Denholm MacNamee SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denholm MacNamee Bundle

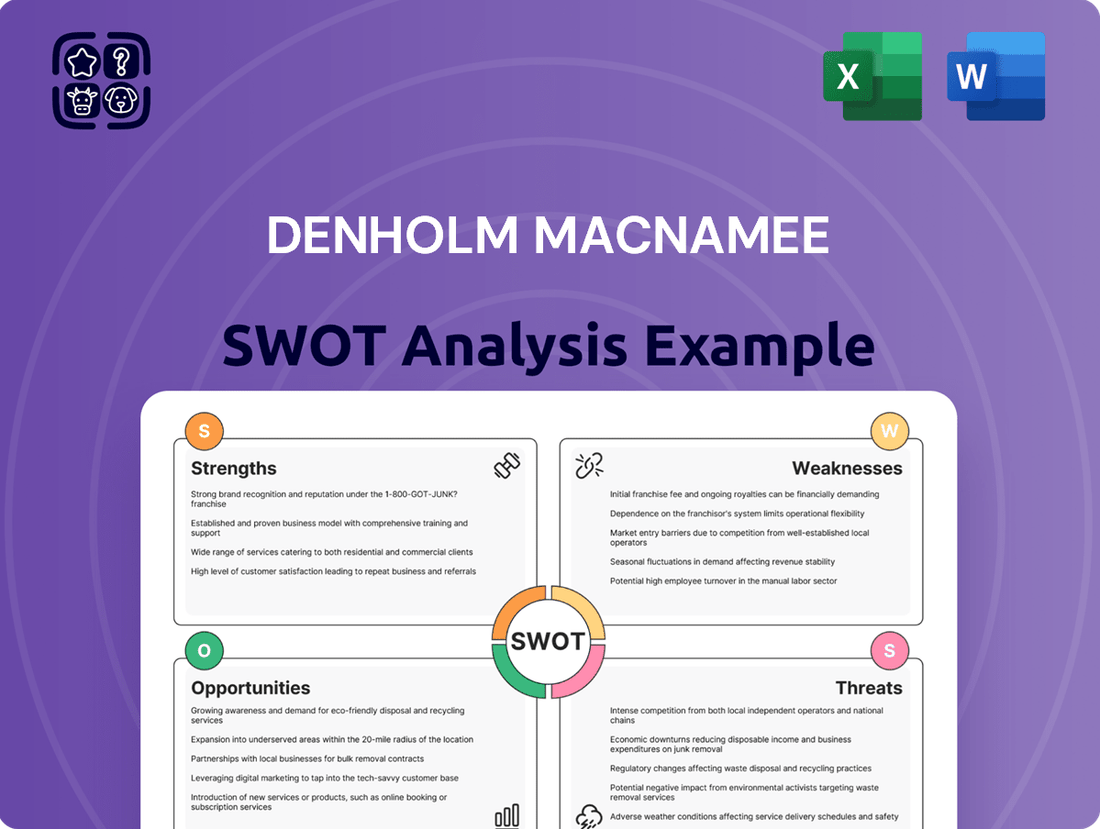

Denholm MacNamee's SWOT analysis reveals a company with robust operational strengths and a clear market niche, yet it also highlights potential vulnerabilities in its competitive landscape and the need for strategic adaptation. Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Denholm MacNamee's strength lies in its profound expertise in specialized engineering, inspection, repair, and maintenance. This includes advanced non-destructive testing (NDT) methods, crucial for maintaining asset integrity in demanding industries.

This deep specialization translates into high-value services that are critical for ensuring the safety and reliability of clients' infrastructure. For example, their NDT capabilities are vital in sectors like oil and gas, where detecting minute flaws can prevent catastrophic failures.

By offering comprehensive asset integrity solutions, Denholm MacNamee directly contributes to operational efficiency and risk reduction for their clients. This focus ensures that critical infrastructure operates safely and reliably, a key concern for many industrial partners.

Denholm MacNamee excels by offering a complete package for asset integrity, covering everything from initial inspection to ongoing repair and maintenance across an asset's entire lifespan. This all-encompassing approach, which notably includes robust mechanical services, makes them a go-to provider for clients facing intricate operational challenges.

