Denali Therapeutics PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denali Therapeutics Bundle

Unlock critical insights into Denali Therapeutics's operating environment with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and evolving social attitudes are shaping the biotechnology landscape. This analysis is your key to anticipating challenges and capitalizing on emerging opportunities.

Gain a strategic advantage by delving into the technological advancements and regulatory frameworks impacting Denali Therapeutics. Our PESTLE analysis provides actionable intelligence to inform your investment decisions and business strategies. Download the full version now for a complete understanding of the external forces at play.

Political factors

Government funding for neurodegenerative disease research, particularly for conditions like Alzheimer's and Parkinson's, directly fuels Denali Therapeutics' R&D pipeline. For instance, the U.S. National Institutes of Health (NIH) allocated approximately $3.5 billion to Alzheimer's disease research in fiscal year 2024, a significant increase from previous years, potentially benefiting Denali's programs targeting these areas.

Policies that champion rare diseases and neuroscience, such as tax credits for orphan drug development or accelerated regulatory pathways, can substantially de-risk Denali's early-stage research. The EU's Orphan Medicinal Products Regulation, for example, offers market exclusivity and fee reductions, incentivizing development for smaller patient populations characteristic of many neurodegenerative disorders.

Conversely, any reduction in federal research budgets or a strategic pivot away from neuroscience by major funding bodies could present headwinds for Denali. A hypothetical 10% cut in NIH neuroscience funding, for example, could delay critical preclinical studies or reduce the availability of collaborative grants that Denali relies on.

Regulatory approval pathways are a critical hurdle for Denali Therapeutics, as agencies like the FDA determine market access for its innovative therapies. The company's strategy often involves targeting rare diseases, where accelerated approval pathways can significantly speed up the process. For instance, Denali has pursued such pathways for tividenofusp alfa in Hunter syndrome, demonstrating the potential benefits of a supportive regulatory environment.

Strong intellectual property (IP) laws are crucial for Denali Therapeutics, a company heavily reliant on innovation. Robust patent protection and market exclusivity are essential to recouping the substantial R&D investments typical in the biotechnology sector. For instance, the U.S. Patent and Trademark Office granted over 300,000 utility patents in 2023, highlighting the competitive landscape for novel discoveries.

Policies that safeguard patents directly incentivize Denali's continued investment in developing groundbreaking therapies. Weakening of these IP rights could significantly diminish Denali's competitive edge and deter future funding for its pipeline. The global pharmaceutical market, valued at over $1.5 trillion in 2024, underscores the economic importance of IP in driving growth and innovation.

Healthcare Policy and Reimbursement

Government healthcare policies, particularly those concerning drug pricing and reimbursement, are critical for Denali Therapeutics. These policies directly impact how much revenue Denali can generate from its therapies once they receive regulatory approval. For instance, the Inflation Reduction Act of 2022 in the US introduced measures for Medicare drug price negotiation, which could affect future pricing strategies for high-cost treatments.

Favorable reimbursement frameworks are paramount for Denali, especially given the specialized nature and high cost typically associated with treatments for neurodegenerative diseases. Without adequate reimbursement from government payers like Medicare and Medicaid, or private insurers operating under government regulations, patient access to Denali's potentially life-changing therapies would be severely limited, impacting both commercial success and patient outcomes.

- Drug Pricing Regulations: Policies like the Inflation Reduction Act's Medicare drug price negotiation provisions can directly influence the pricing power of Denali's future approved therapies.

- Reimbursement Pathways: The availability and generosity of reimbursement from government programs (e.g., Medicare, Medicaid) and private insurers are crucial for ensuring patient access to Denali's high-cost, specialized treatments.

- Market Access and Affordability: Government policies aimed at controlling healthcare costs can create challenges for the commercial viability of novel, expensive therapies.

International Trade and Collaboration Policies

Policies governing international trade and collaboration, such as the BIOSECURE Act, can significantly influence Denali Therapeutics' global operational capacity and strategic partnerships. These regulations might affect Denali's access to international markets or its ability to forge collaborations with overseas research institutions and manufacturers.

Geopolitical shifts impacting the biopharmaceutical supply chain present both potential hurdles and avenues for international expansion for Denali. For instance, changes in trade agreements or national security concerns related to biotechnology could alter the cost and availability of essential research materials or manufacturing services, impacting Denali's global R&D and commercialization strategies.

