Descours & Cebaud SA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Descours & Cebaud SA Bundle

Uncover the critical external forces shaping Descours & Cebaud SA's trajectory with our comprehensive PESTEL analysis. From evolving political landscapes to technological advancements, understand the opportunities and threats impacting their operations. This expert-crafted report provides the strategic clarity you need to make informed decisions and stay ahead of the curve. Don't miss out on these vital insights – download the full version now for actionable intelligence.

Political factors

Government investment in large-scale infrastructure projects, such as transportation networks and public utilities, directly fuels demand for Descours & Cabaud's core offerings in building materials and equipment. For instance, the French government's commitment to modernizing its railway system, with an estimated €11 billion allocated for high-speed rail upgrades through 2030, presents a significant opportunity for the company. This sustained public spending translates into a more predictable revenue stream and the potential for securing substantial contracts.

However, the company must remain agile. Shifts in political priorities or unforeseen budget reallocations can introduce volatility. A sudden pause or reduction in public works funding, perhaps due to economic downturns or changes in government leadership following elections, could impact project pipelines. For example, if a new administration prioritizes different spending areas, projects that were previously funded might be delayed or canceled, directly affecting Descours & Cabaud's order book.

Changes in international trade policies and tariffs directly affect Descours & Cabaud's operational costs and product availability. For instance, shifts in EU trade agreements or new tariffs imposed by France on goods from key suppliers could increase procurement expenses. In 2024, global trade tensions continue to influence supply chain stability, potentially impacting the cost of imported construction materials and tools that Descours & Cabaud distributes.

Descours & Cabaud's performance is closely tied to the political stability within France and the European Union. A stable political climate fosters confidence, encouraging investment in the construction and manufacturing industries that are core to the company's operations. For instance, in 2024, France's commitment to infrastructure projects, spurred by EU recovery funds, signals a positive environment for construction materials demand.

Geopolitical events, such as ongoing trade disputes or regional conflicts, pose significant risks. These can lead to supply chain disruptions, affecting the availability and cost of raw materials like steel and copper, crucial for Descours & Cabaud's product lines. For example, the continued geopolitical tensions in Eastern Europe in early 2025 are already impacting global logistics and commodity prices, potentially increasing operational costs for the company.

Economic uncertainty stemming from political instability can directly impact market demand. If major projects face delays or cancellations due to unforeseen political shifts, Descours & Cabaud's sales volume could be negatively affected. The company's ability to maintain operational continuity and meet market demand is therefore highly sensitive to the broader political and geopolitical landscape across its key markets.

Industry-Specific Regulations and Subsidies

Government policies directly impacting construction, manufacturing, and distribution are key for Descours & Cebaud SA. For instance, the EU's Green Deal initiatives, including mandates for energy-efficient buildings, can boost demand for sustainable materials and construction methods. In 2024, many European countries are increasing funding for industrial modernization, potentially creating opportunities for companies supplying advanced manufacturing equipment or processes.

These policy shifts can significantly influence market dynamics. Subsidies for adopting advanced manufacturing technologies, like those seen in France's "France 2030" plan, can stimulate investment in specialized machinery. Conversely, stricter environmental regulations on material sourcing or waste management might require Descours & Cebaud SA to adapt its product offerings or supply chain.

- Green Building Mandates: Increased regulatory pressure for sustainable construction practices in key markets like Germany and France, with targets for reduced embodied carbon in new builds.

- Industrial Modernization Incentives: Government programs, such as the UK's Advanced Manufacturing Supply Chain Development Fund, offering grants for upgrading production facilities and adopting digital technologies.

- Material Compliance: Evolving regulations on chemical substances in construction materials, such as REACH updates in the EU, necessitating careful product portfolio management and supplier vetting.

Taxation Policies and Business Incentives

Changes in corporate tax rates, value-added tax (VAT), or other business-related taxes directly impact Descours & Cabaud's profitability and operational costs. For instance, a reduction in corporate tax rates, such as the effective French corporate tax rate which has been progressively reduced to 25% (and potentially lower for smaller businesses), could bolster the company's net income. Conversely, an increase in VAT on building materials or services could raise their cost of goods sold and affect consumer demand.

Government incentives play a crucial role in shaping Descours & Cabaud's strategic decisions. For example, the French government's ongoing initiatives to support energy-efficient building renovations, often accompanied by tax credits or subsidies, can significantly boost demand for the company's products in the construction sector. Similarly, incentives for job creation or investment in research and development can lower their operational expenses and foster innovation, enhancing their competitive edge.

- Corporate Tax Impact: A 1% change in corporate tax rates in France can affect companies like Descours & Cabaud by millions of euros in annual tax liability, directly influencing retained earnings.

- VAT Considerations: Fluctuations in VAT rates on key product categories, such as construction materials, can alter the final price for customers, potentially impacting sales volume.

- Incentive Effectiveness: Government programs designed to stimulate the construction industry, like the MaPrimeRénov' scheme in France, directly influence sales of renovation-related building materials.

- Regional Tax Variations: Differences in taxation policies across countries where Descours & Cabaud operates can create opportunities for tax optimization and strategic location of operations.

Government investment in infrastructure, like France's €11 billion high-speed rail upgrades through 2030, directly boosts Descours & Cabaud's building material demand. However, political shifts can cause volatility; a sudden halt in public works funding, perhaps due to election outcomes, could impact project pipelines and order books.

