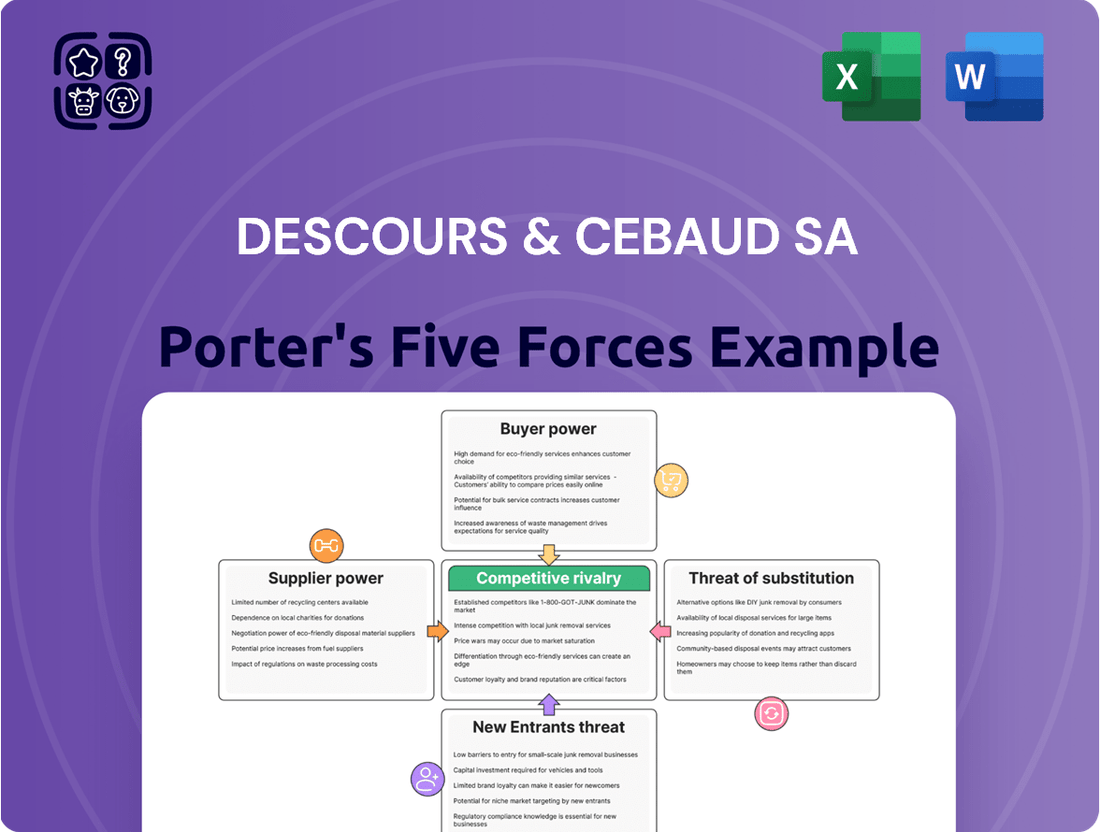

Descours & Cebaud SA Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Descours & Cebaud SA Bundle

Descours & Cebaud SA operates in a landscape shaped by several powerful market forces. Understanding the intensity of buyer power, the threat of substitutes, and the bargaining leverage of suppliers is crucial for strategic planning.

The competitive rivalry within their industry significantly impacts pricing and innovation strategies, while the barriers to entry for new players determine the long-term market structure.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Descours & Cebaud SA’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Descours & Cabaud's bargaining power with its suppliers is significantly shaped by supplier concentration, particularly in specialized product categories like industrial supplies, metal, plumbing, heating, and personal protective equipment. When a few large suppliers dominate the market for essential components or specialized items, they can dictate terms and pricing, thereby reducing Descours & Cabaud's leverage. For example, if a critical type of specialized pipe fitting is only produced by two or three manufacturers globally, those suppliers hold considerable sway.

