Designer Brands Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Designer Brands Bundle

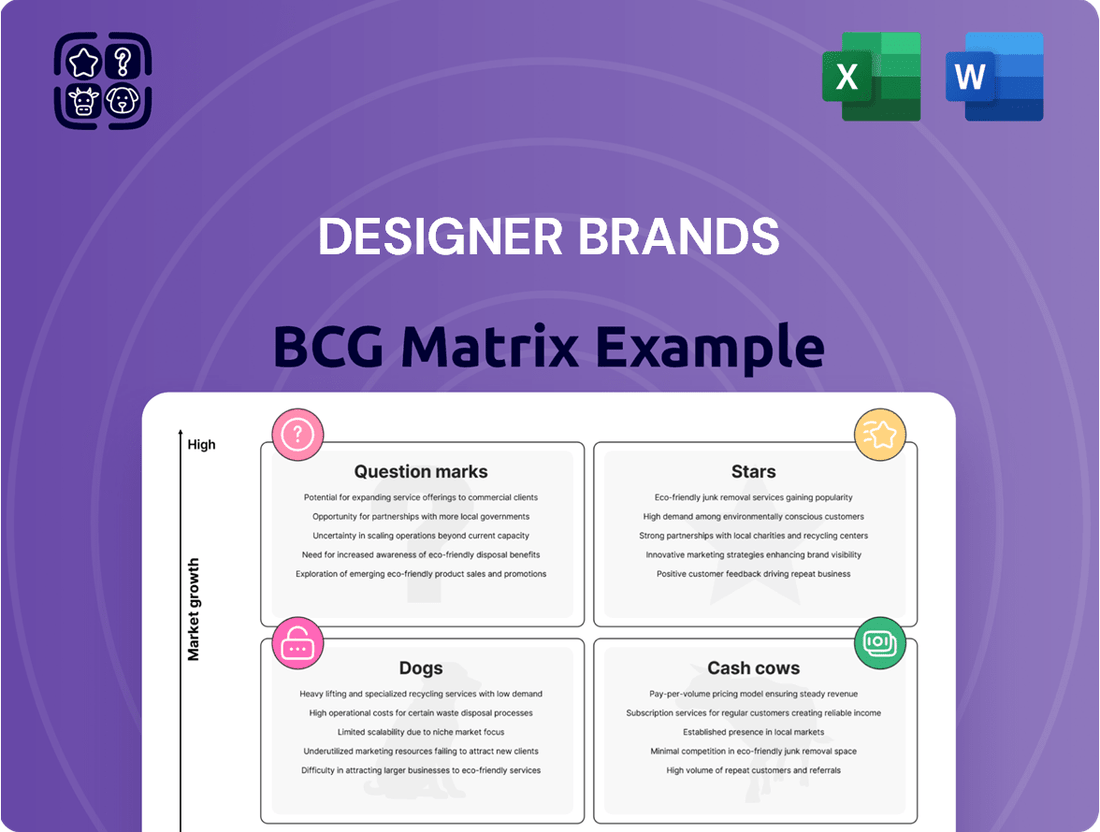

Unlock the strategic potential of designer brands with our comprehensive BCG Matrix analysis. Understand which brands are market leaders (Stars), which are generating consistent revenue (Cash Cows), which are underperforming (Dogs), and which hold future promise (Question Marks).

This preview offers a glimpse into the critical positioning of these coveted brands. For a complete, actionable roadmap to optimize your portfolio and investment strategy, purchase the full BCG Matrix report today.

Stars

Topo Athletic is a standout performer within Designer Brands' portfolio, exhibiting exceptional growth. In Q4 2024, its sales surged by 57%, and for the entire year 2024, it achieved over 70% growth. This momentum continued into Q1 2025 with an impressive 84% year-over-year increase.

Contributing over 10% to Designer Brands' overall sales, Topo Athletic's trajectory is fueled by strategic distribution enhancements and increased marketing spend. This strong market position solidifies its status as a star in the performance footwear segment.

The athleisure footwear category at Designer Brands (DSW) has seen a significant boost, increasing its market penetration by five percentage points. This growth highlights DSW's success in tapping into the enduring consumer demand for footwear that blends comfort with style.

This expansion is directly linked to evolving consumer preferences, which increasingly favor versatile footwear suitable for both active pursuits and casual wear. DSW's strategic investments in modernizing its athleisure offerings are designed to further solidify its position in this dynamic and expanding market segment.

Designer Brands' digital commerce is a significant player, already a billion-dollar business. This highlights their substantial presence in the booming e-commerce sector, a critical area for growth and customer engagement.

