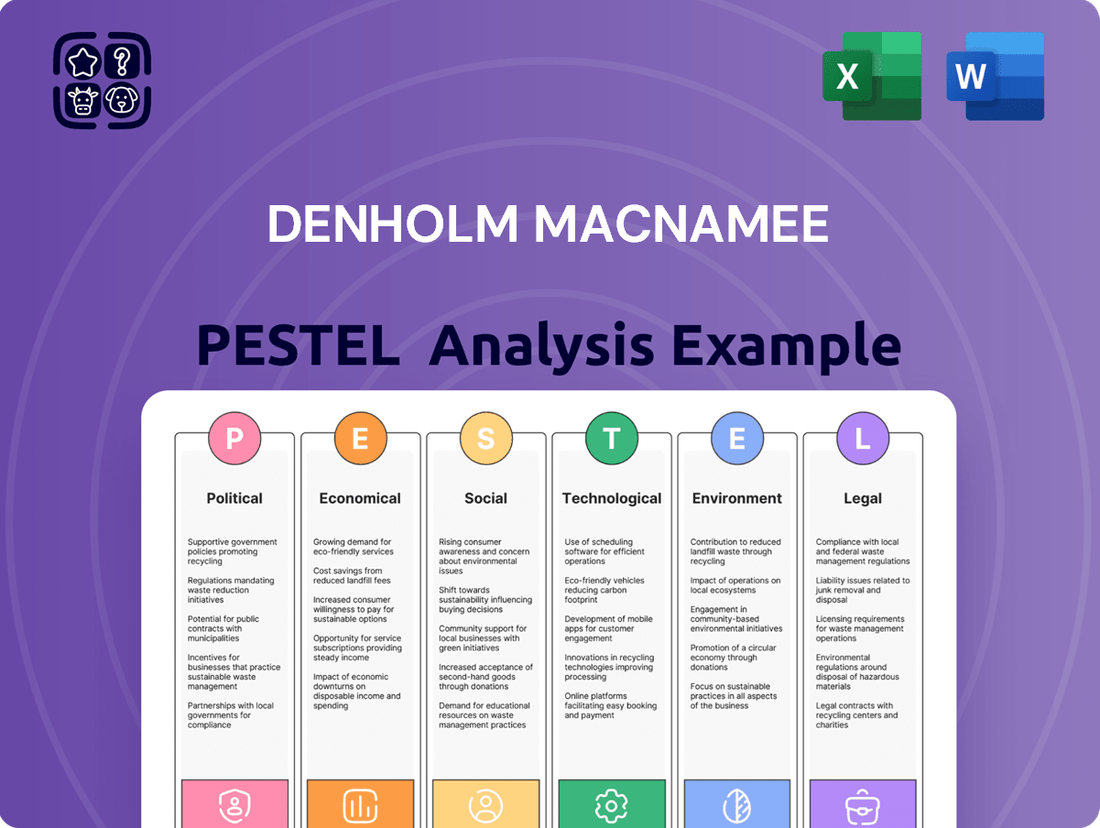

Denholm MacNamee PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denholm MacNamee Bundle

Unlock the external forces shaping Denholm MacNamee's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that influence its operations and strategic decisions. Gain a critical advantage by identifying opportunities and mitigating risks. Download the full analysis now for actionable intelligence.

Political factors

Government energy policies, especially those pushing for a transition to cleaner energy and decarbonization, are a major driver for investment in both traditional and renewable energy sectors. Denholm MacNamee's demand for asset integrity services will fluctuate based on these policy shifts, whether it's maintaining older fossil fuel infrastructure or supporting the build-out of new green energy projects.

For instance, the European Union's Green Deal aims for climate neutrality by 2050, which is influencing substantial investments in renewable energy infrastructure, potentially increasing demand for Denholm MacNamee's expertise in new installations and the integrity of offshore wind farms. Conversely, policies that extend the lifespan of existing fossil fuel assets could maintain demand for their services in that segment.

Regulatory stability and changes in subsidies or tax incentives for renewable energy projects, such as those seen in the United States with the Inflation Reduction Act of 2022, directly impact the viability and pipeline of new projects. A stable and supportive policy environment, like the UK's commitment to offshore wind targets, can provide a predictable revenue stream for companies like Denholm MacNamee.

Global geopolitical events, such as the ongoing conflicts in Eastern Europe and the Middle East, directly impact energy supply chains. These disruptions can lead to increased volatility in energy prices, influencing investment decisions for infrastructure projects. For Denholm MacNamee, this instability might translate into greater demand for services related to maintaining and repairing domestic energy assets as nations prioritize energy security.

The ongoing tensions in various regions could also affect international trade and project financing. For instance, sanctions or trade restrictions stemming from geopolitical instability might cause delays or cancellations of projects in affected areas, potentially impacting Denholm MacNamee's international project pipeline. The global defense spending increase, projected to reach $2.2 trillion in 2024 according to some estimates, highlights a broader trend of heightened geopolitical concern that could indirectly benefit companies involved in critical infrastructure.