Conversely, for more standard or commoditized products within their vast portfolio, Descours & Cabaud likely benefits from a more fragmented supplier landscape. This wider choice among numerous producers of items like basic fasteners or common safety gloves allows the company to negotiate more favorable prices and terms due to healthy competition. In 2024, the global industrial supply chain continues to see consolidation in some niche sectors, making supplier concentration a persistent factor to monitor for companies like Descours & Cabaud, impacting their cost of goods sold.

The degree to which Descours & Cabaud's suppliers offer unique products significantly influences their leverage. When suppliers provide specialized or patented materials and equipment, critical for Descours & Cabaud's varied customer base, the cost and difficulty of switching suppliers escalate, thereby enhancing the suppliers' standing. This dynamic is especially pronounced for providers of niche industrial machinery or safety gear, where alternatives are scarce.

Descours & Cabaud faces significant supplier bargaining power when switching costs are high. Imagine needing to retool entire production lines or requalify new product specifications; these are substantial hurdles. For instance, if a critical component requires extensive testing and certification with a new supplier, the time and expense involved deter immediate changes. This inertia allows suppliers to maintain leverage, even if their prices edge upwards, as the cost of disruption outweighs the potential savings for Descours & Cabaud.

In 2024, the complexity of integrating new suppliers into established logistics networks for industrial supplies presents a tangible barrier. Renegotiating contracts for specialized materials, especially those with unique performance requirements, adds another layer of difficulty. These factors collectively strengthen the hand of existing suppliers, as the effort and risk associated with finding and onboarding alternatives can be considerable, impacting Descours & Cabaud's procurement flexibility.

Supplier Importance to Buyer

The volume of business Descours & Cabaud directs to its key suppliers significantly influences supplier bargaining power. When Descours & Cabaud constitutes a large percentage of a supplier's total sales, that supplier is likely to be more accommodating with pricing and terms to secure the continued business. For instance, in 2024, major suppliers to the construction materials distribution sector often rely on large, consistent orders from key players like Descours & Cabaud.

Conversely, for smaller, niche suppliers, Descours & Cabaud's business might represent a more critical portion of their revenue. This could shift the power dynamic, making these smaller suppliers more eager to meet Descours & Cabaud's demands to secure a vital sales channel. It's a balancing act where the supplier's dependence on the buyer is a crucial factor.

- Supplier Dependence: Descours & Cabaud's purchasing volume can make or break smaller suppliers, enhancing buyer power.

- Key Account Value: For larger suppliers, Descours & Cabaud's status as a major client encourages favorable terms.

- Market Concentration: In markets where suppliers are fragmented, Descours & Cabaud's procurement scale is amplified.

- Strategic Importance: The necessity of specific materials or components can also dictate the leverage each party holds.

Threat of Forward Integration by Suppliers

Suppliers might consider moving into direct distribution, which could directly compete with Descours & Cabaud's core business. This threat is particularly concerning if suppliers find it easy to bypass intermediaries like Descours & Cabaud and reach the end-users themselves. For a large, diversified distributor such as Descours & Cabaud, this risk is generally mitigated by the significant investment required in logistics, established customer networks, and the sheer breadth of its product offerings, which are difficult for individual suppliers to replicate.

The potential for suppliers to integrate forward is a key aspect of their bargaining power. If suppliers can establish their own distribution channels or sell directly to customers, they can capture more of the value chain. For example, a major steel supplier could theoretically set up its own sales and delivery network to serve construction companies, thereby cutting out distributors like Descours & Cabaud. However, this often involves substantial capital investment and the development of complex customer service and logistics capabilities.

Descours & Cabaud's value proposition as a comprehensive distributor, offering a wide array of products from numerous suppliers, creates a barrier to suppliers attempting forward integration. Suppliers benefit from Descours & Cabaud's established market access and economies of scale in distribution. In 2024, the complexity of managing diverse customer needs and regulatory environments across different sectors, which Descours & Cabaud excels at, presents a high hurdle for individual suppliers looking to establish direct sales operations.

- Supplier Forward Integration Threat: Suppliers may attempt to sell directly to Descours & Cabaud's customers.