- Global R&D Partnerships: Denali's research into neurodegenerative diseases often involves international collaboration. Policies affecting cross-border data sharing and intellectual property rights are critical.

- Supply Chain Resilience: As of early 2024, the biopharmaceutical industry continues to assess supply chain vulnerabilities exposed by recent global events, with a focus on diversifying sourcing and manufacturing locations.

- Market Access: Denali's future success in bringing therapies to patients worldwide depends on navigating varied international regulatory approval processes and trade policies that influence drug pricing and distribution.

Government funding for neurodegenerative disease research, particularly for conditions like Alzheimer's and Parkinson's, directly fuels Denali Therapeutics' R&D pipeline. For instance, the U.S. National Institutes of Health (NIH) allocated approximately $3.5 billion to Alzheimer's disease research in fiscal year 2024, a significant increase from previous years, potentially benefiting Denali's programs targeting these areas.

Policies that champion rare diseases and neuroscience, such as tax credits for orphan drug development or accelerated regulatory pathways, can substantially de-risk Denali's early-stage research. The EU's Orphan Medicinal Products Regulation, for example, offers market exclusivity and fee reductions, incentivizing development for smaller patient populations characteristic of many neurodegenerative disorders.

Conversely, any reduction in federal research budgets or a strategic pivot away from neuroscience by major funding bodies could present headwinds for Denali. A hypothetical 10% cut in NIH neuroscience funding, for example, could delay critical preclinical studies or reduce the availability of collaborative grants that Denali relies on.

Regulatory approval pathways are a critical hurdle for Denali Therapeutics, as agencies like the FDA determine market access for its innovative therapies. The company's strategy often involves targeting rare diseases, where accelerated approval pathways can significantly speed up the process. For instance, Denali has pursued such pathways for tividenofusp alfa in Hunter syndrome, demonstrating the potential benefits of a supportive regulatory environment.

Strong intellectual property (IP) laws are crucial for Denali Therapeutics, a company heavily reliant on innovation. Robust patent protection and market exclusivity are essential to recouping the substantial R&D investments typical in the biotechnology sector. For instance, the U.S. Patent and Trademark Office granted over 300,000 utility patents in 2023, highlighting the competitive landscape for novel discoveries.

Policies that safeguard patents directly incentivize Denali's continued investment in developing groundbreaking therapies. Weakening of these IP rights could significantly diminish Denali's competitive edge and deter future funding for its pipeline. The global pharmaceutical market, valued at over $1.5 trillion in 2024, underscores the economic importance of IP in driving growth and innovation.

Government healthcare policies, particularly those concerning drug pricing and reimbursement, are critical for Denali Therapeutics. These policies directly impact how much revenue Denali can generate from its therapies once they receive regulatory approval. For instance, the Inflation Reduction Act of 2022 in the US introduced measures for Medicare drug price negotiation, which could affect future pricing strategies for high-cost treatments.

Favorable reimbursement frameworks are paramount for Denali, especially given the specialized nature and high cost typically associated with treatments for neurodegenerative diseases. Without adequate reimbursement from government payers like Medicare and Medicaid, or private insurers operating under government regulations, patient access to Denali's potentially life-changing therapies would be severely limited, impacting both commercial success and patient outcomes.

- Drug Pricing Regulations: Policies like the Inflation Reduction Act's Medicare drug price negotiation provisions can directly influence the pricing power of Denali's future approved therapies.

- Reimbursement Pathways: The availability and generosity of reimbursement from government programs (e.g., Medicare, Medicaid) and private insurers are crucial for ensuring patient access to Denali's high-cost, specialized treatments.

- Market Access and Affordability: Government policies aimed at controlling healthcare costs can create challenges for the commercial viability of novel, expensive therapies.

Policies governing international trade and collaboration, such as the BIOSECURE Act, can significantly influence Denali Therapeutics' global operational capacity and strategic partnerships. These regulations might affect Denali's access to international markets or its ability to forge collaborations with overseas research institutions and manufacturers.

