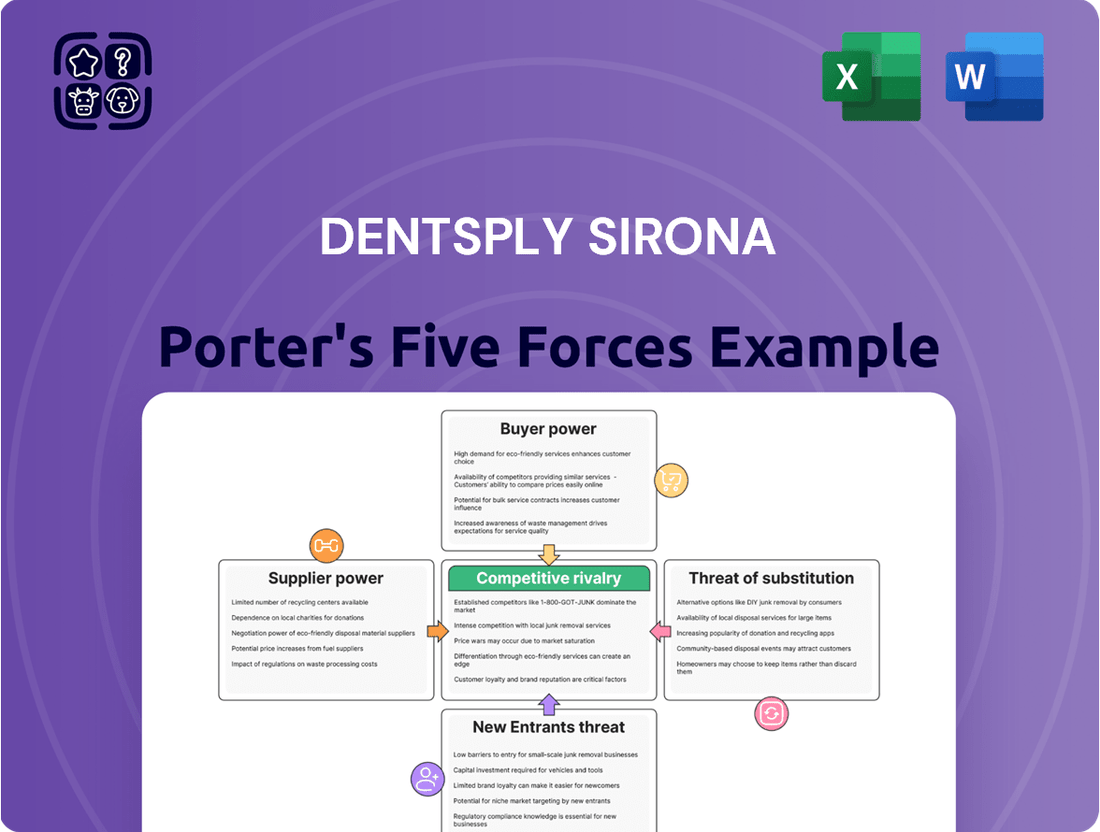

Dentsply Sirona Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dentsply Sirona Bundle

Dentsply Sirona operates in a dynamic dental market, facing significant pressures from powerful buyers and intense rivalry among established players. Understanding these forces is crucial for navigating the competitive landscape and identifying strategic opportunities.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Dentsply Sirona’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Dentsply Sirona, a major player in the dental industry, depends on a diverse supply chain for raw materials, components, and specialized manufacturing equipment. The concentration of these suppliers significantly impacts their bargaining power.

When a few suppliers dominate the market for critical, specialized dental materials or advanced manufacturing machinery, their ability to dictate terms to Dentsply Sirona grows. For instance, if only a handful of companies produce a unique ceramic compound essential for high-end dental restorations, these suppliers hold considerable leverage.

In 2023, the global dental materials market saw significant growth, with specialized ceramics and polymers being key drivers. Companies that control the production of these niche, high-value inputs often command premium pricing and favorable contract terms, directly affecting Dentsply Sirona's cost structure and operational flexibility.

Dentsply Sirona faces substantial switching costs when changing suppliers, particularly for specialized dental equipment components and integrated software solutions. These costs can include significant investments in re-tooling manufacturing lines, extensive requalification processes for new materials or parts, and the potential for costly disruptions to their production schedules. For example, a shift in a key component supplier for their CAD/CAM milling machines could necessitate months of testing and validation to ensure compatibility and performance standards are met.

