Designer Brands Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Designer Brands Bundle

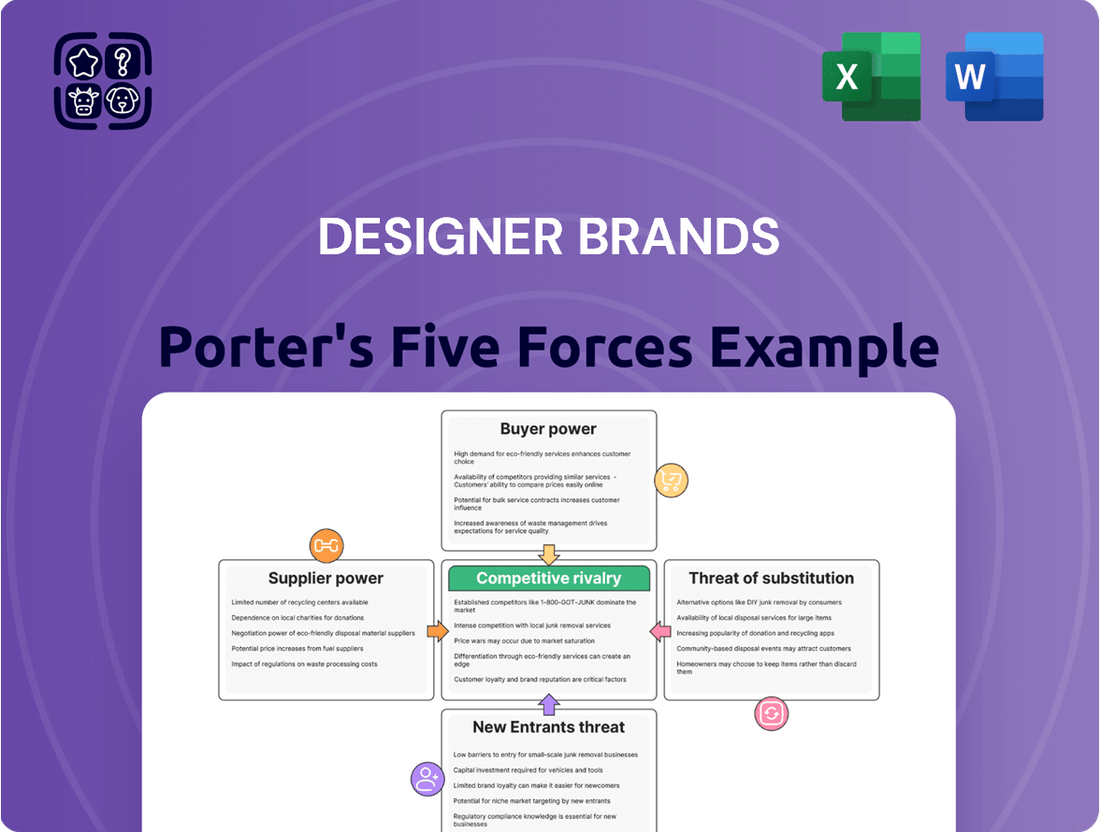

Designer Brands faces a dynamic industry landscape, with significant pressure from powerful buyers and the constant threat of new entrants. Understanding these forces is crucial for navigating the competitive retail environment.

The complete report reveals the real forces shaping Designer Brands’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The footwear industry's reliance on a concentrated global supply chain, with major production hubs in China, Vietnam, India, and Indonesia, can significantly influence supplier power. While China remains a volume leader, Vietnam's increasing market share, especially for athletic and fashion footwear, suggests that these key manufacturing centers could wield considerable leverage.

Designer Brands Inc. (DBI) navigates a complex supply landscape, sourcing both recognized brand-name products and their own private label items. For the sought-after brands they carry, the suppliers – these brands themselves – often hold considerable sway. This power stems from the unique designs, established brand recognition, and protected intellectual property that these brands possess, making them difficult to replicate or substitute.

In contrast, when DBI deals with private label components or more generic accessories, the bargaining power tends to shift. The availability of numerous manufacturers capable of producing these less differentiated items means DBI can often negotiate more favorable terms. For instance, in 2023, DBI reported that their private label brands contributed a significant portion of their sales, highlighting the importance of managing supplier relationships for these product lines.