Geopolitical shifts impacting the biopharmaceutical supply chain present both potential hurdles and avenues for international expansion for Denali. For instance, changes in trade agreements or national security concerns related to biotechnology could alter the cost and availability of essential research materials or manufacturing services, impacting Denali's global R&D and commercialization strategies.

- Global R&D Partnerships: Denali's research into neurodegenerative diseases often involves international collaboration. Policies affecting cross-border data sharing and intellectual property rights are critical.

- Supply Chain Resilience: As of early 2024, the biopharmaceutical industry continues to assess supply chain vulnerabilities exposed by recent global events, with a focus on diversifying sourcing and manufacturing locations.

- Market Access: Denali's future success in bringing therapies to patients worldwide depends on navigating varied international regulatory approval processes and trade policies that influence drug pricing and distribution.

Governmental support for scientific research, particularly in neuroscience, directly impacts Denali's ability to advance its drug development pipeline. Policies related to intellectual property protection are vital for securing the company's innovations and R&D investments. Furthermore, healthcare reimbursement policies significantly influence market access and the commercial viability of Denali's therapies.

What is included in the product

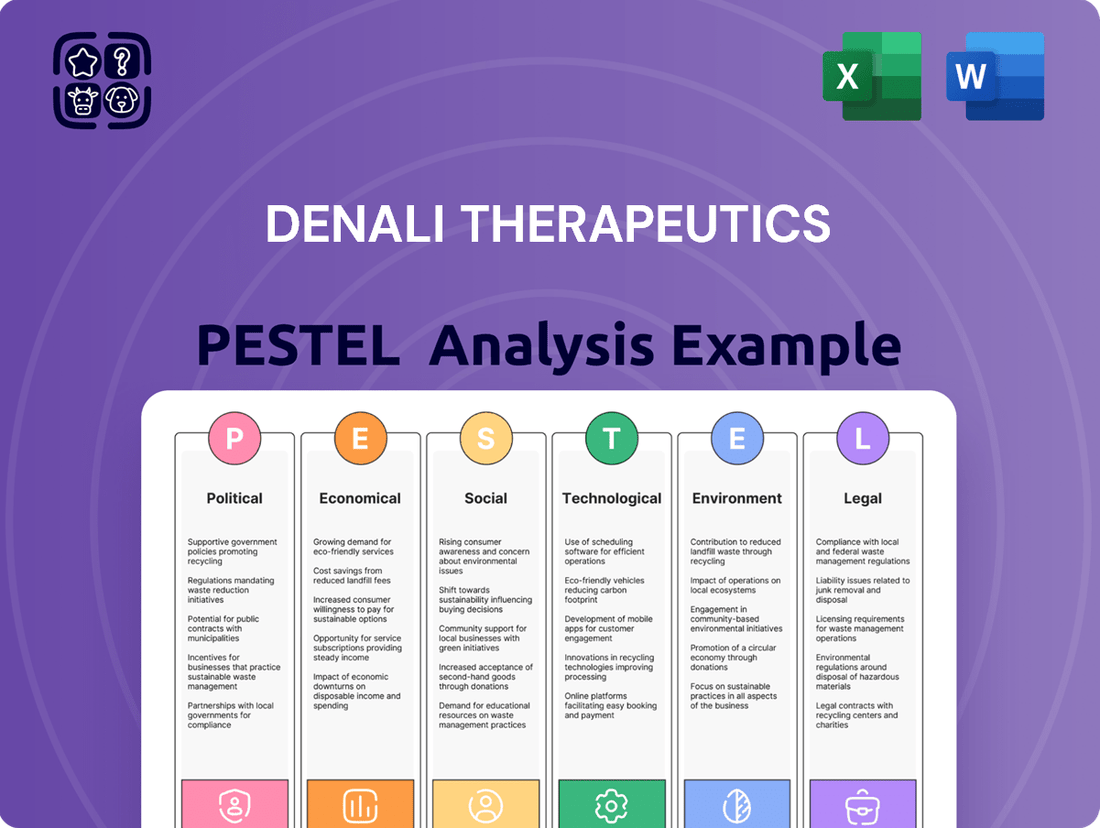

This PESTLE analysis comprehensively examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing Denali Therapeutics's operations and strategic planning.

It provides a data-driven overview of external forces, identifying potential threats and opportunities to inform Denali's business strategy and market positioning.

