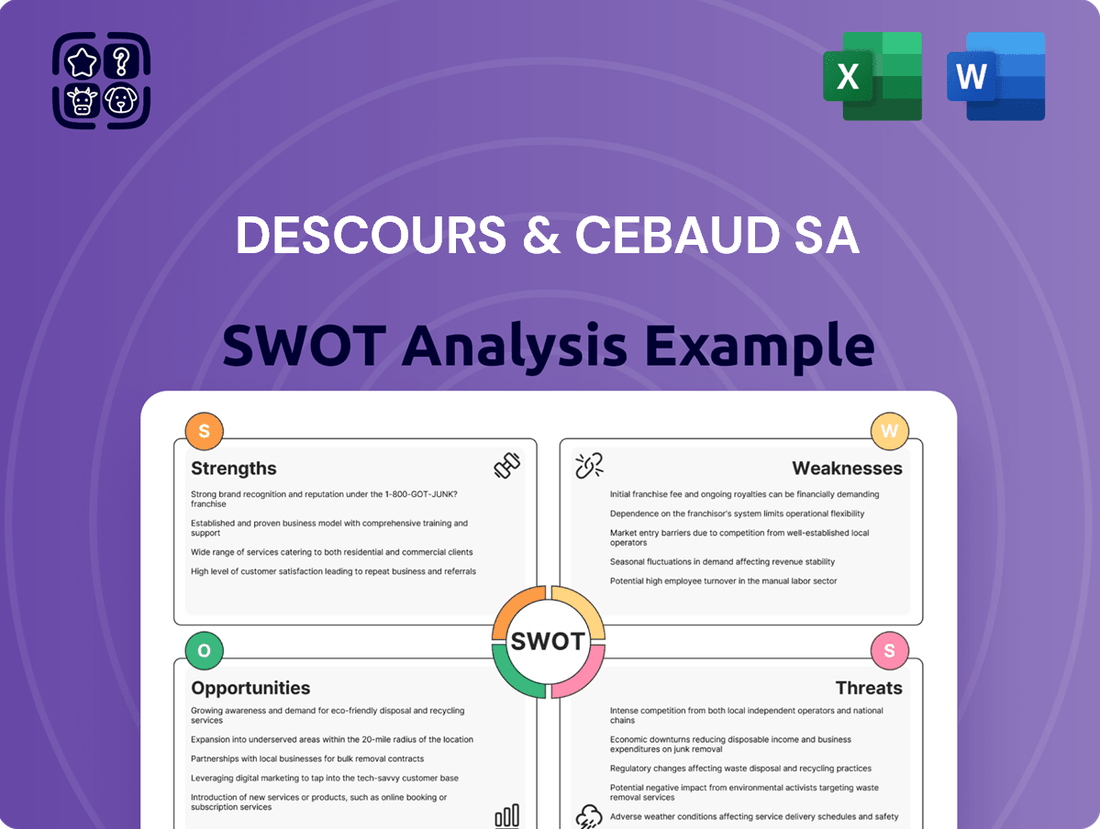

Descours & Cebaud SA SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Descours & Cebaud SA Bundle

Descours & Cebaud SA's SWOT analysis reveals a strong market presence fueled by established brands and a loyal customer base. However, the company faces challenges from evolving consumer preferences and intense competition within its sector.

Uncover the full strategic picture behind Descours & Cebaud SA's competitive edge and potential vulnerabilities with our comprehensive SWOT analysis. This in-depth report provides actionable insights and a detailed understanding of the company's market dynamics.

Want the complete story behind Descours & Cebaud SA's strengths, weaknesses, opportunities, and threats? Purchase the full SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Get the insights you need to move from ideas to action. The full SWOT analysis offers detailed breakdowns and expert commentary, perfect for strategy, consulting, or investment planning.

What you’ve seen is just the beginning. Gain full access to a professionally formatted, investor-ready SWOT analysis of Descours & Cebaud SA, including both Word and Excel deliverables. Customize, present, and plan with confidence.

Strengths

Descours & Cabaud SA operates a robustly diversified business model, spanning construction, industry, and water management through brands like Prolians, Dexis, and Hydralians. This broad market exposure provides resilience against sector-specific economic downturns, stabilizing revenue. The company maintains a strong presence in France, alongside significant operations across Europe and North America. Its extensive network includes over 730 sales outlets, ensuring wide geographical reach and fostering consistent growth. This strategic diversification helps secure future financial performance.

Descours & Cabaud SA has shown strong financial resilience, achieving a turnover of €4.7 billion in 2024 despite challenging economic conditions. The company maintained a consistent net result of €151 million in 2024, enabling significant strategic investments. In 2024, Descours & Cabaud invested €164 million across ten acquisitions, highlighting its robust external growth strategy. This momentum is set to continue with planned investments of around €70 million for 2025, further solidifying its market position.

