Denny's Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denny's Bundle

Denny's faces moderate bargaining power from buyers due to the availability of casual dining alternatives, but this is balanced by its established brand and value proposition. The threat of new entrants is significant, as the barrier to entry in the casual dining sector is relatively low, requiring substantial investment in real estate and marketing to compete effectively.

The complete report reveals the real forces shaping Denny's’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Denny's dependence on food commodities like eggs, beef, and produce makes it vulnerable to price swings. For instance, the U.S. Department of Agriculture reported that the average price for a dozen large eggs saw significant volatility throughout 2023 and early 2024, impacting restaurant operational costs.

These price fluctuations, driven by factors such as weather patterns affecting crop yields or avian flu outbreaks impacting poultry, directly influence Denny's cost of goods sold. Unexpected spikes in commodity prices can squeeze profit margins, as the company may struggle to pass these increases onto consumers without affecting demand.

The fragmented nature of many agricultural markets grants suppliers considerable bargaining power. When a few key suppliers control a significant portion of a necessary commodity, they can exert pressure on major buyers like Denny's, especially during periods of tight supply.

While the restaurant industry has numerous kitchen equipment suppliers, Denny's may face concentrated bargaining power from vendors offering highly specialized or proprietary machinery. If Denny's relies on specific, custom-built equipment for its operations, these niche suppliers hold significant leverage. For instance, a 2024 industry report indicated that the average cost for specialized commercial kitchen equipment can range from $5,000 to $50,000 per unit, and switching to a different supplier for these critical items could incur substantial costs for Denny's due to integration and training needs across its franchise network.

The availability and cost of restaurant staff, from cooks to servers, directly affect Denny's operating costs. In 2024, the restaurant industry continued to grapple with labor shortages, with the U.S. Bureau of Labor Statistics reporting that leisure and hospitality employment remained below pre-pandemic levels. This scarcity empowers potential employees, who can negotiate for higher wages and improved benefits, potentially squeezing Denny's profit margins if not offset by operational efficiencies or strategic price adjustments.

Importance of consistent quality and delivery

Denny's brand promise hinges on delivering a consistent dining experience, meaning the quality and availability of ingredients are paramount. Suppliers who can reliably provide high-quality food items without interruption are essential for Denny's operations, especially given its 24/7 service model.

This reliance on dependable suppliers grants them significant bargaining power. Denny's faces substantial risks, including customer dissatisfaction and lost revenue, if ingredient quality falters or deliveries are delayed. Consequently, switching suppliers is not a simple or risk-free decision.

- Supplier Reliability: Consistent quality and on-time delivery are non-negotiable for Denny's, empowering suppliers who meet these demands.

- Operational Impact: Disruptions in supply can directly affect Denny's ability to operate 24/7 and maintain its brand promise.

- Switching Costs: The effort and potential negative impact of finding and onboarding new suppliers limit Denny's ability to pressure existing ones.

Contractual agreements and volume purchasing

Denny's, operating as a substantial restaurant chain, likely leverages its scale through long-term contractual agreements and significant volume purchasing with its core suppliers. This strategy is designed to lock in advantageous pricing and ensure a consistent supply of necessary ingredients and materials. However, the bargaining power of these suppliers can fluctuate. If Denny's contracts are relatively short-term or if a particular supplier offers a unique or difficult-to-substitute product, that supplier's leverage may be amplified.

Conversely, Denny's considerable purchasing volume inherently grants it a degree of influence over smaller, less diversified suppliers. This can translate into more favorable terms and conditions. For instance, in 2024, the food service industry continued to grapple with supply chain volatility. Denny's, like many large operators, would have been actively negotiating terms to mitigate these pressures. The ability to commit to large, predictable orders can be a powerful negotiating tool, especially when suppliers are seeking stable demand.

- Contractual Strength: Denny's ability to secure long-term contracts with suppliers can significantly reduce supplier power by guaranteeing demand and allowing for price negotiation.

- Volume Purchasing Power: As a large chain, Denny's order volumes provide substantial leverage, potentially leading to discounts and preferential treatment from suppliers.

- Supplier Dependence: The power dynamic shifts if suppliers offer unique products or if Denny's is heavily reliant on a few key providers, increasing their bargaining position.