- Barriers to Integration: The ease with which suppliers can bypass distributors is a critical factor.

- Descours & Cabaud's Strengths: Extensive logistics, strong customer relationships, and a broad product portfolio act as deterrents.

- Mitigation Factors: High capital investment and the need for specialized distribution capabilities reduce the likelihood of widespread supplier forward integration.

The bargaining power of suppliers for Descours & Cabaud is influenced by market concentration and product specialization. When suppliers are few and offer unique or critical components, their leverage increases. Conversely, a fragmented supplier base for commoditized goods empowers Descours & Cabaud. In 2024, ongoing consolidation in some specialized industrial supply sectors means supplier concentration remains a key factor impacting procurement costs.

High switching costs for Descours & Cabaud, stemming from the need for requalification or logistical integration, strengthen supplier positions. Suppliers who provide essential, difficult-to-substitute materials or equipment benefit from this inertia. The complexity of integrating new suppliers into established logistics in 2024 further reinforces the advantage of existing partners.

Descours & Cabaud's purchasing volume significantly impacts supplier power. For smaller suppliers, the company's business can be crucial, leading to more favorable terms. Conversely, while Descours & Cabaud's scale can mitigate supplier power with larger entities, the threat of forward integration by suppliers is generally low due to the substantial investment required in logistics and customer networks, which Descours & Cabaud already possesses.

What is included in the product

This analysis meticulously examines the five forces impacting Descours & Cebaud SA, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its strategic positioning.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces impacting Descours & Cebaud SA.

Gain a strategic advantage by pinpointing areas of high pressure from suppliers, buyers, new entrants, substitutes, and rivals, enabling targeted responses.

Customers Bargaining Power

Descours & Cabaud's customers, particularly those in major sectors like construction, manufacturing, and public works, wield significant bargaining power due to their sheer concentration and the substantial volume of their purchases. These large-scale buyers can leverage their purchasing might to negotiate more favorable pricing, request tailored services, or secure extended payment terms. For instance, a major construction firm purchasing thousands of tons of steel annually has considerable leverage over a distributor like Descours & Cabaud, potentially impacting the latter's profit margins. In 2024, large industrial clients often represent a significant portion of a distributor's revenue, making their demands a critical factor in the supplier-customer relationship.

For standardized products like basic industrial supplies or certain metal products, customers wield significant bargaining power. They can easily compare prices across different distributors and switch suppliers if a better deal is found. This is particularly true for commoditized items where differentiation is minimal, leading to intense price competition.

Descours & Cabaud's strategy to offer a comprehensive, one-stop-shop experience aims to counter this by increasing customer stickiness and reducing the incentive to shop around for individual items. However, the inherent nature of commoditized goods means that price remains a crucial factor, and customers will still exert pressure to achieve the lowest possible cost.

In 2024, the industrial supply market continued to see robust demand, yet intense competition, especially for standardized items, kept margins tight for many distributors. For instance, reports from industry analysts indicated that price fluctuations for common steel products, a core offering for many in the sector, directly impacted customer purchasing decisions, with even minor price differences driving supplier selection.

The ease or difficulty for Descours & Cabaud's customers to switch to a competitor significantly influences their bargaining power. High switching costs tend to diminish this power.

If clients have deeply integrated Descours & Cabaud's ordering and inventory management systems, the effort and expense required to transition to another supplier become substantial. This integration, often a result of long-term partnerships and customized solutions, creates a sticky relationship, thereby reducing the customers' ability to easily switch.

Furthermore, customers who rely heavily on Descours & Cabaud's specialized technical expertise or value their consistent and reliable supply chain also face higher switching costs. The potential disruption to operations and the loss of accrued knowledge or dependable delivery schedules make a move to a competitor less attractive, thus strengthening Descours & Cabaud's position.

In 2023, for instance, companies in the industrial distribution sector often reported that over 60% of their clients had integrated their procurement platforms, a trend that continued to grow in early 2024, highlighting the increasing impact of system integration on customer loyalty and switching behavior.