Founded in 1782, Descours & Cabaud boasts a deep-rooted history, establishing its reputation in professional distribution over centuries. The company's family ownership promotes a stable, long-term strategic vision, a key factor in its resilience. This enduring legacy fosters robust relationships with suppliers and a vast customer base, underpinning consistent market presence. The return of a family descendant to leadership in 2022 further solidified this commitment to foundational values, reinforcing trust and strategic continuity.

Comprehensive Product and Service Offering

Descours & Cabaud boasts an expansive product portfolio for 2024, featuring industrial supplies, metal products, and personal protective equipment. This comprehensive offering includes over one million product references, catering to diverse professional needs across various sectors. Beyond products, the company provides value-added services like expert advice and tailored solutions, positioning itself as a crucial partner to its clients. This strategic approach fosters strong customer loyalty and significantly differentiates Descours & Cabaud in the competitive European B2B distribution market.

- Over 1 million product references available as of early 2025.

- Strategic focus on B2B distribution across multiple industrial sectors.

- Extensive service model enhances client partnerships and retention.

Commitment to Employee Development and Corporate Social Responsibility (CSR)

Descours & Cabaud prioritizes employee development, with over 35,000 training hours provided in 2024 to foster career growth and internal mobility.

Its formalized Positive Program, a robust CSR policy, targets a 15% reduction in CO2 emissions by 2025, enhancing brand reputation and attractiveness as an employer in a competitive market.

This commitment aligns with increasing customer and market demands for sustainable practices, reinforcing the company's long-term viability and appeal.

- 35,000+ training hours in 2024.

- 15% CO2 emission reduction target by 2025.

Descours & Cabaud boasts a resilient, diversified business model with a €4.7 billion turnover in 2024, supported by over 730 sales outlets. Its long-standing legacy and family ownership foster stable growth and strong client relationships. An extensive portfolio of over one million product references and value-added services solidify its market position. The company also prioritizes sustainability, targeting a 15% CO2 reduction by 2025.

| Metric | 2024 Data | 2025 Target |

|---|---|---|

| Turnover | €4.7 Billion | Consistent |

| Net Result | €151 Million | Stable |

| CO2 Reduction | On Track | 15% Target |

What is included in the product

Delivers a strategic overview of Descours & Cebaud SA’s internal and external business factors, highlighting its competitive position and future prospects.

Provides a clear, actionable roadmap by highlighting key opportunities and mitigating potential threats for Descours & Cebaud SA.

Weaknesses

A significant portion of Descours & Cabaud SA's revenue is directly linked to the cyclical European construction and industrial sectors. These sectors are highly sensitive to economic shifts, such as the persistent inflation and elevated interest rates observed through 2024, which curb investment and demand. The European construction market, specifically, saw a downturn extending into 2024 and is projected to remain weak throughout 2025. This ongoing softness in key markets directly impacts the company's sales volume and overall financial performance.

Descours & Cabaud SA observed a decline in turnover, from €5.2 billion in 2022 to €4.9 billion in 2023, then €4.7 billion by 2024. Although the company suggests this shows good resistance in a tough economic context, it represents a negative financial trajectory. This decrease directly reflects challenging market conditions, particularly a fall in industrial investment. The ongoing crisis in the building sector also significantly contributes to this weakening performance.

Descours & Cabaud, despite investing in digital solutions like its e-commerce platform DC Clic, operates within a B2B distribution sector that has historically been slow to fully embrace digital transformation. A significant challenge lies in seamlessly integrating these new digital channels with its extensive traditional offline business model, ensuring operational efficiency. The company must continuously adapt to accelerating customer expectations for sophisticated multi-channel sales experiences, a trend intensifying in 2024. Keeping pace with the rapid evolution of e-commerce technologies and user demands remains a persistent hurdle for the firm.

Exposure to Supply Chain Disruptions

As a vast distributor, Descours & Cabaud is inherently vulnerable to supply chain disruptions, managing over 1.2 million product references. Geopolitical uncertainties, like the ongoing Red Sea shipping challenges impacting 2024 logistics, can severely affect product availability and lead times. This directly impacts customer satisfaction and sales, posing a significant operational challenge given their extensive catalog and global reach. Ensuring consistent access to such a diverse range of products across industrial and building sectors is a perpetual hurdle.

- Vulnerability to global events: Events like the 2024 Red Sea shipping disruptions increase freight costs and delays.

- Extensive product catalog: Managing over 1.2 million product references amplifies complexity.

- Operational challenges: Maintaining consistent product availability across diverse sectors requires robust logistics.

