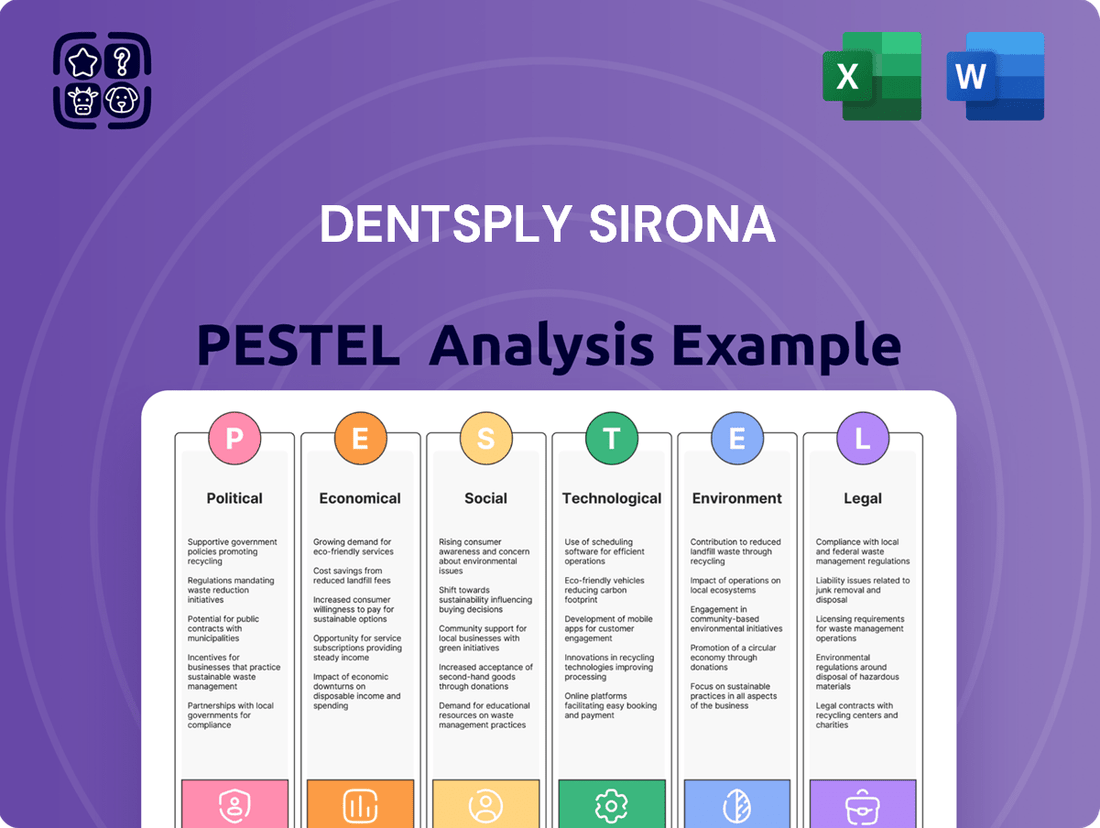

Dentsply Sirona PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dentsply Sirona Bundle

Discover how political stability, economic growth, and technological advancements are shaping Dentsply Sirona's market. Our PESTLE analysis delves into these critical external factors, offering you a strategic advantage. Unlock actionable intelligence to refine your business plans and investments.

Gain a competitive edge by understanding the social, technological, environmental, and legal forces impacting Dentsply Sirona. This comprehensive PESTLE analysis provides the deep insights you need to anticipate market shifts and capitalize on opportunities. Download the full report for immediate strategic clarity.

Navigate the complex external landscape affecting Dentsply Sirona with our expertly crafted PESTLE analysis. From evolving consumer trends to stringent regulations, we provide the essential data for informed decision-making. Secure your copy now and empower your strategic planning.

Political factors

Government healthcare policies, particularly those affecting dental care funding and public health initiatives, directly shape Dentsply Sirona's market potential and strategic direction. For instance, in 2024, many governments are reviewing or implementing reforms to expand access to preventative dental services, which could boost demand for Dentsply Sirona's diagnostic and treatment solutions.

Shifts in national healthcare priorities or reimbursement frameworks can significantly alter the demand for professional dental products. For example, a government's decision to increase coverage for specific dental procedures in 2025 could lead to higher sales volumes for Dentsply Sirona's associated equipment and consumables.

The company must remain agile in adapting to evolving regulatory landscapes that govern dental practices and patient care standards. Compliance with new regulations concerning material safety or digital health records, expected to be implemented across various markets by 2024-2025, is crucial for maintaining market access and operational continuity.