When suppliers offer unique or highly differentiated products and technologies, their bargaining power significantly increases. For Dentsply Sirona, this could involve specialized materials for dental implants or cutting-edge digital imaging sensors that are not easily replicated by competitors. This reliance on such specialized inputs can naturally limit Dentsply Sirona's leverage in negotiations with these key suppliers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into manufacturing dental products themselves significantly bolsters their bargaining power against Dentsply Sirona. This potential for direct competition can compel Dentsply Sirona to agree to less advantageous terms, such as higher prices or less flexible payment schedules, simply to deter their suppliers from entering the market as direct rivals.

For instance, if a key supplier of specialized dental materials, like high-performance polymers or advanced ceramics, were to develop their own line of dental implants or restorative materials, Dentsply Sirona would face a formidable new competitor. This scenario could be particularly impactful if the supplier possesses proprietary technology or cost advantages that would be difficult for Dentsply Sirona to replicate quickly.

- Supplier Integration Threat: Suppliers moving into manufacturing Dentsply Sirona's products directly.

- Increased Bargaining Power: This threat forces Dentsply Sirona to negotiate from a weaker position.

- Impact on Terms: Dentsply Sirona might accept higher costs or less favorable conditions to avoid competition.

Importance of Dentsply Sirona to Suppliers

Dentsply Sirona's position as a major purchaser in the dental industry significantly influences its suppliers. When Dentsply Sirona accounts for a substantial percentage of a supplier's total sales, that supplier's leverage diminishes. This dependency means suppliers are more motivated to offer favorable terms to retain Dentsply Sirona's business, thereby reducing their bargaining power.

For instance, in 2024, Dentsply Sirona's extensive global supply chain involves numerous specialized manufacturers for everything from dental materials to sophisticated equipment components. If a key supplier relies on Dentsply Sirona for over 20% of its annual revenue, their ability to dictate terms or raise prices is considerably curtailed.

- Supplier Dependence: Suppliers who derive a significant portion of their revenue from Dentsply Sirona have less bargaining power.

- Revenue Concentration: If Dentsply Sirona represents a large share of a supplier's customer base, the supplier is more reliant on this relationship.

- Impact on Pricing: This reliance can lead to more competitive pricing and favorable terms for Dentsply Sirona.

- Strategic Importance: Dentsply Sirona's purchasing volume makes it a strategically vital customer for many suppliers in the dental sector.

The bargaining power of Dentsply Sirona's suppliers is a key factor influencing its operational costs and strategic flexibility. When suppliers offer unique or highly differentiated products, such as specialized materials for dental implants or advanced digital imaging sensors, their leverage naturally increases, limiting Dentsply Sirona's negotiation power.

High switching costs for Dentsply Sirona, involving re-tooling and requalification processes for new materials or equipment components, further strengthen supplier leverage. For example, changing a supplier for critical components in CAD/CAM milling machines could lead to months of costly validation. The threat of suppliers integrating forward into manufacturing dental products themselves also compels Dentsply Sirona to accept less advantageous terms to avoid direct competition.

However, Dentsply Sirona's significant purchasing volume can diminish supplier power. If a supplier relies on Dentsply Sirona for a substantial portion of its revenue, such as over 20% in 2024, their ability to dictate terms is considerably curtailed, leading to more competitive pricing.

| Factor | Impact on Dentsply Sirona | Example/Data Point |

|---|---|---|

| Supplier Concentration | High for specialized inputs | Few suppliers for unique ceramic compounds |

| Switching Costs | Significant for specialized equipment | Re-tooling for CAD/CAM components |

| Product Differentiation | Increases supplier leverage | Proprietary technology in dental imaging sensors |

| Supplier Dependence | Lowers supplier leverage | Supplier reliant on >20% Dentsply Sirona revenue (2024) |

| Forward Integration Threat | Strengthens supplier bargaining power | Supplier developing own dental implant lines |

What is included in the product

This analysis dissects the competitive forces impacting Dentsply Sirona, revealing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants and substitutes within the dental industry.

Effortlessly identify and address competitive threats with a visual breakdown of industry power dynamics.