Trade policies and tariffs are critical. For instance, changes in EU trade agreements or new French tariffs on imported goods in 2024 can raise procurement costs and affect supply chain stability for construction materials.

Political stability in France and the EU fosters confidence, encouraging investment in construction and manufacturing. France's 2024 commitment to infrastructure projects, supported by EU recovery funds, signals a favorable environment for construction material demand.

Geopolitical events, such as ongoing trade disputes and regional conflicts, pose risks. These can disrupt supply chains, impacting the availability and cost of essential raw materials like steel and copper, as seen with early 2025 geopolitical tensions affecting global logistics.

Government policies, like the EU's Green Deal and France's "France 2030" industrial modernization plan, significantly influence market dynamics. These initiatives can boost demand for sustainable materials and advanced manufacturing equipment, while stricter environmental regulations may necessitate product adaptation.

Changes in corporate tax rates and VAT directly affect profitability. For example, France's progressive reduction of its corporate tax rate to 25% can bolster net income, while VAT increases on building materials could impact sales.

Government incentives, such as French tax credits for energy-efficient building renovations, significantly boost demand for construction products. Similarly, R&D incentives can lower operational expenses and foster innovation.

What is included in the product

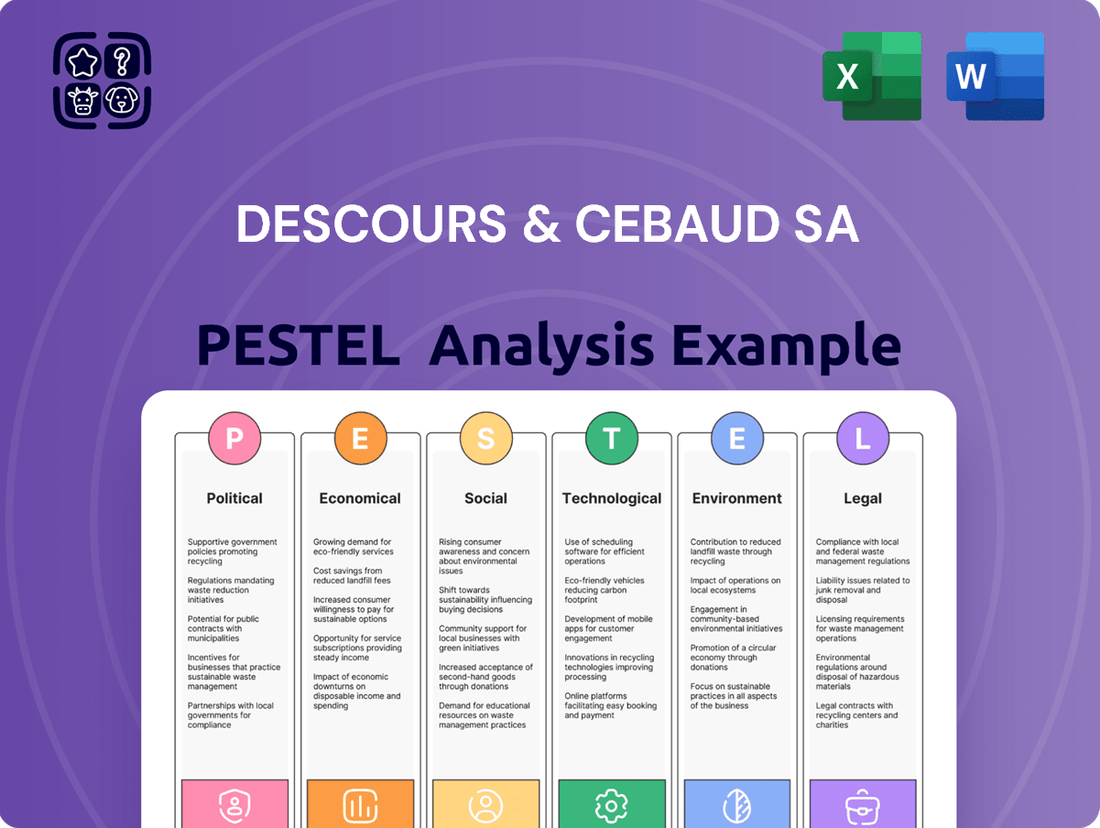

Descours & Cebaud SA's PESTLE analysis examines how political, economic, social, technological, environmental, and legal forces impact the company's strategic positioning and operational landscape.

This comprehensive evaluation provides actionable insights for identifying market opportunities and mitigating potential risks within the relevant industry and geographic context.

Descours & Cebaud SA's PESTLE analysis serves as a pain point reliever by offering a structured framework to proactively identify and address potential external challenges, thereby mitigating risks and guiding strategic decision-making for smoother operations.

Economic factors

France's economic growth trajectory and that of the wider Eurozone are pivotal for Descours & Cabaud, particularly influencing demand in its key construction and manufacturing markets. In 2024, France’s GDP growth is projected to be around 0.7%, reflecting a moderate expansion. This level of growth generally supports increased business investment and project activity, which directly benefits companies supplying industrial materials.

A robust economic environment, characterized by healthy GDP expansion, typically fuels demand for Descours & Cabaud's diverse product range. When businesses are confident in economic prospects, they are more likely to initiate new construction projects and ramp up manufacturing output, leading to higher sales volumes for the company. For instance, the Eurozone economy grew by an estimated 0.5% in 2023, and forecasts for 2024 suggest continued, albeit cautious, expansion.