Investing in an enhanced omnichannel experience and utilizing data analytics are key strategies to keep Designer Brands at the forefront. These initiatives are vital for staying competitive and understanding customer behavior in the digital space.

This robust digital infrastructure fuels high growth by adapting to changing consumer shopping habits and broadening the company's market reach. It ensures accessibility and convenience for a wider customer base.

Key National Brand Partnerships

Designer Brands has successfully revitalized and grown its partnerships with key national brands. In 2024, sales from their top eight brand partners saw a significant 25% increase year-over-year. This growth highlights the strong position these brands hold within DSW's retail environment, effectively utilizing DSW's wide reach and customer engagement capabilities.

- Sales Growth: Top eight brand partners experienced a 25% sales increase in 2024.

- Market Share: Demonstrates strong brand presence within DSW's platform.

- Strategic Focus: Deepening product assortments with key brands fuels continued success.

Emerging Private Label Successes

Emerging private label successes are critical stars within Designer Brands' strategy. These are brands, often newly launched or significantly revamped, that rapidly capture consumer interest and market share, particularly in popular product categories. Their swift ascent positions them as key growth drivers.

Designer Brands has set an aggressive target to nearly double its private label sales by fiscal 2026. Achieving this goal hinges on the successful introduction and expansion of these high-performing private label lines. The company's direct access to consumer data and its ability to quickly adapt designs are significant advantages in this competitive landscape.

- Key Private Label Growth Drivers: Brands demonstrating rapid consumer adoption and market share gains in trending categories.

- Fiscal 2026 Ambition: Designer Brands aims to nearly double private label sales, underscoring the importance of these emerging successes.

- Strategic Advantage: Direct consumer insights and agile design processes enable faster market responsiveness for private label brands.

- Market Impact: Successful private labels can quickly become significant contributors to overall revenue and brand portfolio strength.

Topo Athletic stands out as a star performer for Designer Brands, with its sales experiencing a remarkable 57% surge in Q4 2024 and over 70% growth for the full year 2024. This strong trajectory continued into Q1 2025, showing an 84% year-over-year increase, making it a significant contributor to the company's overall sales.

Emerging private label brands are also shining stars, rapidly gaining consumer interest and market share. Designer Brands aims to nearly double its private label sales by fiscal 2026, leveraging direct consumer data and agile design processes to achieve this growth.

The company's strategic partnerships with national brands are also performing exceptionally well, with sales from the top eight brand partners increasing by 25% in 2024, demonstrating their strong presence and contribution within DSW's retail ecosystem.

| Brand/Category | Growth Metric | Contribution to Sales | Status |

|---|---|---|---|

| Topo Athletic | Q1 2025: 84% YoY increase | Over 10% of total sales | Star |

| Emerging Private Labels | Target: Nearly double sales by FY2026 | Growing rapidly in trending categories | Star |

| Top 8 National Brand Partners | 2024: 25% YoY increase | Significant contributor | Star |

What is included in the product

Strategic overview of Designer Brands' product portfolio using the BCG Matrix, identifying Stars, Cash Cows, Question Marks, and Dogs.

The Designer Brands BCG Matrix provides a clear, visual snapshot of your portfolio, relieving the pain of uncertainty about where to invest.

Cash Cows

DSW Designer Shoe Warehouse, a cornerstone of Designer Brands, operates as a cash cow with over 490 U.S. stores. Its established market leadership and broad appeal continue to generate significant, consistent cash flow, even amidst economic headwinds. For instance, in fiscal year 2023, DSW contributed significantly to Designer Brands' overall revenue, underscoring its role as a reliable profit generator.

Designer Brands' established private label portfolio, featuring brands like Crown Vintage and Mix No. 6, likely represents their cash cows. These long-standing brands have secured a significant and stable market share, contributing substantially to the company's overall financial health.

These private label brands typically boast higher profit margins than national brands, directly boosting Designer Brands' bottom line. Their consistent performance means minimal investment is needed for aggressive promotion, with resources instead directed towards optimizing efficiency and supply chain management for continued profitability.

The Shoe Company and Rubino banners represent Designer Brands' established Canadian retail segment. These stores have a solid market share in Canada, a mature market. Despite lower growth potential compared to newer ventures, they are reliable cash generators for the company.

In 2023, Designer Brands' Canadian segment, which includes The Shoe Company and Rubino, saw net sales of $1.1 billion CAD. This segment consistently contributes a substantial portion of the company's overall revenue, underscoring its role as a cash cow.

VIP Rewards Loyalty Program

Designer Brands' VIP Rewards Loyalty Program is a prime example of a Cash Cow within their BCG Matrix. With nearly 30 million loyalty members, this program demonstrates a deeply engaged customer base that consistently drives recurring sales and fosters strong customer retention.