Gain immediate clarity on market pressures, enabling swift and informed strategic adjustments.

Customers Bargaining Power

Dentsply Sirona's customer base primarily consists of dental professionals, specialists, dental laboratories, and authorized retailers worldwide. The influence these customers wield is directly tied to how concentrated they are and how much they buy.

For instance, major dental service organizations (DSOs) or large retail chains can exert greater bargaining power because of their substantial purchasing volumes and their capacity to consolidate demand from numerous smaller entities.

In 2023, the dental industry saw continued consolidation, with larger DSOs acquiring smaller practices, potentially increasing their collective purchasing power with suppliers like Dentsply Sirona.

Customer switching costs significantly impact the bargaining power of dental professionals and laboratories when considering Dentsply Sirona. If it's easy and inexpensive to switch to a competitor, customers gain more leverage. For instance, if a dental practice needs to invest heavily in new training or equipment to adopt a competitor's product, their incentive to switch diminishes, thereby reducing their bargaining power.

Dentsply Sirona's strategy of offering integrated solutions, such as their digital dentistry platforms that connect various devices and software, can effectively raise these switching costs. This ecosystem approach means a customer might not only have to replace a single product but potentially reconfigure their entire workflow. This increased integration and the associated costs of retraining staff or recalibrating systems create a stickier customer base, limiting their ability to easily switch and thus reducing their bargaining power.

Customers in the dental sector, especially when purchasing consumables and equipment, often exhibit considerable price sensitivity. This is amplified by prevailing economic conditions and the complexities of different reimbursement structures, making cost a significant factor in their purchasing decisions.

When customers are highly sensitive to price, and when a good number of alternative products are readily available, their ability to negotiate better terms and lower prices significantly increases. This dynamic directly enhances their bargaining power against companies like Dentsply Sirona.

For instance, in 2024, the global dental market experienced fluctuations, with some segments reporting price pressures. Reports indicated that for certain dental consumables, average selling prices saw a modest decline in specific regions due to increased competition and a focus on cost-effectiveness by dental practices aiming to manage overheads.

Customer Information Availability

The increasing accessibility of detailed product specifications, competitive pricing, and supplier comparisons online significantly bolsters customer bargaining power. When customers can easily research and compare offerings from various dental equipment providers, they are better equipped to demand favorable terms. For instance, a dentist researching a new dental chair can readily find reviews, technical data, and price lists from multiple manufacturers, enabling them to negotiate better on features and cost.

This heightened information availability translates directly into stronger customer leverage. In 2024, the digital landscape continued to mature, with platforms offering extensive product databases and user-generated reviews becoming standard tools for professional buyers. This transparency means that companies like Dentsply Sirona must be competitive not only in product quality but also in pricing and service, as customers can quickly identify and act on better deals elsewhere.

- Informed Decisions: Customers can easily access technical specifications, clinical studies, and pricing across various dental equipment manufacturers.

- Price Transparency: Online platforms and industry publications provide comparative pricing, reducing information asymmetry.

- Supplier Comparison: Buyers can readily assess alternative suppliers, their product portfolios, and service offerings, increasing their negotiation leverage.

Threat of Backward Integration by Customers

The threat of backward integration by customers, while generally low for Dentsply Sirona, can still exert pressure. Large dental laboratories or Dental Support Organizations (DSOs) could potentially manufacture certain dental products or components in-house, thereby increasing their bargaining power.

This possibility is typically constrained by the significant capital investment and stringent regulatory hurdles associated with manufacturing dental goods. However, emerging technologies like advanced 3D printing are beginning to democratize manufacturing capabilities, potentially altering this landscape over time.

- Threat of Backward Integration: Customers gaining leverage by producing goods internally.

- Key Customers: Large dental labs and DSOs are the primary entities capable of such integration.

- Barriers to Integration: High capital expenditure and regulatory compliance for manufacturing.

- Technological Influence: Advancements like 3D printing may lower entry barriers for customers.

The bargaining power of Dentsply Sirona's customers is moderate, influenced by customer concentration, switching costs, price sensitivity, and information availability. Large dental service organizations (DSOs) and retail chains possess significant leverage due to their purchasing volume, as seen in the ongoing consolidation within the dental industry in 2023 which amplified their collective buying power.

