Dentsply Sirona Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dentsply Sirona Bundle

Curious about Dentsply Sirona's product portfolio performance? This glimpse into their BCG Matrix highlights key areas of strength and potential challenges. To truly unlock strategic advantages and make informed decisions about resource allocation, you need the complete picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

SureSmile Clear Aligners are showing impressive results for Dentsply Sirona, with double-digit growth and increased market share, especially noted in the final quarter of 2023. This success is fueled by innovative new products and the unique benefits they offer patients, such as the SureSmile simulator integrated into DS Core.

The ongoing commitment and positive trajectory for SureSmile solidify its standing as a top contender in the expanding clear aligner market. For instance, Dentsply Sirona reported that SureSmile contributed significantly to their Orthodontics segment's performance in 2023, reflecting strong demand and market penetration.

The Primescan 2 Intraoral Scanner, launched in 2024, represents a pivotal advancement for Dentsply Sirona in the realm of digital dentistry. This cloud-native technology is engineered to boost efficiency and precision for dental practitioners, aligning with the company's strategy for a more connected dental ecosystem.

With the digital dentistry market experiencing robust growth, the Primescan 2 is strategically positioned as a high-potential product. Its enhanced accuracy and user-friendliness aim to capture a larger segment of this expanding market, solidifying Dentsply Sirona's competitive edge.

The DS Core Digital Platform represents a significant investment for Dentsply Sirona, positioning it as a potential star in the BCG matrix. The company's commitment is evident in the launch of 85 new capabilities and its expansion into 39 countries since its introduction. This aggressive development and rollout underscore the platform's strategic importance in digitalizing dental workflows and enhancing efficiency.

X-Smart Pro+ Endodontic Motor and Reciproc Blue File

The X-Smart Pro+ Endodontic Motor and Reciproc Blue File, launched in the U.S. in August 2024, are Dentsply Sirona's latest offerings in the endodontics sector. This segment is a significant revenue driver for the company, and the introduction of these advanced, efficient tools positions them to capitalize on the expanding global endodontics market.

Dentsply Sirona is a leading entity in the endodontics market, which is projected for continued growth. The X-Smart Pro+ and Reciproc Blue File are designed to enhance the efficiency of root canal procedures, addressing a fundamental and growing demand within the dental industry.

- Market Position: Dentsply Sirona holds a substantial revenue share in the endodontics market.

- Product Launch: The X-Smart Pro+ Endodontic Motor and Reciproc Blue File were introduced in the U.S. in August 2024.

- Market Growth: The global endodontics market is experiencing growth, creating opportunities for new, efficient products.

- Product Aim: These innovations are intended to streamline root canal treatments, a critical dental procedure.

Implants in High-Growth Regions (e.g., China)

Implants in high-growth regions like China are a shining example of Dentsply Sirona's Stars. Despite broader market headwinds, China's implant segment was a significant contributor to organic sales growth within the Rest of World category during Q1 2025. This performance highlights a robust expansion and deepening market penetration in key strategic areas.

The strong performance in China suggests a high-growth trajectory for Dentsply Sirona's implant offerings in this vital market. Continued strategic investment and focused execution in such regions are crucial for reinforcing their Star status and capitalizing on emerging opportunities.

- China's implant market is a key growth engine for Dentsply Sirona.

- The company saw significant organic sales growth driven by implants in China in Q1 2025.

- This indicates increasing market penetration and demand in strategically important geographies.

- Further investment in these high-growth regions is essential to maintain and enhance their Star position.

SureSmile Clear Aligners and the Primescan 2 Intraoral Scanner are prime examples of Dentsply Sirona's Stars. SureSmile has demonstrated double-digit growth and increased market share, particularly in late 2023, driven by product innovation and features like the SureSmile simulator. The Primescan 2, launched in 2024, is a cloud-native intraoral scanner designed to enhance dental practitioner efficiency and precision, capitalizing on the expanding digital dentistry market.