Their ability to deliver these integrated solutions not only boosts client happiness but also significantly increases the likelihood of securing and retaining long-term agreements, demonstrating a strong competitive advantage in the market.

Denholm MacNamee's strategic geographic footprint is a significant strength, bolstered by its parent company, Denholm Energy Services. This allows for a cohesive expansion strategy across key markets.

Recent acquisitions have solidified Denholm MacNamee's presence, creating a comprehensive Scotland-wide network and securing access to the crucial English waste management sector. This dual-market capability is a powerful differentiator.

This expanded operational reach directly translates to a broader client base and the ability to capitalize on emerging opportunities within these vital regional economies, enhancing revenue potential.

Strong Parent Company Backing

Being a part of Denholm Energy Services offers Denholm MacNamee significant advantages through shared resources, strategic direction, and access to an expanded service range. This affiliation bolsters Denholm MacNamee's operational capabilities and market reach.

Denholm Energy Services is committed to market leadership, focusing on superior operations, client satisfaction, and portfolio expansion via strategic acquisitions. For instance, Denholm Oil & Gas, a key segment, reported a turnover of £150 million in 2023, demonstrating the group's substantial market presence and financial strength, which indirectly benefits Denholm MacNamee.

- Robust Corporate Support: Denholm MacNamee benefits from the financial stability and strategic oversight of its parent company, Denholm Energy Services.

- Expanded Service Portfolio: Access to the broader service offerings within the Denholm Energy Services group enhances Denholm MacNamee's ability to meet diverse client needs.

- Strategic Alignment for Growth: Denholm Energy Services' focus on operational excellence and market leadership provides a clear growth trajectory and supportive environment for Denholm MacNamee.

- Financial Strength of Parent: The overall financial health of Denholm Energy Services, exemplified by its segments' performance, underpins Denholm MacNamee's stability and investment capacity.

Focus on Critical Infrastructure

Denholm MacNamee's strategic concentration on critical infrastructure, particularly within the energy, power, and industrial sectors, is a significant strength. This specialization means their services are indispensable for maintaining the safety and reliability of essential operations. These sectors, by their nature, demand continuous upkeep and rigorous inspection to avert failures and adhere to strict regulatory standards, ensuring a steady revenue stream.

The company's focus on critical infrastructure translates into a consistent demand for its services. For instance, the energy sector alone saw global investment in infrastructure reach an estimated $1.5 trillion in 2024, highlighting the ongoing need for maintenance and inspection. Denholm MacNamee's expertise directly addresses this persistent requirement, underpinning the operational uptime and structural integrity of high-value assets crucial to the economy.

- Essential Services: Denholm MacNamee provides vital services for energy, power, and industrial sectors.

- Consistent Demand: Focus on critical infrastructure ensures ongoing need for maintenance and inspection.

- Regulatory Compliance: Services are key for industries requiring strict adherence to safety and reliability standards.

- Asset Integrity: Their work is crucial for maintaining the operational uptime of valuable industrial assets.

Denholm MacNamee's core strength is its specialized engineering and maintenance expertise, particularly in advanced non-destructive testing (NDT). This focus on asset integrity is critical for industries like oil and gas, where detecting even minor flaws is paramount to preventing major failures.

Their comprehensive approach to asset integrity, covering the entire lifecycle from inspection to repair, makes them a valuable partner for clients facing complex operational challenges. This integrated service offering fosters client loyalty and secures long-term contracts.

The company's strategic geographic expansion, supported by Denholm Energy Services, has created a strong presence across Scotland and into the English waste management sector. This broadened operational footprint allows them to serve a wider client base and capitalize on regional economic opportunities.