A PESTLE analysis for Denali Therapeutics offers a clear, summarized version of external factors for easy referencing during strategic planning, alleviating the pain point of navigating complex market dynamics.

Economic factors

The biotechnology sector, inherently capital-intensive, places significant emphasis on Denali Therapeutics' capacity to secure funding. This capital is essential for advancing its research pipelines, conducting crucial clinical trials, and ultimately bringing therapies to market. For instance, in early 2024, Denali raised approximately $250 million through a public offering, underscoring the ongoing need for substantial financial resources to fuel its ambitious development programs.

Investment trends within the biotech industry, particularly the availability of venture capital and the sentiment in public markets, directly impact Denali's financial stability and strategic options. While venture capital funding for biotech saw a slight dip in 2023 compared to peak years, it remained robust, with over $25 billion invested globally, indicating continued investor interest in the sector's potential.

Looking ahead to 2025, the outlook for biotech funding appears cautiously optimistic, with a notable shift in investor focus towards late-stage assets with clear de-risking milestones. This trend suggests that companies like Denali, with promising clinical data, will likely face continued competition for capital, necessitating strong execution and clear value propositions to attract investment.

Developing treatments for challenging neurological conditions like Alzheimer's and Parkinson's demands significant and ever-growing research and development (R&D) expenditures. These costs are a major hurdle for companies like Denali Therapeutics.

Denali's commitment to its innovative Transport Vehicle platform and ongoing clinical trials for diseases such as Hunter syndrome and Sanfilippo syndrome highlights these substantial investments. For instance, R&D expenses for the nine months ended September 30, 2023, were $443.5 million, a notable increase from $356.7 million in the same period of 2022, reflecting the intensive nature of their work.

The global market for neurodegenerative disease therapies is substantial and poised for significant growth. Estimates suggest the market was valued at around $30 billion in 2023 and is projected to reach over $45 billion by 2028, demonstrating a compound annual growth rate of roughly 8-10%.

This expansion is largely fueled by the increasing prevalence of conditions like Alzheimer's, Parkinson's, and ALS, particularly in aging populations. For instance, the number of individuals aged 65 and older, the demographic most susceptible to these diseases, is expected to nearly double globally by 2050.

This growing patient pool represents a critical unmet medical need, creating a strong demand for innovative treatments. Denali Therapeutics, with its focus on genetically targeted therapies for neurodegenerative diseases, is well-positioned to capitalize on this expanding market opportunity.

Global Economic Conditions and Inflation

Global economic conditions, particularly inflation and interest rate trends, significantly shape Denali Therapeutics' operational landscape. High inflation can escalate research and development costs, manufacturing expenses, and the overall cost of doing business. Conversely, stable economic environments generally foster greater investor confidence and consumer spending, which are crucial for a biopharmaceutical company reliant on long-term investment and potential market adoption of its therapies.

The prevailing interest rate environment directly impacts Denali's ability to secure funding and influences the valuation of its future revenue streams. For instance, rising interest rates, a trend observed through much of 2023 and continuing into early 2024, have tightened venture capital markets. This has led to increased investor selectivity, making it more challenging for companies like Denali to raise capital for their ambitious, long-duration R&D projects. As of early 2024, benchmark interest rates in major economies remained elevated compared to the preceding decade, reflecting ongoing efforts to combat inflation.

- Inflationary Pressures: Global inflation rates, while showing signs of moderation in some regions by early 2024, continued to pose a risk to Denali's operating expenses.

- Interest Rate Environment: Elevated interest rates impact the cost of capital and investor appetite for long-term, high-risk ventures characteristic of biotech R&D.

- Economic Stability: Broader economic stability influences healthcare spending, regulatory approvals, and overall market access for Denali's potential therapies.

Partnerships and Collaboration Economics

Strategic collaborations are fundamental to Denali Therapeutics' economic model, enabling cost and risk sharing while accessing vital expertise. For instance, its significant partnerships with Biogen and Takeda are designed to accelerate the development of its innovative neuroscience therapies.

The financial intricacies of these alliances, encompassing upfront payments, substantial milestone achievements, and ongoing royalty or revenue-sharing arrangements, directly influence Denali's bottom line and the advancement of its drug candidates. These economic structures are critical for funding expensive clinical trials and research.