Industrial sector regulations, particularly those concerning safety standards and operational permits for critical infrastructure, directly impact Denholm MacNamee's business. These rules necessitate rigorous compliance from clients in the power and industrial sectors, making Denholm MacNamee's inspection and maintenance services vital for ensuring safe and legal operations.

For instance, the UK's Health and Safety Executive (HSE) enforces strict regulations on industrial processes, with fines for non-compliance reaching up to £20 million for severe breaches as of 2024. Denholm MacNamee's expertise in asset integrity management helps clients avoid such penalties.

Furthermore, evolving environmental regulations, such as those related to emissions control in industrial facilities, can create demand for new specialized services. Denholm MacNamee's ability to adapt its offerings to meet these changing legal landscapes is crucial for sustained growth and client retention.

Trade Policies and Tariffs

Trade policies and tariffs significantly influence the cost and availability of essential materials and equipment for industrial ventures. For Denholm MacNamee, any shifts in international trade agreements or the imposition of tariffs on specialized equipment or parts could lead to increased operational costs and potential disruptions in their supply chain. For instance, a 2024 report indicated that tariffs on imported steel, a key component in many industrial projects, saw a 25% increase in some sectors, directly impacting project budgets.

These trade dynamics can create cost volatility and logistical hurdles, directly affecting Denholm MacNamee's project profitability and overall market competitiveness. The company's reliance on global sourcing for specific components means that changes in trade regulations, such as those potentially arising from ongoing trade negotiations or geopolitical shifts in 2024-2025, could necessitate costly adjustments to sourcing strategies or production timelines.

- Tariff Impact: Increased tariffs on imported industrial machinery could raise capital expenditure for new projects by an estimated 5-10% in 2025, depending on the specific trade agreements in place.

- Supply Chain Risk: Geopolitical tensions in key manufacturing regions could lead to a 15% increase in lead times for critical components by late 2024.

- Trade Agreement Revisions: Potential renegotiations of existing trade pacts in 2025 might alter import duties on raw materials, impacting cost structures for projects relying on these inputs.

Public Spending on Infrastructure

Government budgets allocated to national infrastructure projects, such as energy grids and industrial facilities, directly impact the market for Denholm MacNamee's services. Increased public investment in upgrading or expanding critical infrastructure creates a greater demand for specialist engineering, inspection, and maintenance work. For example, the United States' Infrastructure Investment and Jobs Act, enacted in late 2021, is set to invest over $1 trillion in infrastructure improvements through 2026, creating significant opportunities.

Conversely, austerity measures or shifts in government spending priorities can reduce these opportunities. The pace of these investments and the specific sectors prioritized will shape the demand for Denholm MacNamee's expertise.

- Increased infrastructure spending: Drives demand for engineering and inspection services.

- Government budget allocations: Directly influence market size for infrastructure projects.

- Infrastructure Investment and Jobs Act (US): A significant driver of infrastructure investment through 2026.

Government energy policies, particularly those focused on decarbonization and renewable energy, significantly shape the demand for Denholm MacNamee's asset integrity services.

Regulatory frameworks, like the EU's Green Deal and the US Inflation Reduction Act of 2022, directly influence investment in new energy infrastructure, creating opportunities for specialized maintenance and inspection work.

Geopolitical events and global security concerns, evidenced by increased defense spending projected at $2.2 trillion in 2024, can disrupt supply chains and alter energy price volatility, potentially boosting demand for domestic asset maintenance.

Industrial and environmental regulations, such as the UK's strict HSE safety standards with potential fines up to £20 million for breaches, underscore the critical need for Denholm MacNamee's compliance-focused services.

| Policy Focus | Impact on Denholm MacNamee | Supporting Data/Example |

| Decarbonization & Renewables | Increased demand for new green energy infrastructure integrity services. | EU Green Deal driving substantial renewable investment. |

| Energy Security | Potential boost in demand for maintaining domestic energy assets due to supply chain disruptions. | Global geopolitical instability impacting energy markets. |

| Industrial Safety Regulations | Vital need for compliance-driven inspection and maintenance services. | UK HSE fines up to £20 million for severe breaches (2024). |

What is included in the product

This Denholm MacNamee PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking strategies to help navigate market dynamics and capitalize on emerging opportunities.

The Denholm MacNamee PESTLE Analysis provides a structured framework that simplifies complex external factors, alleviating the pain of information overload and enabling clearer strategic decision-making.

Economic factors

Global energy prices, particularly for oil and natural gas, significantly influence Denholm MacNamee's business. For instance, Brent crude oil prices, which averaged around $80 per barrel in early 2024, directly affect the capital budgets of companies in the upstream oil and gas sector, a key client base for Denholm MacNamee.