- Market Conditions: In 2024, ongoing supply chain challenges meant that the ability of large buyers like Denny's to commit to volume purchases was a critical factor in managing supplier relationships and costs.

Denny's faces moderate bargaining power from its suppliers due to its reliance on essential commodities like eggs, beef, and produce, which are subject to price volatility and supply chain disruptions. For example, the U.S. Bureau of Labor Statistics reported that the average price of food away from home increased by 4.2% in 2023, impacting restaurant operational costs and potentially limiting Denny's ability to absorb supplier price hikes.

While Denny's significant purchasing volume provides some leverage, the fragmented nature of agricultural markets and the specialized nature of some equipment suppliers can empower those entities. This dynamic is further influenced by labor market conditions, with shortages in 2024 giving workers more negotiating power, indirectly affecting the cost of services and materials sourced by Denny's.

| Factor | Impact on Denny's | Supplier Leverage |

|---|---|---|

| Commodity Price Volatility | Increased cost of goods sold, potential margin squeeze | Moderate to High (depending on specific commodity and market conditions) |

| Supplier Reliability | Essential for brand promise, limits switching flexibility | High (for reliable suppliers) |

| Specialized Equipment Needs | High switching costs, reliance on niche vendors | High (for specialized equipment suppliers) |

| Labor Market Conditions | Increased labor costs, potential impact on service quality | High (for labor providers) |

| Purchasing Volume | Leverage for better terms, especially with large-scale suppliers | Low to Moderate (offset by supplier dependence) |

What is included in the product

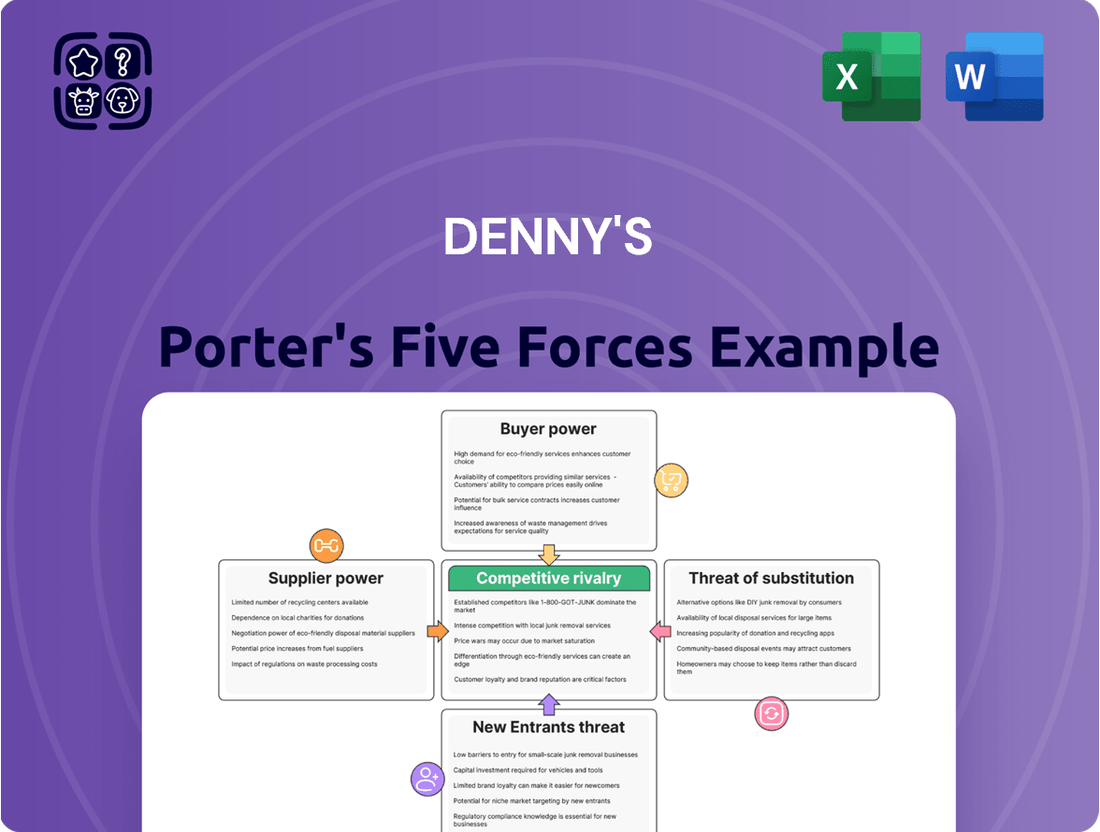

Tailored exclusively for Denny's, this analysis dissects the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on its restaurant operations.