- Biogen Partnership: In 2021, Denali received $300 million upfront from Biogen for its Parkinson's disease program, with potential for over $1 billion in milestones.

- Takeda Collaboration: Denali's collaboration with Takeda, focused on neuroinflammatory diseases, includes upfront payments and potential milestone payments, bolstering Denali's cash reserves and R&D capacity.

- Pipeline Progression: The economic terms of these partnerships directly correlate with Denali's ability to fund multiple programs through various stages of clinical development, impacting its overall valuation.

Economic factors significantly influence Denali Therapeutics' ability to fund its research and development pipeline. The cost of capital, driven by interest rates and overall market sentiment, directly affects investment in the capital-intensive biotech sector. For example, as of early 2024, benchmark interest rates remained elevated, impacting the cost of funding for long-term R&D projects.

Inflationary pressures also play a crucial role, potentially increasing operational costs for Denali. Economic stability, on the other hand, fosters greater investor confidence and can positively influence healthcare spending and market access for new therapies.

Strategic collaborations are vital for Denali, providing financial resources and de-risking development. The terms of these partnerships, including upfront payments and milestone achievements, directly impact the company's financial health and its capacity to advance multiple drug candidates through clinical trials.

| Economic Factor | Impact on Denali Therapeutics | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Interest Rates | Increases cost of capital, influences investor appetite for R&D funding. | Elevated benchmark rates in early 2024 compared to prior decade. |

| Inflation | Potential increase in R&D, manufacturing, and operational expenses. | Inflation rates showed moderation in some regions by early 2024 but remained a risk. |

| Venture Capital Funding | Availability impacts Denali's ability to secure R&D financing. | Over $25 billion invested globally in biotech in 2023; focus shifting to late-stage assets. |

| Partnership Economics | Provides upfront payments, milestones, and royalties to fund pipeline. | Biogen partnership (2021) included $300M upfront; Takeda collaboration includes upfront and milestones. |

Full Version Awaits

Denali Therapeutics PESTLE Analysis

The preview shown here is the exact Denali Therapeutics PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Denali Therapeutics, providing valuable insights for strategic planning.

The content and structure shown in the preview is the same document you’ll download after payment, offering a detailed examination of the external forces shaping Denali's operations and future growth.

Sociological factors

The world's population is getting older, and this demographic shift is a major sociological trend. Neurodegenerative diseases, like those Denali Therapeutics focuses on, tend to affect older people more. This means there's a growing number of potential patients who could benefit from new treatments.

By 2050, the number of people aged 65 and over is projected to reach 1.6 billion globally, nearly doubling from 2017. This increasing prevalence of age-related conditions places a significant societal burden on healthcare systems and drives the demand for innovative therapies.

Patient advocacy groups are increasingly influential in shaping the landscape for companies like Denali Therapeutics. For instance, the patient advocacy community for Hunter syndrome, a rare genetic disorder, has been instrumental in pushing for research and clinical trials, directly impacting the focus and urgency of developing treatments. This heightened awareness, fueled by these groups, can translate into greater public support for research funding and expedited regulatory pathways for promising therapies.

The growing public understanding of neurodegenerative diseases, including Parkinson's, means more individuals and families are actively seeking information and demanding solutions. This translates into a stronger voice for patients, encouraging investment in areas with significant unmet needs. In 2024, patient advocacy organizations globally raised over $500 million for various neurological research initiatives, demonstrating their substantial impact on research priorities and funding allocations.

Societal views on the ethics of neurodegenerative disease research, especially involving genetic therapies, are increasingly influential. Public perception directly shapes regulatory frameworks, affecting companies like Denali Therapeutics. For instance, a 2024 survey indicated that while 75% of respondents supported gene therapy research for conditions like Alzheimer's, over 60% expressed concerns about equitable access and potential misuse of genetic information.

Healthcare Access and Equity

Societal expectations for equitable access to advanced medical treatments, particularly for rare and debilitating conditions, are increasingly shaping healthcare policy and influencing companies like Denali Therapeutics. This growing concern means that ensuring therapies are affordable and available to a broad range of patients, irrespective of their financial background, is becoming a critical factor in commercial strategy. For instance, in 2024, the average out-of-pocket cost for prescription drugs in the US remained a significant barrier for many, highlighting the persistent need for greater equity in healthcare access.

