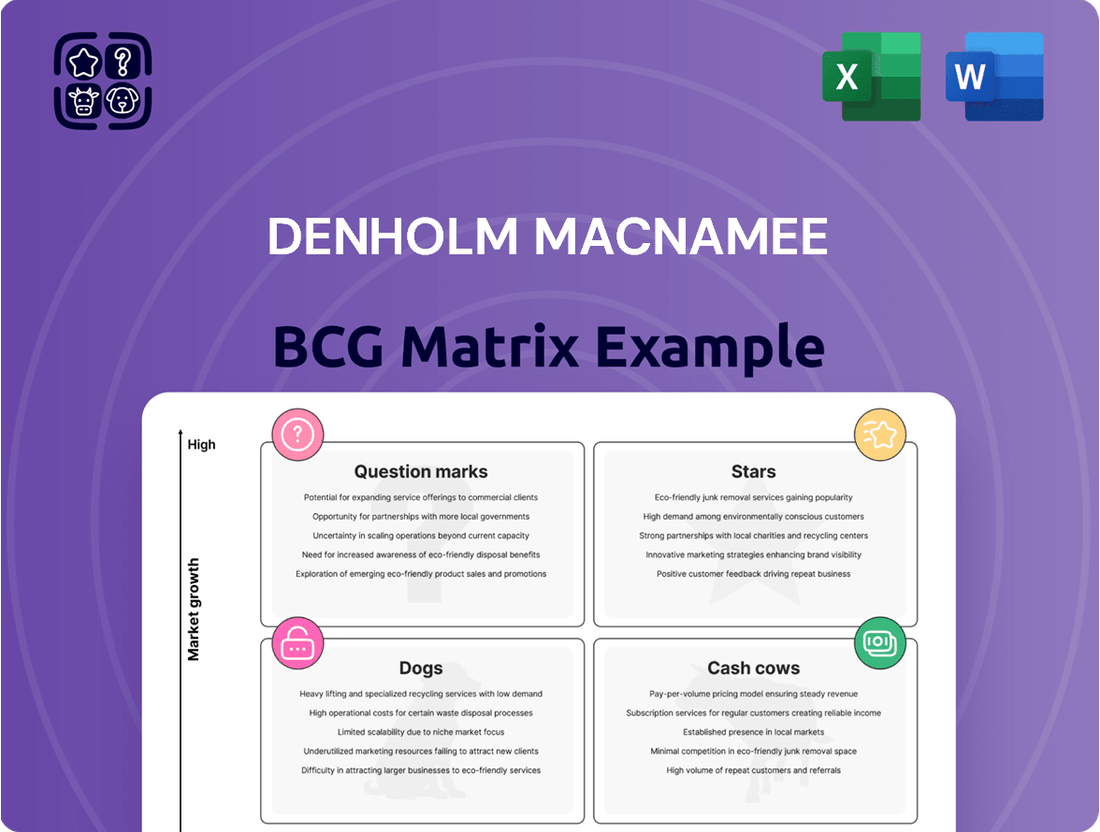

Denholm MacNamee Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denholm MacNamee Bundle

Unlock the strategic potential of Denholm MacNamee's product portfolio with our comprehensive BCG Matrix. Understand how each offering fits into the critical categories of Stars, Cash Cows, Dogs, and Question Marks, and identify key areas for growth and resource allocation.

This insightful preview is just the beginning. Purchase the full BCG Matrix report to gain detailed quadrant placements, actionable data-backed recommendations, and a clear roadmap for optimizing your investment and product strategies.

Don't miss out on the complete picture; buy the full BCG Matrix to receive a detailed Word report alongside a high-level Excel summary, equipping you to evaluate, present, and strategize with unparalleled confidence.

Stars

Denholm MacNamee is making significant strides in advanced Non-Destructive Testing (NDT) by integrating AI and robotics into its services. This includes sophisticated techniques like Phased Array Ultrasonics (PAUT) and the Total Focusing Method (TFM), where AI optimizes data interpretation and robotics automate inspection processes.

The global NDT market is experiencing robust growth, with projections indicating a Compound Annual Growth Rate (CAGR) between 7.7% and 8.7% extending to 2035. This expansion is fueled by innovations in digital radiography, AI-powered analytics, and the increasing adoption of robotics, all of which contribute to faster, more precise, and safer inspections.

Denholm MacNamee's focus on these high-growth segments, leveraging its specialized expertise in AI and robotics for NDT, positions the company to secure a considerable share of this expanding market.