High switching costs, often incurred through integrated digital dentistry platforms, limit customers' ability to easily move to competitors, thereby reducing their leverage. However, price sensitivity remains a key factor, particularly for consumables, with some segments of the global dental market experiencing price pressures in 2024 due to competition and a focus on cost-effectiveness.

The increasing availability of online information and price comparisons empowers dental professionals to negotiate better terms, as demonstrated by the mature digital landscape in 2024 where transparency is paramount. While backward integration by large customers is a potential, albeit low, threat, technological advancements like 3D printing could gradually lower these barriers.

| Factor | Impact on Dentsply Sirona | 2023/2024 Data/Trend |

|---|---|---|

| Customer Concentration | Moderate to High for large DSOs/retailers | Consolidation in dental industry increased DSO purchasing power in 2023. |

| Switching Costs | Moderate, reduced by integrated solutions | Dentsply Sirona's ecosystem approach aims to increase stickiness. |

| Price Sensitivity | Moderate to High for consumables | Price pressures observed in some dental consumables segments in 2024. |

| Information Availability | High, empowering customers | Maturity of online platforms in 2024 increased price and product transparency. |

| Backward Integration Threat | Low | Capital and regulatory hurdles remain significant barriers. |

Same Document Delivered

Dentsply Sirona Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. You're looking at the actual Dentsply Sirona Porter's Five Forces Analysis, detailing the competitive landscape of the dental industry, including threats of new entrants, bargaining power of buyers and suppliers, and the intensity of rivalry among existing firms. Once you complete your purchase, you’ll get instant access to this exact file, ready for your strategic planning.

Rivalry Among Competitors

The dental industry is a crowded marketplace, featuring both massive global corporations and niche specialists. Dentsply Sirona navigates this landscape alongside formidable rivals such as Straumann Group, a leader in implantology and regenerative dentistry, and Henry Schein, a major distributor of dental products and services.

Further intensifying the competitive fray are companies like 3M Company, with its broad portfolio of dental materials and technologies, and Align Technology, the innovator behind Invisalign clear aligners. This diverse array of competitors, each offering distinct but often overlapping product lines and solutions, creates a dynamic and demanding environment.

The global dental market is on a strong upward trajectory, with projections indicating it will reach approximately $121.36 billion by 2034. This robust growth, estimated at a compound annual growth rate of 11.84% from 2025 to 2034, suggests a generally favorable environment for companies like Dentsply Sirona. However, even within a growing market, the intensity of competition can remain high.

This substantial market expansion, while positive, doesn't necessarily eliminate fierce competition. Companies are actively pursuing market share, particularly in rapidly advancing areas such as digital dentistry and 3D printing technologies. This means that despite the overall market growth, the rivalry among players vying for dominance in these high-potential segments is likely to be significant.

Dentsply Sirona stands out by offering a broad range of dental products and dedicating substantial resources to research and development, investing around 4% of its revenue in R&D during 2024. This commitment fuels its ability to innovate and differentiate its offerings in the market.

However, the competitive landscape is intense, with rivals also making significant investments in innovation, especially in cutting-edge fields like artificial intelligence, 3D printing, and digital dental solutions. This constant drive for new technologies means continuous product differentiation is the norm, creating a highly dynamic environment.

Exit Barriers

High exit barriers can trap companies in the dental manufacturing market, even when they're not performing well, which fuels competitive rivalry. These barriers include specialized production equipment and substantial investments in intellectual property, making it difficult and costly for firms to leave.

For instance, companies like Dentsply Sirona have significant investments in highly specialized manufacturing facilities for dental instruments and prosthetics. These assets are not easily repurposed or sold, increasing the cost of exiting the market.

- Specialized Assets: Dental manufacturers often rely on unique, high-precision machinery for producing items like dental implants or CAD/CAM milling equipment, which have limited alternative uses.

- Intellectual Property: Patents and proprietary technologies related to dental materials and procedures represent a significant investment that is difficult to recoup upon exiting.

- Long-Term Contracts: Agreements with distributors or dental practices can obligate companies to continue operations even in less profitable segments.

- Employee Severance Costs: Significant costs associated with laying off a specialized workforce can also deter a swift exit.