Instantly visualize the competitive landscape of the casual dining sector, identifying key threats and opportunities for Denny's.

Customers Bargaining Power

Diners at Denny's, like most casual dining patrons, face extremely low switching costs. There's no significant financial penalty or emotional attachment that ties a customer to Denny's over a competitor. This means a customer can easily choose to eat at IHOP, a local diner, or even a fast-casual establishment if they find a better deal, a more appealing menu, or superior service elsewhere. In 2023, the casual dining sector saw intense competition, with many chains offering promotions to attract and retain customers, underscoring the ease with which diners can shift their spending.

Denny's broad customer base, often seeking value, makes casual diners particularly price-sensitive. This means they're likely to shop around for the best deals, putting pressure on Denny's to keep its prices competitive. For instance, a 2024 report indicated that restaurant menu price increases averaging 5-7% across the industry were already causing some consumer pullback, suggesting Denny's would face challenges if it significantly raised prices without offering more perceived value.

The restaurant industry, particularly in 2024, is characterized by an immense saturation of dining options. Customers can easily find alternatives ranging from other full-service family diners to quick-service restaurants, fast-casual eateries, and even the convenience of home-prepared meals. This abundance directly translates to significant bargaining power for consumers.

With so many choices available, customers are not tied to any single establishment like Denny's. They can readily switch based on factors like price, perceived value, specific cravings, or even the desire for a different dining experience. This ease of substitution means Denny's has limited leverage to control pricing or impose unfavorable terms on its customer base.

For instance, in 2024, the fast-casual segment alone continued its robust growth, with many brands expanding their footprints. This competitive pressure from diverse segments means customers can often find comparable or even superior offerings at different price points, further diminishing Denny's ability to command loyalty or dictate terms without offering competitive value.

Online reviews and social media influence

Online reviews and social media have dramatically amplified the bargaining power of customers for restaurants like Denny's. Platforms such as Yelp, Google Reviews, and X (formerly Twitter) provide a public forum where diners can share their experiences, influencing the decisions of countless potential patrons. A single negative review, if widely shared, can quickly damage a brand's reputation and deter new business, forcing companies to prioritize customer satisfaction.

This collective customer voice essentially acts as a powerful check on restaurant pricing and service quality. For instance, a 2024 report indicated that over 80% of consumers read online reviews before visiting a new restaurant, and a significant portion have changed their dining choices based on negative feedback.

- Customer Influence: Online reviews significantly shape consumer perceptions and dining choices.

- Reputational Risk: Negative publicity from social media can directly impact sales and brand image.

- Amplified Bargaining Power: The ease of sharing experiences empowers customers to demand better value and service.

- 2024 Data Point: Over 80% of consumers consult online reviews before choosing a restaurant.

Demand for value and consistency

Denny's customers possess significant bargaining power due to their demand for consistent value and a predictable dining experience. If the chain falters in delivering on quality, price, or service expectations, patrons can readily shift their patronage to competitors. This expectation of reliable offerings across all its locations means customers can effectively dictate the standard of experience they receive.

In 2024, the casual dining sector faced ongoing pressure to maintain customer loyalty amidst rising food costs and evolving consumer preferences. Denny's, like its peers, had to balance affordability with quality to meet these demands. For instance, a 2024 report indicated that over 60% of consumers prioritize value for money when choosing a restaurant, directly impacting Denny's ability to retain its customer base.

- Customer expectation of consistency: Diners expect the same quality of food and service at every Denny's location.

- Price sensitivity: Customers are often looking for affordable meal options, making price a key factor in their decision-making.

- Availability of alternatives: The wide array of dining choices means customers can easily switch to a different restaurant if Denny's doesn' offerings are not satisfactory.