Customer Price Sensitivity

Customer price sensitivity is a significant factor for Descours & Cabaud, particularly within its core markets like construction and manufacturing. In challenging economic periods, customers in these sectors become even more focused on cost, making them highly responsive to price changes. This pressure compels Descours & Cabaud to maintain competitive pricing structures to retain business, especially for substantial orders where even minor price variations can significantly impact a buyer's overall expenditure.

The company's ability to manage its pricing strategy directly influences its profitability. For instance, if raw material costs increase, passing those higher costs onto customers can be difficult without risking lost sales. In 2024, many industrial sectors experienced fluctuating input costs, reinforcing the need for efficient cost management and strategic pricing by distributors like Descours & Cabaud.

- High Price Sensitivity in Key Sectors: Customers in construction and manufacturing, the primary markets for Descours & Cabaud, exhibit strong price sensitivity, especially during economic downturns.

- Margin Erosion Risk: The need to offer competitive prices, particularly on large-volume orders, can put pressure on Descours & Cabaud's profit margins.

- Impact of Economic Climate: A challenging economic environment in 2024 amplified customer focus on price, making it harder for distributors to absorb cost increases.

Threat of Backward Integration by Customers

The threat of backward integration by customers poses a significant challenge for distributors like Descours & Cebaud SA. Large, influential clients, especially major construction or manufacturing companies, could potentially bypass distributors and source materials directly from manufacturers. This move, while demanding considerable investment in their own logistics and warehousing infrastructure, is a tangible possibility for very substantial market players.

Such a capability would dramatically amplify the latent bargaining power of these key customers. By controlling their supply chain, these large firms could exert greater pressure on pricing and terms, potentially reducing the profit margins for distributors. For instance, a large construction firm might leverage its purchasing volume to negotiate direct deals with cement or steel producers, cutting out the intermediary.

- Customer Integration Risk: Major clients may opt for backward integration to secure supplies directly from manufacturers, bypassing distributors.

- Investment Threshold: While requiring substantial investment in logistics and warehousing, this threat is real for very large customer entities.

- Enhanced Bargaining Power: Successful backward integration grants customers increased leverage over distributors regarding pricing and supply terms.

- Impact on Distributors: This can lead to reduced profit margins and a diminished role for distributors in the supply chain.

Descours & Cabaud's customers, particularly large entities in construction and manufacturing, hold significant bargaining power due to their substantial order volumes and the commoditized nature of many products. In 2024, these clients could leverage this power to negotiate lower prices, favorable payment terms, or specific service level agreements, directly impacting distributor margins. For example, a major construction firm procuring thousands of tons of steel annually wields considerable influence.

Customers' ability to switch suppliers easily, especially for standardized goods where price is the primary differentiator, amplifies their bargaining power. High switching costs, such as deep integration with Descours & Cabaud's inventory systems or reliance on specialized technical support, mitigate this power. In 2023, industry data showed over 60% of clients had integrated procurement platforms, a trend continuing into 2024.

| Factor | Impact on Descours & Cabaud | 2024 Context |

| Customer Concentration & Volume | High leverage for large buyers | Key clients drive significant revenue |

| Product Standardization | Enables easy price comparison and switching | Price remains a critical decision factor |

| Switching Costs (System Integration) | Reduces customer ability to switch | Increasing integration creates customer stickiness |

| Price Sensitivity | Pressure on margins, difficulty passing cost increases | Fluctuating input costs exacerbate margin pressure |

Full Version Awaits

Descours & Cebaud SA Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of Descours & Cebaud SA's competitive landscape through a detailed examination of the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors. This analysis is meticulously crafted to provide actionable insights for strategic decision-making.

Rivalry Among Competitors

The French professional supplies distribution market features a dynamic competitive landscape, populated by a handful of large, nationally recognized companies and a multitude of smaller, localized distributors. Descours & Cabaud finds itself in direct competition with these entities, all vying for significant market share.