Benefiting from the financial backing and strategic direction of Denholm Energy Services provides Denholm MacNamee with stability and resources for growth. The group's overall financial health, as evidenced by segments like Denholm Oil & Gas reporting £150 million in turnover in 2023, directly supports Denholm MacNamee's capacity for investment and market expansion.

| Strength Area | Description | Impact | Supporting Data (2023/2024) |

|---|---|---|---|

| Specialized Expertise | Advanced NDT, inspection, repair, and maintenance for critical infrastructure. | Ensures asset safety, reliability, and operational uptime for clients. | NDT is vital in sectors where early flaw detection prevents catastrophic failures. |

| Integrated Solutions | End-to-end asset integrity management, including mechanical services. | Enhances client satisfaction and secures long-term service agreements. | Comprehensive service packages lead to higher client retention rates. |

| Strategic Geographic Footprint | Expanded network across Scotland and into English waste management. | Broadens client base and allows for capitalizing on regional growth. | Recent acquisitions have solidified presence in key markets. |

| Corporate Support | Financial stability and strategic oversight from Denholm Energy Services. | Underpins operational capabilities, market reach, and investment capacity. | Denholm Oil & Gas turnover of £150 million (2023) indicates group financial strength. |

What is included in the product

Delivers a strategic overview of Denholm MacNamee’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic weaknesses, turning potential threats into opportunities.

Weaknesses

Denholm MacNamee's strong historical ties to the energy, power, and industrial sectors, especially oil and gas, present a weakness through potential market concentration. This focus, while historically profitable, leaves the company vulnerable to the inherent volatility and policy shifts within these specific industries. For instance, a significant downturn in global oil prices, as seen during periods like early 2020, could disproportionately impact Denholm MacNamee's performance compared to a more diversified entity.

Denholm MacNamee's reliance on the economic cycle is a significant weakness. The demand for their specialized engineering, inspection, repair, and maintenance services is closely linked to capital expenditure and operational budgets within the industrial and energy sectors. For instance, a slowdown in infrastructure projects or a reduction in energy sector investments directly impacts their service utilization.

This cyclical dependency can introduce considerable volatility into Denholm MacNamee's revenue streams. During economic downturns, companies often scale back on non-essential maintenance and defer new capital projects, leading to a direct decrease in demand for Denholm MacNamee's offerings. This was evident in the 2020-2021 period, where global industrial output saw significant contractions, impacting service providers across the board.

Denholm MacNamee's commitment to providing specialist engineering, advanced inspection, and mechanical services necessitates substantial investment in highly skilled professionals and cutting-edge equipment. For instance, the specialized training and certifications required for advanced non-destructive testing (NDT) personnel, a core offering, represent a significant ongoing expense. This focus on expertise and technology, while crucial for quality, inherently drives up operational costs.

The need to maintain rigorous safety standards, a non-negotiable in the engineering and inspection sectors, further contributes to elevated operational expenses. Compliance with industry-specific regulations and the implementation of robust safety protocols require continuous investment in training, equipment maintenance, and oversight. This can impact the company's ability to compete on price if these costs aren't effectively managed.

Balancing the high cost of specialized services with the need for competitive pricing presents a persistent challenge for Denholm MacNamee. For example, the capital expenditure on advanced robotic inspection systems, while enhancing service delivery, must be factored into pricing structures. This delicate act of cost management is vital for maintaining profitability and market share in a demanding industry.

Competition in Growing Markets

While the asset integrity management, NDT, and industrial maintenance sectors are experiencing growth, they are also characterized by significant competition. Denholm MacNamee faces a landscape with numerous established and emerging players vying for market share. For instance, the global non-destructive testing market was valued at an estimated USD 12.5 billion in 2023 and is projected to reach USD 20.1 billion by 2030, indicating substantial growth but also intense rivalry.

To effectively compete, Denholm MacNamee must consistently highlight its unique service offerings and ensure it maintains a technological edge. The company needs to invest in advanced NDT techniques and digital solutions to stay ahead. This competitive pressure can translate into pricing challenges and necessitate continuous investment in research and development to foster innovation and maintain service quality.

- Intense Rivalry: The asset integrity and NDT markets are crowded with many service providers, increasing competitive pressure.

- Technological Advancement: Competitors are also investing in new technologies, requiring Denholm MacNamee to maintain its own innovation pipeline.

- Pricing Pressures: A highly competitive market can lead to downward pressure on pricing, impacting profit margins.

- Market Share Erosion: Failure to differentiate and innovate could result in a loss of market share to more agile competitors.

Potential for 'Dormant Company' Implications

Denholm MacNamee Limited's classification as a 'Dormant Company' with SIC code 99999, despite recent filing activity and director changes, presents a potential weakness. This designation might lead some stakeholders to question the entity's active operational status and direct revenue-generating capacity under this specific name, potentially impacting perceptions of transparency.