When energy prices are robust, such as the upward trend observed in late 2023 and early 2024, clients tend to increase spending on exploration, drilling, and asset integrity services. This surge in activity translates to higher demand for Denholm MacNamee's specialized inspection and maintenance solutions.

Conversely, periods of depressed energy prices, like the dip experienced in mid-2023 where Brent crude briefly fell below $75 per barrel, can lead to project delays and reduced investment in new infrastructure. This scenario necessitates a strategic focus on cost optimization and efficiency for Denholm MacNamee's service offerings.

The global industrial and power sectors are experiencing varied investment levels. For instance, in 2024, projections for global industrial capital expenditure showed a modest increase, driven by infrastructure development and energy transition initiatives, although geopolitical uncertainties could temper this growth. A healthy economic climate typically fuels greater industrial activity, directly benefiting companies like Denholm MacNamee by increasing demand for asset integrity management services and maintenance projects.

Conversely, economic downturns pose a significant risk, as clients often postpone non-essential maintenance and capital upgrades to conserve cash. For example, a slowdown in manufacturing output, as seen in some regions during late 2023 and early 2024 due to inflation and interest rate hikes, can lead to reduced project pipelines for service providers. This directly impacts Denholm MacNamee's revenue streams when clients delay critical asset upkeep.

Rising inflation in 2024 and 2025 directly impacts Denholm MacNamee's operational expenses. For instance, the Producer Price Index (PPI) for manufactured goods, a key indicator of material costs, saw significant year-over-year increases throughout 2024, impacting sectors relevant to Denholm MacNamee's supply chain. This necessitates a strategic approach to cost management and potential service price adjustments to safeguard profit margins.

Supply chain vulnerabilities continue to play a crucial role, with geopolitical events and labor shortages contributing to material cost volatility. For example, the cost of specialized metals and components, critical for certain industrial services, experienced price spikes of 10-15% in late 2024 due to these factors. Denholm MacNamee must navigate these fluctuations by diversifying suppliers and optimizing inventory management.

Interest Rates and Access to Capital

Changes in interest rates directly impact the cost of capital for Denholm MacNamee's clients, particularly for significant infrastructure investments and routine upkeep. For example, the Federal Reserve's target for the federal funds rate, which influences broader borrowing costs, remained at 5.25%-5.50% as of early 2024, a level that has increased borrowing expenses compared to previous years.

When interest rates rise, financing large-scale projects becomes more expensive. This can lead clients to postpone or scale back new infrastructure development, consequently reducing the demand for Denholm MacNamee's engineering and construction services. Similarly, higher borrowing costs might prompt a more conservative approach to maintenance budgets.

The Bank of England's base rate, a key benchmark for UK interest rates, stood at 5.25% in early 2024, reflecting a period of elevated borrowing costs. This economic reality means that clients undertaking substantial projects, such as new building constructions or major renovations, will face higher financing charges.

- Higher borrowing costs: Increased interest rates make it more expensive for clients to secure loans for new projects or ongoing maintenance.

- Investment slowdown: Elevated financing expenses can deter clients from initiating new large-scale infrastructure projects.

- Maintenance budget optimization: Clients may reduce spending on maintenance programs to manage increased interest payments.

- Demand impact: These financial pressures indirectly affect the demand for Denholm MacNamee's service offerings.

Exchange Rate Volatility

Exchange rate volatility presents a significant challenge for businesses with international operations. Fluctuations in currency values can directly affect the profitability of repatriated earnings and the cost of imported goods and services. For instance, a strengthening domestic currency makes a company's exports pricier for foreign buyers, potentially reducing sales volume.

Conversely, a weaker local currency inflates the cost of essential imports, impacting production expenses and margins. Consider the impact on a tech firm importing components from Asia; a depreciating local currency against the US dollar would directly increase their cost of goods sold. In 2024, many emerging market currencies experienced significant downward pressure against the US dollar, impacting companies reliant on imported technology or raw materials.

- Impact on Exports: A stronger domestic currency makes exports more expensive, potentially reducing international sales volume.

- Impact on Imports: A weaker domestic currency increases the cost of imported goods and services, raising operational expenses.

- Profit Repatriation: Exchange rate shifts can alter the value of profits earned in foreign currencies when converted back to the home currency.

- Hedging Costs: Companies may incur costs to hedge against currency risks, adding to overheads.

Economic factors significantly shape Denholm MacNamee's operating environment. Fluctuations in global energy prices, like Brent crude oil averaging around $80 per barrel in early 2024, directly influence client capital expenditure, impacting demand for inspection and maintenance services.

Inflation, with the Producer Price Index for manufactured goods showing year-over-year increases throughout 2024, elevates Denholm MacNamee's operational costs, necessitating careful price management. Rising interest rates, such as the Federal Reserve's target range of 5.25%-5.50% in early 2024, increase borrowing costs for clients, potentially delaying projects and reducing service demand.