Major competitors like Würth France, with its extensive product range and strong brand recognition, and Saint-Gobain Distribution Bâtiment France, a leader in building materials, represent substantial challenges. These larger players often benefit from economies of scale and established distribution networks, intensifying the rivalry.

In 2023, the French construction materials distribution sector, a key area for Descours & Cabaud, saw continued activity despite economic headwinds. For instance, while specific market share data for all distributors is often proprietary, industry reports indicated robust performance from the top tier players, underscoring the scale of competition Descours & Cabaud navigates.

The French construction and industrial sectors, which are crucial for Descours & Cabaud, experienced a slowdown in 2024. Activity in these key markets declined, painting a less than optimistic picture for 2025, particularly within residential construction. This subdued economic climate, characterized by slow or contracting market growth, naturally fuels more intense competition among players vying for a smaller pool of business.

While many products in the distribution sector are becoming commodities, Descours & Cabaud, like its rivals such as Sonepar, actively differentiates itself through superior service quality. This includes efficient logistics, ensuring timely delivery and reliable stock availability, which is a significant factor for customers needing uninterrupted operations. For example, in 2023, the company continued to invest in its supply chain infrastructure to bolster these capabilities.

Technical expertise is another key differentiator. Descours & Cabaud provides specialized knowledge and support, helping clients select the right products and optimize their applications. This value-added service goes beyond mere product sales, fostering stronger customer relationships and loyalty. Their commitment to technical support remains a cornerstone of their strategy to combat price-based competition.

The company's emphasis on a broad product offering, coupled with a focus on the overall customer experience, is central to its competitive strategy. By offering a comprehensive range of solutions and ensuring a smooth, supportive interaction at every touchpoint, Descours & Cabaud aims to build a distinct market position. This holistic approach is crucial for standing out against competitors who may focus on narrower niches.

High Exit Barriers

Descours & Cebaud SA operates in a sector where high exit barriers significantly influence competitive rivalry. The extensive warehousing, sophisticated logistics networks, and specialized inventory required for efficient distribution represent substantial fixed costs.

These considerable investments mean that companies like Descours & Cebaud SA face a difficult decision when considering an exit from the market. The sunk costs associated with these assets make it economically challenging to simply shut down operations.

Consequently, even firms experiencing lower profitability may choose to continue operating rather than incur the full loss associated with exiting. This dynamic can perpetuate a level of competitive pressure, as underperforming companies remain in the market, impacting overall industry profitability.

For instance, the European logistics and distribution sector, where Descours & Cebaud SA is active, has seen significant investment in infrastructure. In 2023, capital expenditure in logistics infrastructure across Europe was robust, with projections indicating continued growth, underscoring the substantial fixed asset base that creates these exit barriers.

- High fixed costs: Significant investment in warehousing and logistics infrastructure.

- Sunk costs: Difficult to recoup investments in specialized distribution networks.

- Persistence of struggling firms: Lower profitability is often preferred over outright exit.

- Market saturation: Continued presence of less profitable players intensifies competition.

Strategic Acquisitions and Consolidation

Competitive rivalry within the industrial supplies sector is intensifying, marked by significant consolidation. Descours & Cabaud actively participated in this trend during 2024, executing ten strategic acquisitions. This aggressive M&A strategy aims to bolster its market presence and expand its geographical reach, indicating a strong competitive drive among industry leaders.

These acquisitions are not isolated events but rather reflect a broader market trend towards consolidation. The pursuit of scale and market share through mergers and acquisitions poses a substantial threat to smaller, independent distributors who may struggle to compete with the expanded capabilities and networks of larger entities. This dynamic reshapes the competitive landscape, potentially leading to fewer, larger players dominating the market.

- Acquisition Drive Descours & Cabaud completed ten acquisitions in 2024.

- Market Share Growth This M&A activity is designed to strengthen market share and territorial coverage.

- Competitive Intensity The trend highlights fierce competition and a race for scale within the sector.

- Threat to Smaller Players Consolidation pressures smaller competitors, potentially forcing them out or into mergers.

