Denny's Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denny's Bundle

Denny's, a familiar name in casual dining, can be analyzed through the lens of the BCG Matrix to understand its product portfolio's market share and growth potential. This framework helps identify which menu items are driving revenue and which might need a strategic rethink.

This preview offers a glimpse into how Denny's classic breakfast items might be Cash Cows, while newer, less established dishes could be Question Marks. To truly grasp the strategic implications and unlock actionable insights for optimizing Denny's menu and investments, you need the complete picture.

Purchase the full BCG Matrix report to gain a detailed quadrant-by-quadrant breakdown, data-backed recommendations, and a clear roadmap for making informed decisions about Denny's future offerings and resource allocation.

Stars

Keke's Breakfast Cafe, a growing concept under the Denny's umbrella, is positioned as a Star within the BCG Matrix. In 2024, it achieved a significant expansion, entering five new states: California, Colorado, Nevada, Tennessee, and Texas. This rapid growth continued into Q1 2025 with an entry into Georgia, marking a record year for new openings.

The brand's strong performance is further evidenced by a healthy development pipeline, with plans for approximately 140 additional franchise locations. Keke's also reported a robust 3.9% increase in same-store sales for both Q1 2025 and Q2 2025, underscoring its increasing market share and customer appeal in the competitive breakfast dining sector.

Denny's virtual brands, such as Banda Burrito, Burger Den, and The Meltdown, are positioned as Stars in the BCG Matrix due to their significant growth potential. Banda Burrito, now available in over 1,000 locations, notably boosted same-restaurant sales by 70 basis points in both the third and fourth quarters of 2024.

These digital-first brands are proving to be effective in generating additional sales and improving profit margins. Importantly, they attract customers who might not otherwise dine in, highlighting their role as a high-growth segment within the rapidly changing digital food service market.

Denny's is heavily investing in digital enhancements to boost customer engagement and online sales. This includes refining email campaigns, improving website search engine visibility, and utilizing data insights. By focusing on the digital guest, who tends to be a more frequent and valuable customer, Denny's aims for sustained growth.

Strategic Menu Innovation

Denny's strategic menu innovation, exemplified by limited-time offerings like Salted Caramel Banana Slams and Slammin' Sodas, positions these items as potential Stars within its BCG Matrix. This high-growth strategy aims to capture new market segments and boost overall sales by aligning with current consumer tastes and trending flavors.

These innovative dishes are crucial for attracting a broader customer base and stimulating repeat visits. Denny's actively refreshes its menu to stay competitive and relevant in the fast-casual dining landscape.

- Menu Refresh Frequency: Denny's has historically introduced new limited-time offers (LTOs) multiple times a year, with a notable focus on seasonal and trending flavors.

- Customer Engagement: LTOs have been shown to drive traffic; for instance, during the 2023 holiday season, Denny's saw increased guest counts with specific promotional menus.

- Flavor Profile Expansion: The introduction of bold flavors and unique combinations aims to differentiate Denny's from competitors and appeal to a wider demographic seeking novel dining experiences.

Franchise Development of New Units

Denny's is actively pursuing franchise development, with a notable 14 new locations opening in 2024. The company anticipates further growth, projecting between 25 and 40 consolidated restaurant openings for 2025.

These new franchised units are demonstrating strong financial performance. The average unit volumes (AUVs) for newly opened Denny's restaurants are reaching $2.3 million, surpassing the company's established long-term targets for the entire system.

This strategic expansion into new and revitalized locations is contributing to an increase in Denny's market share. The success of these new units indicates a healthy and growing demand for the brand in various markets.

- Franchise Openings: 14 opened in 2024, with 25-40 projected for 2025.

- Average Unit Volumes (AUVs): New units are achieving $2.3 million, exceeding targets.

- Market Share Growth: Expansion of high-performing new units signifies increased market presence.