The X-Smart Pro+ Endodontic Motor and Reciproc Blue File, launched in August 2024 in the U.S., are positioned to drive growth in the endodontics sector. This segment is a significant revenue contributor, and these advanced tools are designed to improve the efficiency of root canal procedures, meeting a fundamental and growing demand in the dental industry.

Implants in high-growth regions, specifically China, represent another significant Star for Dentsply Sirona. Despite broader market challenges, China's implant segment was a key driver of organic sales growth within the Rest of World category in Q1 2025, signaling robust expansion and market penetration in this vital area.

| Product/Segment | Market Position | Growth Trajectory | Key Drivers | Launch/Update |

|---|---|---|---|---|

| SureSmile Clear Aligners | Increasing Market Share | Double-Digit Growth | Product Innovation, DS Core Integration | Ongoing |

| Primescan 2 Intraoral Scanner | High Potential in Digital Dentistry | Robust Market Growth | Enhanced Accuracy, User-Friendliness, Cloud-Native | 2024 |

| X-Smart Pro+ & Reciproc Blue File | Leading Endodontics Offerings | Projected Market Growth | Efficiency in Root Canal Procedures | August 2024 (US) |

| Implants (China) | Significant Growth Contributor | Strong Expansion | High Demand in Strategic Geography | Q1 2025 Performance |

What is included in the product

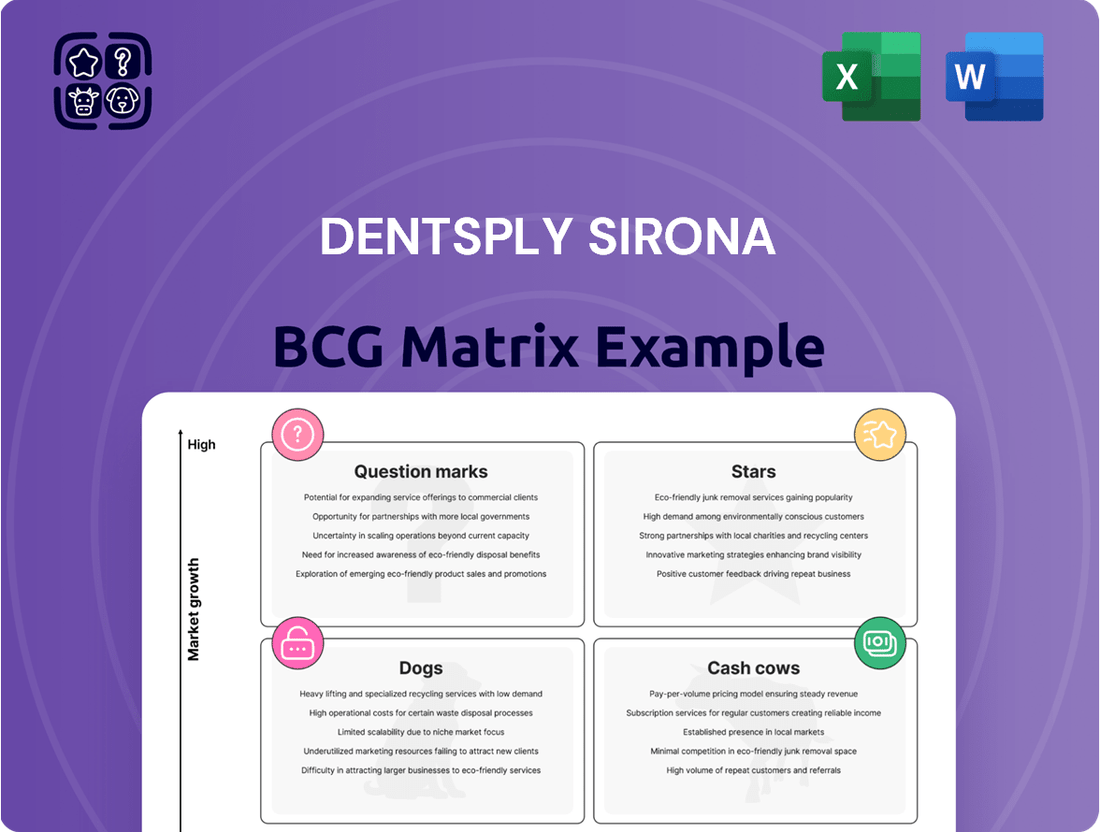

The Dentsply Sirona BCG Matrix provides a strategic overview of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Provides a clear, visual representation of Dentsply Sirona's portfolio, simplifying strategic decision-making.