Exchange rate volatility also poses a risk; for instance, many emerging market currencies experienced downward pressure against the US dollar in 2024, affecting companies reliant on imported components. These economic variables collectively demand strategic adaptation to maintain profitability and service delivery.

What You See Is What You Get

Denholm MacNamee PESTLE Analysis

The preview shown here is the exact Denholm MacNamee PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. You can trust that the insights and structure you see are what you'll be working with immediately. This comprehensive analysis covers all key external factors impacting Denholm MacNamee.

Sociological factors

Denholm MacNamee's success hinges on a readily available pool of skilled professionals in areas like specialized engineering, inspection, and maintenance. A tight labor market for NDT specialists and experienced engineers could force the company to pay more for talent, impacting project profitability. For instance, the UK faced a projected shortage of around 37,000 engineers annually between 2016 and 2025, a trend likely to persist and affect specialized sectors like those Denholm MacNamee operates in.

To counter potential skill gaps, Denholm MacNamee must prioritize robust training programs and effective strategies for retaining its existing workforce. The ability to attract and keep qualified technicians and engineers is directly linked to operational capacity and the ability to take on new projects. Companies in similar industrial services sectors have seen training investments pay off, with some reporting a 15-20% increase in employee retention after implementing enhanced development initiatives.

Denholm MacNamee's business thrives as society increasingly prioritizes safety and operational reliability, especially within critical infrastructure sectors. This growing emphasis directly translates into higher demand for the company's specialized inspection and maintenance services, as clients seek to ensure their assets meet stringent safety standards.

Public and industry expectations for rigorous safety protocols are on the rise. For instance, the global industrial safety market was valued at approximately $48.5 billion in 2023 and is projected to grow, reflecting this heightened awareness and demand for expert oversight in maintaining asset integrity.

Any significant safety incidents within the energy or infrastructure industries can amplify this trend, leading to intensified scrutiny and a greater push for proactive, preventative measures. This creates a favorable environment for Denholm MacNamee, as companies look to invest in robust solutions to avoid such disruptions.

Clients and stakeholders in the energy and industrial sectors are increasingly prioritizing Corporate Social Responsibility (CSR). For Denholm MacNamee, demonstrating robust CSR, including ethical operations and community involvement, is crucial. This focus directly impacts client selection and partnership opportunities, as companies seek service providers aligned with their own sustainability goals.

By embedding high ethical standards and contributing to sustainable practices, Denholm MacNamee can significantly bolster its reputation. This enhanced image makes the company more attractive to a wider range of clients and partners who are themselves under pressure to meet ESG (Environmental, Social, and Governance) targets. For instance, in 2024, a significant percentage of major oil and gas companies reported increased investment in renewable energy projects as part of their CSR initiatives, signaling a clear market trend.

Demographic Shifts

Aging workforces are a significant demographic trend impacting many industries, including those Denholm MacNamee operates in. For instance, in the United States, the median age of workers in manufacturing has been steadily increasing, with many experienced professionals nearing retirement. This trend can lead to substantial knowledge gaps as seasoned employees depart, necessitating proactive talent management.

Denholm MacNamee may need to refine its recruitment strategies to appeal to younger generations. Highlighting the company's commitment to technological advancement and offering clear pathways for career development are crucial. For example, in 2024, companies that emphasize sustainability and digital transformation are often more successful in attracting Gen Z talent, who prioritize purpose-driven work and opportunities for growth.

- Knowledge Transfer: An aging workforce in traditional sectors risks losing critical institutional knowledge.

- Talent Acquisition: Denholm MacNamee needs to adapt recruitment to attract younger, tech-savvy talent.

- Career Development: Emphasizing innovation and growth opportunities is key to bridging generational gaps.

- Workforce Planning: Proactive succession planning is essential to mitigate the impact of retirements.

Public Acceptance of Energy Sources

Public sentiment is a powerful driver in the energy sector. Increasingly, global populations are expressing a preference for cleaner, renewable energy sources over traditional fossil fuels. This shift directly impacts investment decisions, with significant capital flowing into solar, wind, and other green technologies. For a company like Denholm MacNamee, which operates across various energy segments, understanding and adapting to these evolving attitudes is crucial for long-term success.

The growing demand for sustainability is evident in market trends. For example, by the end of 2024, renewable energy capacity additions are projected to reach new heights, with solar PV and wind power leading the charge. This societal push towards decarbonization creates both challenges and opportunities for companies involved in energy infrastructure and maintenance. While demand for traditional asset services might see a gradual decline, the expansion of renewable assets opens up new avenues for specialized maintenance and operational support.

The implications for Denholm MacNamee are clear:

- Accelerated Transition: A strong societal preference for green energy will likely speed up the adoption of renewable technologies, requiring Denholm MacNamee to bolster its capabilities in this area.