Switching Costs for Customers

Low switching costs for customers significantly fuel competitive rivalry in the dental industry. When it's easy and inexpensive for dental practices to switch from one supplier to another, the pressure on Dentsply Sirona to retain its customer base intensifies. This ease of transition means competitors can more readily attract Dentsply Sirona's clients, leading to a more aggressive marketplace.

Dentsply Sirona actively works to create integrated workflows and digital solutions, aiming to increase customer stickiness. However, if the perceived cost or effort for a dental practice to adopt a competitor's system is minimal, the underlying rivalry remains potent. For instance, in 2024, the dental equipment market saw continued innovation in digital dentistry, making it easier for practices to integrate new technologies, potentially lowering switching barriers.

- Low Switching Costs: Customers can easily switch between dental suppliers with minimal financial or operational disruption.

- Impact on Rivalry: This ease of switching directly increases competitive intensity as customers are less bound to existing relationships.

- Dentsply Sirona's Strategy: The company focuses on integrated workflows to build loyalty, but the low switching costs challenge this.

- Market Dynamics: In 2024, the rapid advancement of digital dental solutions further facilitated easier transitions for practices, underscoring the persistent threat of customer churn due to low switching costs.

Competitive rivalry is a significant force within the dental industry, impacting Dentsply Sirona's market position. The presence of major players like Straumann Group and Henry Schein, alongside innovators such as 3M and Align Technology, creates a dynamic and often aggressive marketplace. Even with the global dental market projected to reach $121.36 billion by 2034, companies are intensely vying for market share, particularly in emerging digital dentistry sectors.

Dentsply Sirona's investment of around 4% of its revenue in R&D in 2024 highlights the industry's focus on innovation to differentiate offerings. However, rivals are also investing heavily in advanced technologies, intensifying the need for continuous product development. This high level of competition is further exacerbated by substantial exit barriers, such as specialized equipment and intellectual property, which can keep less successful firms engaged in the market, thereby sustaining rivalry.

The low switching costs for customers in the dental sector directly fuel this intense rivalry. Dental practices can readily transition between suppliers, putting pressure on Dentsply Sirona to maintain customer loyalty. The rapid advancements in digital dentistry in 2024 have further eased these transitions, making it easier for practices to adopt new technologies and potentially switch providers, underscoring the persistent threat of customer churn.

| Competitor | Key Focus Areas | R&D Investment Example (Approximate) |

| Straumann Group | Implantology, Regenerative Dentistry | Undisclosed, but significant investment in R&D |

| Henry Schein | Dental Product Distribution, Services | Undisclosed, focus on supply chain and digital solutions |

| 3M Company | Dental Materials, Technologies | Part of broader 3M R&D budget, significant dental segment investment |

| Align Technology | Clear Aligners (Invisalign) | Significant investment in digital treatment planning and manufacturing |

SSubstitutes Threaten

The threat of substitutes for Dentsply Sirona's offerings is amplified by alternative dental care providers and methods that can lessen the reliance on traditional procedures and products. This includes the rise of teledentistry, which allows for remote consultations and diagnostics, potentially reducing the need for in-office visits for certain issues.

Furthermore, the increasing availability of advanced at-home oral care solutions, such as specialized electric toothbrushes and interdental cleaners, can also act as substitutes by improving preventative care and potentially delaying or reducing the need for professional interventions. By 2024, the global teledentistry market was projected to reach $2.1 billion, demonstrating significant growth in this substitute area.

The rise of direct-to-consumer dental aligners and at-home whitening kits presents a significant threat. These DIY solutions, while varying in quality and safety, appeal to budget-conscious consumers, potentially siphoning off demand from professional dental products and services.

The growing emphasis on preventive oral health is a significant threat. As consumers become more proactive with daily hygiene, using advanced tools like smart toothbrushes, the need for more complex dental procedures, and by extension, Dentsply Sirona's advanced equipment and consumables, could diminish. For instance, a 2024 report indicated a 15% year-over-year increase in sales of premium electric toothbrushes, suggesting a consumer shift towards preventative care.

Advancements in Non-Dental Medical Treatments

Advancements in non-dental medical treatments present a subtle but growing threat of substitutes for Dentsply Sirona. Pharmaceutical innovations targeting oral conditions, like advanced anti-inflammatories or regenerative therapies, could lessen the need for certain dental procedures. For instance, breakthroughs in systemic disease management that positively impact oral health might reduce the demand for restorative dental work.