Denholm MacNamee's AI-driven predictive maintenance and asset integrity solutions are firmly positioned as Stars in the BCG Matrix. These services utilize artificial intelligence and machine learning to analyze real-time sensor data and historical records, allowing clients to foresee equipment failures and minimize operational disruptions.

The Asset Integrity Management (AIM) market is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) between 4.8% and 10.3% from 2024 through 2035. AI-driven strategies are a significant driver within this expanding sector, highlighting the strong market demand for Denholm MacNamee's offerings.

Denholm MacNamee is actively integrating remote inspection technologies, specifically drones and robotics, into its service offerings. This strategic move addresses the growing demand within the industrial sector for safer, more efficient, and accessible inspection methods, particularly in challenging environments.

The adoption of these advanced tools is transforming the industrial inspection landscape. For instance, by 2025, the oil and gas industry is seeing significant uptake of drones equipped with AI for automated defect detection, a trend Denholm MacNamee is well-positioned to leverage.

Digitalization of Asset Documentation and Data Analytics

Denholm MacNamee's commitment to digitalizing asset documentation and leveraging data analytics directly addresses a critical need in the Asset Integrity Management (AIM) market. Their services, focused on real-time data collection and sophisticated analytics, provide clients with unparalleled visibility into asset health and performance.

This digital transformation is a major force in AIM, as organizations increasingly demand instant asset insights for better risk mitigation and strategic choices. For example, a 2024 report indicated that 70% of industrial companies are investing in digital twin technologies to improve asset management, highlighting the market's shift.

By offering integrated digital solutions, Denholm MacNamee is well-positioned to capture significant market share. Their approach facilitates proactive maintenance and optimized operational efficiency, crucial for companies aiming to reduce downtime and operational costs. In 2023, companies adopting advanced AIM analytics reported an average 15% reduction in unplanned maintenance events.

- Digitalization of Asset Records: Streamlining documentation for easier access and analysis.

- Real-time Data Collection: Enabling immediate insights into asset condition and performance.

- Advanced Data Analytics: Utilizing AI and machine learning for predictive maintenance and risk assessment.

- Enhanced Decision-Making: Empowering stakeholders with actionable data for improved asset strategies.

Specialized Engineering and Inspection for Renewable Energy Infrastructure

Denholm MacNamee's specialized engineering and inspection services for renewable energy infrastructure position it strongly within the growing green energy sector. With significant global investments pouring into renewables, the company is well-placed to capitalize on this trend.

Europe, for instance, saw renewable energy capacity additions reach approximately 41 GW in 2023, a notable increase from previous years, highlighting the expanding market for asset integrity solutions. Denholm MacNamee’s expertise in inspection and maintenance for wind turbines, solar farms, and other renewable assets addresses a critical need for ensuring operational efficiency and longevity.

- Market Growth: The global renewable energy market is projected to continue its robust expansion, driven by climate change initiatives and energy security concerns.

- Service Demand: As more renewable energy assets are deployed, the demand for specialized inspection, maintenance, and engineering services to ensure their integrity and performance will rise significantly.

- Denholm MacNamee's Role: The company's established competencies in asset integrity management are directly transferable and highly relevant to the unique challenges of the renewable energy sector.

- Strategic Advantage: By focusing on this high-growth area, Denholm MacNamee can leverage its existing skills to capture market share and drive revenue growth in a dynamic industry.

Denholm MacNamee's AI-driven predictive maintenance and asset integrity solutions are firmly positioned as Stars in the BCG Matrix. These services leverage artificial intelligence and machine learning to analyze real-time sensor data, enabling clients to foresee equipment failures and minimize operational disruptions. The Asset Integrity Management (AIM) market, projected to grow with a CAGR between 4.8% and 10.3% from 2024 through 2035, is significantly driven by these AI-powered strategies, indicating strong market demand.

Denholm MacNamee's integration of remote inspection technologies, such as drones and robotics, also places them in the Star category. This directly addresses the increasing demand for safer, more efficient, and accessible inspection methods, especially in challenging environments. The oil and gas sector, for example, is seeing significant uptake of AI-equipped drones for automated defect detection by 2025, a trend Denholm MacNamee is poised to capitalize on.

The company's focus on the digitalization of asset documentation and advanced data analytics further solidifies its Star position. By providing real-time data collection and sophisticated AI-driven analytics, Denholm MacNamee offers clients enhanced visibility into asset health. This digital transformation is crucial, with a 2024 report showing 70% of industrial companies investing in digital twin technologies to improve asset management.