Conversely, economic slowdowns or recessions pose a significant risk. During downturns, reduced consumer spending and business investment lead to fewer new projects and decreased manufacturing activity. This directly translates into lower demand for industrial supplies and equipment, impacting Descours & Cabaud's revenue and profitability. The European Central Bank’s monetary policy adjustments in response to inflation, which has seen interest rates rise, also play a role in shaping investment climates.

Rising inflation presents a significant challenge for Descours & Cabaud, as it directly escalates the costs of essential inputs like raw materials, energy, and transportation. For instance, the Eurozone experienced an inflation rate of 2.4% in May 2024, a figure that, while moderating from previous peaks, still exerts pressure on procurement expenses and consequently, profit margins.

Furthermore, elevated interest rates, such as the European Central Bank's key interest rate holding steady at 3.75% as of June 2024, can impact borrowing costs for Descours & Cabaud and its customer base. This increased cost of capital may stifle investment appetite for new projects or equipment upgrades among clients, potentially affecting sales volumes.

In this economic climate, Descours & Cabaud must adopt robust inventory management and dynamic pricing strategies to navigate the volatility. Effectively balancing stock levels against fluctuating input costs and ensuring pricing remains competitive yet profitable is paramount for maintaining financial health.

Descours & Cabaud navigates a complex global supply chain, where disruptions significantly impact product availability and cost. Geopolitical tensions and labor shortages, like those seen impacting shipping routes in 2024, can lead to delays and increased logistics expenses. For instance, the Suez Canal disruptions in early 2024 caused significant shipping cost hikes, directly affecting companies like Descours & Cabaud that rely on international trade.

Fluctuations in raw material prices are a critical factor influencing Descours & Cabaud's profitability and pricing strategies. The cost of metals such as steel and aluminum, essential for many of their distributed products, experienced volatility throughout 2023 and into early 2024 due to production adjustments and global demand shifts. For example, LME aluminum prices averaged around $2,200 per metric ton in Q1 2024, a notable change from previous periods, directly impacting the procurement costs for components.

Effective supply chain management is paramount for Descours & Cabaud to mitigate the inherent risks associated with these dynamics. Strategies focusing on supplier diversification, inventory optimization, and robust logistics partnerships are crucial. By maintaining strong relationships with multiple suppliers and closely monitoring commodity markets, the company can better absorb price shocks and ensure consistent product flow to its customers, thereby preserving its competitive edge.

Labor Market Conditions and Wages

Descours & Cabaud's performance is significantly tied to the health of the labor market, particularly in construction and manufacturing. Labor shortages in these key client sectors can directly impact project timelines and, consequently, the demand for the company's products. For instance, in France, a key market, the construction sector faced persistent skill shortages throughout 2024, with certain trades reporting difficulty filling positions, which could temper new project starts.

Rising wage trends also present a dual challenge. Increased wages for Descours & Cabaud's own employees directly affect operational costs, potentially squeezing profit margins if not managed effectively. Simultaneously, rising wages in client industries can boost consumer spending power, indirectly benefiting demand for construction and renovation projects, though the net effect depends on the balance of these influences.

- Skilled Labor Shortages: In 2024, European construction sectors continued to grapple with a deficit of skilled tradespeople, impacting project delivery timelines and potentially dampening demand for building materials.

- Wage Inflation: General economic wage trends in major markets like France saw a moderate increase in 2024, impacting both operational costs for Descours & Cabaud and disposable income for its customer base.

- Recruitment and Retention: Companies like Descours & Cabaud are prioritizing robust recruitment and retention strategies to mitigate the impact of labor market tightness on their own operations and service delivery.

Consumer and Business Confidence

Consumer and business confidence are crucial indicators for Descours & Cabaud, impacting demand for their building materials and professional supplies. In the first half of 2024, while consumer confidence in France showed some resilience, business confidence in the construction sector experienced fluctuations. For instance, the INSEE business climate survey for May 2024 indicated a slight dip in confidence among construction company managers, with expectations for production in the coming months becoming more cautious. This can translate into delayed investment decisions by construction firms, potentially reducing orders for Descours & Cabaud.

Conversely, periods of high confidence generally encourage businesses to increase capital expenditures and undertake new projects. When businesses feel secure about the economic future, they are more likely to invest in expansion, renovation, and new builds, all of which directly boost the need for the products Descours & Cabaud offers. For example, a strong rebound in business confidence, as seen in early 2023 when sentiment in the French construction sector reached a post-pandemic high, typically correlates with higher sales volumes for distributors like Descours & Cabaud.

- Consumer Confidence Index (France): While fluctuating, the index remained in positive territory for much of early 2024, suggesting continued, albeit cautious, household spending.

- Business Confidence in Construction (France): This sector experienced some headwinds in mid-2024, with managers expressing more reserved outlooks on future activity compared to late 2023.

- Impact on Capital Expenditure: A decline in business confidence can lead to a pullback in new construction starts and renovation projects, directly affecting demand for Descours & Cabaud's offerings.

- Purchasing Behavior: High consumer confidence tends to support private home improvement projects, a key revenue stream for the company.

