Denny's SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denny's Bundle

Denny's leverages its strong brand recognition and 24/7 accessibility as key strengths, but faces challenges from evolving consumer preferences and intense competition in the casual dining sector. Understanding these dynamics is crucial for navigating the market.

Want the full story behind Denny's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Denny's key strength lies in its 24/7 operational model across many of its locations, providing a significant advantage in customer accessibility. This constant availability caters to a wide demographic, from overnight workers to early morning commuters, ensuring a consistent revenue stream regardless of typical dining hours.

The company's diverse menu is another major strength, offering a comprehensive selection of breakfast, lunch, and dinner options at any time of day. This broad appeal helps Denny's capture a larger share of the market by satisfying varied customer tastes and cravings, a strategy that has proven resilient. For instance, in the fiscal year 2023, Denny's reported total revenue of $1.75 billion, demonstrating the success of its widespread appeal and operational model.

Denny's boasts significant brand recognition, a valuable asset cultivated since its founding in 1953, making it a household name across America's extensive full-service restaurant landscape.

The company's strategic reliance on a franchise model, with 1,475 franchised and licensed locations compared to 82 company-owned as of March 2025, facilitates rapid expansion and market penetration while minimizing direct capital investment for Denny's Corporation.

Denny's has solidified its standing as a value leader within the family dining sector, attracting a wide range of customers seeking budget-friendly meals. This strategic advantage is particularly potent in the current economic climate, where consumers are increasingly prioritizing affordability.

The company's successful reinvigoration of its value menus, notably the '$2-$4-$6-$8' initiative, has significantly reinforced this perception and demonstrably boosted customer visits. For instance, in the first quarter of 2024, Denny's reported a 3.7% increase in same-store sales, a performance partly attributed to the appeal of these value-driven offerings.

Keke's Breakfast Cafe Growth and Diversification

The acquisition and subsequent expansion of Keke's Breakfast Cafe represent a significant growth engine for Denny's Corporation, effectively diversifying its brand offerings. This strategic move taps into the robust breakfast and brunch market, a segment demonstrating consistent consumer demand.

Keke's has shown impressive performance, with domestic system-wide same-restaurant sales climbing by 3.9% in the first quarter of 2025. The brand's expansion is accelerating, marked by new cafe openings in previously untapped states, indicating strong market reception and operational scalability.

- Brand Diversification: Keke's Breakfast Cafe acquisition broadens Denny's Corporation's market reach beyond its traditional diner model.

- Sales Growth: Keke's achieved a 3.9% increase in domestic system-wide same-restaurant sales in Q1 2025, showcasing strong customer traffic and spending.

- Geographic Expansion: The brand is actively entering new states, with a record number of new cafe openings in the 2024-2025 period, signaling successful market penetration strategies.

Strategic Remodel Program

Denny's Strategic Remodel Program, particularly its Diner 2.0 initiative, represents a significant strength. The company actively invested in modernizing its restaurant footprint, completing 23 remodels in 2024 alone. This program is designed to enhance the guest experience and drive improved financial performance.

The impact of these remodels is already evident, with testing showing a notable uplift in both sales and traffic. This suggests the program is effectively resonating with customers and translating into tangible business gains. Denny's is strategically focusing on updating its older locations to remain competitive and appealing.

- Strategic Remodel Program: Denny's completed 23 Diner 2.0 remodels in 2024.

- Sales Uplift: Remodeled locations have shown a notable increase in sales and traffic during testing phases.

- Guest Experience Enhancement: The program aims to modernize restaurants, improving the overall customer experience.

- Performance Improvement: The remodels are expected to boost the financial performance of individual locations.

Denny's commitment to value, exemplified by initiatives like the '$2-$4-$6-$8' menu, has proven highly effective in attracting budget-conscious consumers. This strategy directly contributed to a 3.7% increase in same-store sales in Q1 2024, highlighting its impact on customer traffic and revenue. The brand's strong value proposition is a key differentiator in the competitive family dining market.

The acquisition of Keke's Breakfast Cafe is a significant strategic move, diversifying Denny's portfolio into the popular breakfast and brunch segment. Keke's demonstrated strong performance with a 3.9% rise in domestic system-wide same-restaurant sales in Q1 2025 and is expanding into new states, indicating successful market penetration and scalability.

Denny's ongoing Diner 2.0 remodel program, which saw 23 locations updated in 2024, is a core strength. These modernizations are designed to elevate the guest experience and have shown promising results in testing, with notable uplifts in sales and traffic, reinforcing the brand's appeal and competitiveness.