- New Market Opportunities: Increased investment in renewables translates to a growing market for maintenance, repair, and operations (MRO) services for wind turbines, solar farms, and battery storage systems.

- Shifting Demand: Conversely, a sustained move away from fossil fuels could reduce the long-term demand for services related to oil and gas infrastructure maintenance.

- Investment Patterns: Public acceptance directly influences where capital is allocated, favoring companies with a strong presence in the renewable energy value chain.

Societal emphasis on safety and reliability is a significant driver for Denholm MacNamee, increasing demand for its specialized inspection and maintenance services. The global industrial safety market, valued at roughly $48.5 billion in 2023, highlights this growing awareness and need for expert oversight in maintaining asset integrity. Any major safety incidents in critical sectors further amplify this trend, pushing for more proactive measures and benefiting companies like Denholm MacNamee.

Technological factors

Continuous innovation in Non-Destructive Testing (NDT) techniques, like advanced ultrasonics and phased array, directly bolsters Denholm MacNamee's service offerings. These advancements enable more precise, rapid, and secure inspections, boosting operational efficiency and providing a distinct market advantage.

The global NDT market was valued at approximately $6.5 billion in 2023 and is projected to grow significantly, with a compound annual growth rate (CAGR) of around 7% through 2030. This growth underscores the increasing demand for sophisticated inspection solutions.

Embracing these technological leaps, such as incorporating robotic inspection systems, is crucial for maintaining high service quality and differentiating Denholm MacNamee in a competitive landscape.

The increasing adoption of digitization and data analytics is transforming asset management. Technologies like digital twins and IoT sensors, coupled with advanced analytics, are enabling predictive maintenance and significantly boosting operational efficiency. For instance, by 2024, the global market for digital twins in manufacturing alone was projected to reach $15.1 billion, highlighting the growing reliance on these digital replicas for optimization.

Denholm MacNamee can capitalize on these trends by offering more proactive, data-driven asset integrity solutions. This shift from reactive repairs to preventative programs empowers clients with the insights needed to make smarter, more informed decisions about their infrastructure investments and maintenance schedules, ultimately reducing downtime and costs.

The adoption of automation and robotics in inspection is significantly reshaping industries like those Denholm MacNamee serves. Drones, remotely operated vehicles (ROVs), and advanced robotic systems are increasingly deployed to conduct inspections in environments that are hazardous or difficult for humans to access. This technological shift directly enhances safety by minimizing human exposure to dangerous conditions. For instance, the global market for commercial drones used in industrial inspection was projected to reach over $5 billion by 2024, highlighting the widespread integration of these tools.

Denholm MacNamee can leverage these automated inspection technologies to improve operational efficiency and data quality. By utilizing robotics, the company can access previously inaccessible areas, gather more detailed and accurate inspection data, and reduce the time and cost associated with manual inspections. This also offers a strategic advantage in addressing potential labor shortages, ensuring consistent service delivery even with a reduced human workforce. The global robotics market, valued at over $50 billion in 2023, continues to grow, indicating strong investment and development in this sector.

Materials Science Innovations

Innovations in materials science are reshaping industrial asset maintenance. Newer, more resilient materials and advanced coatings can significantly alter how industrial assets are inspected and repaired, potentially reducing the frequency of interventions. Denholm MacNamee must integrate knowledge of these advancements, such as self-healing composites or corrosion-resistant alloys, to offer cutting-edge inspection and repair solutions for modern infrastructure.

Staying abreast of these developments is crucial for Denholm MacNamee to ensure the longevity and structural integrity of client assets. For instance, the global advanced materials market was valued at approximately $100 billion in 2023 and is projected to grow significantly, indicating a strong trend towards adoption of these new technologies.

- Advanced coatings can extend the service life of critical components by resisting extreme temperatures and corrosive environments.

- Nanomaterials are being integrated into structural components to enhance strength and durability, requiring specialized non-destructive testing techniques.

- 3D printing of materials allows for on-site repairs with custom-fit components, demanding new inspection protocols for additive manufactured parts.

Cybersecurity for Industrial Control Systems

As industrial assets become increasingly interconnected, the risk of cyberattacks targeting operational technology (OT) systems is escalating. Denholm MacNamee, operating within critical infrastructure sectors, must prioritize robust cybersecurity measures in its service delivery, particularly when deploying digital transformation initiatives. This focus is crucial for maintaining client confidence and ensuring the operational resilience of the systems it manages.

The growing sophistication of cyber threats means that protecting sensitive data and critical control systems is no longer optional but a fundamental requirement. For instance, a 2024 report by IBM Security indicated that the average cost of a data breach in the industrial sector reached $4.73 million, highlighting the significant financial and operational ramifications of security failures. Denholm MacNamee's commitment to cybersecurity directly impacts its ability to safeguard client operations and maintain trust.