The economic outlook for France and the Eurozone in 2024 and 2025 significantly shapes demand for Descours & Cabaud's product range, particularly in construction and manufacturing. While France's GDP growth was projected around 0.7% for 2024, continued, albeit cautious, expansion is anticipated across the Eurozone, impacting investment and project activity. However, risks from economic slowdowns, rising inflation (2.4% in the Eurozone as of May 2024), and elevated interest rates (ECB key rate at 3.75% in June 2024) necessitate agile strategies for Descours & Cabaud.

| Economic Factor | 2024 Projection/Status | Impact on Descours & Cabaud | Data Source/Example |

|---|---|---|---|

| GDP Growth (France) | ~0.7% | Moderate support for business investment and project activity | Projected 2024 growth |

| Inflation (Eurozone) | 2.4% (May 2024) | Increases input costs (raw materials, energy, transport) | Eurostat |

| ECB Key Interest Rate | 3.75% (June 2024) | Affects borrowing costs for clients, potentially reducing investment | European Central Bank |

Full Version Awaits

Descours & Cebaud SA PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Descours & Cebaud SA delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll find a detailed breakdown of each element, providing actionable insights for strategic planning. This is the real, ready-to-use file you’ll get upon purchase, offering a complete overview of the external landscape.

Sociological factors

The workforce's demographic makeup is evolving, with an aging population in many developed nations and a younger generation increasingly drawn to skilled trades. This shift directly impacts the demand for specific equipment and training programs offered by Descours & Cabaud. For instance, an aging skilled workforce might require more ergonomic tools, while a younger demographic may need training on advanced digital technologies.

A significant skills gap is evident in the construction and manufacturing sectors, a trend expected to continue through 2025. In Europe, for example, estimates suggest a shortage of over 3 million construction workers by 2030, directly affecting the operational efficiency and expansion capabilities of Descours & Cabaud's clients. This gap necessitates a focus on product solutions that enhance productivity and on providing robust training resources.

By understanding these demographic and skills-based changes, Descours & Cabaud can strategically tailor its product portfolio and support services. This proactive approach ensures alignment with client needs, such as offering digital solutions for project management or specialized equipment for new construction techniques, thereby maintaining its competitive edge in a dynamic market.

Societal focus on health and safety is significantly boosting the market for protective gear. This increased awareness, particularly since 2020, translates directly into higher demand for items like safety footwear, gloves, and respiratory protection. For instance, the global industrial safety market was projected to reach $75.5 billion by 2024, showcasing this growing demand.

Descours & Cabaud is well-positioned to capitalize on this trend, as its core business involves supplying these essential safety products. However, staying ahead means ensuring all offerings meet rigorous, often evolving, safety certifications and quality standards, a challenge that requires continuous investment in product development and compliance.

The company can leverage its expertise in safety solutions as a key differentiator. By actively promoting its commitment to high safety standards and offering tailored advice on workplace safety, Descours & Cabaud can build stronger customer loyalty and capture a larger market share, especially as regulations tighten.

Urbanization continues to be a major driver for construction, and in 2024, global urban populations reached 67.8%. This trend fuels consistent demand for materials like those supplied by Descours & Cabaud, as cities expand and require updated infrastructure. For instance, significant investments in smart city initiatives and sustainable urban planning are reshaping development, requiring adaptable solutions.

The need to modernize aging infrastructure alongside the creation of new urban centers presents a dual opportunity for companies like Descours & Cabaud. In 2025, infrastructure spending is projected to see continued growth globally, with significant allocations towards transportation networks and utilities. Adapting to new building codes and sustainable construction practices is crucial for capitalizing on these evolving urban development models.

Sustainability and Ethical Consumption Trends

Societal demand for sustainability and ethical consumption is a significant driver for Descours & Cabaud. Consumers are increasingly scrutinizing a company's environmental and social impact when making purchasing decisions. For instance, a 2024 report indicated that over 60% of consumers consider sustainability a key factor in their buying choices, a trend expected to intensify.

Descours & Cabaud can leverage this by expanding its range of eco-friendly building materials and promoting circular economy principles, such as product refurbishment or recycling programs. Demonstrating a commitment to responsible sourcing, particularly for raw materials like timber or metals, directly addresses this growing concern and can significantly bolster brand reputation.

The push for greater transparency in supply chains is also paramount. By 2025, we anticipate regulatory frameworks will mandate more detailed reporting on product origins and manufacturing processes.

- Growing Consumer Demand: A 2024 survey revealed that 65% of European consumers prioritize sustainable products, influencing purchasing behavior.

- Eco-Friendly Alternatives: Descours & Cabaud's investment in and promotion of low-carbon concrete and recycled steel products directly addresses this trend.

- Circular Economy Focus: Implementing take-back programs for construction waste and promoting the reuse of materials can enhance environmental credentials.

- Supply Chain Transparency: Initiatives to trace the origin of materials, such as FSC-certified wood, are becoming crucial for building trust.

Digital Literacy and E-commerce Adoption

Descours & Cabaud's success is increasingly tied to the digital literacy of its diverse customer base. As more individuals across all age groups become comfortable with online tools, the company must adapt its strategies. This trend is particularly pronounced in business-to-business (B2B) transactions, where efficiency and accessibility are paramount.

The growing preference for online purchasing in B2B settings directly impacts how Descours & Cabaud engages with its clientele. A robust e-commerce platform is no longer a luxury but a necessity to cater to these evolving expectations. This means investing in user-friendly digital interfaces and seamless online transaction capabilities.