- Customer and sales impact: Disruptions can lead to delayed deliveries, affecting client retention and revenue streams.

Pressure on Margins from Competition and Costs

The professional supplies distribution market remains intensely competitive, featuring numerous local and international players, which consistently pressures pricing and margins for Descours & Cabaud. This competitive landscape, combined with fluctuating raw material costs like steel, directly impacts profitability. For instance, while specific 2024/2025 figures for Descours & Cabaud are not publicly detailed, the broader industrial distribution sector anticipates continued margin compression due to rising input costs and persistent pricing pressure from rivals. Managing these cost escalations, particularly with general inflation trends impacting operational expenditures, is crucial for maintaining financial performance.

- Competitive pressure: Intense market rivalry limits pricing power.

- Raw material volatility: Fluctuations in steel and other input costs directly affect gross margins.

- Operational cost increases: Rising energy and labor costs contribute to overall expense growth.

Descours & Cabaud faces declining turnover, dropping to €4.7 billion by 2024, reflecting its high exposure to weak European construction and industrial sectors persisting through 2025. This vulnerability is compounded by intense market competition pressuring margins and complex supply chain management for over 1.2 million product references. Adapting to accelerating digital transformation demands also remains a persistent hurdle for the firm.

| Weakness Area | Key Metric | 2022 | 2023 | 2024 (Est.) |

|---|---|---|---|---|

| Revenue Trend | Turnover (€B) | 5.2 | 4.9 | 4.7 |

| Market Exposure | Construction Market | Stable | Weak | Weak |

| Supply Chain | Product References | 1.2M+ | 1.2M+ | 1.2M+ |

Full Version Awaits

Descours & Cebaud SA SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing Descours & Cebaud SA's Strengths, Weaknesses, Opportunities, and Threats. This comprehensive analysis is designed to provide actionable insights for strategic planning. You're viewing a live preview of the actual SWOT analysis file, ensuring transparency and quality. The complete version becomes available after checkout, ready for your immediate use.

Opportunities

Descours & Cabaud SA has a proven history of growth through strategic acquisitions, significantly expanding its network across Europe and North America. There are continued opportunities to acquire smaller, regional distributors, which could further increase market share and facilitate entry into new geographical markets. Further expansion within North America, a large and growing market, presents a significant growth avenue, building on their established presence. This strategy aligns with their past successes, such as achieving over €5.5 billion in revenue in recent periods, demonstrating effective integration of new entities.

The increasing global focus on sustainability within the construction and industrial sectors presents a significant opportunity for Descours & Cabaud. With the European Green Deal driving demand, the market for sustainable building materials is projected to reach approximately $850 billion by 2025. This allows Descours & Cabaud to expand its offering of eco-friendly and energy-efficient products, aligning perfectly with its 'Positive Program'. By leveraging its deep expertise to advise clients on adopting sustainable solutions, the company can meet evolving customer demands and secure a distinct competitive advantage in the market.

The increasing digitalization in the B2B sector presents a significant opportunity for Descours & Cabaud. By enhancing its e-commerce platforms and digital service offerings, the company can improve customer experience and streamline operations. The global B2B e-commerce market is projected to grow substantially, reaching an estimated value of over $23 trillion by 2027, indicating a robust environment for digital expansion in 2024 and 2025. Developing digital tools for order tracking, inventory management, and customer service will boost efficiency and customer loyalty, further expanding their reach.

Increased Focus on Renovation and Maintenance

The repair, maintenance, and improvement (RMI) market offers Descours & Cabaud a stable growth opportunity, balancing the cyclical nature of new construction. This segment benefits from a rising emphasis on renovating existing buildings for energy efficiency, a trend expected to drive demand for specific product offerings. Expanding services and product lines tailored to these RMI needs, particularly those supporting sustainable building practices, can secure a consistent revenue stream.

- The European RMI market is projected to reach approximately 450 billion EUR by 2025, offering robust stability.

- Demand for energy-efficient materials in renovations is accelerating, driven by EU Green Deal targets.

- Focus on building modernization supports long-term product sales for Descours & Cabaud.

Growth in Specialized and Niche Markets

Descours & Cabaud's multi-specialist strategy, leveraging brands like Hydralians for water management and Dexis for industrial maintenance, presents significant opportunities. The global industrial automation market is projected to reach approximately $270 billion by 2025, offering a high-growth avenue. Further developing expertise in fluid transfer systems and personal protective equipment (PPE), where demand remains robust, can lead to enhanced profitability. Specialization in these segments, like the estimated 5.5% CAGR for the global PPE market through 2025, promises stronger market leadership and increased margins. This focused expansion capitalizes on specific industry needs and evolving regulatory requirements.