Global trade policies, including tariffs and import/export regulations, directly impact Dentsply Sirona's supply chain costs and market access. For instance, changes in tariffs on medical devices or raw materials can significantly alter the company's cost of goods sold. In 2024, the ongoing evolution of trade agreements and potential for new tariffs, particularly between major economic blocs, necessitates careful monitoring to mitigate disruptions and maintain competitive pricing for its dental and healthcare products.

Political stability in key markets is paramount for Dentsply Sirona's operations. For instance, in 2024, regions experiencing political volatility, such as parts of Eastern Europe and certain emerging economies, present increased risks to supply chain integrity and market access. The company's extensive global footprint, spanning over 100 countries, means that shifts in government policies, trade agreements, or geopolitical tensions can directly impact sales and manufacturing continuity.

Regulatory Environment and Compliance

Dentsply Sirona navigates a stringent regulatory landscape, essential for its dental and medical device offerings. Compliance with national and international standards, such as those set by the FDA in the United States and the European Medicines Agency (EMA) in Europe, dictates product approval, manufacturing processes, and post-market surveillance. Failure to meet these requirements can result in significant financial penalties and operational disruptions.

The company's commitment to regulatory adherence is critical for maintaining market access and consumer trust. For instance, the Medical Device Regulation (MDR) in the EU, fully implemented by May 2021, introduced more rigorous requirements for conformity assessment and post-market surveillance, impacting device manufacturers like Dentsply Sirona. The company's 2023 annual report highlights ongoing efforts and investments in quality systems and regulatory affairs to ensure continued compliance with evolving global regulations.

- Product Safety and Efficacy: Strict adherence to global safety and efficacy standards is non-negotiable for dental products and medical devices.

- Regulatory Bodies: Key regulators include the FDA (US), EMA (EU), and other national health authorities worldwide.

- Compliance Costs: Significant resources are allocated to quality management systems and regulatory affairs to meet evolving requirements like the EU MDR.

- Market Access: Non-compliance can lead to product recalls, fines, and exclusion from key markets, impacting revenue streams.

Anti-ESG Sentiment

The growing 'anti-ESG' movement, especially prominent in the United States, presents a significant political challenge for Dentsply Sirona's sustainability efforts. This sentiment, often fueled by concerns about perceived political agendas in corporate policies, could lead to governmental or investor resistance against ESG frameworks. For instance, some US states have enacted legislation restricting state pension funds from investing in companies prioritizing ESG factors, potentially impacting capital access for companies like Dentsply Sirona if they are perceived as overly committed to certain ESG mandates without clear financial returns.

This political pushback could hinder Dentsply Sirona's ability to implement and advance its corporate social responsibility and sustainability goals. Companies may face pressure to de-emphasize or reframe their ESG commitments to align with prevailing political narratives, potentially affecting brand reputation and stakeholder relations. Navigating this landscape requires a careful balance between maintaining core values and adapting to evolving political and economic pressures.

Dentsply Sirona must proactively manage its public image and communication strategies to address these anti-ESG sentiments. This involves clearly articulating the business case for its sustainability initiatives, demonstrating tangible benefits beyond environmental or social metrics, and engaging with stakeholders to build consensus. The company's 2024 sustainability reports will be crucial in showcasing how it integrates ESG principles with financial performance, aiming to mitigate potential negative impacts from political opposition.

Government healthcare policies directly influence Dentsply Sirona's market, with reforms in 2024 aiming to expand preventative dental care, potentially boosting demand for their solutions. Shifts in national priorities or reimbursement frameworks, like increased coverage for specific procedures in 2025, could significantly impact sales volumes for Dentsply Sirona's equipment and consumables. Navigating evolving regulatory landscapes, including material safety and digital health records compliance expected by 2024-2025, is critical for market access.

Global trade policies, including tariffs on medical devices and raw materials, directly affect Dentsply Sirona's supply chain costs and market access. Political stability in key markets is also paramount, as geopolitical tensions and policy shifts in 2024 can disrupt supply chains and market access for the company's extensive global operations.

The company must also contend with the growing anti-ESG movement, particularly in the United States, which could lead to resistance against sustainability initiatives and impact capital access. This political pushback necessitates a careful balance between core values and adapting to evolving political pressures, with 2024 sustainability reports crucial for demonstrating the integration of ESG with financial performance.

| Factor | 2024/2025 Outlook | Impact on Dentsply Sirona |

| Healthcare Policy Reforms | Expansion of preventative dental services in many nations. | Increased demand for diagnostic and treatment solutions. |

| Reimbursement Frameworks | Potential increase in coverage for specific dental procedures. | Higher sales volumes for associated equipment and consumables. |

| Regulatory Compliance | New standards for material safety and digital health records expected. | Crucial for market access and operational continuity. |

| Trade Policies | Ongoing evolution of trade agreements and potential for new tariffs. | Impacts supply chain costs and market access for products. |

| Political Stability | Volatility in Eastern Europe and emerging economies noted. | Increased risks to supply chain integrity and market access. |

| Anti-ESG Movement | Growing resistance to ESG frameworks, particularly in the US. | Potential impact on capital access and brand reputation. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors impacting Dentsply Sirona, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It provides a comprehensive understanding of how these forces shape the company's strategic landscape, identifying potential threats and opportunities within the dental industry.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of the external factors impacting Dentsply Sirona's strategic decisions.