Cash Cows

Wellspect Healthcare, a key part of Dentsply Sirona's portfolio, has demonstrated robust performance. Throughout 2023 and continuing into the first three quarters of 2024, the business achieved consistent positive organic sales growth across all geographical segments.

Operating within the significant continence care market, Wellspect functions as a classic cash cow. It reliably generates more cash than it requires for its operations, solidifying its position as a stable and profitable asset for Dentsply Sirona.

Dentsply Sirona is actively exploring strategic alternatives for Wellspect. This move underscores the business unit's value as a mature, cash-generating entity, potentially unlocking further stakeholder value through divestiture or other strategic maneuvers.

Dentsply Sirona's established endodontic consumables are firmly positioned as Cash Cows. The global endodontic consumables market was valued at $1.62 billion in 2024, a sector Dentsply Sirona commands a significant share of.

Products such as endodontic files, sealers, and gutta-percha are fundamental to everyday dental procedures, generating consistent and predictable revenue streams. This mature market segment, characterized by its essential nature and recurring demand, provides a stable foundation for the company's cash flow.

Dentsply Sirona, as the world's largest manufacturer of professional dental products, holds a substantial share in the broad dental consumables market. This segment, projected to be worth $30.47 billion in 2024, offers a stable and consistent revenue base.

These core products, such as restorative materials and everyday dental supplies, are indispensable for routine dental procedures. Their high market penetration within a mature industry solidifies their position as cash cows.

Dental Light-Curing Resins

Dentsply Sirona's dental light-curing resins are a prime example of a Cash Cow within their portfolio. The global market for these essential dental materials was valued at approximately $2.5 billion in 2024, and Dentsply Sirona holds a significant 60% of this market share, placing them among the top five players. This strong market position in a product category with consistent, high demand ensures a steady and predictable stream of revenue for the company.

The consistent demand for light-curing resins stems from their fundamental role in a wide array of restorative dental procedures. Dental professionals rely on these materials for fillings, bonding, and other common treatments, making them a staple in dental practices worldwide. This widespread and ongoing need translates into stable sales volumes for Dentsply Sirona's resin products.

- Market Dominance: Dentsply Sirona commands approximately 60% of the global dental light-curing resin market.

- Market Size: The global market was estimated at $2.5 billion in 2024.

- Consistent Demand: Light-curing resins are essential for routine restorative dental procedures, ensuring stable sales.

- Revenue Generation: The strong market share in this stable category guarantees reliable cash flow for Dentsply Sirona.

Dental Laboratory Products

Dentsply Sirona's dental laboratory products, including CAM Ceramic Systems and Porcelain Furnaces, are considered cash cows. These offerings cater to a mature segment of the dental industry where demand is stable and operational processes are well-established. The company holds a significant market share in these critical laboratory tools, which translates into reliable cash flow generation with minimal need for substantial reinvestment.

The consistent performance of these products is a key factor in their classification. For instance, Dentsply Sirona's market share in CAD/CAM systems for dental labs has remained robust, contributing to predictable revenue streams. This stability allows the company to leverage these established product lines for ongoing financial support.

- Stable Demand: The dental laboratory sector exhibits consistent demand for essential equipment like CAM systems.

- Mature Market: These products operate within an established market with predictable customer needs.

- High Market Share: Dentsply Sirona's strong position in laboratory tools ensures consistent cash flow.

- Low Growth Investment: The mature nature of the market requires limited capital for expansion, maximizing cash generation.

Dentsply Sirona's established endodontic consumables are firmly positioned as Cash Cows. The global endodontic consumables market was valued at $1.62 billion in 2024, a sector Dentsply Sirona commands a significant share of.