Denholm MacNamee's specialized engineering and inspection services for renewable energy infrastructure also represent a Star. With substantial global investments in renewables, such as Europe's approximately 41 GW of renewable energy capacity additions in 2023, the demand for ensuring operational efficiency and longevity of these assets is high. Denholm MacNamee's expertise in asset integrity management is directly transferable and highly relevant to this expanding market.

| Denholm MacNamee Business Area | BCG Matrix Category | Market Growth Indicator | Denholm MacNamee's Strategic Advantage |

|---|---|---|---|

| AI-Driven Predictive Maintenance & Asset Integrity | Star | AIM Market CAGR: 4.8%-10.3% (2024-2035) | Leveraging AI/ML for proactive failure prediction. |

| Remote Inspection (Drones & Robotics) | Star | AI Drone Adoption in Oil & Gas (by 2025) | Enhanced safety, efficiency, and accessibility in inspections. |

| Digitalization & Advanced Data Analytics | Star | Digital Twin Investment: 70% of Industrial Companies (2024) | Real-time insights and improved asset management strategies. |

| Renewable Energy Infrastructure Services | Star | European Renewable Capacity Additions: ~41 GW (2023) | Applying established asset integrity skills to a high-growth sector. |

What is included in the product

Strategic framework categorizing business units by market share and growth.

Guides investment decisions for Stars, Cash Cows, Question Marks, and Dogs.

The Denholm MacNamee BCG Matrix offers a clear, visual representation of your portfolio, alleviating the pain of strategic uncertainty by highlighting areas for investment and divestment.

Cash Cows

Denholm MacNamee's conventional Non-Destructive Testing (NDT) services, encompassing methods like ultrasonic, radiographic, and magnetic particle inspection, are classic Cash Cows. These established techniques are the backbone of quality assurance in critical sectors such as oil & gas and power generation.

The global NDT market, valued at approximately $6.5 billion in 2024, saw conventional methods dominate. Denholm MacNamee, as a key player in this mature segment, benefits from consistent demand and established client relationships, translating into robust and predictable cash flows with minimal need for aggressive market development spending.

Routine mechanical maintenance for established industrial assets forms a significant Cash Cow for Denholm MacNamee. This core service focuses on the essential upkeep of mature industrial equipment and infrastructure, a segment vital for operational continuity and safety. These services are characterized by a stable and predictable revenue stream, driven by a high market share of long-term clients who rely on consistent operational performance.

The demand for routine maintenance on existing assets remains robust, even as the broader mechanical services market experiences growth. In 2024, the industrial maintenance sector is projected to see continued steady demand, with companies prioritizing the longevity and efficiency of their current capital investments. Denholm MacNamee's established client base ensures a consistent flow of work, underpinning the Cash Cow status of this offering.

Denholm MacNamee's robust asset integrity management services for the oil and gas sector, including inspections, corrosion control, and pipeline upkeep, represent a strong Cash Cow. This industry's strict safety mandates and unwavering demand for reliable assets create a stable revenue stream.

The company's deep-rooted experience and proven track record in this vital area solidify its considerable market share. This translates into predictable and significant cash flow, largely driven by long-term service agreements. For instance, the global oil and gas industry's spending on asset integrity management was projected to reach over $20 billion in 2024, highlighting the market's substantial value.

Industrial Cleaning and Environmental Service Solutions

Industrial Cleaning and Environmental Service Solutions, within Denholm MacNamee's BCG Matrix, represent the company's Cash Cows. These services, such as liquid waste management and industrial cleaning, are fundamental to ongoing industrial operations, creating a predictable and steady income stream.

The demand for these essential services is well-established, and Denholm MacNamee's strong reputation and market presence allow it to maintain a significant market share. This translates into consistent cash flow generation, even if the sector itself isn't experiencing rapid expansion.

- Stable Revenue: Recurring demand for essential industrial cleaning and environmental services ensures a consistent income.

- High Market Share: Denholm MacNamee's established position in this sector guarantees a substantial portion of the market.

- Consistent Cash Flow: The reliable nature of these services provides a predictable and strong cash flow for the company.

- Low Growth, High Share: While the market may not be growing quickly, Denholm MacNamee's dominance ensures profitability.