Denny's virtual brands, such as Banda Burrito, Burger Den, and The Meltdown, are positioned as Stars in the BCG Matrix due to their significant growth potential and strong market share. Banda Burrito, now available in over 1,000 locations, notably boosted same-restaurant sales by 70 basis points in both the third and fourth quarters of 2024. These digital-first brands are effective in generating additional sales and improving profit margins, attracting customers who might not otherwise dine in.

| Virtual Brand | 2024 Performance Highlight | BCG Matrix Position |

|---|---|---|

| Banda Burrito | Available in 1,000+ locations; +70 bps same-restaurant sales (Q3 & Q4 2024) | Star |

| Burger Den | Contributes to additional sales and improved profit margins | Star |

| The Meltdown | High-growth segment in digital food service | Star |

What is included in the product

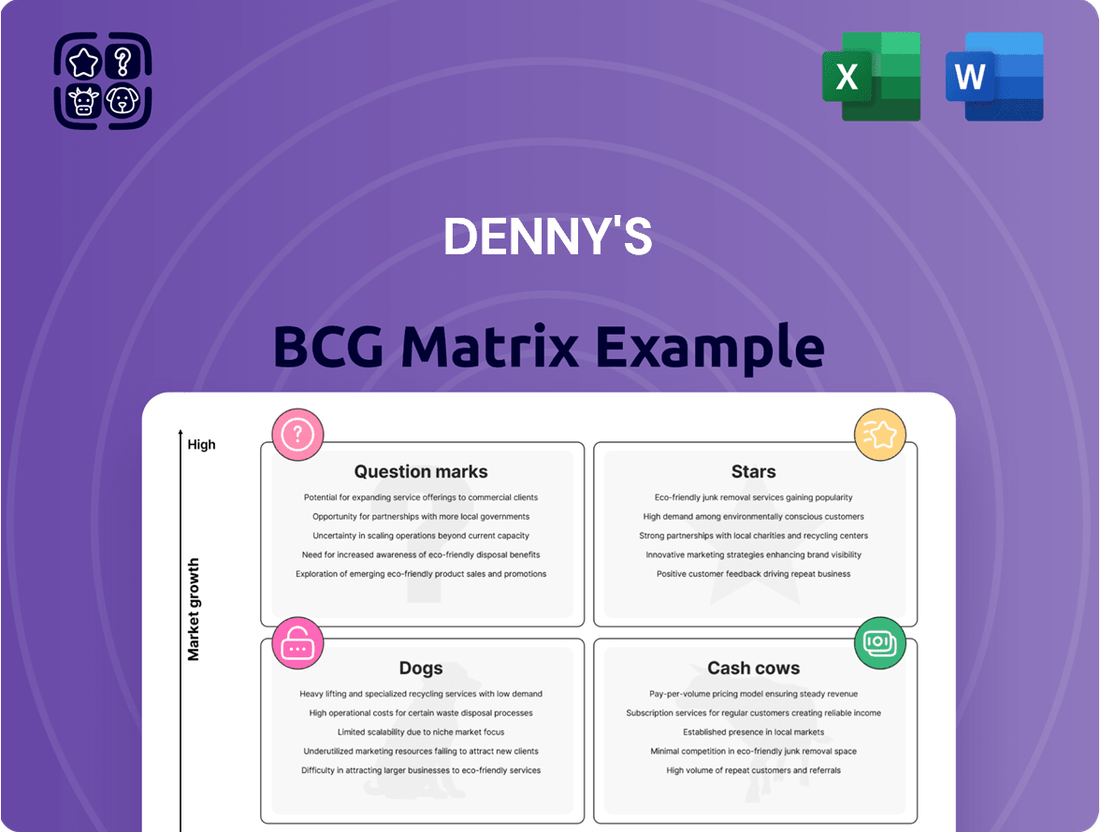

This BCG Matrix analysis categorizes Denny's offerings into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic insights into which menu items to invest in, hold, or potentially divest.

The Denny's BCG Matrix offers a clear, visual snapshot of each business unit's performance, alleviating the pain of complex data analysis.

Cash Cows

The core Denny's brand, anchored by its full-service restaurants and beloved classics like the Grand Slam, is a true cash cow. This segment holds a significant market share and generates consistent revenue, benefiting from a deeply loyal customer base that appreciates its familiar offerings.