The company's 24/7 operational model across many locations ensures constant accessibility for a broad customer base, supporting consistent revenue generation. Coupled with a diverse menu that caters to all dayparts, Denny's effectively captures a wide market share. This operational resilience is a cornerstone of its sustained performance, as evidenced by its $1.75 billion in total revenue for fiscal year 2023.

| Strength | Description | Supporting Data |

|---|---|---|

| 24/7 Operations | Constant accessibility for diverse customer segments. | Ensures consistent revenue regardless of dining hours. |

| Diverse Menu | Offers breakfast, lunch, and dinner options anytime. | Appeals to varied tastes, capturing larger market share. |

| Brand Recognition | Established name since 1953. | Household name in the full-service restaurant sector. |

| Franchise Model | Facilitates rapid expansion with minimal capital investment. | 1,475 franchised locations vs. 82 company-owned (as of March 2025). |

| Value Leadership | Focus on affordability attracts budget-conscious consumers. | Reinforced by initiatives like the '$2-$4-$6-$8' menu. |

| Keke's Acquisition | Diversifies into the breakfast/brunch market. | Keke's Q1 2025 sales up 3.9%; expanding into new states. |

| Diner 2.0 Remodels | Modernizes restaurant footprint to enhance guest experience. | 23 remodels completed in 2024; testing shows sales/traffic uplift. |

What is included in the product

Delivers a strategic overview of Denny's’s internal and external business factors, highlighting its brand recognition and value proposition against market challenges and evolving consumer preferences.

Offers a clear, actionable framework to address Denny's operational challenges and market positioning.

Weaknesses

The Denny's brand is facing headwinds, as evidenced by a 3.0% decrease in domestic system-wide same-restaurant sales during the first quarter of 2025. This downturn indicates persistent difficulties in drawing and keeping customers to its primary brand, likely influenced by broader economic pressures affecting consumer spending habits.

Denny's has been actively closing underperforming locations, with 88 restaurants shut down in 2024. This strategic move is projected to continue, with an estimated 70 to 90 more closures anticipated for 2025.

These closures are largely driven by factors such as expiring lease agreements and the need to address aging restaurant infrastructure. While this streamlines the company's operations, it also represents a reduction in its overall physical presence in the market.

Denny's acknowledged that early 2025 brought considerable consumer headwinds, directly affecting its financial performance. Persistent inflation, for instance, has demonstrably dampened consumer confidence and reduced the willingness to spend on non-essential items like dining out, thereby impacting Denny's customer traffic and overall sales volume.

Historical Dependence on Breakfast Items

Denny's historical success is deeply rooted in its breakfast menu, which, while a core strength, also presents a significant weakness. The brand has consistently relied on morning meals to drive a substantial portion of its revenue. For instance, in 2023, breakfast items continued to be a primary draw, though the company has been actively working to boost lunch and dinner sales. This over-reliance means that if Denny's cannot effectively expand its appeal and capture a larger share of diners during lunch, dinner, and even late-night hours, it limits its overall growth potential and market penetration.

This dependence can be problematic as consumer dining habits evolve. While Denny's has made efforts to diversify its offerings and promote its lunch and dinner menus, the perception of being primarily a breakfast destination can hinder its ability to attract customers for other dayparts. This creates a vulnerability, especially in a competitive casual dining landscape where consumers seek variety and specific daypart-focused experiences.

- Revenue Concentration: A significant portion of Denny's revenue is historically tied to breakfast sales, potentially limiting growth in other dayparts.

- Market Perception: The brand's strong association with breakfast might deter customers seeking lunch or dinner options.

- Competitive Disadvantage: Competitors focusing on specific dayparts may capture market share that Denny's struggles to penetrate due to its breakfast-centric image.

- Limited Occasion Capture: Inability to fully capitalize on lunch, dinner, and late-night dining occasions restricts overall customer engagement and sales opportunities.

Inconsistent Brand Image and Aging Locations

Denny's faces a challenge with its brand image, as an internal review highlighted significant inconsistencies in how its restaurants look across different regions. Many older locations, in particular, detract from a unified and modern brand perception.

Revitalizing these aging facilities to create a consistent, appealing aesthetic demands considerable financial outlay and sustained commitment. For instance, Denny's reported capital expenditures of $275 million in fiscal year 2023, a portion of which would be allocated to remodels and upgrades, underscoring the scale of investment needed for such an undertaking.

- Inconsistent Unit Appearance: A significant variation in store aesthetics across different markets.

- Aging Infrastructure: Many older locations contribute to a dated and less appealing brand image.

- Capital Investment Required: Substantial financial resources are necessary to update and standardize locations.

- Ongoing Maintenance Needs: Continuous effort and investment are crucial to maintain a uniform, modern look.