Switching suppliers for Designer Brands Inc. (DBI) can incur significant costs. These include expenses for retooling manufacturing equipment, adjusting quality control processes to meet new supplier standards, and establishing entirely new logistical and supply chain frameworks. These are not trivial expenses and can impact operational efficiency.

DBI's extensive network, boasting over 400 special footwear vendor relationships through its Affiliated Business Group (ABG), highlights a deep level of integration. This embeddedness means that shifting away from these established partnerships would likely involve considerable effort and investment to find, vet, and integrate new suppliers, thereby increasing switching costs.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward, meaning they start selling directly to consumers, poses a potential challenge. For instance, a major footwear manufacturer could decide to open its own stores or boost its online direct-to-consumer sales, cutting out retailers like DSW. This move could give those suppliers more leverage, particularly if their brands are highly sought after. However, DSW's broad network of physical stores and its established e-commerce presence provide a significant advantage in reaching a wide customer base, mitigating this threat to some extent.

While less frequent, the possibility of suppliers vertically integrating forward by establishing their own retail operations or expanding direct-to-consumer (DTC) channels, thereby bypassing intermediaries like DSW, exists. This potential action could enhance supplier bargaining power, especially for highly desirable brands. For example, if a prominent sneaker brand were to significantly ramp up its DTC sales, it could reduce its reliance on traditional retail partners.

- Forward Integration Threat: Suppliers, particularly large footwear manufacturers, could launch their own retail or direct-to-consumer (DTC) operations.

- Impact on Retailers: This bypasses existing retailers, potentially increasing supplier leverage, especially for popular brands.

- DSW's Counterbalance: DSW's extensive retail footprint and e-commerce platforms offer a robust distribution channel that can absorb or mitigate this threat.

- Example Scenario: A major athletic shoe brand increasing its DTC sales by 20% in 2024 could put pressure on multi-brand retailers.

Supplier's Importance to DBI

Designer Brands Inc. (DBI), operating DSW stores, relies heavily on its suppliers to offer a wide array of shoe styles and brands. Strong vendor relationships are therefore fundamental to DBI's strategy of providing customers with a diverse and appealing product selection.

DBI's commitment to curating the 'best shoe assortment possible' directly underscores the vital role suppliers play. Without robust partnerships, maintaining this curated offering, which is central to DSW's value proposition, would be significantly challenged.

- Supplier Dependence: DBI's business model is built on offering a broad selection, making it dependent on suppliers for product variety.

- Relationship Management: Maintaining strong vendor relationships is key to ensuring a consistent and desirable product assortment for DSW customers.

- Strategic Importance: Suppliers are not just sources of goods but strategic partners in DBI's effort to deliver a compelling customer experience.

Designer Brands Inc. (DBI) faces considerable supplier power when sourcing recognized brands due to their unique designs and intellectual property, which are difficult to substitute. However, for private label components and less differentiated accessories, DBI can leverage a wider pool of manufacturers to negotiate more favorable terms. In 2023, private label sales represented a significant portion of DBI's revenue, underscoring the importance of these relationships.

Switching costs for DBI are substantial, encompassing retooling, quality control adjustments, and establishing new logistics, impacting operational efficiency. With over 400 vendor relationships through its Affiliated Business Group (ABG), DBI's deep integration means significant effort and investment would be required to transition to new suppliers.

The threat of suppliers integrating forward by establishing their own direct-to-consumer (DTC) channels could increase their leverage, particularly for sought-after brands. For example, a significant increase in DTC sales by a major athletic brand in 2024 could pressure multi-brand retailers.

DBI's business model hinges on offering a diverse product assortment, making strong vendor partnerships crucial for its curated offering and customer experience.

| Supplier Characteristic | Impact on DBI | Example/Data Point |

|---|---|---|

| Brand Recognition & IP | High Bargaining Power | Suppliers of recognized brands can command premium pricing. |

| Availability of Alternatives | Low Bargaining Power | For private label items, numerous manufacturers exist, allowing for negotiation. |

| Switching Costs | High for DBI | Retooling, quality control, and logistics integration are costly. |

| Forward Integration Threat | Potential Leverage Increase | A major athletic brand increasing DTC sales by 20% in 2024 could impact retailers. |

| Vendor Relationships | Strategic Importance | Over 400 ABG vendor relationships highlight deep integration. |

What is included in the product

This analysis unpacks the competitive forces impacting Designer Brands, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the influence of substitutes to understand its strategic positioning.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces model, allowing for rapid identification of strategic vulnerabilities and opportunities.