Competitive rivalry is fierce, with Descours & Cabaud facing established giants like Würth France and Saint-Gobain Distribution Bâtiment France. The market's subdued growth in 2024, particularly in residential construction, amplifies this competition as companies fight for a smaller pool of business.

Descours & Cabaud's strategy of differentiation through superior service and technical expertise is crucial in this environment. The company's aggressive acquisition strategy in 2024, including ten strategic acquisitions, underscores the intense drive for market share and scale among industry leaders.

The sector's high exit barriers, due to substantial investments in warehousing and logistics, mean that even struggling firms tend to persist, maintaining competitive pressure.

In 2023, the French construction materials distribution sector showed resilience, with top players reporting strong performance, indicating the scale of competition Descours & Cabaud contends with.

| Competitor | Key Strengths | 2023 Market Performance Indication |

|---|---|---|

| Würth France | Extensive product range, strong brand recognition | Robust performance |

| Saint-Gobain Distribution Bâtiment France | Leader in building materials, established networks | Robust performance |

| Sonepar | Broad product offering, focus on customer experience | Robust performance |

SSubstitutes Threaten

Customers, especially large corporations with substantial purchasing power, can bypass intermediaries like Descours & Cabaud by sourcing materials directly from manufacturers. This direct procurement can lead to significant cost savings, particularly for high-volume or specialized items. For instance, in the construction materials sector, major developers might negotiate bulk discounts directly with cement or steel producers, cutting out the traditional distribution markups.

The proliferation of online marketplaces, both generalist and specialized, presents a significant threat of substitution for Descours & Cabaud. These platforms enable customers to effortlessly compare prices and procure professional supplies, bypassing traditional distribution networks. For instance, in 2024, the global e-commerce market was projected to reach over $6.3 trillion, with a substantial portion dedicated to business-to-business (B2B) transactions, highlighting the scale of this digital shift. This ease of access and price transparency on platforms like Amazon Business or specialized industry e-tailers offers a compelling alternative for many standard product categories that Descours & Cabaud traditionally supplies through its established channels.

Innovation in construction materials and techniques presents a significant threat of substitution for Descours & Cabaud. For example, the development of lighter, stronger, or more sustainable building materials could displace traditional offerings in areas like steel or concrete. The global construction materials market is projected to reach USD 1.3 trillion by 2024, highlighting the potential for shifts driven by new technologies.

Similarly, advancements in personal protective equipment (PPE) technology could reduce demand for existing product lines. Innovations like smart textiles offering enhanced durability or integrated safety features might render traditional workwear less appealing. The global PPE market was valued at over USD 60 billion in 2023, with ongoing R&D in material science poised to introduce disruptive alternatives.

Rental Services for Equipment

The threat of substitute products or services for Descours & Cabaud primarily comes from rental options for certain tools and heavy equipment. Customers, especially those with short-term or project-specific needs, might find renting a more cost-effective solution than purchasing, thus bypassing the need for Descours & Cabaud's distribution channels for new equipment sales.

This rental alternative directly impacts the demand for outright equipment purchases. For instance, the global equipment rental market was valued at over $100 billion in 2023 and is projected to grow, indicating a significant customer preference for flexible access over ownership for many types of machinery. This trend suggests that Descours & Cabaud must consider how these rental services impact their sales volume and market share for equipment.

- Rental services offer a lower upfront cost for users needing equipment temporarily.

- This bypasses the capital expenditure associated with purchasing from distributors like Descours & Cabaud.

- The growing equipment rental market, exceeding $100 billion globally in 2023, highlights this as a significant substitute.

- It reduces the long-term reliance on traditional distribution channels for equipment acquisition.

In-house Production or Self-Supply by Large Firms

Large manufacturing or construction firms, especially those with significant scale and integration, may opt to produce key components or materials internally. This strategy bypasses the need for external distributors like Descours & Cebaud SA for essential, high-volume items. For instance, a major construction conglomerate might invest in its own concrete batching plants or steel fabrication facilities to ensure supply and potentially lower costs for its projects. This move reduces reliance on outside suppliers, thereby diminishing the threat of substitutes.