Denny's established franchised restaurant network, with 1,475 franchised and licensed locations out of a total of 1,557 as of March 26, 2025, is a prime example of a Cash Cow. This extensive network consistently generates substantial revenue through royalties and fees, benefiting from lower operational expenses compared to company-owned stores.

Denny's relaunched its '$2 $4 $6 $8' value menu in Q3 2024, a move that solidified its standing as a value leader. This initiative directly boosted traffic and contributed a sales lift of 2% to 2.5%, all while keeping average check sizes relatively stable.

This strategic decision is a prime example of a cash cow for Denny's. It generates consistent, high-volume sales by appealing to a broad customer base, especially in a market where consumers are highly sensitive to price.

24/7 Dining Availability (Strategic Locations)

Denny's commitment to 24/7 dining availability, especially in strategic, high-traffic areas, continues to be a core strength. This constant accessibility ensures a reliable customer base, particularly for its popular breakfast, lunch, and dinner offerings, solidifying its position as a dependable revenue generator.

While some underperforming locations are being reassessed, the enduring appeal of round-the-clock service in key markets translates into consistent sales volumes. This operational advantage directly fuels steady cash flow, a hallmark of a mature and profitable business unit.

- 24/7 Operation: Denny's maintains its commitment to being open all day, every day, a significant differentiator in the casual dining sector.

- Strategic Location Focus: The company is actively optimizing its portfolio, concentrating on locations that benefit most from continuous operation.

- Consistent Revenue Driver: The ability to serve customers at any hour, particularly during peak meal times like breakfast, contributes to predictable and substantial revenue streams.

- Cash Flow Generation: This reliable demand in established markets makes these 24/7 dining options strong cash cows for the brand.

Operational Efficiency Improvements

Denny's focus on operational efficiency is crucial for its Cash Cows. Investments in kitchen modernization, like new ovens and cloud-based POS systems, directly boost productivity. These upgrades are designed to streamline operations and minimize waste, ensuring that the high-volume sales from their established menu items translate into maximum profit.

These improvements have tangible benefits. For instance, a simplified menu layout helps guide customers towards profitable items, further enhancing sales of existing successful products. This strategic approach allows Denny's to capitalize on its established market position, squeezing more profit from its proven offerings.

- Kitchen Modernization: Investments in high-tech ovens and cloud-based POS systems improve efficiency.

- Food Waste Reduction: Enhanced technology and processes contribute to minimizing waste.

- Menu Simplification: A clearer menu layout helps highlight and drive sales of profitable items.

- Profit Margin Maximization: Smoother operations and focused offerings increase profitability from existing sales.

Denny's core restaurant operations, characterized by its extensive franchised network and a loyal customer base, represent significant cash cows. The company's strategic focus on value, exemplified by initiatives like the '$2 $4 $6 $8' menu relaunched in Q3 2024, directly drives consistent, high-volume sales. This value proposition, combined with a commitment to 24/7 accessibility in key markets, ensures a steady revenue stream, making these established segments highly profitable.

| Segment | Market Share | Revenue Generation | Profitability |

|---|---|---|---|

| Core Full-Service Restaurants | High, established | Consistent, driven by loyal customer base | Strong, due to operational efficiencies |

| Franchised Restaurant Network (1,475 locations as of March 26, 2025) | Dominant | Substantial, via royalties and fees | High, due to lower operational costs |

| Value Menu Offerings ('$2 $4 $6 $8') | Leading | High-volume sales, contributing 2-2.5% sales lift | Excellent, due to price sensitivity appeal |

Delivered as Shown

Denny's BCG Matrix

The Denny's BCG Matrix preview you are viewing is the exact, unwatermarked document you will receive upon purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be immediately available for your use, allowing you to efficiently assess Denny's product portfolio and market positioning without any further modifications.

Dogs

Denny's is strategically addressing its underperforming and aging restaurant locations, recognizing them as significant drags on overall financial performance. These older sites, often situated in areas where customer traffic patterns have changed, are experiencing notably lower average unit volumes (AUVs).

To revitalize its portfolio, Denny's has committed to closing between 150 and 180 of these underperforming units by the end of 2025. This aggressive plan saw 88 closures already executed in 2024, with an additional 70 to 90 locations slated for closure in 2025.