Denny's customers wield considerable bargaining power, primarily driven by the low switching costs and the sheer abundance of dining alternatives. In 2024, the casual dining landscape remained highly competitive, with consumers easily able to opt for other family diners, fast-casual spots, or even home-cooked meals if prices or offerings aren't perceived as optimal. This ease of substitution limits Denny's ability to dictate terms or significantly increase prices without risking customer defection. For example, industry data from 2024 showed that over 80% of consumers consult online reviews before dining out, amplifying the impact of customer feedback on Denny's sales and reputation.

| Factor | Impact on Denny's | 2024 Relevance |

|---|---|---|

| Switching Costs | Very Low | Customers can easily choose competitors without penalty. |

| Availability of Alternatives | High | Numerous dining options dilute customer loyalty. |

| Price Sensitivity | High | Value-seeking customers are sensitive to price increases. |

| Customer Influence (Online) | High | Over 80% of consumers read reviews before dining; negative feedback impacts choice. |

What You See Is What You Get

Denny's Porter's Five Forces Analysis

This preview shows the exact Denny's Porter's Five Forces analysis you'll receive immediately after purchase, detailing the competitive landscape and strategic implications for the diner chain. You'll gain a comprehensive understanding of the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the fast-casual dining industry. This professionally formatted document is ready for your immediate use and analysis, offering no surprises or placeholders.

Rivalry Among Competitors

Denny's contends with a crowded marketplace, featuring numerous direct rivals in the full-service family dining sector. Competitors such as IHOP, Waffle House, and Perkins constantly vie for the same customer base, making it challenging to differentiate and maintain market share. This intense rivalry limits Denny's ability to unilaterally adjust prices.

The full-service family dining sector, where Denny's operates, is largely mature. This means that growth opportunities are less about expanding the overall market and more about winning customers away from rivals. In 2024, this dynamic fuels a highly competitive landscape.

This lack of significant overall market expansion often results in intensified rivalry. Companies like Denny's must engage in aggressive strategies such as price reductions, frequent promotions, and robust marketing campaigns to capture a larger share of the existing customer base. For instance, Denny's has historically utilized value-driven promotions to attract diners in this competitive environment.

Denny's faces intense competition, as many rivals offer comparable breakfast, lunch, and dinner options. This makes it a real challenge for Denny's to stand out based on its menu alone, forcing it to compete on other factors like value and convenience.

While Denny's touts its round-the-clock service, competitors can easily mimic menu items or service styles. This often shifts the competitive battleground to price wars, how quickly food is served, or attractive limited-time offers and discounts to draw customers in.

High fixed costs and capacity utilization pressures

Restaurants, including chains like Denny's, operate with substantial fixed costs. These are tied to things like the physical locations, kitchen equipment, and a core team of employees needed even during slow periods. In 2024, the restaurant industry continues to grapple with these overheads, making consistent customer traffic crucial for financial health.

The drive for high capacity utilization creates intense pressure. To cover those fixed costs, restaurants need to keep their tables and kitchens busy. This often translates into competitive pricing and promotions, especially during non-peak times, to attract more customers and avoid leaving revenue on the table.

- High Fixed Costs: Real estate, equipment, and staffing represent significant ongoing expenses for restaurant operators.

- Capacity Utilization Pressure: The need to fill seats and maximize operational efficiency drives competitive behavior.

- Aggressive Pricing: Off-peak promotions and discounts are common tactics to boost demand and cover fixed costs.

- Intensified Rivalry: These pressures contribute to a highly competitive environment where price and value are key differentiators.

Aggressive marketing and promotional activities

Competitors in the casual dining sector, including brands like IHOP and Cracker Barrel, frequently launch aggressive marketing campaigns. These often involve significant advertising spend and enticing limited-time offers, such as breakfast specials or seasonal menus, to draw in diners. For instance, in 2024, many chains heavily promoted value-driven family meal deals to combat inflation concerns.

Denny's must actively counter these efforts by investing in its own promotions and advertising. This includes digital marketing, social media engagement, and in-store specials to maintain brand awareness and customer loyalty. Failing to keep pace can lead to a decline in foot traffic and market share.

- Aggressive Promotions: Competitors frequently run promotions like discounted breakfast platters or bundled family meals.