The decision to pursue in-house production is often driven by a desire for greater control over quality, supply chain security, and cost management. While requiring substantial upfront capital investment, it can be a compelling substitute for established distribution channels, particularly for companies with a consistent and predictable demand for specific materials. Companies that achieve vertical integration through in-house production can gain a competitive edge by streamlining operations and reducing lead times, directly impacting their ability to compete with firms that rely on external distributors.

- Vertical Integration: Large firms can integrate backward into component manufacturing or forward into distribution, creating self-sufficiency.

- Capital Investment: Establishing in-house production requires significant capital for facilities, machinery, and skilled labor.

- Cost Savings Potential: For high-volume, standardized components, internal production can sometimes yield lower per-unit costs than external purchasing.

- Supply Chain Control: In-house production offers greater control over quality, lead times, and overall supply chain reliability.

The threat of substitutes for Descours & Cabaud is multifaceted, encompassing direct sourcing, online marketplaces, innovative materials, and rental services. Customers' ability to bypass traditional distributors through direct procurement from manufacturers or by leveraging the transparency and accessibility of B2B e-commerce platforms poses a significant challenge. Furthermore, advancements in materials science and the growing popularity of equipment rental services offer viable alternatives that can reduce reliance on Descours & Cabaud's product and service offerings.

| Threat Category | Description | Impact on Descours & Cabaud | Supporting Data (2023-2024) |

| Direct Procurement | Customers bypassing intermediaries by buying directly from manufacturers. | Reduced sales volume and margin erosion for Descours & Cabaud. | Large corporations often account for a significant portion of B2B sales, making direct access a key concern. |

| Online Marketplaces | Increased accessibility and price transparency through e-commerce platforms. | Intensified price competition and potential disintermediation. | Global B2B e-commerce market projected to exceed $6.3 trillion in 2024. |

| Innovative Materials | New materials offering superior performance or cost-effectiveness. | Obsolescence of existing product lines and need for portfolio adaptation. | Global construction materials market valued at USD 1.3 trillion by 2024, with innovation driving shifts. |

| Rental Services | Customers opting for temporary equipment use over ownership. | Decreased demand for new equipment sales. | Global equipment rental market exceeded $100 billion in 2023, indicating strong preference for rental. |

Entrants Threaten

Entering the professional supplies distribution market, especially in a mature economy like France, demands considerable upfront capital. New players need to invest heavily in building or leasing extensive warehousing space to stock a diverse range of products, from tools to safety equipment. For instance, establishing a national distribution network requires significant outlays for vehicles, warehousing infrastructure, and technology to manage inventory and logistics efficiently.

Managing a broad and varied inventory is another capital-intensive aspect. Descours & Cebaud SA, as a major distributor, carries a vast catalog of products, requiring substantial working capital to maintain optimal stock levels. New entrants must be prepared to fund the acquisition and storage of this diverse inventory, which can tie up significant financial resources, creating a formidable barrier.

The operational costs associated with setting up efficient logistics and transportation networks across France also represent a major capital hurdle. This includes acquiring and maintaining a fleet of delivery vehicles, implementing sophisticated tracking systems, and hiring skilled personnel. In 2024, the cost of commercial vehicles and fuel continued to be significant factors, adding to the initial investment required for a new entrant to compete effectively.

Established players like Descours & Cabaud have spent decades building extensive and efficient distribution networks, including numerous local branches and finely tuned logistics operations. This deep-rooted infrastructure provides a significant advantage, making it difficult for newcomers to compete on cost and speed.

For new entrants, replicating this level of reach and operational efficiency would require massive upfront investment and time, posing a substantial barrier. For instance, the cost of establishing a comparable warehousing and transportation system across multiple geographies can run into hundreds of millions of euros.

This existing network not only ensures timely delivery but also allows for economies of scale in purchasing and transportation, further solidifying the competitive position of incumbents like Descours & Cabaud.