Economic factors

Global economic growth significantly impacts Dentsply Sirona, as robust economies tend to boost consumer discretionary spending on dental care, including elective procedures. For instance, in 2024, while global GDP growth is projected to moderate from 2023's rebound, it remains a key indicator for market expansion within the dental sector.

Economic downturns or recessions pose a direct challenge, potentially leading to decreased patient visits and reduced capital expenditure by dental practices on new equipment and advanced consumables. This sensitivity means Dentsply Sirona's revenue streams are closely tied to the overall health of major economies worldwide.

Inflationary pressures are a significant concern for Dentsply Sirona. For instance, the US Consumer Price Index (CPI) saw a notable increase, reaching 3.4% year-over-year in April 2024, impacting the costs of raw materials and labor. This directly affects Dentsply Sirona's manufacturing expenses and can squeeze profit margins if not effectively managed through pricing adjustments.

Rising interest rates present another challenge. The Federal Reserve's benchmark interest rate remained in the 5.25%-5.50% range through mid-2024. This makes it more expensive for Dentsply Sirona to finance its operations and for dental practices to invest in new equipment, potentially slowing down capital expenditure in the sector.

As a global entity, Dentsply Sirona's reported financial performance is inherently sensitive to currency exchange rate fluctuations. When foreign earnings are translated into its primary reporting currency, the US dollar, variations in exchange rates can significantly alter reported revenues and expenses. For instance, a stronger dollar against other currencies can make Dentsply Sirona's overseas sales appear lower in dollar terms.

These currency movements directly influence the profitability of international transactions and the cost of sourcing materials from different countries. A weakening of a key operating currency, such as the Euro, against the US dollar, could reduce the dollar value of sales made in Europe, while simultaneously increasing the dollar cost of components imported from non-Eurozone countries. Dentsply Sirona's financial statements frequently highlight the impact of these foreign currency translation adjustments.

For example, in the first quarter of 2024, Dentsply Sirona reported that foreign currency movements had a negative impact on its net sales, contributing to a slight drag on overall revenue growth compared to constant currency figures. The company's management actively monitors these currency exposures and employs hedging strategies to mitigate potential adverse effects on its profitability.

Dental Insurance and Reimbursement Models

The landscape of dental insurance and reimbursement significantly shapes patient demand for dental services and, consequently, the adoption of dental products. In 2024, it's estimated that over 200 million Americans have some form of dental insurance, though coverage levels and out-of-pocket costs vary widely. Dentsply Sirona must monitor evolving reimbursement models, such as fee-for-service, capitation, and value-based care, as these directly influence how dental practices budget for and purchase equipment and supplies.

Shifts in insurance policy coverage, like expanded benefits for preventative care or limitations on cosmetic procedures, can directly impact patient willingness to undergo certain treatments. For instance, a 2024 survey indicated that patients with comprehensive dental insurance were 30% more likely to seek regular check-ups and cleanings compared to those with limited coverage. This trend influences the demand for diagnostic tools and preventative materials offered by companies like Dentsply Sirona.

Understanding these economic factors is crucial for Dentsply Sirona's strategic planning. The company needs to anticipate how changes in insurance penetration, benefit structures, and payment methodologies will affect the purchasing power and priorities of dental professionals. This includes adapting product offerings and marketing strategies to align with the financial realities faced by dental practices operating within different reimbursement frameworks.

- Insurance Penetration: Over 200 million Americans have dental insurance in 2024, influencing patient access.

- Reimbursement Models: Fee-for-service, capitation, and value-based care impact practice revenue and spending.

- Coverage Impact: Comprehensive insurance correlates with higher utilization of preventative dental services.

- Strategic Alignment: Dentsply Sirona must adapt to evolving insurance policies and payment structures to meet market needs.

Competitive Market Dynamics

The dental industry is characterized by a fragmented and highly competitive landscape, featuring a multitude of global and regional manufacturers. Dentsply Sirona faces pressure from established giants and emerging innovators alike, all vying for market share across diverse product categories from consumables to high-tech equipment. This intense rivalry necessitates continuous investment in research and development to maintain a competitive edge.