While not a direct replacement for most dental services, these medical shifts can erode the market for specific dental products and treatments. Consider the potential impact of novel drug delivery systems that address periodontal disease without surgical intervention, a market segment Dentsply Sirona serves. The long-term implications of these interdisciplinary medical advancements warrant careful monitoring as they could influence patient choices and healthcare spending priorities.

- Pharmaceutical Alternatives: Development of drugs that can treat or prevent conditions like gingivitis or early-stage cavities, reducing the need for fillings or scaling.

- Systemic Health Focus: Medical treatments for conditions like diabetes or autoimmune diseases that improve overall oral health, potentially decreasing reliance on dental interventions for related issues.

- Regenerative Medicine: Emerging non-dental therapies for tissue regeneration could eventually offer alternatives to bone grafts or gum surgery in some restorative dental cases.

Changing Consumer Preferences and Affordability

Consumer preferences are indeed shifting, with a growing interest in less invasive dental options and more budget-friendly alternatives. This is particularly noticeable in elective cosmetic treatments. For example, the global dental consumables market, which includes many products Dentsply Sirona offers, saw significant growth, but a portion of this growth is attributed to more accessible, albeit less technologically advanced, solutions.

If patients increasingly choose simpler, less expensive treatments over complex procedures that rely on Dentsply Sirona's advanced technologies, demand for their higher-end products could be impacted. This trend is amplified by economic pressures, where affordability becomes a primary driver for patient decisions. In 2024, many consumers are more cost-conscious than in previous years, leading them to explore a wider range of treatment possibilities.

- Shifting Patient Priorities: A move towards preventative care and minimally invasive treatments can reduce the need for advanced restorative or surgical equipment.

- Affordability Concerns: Economic downturns or rising healthcare costs can push patients towards more basic, lower-cost dental solutions, bypassing premium offerings.

- Technological Accessibility: The availability of competent, lower-cost alternatives in emerging markets or from competitors can dilute the perceived value of Dentsply Sirona's premium technology.

- Impact on Elective Procedures: Treatments like teeth whitening or simple cosmetic enhancements, which may not require Dentsply Sirona's specialized equipment, can see increased adoption as patients seek more affordable aesthetic improvements.

The threat of substitutes for Dentsply Sirona is significant, driven by advancements in teledentistry and at-home oral care solutions. These alternatives offer convenience and cost savings, potentially reducing patient reliance on traditional dental practices and products. For instance, the global teledentistry market was projected to reach $2.1 billion in 2024, highlighting the growing adoption of these substitute services.

Direct-to-consumer aligners and whitening kits also pose a threat by appealing to budget-conscious consumers seeking more affordable cosmetic treatments. Furthermore, a growing emphasis on preventative oral health, supported by advanced at-home tools like smart toothbrushes, could diminish the demand for complex dental procedures and the specialized equipment Dentsply Sirona provides. Sales of premium electric toothbrushes saw a 15% year-over-year increase in 2024, indicating this consumer shift.

| Substitute Category | Examples | Impact on Dentsply Sirona | 2024 Market Indicator |

|---|---|---|---|

| Teledentistry | Remote consultations, diagnostics | Reduces need for in-office visits | Market projected at $2.1 billion |

| At-Home Oral Care | Electric toothbrushes, aligners, whitening kits | Improves preventative care, offers cost-effective cosmetic options | 15% YoY growth in premium electric toothbrush sales |

| Pharmaceutical/Medical Innovations | Advanced anti-inflammatories, regenerative therapies | May lessen need for certain dental procedures | Emerging therapies for periodontal disease |

Entrants Threaten

Entering the professional dental products and technologies market demands significant upfront capital. Companies need to invest heavily in research and development to create innovative solutions, establish state-of-the-art manufacturing facilities, and build robust global distribution networks. For instance, developing a new dental implant system can cost tens of millions of dollars, encompassing extensive clinical trials and regulatory approvals.

The dental industry is a heavily regulated space, demanding rigorous approvals and adherence to numerous health and safety standards. For instance, obtaining FDA clearances for new dental devices can be a lengthy and costly process, significantly deterring potential new entrants. This complex regulatory environment acts as a substantial barrier to entry.