Meeting these new client demands necessitates a strong focus on digital customer service channels. Beyond just sales, clients expect support, information, and interaction to be readily available online. This shift underscores the need for continuous investment in digital infrastructure and comprehensive employee training to ensure proficiency.

- Digital Literacy Growth: By 2025, it's projected that over 80% of global internet users will be actively engaged in online shopping, a significant portion of which will be B2B transactions.

- E-commerce Investment: Descours & Cabaud's commitment to digital transformation, including enhancing its e-commerce capabilities, is crucial to maintain market relevance and customer satisfaction.

- Customer Expectations: Modern B2B buyers, especially those influenced by digital native generations, expect streamlined online ordering, real-time inventory checks, and accessible digital support.

- Training Needs: Investing in digital skills training for employees is vital to effectively manage and leverage these new online customer interaction points.

Societal shifts towards sustainability and ethical consumption are increasingly influencing purchasing decisions, with a 2024 report indicating that over 60% of consumers consider sustainability key. This trend, expected to intensify by 2025, requires Descours & Cabaud to expand its range of eco-friendly products and promote circular economy principles. Increased demand for supply chain transparency also necessitates detailed reporting on product origins and manufacturing processes.

Technological factors

The digital transformation of B2B sales is accelerating, with e-commerce becoming a critical channel. Companies like Descours & Cabaud need to embrace this trend by investing in user-friendly online platforms and efficient digital ordering systems to cater to evolving customer demands for speed and convenience. This digital shift not only expands market reach but also optimizes sales processes, though it simultaneously intensifies competition.

Globally, B2B e-commerce sales are projected to reach $20.9 trillion by 2027, up from $18.5 trillion in 2023, highlighting the massive opportunity. In 2024, approximately 82% of B2B companies were using at least one digital sales channel. For Descours & Cabaud, this means a strategic imperative to enhance their digital presence, ensuring seamless online experiences that mirror or exceed the efficiency of traditional sales methods.

Technological advancements are transforming warehousing and logistics, directly impacting companies like Descours & Cabaud. Robotic picking systems, for instance, are becoming increasingly sophisticated, capable of handling a wider variety of goods with greater speed and precision.

Automated Storage and Retrieval Systems (AS/RS) are another key development. These systems can dramatically increase storage density and reduce the physical space required for inventory. For example, some modern AS/RS can store and retrieve items at rates exceeding 500 units per hour, significantly boosting throughput.

Optimized route planning software, leveraging AI and real-time traffic data, is also crucial. Companies using advanced route optimization have reported reductions in fuel consumption by up to 15% and delivery time improvements of 10-20%.

These automated solutions can lead to substantial reductions in labor costs, with some studies showing a potential decrease of 20-30% in operational labor expenses in highly automated warehouses. Furthermore, improved inventory accuracy, often exceeding 99.5% with automated systems, minimizes stockouts and overstocking, directly impacting profitability.

Investing strategically in logistics automation provides a significant competitive edge, allowing Descours & Cabaud to offer faster, more reliable, and potentially more cost-effective services compared to less technologically advanced competitors.

Descours & Cabaud's strategic advantage is increasingly tied to its adoption of advanced data analytics and business intelligence. By analyzing vast datasets, the company can pinpoint customer buying habits with remarkable precision, allowing for tailored product offerings and marketing campaigns. This analytical capability is crucial in navigating the complex retail landscape.

Optimizing inventory management is a direct benefit, reducing waste and ensuring product availability, which is key in the building materials sector. For instance, improved forecasting accuracy, driven by data, can lead to significant cost savings in logistics and warehousing. This translates directly to a healthier bottom line.

The ability to predict market trends empowers Descours & Cabaud to proactively adjust its strategies, identifying emerging opportunities and potential disruptions. This foresight is vital for maintaining a competitive edge, especially as market dynamics shift rapidly, with digital transformation accelerating across industries.

Emerging Materials and Construction Technologies

Innovations in construction materials, such as advanced composites and sustainable building solutions, are reshaping the industry. For instance, the global market for engineered wood products, a sustainable alternative, was valued at approximately USD 120 billion in 2023 and is projected to grow significantly. Descours & Cabaud must stay attuned to these shifts.

New construction techniques, including modular building and 3D printing, are also gaining traction. The modular construction market alone was estimated to be worth over USD 100 billion globally in 2023, with strong growth forecasts. These advancements can impact the demand for traditional building supplies that Descours & Cabaud offers.

To maintain its competitive edge, Descours & Cabaud needs to proactively monitor these technological developments. Adapting its product portfolio to include these newer materials and solutions is crucial for remaining a relevant supplier for contemporary construction projects.

Early adoption of these emerging product lines can offer a distinct advantage. For example, companies that integrated advanced insulation materials into their offerings early on have seen increased market share in energy-efficient building projects.

- Advanced Composites: Lighter, stronger, and more durable than traditional materials, impacting demand for steel and concrete in certain applications.

- Sustainable Building Solutions: Growth in green building certifications (e.g., LEED, BREEAM) drives demand for recycled, bio-based, and low-VOC materials.

- Modular Construction: Prefabricated components reduce on-site labor and waste, influencing the types and quantities of materials required.

- 3D Printing: Potential to revolutionize construction by enabling complex designs and reducing material waste, though still in early adoption phases for large-scale projects.