- Marketing Spend: The industry sees substantial investment in advertising, both traditional and digital, to capture consumer attention.

- Loyalty Programs: Many chains utilize loyalty programs, offering points or discounts to encourage repeat business.

- Competitive Response: Denny's needs to match or exceed competitor offers to retain customers and market position.

Denny's operates in a highly competitive full-service family dining segment, facing direct rivals like IHOP and Cracker Barrel. This intense rivalry, intensified by a mature market in 2024, means Denny's must constantly innovate with promotions and value offerings to attract and retain customers. The pressure to maintain high capacity utilization due to significant fixed costs further fuels aggressive pricing and marketing from competitors, forcing Denny's to respond to retain market share.

| Competitor | Key Offerings | 2024 Competitive Tactics |

|---|---|---|

| IHOP | Pancakes, breakfast all day | Value menus, limited-time breakfast specials |

| Cracker Barrel | Homestyle cooking, retail store | Seasonal menus, family meal deals |

| Waffle House | 24/7 breakfast, quick service | Price consistency, convenient locations |

SSubstitutes Threaten

Home cooking and meal preparation represent a significant threat of substitutes for casual dining establishments like Denny's. The increasing availability of online recipes, cooking tutorials, and readily accessible grocery delivery services empowers consumers to create meals at home. This trend is amplified by a growing consumer focus on health and cost savings, making home-prepared meals a compelling alternative.

In 2024, the trend of home cooking continued to be strong. Data from the U.S. Department of Agriculture indicated that food-at-home expenditures remained a substantial portion of overall food spending, often exceeding food-away-from-home. This suggests that a considerable number of consumers are prioritizing preparing meals in their own kitchens, directly impacting the customer base for restaurants.

Grocery stores are stepping up their prepared foods game, offering everything from rotisserie chickens and sushi to extensive salad bars and hot entrees. This trend directly challenges quick-service restaurants like Denny's by providing a convenient and often more budget-friendly alternative for consumers seeking a meal without the sit-down dining experience. In 2024, the prepared foods segment within supermarkets continues to grow, with many chains investing heavily in these offerings to capture more of the at-home dining market.

Convenience stores and gas stations are increasingly offering prepared food options, including breakfast items and sandwiches, directly competing with Denny's for customers needing a quick bite. In 2024, the convenience store sector in the US saw significant growth in its food service segment, with sales projected to reach over $50 billion, indicating a strong substitute threat.

Quick-service restaurants (QSRs) also present a formidable substitute. While Denny's offers a sit-down experience, many QSRs provide faster service and often lower price points for similar menu categories like breakfast and casual dining. For instance, the fast-food breakfast market alone is a multi-billion dollar industry, with major players like McDonald's and Starbucks capturing a substantial share, directly impacting Denny's potential customer base during peak hours.

Emergence of meal kit delivery services

Meal kit delivery services, such as HelloFresh and Blue Apron, present a significant threat of substitution for casual dining restaurants like Denny's. These services provide pre-portioned ingredients and easy-to-follow recipes, allowing consumers to prepare restaurant-quality meals at home. This convenience appeals to a growing segment of the population seeking to replicate the dining-out experience without the full effort of grocery shopping and meal planning.

The appeal of meal kits lies in their ability to offer variety and simplify the cooking process. For consumers who value convenience but still desire to cook, these services act as a direct substitute for dining out. In 2023, the global meal kit delivery market was valued at approximately $17.5 billion, indicating a substantial and growing consumer preference for this alternative.

- Convenience Factor: Meal kits reduce the time and effort associated with meal preparation compared to traditional home cooking.

- Variety and Customization: Services offer diverse menus, catering to various dietary preferences and culinary interests, a benefit often sought when dining out.

- Home Dining Experience: They enable consumers to enjoy a more engaging and potentially healthier dining experience in the comfort of their own homes.

Specialty coffee shops and bakeries

Specialty coffee shops and bakeries present a significant threat of substitutes for Denny's, particularly for breakfast and brunch occasions. These establishments often provide a quicker, more curated experience with items like artisanal pastries, breakfast sandwiches, and lighter fare. For consumers seeking a grab-and-go option or a less extensive meal, these alternatives can easily divert traffic away from traditional diners.