Products such as endodontic files, sealers, and gutta-percha are fundamental to everyday dental procedures, generating consistent and predictable revenue streams. This mature market segment, characterized by its essential nature and recurring demand, provides a stable foundation for the company's cash flow.

Dentsply Sirona's dental light-curing resins are a prime example of a Cash Cow within their portfolio. The global market for these essential dental materials was valued at approximately $2.5 billion in 2024, and Dentsply Sirona holds a significant 60% of this market share, placing them among the top five players.

| Product Category | Market Value (2024) | Dentsply Sirona Market Share | Cash Cow Status |

|---|---|---|---|

| Endodontic Consumables | $1.62 billion | Significant | Yes |

| Dental Light-Curing Resins | $2.5 billion | ~60% | Yes |

| Dental Laboratory Products (CAM Systems, Furnaces) | Mature Market Segment | Robust | Yes |

What You See Is What You Get

Dentsply Sirona BCG Matrix

The Dentsply Sirona BCG Matrix you are previewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no incomplete sections, and no demo content – just the comprehensive strategic analysis ready for your immediate use.

Rest assured, the previewed Dentsply Sirona BCG Matrix is the final, polished report you'll download upon completing your purchase. It's been meticulously crafted with market insights and strategic frameworks, ensuring you receive a professional, actionable tool without any hidden surprises.

What you see here is the actual Dentsply Sirona BCG Matrix file that will be yours once you complete the purchase. This allows you to assess its value and relevance firsthand, knowing that the unlocked version will be instantly available for editing, presentation, or integration into your business strategy.

You are currently viewing the authentic Dentsply Sirona BCG Matrix document that you will own after your purchase. This isn't a mockup; it's a professionally designed, analysis-ready file that’s instantly downloadable, empowering you to make informed strategic decisions without delay.

Dogs

Byte Aligners have presented a significant challenge for Dentsply Sirona, negatively impacting their organic sales throughout 2024 and into Q1 2025. This segment's performance has been a key factor in the company's overall sales downturn.

In a stark acknowledgment of Byte Aligners' struggles, Dentsply Sirona recorded substantial non-cash impairment charges and completely wrote off the Byte trademark in the fourth quarter of 2024. This action strongly suggests the company no longer foresees the Byte brand playing a role in its future aligner business strategies.

Adding to these difficulties, Dentsply Sirona voluntarily suspended sales, marketing, and shipments for both Byte Aligners and their associated Impression Kits. This move, coupled with the trademark write-off, underscores a very low market share for Byte Aligners and points to dim future prospects for the product line.

Dentsply Sirona's U.S. implants business is currently struggling, showing a notable decline. This underperformance directly impacted the Orthodontic and Implant Solutions segment, contributing to a significant drop in net sales during 2024.

The situation was further compounded by substantial goodwill and intangible asset impairment charges recorded in the fourth quarter of 2024 for this segment. These financial hits suggest a challenging market position for U.S. implants.

This scenario paints a picture of a 'Dog' within the BCG matrix: a business with low market share and negative growth in a crucial market. It is consuming valuable resources without generating sufficient returns, a classic indicator of a business unit needing strategic re-evaluation.

Legacy CAD/CAM equipment within Dentsply Sirona's portfolio likely falls into the Dogs category of the BCG Matrix. This is evidenced by the Connected Technology Solutions segment, which includes CAD/CAM, seeing an 8.3% net sales decline in Q4 2024 and a 9.2% drop for the full year 2024.

This downturn was primarily driven by soft U.S. retail demand for CAD/CAM gear, alongside competitive challenges and the impact of high interest rates on the broader economy. While newer products show potential, older or less competitive CAD/CAM solutions are probably facing diminished market share and negative growth trends.

Outdated Restorative Materials

Within Dentsply Sirona's extensive product range, certain older restorative materials might be classified as Dogs. Despite a growing global dental restorative materials market, projected to reach approximately $10.8 billion by 2027, these legacy products could be facing declining market share.