Denny's faces a significant challenge with its brand perception, as many of its locations, particularly older ones, present an inconsistent and dated appearance. This lack of uniformity across its nearly 1,300 restaurants can dilute brand appeal and create a less inviting customer experience.

The company acknowledges this issue, with efforts underway to modernize its image. However, the scale of the problem requires substantial capital investment. For instance, while Denny's invested $275 million in capital expenditures in fiscal year 2023, a significant portion of this must be dedicated to remodels and upgrades to address the aging infrastructure and create a more cohesive brand aesthetic.

This inconsistency in unit appearance is a key weakness, potentially impacting customer acquisition and retention, especially when competing against newer or more consistently branded casual dining establishments.

| Weakness | Description | Impact |

|---|---|---|

| Inconsistent Unit Appearance | Significant variation in store aesthetics across different markets and age of locations. | Detracts from a unified and modern brand perception, potentially alienating customers. |

| Aging Infrastructure | Many older locations contribute to a dated and less appealing brand image. | Requires substantial financial outlay for revitalization, impacting profitability and brand modernization efforts. |

| Capital Investment Required | Substantial financial resources are necessary to update and standardize locations to meet modern consumer expectations. | Can strain financial resources, potentially delaying other strategic initiatives or growth opportunities. |

What You See Is What You Get

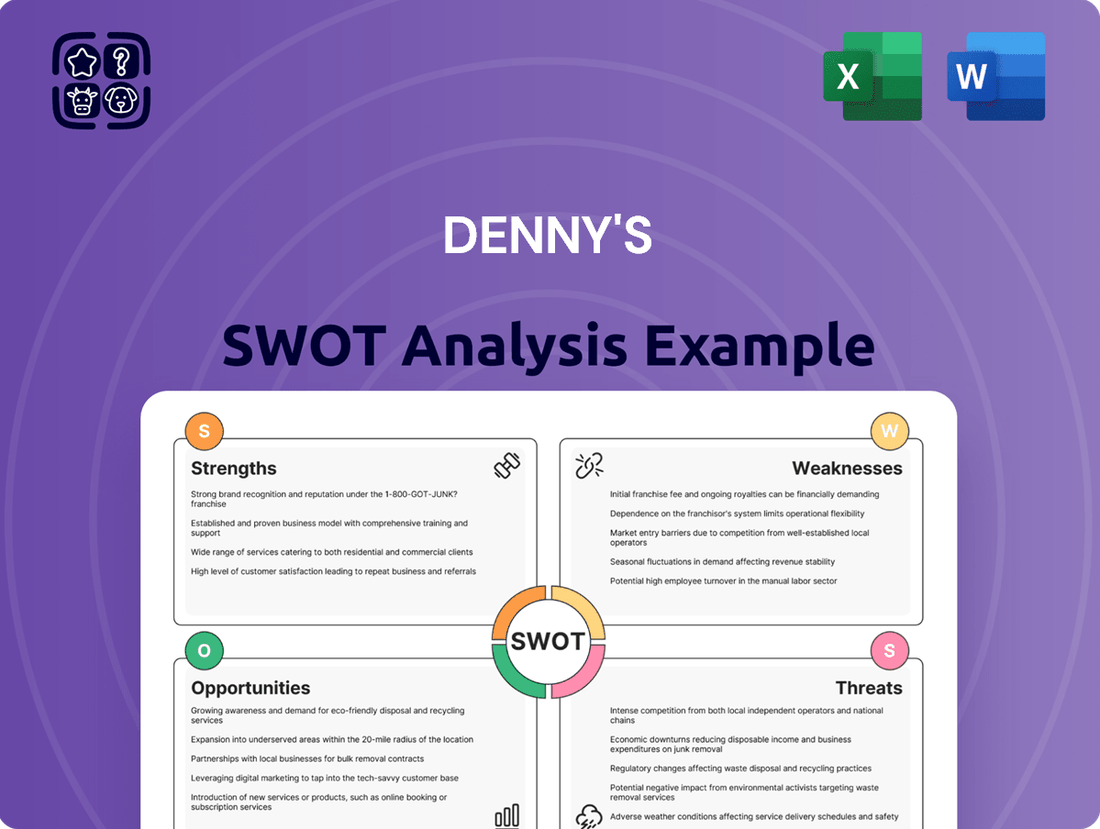

Denny's SWOT Analysis

This is the same Denny's SWOT analysis document included in your download. The full content is unlocked after payment, providing a comprehensive overview of their Strengths, Weaknesses, Opportunities, and Threats.

