical and sustainable practices.

Regulatory Pressure for Environmental Disclosure

Governments worldwide are increasingly mandating environmental disclosures for businesses, including those in the designer brand sector. This regulatory shift aims to enhance corporate accountability and transparency regarding environmental footprints and climate-related risks. For instance, by 2024, the European Union's Corporate Sustainability Reporting Directive (CSRD) requires many large companies to report on sustainability matters, including environmental impacts, with a significant portion of the designer brand market falling under its scope. This means brands must meticulously track and report on everything from their carbon emissions to water usage and waste management.

The push for greater transparency means that fashion companies, a core part of the designer brand industry, are facing heightened scrutiny over their supply chains and manufacturing processes. For example, the UK's Modern Slavery Act, while not strictly environmental, has paved the way for broader ESG (Environmental, Social, and Governance) reporting, with environmental factors becoming a key component. Brands are now expected to provide detailed data on their efforts to reduce pollution, manage resources sustainably, and mitigate climate change impacts. This data will likely be publicly available, allowing consumers and investors to make more informed decisions.

These regulations are driving significant changes in how designer brands operate and communicate their sustainability efforts. The expectation is that by 2025, a substantial number of publicly traded designer brands will be adhering to new, more stringent disclosure frameworks. This includes providing quantifiable data on environmental performance. Consider these key areas of focus:

- Carbon Footprint Reporting: Brands are increasingly required to report Scope 1, 2, and 3 emissions, with many aiming for net-zero targets by 2030.

- Water and Waste Management: Detailed reporting on water consumption in manufacturing and waste reduction strategies, particularly for textile production, is becoming standard.

- Sustainable Sourcing: Disclosure on the percentage of materials sourced from certified sustainable origins, such as organic cotton or recycled polyester, is gaining prominence.

- Climate Risk Assessment: Companies are being asked to assess and report on the physical and transitional risks posed by climate change to their operations and supply chains.

Environmental regulations are compelling designer brands to adopt more sustainable practices, influencing material sourcing and production methods. By 2024, the EU's CSRD mandated extensive environmental impact reporting for many large companies, including those in the fashion sector, pushing for greater accountability and transparency.

Brands are responding by investing in greener technologies and setting ambitious carbon reduction targets. For instance, many aim for 30% less carbon intensity by 2025 compared to 2019 levels, reflecting a proactive approach to environmental stewardship.

The industry is also seeing a rise in waste reduction initiatives and the development of circular economy models. By 2025, it's projected that up to 20% of new collections from leading designers will incorporate recycled or bio-based materials, a significant jump from previous years.

| Environmental Focus Area | 2023 Status/Trend | 2024/2025 Outlook | Impact on Designer Brands |

|---|---|---|---|

| Sustainable Materials Adoption | Growing consumer demand for recycled/organic materials | Projected 20% of new collections using recycled/bio-based materials by 2025 | Increased R&D, supply chain adjustments |

| Carbon Footprint Reduction | Industry-wide pressure to curb emissions | Many brands targeting 30% carbon intensity reduction by 2025 (vs. 2019) | Investment in energy efficiency, renewable energy sources |

| Waste Management & Circularity | Initiatives like take-back programs gaining traction | Pilot recycling programs launched by major luxury brands in 2024 | Focus on product lifecycle, design for recyclability |

| Regulatory Compliance | Increasingly stringent environmental disclosures | EU CSRD mandates reporting; broader ESG reporting expected | Enhanced data tracking, transparency in operations |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Designer Brands is built on a foundation of current data from reputable market research firms, financial news outlets, and government economic reports. We analyze trends in consumer behavior, technological advancements, and regulatory changes to provide a comprehensive overview.