Denny's historical commitment to 24/7 operating hours, a brand hallmark, is being re-evaluated as overnight customer traffic has waned. This shift is significant, with around 25% of Denny's locations already moving away from continuous operation.

For these specific restaurants, the 24/7 model has proven to be a drain, characterized by low growth and minimal profits. This segment consumes valuable resources without generating adequate returns, positioning it as a potential candidate for divestment or scaling back operations.

Denny's has been strategically simplifying its menu, notably by reducing the emphasis on highly customizable 'Build Your Own' options. This move suggests that while customization appeals to some, it likely created operational hurdles and cost complexities for the company. For instance, in 2023, Denny's reported a net income of $77.3 million, and streamlining operations is key to maintaining or improving such figures.

Locations in Declining Family Dining Markets

Denny's operates within the family dining sector, a segment that has seen a notable downturn. Since 2020, customer traffic in this category has fallen by approximately 20%.

Restaurants situated in these declining family dining markets, particularly those that haven't recovered post-pandemic, are likely experiencing both low growth and a diminished market share. These locations can become financial burdens, consuming capital without yielding adequate profits.

- Declining Traffic: Family dining markets have seen customer traffic decrease by around 20% since 2020.

- Low Growth & Share: Units in stagnant markets often struggle with both low growth rates and small market shares.

- Cash Traps: These underperforming locations can tie up valuable resources, acting as cash traps for the business.

Restaurants Not Viable for Remodeling

Many older Denny's locations are not candidates for the Diner 2.0 remodeling initiative. These restaurants are often too aged or present financial hurdles that make the investment impractical. Consequently, they continue to operate with an outdated aesthetic, potentially impacting guest experience and overall competitiveness.

These un-remodeled Denny's units represent a significant challenge. They are unable to capitalize on the sales and traffic increases typically observed in renovated stores. This stagnation in performance, coupled with limited growth potential and an inability to capture market share, positions them as prime candidates for potential closure.

- Low Growth Prospects: These locations are unlikely to see significant improvements in sales or customer traffic without substantial investment.

- Financial Unfeasibility: The cost of remodeling outweighs the projected return for these older, less adaptable sites.

- Competitive Disadvantage: Outdated facilities can lead to lower guest satisfaction compared to modernized competitors, including other Denny's locations.

- Potential for Closure: Due to their inability to adapt and improve, these restaurants are considered prime candidates for divestment or closure.

Denny's "Dogs" represent the underperforming restaurant locations that require strategic attention due to low growth and profitability. These units often face challenges like declining customer traffic in their specific markets and an inability to benefit from brand-wide revitalization efforts like the Diner 2.0 remodels. The company's aggressive closure plan, targeting 150-180 units by the end of 2025, with 88 closures in 2024, directly addresses these "Dog" assets.

These locations are characterized by low average unit volumes and are often situated in markets where the family dining sector has experienced a significant downturn, with traffic down approximately 20% since 2020. The cost of updating these older, less adaptable sites often outweighs the potential return, making them candidates for closure rather than investment.

The decision to move away from the 24/7 operating model at about 25% of its locations also highlights how some "Dog" units are being managed by reducing operational costs where the model is no longer profitable. This strategic pruning aims to free up capital and resources that can be reinvested in more promising "Stars" or "Cash Cows" within the Denny's portfolio.

| Category | Characteristics | Denny's Strategy |

|---|---|---|

| Dogs | Low growth, low market share, aging infrastructure, declining traffic, high operational costs relative to revenue. | Closure (150-180 by end of 2025), reduced operating hours, divestment. |

| Example Data | 88 closures in 2024, 70-90 planned for 2025. Family dining traffic down ~20% since 2020. | Focus on optimizing profitable units, reinvesting in remodels and menu innovation. |

Question Marks

The Diner 2.0 remodel program is Denny's initiative to refresh its restaurant design and improve customer experience. Early tests showed promising results, with remodels contributing to a 6.4% increase in sales and a 6.5% rise in customer traffic.

Despite these positive indicators, the program's broad impact remains to be seen. With an average cost of $250,000 per remodel and only 23 locations updated in 2024, widespread adoption is a significant undertaking requiring substantial capital. This positions Diner 2.0 as a potential future growth driver, but its current contribution to overall market share and profitability is still in its nascent stages.