Pricing strategies are significantly influenced by this competitive environment. Companies must balance the need for profitability with the market's sensitivity to cost, particularly as new technologies are introduced. Dentsply Sirona's ability to innovate and offer differentiated solutions is crucial for commanding premium pricing and protecting its market position.

The growing consolidation of dental practices into Dental Service Organizations (DSOs) is a notable trend impacting competitive dynamics. DSOs, with their increased purchasing power, can negotiate more favorable terms, potentially affecting pricing and distribution strategies for suppliers like Dentsply Sirona. For instance, by 2024, it's estimated that over 30% of dentists in the United States are affiliated with a DSO, a figure projected to rise further.

- Intense Rivalry: Numerous global and regional players compete across the dental product spectrum.

- Pricing Pressures: Competition forces companies to manage pricing carefully while emphasizing innovation.

- DSO Influence: The rise of Dental Service Organizations alters negotiation power and distribution channels.

- Innovation Imperative: Continuous R&D is essential for differentiation and market share defense.

The economic environment significantly shapes Dentsply Sirona's performance, with global growth influencing demand for dental services and products. Inflation and interest rates directly impact operational costs and investment decisions for both the company and its customers. Fluctuations in currency exchange rates also play a critical role in the financial reporting of this multinational corporation.

The increasing prevalence of dental insurance, with over 200 million Americans covered in 2024, directly affects patient access to care and the purchasing decisions of dental practices. Evolving reimbursement models and coverage variations necessitate strategic adaptation by Dentsply Sirona to align with market financial realities.

The competitive landscape of the dental industry, marked by intense rivalry and the growing influence of Dental Service Organizations (DSOs), where over 30% of US dentists were affiliated by 2024, pressures pricing and distribution strategies. Continuous innovation is paramount for Dentsply Sirona to maintain its market position and differentiation.

Full Version Awaits

Dentsply Sirona PESTLE Analysis

The Dentsply Sirona PESTLE analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Dentsply Sirona, offering actionable insights for strategic planning.

No placeholders, no teasers—this is the real, ready-to-use Dentsply Sirona PESTLE analysis you’ll get upon purchase.

Sociological factors

The world's population is getting older, and this trend significantly boosts the need for dental work like implants, crowns, and dentures. By 2023, over 10% of the global population was 65 or older, a figure projected to climb steadily. This demographic shift is a major growth area for companies like Dentsply Sirona, as older individuals often require more extensive dental treatments.

Dentsply Sirona's product offerings, particularly in implantology and restorative dentistry, are well-positioned to capitalize on this aging population. For instance, the company's CEREC system, which allows for same-day crowns, directly addresses the demand for efficient restorative solutions among older patients. This demographic's increasing dental needs translate into higher sales volumes for Dentsply Sirona's specialized product lines.

Public awareness regarding oral health's impact on overall systemic well-being is on the rise. This growing understanding fuels demand for preventive care and advanced dental procedures. For instance, a 2024 survey indicated that 78% of adults now consider oral health a crucial component of their general health, a significant jump from previous years.

This heightened consciousness encourages more frequent dental check-ups and a greater willingness to embrace comprehensive treatment plans. Dentsply Sirona, a leader in dental technology, is well-positioned to capitalize on this trend, as it directly correlates with improved oral health outcomes and increased adoption of their innovative solutions.

Societal emphasis on personal appearance is fueling a significant increase in demand for aesthetic and cosmetic dental procedures. This includes popular treatments like clear aligners, teeth whitening, and veneers, reflecting a growing consumer desire for improved smiles.

This trend directly benefits Dentsply Sirona, as it drives market growth for their SureSmile aligner solutions and a range of other aesthetic dental products. The company is strategically positioned to capitalize on this upward trajectory in the cosmetic dentistry sector.

Dentsply Sirona's continued investment in these high-growth categories underscores their commitment to meeting this evolving consumer demand. For instance, the clear aligner market alone is projected to reach approximately $20 billion globally by 2027, according to recent market research from 2024.

Growth of Teledentistry

The societal embrace of accessible and convenient healthcare, amplified by recent global events, has fueled the significant expansion of teledentistry and remote patient monitoring. This shift is reshaping dental care delivery and patient engagement, driving demand for advanced digital diagnostic and communication technologies.

For instance, the global teledentistry market was valued at approximately $2.1 billion in 2023 and is projected to reach $6.7 billion by 2030, exhibiting a compound annual growth rate of 18.1%. This growth indicates a strong societal preference for virtual consultations and remote care options.

- Societal Shift: Growing demand for convenient, accessible healthcare solutions is a primary driver.

- Market Growth: The teledentistry market is experiencing rapid expansion, with significant projected growth.