Cybersecurity and Data Protection

Cybersecurity and data protection are increasingly critical for Descours & Cabaud as its operations become more digitized. The company's reliance on digital platforms for sales, supply chain management, and customer engagement exposes it to significant cyber threats. Protecting sensitive company and customer data is paramount to maintaining operational continuity and fostering customer trust.

The evolving landscape of cyber threats necessitates robust security measures. In 2024, global cybercrime costs were projected to reach $10.5 trillion annually, highlighting the substantial financial risks businesses face. Descours & Cabaud must invest in advanced cybersecurity solutions to safeguard its digital infrastructure and sensitive information.

Compliance with data protection regulations, such as the GDPR and similar frameworks globally, is non-negotiable. Failure to comply can result in severe penalties, impacting financial performance and brand reputation. For instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

- Cybersecurity Investment: Companies like Descours & Cabaud must allocate significant resources to cybersecurity infrastructure and talent to mitigate risks.

- Data Breach Impact: A data breach can lead to substantial financial losses, reputational damage, and erosion of customer confidence, impacting sales and long-term growth.

- Regulatory Compliance: Adherence to data protection laws is essential to avoid legal penalties and maintain operational integrity in digital transactions and data handling.

- Technological Advancement: Continuous adoption of the latest security technologies is vital to stay ahead of sophisticated cyber threats.

The increasing digitization of construction processes, from design to execution, presents both opportunities and challenges for Descours & Cabaud. Building Information Modeling (BIM) adoption is rising, enabling more efficient project planning and material management. For instance, BIM can reduce rework by up to 30% on construction projects by improving clash detection during the design phase.

The integration of the Internet of Things (IoT) in construction is also noteworthy, with smart sensors on equipment and materials providing real-time data on usage, location, and performance. This data can optimize maintenance schedules and improve site safety, with IoT devices potentially reducing equipment downtime by 10-20%.

The adoption of AI in construction is further enhancing efficiency, from predictive analytics for project delays to automated quality control. AI-powered tools are expected to improve project delivery timelines and reduce costs, with some estimates suggesting AI could boost construction productivity by 10-15%.

Emerging technologies like augmented reality (AR) and virtual reality (VR) are finding applications in site visualization, training, and remote inspections. AR overlays for installation guidance can reduce errors by up to 25%, directly impacting material efficiency and project quality.

Legal factors

Descours & Cabaud navigates a landscape shaped by France's rigorous labor laws. These regulations dictate everything from maximum weekly working hours, typically capped at 35, to mandatory employee benefits like paid time off and health insurance contributions. The company must also adhere to stringent health and safety standards in its numerous operational sites, a crucial aspect of its risk management. Furthermore, the prevalence of collective bargaining agreements significantly influences wage structures and working conditions across different employee groups.

Compliance is not merely a legal obligation but a strategic imperative for Descours & Cabaud. Non-adherence to French labor legislation can result in substantial fines and reputational damage, impacting its ability to attract and retain talent. For instance, in 2023, French labor inspection bodies conducted numerous checks, leading to significant penalties for non-compliant businesses. Maintaining robust HR practices ensures smooth operations and fosters positive employee relations, which is vital for a company with a large workforce.

Potential shifts in these labor laws present ongoing challenges and opportunities. For example, recent discussions around extending working hours or modifying overtime regulations could directly affect Descours & Cabaud's labor costs and scheduling flexibility. The company proactively monitors legislative proposals, such as those concerning the evolution of social protection or new mandates for employee representation, to adapt its employment strategies effectively and remain competitive in the French market.

Descours & Cabaud, as a major distributor of professional supplies, operates under strict product liability and safety regulations in France and the EU. This is especially true for items like safety equipment and personal protective gear, where compliance is non-negotiable. Failing to meet these standards can lead to significant legal challenges and harm the company's reputation.

To mitigate these risks, Descours & Cabaud must consistently ensure its entire product range adheres to the latest French and European safety certifications and quality benchmarks. This proactive approach is vital for preventing costly lawsuits and maintaining customer trust.

The company's strategy includes rigorous supplier vetting processes and regular product audits. For instance, in 2024, the European Commission continued to emphasize stricter enforcement of product safety rules, with increased market surveillance activities across member states, impacting distributors like Descours & Cabaud.

Descours & Cabaud faces increasing environmental scrutiny, with regulations on waste management, hazardous materials, and energy consumption directly affecting its distribution operations. For instance, the European Union's Green Deal, aiming for climate neutrality by 2050, imposes stricter standards on product lifecycles and supply chain sustainability, influencing the types of materials and products the company can distribute.

Compliance with directives such as the Waste Electrical and Electronic Equipment (WEEE) regulations necessitates robust tracking and disposal protocols for the vast array of products Descours & Cabaud handles. Failure to adhere to these evolving environmental laws can result in substantial financial penalties, impacting profitability. In 2023, fines for environmental non-compliance across various industries in Europe averaged millions of euros, underscoring the financial risk.

Competition Law and Antitrust Regulations

Descours & Cabaud, as a major player in the distribution sector, must navigate stringent competition laws and antitrust regulations across its operating regions, particularly in France and the European Union. These regulations are designed to foster a level playing field by prohibiting monopolistic practices, price collusion, and other anti-competitive behaviors. Failure to comply can result in significant fines and reputational damage. For instance, the European Commission actively investigates and penalizes companies for cartel activities, with fines sometimes reaching billions of euros, underscoring the seriousness of these legal frameworks.