Dentsply Sirona, as the world's largest manufacturer in the dental industry, leverages an exceptionally strong brand reputation built over decades. This established trust and loyalty among dental professionals is a significant barrier to new entrants. For instance, in 2023, Dentsply Sirona reported net sales of $4.1 billion, a testament to its market penetration and the enduring relationships it has cultivated.

New companies entering the market would face the daunting task of replicating this deep-seated trust and customer loyalty. Building a comparable brand image and securing consistent business from dentists and dental labs requires substantial time, marketing investment, and a proven track record of product quality and reliability, which Dentsply Sirona already possesses.

Intellectual Property and Patents

Dentsply Sirona's robust portfolio of dental and oral health products is heavily safeguarded by patents and other intellectual property. This intellectual property acts as a significant barrier to entry, making it difficult for new companies to develop competing technologies without infringing on Dentsply Sirona's existing patents.

For instance, Dentsply Sirona holds numerous patents across various product categories, including dental implants, restorative materials, and digital dentistry solutions. These patents often cover unique manufacturing processes, material compositions, and innovative design features, requiring substantial investment in research and development to circumvent.

- Patent Protection: Dentsply Sirona's extensive patent portfolio covers a wide range of its core products, including CAD/CAM restorations and implant systems.

- R&D Investment: The company's commitment to innovation is reflected in its substantial research and development expenditures, which are crucial for maintaining its technological edge and patent protection. In 2023, Dentsply Sirona reported R&D expenses of approximately $235 million.

- Barriers to Entry: The cost and time required to develop novel, non-infringing technologies represent a significant hurdle for potential new competitors in the dental market.

Access to Distribution Channels

Dentsply Sirona benefits from its extensive global distribution network, a significant barrier for potential new entrants. This established infrastructure provides access to dentists, specialists, dental laboratories, and authorized retailers worldwide, a feat that is difficult and costly to replicate.

The sheer scale and depth of Dentsply Sirona's distribution channels are crucial for effective market penetration and widespread product availability. For instance, in 2023, the company reported a net sales revenue of $4.05 billion, underscoring the reach and efficiency of its sales and distribution operations.

- Established Global Reach: Dentsply Sirona's distribution network spans numerous countries, ensuring broad market access.

- Customer Relationships: Long-standing relationships with dental professionals and labs create loyalty and preferred access.

- Logistical Expertise: Managing a complex global supply chain efficiently is a core competency that new players would find challenging to match.

The threat of new entrants in the professional dental products market is generally considered moderate, primarily due to substantial capital requirements and the need for extensive R&D to develop innovative, compliant products. For example, developing a new dental implant system can cost tens of millions of dollars, encompassing clinical trials and regulatory approvals.

The industry's rigorous regulatory landscape, including lengthy FDA clearance processes for new devices, further acts as a significant deterrent. Dentsply Sirona's strong brand reputation, built over decades and supported by $4.1 billion in net sales in 2023, creates deep-seated trust among dental professionals, making it hard for newcomers to gain traction.

Furthermore, Dentsply Sirona's extensive patent portfolio, covering areas like CAD/CAM restorations and implant systems, alongside its $235 million R&D investment in 2023, presents a technological barrier. Replicating its established global distribution network, which facilitated $4.05 billion in net sales in 2023, also demands considerable investment and logistical expertise.

| Barrier Type | Description | Impact on New Entrants | Dentsply Sirona's Advantage |

|---|---|---|---|

| Capital Requirements | High R&D, manufacturing, and distribution setup costs. | Significant hurdle; requires substantial funding. | Established infrastructure and scale. |

| Regulation & Compliance | Lengthy and costly approval processes (e.g., FDA). | Time-consuming and expensive to navigate. | Expertise and experience in compliance. |

| Brand Loyalty & Reputation | Trust built over decades with dental professionals. | Difficult to overcome existing customer relationships. | Strong market presence and proven track record. |

| Intellectual Property | Extensive patents on core technologies and products. | Requires significant investment to develop non-infringing alternatives. | Proprietary technologies and innovation pipeline. |

| Distribution Network | Established global reach and logistical capabilities. | Challenging and costly to replicate market access. | Widespread availability and efficient supply chain. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Dentsply Sirona is built upon a foundation of verified data, including annual reports, industry-specific market research from firms like Statista and IBISWorld, and regulatory filings. This comprehensive approach ensures a robust understanding of competitive dynamics.