- Technological Demand: This trend necessitates increased adoption of digital diagnostic and communication tools by dental professionals.

- Impact on Dentsply Sirona: Dentsply Sirona's digital platforms, such as DS Core, are well-positioned to support these evolving care models.

Shifting Patient Expectations

Patients today expect a more personalized and efficient dental experience, leaning heavily on data and digital tools. They want appointments that fit their schedules, easy online communication, and clear explanations of their treatment plans. This shift means dental providers need to offer more than just clinical services; they need to deliver a seamless, patient-centric journey.

Dentsply Sirona is actively addressing these evolving patient demands by investing in digital dentistry solutions. Their commitment to creating integrated digital workflows, from diagnostics to treatment, directly supports dental practices in meeting these expectations. By enhancing the patient experience through technology, Dentsply Sirona aims to foster greater satisfaction and loyalty.

- Personalized Care: Patients are increasingly researching and expecting tailored treatment plans based on their individual needs and preferences.

- Digital Engagement: A significant portion of patients, particularly younger demographics, prefer digital channels for appointment booking, communication, and accessing treatment information. For instance, a 2024 survey indicated that over 60% of patients would choose a dental practice offering online scheduling and digital check-in.

- Convenience and Efficiency: Streamlined processes, reduced waiting times, and transparent communication about costs and procedures are paramount for patient satisfaction.

- Data-Driven Decisions: Patients are more receptive to treatments recommended through clear, data-backed explanations, often facilitated by advanced imaging and diagnostic technologies.

Societal expectations for personalized and convenient dental care are reshaping the industry. Patients, especially younger demographics, increasingly prefer digital platforms for scheduling, communication, and accessing treatment information, with over 60% favoring online booking as of a 2024 survey. This demand for efficiency and transparency in communication and cost is driving dental practices to adopt more integrated digital solutions.

Dentsply Sirona is responding by enhancing its digital offerings, such as the DS Core platform, to support these patient-centric models. The company's focus on integrated digital workflows, from diagnostics to treatment, aims to improve the overall patient experience and foster greater satisfaction.

The growing emphasis on aesthetic dentistry, driven by societal focus on personal appearance, is a significant market driver. The clear aligner market alone is projected to reach approximately $20 billion globally by 2027, according to 2024 market research, directly benefiting companies like Dentsply Sirona with their SureSmile solutions.

| Sociological Factor | Description | Impact on Dentsply Sirona | Relevant Data (2023-2025+) |

|---|---|---|---|

| Aging Population | Increasing global median age drives demand for restorative and implant dentistry. | Boosts sales for implants, crowns, and dentures; CEREC system benefits from efficiency demand. | Over 10% of global population aged 65+ in 2023, with steady increase. |

| Oral Health Awareness | Greater understanding of oral health's link to systemic well-being. | Increases demand for preventive care and advanced procedures. | 78% of adults in a 2024 survey considered oral health crucial to general health. |

| Aesthetic Focus | Societal emphasis on personal appearance fuels demand for cosmetic dental procedures. | Drives growth for clear aligners, teeth whitening, and veneers; SureSmile solutions are well-positioned. | Clear aligner market projected to reach ~$20 billion globally by 2027 (2024 data). |

| Digitalization & Convenience | Patient preference for accessible, convenient, and personalized digital healthcare experiences. | Increases demand for teledentistry and digital diagnostic tools; DS Core platform supports these models. | Teledentistry market valued at ~$2.1 billion in 2023, projected to reach $6.7 billion by 2030 (18.1% CAGR). 60%+ patients prefer online scheduling (2024 survey). |

Technological factors

The digital dentistry revolution, marked by innovations like Dentsply Sirona's Primescan 2 intraoral scanner and advanced CAD/CAM systems, is fundamentally reshaping dental practices. These technologies significantly boost precision and operational efficiency, leading to quicker patient treatment cycles.

Dentsply Sirona's commitment to this sector is evident in its consistent expansion of its digital and connected dentistry offerings, positioning the company at the forefront of this technological wave. For instance, the global digital dentistry market was valued at approximately USD 3.5 billion in 2023 and is projected to reach over USD 7.0 billion by 2028, growing at a CAGR of around 15%.

Artificial intelligence and machine learning are rapidly transforming dentistry, from diagnostics to treatment planning. AI-powered systems can analyze dental images with remarkable speed and accuracy, potentially identifying issues that might be missed by the human eye. This technology promises to reduce diagnostic errors and streamline workflows for dental professionals.

Dentsply Sirona is actively embracing these advancements, integrating AI into its digital platforms. For instance, DS Core Diagnose with Smart View leverages AI to assist clinicians in interpreting imaging data, thereby enhancing diagnostic capabilities. This integration aims to empower dental practitioners with better tools for clinical decision-making and more effective patient communication.