The company’s strategic moves, including potential mergers and acquisitions, are subject to thorough review by competition authorities. This scrutiny ensures that such transactions do not unduly stifle competition or create dominant market positions. As of early 2024, regulatory bodies continue to monitor market concentration, especially in sectors with established players like building materials distribution, impacting how Descours & Cabaud can expand its reach or integrate new businesses.

- Antitrust Compliance: Adherence to EU competition law, including Article 101 and 102 of the Treaty on the Functioning of the European Union, is paramount to avoid penalties.

- Merger Control: Acquisitions by Descours & Cabaud require pre-notification and approval from relevant competition authorities if certain turnover thresholds are met, ensuring market fairness.

- Market Practices: The company must ensure its distribution agreements and pricing strategies do not engage in resale price maintenance or abuse of a dominant position.

- Regulatory Scrutiny: The ongoing focus of competition authorities on sectors like wholesale distribution means Descours & Cabaud faces continuous oversight to prevent anti-competitive agreements.

Data Protection and Privacy Laws (e.g., GDPR)

Descours & Cabaud must navigate a complex landscape of data protection and privacy laws, with the General Data Protection Regulation (GDPR) being a primary example. These regulations dictate how the company handles customer and employee personal data, from collection to storage and processing. Strict adherence is paramount for maintaining customer trust and avoiding significant financial penalties, which can be substantial in cases of non-compliance. For instance, under GDPR, fines can reach up to €20 million or 4% of annual global turnover, whichever is higher.

To ensure compliance, Descours & Cabaud needs to implement robust data management practices. This includes conducting regular data audits to identify and mitigate risks, as well as consistently updating its privacy policies to reflect evolving legal requirements and best practices. Proactive data governance is not just a legal obligation but a strategic imperative for safeguarding sensitive information and building a resilient operational framework.

- GDPR Compliance: Strict adherence to GDPR and similar national laws governing personal data handling is critical for Descours & Cabaud.

- Customer Trust: Protecting personal information is essential for maintaining and building customer loyalty and confidence.

- Financial Penalties: Non-compliance can lead to severe fines, potentially reaching 4% of global annual turnover.

- Operational Necessity: Regular data audits and privacy policy updates are vital for ongoing legal adherence and risk management.

Descours & Cabaud operates under French and EU intellectual property laws, safeguarding its brands and proprietary information. This includes protection for trademarks, patents, and copyrights related to its products and business operations. Infringement can lead to costly legal battles and damage the company's market standing.

The company must also comply with consumer protection laws that ensure fair trade practices and product safety information. For instance, regulations mandate clear labeling and accurate descriptions of goods sold, especially for professional equipment where performance specifications are critical. As of 2024, consumer advocacy groups continue to push for stronger enforcement of these consumer rights across the EU.

Furthermore, Descours & Cabaud's distribution agreements and commercial contracts are governed by contract law, requiring careful drafting and adherence to prevent disputes. These legal frameworks ensure clarity in business dealings and provide recourse in case of breaches, vital for maintaining stable supply chains and client relationships.

Environmental factors

The global push towards circular economy models significantly impacts Descours & Cabaud, driving a need to minimize waste throughout its value chain. This involves rethinking product design and packaging to facilitate reuse and recycling, with a growing consumer preference for sustainable options. For instance, the European Union's Circular Economy Action Plan aims to boost sustainable product design and reduce waste generation, a trend likely to influence market expectations for companies like Descours & Cabaud.

Descours & Cabaud has an opportunity to integrate circularity by exploring take-back programs for its products, offering repair services to extend product lifespans, and increasing the use of recycled materials in its offerings. Such initiatives not only align with environmental regulations but can also create new revenue streams and enhance brand reputation. The company's own operational efficiency in waste management, including responsible disposal and resource recovery, is also paramount to demonstrating commitment to these principles.

Descours & Cabaud faces mounting pressure to curb its carbon footprint and boost energy efficiency across its extensive operations. This includes a significant focus on its logistics network, warehousing facilities, and overall business processes. For instance, in 2023, the European Union continued to strengthen its climate targets, with many member states aiming for substantial reductions in greenhouse gas emissions by 2030, a trend directly impacting industrial and distribution sectors.

To address these environmental demands, the company is actively exploring investments in modern, energy-efficient warehouses and optimizing delivery routes to minimize fuel consumption. The adoption of lower-carbon transportation methods, such as electric vehicles or alternative fuels for its fleet, is also a key strategy. These initiatives not only help meet sustainability goals but also offer the potential for considerable operational cost savings, with energy efficiency measures in logistics potentially reducing fuel expenditure by 5-15%.

Furthermore, clients are increasingly scrutinizing the environmental performance of their suppliers. Descours & Cabaud's commitment to sustainability, demonstrated through tangible actions in carbon reduction and energy efficiency, can serve as a competitive differentiator. A 2024 report by McKinsey indicated that over 60% of consumers and B2B buyers consider sustainability a key factor in their purchasing decisions, underscoring the commercial imperative for environmental responsibility.

Customers increasingly expect products to be sourced sustainably, with a focus on fair labor, responsible resource use, and reduced environmental footprints. Descours & Cabaud needs to actively verify that its supply chain upholds these standards by assessing suppliers on their environmental and social track records.