Descours & Cabaud's significant market presence grants it substantial economies of scale in purchasing. This means they can negotiate better prices with suppliers due to the sheer volume of goods they procure, directly impacting their cost of goods sold. For instance, in 2024, their procurement volume likely continued to leverage supplier relationships for preferential pricing, a key advantage.

These operational efficiencies extend to logistics and distribution, where a larger scale allows for optimized routes and reduced per-unit shipping costs. New entrants, lacking this established infrastructure and purchasing power, would face considerably higher operational expenses, making it a significant hurdle to match Descours & Cabaud's pricing or achieve similar profit margins from the outset.

Strong Customer Relationships and Brand Loyalty

In the competitive B2B professional supplies market, Descours & Cabaud benefits significantly from strong customer relationships and deep-rooted brand loyalty. These established connections, built over years of reliable service and trust, act as a substantial barrier to entry for potential new competitors. Customers often value the continuity and proven track record that Descours & Cabaud offers, making switching to an unknown entity a considerable risk.

The company's focus on delivering consistent service quality and fostering personalized interactions further solidifies these bonds. This dedication to customer experience translates into high switching costs, as clients are reluctant to disrupt their existing supply chains and risk service degradation. For instance, in 2023, Descours & Cabaud reported a customer retention rate exceeding 90%, underscoring the strength of these relationships.

- Customer Retention: Descours & Cabaud maintained over 90% customer retention in 2023, highlighting strong loyalty.

- Brand Loyalty: Decades of operation have cultivated significant brand trust and preference among professional clients.

- Switching Costs: The established service infrastructure and supplier relationships create high costs for customers to change providers.

- Market Penetration: New entrants face a challenging landscape due to the ingrained loyalty and service expectations of the customer base.

Regulatory Requirements and Certifications

The distribution of professional supplies, particularly personal protective equipment (PPE) and specialized industrial materials, is heavily regulated. New companies entering this market must navigate a complex web of safety standards, certifications, and compliance requirements. For instance, in the European Union, PPE must comply with Regulation (EU) 2016/425, requiring extensive testing and documentation. This adherence adds significant upfront costs and operational complexity, acting as a substantial barrier.

Meeting these stringent regulatory demands necessitates considerable investment in product testing, quality assurance, and obtaining necessary certifications. For example, a new entrant might need to spend upwards of €10,000 to €50,000 or more on initial certifications alone, depending on the product category and regions targeted. This financial burden, coupled with the time investment required to understand and implement these regulations, deters many potential new competitors from entering the professional supplies distribution sector.

- Regulatory Compliance Costs: New entrants face substantial expenses for product testing and certification, potentially ranging from €10,000 to €50,000+ for initial approvals.

- Certification Timeframes: Obtaining necessary certifications can be a lengthy process, often taking several months to over a year, delaying market entry.

- Evolving Standards: The need to continuously adapt to changing safety standards and regulations requires ongoing investment and expertise, a challenge for new players.

- Specialized Knowledge Requirement: Navigating complex regulatory landscapes demands specialized legal and technical knowledge, which new entrants may lack or need to acquire at significant cost.

The threat of new entrants for Descours & Cabaud is moderate, primarily due to high capital requirements and established distribution networks. New companies need substantial investment for inventory, warehousing, and logistics, a significant barrier. For instance, building a national distribution network in 2024 involves considerable outlays for vehicles and infrastructure.

Moreover, Descours & Cabaud benefits from strong brand loyalty and high switching costs for its B2B customers, cultivated over decades of reliable service. In 2023, the company reported a customer retention rate exceeding 90%, illustrating the depth of these established relationships and the difficulty for newcomers to gain traction.

Regulatory compliance, particularly for safety equipment, also presents a considerable hurdle. Obtaining necessary certifications can cost tens of thousands of euros and take significant time, adding to the financial and operational burden for potential new entrants. This complex landscape deters many smaller players from entering the professional supplies distribution market.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Descours & Cebaud SA is built upon data from the company's official annual reports, investor presentations, and press releases. We also incorporate insights from reputable industry research firms and market intelligence platforms to gain a comprehensive understanding of the competitive landscape.