The rise of connected dentistry ecosystems, like Dentsply Sirona's DS Core platform, is revolutionizing dental practices. This integration of digital tools streamlines everything from diagnostics to treatment planning and patient management, fostering better collaboration among dental teams.

DS Core, for instance, allows for seamless data flow, enhancing practice efficiency and patient outcomes. Dentsply Sirona's ongoing investment in expanding DS Core’s functionalities underscores the growing importance of these connected solutions in modern dentistry, aiming to boost productivity and patient satisfaction.

Innovative Materials and Devices

Dentsply Sirona is at the forefront of developing novel dental materials and devices, driven by continuous research and development. This includes advanced biomaterials that enhance the success of implants and restorative dentistry, alongside cutting-edge, radiation-free imaging technologies such as dental-specific MRI systems.

These technological advancements are designed to deliver superior performance, improved biocompatibility, and a more comfortable experience for patients. For instance, the company’s commitment to innovation is reflected in its substantial investments in R&D, aiming to introduce these transformative solutions to the dental market.

- Biomaterials Advancement: Focus on next-generation biomaterials for enhanced osseointegration and tissue regeneration in implantology.

- Radiation-Free Imaging: Development and integration of technologies like dental MRI to reduce patient exposure to radiation.

- Digital Workflow Integration: Innovations supporting seamless digital workflows from diagnostics to treatment delivery.

- R&D Investment: Dentsply Sirona's significant allocation of resources to fuel innovation and market leadership.

Automation in Practice Management

Technological advancements are significantly automating tasks in dental practice management. Solutions now handle everything from booking appointments and processing payments to managing supplies, leading to greater efficiency and lower operating costs. This frees up dental staff to concentrate more on patient treatment and experience.

Dentsply Sirona is a key player in this trend, offering digital solutions that streamline practice operations. For instance, their integrated software platforms can automate patient communication and billing cycles. By 2024, it’s estimated that over 70% of dental practices are utilizing some form of practice management software, a figure expected to climb as automation becomes more sophisticated.

- Increased Efficiency: Automation reduces time spent on administrative tasks, allowing for more patient appointments.

- Cost Reduction: Streamlined processes minimize errors and reduce the need for extensive administrative staff.

- Focus on Patient Care: By offloading routine tasks, dental professionals can dedicate more attention to clinical services.

- Data-Driven Insights: Automated systems often provide analytics on practice performance, aiding strategic decisions.

The company's technological trajectory is heavily influenced by advancements in digital dentistry, with innovations like intraoral scanners and CAD/CAM systems becoming standard. Dentsply Sirona's investment in these areas, as seen with their Primescan 2 scanner, enhances precision and patient treatment speed. The global digital dentistry market, valued at approximately USD 3.5 billion in 2023, is projected to exceed USD 7.0 billion by 2028, reflecting a robust 15% compound annual growth rate.

| Technology Area | Market Size (USD Billion) 2023 | Projected Market Size (USD Billion) 2028 | CAGR (%) |

|---|---|---|---|

| Digital Dentistry | ~3.5 | ~7.0 | ~15 |

| AI in Dentistry | N/A (emerging) | N/A (emerging) | High |

| Connected Dental Platforms | N/A (integrated) | N/A (integrated) | High |

Legal factors

Dentsply Sirona faces a complex landscape of regulatory approvals, particularly for its innovative dental products. Obtaining clearances from bodies like the U.S. Food and Drug Administration (FDA) is a non-negotiable step before new devices and technologies can reach the market, directly impacting launch timelines and market entry success.

The company's ability to efficiently manage these regulatory hurdles was evident in 2024, when Dentsply Sirona secured all eight FDA clearances it pursued. This strong track record highlights the company's proficiency in meeting rigorous compliance standards and effectively navigating the approval pathways, which is crucial for sustained growth and market leadership.

Dentsply Sirona navigates significant legal risks stemming from product liability, particularly concerning the safety and effectiveness of its dental offerings. Adverse events, such as reported patient injuries or product malfunctions, can trigger costly lawsuits, prompt regulatory scrutiny, and inflict substantial financial and reputational harm.

The company has encountered class action litigation tied to product safety claims, underscoring the persistent nature of this legal challenge. For instance, in early 2024, Dentsply Sirona continued to address ongoing litigation related to its dental implants, with reports indicating settlements in some cases to mitigate further legal and financial exposure.