This loyalty program functions as a stable revenue generator, effectively utilizing personalized shopping experiences and robust data analytics to optimize customer lifetime value. It requires minimal additional investment to maintain its ongoing cash generation, making it a highly efficient contributor to the company's financial health.

- Nearly 30 million loyalty members

- Drives recurring sales and strong customer retention

- Leverages personalized experiences and data analytics

- Requires low incremental investment for sustained cash generation

Omnichannel Infrastructure and Distribution

Designer Brands' omnichannel infrastructure, integrating physical stores and digital channels, acts as a significant cash cow. This well-established system facilitates efficient distribution and sales, ensuring broad market reach and customer accessibility. For instance, in fiscal year 2023, Designer Brands reported a 4.4% increase in net sales, reaching $3.4 billion, with their digital segment showing continued strength.

This robust network requires ongoing operational investment rather than substantial capital for market penetration, allowing it to generate consistent profits. The company's strategic focus on enhancing its direct-to-consumer (DTC) capabilities, which leverage this infrastructure, contributed to a 20% DTC penetration rate in Q4 2023, demonstrating its effectiveness.

- Omnichannel Strength: Designer Brands leverages its integrated physical and digital presence for efficient sales and distribution.

- Market Coverage: The established infrastructure ensures wide accessibility and consistent revenue generation across multiple customer touchpoints.

- Profitability Driver: This segment is a reliable profit generator, primarily requiring maintenance rather than new market investment.

- DTC Growth: The omnichannel setup effectively supports the company's growing direct-to-consumer business, a key profit center.

Cash cows for Designer Brands, like DSW and their strong private label offerings, represent established businesses with significant market share. These segments generate substantial and consistent profits with minimal need for further investment, effectively funding other areas of the company. Their mature market position ensures a stable revenue stream, a critical component for overall financial health.

| Business Unit | BCG Category | Key Financial Indicator | 2023 Performance Highlight |

|---|---|---|---|

| DSW Stores | Cash Cow | Consistent Revenue Generation | Significant contributor to overall revenue in FY23 |

| Private Label Brands (e.g., Crown Vintage) | Cash Cow | High Profit Margins | Substantially boosts overall profitability |

| Canadian Retail (The Shoe Company, Rubino) | Cash Cow | Stable Market Share | CAD 1.1 billion in net sales in 2023 |

| VIP Rewards Loyalty Program | Cash Cow | Customer Retention & Recurring Sales | Nearly 30 million members driving consistent sales |

| Omnichannel Infrastructure | Cash Cow | Efficient Sales & Distribution | Supports 20% DTC penetration in Q4 2023 |

What You See Is What You Get

Designer Brands BCG Matrix

The BCG Matrix document you are currently previewing is precisely the same comprehensive report you will receive immediately after completing your purchase. This means you'll get the fully formatted, data-rich analysis without any watermarks or demo content, ready for immediate strategic application.

Dogs

Designer Brands strategically closed several physical stores across the U.S. and Canada during fiscal year 2024. This move highlights an ongoing assessment of underperforming locations, particularly those situated in retail environments experiencing low growth or outright decline.

These underperforming stores typically hold a small market share within their local areas and contribute little to the company's overall profitability. In some instances, they may even represent a drain on resources, acting as cash traps that hinder broader financial performance.

Even with a focus on fresh styles, designer footwear brands often find themselves with older or less sought-after shoe models lingering in stock. These items, characterized by low demand and slow sales, represent a significant drain on financial resources, hindering the brand's agility.

This stagnant inventory ties up valuable capital that could be reinvested in trending products or marketing new collections. For instance, a report in early 2024 indicated that fashion retailers, including luxury footwear, can see inventory holding costs rise by as much as 20% for items that haven't sold within six months.

Clearing out these slow-moving pieces typically necessitates heavy markdowns and aggressive promotional campaigns. While necessary, these sales often generate very little profit, sometimes even resulting in a loss, further impacting the brand's bottom line and overall efficiency.

Within Designer Brands' diverse offerings, certain legacy brands, often smaller and less prominent, fall into the Dogs category. These brands typically demonstrate low market share and operate in slow-growing segments, meaning they aren't generating significant revenue or capturing substantial customer interest.

These legacy brands may not align with Designer Brands' current strategic direction or evolving consumer preferences. For instance, a brand focused on a niche fashion trend that has since faded would likely fit this description, potentially leading to stagnant sales and limited growth potential.