While the 'dormant' status could indicate a strategic holding function, it may still create ambiguity for investors or partners seeking clear insights into the company's immediate operational performance and business model. This could necessitate additional due diligence to fully understand the underlying economic activities.

- Dormant Company Status: SIC code 99999, suggesting non-trading activity.

- Recent Filings: Despite the dormant classification, the company has recent filing history and director changes, creating a potential disconnect.

- Stakeholder Perception: This status might raise questions about operational transparency and direct revenue generation for external parties.

- Ambiguity: The classification could imply a holding structure, but may not fully clarify immediate operational engagement for all stakeholders.

Denholm MacNamee's specialization in the energy and industrial sectors, particularly oil and gas, creates a significant weakness due to market concentration. This focus makes the company highly susceptible to the inherent volatility and policy shifts within these specific industries. For example, a sharp decline in global oil prices, as experienced in early 2020, could disproportionately affect Denholm MacNamee's financial performance compared to a more diversified competitor.

What You See Is What You Get

Denholm MacNamee SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're seeing the actual Denholm MacNamee SWOT analysis, ensuring transparency. Once purchased, the complete, detailed report will be yours to download.

Opportunities

The asset integrity management market is a significant growth area, expected to climb from $29.16 billion in 2024 to $31.49 billion in 2025, representing an 8% compound annual growth rate. This expansion, projected to reach $46.59 billion by 2029, is fueled by the critical need for asset maintenance, safety compliance, and environmental stewardship across industries.

This robust market trend directly aligns with Denholm MacNamee's expertise, offering substantial opportunities to leverage its core services in an environment where clients are increasingly prioritizing the longevity and reliability of their critical assets.

The global shift towards cleaner energy sources presents a significant opportunity. Projections indicate that by 2030, hydro, solar, and wind power generation will see substantial increases, creating a robust market for specialized services.

Denholm MacNamee's established capabilities in inspection, repair, and maintenance are directly transferable to the essential infrastructure supporting this expanding renewable energy landscape, including wind turbines and solar farms.

By strategically expanding its service offerings into the renewable energy sector, Denholm MacNamee can effectively reduce its dependence on the volatile traditional oil and gas markets, thereby enhancing overall business resilience.

The predictive maintenance market is set for remarkable expansion, forecasted to grow from $10.6 billion in 2024 to an impressive $47.8 billion by 2029. This surge is fueled by advancements in artificial intelligence, machine learning, and the Internet of Things.

Denholm MacNamee can capitalize on this trend by integrating advanced data analytics, remote monitoring, and digital twin technologies. These tools will allow the company to enhance its service portfolio, boost operational efficiency, and offer clients more proactive, data-driven solutions.

Embracing these digital advancements offers Denholm MacNamee a substantial competitive edge, positioning the company as a leader in technologically advanced asset management and maintenance services.

Increasing Demand for NDT Services

The non-destructive testing (NDT) market is experiencing robust growth, with projections indicating a rise from an estimated $16.41 billion in 2024 to $35.39 billion by 2032. This expansion is fueled by critical factors such as the ongoing need to maintain aging infrastructure, the implementation of stricter safety regulations, and the universal demand for stringent quality assurance across diverse industrial sectors. Denholm MacNamee, with its expertise in advanced NDT methodologies, is strategically positioned to leverage this escalating demand, particularly within the services segment of the market.

This presents a significant opportunity for Denholm MacNamee to increase its market share and revenue streams.

- Growing Market Size: The NDT market is forecast to more than double in value between 2024 and 2032.

- Key Market Drivers: Aging infrastructure, enhanced safety regulations, and quality assurance needs are propelling NDT service demand.

- Denholm MacNamee's Position: The company's advanced NDT capabilities align perfectly with these growth drivers.

- Service Segment Focus: The increasing demand is particularly pronounced in the services aspect of NDT, where Denholm MacNamee excels.

Strategic Acquisitions and Geographic Reach

Denholm MacNamee can leverage the Denholm Energy Services group's overarching strategy of expanding its service capabilities and geographic footprint through targeted acquisitions. This approach allows for the integration of new technologies and market access, enhancing Denholm MacNamee's competitive position.