Dentsply Sirona must navigate a complex web of data privacy and cybersecurity regulations, including GDPR and HIPAA, especially as its digital platforms like DS Core manage sensitive patient information. Failure to comply can lead to significant legal penalties and financial repercussions, impacting the company's bottom line. For instance, in 2023, data breaches globally cost an average of $4.45 million, a figure Dentsply Sirona aims to mitigate through robust security measures.

Intellectual Property Rights

Dentsply Sirona’s competitive edge hinges on safeguarding its intellectual property, encompassing patents, trademarks, and trade secrets for its advanced dental solutions. The company actively employs legal strategies to enforce these rights and counter infringement, a constant operational focus. For instance, Dentsply Sirona was involved in patent litigation concerning dental implants and related technologies in recent years, underscoring the importance of IP defense.

The company's significant investment in research and development, a key driver of its innovation pipeline, is directly supported by strong intellectual property protection. This commitment ensures that novel products and processes, such as advancements in digital dentistry or biomaterials, are adequately shielded. In 2023, Dentsply Sirona reported spending approximately $345 million on R&D, a testament to its reliance on IP to maintain market leadership.

- Patent Portfolio Strength: Dentsply Sirona maintains a robust portfolio of patents covering a wide array of dental products and manufacturing processes, crucial for defending its market share.

- Trademark Protection: Key brand names and logos are legally protected to prevent counterfeiting and maintain brand integrity in the global dental market.

- Trade Secret Management: Proprietary manufacturing techniques and unpatented innovations are guarded as trade secrets, requiring stringent internal controls and legal agreements.

- Enforcement Actions: The company actively monitors for and pursues legal action against entities infringing on its intellectual property rights.

Anti-Corruption and Ethical Business Conduct Laws

Dentsply Sirona, as a global entity, navigates a complex web of anti-corruption and ethical business conduct laws, including stringent regulations like the U.S. Foreign Corrupt Practices Act (FCPA). Adherence to these laws is paramount for maintaining operational integrity and avoiding severe penalties. The company's commitment to robust compliance programs and a clear Code of Ethics is vital for fostering lawful and transparent dealings with all stakeholders.

These legal frameworks are designed to prevent bribery, kickbacks, and other unethical practices that can distort markets and undermine fair competition. For Dentsply Sirona, this means implementing rigorous internal controls and training protocols across its international operations to ensure all employees and representatives act with the highest ethical standards. Failure to comply can result in substantial fines, reputational damage, and even criminal charges.

- Global Reach, Local Laws: Dentsply Sirona's operations in over 120 countries necessitate a deep understanding and application of diverse anti-corruption statutes.

- FCPA Enforcement: The FCPA, for instance, carries significant penalties, with companies facing fines that can reach millions of dollars, alongside potential debarment from government contracts.

- Ethical Framework: A strong Code of Ethics serves as the foundation for preventing misconduct and promoting a culture of integrity, crucial for building trust with customers, suppliers, and regulatory bodies.

- Compliance Investment: Companies like Dentsply Sirona invest heavily in compliance programs, including regular audits and employee training, to mitigate risks associated with global business interactions.

Dentsply Sirona's legal environment is shaped by stringent product approval processes, with regulatory bodies like the FDA requiring clearance for new dental devices, impacting market entry timelines. The company's 2024 success in securing all eight FDA clearances pursued demonstrates its adeptness at navigating these complex requirements.

Product liability remains a significant legal risk, with potential for costly lawsuits and regulatory scrutiny due to adverse events or product malfunctions. Ongoing litigation, such as that concerning dental implants in early 2024, highlights the persistent challenges in managing these claims, with some cases involving settlements.

Data privacy and cybersecurity regulations, including GDPR and HIPAA, are critical for Dentsply Sirona's digital platforms handling sensitive patient data. Non-compliance can result in substantial penalties, with global data breaches averaging $4.45 million in 2023, underscoring the need for robust security measures.

Protecting intellectual property is paramount for Dentsply Sirona's competitive edge, involving patents, trademarks, and trade secrets for its advanced dental solutions. The company actively defends its IP through legal enforcement, as seen in patent litigation related to dental implants in recent years.

| Legal Factor | Description | 2023/2024 Relevance |

|---|---|---|

| Regulatory Approvals | Securing FDA and similar clearances for new dental products. | Dentsply Sirona obtained all 8 FDA clearances sought in 2024. |

| Product Liability | Addressing lawsuits and claims related to product safety and efficacy. | Ongoing litigation regarding dental implants continued into early 2024. |

| Data Privacy & Cybersecurity | Compliance with GDPR, HIPAA for digital platforms handling patient data. | Global data breaches averaged $4.45 million in 2023. |

| Intellectual Property | Protecting patents, trademarks, and trade secrets for dental innovations. | Active involvement in patent litigation concerning dental implants and related technologies. |

Environmental factors

Dentsply Sirona is actively working to lessen its environmental impact by cutting down its carbon footprint and greenhouse gas (GHG) emissions. The company has not only met but surpassed its initial environmental targets, achieving a notable decrease in the intensity of its Scope 1 and 2 GHG emissions.