Customers Bargaining Power

Customers in the footwear market are showing a growing sensitivity to price. Many shoppers are actively hunting for discounts or holding off on purchases until sales events occur. In fact, a substantial number of consumers report pausing or abandoning purchases even when faced with modest price hikes, indicating a strong inclination to seek better value.

The digital landscape has significantly amplified customer bargaining power. The proliferation of e-commerce platforms and the ease of online price comparison mean consumers can readily find the best deals. For instance, a significant percentage of footwear searches begin on major online retailers like Amazon, which heightens price transparency and empowers buyers to negotiate or choose lower-cost alternatives.

The footwear market is incredibly crowded, meaning customers have a wealth of choices. Think about it, there are countless brands, styles, and ways to buy shoes – online, in physical stores, even at discount retailers. This sheer volume of options directly impacts a company like DSW.

Because there are so many alternatives readily available, customers hold significant bargaining power. If a customer isn't happy with DSW's prices, the selection, or even the shopping experience, they can very easily just walk away and buy from a competitor. This ease of switching is a major factor in how much influence customers have.

Consider the competitive landscape: in 2023, the US footwear market was valued at approximately $70 billion, with online sales continuing to grow significantly. This means customers have more access than ever to compare prices and products from various sources, further strengthening their position.

DSW's customer base is widely dispersed throughout North America, spanning numerous retail locations and its online presence. This broad reach means no single customer holds significant leverage, effectively minimizing individual customer concentration.

While individual customers have limited power, DSW's performance is still swayed by broader consumer sentiment and prevailing fashion trends. In 2023, DSW reported total net sales of $3.4 billion, underscoring the collective impact of its vast customer network.

Switching Costs for Customers

The bargaining power of customers in the designer footwear market, particularly concerning switching costs, is generally low. For consumers, moving between different designer footwear retailers requires minimal effort, often just a few clicks or a short visit to another store. This ease of transition means customers can readily explore alternatives without significant inconvenience or expense.

While many designer brands and retailers offer loyalty programs, their effectiveness in truly locking in customers can be limited. Many consumers remain highly price-sensitive and are willing to switch for better deals or a broader selection of styles. For instance, a 2024 survey indicated that over 60% of luxury footwear buyers consider price promotions when making a purchase, suggesting that loyalty programs alone are not a strong enough deterrent against exploring competitor offerings.

- Low Switching Costs: Customers face minimal barriers when moving between footwear retailers, making it easy to compare prices and products.

- Limited Loyalty Program Impact: Despite the existence of loyalty programs, their ability to significantly retain customers is often overshadowed by price sensitivity and the desire for wider product variety.

- Price Sensitivity: A significant portion of consumers, even in the luxury segment, actively seek out discounts and promotions, indicating a willingness to switch for better value.

Product Differentiation and Brand Loyalty

Product differentiation and brand loyalty significantly influence the bargaining power of customers in the footwear industry. While retailers like DSW offer a diverse selection, including private labels, true brand loyalty often resides with established athletic and fashion brands such as Nike and Adidas. This means customers may prioritize specific shoe brands over the retailer itself, giving those brands more leverage.

DSW's strategy to counter this involves cultivating loyalty to its own platform. This is achieved by emphasizing unique value propositions that extend beyond just the product selection. Key elements include offering a broad and convenient shopping experience, both online and in-store, and implementing robust loyalty programs. For instance, DSW's loyalty program rewards repeat purchases, aiming to incentivize customers to choose DSW as their primary footwear destination.

- Brand Loyalty Concentration: Customer loyalty in footwear often centers on specific shoe manufacturers (e.g., Nike, Adidas) rather than the retail platform.

- Retailer Value Proposition: DSW aims to build its own brand loyalty by focusing on a wide selection, shopping convenience, and rewarding customer experiences.

- Competitive Landscape: The ability of retailers to differentiate their offerings and build a strong customer connection is crucial in mitigating customer bargaining power.