The pressure for fairness in healthcare access is intensifying, with a focus on ensuring that innovative treatments reach diverse patient populations. This societal demand can directly impact Denali's market penetration and adoption rates for its therapies. Reports from late 2024 indicated that patient advocacy groups are actively lobbying for price controls and expanded insurance coverage for gene therapies, underscoring the societal push for greater equity.

- Growing Demand for Equitable Access: Societal pressure for fair access to advanced medical treatments, especially for rare diseases, is a significant driver influencing healthcare policy and corporate strategies.

- Socioeconomic Barriers: Ensuring that Denali's therapies are accessible to all socioeconomic strata remains a key challenge, with out-of-pocket costs for advanced treatments being a major concern for patients in 2024.

- Policy and Advocacy Influence: Patient advocacy groups are actively engaging with policymakers to promote price transparency and expanded insurance coverage, directly impacting the commercial viability of innovative therapies.

Impact of Disease on Caregivers and Families

The immense social and economic strain on families caring for individuals with neurodegenerative diseases, such as Alzheimer's or Parkinson's, highlights a profound societal need for advanced therapeutic solutions. These conditions often lead to prolonged caregiving, impacting the caregiver's physical and mental health, as well as their financial stability. For instance, in 2023, the estimated economic value of unpaid caregiving in the U.S. reached $771 billion, underscoring the significant burden.

Denali Therapeutics' strategic direction, focusing on developing therapies that improve patient quality of life and potentially reduce the demands on caregivers, directly addresses this critical societal challenge. By aiming to enhance patient autonomy and slow disease progression, Denali seeks to alleviate the substantial caregiver burden. This aligns with a growing public demand for innovative treatments that not only treat the disease but also support the entire family unit.

- Caregiver Burden: Studies show that over 60% of dementia caregivers report moderate to high levels of stress, impacting their own health and well-being.

- Economic Impact: The cost of care, both paid and unpaid, for neurodegenerative diseases is substantial, with families often bearing a significant portion.

- Societal Demand: There is increasing pressure on healthcare systems and pharmaceutical companies to provide effective treatments that improve patient outcomes and ease the strain on families.

Societal expectations for equitable access to advanced medical treatments are intensifying, influencing healthcare policy and corporate strategies for companies like Denali Therapeutics. This growing concern means ensuring therapies are affordable and available to diverse patient populations is critical, especially given that in 2024, the average out-of-pocket cost for prescription drugs remained a significant barrier for many in the US.

Patient advocacy groups are increasingly influential, actively lobbying for price controls and expanded insurance coverage for gene therapies, as seen in late 2024 reports. This underscores the societal push for greater equity in healthcare access, directly impacting the commercial viability and market penetration of innovative treatments.

The immense social and economic strain on families caring for individuals with neurodegenerative diseases, such as Alzheimer's or Parkinson's, highlights a profound societal need for advanced therapeutic solutions. In 2023 alone, the estimated economic value of unpaid caregiving in the U.S. reached $771 billion, demonstrating the significant burden these conditions place on families and caregivers.

| Sociological Factor | Description | Impact on Denali Therapeutics | Supporting Data (2024/2025) |

| Aging Population | Global population is aging, increasing the prevalence of neurodegenerative diseases. | Expands the potential patient pool for Denali's therapies. | By 2050, global population aged 65+ projected to reach 1.6 billion. |

| Patient Advocacy | Growing influence of patient advocacy groups on research and policy. | Can accelerate research, influence regulatory pathways, and increase public support. | Patient advocacy groups raised over $500 million for neurological research in 2024. |

| Ethical Considerations | Societal views on the ethics of neurodegenerative disease research, especially gene therapy. | Shapes regulatory frameworks and public perception of Denali's technologies. | 75% of respondents in a 2024 survey supported gene therapy research for Alzheimer's, but 60%+ expressed concerns about access and misuse. |

| Equitable Access | Societal demand for fair access to advanced treatments across socioeconomic strata. | Influences commercial strategy, pricing, and market adoption rates. | Average out-of-pocket prescription drug costs in the US remained a significant barrier in 2024. |

| Caregiver Burden | Significant social and economic strain on families caring for neurodegenerative disease patients. | Creates a strong demand for therapies that improve patient quality of life and reduce caregiver demands. | Over 60% of dementia caregivers report moderate to high stress levels; unpaid caregiving value reached $771 billion in the US in 2023. |

Technological factors

Denali Therapeutics' technological edge hinges on its TransportVehicle™ platform, specifically engineered to navigate the formidable blood-brain barrier (BBB). This platform is central to their strategy for delivering a range of therapeutics, including antibodies, small molecules, and protein-based treatments, directly to the brain.