These efforts are supported by tangible actions like installing solar panels at manufacturing facilities and conducting thorough energy audits. For instance, in 2023, Dentsply Sirona reported a 21% reduction in Scope 1 and 2 GHG emission intensity compared to their 2019 baseline, exceeding their initial goal of 15%.

Dentsply Sirona is actively working to minimize waste and conserve resources across its operations. A key focus is reducing waste generated during manufacturing and promoting sustainable practices, like reuse and recycling, within dental clinics. For instance, in 2023, the company reported a 5% reduction in manufacturing waste intensity compared to their 2020 baseline.

The company's strategy includes a proactive approach to identifying and implementing new methods for waste reduction. They are also exploring opportunities to conserve water, a vital resource, in their production facilities. Dentsply Sirona aims to increase the percentage of recycled materials used in their packaging, targeting a 15% increase by the end of 2025.

Dentsply Sirona is actively pursuing sustainable packaging, with a goal for all product packaging, including plastics, to be recyclable by 2030. This involves a strategic shift towards paper-based and corrugated cardboard materials, replacing foam inserts with paper, and optimizing label and box dimensions to cut down on material consumption and associated CO2 emissions.

Water Usage Reduction

Dentsply Sirona is actively working to lower its water usage intensity, having already achieved this goal ahead of its initial timeline. This focus on water conservation is a significant component of their broader environmental approach.

Their strategy includes investing in technologies like closed-loop chillers at manufacturing facilities. These systems recirculate water, leading to a substantial decrease in overall water consumption.

- Water Withdrawal Intensity Reduction: Dentsply Sirona exceeded its targets for reducing water withdrawal intensity, demonstrating proactive environmental management.

- Closed-Loop Chiller Investments: The company has invested in closed-loop chillers at its manufacturing sites, a key initiative for water recirculation.

- Significant Consumption Decrease: These investments have resulted in a notable reduction in overall water usage across their operations.

Commitment to Circular Economy Principles

Dentsply Sirona is actively integrating circular economy principles, focusing on reducing, reusing, and recycling across its operations. This commitment is notably evident in their packaging strategies, where they aim to design out waste and pollution. For instance, in 2023, the company reported a 15% reduction in virgin plastic used in its product packaging compared to a 2020 baseline.

This strategic shift not only minimizes environmental impact but also aligns with global efforts to combat plastic pollution. By prioritizing the keeping of products and materials in use and aiming to regenerate natural systems, Dentsply Sirona is positioning itself as a responsible player in the healthcare industry. Their initiatives support the growing consumer and regulatory demand for sustainable business practices.

Key aspects of their commitment include:

- Packaging Redesign: Implementing initiatives to reduce the amount of packaging material used and increase the use of recycled content.

- Waste Reduction Programs: Establishing internal programs to minimize waste generation throughout the manufacturing and supply chain processes.

- Material Innovation: Exploring and adopting innovative materials that are more sustainable and easier to recycle or compost.

- Partnerships for Recycling: Collaborating with external partners to improve the recyclability of their products and packaging.

Dentsply Sirona is making significant strides in environmental stewardship, particularly in reducing its carbon footprint. The company has surpassed its initial targets for decreasing Scope 1 and 2 greenhouse gas (GHG) emissions intensity, achieving a 21% reduction by 2023 against a 2019 baseline, exceeding its 15% goal.

Their commitment extends to waste reduction, with a 5% decrease in manufacturing waste intensity reported in 2023 compared to 2020. Dentsply Sirona is also focused on water conservation, having already met its water withdrawal intensity reduction targets ahead of schedule through investments in technologies like closed-loop chillers.

The company is actively embracing circular economy principles, aiming for all product packaging to be recyclable by 2030. This includes reducing virgin plastic usage in packaging by 15% by 2023 compared to a 2020 baseline, and increasing the use of recycled materials.

| Environmental Metric | 2023 Performance | Baseline Year | Target |

| Scope 1 & 2 GHG Emission Intensity Reduction | 21% | 2019 | 15% |

| Manufacturing Waste Intensity Reduction | 5% | 2020 | N/A |

| Virgin Plastic Reduction in Packaging | 15% | 2020 | N/A |

PESTLE Analysis Data Sources

Our Dentsply Sirona PESTLE analysis is meticulously crafted using data from leading industry associations, reputable market research firms, and official government publications. We incorporate economic indicators, regulatory updates, technological advancements, and socio-cultural trends to provide a comprehensive view.