Opportunities

The continued expansion of Keke's Breakfast Cafe presents a compelling growth avenue for Denny's Corporation. By strategically opening new locations, Denny's aims to solidify its presence and capture a larger share of the lucrative breakfast and brunch market. This expansion leverages Keke's proven track record of positive sales growth, a key indicator of its market appeal and operational success.

Denny's ongoing Diner 2.0 remodel program presents a significant growth opportunity. Stores that have undergone this renovation have seen impressive results, with a 6.4% increase in sales and a 6.5% boost in traffic during testing phases. This clearly indicates the program's success in revitalizing locations and attracting more customers.

By continuing to allocate resources towards these strategic remodels, Denny's can further enhance its existing store portfolio. This investment not only improves the physical appearance and customer experience but also directly translates into incremental revenue growth, making it a key driver for the brand's expansion and profitability.

Denny's has a significant opportunity to build on its digital and off-premise strengths. With off-premise sales, encompassing delivery and virtual brands, already representing about 20% of their total revenue in 2024, there's a clear path to further optimize online ordering systems.

Expanding the virtual brand portfolio is another avenue for growth, directly addressing consumer demand for convenient takeout and delivery options. This strategic focus on digital channels and off-premise solutions is crucial for adapting to changing dining habits and capturing a larger share of the market.

Menu Diversification to Attract New Demographics

Denny's has a significant opportunity to diversify its menu, especially by incorporating plant-based options. This strategy is designed to attract younger consumers, like Millennials and Gen Z, who show a strong preference for these types of foods.

Market research consistently highlights this trend, with a growing demand for sustainable and alternative protein sources. Denny's can leverage this by introducing innovative plant-based dishes that align with current consumer tastes and dietary preferences.

By strategically expanding its offerings to include these popular choices, Denny's could see a tangible increase in its customer base and, consequently, its revenue. Analysts project that such targeted menu innovations could boost overall revenue by an estimated 6-8% in the coming fiscal year.

- Targeted Menu Innovation: Focus on plant-based proteins and globally inspired flavors to attract younger demographics.

- Market Research Validation: Consumer surveys indicate a strong and growing demand for diverse dietary options beyond traditional American diner fare.

- Revenue Growth Potential: Successful menu diversification could lead to an estimated 6-8% increase in overall revenue.

- Demographic Expansion: Attracting Millennials and Gen Z can broaden Denny's customer base and ensure long-term market relevance.

Launch of New Loyalty Program

Denny's is set to launch a new loyalty CRM program in the latter half of 2025. This strategic move offers a significant opportunity to cultivate deeper customer loyalty and encourage more frequent visits. By incentivizing repeat business, Denny's aims to enhance customer lifetime value.

The new program will also serve as a crucial tool for data collection, enabling personalized marketing campaigns and a more tailored customer experience. This data-driven approach is expected to boost overall customer engagement and satisfaction.

- Enhanced Customer Retention: Loyalty programs are proven to increase customer retention rates. For instance, a 2024 report by LoyaltyLion indicated that companies with robust loyalty programs saw an average increase of 15% in repeat purchase frequency.

- Personalized Marketing: The CRM aspect allows Denny's to gather valuable insights into customer preferences, leading to more effective and targeted promotions.

- Competitive Advantage: In a competitive casual dining market, a well-executed loyalty program can differentiate Denny's and attract new customers seeking rewards.

- Data-Driven Insights: The collected data can inform menu development, operational improvements, and marketing strategies, ensuring they align with customer desires.

Denny's has a significant opportunity to leverage its digital and off-premise capabilities further. In 2024, off-premise sales, including delivery and virtual brands, accounted for approximately 20% of total revenue, highlighting a strong foundation for expansion.

Expanding the virtual brand portfolio directly addresses the growing consumer demand for convenient takeout and delivery. This strategic focus on digital channels and off-premise solutions is essential for adapting to evolving dining habits and capturing a larger market share.

Denny's can also capitalize on menu diversification, particularly by introducing plant-based options. This move targets younger demographics like Millennials and Gen Z, who increasingly favor such choices, with market research showing a consistent rise in demand for sustainable and alternative proteins.

The upcoming launch of a new loyalty CRM program in late 2025 presents a prime opportunity to foster deeper customer loyalty and encourage repeat visits, thereby enhancing customer lifetime value. This program will also be instrumental in collecting data for personalized marketing efforts.

Threats

Denny's faces formidable competition from a broad spectrum of dining options, including established family dining rivals, the rapidly growing fast-casual segment, and ubiquitous quick-service restaurants. This crowded market demands constant adaptation and strategic investment in customer engagement. For instance, the U.S. restaurant industry saw over 1 million establishments in 2023, highlighting the sheer density of players Denny's must contend with.