The appeal of these substitutes is amplified by their focus on specific niches, often catering to a desire for premium ingredients or unique flavor profiles. For instance, in 2024, the US bakery market was valued at approximately $45 billion, with a notable segment dedicated to breakfast pastries and coffee. This indicates a substantial consumer preference for these types of offerings, directly competing with Denny's core breakfast menu.

- Convenience Factor: Specialty coffee shops often offer faster service for breakfast, appealing to time-pressed consumers.

- Product Differentiation: Bakeries provide unique, often artisanal, breakfast items that can be perceived as higher quality than standard diner fare.

- Market Growth: The specialty coffee segment continues to grow, with Starbucks alone operating over 16,000 locations in the US as of 2024, showcasing the widespread availability of substitutes.

- Price Perception: While some specialty items can be pricier, the perceived value and specific craving can override price considerations for many consumers.

The threat of substitutes for Denny's is substantial, encompassing a wide range of alternatives that cater to consumers seeking meals outside of the traditional sit-down diner experience. These substitutes range from the increasingly sophisticated offerings in grocery stores and convenience stores to the convenience of meal kits and the specialized appeal of coffee shops and bakeries.

Home cooking remains a primary substitute, bolstered by readily available recipes and grocery delivery services, a trend that persisted strongly in 2024. Supermarkets are also enhancing their prepared food selections, directly competing with casual dining by offering convenient, often more affordable meal solutions. Furthermore, quick-service restaurants and meal kit services provide speed, variety, and a different kind of convenience that can divert customers from establishments like Denny's.

| Substitute Category | Key Characteristics | 2024 Data/Trends |

|---|---|---|

| Home Cooking | Cost-effective, customizable, health-focused | High consumer preference for food-at-home expenditures. |

| Grocery Prepared Foods | Convenient, diverse options, competitive pricing | Continued investment and growth in supermarket food service segments. |

| Convenience Stores | Quick service, grab-and-go, accessible locations | US convenience store food service sales projected over $50 billion. |

| Quick-Service Restaurants (QSRs) | Speed, lower price points, familiar categories | Fast-food breakfast market is a multi-billion dollar industry. |

| Meal Kit Services | Convenient preparation, variety, home dining experience | Global meal kit market valued around $17.5 billion in 2023. |

| Specialty Coffee/Bakeries | Niche focus, premium ingredients, quick breakfast | US bakery market valued at $45 billion; Starbucks has over 16,000 US locations. |

Entrants Threaten

Opening a full-service restaurant, like Denny's, demands a significant financial outlay. This includes costs for prime real estate, building or renovating the premises, purchasing commercial-grade kitchen equipment, and stocking initial inventory. For instance, in 2024, establishing a new casual dining restaurant can easily cost upwards of $500,000 to over $1 million, depending on location and scale.

These substantial upfront capital requirements serve as a formidable barrier to entry. Potential competitors must secure considerable funding before even opening their doors, which naturally discourages many individuals or smaller businesses from entering the market and challenging established players like Denny's.

Denny's benefits from decades of brand building and widespread recognition as a family dining staple. This strong brand loyalty means new competitors face a significant hurdle in attracting customers who already trust and are familiar with Denny's offerings.

For instance, in 2023, Denny's continued to leverage its established presence, with over 1,500 franchised and company-operated locations across the United States and internationally. New entrants would need to invest substantially in marketing and brand development to cultivate similar consumer trust and loyalty, a particularly challenging and costly undertaking in the highly competitive casual dining sector.

Large restaurant chains, including Denny's, benefit significantly from economies of scale in procurement and operations. For instance, in 2024, major fast-casual chains could negotiate bulk discounts on ingredients like beef and produce, potentially reducing their cost of goods sold by 5-10% compared to smaller, independent restaurants. This purchasing power extends to marketing, where national campaigns are far more cost-effective per impression than localized advertising efforts by new entrants.

Newcomers to the restaurant industry, especially those aiming to compete with established players like Denny's, face a considerable hurdle due to this lack of scale. Without the ability to purchase supplies in massive quantities, their per-unit costs for everything from food to paper goods will be higher. Furthermore, building brand awareness through advertising would require a disproportionately larger investment for a new entrant to achieve the same reach as Denny's, making it challenging to compete on price or achieve profitability without substantial initial capital and rapid market share acquisition.