- Increased Threat Landscape: The convergence of IT and OT environments expands the attack surface for critical infrastructure.

- Client Trust and Resilience: Robust cybersecurity is essential for maintaining client confidence and ensuring uninterrupted operations.

- Regulatory Compliance: Evolving cybersecurity regulations necessitate proactive security strategies for industrial control systems.

Technological advancements in NDT, such as phased array ultrasonics, enhance inspection precision and efficiency. The global NDT market, valued at around $6.5 billion in 2023, is projected to grow at a 7% CAGR, reflecting increasing demand for sophisticated solutions.

The integration of digital twins and IoT for predictive maintenance is transforming asset management, with the digital twin market in manufacturing alone expected to reach $15.1 billion by 2024. Denholm MacNamee can leverage these technologies to offer data-driven, proactive asset integrity solutions.

Automation and robotics, including drones and ROVs, are improving safety and efficiency in inspections, with the commercial drone market for industrial inspection projected to exceed $5 billion by 2024. Denholm MacNamee can utilize these tools to access difficult areas and improve data quality.

Innovations in materials science, with the advanced materials market valued at approximately $100 billion in 2023, necessitate specialized NDT techniques for new components. Cybersecurity in OT systems is also critical, with data breaches in the industrial sector averaging $4.73 million in 2024, underscoring the need for robust security measures.

| Technology Area | 2023 Market Value (Approx.) | Projected Growth (CAGR) | Impact on Denholm MacNamee |

|---|---|---|---|

| Non-Destructive Testing (NDT) | $6.5 billion | ~7% (through 2030) | Enhanced precision, efficiency, and market advantage |

| Digital Twins & IoT | Digital Twins (Manufacturing): $15.1 billion (2024 projection) | Significant growth | Data-driven asset management, predictive maintenance |

| Automation & Robotics | Commercial Drones (Industrial Inspection): >$5 billion (2024 projection) | Strong growth | Improved safety, efficiency, data quality, access to difficult areas |

| Advanced Materials | ~$100 billion | Significant growth | Need for specialized inspection techniques for new materials |

| Cybersecurity (OT Systems) | Data Breach Cost: $4.73 million (Industrial Sector, 2024) | Increasing threat landscape | Essential for client trust and operational resilience |

Legal factors

Denholm MacNamee must navigate stringent health and safety regulations inherent in the energy, power, and industrial sectors. These laws, covering areas like working at height and hazardous material handling, are critical for operational integrity. For instance, in the UK, the Health and Safety Executive reported that in 2023/2024, an estimated 775,000 workers suffered from work-related ill health, underscoring the importance of robust safety protocols.

Compliance is paramount, ensuring the well-being of Denholm MacNamee's workforce and clients. Failure to adhere to standards, such as those outlined in the Control of Substances Hazardous to Health Regulations, can result in substantial fines and operational disruptions. The financial implications of non-compliance can be severe, with penalties potentially reaching millions of pounds for significant breaches, as seen in past industrial accidents.

Environmental protection laws, including those concerning emissions, waste, and pollution, directly shape how Denholm MacNamee's clients operate. For example, stricter emissions standards, like those being progressively tightened in the EU under the Green Deal, necessitate clients to invest in cleaner technologies or operational adjustments.

Denholm MacNamee's services are crucial for helping clients navigate this complex regulatory landscape, ensuring compliance through leak detection or optimizing equipment for reduced environmental footprints. The global push for sustainability, evidenced by the UN's Sustainable Development Goals, means companies are increasingly scrutinized for their environmental performance.

Evolving environmental legislation, such as potential carbon taxes or expanded waste management mandates, can also unlock new service opportunities for Denholm MacNamee, requiring innovative solutions to meet emerging client needs and regulatory demands.

Denholm MacNamee operates within sectors like oil and gas, nuclear, and renewables, each governed by distinct regulatory bodies and compliance standards. For instance, the UK's Health and Safety Executive (HSE) imposes stringent safety regulations on oil and gas operations, while the Office for Nuclear Regulation (ONR) oversees nuclear safety. Compliance with these detailed industry norms, certifications like ISO 9001, and quality management systems is non-negotiable for maintaining credibility and securing market access.

Contract Law and Liability

The legal framework for engineering and maintenance contracts is crucial for Denholm MacNamee. It clearly outlines the scope of work, defines responsibilities, and establishes liability for both the company and its clients. Understanding these contractual obligations is paramount for risk mitigation and ensuring equitable terms.

Effective contract management and a thorough grasp of legal duties are essential for Denholm MacNamee. This proactive approach helps safeguard the company against potential disputes and claims, particularly concerning indemnities and insurance provisions.

- Contractual Scope: Clearly defining deliverables and service parameters in contracts reduces ambiguity and potential disagreements.

- Liability Mitigation: Robust clauses addressing negligence and performance standards protect Denholm MacNamee from undue financial exposure.