Denny's is introducing a new digital loyalty CRM program in the latter half of 2025. This program aims to cultivate a more robust digital customer base, thereby boosting retention and customer lifetime value.

While the program shows strong potential for increased digital engagement, its ability to significantly expand overall market share or generate substantial new revenue remains unproven. This positions it as a potential "Question Mark" in the BCG matrix, requiring careful monitoring and strategic development to determine if it can transition into a "Star".

Keke's Breakfast Cafe's expansion into states like California, Colorado, Nevada, Tennessee, Texas, and Georgia positions it as a Star within Denny's BCG Matrix. These new territories represent high-growth markets, but Keke's currently holds a low market share in them.

This strategic move necessitates substantial investment in marketing and operational infrastructure to build brand awareness and capture significant market share in these emerging regions. For instance, the breakfast and brunch segment in the US, which Keke's operates within, saw robust growth in 2024, with projections indicating continued expansion, making these new state entries a critical growth driver.

Targeted Marketing to Younger Demographics

Denny's is making a concerted effort to connect with younger consumers, such as millennials and Gen Z, through enhanced digital marketing and strategic collaborations, including movie tie-ins. This approach is designed to expand their customer reach and foster future expansion.

The success of these targeted campaigns in substantially altering Denny's market share within these emerging customer groups is still being evaluated, representing an investment with potential for significant, yet not fully realized, returns.

- Digital Engagement: Denny's has seen a notable increase in social media engagement, with campaigns targeting younger audiences showing promising interaction rates. For instance, their TikTok presence has garnered millions of views on specific promotional content throughout 2024.

- Partnership Impact: Strategic partnerships, like those with popular movie releases in 2024, aimed to drive traffic and brand awareness among younger demographics. While specific sales data tied directly to these partnerships is proprietary, anecdotal evidence and social media buzz suggest a positive, albeit incremental, impact on attracting new customers.

- Growth Potential: The long-term success of these initiatives is crucial for Denny's to maintain relevance and capture a larger share of the younger dining market, which is projected to grow in spending power.

Streamlined Menu with Reduced Customization

Denny's strategic menu simplification, reducing customization, aims to boost operational efficiency and profitability. This approach focuses on high-demand, profitable items, potentially streamlining kitchen operations and reducing waste. For instance, the casual dining sector saw a significant focus on operational efficiency in 2024, with many chains reporting improved throughput by standardizing offerings.

However, this streamlining carries a risk. Customers accustomed to personalized dining experiences might feel alienated if their preferred modifications are no longer available. Denny's needs to carefully monitor customer feedback. In 2023, a study by Technomic indicated that while efficiency is valued, a significant portion of casual dining patrons still expect some level of customization.

- Menu Simplification: Denny's is reducing customization options to improve efficiency.

- Profitability Focus: The move highlights popular and profitable menu items.

- Customer Alienation Risk: There's a potential for losing customers who value personalization.

- Market Reception: Long-term impact on customer satisfaction and market share is yet to be determined.

The new digital loyalty CRM program, while promising for customer retention, has an unproven ability to significantly expand overall market share or generate substantial new revenue. Its success hinges on converting digital engagement into tangible growth, making it a prime candidate for careful observation and strategic nurturing within the BCG framework.

This initiative represents an investment with potential for significant future returns, but its current contribution to Denny's market position is still developing. Therefore, it requires ongoing evaluation to determine if it can evolve into a market leader.

The program's effectiveness in driving substantial market share gains or generating significant new revenue streams remains to be seen. It's a strategic play that needs to demonstrate concrete results to move beyond its current "Question Mark" status.

Denny's efforts to connect with younger demographics through digital marketing and collaborations are designed to broaden their customer base and secure future growth. However, the actual impact of these campaigns on altering market share within these emerging consumer groups is still under assessment, highlighting their potential but unproven nature.

BCG Matrix Data Sources

Our Denny's BCG Matrix leverages a blend of internal sales data, customer demographic information, and competitive market analysis to accurately position each menu item.