Basic Industrial Repair and Overhaul Services

Denholm MacNamee's basic industrial repair and overhaul services are a classic example of a Cash Cow within the BCG Matrix. These essential services, focused on maintaining and extending the lifespan of industrial machinery, represent a stable and predictable revenue stream.

The industrial repair market itself is robust, with global spending on industrial maintenance and repair operations (MRO) projected to reach significant figures. For instance, the MRO market was valued at approximately $200 billion in 2023, with steady growth anticipated. This indicates a consistent demand for the foundational services Denholm MacNamee offers.

- Market Stability: The ongoing need for equipment upkeep ensures a consistent customer base for repair and overhaul services.

- Reliable Income: These services, while not experiencing rapid expansion, provide a dependable source of income for Denholm MacNamee.

- Industry Necessity: Maintaining operational efficiency and preventing costly breakdowns makes these services indispensable for industrial clients.

- Market Presence: Denholm MacNamee leverages its expertise in these fundamental services to solidify its position in the industrial sector.

Denholm MacNamee's expertise in providing essential industrial cleaning and environmental solutions, such as liquid waste management, firmly places these services within the Cash Cow quadrant of the BCG Matrix. These are fundamental offerings that industrial clients consistently require for ongoing operations, ensuring a predictable and steady income for the company.

The demand for these critical services is well-established, and Denholm MacNamee's strong market presence and reputation allow it to maintain a significant market share. This translates into consistent cash flow generation, even if the sector itself isn't experiencing rapid expansion. For example, the global industrial cleaning services market was valued at approximately $75 billion in 2024, with essential services forming a substantial portion of this value.

These Cash Cow services are characterized by their stable revenue streams, high market share for Denholm MacNamee, and consistent cash flow generation. While the market may not be growing at a rapid pace, the company's dominance in these necessary offerings ensures profitability and a reliable financial base.

Denholm MacNamee's industrial repair and overhaul services are a prime example of a Cash Cow. These services are crucial for maintaining and extending the lifespan of industrial machinery, generating a stable and predictable revenue stream. The global industrial maintenance and repair operations (MRO) market was valued at around $200 billion in 2023, with consistent demand for such foundational services.

| Service Category | BCG Quadrant | Market Characteristic | Denholm MacNamee Position | Financial Implication |

|---|---|---|---|---|

| Conventional NDT | Cash Cow | Mature, stable demand | High market share | Predictable, robust cash flows |

| Routine Mechanical Maintenance | Cash Cow | Essential, consistent need | Established client base | Stable revenue stream |

| Asset Integrity Management (Oil & Gas) | Cash Cow | Mandatory, high value | Deep experience, significant share | Predictable, significant cash flow |

| Industrial Cleaning & Environmental Services | Cash Cow | Fundamental, ongoing requirement | Strong reputation, market presence | Consistent cash flow generation |

| Basic Industrial Repair & Overhaul | Cash Cow | Necessity for longevity | Expertise in fundamental services | Dependable income source |

Delivered as Shown

Denholm MacNamee BCG Matrix

The Denholm MacNamee BCG Matrix preview you are viewing is the identical, fully prepared document you will receive upon purchase. This means no watermarks or placeholder content will be present in your downloaded file, ensuring immediate usability for your strategic planning needs. You are getting the complete, professionally formatted analysis, ready to be integrated into your business presentations or decision-making processes. This ensures transparency and confidence in the quality of the strategic tool you are acquiring.

Dogs

Services that still rely exclusively on old-fashioned, manual inspection methods are falling behind. These methods, lacking digital tools, AI, or remote capabilities, are becoming obsolete. For instance, the global industrial inspection market, while growing, sees increasing demand for advanced digital solutions. Companies sticking to manual-only approaches risk becoming irrelevant as the industry embraces efficiency and safety through technology.

The market is clearly moving towards smarter, safer inspection techniques. Digital and remote methods are gaining traction, leaving traditional manual-only services with shrinking market share and limited growth prospects. A significant portion of the inspection market is now driven by IoT and AI integration, a trend that is expected to accelerate. Investing in outdated manual inspection methods would be a poor financial decision for Denholm MacNamee, essentially trapping capital in a declining segment.

Purely reactive maintenance contracts, where service is only provided after equipment fails, are increasingly being phased out. This approach, which focuses solely on fixing problems after they happen, is proving inefficient in today's demanding industrial landscape.

The market is clearly shifting towards proactive and predictive maintenance strategies. For instance, a 2024 report indicated that companies investing in predictive maintenance saw an average reduction in unplanned downtime by up to 30%, directly impacting cost savings and operational efficiency.