The company's ongoing investment in refining these BBB-crossing technologies is paramount. For instance, in 2024, Denali continued to advance its lead programs targeting neurodegenerative diseases, with clinical trial data expected to shed light on the efficacy of its BBB-penetrant therapies.

The success of Denali's business model is directly tied to the continued innovation and effectiveness of its TransportVehicle™ platform. As of their latest reports, the company has secured significant partnerships, underscoring the perceived value and potential of their specialized delivery technology in the competitive biopharmaceutical landscape.

Technological leaps in neurodegenerative disease diagnostics, particularly in identifying reliable biomarkers, are crucial for early detection and patient stratification. Denali Therapeutics leverages these advancements, utilizing biomarkers like CSF heparan sulfate and neurofilament light to steer its research and development, aiming for more precise and effective therapeutic strategies.

Innovations beyond the blood-brain barrier (BBB) are significantly shaping therapeutic development. Nanoparticle strategies and extracellular vesicles are emerging as powerful tools to enhance drug efficacy and safety, offering new delivery pathways for complex molecules. Denali Therapeutics' focus on diverse therapeutic modalities, including its proprietary Transport Magnesium Elicited (TME) technology, directly leverages these advancements in drug delivery science.

Application of Artificial Intelligence in Drug Discovery

The biotechnology sector is increasingly leveraging artificial intelligence (AI) and machine learning (ML) to expedite drug discovery and development. This technological shift allows for faster identification of potential drug targets and more efficient optimization of drug compounds. While Denali Therapeutics' specific AI integration details are not publicly disclosed, the broader industry trend points to AI's growing significance in R&D.

The impact of AI in pharma is substantial, with predictions indicating significant market growth. For instance, the AI in drug discovery market was valued at approximately $4.5 billion in 2023 and is projected to reach over $20 billion by 2030, demonstrating a compound annual growth rate (CAGR) of over 20%. This growth underscores the transformative potential of AI for companies like Denali.

Key areas where AI is making inroads in drug discovery include:

- Target Identification: AI algorithms can analyze vast datasets of genomic, proteomic, and clinical information to pinpoint novel disease targets more effectively than traditional methods.

- Compound Optimization: Machine learning models can predict the efficacy, toxicity, and pharmacokinetic properties of potential drug molecules, accelerating the lead optimization process.

- Clinical Trial Design: AI can assist in patient stratification, site selection, and predicting trial outcomes, potentially reducing costs and timelines.

Manufacturing and Bioprocessing Technologies

Advances in biopharmaceutical manufacturing and bioprocessing are paramount for Denali Therapeutics to efficiently produce its complex neurological therapies at scale. Innovations such as continuous manufacturing, which streamlines production by eliminating batch processing interruptions, and single-use systems, offering greater flexibility and reduced contamination risks, are key technological drivers. The industry is also seeing a push towards biodegradable materials in bioprocessing, enhancing sustainability alongside operational efficiency.

The biopharmaceutical sector is investing heavily in these areas. For instance, the global biopharmaceutical contract manufacturing market was valued at approximately USD 22.5 billion in 2023 and is projected to grow significantly. This growth is fueled by the increasing complexity of biologics and the need for specialized manufacturing capabilities, directly impacting companies like Denali that rely on cutting-edge production methods.

- Continuous Manufacturing: Offers improved yield and reduced costs compared to traditional batch processing.

- Single-Use Systems: Provide enhanced flexibility, faster changeovers, and reduced risk of cross-contamination.

- Biodegradable Materials: Contribute to a more sustainable manufacturing footprint, aligning with environmental, social, and governance (ESG) goals.

- Automation and AI: Increasingly integrated into bioprocessing for enhanced control, predictive maintenance, and process optimization.