The shift in patient and dentist preference towards advanced, aesthetically pleasing, and highly durable materials, such as modern resin composites, leaves older formulations vulnerable. Products that do not align with these evolving demands are likely experiencing low growth and a shrinking footprint.

For these outdated restorative materials, a significant investment might be necessary to revitalize them, with the potential for turnaround remaining uncertain.

- Declining Market Share: Older restorative materials are losing ground to advanced alternatives.

- Market Shift: Demand favors aesthetically superior and durable materials like resin composites.

- Investment Risk: Revitalizing these products carries high costs and uncertain returns.

Certain Traditional Equipment & Instruments

The traditional equipment and instruments segment within Dentsply Sirona faced significant headwinds, marked by a double-digit decline in Q4 2023. This downturn suggests these product lines may be struggling with low market share in slow-growing niches or are being outpaced by newer, more competitive offerings.

These underperforming assets likely generate minimal profits or even consume cash, positioning them as potential candidates for divestment or a strategic reduction in focus to reallocate resources.

- Double-digit decline in Q4 2023

- Potential low market share in slow-growth sub-markets

- Facing competition from advanced or cost-effective alternatives

- Likely cash consumers with low returns

Dentsply Sirona's Byte Aligners and certain legacy CAD/CAM equipment exemplify the 'Dogs' in a BCG matrix analysis. Byte Aligners experienced substantial impairment charges and a trademark write-off in Q4 2024, alongside a voluntary suspension of sales, indicating a very low market share and poor future prospects. Similarly, the Connected Technology Solutions segment, including CAD/CAM, saw a 9.2% net sales decline in 2024 due to soft U.S. demand and competitive pressures, suggesting older CAD/CAM offerings are likely in a low-growth, low-share position.

The traditional equipment and instruments segment also showed a double-digit decline in Q4 2023, pointing to potential low market share in slow-growth niches or being outcompeted by newer technologies. These underperforming product lines likely consume resources without generating significant returns, fitting the profile of 'Dogs' that require strategic re-evaluation, such as divestment or reduced focus.

| Product Category | BCG Classification | Key Performance Indicators (2024 Data where available) | Strategic Implications |

|---|---|---|---|

| Byte Aligners | Dog | Substantial impairment charges (Q4 2024); Trademark written off (Q4 2024); Sales, marketing, and shipments suspended. | Low market share, negative growth, potential divestment or discontinuation. |

| Legacy CAD/CAM Equipment | Dog | Connected Technology Solutions segment sales down 9.2% (Full Year 2024); Driven by soft U.S. retail demand and competition. | Low market share in a mature or declining segment, requires significant investment for potential turnaround or divestment. |

| Traditional Equipment & Instruments | Dog | Double-digit decline in Q4 2023; Potential low market share in slow-growth niches. | Likely cash consumers with low returns, candidates for divestment or strategic reduction in focus. |

Question Marks

Dentsply Sirona is set to unveil groundbreaking products at its 2024 DS World events, promising to revolutionize digital dentistry and connectivity. These innovations are positioned as potential market leaders, reflecting a high-growth trajectory.

With their novel approach, these new offerings are currently in the nascent stages of market penetration, meaning they hold a relatively low market share. This presents a classic 'question mark' scenario in the BCG matrix, requiring strategic investment to foster growth and capture market dominance.

Dentsply Sirona is strategically investing in digital print materials, recognizing the significant potential to expand 3D printing's use within dental clinics. This focus aligns with the broader market trend of increasing 3D printing adoption in the dental sector, which is projected to reach \$4.9 billion by 2027, up from \$1.7 billion in 2022.

While specific new material solutions from Dentsply Sirona are likely in their nascent stages of market acceptance, they represent a high-growth opportunity. These emerging products, though currently holding a small market share, are poised for substantial expansion, necessitating significant capital investment to secure a dominant position in this evolving landscape.