Customers in the footwear market exhibit significant bargaining power due to low switching costs and a high degree of price sensitivity. Even within the designer segment, consumers can easily move between retailers with minimal effort, often prioritizing price promotions over loyalty programs. This dynamic is further fueled by the vast array of choices available, making it simple for customers to seek out better value elsewhere.

The digital age has amplified this power, offering unprecedented price transparency and comparison tools. A 2024 survey revealed that over 60% of luxury footwear buyers consider price promotions, highlighting a clear preference for value. While retailers like DSW strive to build loyalty through extensive selections and rewards, the inherent ease of switching and the strong pull of specific shoe brands like Nike and Adidas mean customer influence remains substantial.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Examples |

|---|---|---|

| Switching Costs | Low | Minimal effort required to change footwear retailers. |

| Price Sensitivity | High | Over 60% of luxury footwear buyers consider price promotions (2024 survey). |

| Availability of Alternatives | High | Crowded market with numerous brands, styles, and purchasing channels. |

| Brand Loyalty Concentration | Moderate | Loyalty often to specific shoe brands (e.g., Nike) rather than retailers. |

Full Version Awaits

Designer Brands Porter's Five Forces Analysis

The preview you see is the exact Porter's Five Forces Analysis for Designer Brands that you will receive immediately after purchase, ensuring complete transparency and no hidden surprises. This professionally compiled document details the competitive landscape, including threats of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and intensity of rivalry within the designer brand market. You can be confident that the insights and formatting you are viewing are precisely what you will obtain, ready for immediate use.

Rivalry Among Competitors

The footwear retail sector is intensely competitive, with DSW encountering direct rivals such as Zappos, Nike, and department stores like Macy's. This crowded marketplace also features a multitude of physical stores, niche boutiques, and direct-to-consumer brands, creating a highly fragmented environment.

The global footwear market is anticipated to grow robustly, with projected Compound Annual Growth Rates (CAGRs) between 3.4% and 7.6% from 2024 through 2029. This significant expansion, while potentially easing some competitive strains, also acts as a magnet for new entrants and fuels intensified efforts by established brands to secure greater market share.

DSW aims to differentiate through a broad assortment of both established brand names and its own private label footwear. However, this strategy faces a significant hurdle as many rivals also boast extensive selections, diluting the impact of DSW's product breadth. The true challenge lies in cultivating distinctiveness beyond just the product mix.

Brand loyalty in the footwear sector often rests with the shoe manufacturers themselves, not necessarily the retailers. For DSW, this means the focus must shift to enhancing the overall retail experience and developing truly compelling private labels that can capture consumer preference independently. In 2023, DSW reported net sales of $3.4 billion, highlighting the scale of the market it operates within, yet the need for stronger differentiation remains critical to gain a competitive edge.

Exit Barriers

Footwear retailers often face substantial exit barriers due to high fixed costs. These include significant investments in physical retail spaces, managing large inventories, and commitments to long-term leases. For instance, many established brands have extensive store networks that represent substantial sunk costs, making a swift closure financially unviable.

These elevated exit barriers can compel companies to continue operating even when profitability is low. This persistence can intensify competition, leading to more aggressive pricing strategies and frequent promotional events as businesses fight to maintain market share and cover their fixed overheads. This dynamic can put pressure on margins across the entire industry.

- High Fixed Costs: Retail store leases, inventory holding, and brand marketing represent significant upfront and ongoing expenses.

- Sunk Costs: Investments in store build-outs, specialized equipment, and established supply chains are difficult to recover.

- Market Persistence: Companies may stay in the market despite low profits to avoid large write-offs of assets.

- Competitive Impact: Prolonged market presence by struggling firms can lead to increased price wars and promotional activity.

Market Saturation and Consumer Spending

Competitive rivalry within the designer brand sector is intensified by market saturation and shifting consumer spending habits. As consumers grapple with inflationary pressures, they are becoming more price-conscious, leading to a projected decrease in footwear spending per consumer for 2024. This economic climate fosters a highly promotional retail environment.

This heightened price sensitivity forces retailers to frequently offer discounts and sales to capture customer attention and drive sales volume. Consequently, designer brands face increased pressure to compete not only on brand prestige but also on price, impacting profit margins and brand perception.