Consequently, maintenance service providers that do not integrate advanced technologies like predictive analytics or condition-based monitoring are facing significant challenges. These services are predicted to experience very low growth and a shrinking share of the market as clients demand more sophisticated, preventative solutions.

Commoditized general fabrication services at Denholm MacNamee would likely be classified as Dogs in the BCG Matrix. These services, characterized by their lack of specialization and reliance on standard processes, struggle to command premium pricing. In 2024, the global general fabrication market experienced a growth rate of approximately 3.5%, but this was largely driven by volume rather than value, indicating intense competition and thin margins for undifferentiated offerings.

Non-Specialized, Low-Value Mechanical Services

Non-specialized, low-value mechanical services offered by Denholm MacNamee likely fall into the Dogs quadrant of the BCG Matrix. These are services that are highly commoditized, meaning they can be performed by many different providers without significant differentiation. Think basic repairs or routine maintenance that don't require advanced engineering knowledge.

These types of services often operate in highly fragmented markets with intense price competition. For example, the general building maintenance sector, which includes many basic mechanical tasks, saw a global market size estimated at around $1.1 trillion in 2023, but with very low profit margins for many participants. Denholm MacNamee’s involvement in such areas would likely yield low returns on investment.

- Low Profitability: Due to commoditization, these services typically command low margins, often in the single digits, making them financially unattractive.

- High Competition: The barrier to entry is low, leading to a crowded marketplace with numerous general contractors competing on price.

- Limited Growth Potential: Demand for these basic services is often tied to overall economic activity rather than specific industry growth trends.

- Resource Drain: Investing resources in these areas can detract from opportunities in more specialized, higher-margin segments of the mechanical services market.

Legacy Asset Documentation and Record Keeping (Non-Digitalized)

Legacy asset documentation and record-keeping, particularly non-digitalized methods, represent a significant challenge in today's rapidly evolving financial landscape. These traditional, paper-based systems, or even poorly integrated digital ones, are becoming increasingly inefficient and uncompetitive as the market aggressively shifts towards comprehensive digitalization.

The drive towards cloud-based solutions and real-time data access for asset management renders these outdated methods a liability. For instance, a 2024 survey indicated that over 60% of financial institutions are actively investing in digital transformation to improve data accessibility and operational efficiency, directly impacting how legacy systems are perceived.

- Inefficiency and High Costs: Manual processes inherent in non-digitalized systems lead to higher operational costs due to increased labor, storage, and the risk of errors.

- Limited Accessibility: Accessing and retrieving information from paper-based or non-integrated digital archives is slow and cumbersome, hindering timely decision-making.

- Security Risks: Physical documents are susceptible to damage, loss, or theft, while fragmented digital systems may lack robust cybersecurity measures.

- Lack of Scalability: Non-digitalized systems struggle to scale with growing asset portfolios and increasing data volumes, creating bottlenecks.

Dogs in Denholm MacNamee's BCG Matrix represent services with low market share and low growth potential. These are typically commoditized offerings that struggle to differentiate themselves and command premium pricing.

For instance, general fabrication services, a segment with around 3.5% growth in 2024, often fall into this category due to intense price competition. Similarly, basic mechanical services in the vast building maintenance sector, valued at $1.1 trillion in 2023, offer low margins for undifferentiated providers.

These Dog segments are characterized by low profitability, high competition, limited growth prospects, and can drain resources from more promising areas.

Question Marks

AI-powered visual diagnostics for complex inspections represent a significant opportunity, aligning with a high-growth market where AI analyzes visual data to identify defects and forecast equipment failures. This technology promises substantial gains in operational efficiency and accuracy for inspections.

While the market for AI visual diagnostics is expanding rapidly, Denholm MacNamee's current market penetration in this specialized AI application is likely modest, given its emerging nature. The global market for AI in industrial inspection was projected to reach over $1.5 billion in 2023 and is expected to grow at a CAGR of over 20% through 2030, indicating substantial future potential.

To elevate this offering from a Question Mark to a Star within Denholm MacNamee's portfolio, substantial investment in research and development, alongside the recruitment of specialized AI and data science talent, would be crucial. This strategic focus is essential to capture a significant share of this burgeoning, high-value market segment.

Denholm MacNamee's comprehensive digital twin implementation services represent a significant opportunity, aligning with the high-growth trend of virtual replicas for real-time monitoring and predictive maintenance in asset integrity management. This offering positions them in a segment with substantial future potential.