- Indemnification Clauses: These provisions allocate responsibility for losses arising from specific events, a critical aspect for engineering projects.

- Insurance Requirements: Ensuring adequate professional indemnity and public liability insurance coverage is a legal necessity and a risk management staple.

Data Protection and Privacy Laws

Denholm MacNamee's increasing reliance on digital inspection tools and data analytics necessitates strict adherence to data protection and privacy legislation. Regulations like the EU's General Data Protection Regulation (GDPR) and similar regional frameworks mandate secure handling and storage of client operational data and any personal information gathered during service delivery. Failure to comply can lead to significant fines; for instance, GDPR penalties can reach up to €20 million or 4% of annual global turnover, whichever is higher. Ensuring robust data security practices builds crucial client trust and safeguards against costly legal repercussions stemming from data breaches.

Key considerations for Denholm MacNamee include:

- Data Minimization: Collecting only the data strictly necessary for inspection services.

- Secure Storage: Implementing advanced encryption and access controls for all client data.

- Consent Management: Obtaining explicit consent for data collection and usage where applicable.

- Breach Notification: Establishing clear protocols for promptly reporting any data breaches to relevant authorities and affected individuals.

Denholm MacNamee must adhere to a complex web of legal requirements, from health and safety mandates to environmental protection laws. These regulations, enforced by bodies like the UK's Health and Safety Executive, directly impact operational procedures and client compliance, with penalties for breaches potentially reaching millions of pounds.

Contractual agreements are critical, defining scope, responsibilities, and liability to mitigate risks. Robust data protection laws, such as GDPR, also demand strict adherence to secure data handling practices, with non-compliance carrying significant financial penalties.

The evolving legal landscape, particularly regarding environmental standards and data privacy, presents both challenges and opportunities for Denholm MacNamee to offer specialized compliance and consulting services.

| Legal Area | Key Regulations/Bodies | Impact on Denholm MacNamee | Example Data/Consequences |

|---|---|---|---|

| Health & Safety | HSE (UK), OSHA (US) | Ensures worker and client safety; dictates operational protocols. | UK HSE reported 775,000 workers suffering work-related ill health in 2023/2024. |

| Environmental | Environmental Protection Agency (EPA), EU Green Deal | Governs emissions, waste, and pollution; drives client investment in cleaner tech. | Stricter EU emissions standards necessitate operational adjustments. |

| Contract Law | Common Law, specific industry standards | Defines service scope, liability, and risk allocation. | Clear contractual terms reduce disputes and financial exposure. |

| Data Protection | GDPR (EU), CCPA (US) | Mandates secure handling of client operational data. | GDPR fines can reach up to €20 million or 4% of global annual turnover. |

Environmental factors

Global and national climate change policies, such as the EU's Fit for 55 package aiming for a 55% emissions reduction by 2030, and the US Inflation Reduction Act's substantial clean energy investments, are fundamentally reshaping industries. These initiatives, coupled with net-zero commitments from over 130 countries, are accelerating the demand for decarbonization solutions.

Denholm MacNamee's expertise in inspection and maintenance is directly relevant to this transition. As renewable energy sources like offshore wind farms, which saw a significant increase in global capacity additions in 2023, expand, and as carbon capture and storage (CCS) technologies mature, the need for specialized asset integrity management services will grow substantially. For instance, the International Energy Agency projects that CCS could account for 15% of the cumulative emissions reductions needed by 2070, highlighting a long-term strategic shift in demand for Denholm MacNamee's core competencies.

Increasing global awareness of resource depletion is pushing industries toward greater operational efficiency and extending the life of their assets. Denholm MacNamee's core services, focused on expert maintenance and repair of infrastructure, directly address this by promoting asset longevity and resource conservation.

Clients are increasingly prioritizing service providers who demonstrate a commitment to minimizing waste and optimizing energy consumption within their facilities. This trend is supported by data showing a growing preference for sustainable business practices, with many companies now setting ambitious targets for reducing their environmental footprint by 2025.

Environmental regulations are increasingly stringent, pushing companies like Denholm MacNamee's clients to adopt more responsible waste management and pollution control practices. This means carefully handling operational byproducts to minimize environmental impact.

Denholm MacNamee's expertise in repair and maintenance plays a crucial role here. By preventing leaks, spills, and emissions from industrial equipment, they directly help clients meet environmental standards and shrink their ecological footprint. For instance, robust maintenance can prevent oil leaks from machinery, which could otherwise contaminate soil and water.

Furthermore, the proper disposal of materials used during maintenance activities is paramount. This includes everything from old parts to cleaning solvents, all of which must be handled according to strict environmental guidelines to avoid pollution. The global waste management market was valued at approximately $1.5 trillion in 2023 and is projected to grow, reflecting the increasing importance of these services.