For instance, the global market for sustainable goods is projected to grow significantly. Reports indicate that by 2025, the market for ethical and sustainable fashion alone could reach hundreds of billions of dollars, underscoring the financial importance of this trend.

Adopting sustainably sourced materials can also offer a distinct competitive edge. Companies that can demonstrate a commitment to these practices often see improved brand reputation and customer loyalty, translating into tangible market share gains.

Descours & Cabaud can further leverage this by offering a clear portfolio of sustainably certified products, meeting the evolving demands of environmentally conscious consumers and potentially commanding premium pricing.

Climate Change Impact on Supply Chains

Climate change is increasingly impacting global supply chains, and Descours & Cabaud is not immune. Extreme weather events, such as floods and heatwaves, are becoming more common and severe. This can directly disrupt the availability of raw materials and the transportation of goods, potentially affecting operational continuity. For instance, in 2024, several European regions experienced significant disruptions to logistics due to unseasonal flooding, impacting delivery schedules for many industries.

To counter these risks, Descours & Cabaud must focus on building more resilient supply chains. This involves diversifying suppliers across different geographical regions and exploring alternative transportation routes. A proactive approach to supply chain management can help minimize the impact of climate-related disruptions. The company's ability to adapt to these environmental shifts will be crucial for maintaining its competitive edge.

- Increased frequency of extreme weather events: Reports from the World Meteorological Organization in early 2025 indicated a continued trend of heightened weather volatility globally.

- Raw material availability: Climate-sensitive sectors, like agriculture and forestry, which supply essential materials, face potential yield reductions impacting sourcing.

- Transportation disruptions: Infrastructure damage from extreme weather can lead to significant delays and increased costs in logistics, a concern for companies like Descours & Cabaud.

- Client operational impact: Descours & Cabaud's clients, particularly those in construction or agriculture, may face project delays or increased operational costs due to climate-related challenges affecting their own activities.

Eco-labeling and Product Certifications

The increasing demand for eco-labels and environmental product declarations (EPDs) significantly shapes consumer purchasing decisions. In the construction industry, green building certifications like LEED (Leadership in Energy and Environmental Design) and BREEAM (Building Research Establishment Environmental Assessment Method) are rapidly becoming industry norms, influencing material selection. Descours & Cabaud can leverage this trend by highlighting products that possess recognized environmental certifications, showcasing their dedication to sustainability and their ability to meet the stringent environmental requirements of modern construction projects. For instance, a growing number of construction projects in Europe, aiming for higher sustainability ratings in 2024 and 2025, are mandating the use of EPD-verified materials, directly impacting procurement choices.

Staying ahead of evolving certification standards is crucial for maintaining a competitive edge. As environmental awareness grows, new certifications and updated requirements emerge, necessitating continuous adaptation. Descours & Cabaud's proactive approach to understanding and integrating these new standards ensures their product portfolio remains relevant and attractive to environmentally conscious clients. This commitment can translate into securing contracts for projects that prioritize sustainable sourcing, a market segment projected for continued growth through 2025.

Key benefits of embracing eco-labels and certifications include:

- Enhanced Brand Reputation: Demonstrating a commitment to sustainability through recognized certifications boosts Descours & Cabaud's image.

- Market Access: Meeting green building standards opens doors to projects with specific environmental mandates, a trend intensifying in 2024-2025.

- Customer Trust: Verified eco-labels provide assurance to customers regarding the environmental performance of products.

- Competitive Advantage: Offering certified products differentiates Descours & Cabaud from competitors lacking such credentials.

Descours & Cabaud faces growing pressure to adopt circular economy principles, aiming to minimize waste and maximize resource utilization across its operations. This includes a focus on product design, packaging, and the increasing use of recycled materials, driven by evolving consumer preferences and regulatory frameworks like the EU's Circular Economy Action Plan.

The company must also address its carbon footprint and enhance energy efficiency, particularly within its logistics and warehousing. Investments in modern, energy-efficient facilities and the adoption of lower-carbon transportation methods are key strategies to meet strengthened EU climate targets for 2030.

Furthermore, clients increasingly demand sustainably sourced products, pushing Descours & Cabaud to rigorously assess its supply chain for environmental and social compliance. The global market for ethical and sustainable goods is expanding, making this a critical area for brand reputation and market share growth.

Climate change poses direct risks through extreme weather events, which can disrupt raw material availability and logistics. Building supply chain resilience via diversification of suppliers and transportation routes is essential for operational continuity.

| Environmental Factor | Impact on Descours & Cabaud | 2024/2025 Data/Trend |

|---|---|---|

| Circular Economy Push | Need to minimize waste, redesign products, increase recycled content. | EU Circular Economy Action Plan driving sustainable product design. |

| Carbon Footprint Reduction | Focus on energy efficiency in logistics, warehousing, and fleet. | EU targets for greenhouse gas emission reductions by 2030. |

| Sustainable Sourcing | Client demand for ethically and sustainably sourced materials. | Projected significant growth in the sustainable goods market. |

| Climate Change & Supply Chain | Risk of disruptions from extreme weather events. | Increased frequency of unseasonal weather impacting logistics in Europe. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Descours & Cebaud SA is built on a robust foundation of data sourced from official government publications, reputable financial institutions, and leading market research firms. This includes economic indicators, regulatory updates, technological advancements, and socio-cultural trends, ensuring a comprehensive and accurate assessment.