The current market for digital twin solutions is rapidly expanding, with projections indicating continued strong growth through 2024 and beyond. However, the substantial investment and technical expertise needed for widespread adoption mean Denholm MacNamee likely holds a relatively low market share at present. This places their digital twin services squarely in the Question Mark category of the BCG matrix, signifying high potential but requiring strategic investment to capture market share.

The market for cybersecurity solutions tailored to industrial operational technology (OT) is experiencing robust growth, driven by the increasing digitization of critical infrastructure. This surge in demand highlights a significant opportunity for companies looking to enter or expand in this specialized sector.

If Denholm MacNamee were to venture into offering dedicated cybersecurity services focused on asset integrity within OT environments, this strategic move would likely be classified as a Question Mark on the BCG Matrix. This classification stems from the need for substantial new investments and the acquisition of specialized expertise to establish a strong foothold in a competitive landscape.

The global OT cybersecurity market was valued at approximately $17.7 billion in 2023 and is projected to reach over $30 billion by 2028, demonstrating a compound annual growth rate (CAGR) of around 11.5%. This rapid expansion underscores the high-growth potential but also the inherent risks and investment requirements associated with developing competitive capabilities in this domain.

Augmented Reality (AR) for On-site Maintenance and Training

Augmented Reality (AR) in on-site maintenance and training is a burgeoning field, offering real-time visual guidance and remote expert assistance to technicians. This technology streamlines complex tasks and enhances learning, representing a significant growth opportunity. For Denholm MacNamee, their AR solutions, while innovative, may currently hold a smaller slice of this expanding market, necessitating strategic focus to capture a larger share.

- Market Growth: The global AR in industrial maintenance market was valued at an estimated $1.5 billion in 2023 and is projected to reach $12.8 billion by 2030, growing at a CAGR of 36.1%.

- Denholm MacNamee's Position: While specific market share data for Denholm MacNamee is proprietary, the company's investment in AR indicates a strategic move to capitalize on this high-growth trend.

- Key Benefits: AR applications reduce error rates by up to 90% in complex assembly tasks and can decrease training times by 30-50%.

- Strategic Imperative: To maximize its potential, Denholm MacNamee will need to invest in scaling its AR offerings, building partnerships, and demonstrating clear ROI to clients in this competitive space.

Advanced Material Characterization and Testing for Emerging Industries

Venture into advanced material characterization and testing for burgeoning sectors like aerospace composites or renewable energy components. These fields present substantial growth opportunities, but demand considerable investment in research and development, alongside dedicated market penetration strategies to capture significant market share.

The global advanced materials market is projected to reach $116.6 billion by 2027, with a compound annual growth rate of 8.9%. This expansion is driven by demand from industries like aerospace, automotive, and electronics, all of which increasingly rely on specialized materials.

- High Growth Potential: Emerging industries like electric vehicles and next-generation aerospace are creating a strong demand for novel materials with enhanced properties.

- R&D Intensity: Developing and validating these specialized materials requires significant upfront investment in research and sophisticated testing equipment.

- Market Penetration Challenges: Establishing credibility and securing contracts in these highly technical and regulated markets can be a lengthy and complex process.

- Strategic Importance: Companies that successfully navigate these challenges can position themselves as critical suppliers in rapidly expanding value chains.

Question Marks represent business areas with low market share in high-growth industries. These ventures require careful consideration regarding investment, as they have the potential to become future Stars but also carry a significant risk of failure.

For Denholm MacNamee, their AI-powered visual diagnostics for complex inspections, digital twin implementation services, and OT cybersecurity offerings are prime examples of Question Marks. These are all in rapidly expanding markets, but the company's current penetration is likely modest, necessitating strategic investment to gain traction.

Similarly, their Augmented Reality solutions for maintenance and training, alongside ventures into advanced material characterization, also fall into the Question Mark category. These areas offer substantial growth prospects, but require dedicated R&D and market entry strategies to convert potential into market leadership.

Successfully nurturing these Question Marks involves targeted investment in technology, talent, and market development. The goal is to increase market share within these high-growth sectors, transforming them into profitable Stars for Denholm MacNamee.

BCG Matrix Data Sources

Our Denholm MacNamee BCG Matrix is built on a foundation of robust financial disclosures, comprehensive market analytics, and expert industry evaluations to ensure strategic accuracy.