The group's recent activity, including Denholm Environmental's acquisition of Pipetech in 2025 to bolster its Norwegian operations, exemplifies this growth-oriented philosophy. Such moves provide a clear blueprint for how Denholm MacNamee can strategically acquire complementary businesses or expand into underserved markets.

Opportunities for Denholm MacNamee include:

- Acquiring specialized service providers to broaden its existing portfolio, potentially in areas like advanced inspection or niche maintenance.

- Expanding into new geographic territories where demand for its core services is projected to grow, such as emerging energy markets in Asia or Africa.

- Integrating acquired companies to realize synergies, improve operational efficiency, and offer a more comprehensive service package to clients.

Denholm MacNamee is well-positioned to benefit from the expanding asset integrity management market, which is projected to grow significantly from $29.16 billion in 2024 to $46.59 billion by 2029. The company can also capitalize on the surge in the predictive maintenance market, expected to reach $47.8 billion by 2029, by integrating advanced data analytics and IoT technologies. Furthermore, the robust growth in the non-destructive testing (NDT) market, anticipated to hit $35.39 billion by 2032, presents a prime opportunity for Denholm MacNamee to leverage its advanced NDT capabilities and increase its market share.

The company can also strategically expand its service offerings into the burgeoning renewable energy sector, aligning with global trends and reducing reliance on traditional oil and gas markets. Denholm MacNamee can also pursue growth through targeted acquisitions within the Denholm Energy Services group, integrating new technologies and expanding its geographic reach.

| Market Segment | 2024 Value (USD Billion) | 2025 Value (USD Billion) | Projected 2029 Value (USD Billion) | Denholm MacNamee Opportunity |

|---|---|---|---|---|

| Asset Integrity Management | 29.16 | 31.49 | 46.59 | Leverage core services for critical asset maintenance and safety. |

| Predictive Maintenance | 10.60 | - | 47.80 | Integrate AI, ML, and IoT for proactive, data-driven solutions. |

| Non-Destructive Testing (NDT) | 16.41 | - | 35.39 (by 2032) | Capitalize on demand driven by aging infrastructure and safety regulations. |

| Renewable Energy Services | Growing | Growing | Significant Growth | Transfer inspection and maintenance expertise to wind and solar infrastructure. |

Threats

Volatile energy market conditions pose a significant threat to Denholm MacNamee. Fluctuations in global oil and gas prices, often driven by geopolitical instability, directly impact the investment and operational spending of its primary client base in the energy sector. For instance, a sharp decline in crude oil prices, such as the drop seen in early 2024, can lead to project delays and reduced capital expenditure by energy companies, subsequently decreasing demand for Denholm MacNamee's maintenance and inspection services.

The industrial maintenance and asset integrity sectors are seeing an influx of players, from global giants to niche specialists. This crowded landscape naturally intensifies competition, putting pressure on Denholm MacNamee's pricing strategies and potentially squeezing profit margins.

To navigate this, Denholm MacNamee must consistently highlight its unique value proposition, focusing on innovation and service quality to secure and maintain its market position. For instance, the global industrial maintenance market was valued at approximately USD 120 billion in 2023 and is projected to grow, but this growth also attracts more competition, making differentiation crucial.

Denholm MacNamee operates in sectors heavily influenced by a stringent regulatory environment. For instance, in 2024, the energy sector faced increased scrutiny, with the U.S. Environmental Protection Agency (EPA) proposing stricter emissions standards for power plants, potentially impacting operational costs for companies in this space.

Adapting services and equipment to meet evolving safety, environmental, and operational regulations presents a significant financial and operational challenge. Failure to comply can lead to substantial fines and operational disruptions, as seen when several industrial firms in the UK faced penalties in 2023 for non-compliance with waste management directives, costing them millions in remediation and fines.

Continuous adherence to these demanding standards requires ongoing investment in compliance, training, and technological upgrades. The International Energy Agency's 2025 outlook highlights that global investment in clean energy technologies, driven by regulatory push, is projected to reach over $2 trillion annually, indicating the scale of adaptation required.