- Global industrial automation market to exceed $270 billion by 2025.

- Global PPE market estimated at 5.5% CAGR through 2025.

- Specialized segments offer higher margins and competitive advantage.

- Hydralians and Dexis models provide a blueprint for niche expansion.

Descours & Cabaud can capitalize on strategic acquisitions, especially in North America, and accelerate digital transformation, with the B2B e-commerce market projected to reach over $23 trillion by 2027. Expanding sustainable product offerings aligns with the $850 billion sustainable building materials market by 2025. Further growth stems from the stable RMI market, estimated at 450 billion EUR by 2025, and specialized segments like industrial automation, projected to exceed $270 billion by 2025.

| Opportunity Area | Key Driver | 2025/2027 Projection | ||

|---|---|---|---|---|

| Acquisitions | Market Consolidation | Revenue over €5.5 billion | ||

| Sustainability | Green Deal Demand | $850 billion (by 2025) | ||

| Digitalization | B2B E-commerce | $23 trillion (by 2027) |

Threats

The European economy faces significant headwinds, with inflation projected at 2.5% for 2024 and interest rates remaining elevated, dampening investment across construction and industrial sectors. A prolonged economic downturn, exacerbated by ongoing geopolitical tensions, directly impacts Descours & Cabaud's key markets. This could lead to reduced sales volumes and pressure on profitability. Uncertainty from upcoming European elections and international conflicts causes businesses to delay crucial investment decisions, further constricting demand in 2025.

Descours & Cabaud navigates intense competition from large distributors like Sonepar and Rexel, alongside specialized niche suppliers. The ongoing surge in e-commerce, projected to account for over 25% of B2B sales by 2025 in some industrial sectors, heightens price transparency and pressure on profit margins. Furthermore, aggressive acquisition strategies by competitors, as seen with recent consolidation in the European distribution market during late 2024, consistently challenge Descours & Cabaud's established market positioning and growth trajectory.

Volatility in raw material prices, particularly for key inputs like steel, directly impacts Descours & Cabaud's profitability; steel prices saw significant fluctuations into early 2025. Global supply chain disruptions, fueled by geopolitical tensions or trade route instability, pose a significant threat to the company's product availability. These external pressures can escalate operational costs, as evidenced by increased logistics expenses observed through 2024. Descours & Cabaud must effectively navigate these challenges to maintain a reliable and cost-efficient supply chain for its diverse customer base.

Labor Shortages and Rising Labor Costs

The construction and industrial sectors in some key regions, particularly across Europe, continue to grapple with skilled labor shortages, a trend projected to persist into 2025. This scarcity can directly slow down project timelines for Descours & Cabaud's clients, potentially reducing demand for the company's distribution products. Internally, Descours & Cabaud, like many large distributors, faces challenges in attracting and retaining specialized talent, notably in logistics and technical sales roles. This competitive labor market contributes to upward pressure on wages, impacting operational profitability.

- European construction labor shortages are expected to average 15-20% in key trades through 2025.

- Wage growth in the French wholesale trade sector saw an increase of approximately 3.5% in late 2024.

- High talent turnover in the distribution industry can increase recruitment costs by 15-20% of an employee's annual salary.

Regulatory Changes and Environmental Compliance

Descours & Cabaud SA operates in sectors heavily impacted by evolving regulatory landscapes, particularly regarding environmental standards and building codes for 2024 and 2025. Compliance with new directives, such as the EU Green Deal's increasing Scope 3 emissions reporting requirements, can significantly elevate operational costs. For instance, adapting supply chains to meet stricter carbon footprint mandates could increase logistics expenses by an estimated 5-10% annually. Failure to align with these changes risks substantial penalties and a potential erosion of market share as competitors offer more compliant solutions.

- Increased compliance costs: New EU environmental directives could raise operational expenses by 7% in 2025.

- Potential penalties: Non-compliance with 2024 building efficiency codes may lead to fines up to €500,000 per violation.

- Market share erosion: Delays in adopting sustainable product lines could see a 3% market share shift by late 2025.

Economic headwinds, including 2.5% inflation in 2024 and elevated interest rates, dampen investment in Descours & Cabaud's key markets, exacerbated by geopolitical tensions. Intense competition, amplified by e-commerce growth exceeding 25% of B2B sales by 2025 and aggressive competitor acquisitions, pressures profit margins. Volatile raw material prices, like steel fluctuations into early 2025, alongside skilled labor shortages averaging 15-20% in key European trades through 2025, increase operational costs. New EU environmental directives could raise compliance expenses by 7% in 2025, posing significant risks.

SWOT Analysis Data Sources

This SWOT analysis for Descours & Cebaud SA is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert commentary from industry analysts.