- Projected Decrease in Footwear Spending: Analysts anticipate a decline in per-consumer footwear expenditure for 2024, reflecting tighter household budgets.

- Inflationary Impact: Persistent inflation erodes purchasing power, making consumers more discerning about discretionary purchases like designer goods.

- Promotional Retail Environment: The necessity for discounts and sales to attract price-sensitive consumers elevates competitive intensity.

- Margin Pressure: The need to offer competitive pricing can squeeze profit margins for designer brands, even those with strong brand equity.

The designer footwear market is characterized by intense rivalry, fueled by numerous established players and emerging direct-to-consumer brands. This competition is further exacerbated by a projected decrease in per-consumer footwear spending for 2024 due to inflationary pressures, leading to a highly promotional environment. Retailers are compelled to offer frequent discounts, which can compress profit margins even for premium brands. The substantial fixed and sunk costs associated with physical retail operations create high exit barriers, encouraging companies to remain in the market despite lower profitability, thereby intensifying price wars and promotional activities.

| Key Competitor Types | Examples | Impact on Rivalry |

| Established Footwear Brands | Nike, Adidas, Puma | Strong brand equity, extensive marketing budgets, and global distribution networks create significant competitive pressure. |

| Department Stores | Macy's, Nordstrom | Offer a wide range of designer brands, often leveraging loyalty programs and in-store experiences to attract customers. |

| Specialty Retailers | DSW, Famous Footwear | Compete on breadth of selection and value proposition, often featuring private labels alongside national brands. |

| Direct-to-Consumer (DTC) Brands | Allbirds, Rothy's | Agile, digitally native brands that often innovate in product design and customer engagement, bypassing traditional retail channels. |

| Online Marketplaces | Zappos, Amazon | Provide vast product assortments and competitive pricing, leveraging convenience and extensive customer data. |

SSubstitutes Threaten

Consumers today face an expansive landscape of footwear choices, extending far beyond conventional dress shoes. This includes a significant proliferation of athletic footwear like sneakers and running shoes, alongside a growing market for casual comfort styles. For instance, the global athletic footwear market was valued at approximately $71.4 billion in 2023 and is projected to reach $94.6 billion by 2028, highlighting a substantial consumer shift towards these categories.

The surging popularity of athleisure wear directly impacts the demand for traditional footwear. Many consumers now opt for comfortable, sporty alternatives for a wider range of activities and social settings, including work and casual outings. This trend can dilute the market share for designer dress shoes and other formal footwear, as consumers prioritize versatility and comfort, potentially leading to a decrease in sales for less adaptable shoe types.

While consumers can repair their designer shoes or even attempt DIY customization, this threat to new purchases is generally quite low. The allure of new styles and the perceived value of pristine designer footwear often outweigh the cost and effort of repairs or modifications for the target market.

Consumers are increasingly opting to extend the life of their current footwear or reduce their overall purchases, a trend amplified by economic headwinds. For instance, rising inflation in 2024 has made consumers more value-conscious, leading them to prioritize durability and repair over immediate replacement.

Impact of 'Barefoot' or Minimalist Trends

While a niche segment, the growing interest in minimalist or 'barefoot' footwear presents a potential, albeit very long-term, substitute threat. This trend, emphasizing natural foot movement, could gradually diminish the perceived need for conventional, structured shoes for a small but dedicated consumer base. For a broad-spectrum footwear retailer like DSW, which serves a wide array of fashion and functional needs, this impact is currently minimal.

The overall market for footwear remains robust, with global footwear sales projected to reach approximately $400 billion by 2024. This growth indicates that the vast majority of consumers continue to prioritize traditional footwear for its style, comfort, and protection. The minimalist trend, while gaining traction, still represents a very small fraction of this expansive market, making its immediate impact on large retailers negligible.

- Minimalist Footwear Market Share: While specific figures for the minimalist footwear segment are difficult to isolate within broader market data, it is understood to be a small, albeit growing, niche.

- DSW's Market Position: DSW operates within the broader U.S. footwear retail market, which is highly competitive but also very large, indicating significant demand for diverse shoe styles.

- Consumer Preferences: The dominant consumer preference remains for traditional footwear, encompassing a wide range of styles from athletic shoes to dress shoes, which DSW caters to extensively.