Denny's continues to grapple with the persistent challenge of escalating labor and commodity expenses, directly impacting its operating margins. For instance, the company noted in its Q1 2024 earnings call that higher egg prices, a key ingredient, had a noticeable negative effect on its restaurant operating margins.

Furthermore, ongoing labor inflation, including the impact of minimum wage adjustments across various states, remains a significant concern for Denny's profitability. This trend is expected to continue influencing the company's cost structure throughout 2024 and into 2025.

Consumer preferences are definitely changing, and this is a big challenge for restaurants like Denny's. People are increasingly choosing fast-casual and quick-service options over the traditional sit-down family dining experience. This shift means less foot traffic for places that rely on that model.

For instance, the family dining segment has seen a general decline in customer visits. Denny's needs to find ways to stay relevant and appealing in this evolving market. This could involve adapting their menu, service style, or even their overall dining concept to better match what modern consumers are looking for.

Economic Uncertainties and Reduced Discretionary Spending

Ongoing macroeconomic uncertainties and fluctuating consumer confidence present a significant threat to discretionary spending, directly impacting restaurants like Denny's. Inflationary pressures, a key driver of this uncertainty, can lead consumers to cut back on non-essential purchases such as dining out. This reduction in frequency of restaurant visits can directly affect Denny's sales volume and overall profitability.

For instance, the U.S. Consumer Price Index (CPI) saw a notable increase in 2024, with some months reporting year-over-year gains exceeding 3%. This persistent inflation erodes purchasing power, forcing households to prioritize essential goods and services over dining out. Consequently, Denny's, as a casual dining establishment, is particularly vulnerable to shifts in consumer sentiment and disposable income.

- Inflationary pressures: Rising costs for food, labor, and operations can squeeze profit margins if not fully passed on to consumers.

- Reduced dining frequency: Consumers may opt for fewer meals out, choosing home-cooked meals or less expensive alternatives.

- Consumer confidence: A dip in consumer confidence, often linked to economic instability, directly correlates with decreased spending on discretionary items like restaurant meals.

Negative Perception from Extensive Closures

Denny's planned closure of 170-180 locations between 2024 and 2025, while a strategic move to streamline operations and improve profitability, could unfortunately create a negative public perception. This significant number of closures might lead customers and investors to question the brand's stability and long-term growth prospects, potentially impacting brand loyalty and investor confidence.

This perception of instability could be amplified if the closures are not clearly communicated as part of a larger, well-defined turnaround strategy. For instance, if the market interprets these closures solely as a sign of financial distress rather than a proactive measure for future health, it could deter potential new customers and even alienate existing ones who see their local Denny's disappear.

The brand's image could suffer if the narrative surrounding these closures focuses on widespread issues rather than targeted improvements. Denny's reported a net loss of $36.1 million in 2023, and while the closures aim to address this, the optics of shutting down so many outlets could be challenging to manage without a robust public relations effort.

The restaurant industry is intensely competitive, with Denny's facing pressure from family dining, fast-casual, and quick-service rivals. Rising costs for labor and commodities, such as eggs, continue to impact profit margins. Shifting consumer preferences towards faster, more casual dining experiences also pose a significant challenge to Denny's traditional model.

Macroeconomic uncertainties and inflation can reduce consumer discretionary spending, leading to fewer restaurant visits. The planned closure of 170-180 Denny's locations between 2024 and 2025, while strategic, could negatively impact public perception of the brand's stability.

| Threat Category | Specific Threat | Impact on Denny's | Data/Example |

|---|---|---|---|

| Competition | Intense rivalry across dining segments | Market share erosion, pressure on pricing | U.S. restaurant count exceeded 1 million in 2023 |

| Cost Pressures | Rising labor and commodity expenses | Reduced operating margins | Higher egg prices impacted Q1 2024 margins; ongoing labor inflation |

| Changing Consumer Behavior | Shift to fast-casual/quick-service | Decreased foot traffic for traditional sit-down dining | General decline in customer visits for family dining segment |

| Economic Uncertainty | Inflationary pressures, reduced consumer confidence | Lower discretionary spending, fewer dining occasions | U.S. CPI increased, with some months over 3% year-over-year in 2024 |

| Brand Perception | Planned store closures (170-180 locations, 2024-2025) | Potential damage to brand stability image, investor confidence | Net loss of $36.1 million in 2023 |

SWOT Analysis Data Sources

This SWOT analysis for Denny's is built upon a foundation of credible data, including publicly available financial filings, comprehensive industry market research, and expert commentary from seasoned analysts. These sources provide a robust understanding of the company's operational performance and its position within the competitive restaurant landscape.