Technological Disruption and Obsolescence

Denholm MacNamee faces a significant threat from rapid technological advancements in inspection and maintenance. Emerging technologies like AI-powered predictive analytics and advanced robotics are poised to reshape traditional service delivery models, potentially rendering existing methods obsolete. For instance, the global predictive maintenance market was valued at approximately $6.9 billion in 2023 and is projected to reach $28.1 billion by 2030, growing at a CAGR of 22.2% according to MarketsandMarkets. This indicates a substantial shift towards technology-driven solutions.

Failure to proactively invest in and integrate these new technologies, such as sophisticated automation for inspections or AI platforms for proactive maintenance, could erode Denholm MacNamee's competitive standing. Companies that embrace these innovations can offer more efficient, cost-effective, and accurate services, leaving slower adopters behind. The imperative is to stay ahead of the curve to maintain market relevance and capture new opportunities.

The continuous need for technological adaptation presents a considerable challenge, demanding substantial capital investment and specialized expertise. Keeping pace with innovation requires ongoing research and development, as well as the recruitment and retention of highly skilled personnel in areas like data science and robotics. This financial and human capital commitment is crucial for navigating the evolving technological landscape and ensuring long-term viability.

Key considerations for Denholm MacNamee include:

- Investment in AI and Automation: Allocating resources towards the adoption of AI-driven predictive maintenance and robotic inspection technologies is essential to enhance service efficiency and accuracy.

- Talent Acquisition and Development: Building a workforce with expertise in emerging technologies, such as data analytics and advanced robotics, is critical for successful implementation and operation.

- Strategic Partnerships: Collaborating with technology providers or research institutions can accelerate the adoption of new solutions and mitigate the risks associated with in-house development.

- Competitive Landscape Monitoring: Continuously assessing how competitors are leveraging new technologies will inform Denholm MacNamee's own strategic response to maintain a competitive edge.

Skilled Labor Shortages

Denholm MacNamee faces a significant threat from skilled labor shortages, particularly given the highly specialized nature of its engineering, inspection, and maintenance services. The demand for professionals with specific certifications and experience in areas like non-destructive testing (NDT) or advanced mechanical services is outstripping supply.

This scarcity directly impacts operational capacity and growth potential. For instance, a report from the Bureau of Labor Statistics in late 2024 indicated a 15% year-over-year increase in demand for specialized mechanical engineers, a trend likely to continue into 2025. This shortage can force companies to delay projects or accept less favorable terms.

- Specialized Skill Gaps: Niche areas like advanced welding inspection or specialized pipeline integrity services are experiencing critical shortages of certified personnel.

- Increased Labor Costs: Competition for limited talent drives up wages and benefits, impacting project profitability. In 2024, average salaries for certified NDT technicians rose by an estimated 8-10%.

- Project Delays: Inability to secure qualified staff can lead to missed deadlines and reduced project throughput, affecting revenue generation.

Denholm MacNamee faces intense competition from a growing number of players in the industrial maintenance sector, which was valued at approximately $120 billion in 2023. This crowded market puts pressure on pricing and profit margins, necessitating a strong focus on unique value propositions like innovation and service quality to maintain market share.

Strict regulatory environments, particularly in the energy sector, present ongoing challenges. For instance, evolving environmental and safety standards, such as stricter emissions regulations proposed in 2024, require continuous investment in compliance, training, and technology upgrades, impacting operational costs and potentially leading to significant penalties for non-compliance.

Rapid technological advancements, including AI-powered predictive analytics and robotics, are transforming the industry. The global predictive maintenance market, projected to reach $28.1 billion by 2030, highlights the need for Denholm MacNamee to invest in and integrate these new solutions to avoid becoming obsolete and maintain a competitive edge.

Skilled labor shortages, especially for specialized roles like NDT technicians, are a significant threat, with demand increasing by 15% year-over-year for specialized mechanical engineers in late 2024. This scarcity drives up labor costs, estimated at an 8-10% salary increase for certified NDT technicians in 2024, and can lead to project delays, impacting overall profitability and operational capacity.

SWOT Analysis Data Sources

This Denholm MacNamee SWOT analysis is built on a foundation of robust data, including company financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic overview.