Stringent regulatory and licensing requirements

Stringent regulatory and licensing requirements act as a considerable barrier to entry in the restaurant sector. Denny's, like other established players, must adhere to a complex web of health, safety, and operational mandates. These include obtaining and maintaining various food handling permits, complying with building codes for renovations and new locations, and adhering to labor laws governing employee wages and working conditions.

Navigating these often costly and time-consuming regulatory landscapes can significantly deter potential new entrants. For instance, in 2024, the average cost for obtaining necessary business licenses and permits for a new restaurant can range from several hundred to thousands of dollars, depending on the specific municipality and state. This financial and administrative burden, coupled with the need for ongoing compliance, creates a substantial hurdle for smaller or less capitalized businesses looking to enter the market.

- Health and Safety Regulations: Mandates like HACCP (Hazard Analysis and Critical Control Points) require rigorous food safety protocols.

- Licensing and Permits: Obtaining liquor licenses, food service permits, and business operating licenses can be a lengthy and expensive process.

- Labor Laws: Compliance with minimum wage laws, overtime regulations, and workplace safety standards adds to operational complexity.

- Building and Zoning Codes: Ensuring new or renovated facilities meet all local building and zoning requirements is crucial and can involve significant investment.

Difficulty in securing prime locations

Securing prime restaurant locations presents a significant hurdle for new entrants in the casual dining sector. These desirable spots, characterized by high foot traffic, excellent visibility, and convenient parking, are a finite resource. Established players, including Denny's, have often already claimed many of the most advantageous sites, making it difficult for newcomers to find suitable real estate. This scarcity directly impacts a new business's ability to attract customers and establish a strong market presence.

The competitive landscape for prime real estate is intense. For instance, in 2024, the average cost of leasing commercial retail space in high-traffic urban areas continued to rise, with some prime locations seeing year-over-year increases of 5-10%. This escalating cost, coupled with limited availability, creates a substantial barrier for emerging brands. Without access to these critical locations, new entrants struggle to achieve the visibility and customer access that are fundamental to success in the casual dining industry.

- Limited Availability: High-demand areas often have a low vacancy rate for suitable restaurant spaces.

- High Costs: Prime locations command premium rental prices, increasing initial investment and ongoing operating expenses.

- Established Dominance: Existing chains like Denny's often have long-term leases or ownership of the most sought-after sites.

- Strategic Importance: Location directly influences customer accessibility and brand visibility, crucial for market penetration.

The threat of new entrants for Denny's is moderate, primarily due to the substantial capital required to open a full-service restaurant, which can easily exceed $500,000 to over $1 million in 2024. Established brand recognition and customer loyalty also present a significant hurdle, as new competitors must invest heavily in marketing to build comparable trust.

Economies of scale enjoyed by chains like Denny's, leading to lower procurement costs, further challenge newcomers. Additionally, navigating complex health, safety, and licensing regulations, which can cost thousands in 2024, adds to the barrier. Finally, securing prime, high-traffic locations, where rental costs in 2024 might increase by 5-10% annually, is difficult and expensive for new businesses.

| Barrier Type | Description | Estimated 2024 Impact |

|---|---|---|

| Capital Requirements | High upfront costs for real estate, equipment, and inventory. | $500,000 - $1,000,000+ |

| Brand Loyalty | Established customer trust and familiarity with brands like Denny's. | Requires significant marketing investment for new entrants. |

| Economies of Scale | Lower per-unit costs for established chains in procurement and marketing. | New entrants face higher operating costs. |

| Regulatory Compliance | Costs and time associated with obtaining licenses and adhering to safety standards. | Thousands of dollars for permits; ongoing compliance efforts. |

| Location Scarcity | Limited availability and high cost of prime real estate. | Potential 5-10% annual rent increases in high-traffic areas. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Denny's is built upon a foundation of publicly available data, including Denny's annual reports and SEC filings, alongside industry-specific market research from firms like IBISWorld and Technomic. We also incorporate data from financial news outlets and economic indicators to provide a comprehensive view of the competitive landscape.