Shift in Consumer Lifestyle and Fashion Trends

The persistent shift towards casual comfort and athleisure wear directly impacts consumer footwear preferences. For instance, in 2024, the global athleisure market continued its robust growth, with projections indicating a significant expansion driven by demand for versatile and comfortable apparel, including footwear. This trend presents a threat to designer brands if they fail to integrate more casual and athletic-inspired designs into their collections.

Furthermore, the increasing consumer consciousness regarding environmental impact is fueling a demand for sustainable and ethically produced goods. By mid-2024, reports highlighted a growing segment of consumers willing to pay a premium for eco-friendly fashion. Designer brands that do not prioritize sustainable sourcing and manufacturing practices risk losing market share to competitors offering more environmentally aligned options.

If a company like DSW, a major footwear retailer, doesn't proactively adjust its inventory to align with these evolving lifestyle and fashion trends, consumers may divert their spending. They might opt for retailers that are more attuned to the demand for:

- Casual and athleisure footwear: Brands focusing on comfort and sporty aesthetics.

- Sustainable fashion: Companies emphasizing recycled materials and ethical production.

- Direct-to-consumer (DTC) brands: Often quicker to adapt to niche trends and offer specialized products.

The threat of substitutes for designer footwear is amplified by the growing popularity of athletic and casual styles, as consumers increasingly prioritize comfort and versatility. For example, the global athletic footwear market was valued at approximately $71.4 billion in 2023 and is projected to grow significantly. This trend means that sneakers and comfortable casual shoes can serve as substitutes for more formal designer options, especially as athleisure wear continues to dominate fashion choices.

While repair and DIY customization offer a minor substitute threat, the primary substitute pressure comes from alternative footwear categories. The ongoing consumer shift towards casualization and the increasing demand for sustainable products also present challenges. By mid-2024, a notable segment of consumers showed willingness to pay more for eco-friendly fashion, impacting brands that lag in sustainability efforts.

Direct-to-consumer (DTC) brands also pose a substitute threat by quickly adapting to niche trends and offering specialized products, potentially diverting consumers from traditional designer labels. Retailers like DSW must remain attuned to these evolving preferences, including the demand for casual footwear and sustainable options, to maintain market relevance.

| Substitute Category | Key Drivers | Impact on Designer Footwear |

|---|---|---|

| Athletic & Casual Footwear | Comfort, versatility, athleisure trend | Reduces demand for formal/less adaptable styles |

| Sustainable Footwear | Environmental consciousness, ethical production | Challenges brands with non-eco-friendly practices |

| Direct-to-Consumer (DTC) Brands | Niche trend adaptation, specialization | Offers alternatives to mass-market designer offerings |

Entrants Threaten

Entering the footwear retail space, particularly with a brick-and-mortar model like DSW, demands substantial capital. This includes significant investments in stocking a wide range of inventory, securing prime retail locations, and establishing a robust supply chain. For instance, setting up a new DSW store can easily run into millions of dollars for leasehold improvements, initial inventory, and operational setup.

However, the digital revolution has significantly altered this landscape. Online-only footwear retailers face considerably lower capital requirements. They can bypass the hefty expenses associated with physical storefronts, focusing instead on website development, digital marketing, and warehousing. This shift means that while traditional brick-and-mortar entry remains capital-intensive, the online channel presents a more accessible avenue for new competitors, potentially impacting market share for established players.

Designer Brands Inc. benefits significantly from economies of scale, a major barrier for new entrants. Their extensive sourcing network and large-scale distribution channels allow them to negotiate better prices with suppliers and reduce per-unit shipping costs. For instance, in fiscal year 2023, Designer Brands reported net sales of $3.04 billion, illustrating the sheer volume of their operations which underpins these cost advantages.

New companies entering the designer footwear market would find it difficult to match these efficiencies. The initial investment required to build comparable sourcing and distribution infrastructure would be substantial, making it challenging to compete on price against established players like Designer Brands, who can leverage their existing scale to offer more attractive pricing.

DSW's strong brand loyalty, cultivated through initiatives like its rewards program, presents a significant hurdle for potential new entrants. Acquiring customers in the competitive footwear market is costly, particularly when consumers are price-conscious, making it difficult for newcomers to gain traction.