Dentsply Sirona is strategically investing in its e-commerce platform to boost customer engagement and streamline purchasing. This move acknowledges the significant growth potential in online sales, even if current e-commerce market share is still developing compared to established distribution networks. For instance, in 2024, the global dental e-commerce market was projected to reach over $10 billion, highlighting the opportunity.

Expansion of SureSmile, DS Core, and Primeprint in New Geographic Markets

Dentsply Sirona is targeting Brazil and other Latin American markets for the expansion of its SureSmile, DS Core, and Primeprint technologies in the first half of 2024. This strategic move is designed to tap into the significant growth potential within these regions for advanced dental solutions. The company anticipates these markets will offer substantial opportunities for increased adoption of its innovative offerings.

While these new geographic markets present a promising outlook, Dentsply Sirona's current market share in Brazil and other Latin American countries for these specific product lines is expected to be minimal. This necessitates a robust investment in marketing and sales infrastructure to effectively build brand awareness and secure a competitive position.

- Market Entry: Launch of SureSmile, DS Core, and Primeprint in Brazil and other Latin American countries planned for H1 2024.

- Growth Potential: These regions are identified as high-growth opportunities for advanced dental solutions.

- Initial Market Share: Dentsply Sirona's market share in these new expansions is anticipated to be low initially.

- Strategic Investment: Substantial marketing and sales efforts will be required to establish a strong foothold.

Virtual Sales Organization in the United States

Dentsply Sirona's strategic implementation of a virtual sales organization in the United States is a key initiative aimed at enhancing customer engagement and operational efficiency. Early performance metrics suggest this model is yielding positive outcomes, aligning with a high-growth strategy for expanding sales reach.

This innovative sales approach is designed to broaden Dentsply Sirona's market penetration and improve sales effectiveness. While the exact contribution to overall sales is still developing, the initial positive indicators suggest a promising trajectory for this new model.

- Virtual Sales Organization Investment: Dentsply Sirona has committed resources to establish and refine its virtual sales force in the US.

- Early Positive Indicators: Initial performance data points to increased customer reach and improved sales efficiency.

- High Growth Strategy Alignment: The virtual sales model supports Dentsply Sirona's broader objective of pursuing aggressive sales growth.

- Market Penetration and Optimization: As a newer strategy, ongoing investment is crucial to maximize its impact and market share capture.

Dentsply Sirona's new product launches, such as those showcased at DS World 2024, represent classic question marks. These innovations are in their early stages, aiming for high growth but currently holding a small market share.

Significant investment is required to nurture these products, like the digital print materials and the expansion into Latin American markets, to capture their substantial market potential. The company's focus on e-commerce and its virtual sales organization in the US also fall into this category, needing continued support to build market presence.

For example, the global dental e-commerce market was projected to exceed $10 billion in 2024, highlighting the opportunity for Dentsply Sirona's developing online sales channels.

The strategic expansion of technologies like SureSmile, DS Core, and Primeprint into Brazil and other Latin American markets in the first half of 2024 is a prime example of a question mark. While these regions offer high growth potential, Dentsply Sirona's initial market share is expected to be low, necessitating substantial investment in marketing and sales infrastructure to build brand awareness and gain competitive traction.

| Product/Initiative | Market Growth Potential | Current Market Share | Strategic Need | Example Data Point |

|---|---|---|---|---|

| New Product Launches (e.g., DS World 2024) | High | Low | Significant Investment for Growth | Revolutionizing digital dentistry and connectivity |

| Digital Print Materials | High (3D printing market projected to reach $4.9B by 2027) | Low | Investment to expand 3D printing use in clinics | Focus on expanding 3D printing's role |

| E-commerce Platform | High (Global dental e-commerce market >$10B in 2024) | Developing | Investment to boost customer engagement and sales | Streamlining purchasing processes |

| Latin American Expansion (SureSmile, DS Core, Primeprint) | High | Minimal (Initial) | Marketing and sales infrastructure investment | Targeted H1 2024 rollout |

| Virtual Sales Organization (US) | High Growth Strategy | Developing | Investment to maximize impact and market penetration | Early positive performance indicators |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.