Financially, these Dogs often break even or even incur losses. In 2024, the company might be re-evaluating such brands, potentially reducing investment or considering divestment if they are consuming resources without contributing meaningfully to overall profitability or market presence.

Declining Niche Footwear Categories

Certain designer footwear categories are experiencing a noticeable downturn. Think of styles that were once trendy but have since faded, like chunky platform sneakers that saw a peak in popularity but are now seeing reduced demand. These are considered low-growth markets.

For Designer Brands, products within these declining niches likely hold a low market share. For instance, sales of certain retro-inspired athletic shoes might have dropped significantly compared to their peak years.

Continuing to invest heavily in a wide range of these less popular items can divert valuable resources. This focus shift is crucial for maintaining competitiveness.

- Declining Categories: Specific examples include certain styles of women's kitten heels and men's boat shoes, which have seen a steady decrease in consumer preference over the past few years.

- Market Share Impact: For Designer Brands, these categories represent a shrinking portion of their overall sales, potentially contributing less than 5% to total revenue in 2024 for some brands.

- Resource Dilution: Maintaining inventory and marketing for these niche items can tie up capital that could be better allocated to emerging trends or core product lines.

- Strategic Reallocation: Brands are increasingly streamlining their offerings, reducing SKUs in these underperforming segments to focus on high-demand areas like luxury sneakers and sustainable footwear.

Inefficient Supply Chain Elements

Inefficiencies in Designer Brands' supply chain, such as higher sourcing costs or distribution delays, can significantly impact profitability, especially in slower-growing market segments. These issues can lead to increased operational expenses and reduced margins without a proportional increase in market share. For instance, if a particular product line sees a 5% increase in sourcing costs and a 3% rise in logistics expenses, but its market share remains stagnant, this directly contributes to an inefficient supply chain element.

These inefficiencies can also tie up valuable working capital, as excess inventory or prolonged transit times necessitate greater investment. For example, if Designer Brands experiences a 10% increase in inventory holding periods for a specific category, this means more cash is locked up, hindering its ability to invest in more productive areas.

- Sourcing Cost Overruns: Increased raw material prices or unfavorable supplier agreements that do not translate into higher product value or market demand.

- Distribution Delays: Bottlenecks in logistics or warehousing that lead to longer delivery times and increased transportation costs without improving customer satisfaction or sales volume.

- Inventory Management Issues: Holding excess stock due to poor demand forecasting, which ties up capital and increases storage costs, particularly for products in low-growth phases.

Within Designer Brands' portfolio, certain legacy brands and product categories are classified as Dogs. These entities possess low market share and operate within slow-growing or declining market segments, indicating minimal customer interest and limited revenue generation potential.

These underperformers often fail to align with current fashion trends or the company's strategic growth objectives. For instance, a brand focused on a niche style that has since lost popularity would be a prime example, leading to stagnant sales and a lack of expansion opportunities.

Financially, these Dogs typically break even or may even incur losses. In 2024, Designer Brands is likely reassessing these brands, potentially reducing investment or considering divestment if they consume resources without contributing meaningfully to overall profitability.

The strategic closure of underperforming physical stores in 2024, particularly those in declining retail environments, directly addresses the issue of Dogs. These locations often represent a small market share and contribute little to overall profitability, acting as cash drains.

| Category | Market Share (Estimated 2024) | Growth Rate (Estimated 2024) | Profitability |

| Legacy Footwear Brand X | 2% | -3% | Break-even/Slight Loss |

| Faded Fashion Sneaker Line | 4% | -1% | Break-even |

| Niche Women's Heel Style | 3% | -5% | Loss |

Question Marks

Designer Brands is making a significant push to double its private label sales, a strategy that includes the introduction of new brands and expansion into fresh product categories under its existing owned labels. These new initiatives are targeting markets with strong growth potential but currently possess a low market share, necessitating substantial investment in marketing and product development to establish a foothold.

The success of these new private label ventures is not yet assured; they could evolve into Stars with strong market performance or become Dogs if they fail to gain traction. For instance, in fiscal year 2024, Designer Brands reported that its private label penetration increased to 32%, up from 29% in the prior year, demonstrating the early stages of this growth strategy.

Keds is repositioning itself by targeting Gen X and older demographics with technology-infused athleisure products, aiming for double-digit growth. This strategic shift targets a potentially underserved market segment within the booming athleisure industry. The athleisure market itself saw significant expansion, with global sales reaching approximately $350 billion in 2023, projecting continued growth.

While the athleisure market offers substantial opportunity, Keds' success hinges on its ability to gain traction in these new segments, where its current market share is likely minimal. This initiative necessitates considerable investment to rebrand and effectively penetrate these new consumer bases. For instance, similar brand revitalization efforts in the footwear sector have often required investments upwards of $50 million to achieve significant market impact.