Access to Distribution Channels

New entrants face significant hurdles in accessing established distribution channels, a critical factor for designer brands. DSW, for instance, leverages its extensive network of over 2,600 retail stores and robust e-commerce presence. This vast physical footprint and digital infrastructure are not easily replicated by newcomers.

Securing prime retail locations in desirable markets is a major barrier. New brands must compete with established players for limited, high-traffic spaces, often requiring substantial capital investment. Furthermore, building efficient logistics and supply chains to support both online and offline sales channels demands considerable time and resources.

The threat is somewhat mitigated by the growth of online marketplaces and direct-to-consumer (DTC) models, which offer alternative avenues for reaching customers. However, the brand-building power and customer reach of established brick-and-mortar and omnichannel retailers remain a formidable challenge.

Consider these points regarding access to distribution channels:

- Established Retail Footprint: Brands like DSW benefit from extensive physical store networks, providing immediate customer access and brand visibility.

- E-commerce Infrastructure: A well-developed online platform and efficient logistics are crucial for competing in the modern retail landscape.

- Cost of Prime Locations: Securing high-visibility retail spaces in key markets represents a significant capital expenditure for new entrants.

- Supply Chain Complexity: Building and managing an effective supply chain for both online and in-store fulfillment is a complex and costly undertaking.

Regulatory and Legal Barriers

Regulatory and legal barriers, while not always insurmountable for new entrants in the designer footwear market, present a significant hurdle. Companies must adhere to stringent product safety standards, especially concerning materials and manufacturing processes. For instance, in 2024, the European Union continued to enforce REACH regulations, impacting the chemical composition of materials used in footwear, potentially increasing compliance costs for newcomers.

Navigating labor laws, particularly for brands that engage in overseas manufacturing, adds another layer of complexity and cost. Ensuring ethical sourcing and fair labor practices is paramount, and non-compliance can lead to severe reputational damage and legal repercussions. The global fashion industry, including designer footwear, faced increased scrutiny in 2024 regarding supply chain transparency and labor conditions, making adherence to these laws a critical entry requirement.

Intellectual property protection is a cornerstone threat for designer brands, and new entrants must be acutely aware of existing patents, trademarks, and design copyrights. The designer footwear sector is particularly vulnerable to counterfeiting, and establishing robust IP strategies from the outset is essential. In 2024, major fashion houses continued to actively pursue legal action against counterfeiters, highlighting the significant investment required to protect brand identity and exclusivity.

- Product Safety: Compliance with evolving regulations like EU REACH impacts material sourcing and manufacturing costs.

- Labor Laws: Adherence to ethical sourcing and fair labor practices is crucial, especially with global manufacturing.

- Intellectual Property: Protecting trademarks and designs against counterfeiting requires significant legal investment.

The threat of new entrants for Designer Brands is moderate, primarily due to high capital requirements for physical retail and brand building. However, the digital landscape lowers these barriers for online-only players. For instance, while DSW's extensive network of over 2,600 stores represents a significant investment, online DTC models require less upfront capital.

Economies of scale, like Designer Brands' $3.04 billion in net sales for fiscal year 2023, create a cost advantage that new entrants struggle to match. Access to established distribution channels is also a major hurdle, as replicating DSW's omnichannel presence is costly and time-consuming.

Regulatory compliance, particularly concerning product safety and labor laws, adds complexity and expense for newcomers. Protecting intellectual property against counterfeiting is another significant challenge, demanding substantial legal investment.

| Barrier | Impact on New Entrants | Example for Designer Brands |

|---|---|---|

| Capital Requirements (Physical Retail) | High | Millions for store setup and inventory |

| Economies of Scale | High | $3.04 billion in FY2023 net sales |

| Distribution Channels | High | 2,600+ retail stores and e-commerce |

| Brand Loyalty & Customer Acquisition | Moderate to High | Rewards program |

| Regulatory Compliance | Moderate | EU REACH regulations, labor laws |

| Intellectual Property Protection | Moderate | Legal action against counterfeiters |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Designer Brands is built upon a foundation of diverse and reliable data, including Designer Brands' annual reports, investor presentations, and SEC filings. We supplement this with industry-specific market research from firms like Statista and IBISWorld, alongside macroeconomic data to capture the broader competitive landscape.