Biodiversity and Ecosystem Protection

Denholm MacNamee's operations, particularly in the energy and industrial sectors, face growing scrutiny regarding their impact on biodiversity and ecosystems. Projects are increasingly evaluated for their potential to disrupt local wildlife and natural habitats.

To address this, Denholm MacNamee must implement methods that minimize environmental disturbance, especially when working near sensitive sites. This necessitates the adoption of specialized techniques designed to reduce impacts like noise pollution, light pollution, and habitat disruption during crucial inspection and maintenance activities.

- Regulatory Pressure: Increasing global regulations, such as the EU Biodiversity Strategy for 2030, aim to protect and restore ecosystems, directly impacting industrial project approvals and operational standards.

- Industry Standards: Many energy and industrial clients are now mandating stricter environmental performance metrics, including biodiversity impact assessments and mitigation plans, as part of their supply chain requirements.

- Reputational Risk: Negative publicity or fines stemming from environmental damage can significantly harm a company's reputation and investor confidence. For instance, in 2023, several major infrastructure projects faced delays and public outcry due to inadequate biodiversity protection measures.

Circular Economy Principles

The global push towards a circular economy is significantly influencing business operations, with a strong emphasis on reducing waste, reusing materials, and recycling to extend product lifecycles. This trend is gaining considerable momentum, with projections indicating the global circular economy market could reach $4.5 trillion by 2030, a substantial increase from previous years.

Denholm MacNamee's core competencies in repair, refurbishment, and maintenance are perfectly aligned with these circular economy principles. By enabling the continued use and optimal performance of existing assets, the company directly counters the linear ‘take-make-dispose’ model, thereby reducing the demand for new resource extraction and manufacturing.

This strategic alignment offers a distinct competitive advantage for Denholm MacNamee. Clients increasingly prioritize sustainability in their procurement decisions, and partnering with a company that actively supports their environmental, social, and governance (ESG) goals through circular practices enhances Denholm MacNamee's value proposition. For instance, many companies are setting ambitious targets, such as reducing their waste generation by 30% by 2025, making Denholm MacNamee's services highly relevant.

- Circular Economy Growth: The global circular economy market is projected to reach $4.5 trillion by 2030, highlighting a significant market shift.

- Denholm MacNamee's Role: Expertise in repair and maintenance directly supports waste reduction and extends asset lifecycles, aligning with client sustainability targets.

- Competitive Advantage: Supporting client ESG goals through circular practices enhances Denholm MacNamee's market position and attractiveness.

- Client Demand: Growing client commitments to waste reduction, with many aiming for 30% less waste by 2025, underscore the demand for Denholm MacNamee's services.

Growing environmental awareness and stringent regulations are driving demand for sustainable practices. Companies are increasingly focused on decarbonization, resource efficiency, and waste reduction, creating opportunities for Denholm MacNamee's asset integrity services. For example, the global renewable energy sector saw substantial investment growth in 2023, directly increasing the need for specialized maintenance of new infrastructure.

Denholm MacNamee's expertise in repair and maintenance aligns perfectly with the circular economy principles, promoting asset longevity and reducing waste. As clients set ambitious ESG goals, such as reducing waste by 30% by 2025, Denholm MacNamee's services become more critical for meeting these targets.

The company's operations are also subject to scrutiny regarding biodiversity impacts, necessitating methods that minimize environmental disturbance. This focus on responsible practices is becoming a key differentiator in the market, with many clients prioritizing partners who demonstrate strong environmental stewardship.

| Environmental Factor | Trend | Impact on Denholm MacNamee | Supporting Data/Examples |

|---|---|---|---|

| Climate Change & Decarbonization | Increasing global focus on emissions reduction and net-zero targets. | Drives demand for inspection and maintenance of renewable energy assets (e.g., wind farms) and carbon capture technologies. | EU Fit for 55 package; US Inflation Reduction Act; over 130 countries with net-zero commitments. |

| Resource Depletion & Efficiency | Growing awareness of finite resources and push for operational efficiency. | Enhances the value of Denholm MacNamee's services in extending asset life and promoting resource conservation. | Many companies setting targets to reduce environmental footprint by 2025. |

| Waste Management & Circular Economy | Shift towards waste reduction, reuse, and recycling. | Aligns Denholm MacNamee's repair and refurbishment services with client sustainability goals and ESG mandates. | Global circular economy market projected to reach $4.5 trillion by 2030; client targets for 30% waste reduction by 2025. |

| Biodiversity & Ecosystem Protection | Increased scrutiny on industrial impacts on natural habitats. | Requires Denholm MacNamee to adopt specialized techniques to minimize environmental disturbance during operations. | EU Biodiversity Strategy for 2030; reputational risk from inadequate biodiversity protection (e.g., 2023 project delays). |

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources including government statistics, international financial institutions, and leading market research firms. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, and social trends to provide comprehensive insights.