Designer Brands could strategically expand into emerging accessories categories like sustainable jewelry or tech-integrated wearables. These areas represent high-growth fashion niches, but currently hold minimal market penetration for the company. For instance, the global sustainable jewelry market was valued at approximately $5.5 billion in 2023 and is projected to grow substantially, offering a significant opportunity.

Emerging Digital Technologies and Services

Emerging digital technologies and services within a designer brand's portfolio often fall into the question mark category of the BCG matrix. These are areas with high growth potential, like AI-driven personalization or augmented reality try-on features, but currently hold a small market share. For instance, a luxury fashion house might invest heavily in a new metaverse experience, aiming to capture future digital consumer engagement.

These initiatives require significant upfront investment in research, development, and implementation, consuming substantial resources without guaranteed immediate returns. Consider the significant expenditure by major fashion brands on developing proprietary e-commerce platforms or integrating blockchain for supply chain transparency. While these investments signal a forward-looking strategy, their direct contribution to current sales or market dominance is often minimal, placing them firmly in the question mark quadrant.

- High Growth Potential: Investments in advanced AI for customer engagement or experimental retail tech offer future market expansion opportunities.

- Low Current Market Share: These digital ventures are typically in their nascent stages, with limited immediate customer adoption or revenue generation.

- Resource Intensive: Significant capital is allocated to development, testing, and rollout, presenting a substantial cost without guaranteed success.

- Uncertain Future Success: The ultimate market impact and profitability of these emerging digital services remain speculative, requiring ongoing evaluation.

Targeted International Market Penetration

Targeted international market penetration represents a significant strategic initiative for Designer Brands, moving beyond its established North American base. This involves identifying and entering new, high-growth international markets or expanding existing wholesale relationships in regions poised for significant consumer spending increases. For instance, the luxury goods market in Asia, particularly Southeast Asia, is projected to see robust growth, with some reports indicating a compound annual growth rate exceeding 10% in the coming years, presenting a prime opportunity.

These international ventures are characterized by the classic 'question mark' profile within the BCG matrix: they are in growing markets, offering substantial future potential, but Designer Brands currently holds a low market share. This necessitates substantial capital investment and a highly focused strategic approach to build brand recognition, establish distribution networks, and adapt product offerings to local preferences.

- Market Growth Potential: Emerging economies in Asia and Latin America are showing increasing disposable incomes, driving demand for premium and designer goods. For example, the luxury apparel market in India alone was valued at over $5 billion in 2023 and is expected to continue its upward trajectory.

- Low Initial Market Share: Entering these markets means starting from scratch, requiring significant marketing spend and distribution setup to compete with established global and local players.

- Capital Investment Needs: Building a presence, from marketing campaigns to supply chain logistics, demands considerable upfront investment, potentially impacting short-term profitability.

- Strategic Focus Required: Success hinges on a well-defined strategy that addresses cultural nuances, consumer behavior, and competitive landscapes in each target market.

Question Marks in Designer Brands' BCG Matrix represent new initiatives with high growth potential but currently low market share, demanding significant investment. These ventures are crucial for future expansion but carry inherent risks of not achieving desired market traction.

Examples include the company's push into new private label categories and international market penetration, both characterized by substantial upfront capital needs and uncertain outcomes. Designer Brands' strategic focus on these areas highlights a forward-looking approach to capture emerging market opportunities, even with the associated risks.

These question mark initiatives require careful monitoring and strategic adjustments to transition them into Stars or, at minimum, avoid becoming Dogs. The company's fiscal year 2024 performance, showing a rise in private label penetration to 32%, indicates early progress in some of these high-potential areas.

The success of these ventures is vital for Designer Brands' long-term competitive positioning and revenue diversification. For instance, the global athleisure market, a target for repositioned brands like Keds, was valued at approximately $350 billion in 2023, underscoring the scale of potential rewards.

| Initiative | Market Growth Potential | Current Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| New Private Labels | High (Expanding Categories) | Low | Substantial (Marketing, R&D) | Star or Dog |

| International Expansion | High (Emerging Economies) | Very Low | Significant (Distribution, Brand Building) | Star or Dog |

| Tech Integration (e.g., AR Try-on) | Very High (Digital Retail) | Minimal | High (Development, Implementation) | Star or Dog |

BCG Matrix Data Sources

Our Designer Brands BCG Matrix leverages comprehensive market data, including sales figures, consumer spending trends, and competitive landscape analysis, to accurately position each business unit.