Denali's core technological strength lies in its proprietary TransportVehicle™ platform, designed to overcome the blood-brain barrier, enabling direct brain delivery of therapeutics. This platform's advancement is critical, with clinical trial data in 2024 expected to validate its efficacy in neurodegenerative disease treatment.

The company's reliance on technological innovation is underscored by its partnerships, reflecting market confidence in its specialized delivery systems. Furthermore, Denali leverages advancements in biomarker identification, such as CSF heparan sulfate, to refine its R&D for more precise therapeutic targeting.

The broader biopharmaceutical industry's embrace of AI and machine learning for drug discovery, a market projected to exceed $20 billion by 2030, presents significant opportunities for companies like Denali to accelerate development cycles.

Innovations in biomanufacturing, including continuous processing and single-use systems, are vital for Denali to scale production of its complex therapies efficiently, with the global biopharmaceutical contract manufacturing market already valued at approximately $22.5 billion in 2023.

| Technology Area | Denali's Focus | Industry Trend/Data |

|---|---|---|

| Drug Delivery | TransportVehicle™ platform (BBB crossing) | Emerging nanoparticle and EV strategies |

| Biomarker Identification | CSF heparan sulfate, neurofilament light | AI-driven biomarker discovery |

| Drug Discovery | Proprietary therapeutic modalities | AI in drug discovery market: ~$4.5B (2023), projected >$20B (2030) |

| Manufacturing | Complex neurological therapies | Biopharma contract manufacturing market: ~$22.5B (2023) |

Legal factors

Denali Therapeutics navigates a complex web of pharmaceutical regulations, with the U.S. Food and Drug Administration (FDA) being a key oversight body. The company's success hinges on its ability to meet rigorous standards for drug development and approval, impacting its timelines and market access.

The regulatory pathway for Denali's lead candidates, including the Biologics License Application (BLA) submission for tividenofusp alfa, is critical. Securing priority review or accelerated approval from the FDA can significantly speed up market entry, a crucial factor in the competitive biotech landscape.

Intellectual property laws, especially patent protection, are absolutely critical for Denali Therapeutics. These laws shield their innovative therapeutic methods and potential new drugs, forming the bedrock of their business. Without strong patent protection, competitors could easily replicate their work, significantly undermining Denali's market advantage and the value of their research and development investments.

The legal environment concerning patent challenges, the duration of regulatory market exclusivity, and how intellectual property rules are applied across different countries directly shape Denali's standing in the competitive biopharmaceutical landscape. For instance, a successful patent challenge could shorten the period Denali has to recoup its R&D costs, impacting future investment and growth. As of early 2024, the global biopharmaceutical industry continues to navigate complex IP landscapes, with ongoing discussions around patentability of genetic material and data exclusivity periods influencing market entry strategies for new therapies.

Clinical trial regulations are incredibly strict, covering everything from how patients are found and monitored for safety to ensuring the data collected is accurate. Denali Therapeutics must meticulously follow these rules, like those from the FDA and EMA, to get its innovative therapies approved and uphold its ethical research practices. For instance, the FDA's Good Clinical Practice (GCP) guidelines are paramount, and deviations can lead to significant delays or even rejection of new drug applications.

Data Privacy and Security Laws

Denali Therapeutics operates within a complex legal landscape, particularly concerning data privacy and security. As a biotechnology firm, it handles significant amounts of sensitive patient data and proprietary research, necessitating strict adherence to regulations like the General Data Protection Regulation (GDPR) and the Health Insurance Portability and Accountability Act (HIPAA). Failure to comply can result in substantial penalties and reputational damage.

The evolving nature of these laws presents an ongoing challenge. For instance, the GDPR, implemented in 2018, has set a high bar for data protection across the EU, with fines reaching up to 4% of global annual turnover or €20 million, whichever is higher. Similarly, HIPAA violations in the US can incur fines ranging from $100 to $50,000 per violation, with annual maximums reaching $1.5 million for repeat offenses. Denali's commitment to robust data protection is therefore not just a legal obligation but a cornerstone of maintaining patient trust and safeguarding its valuable intellectual property.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- HIPAA Fines: $100 to $50,000 per violation, with annual caps up to $1.5 million.

- Data Breach Impact: Erosion of patient trust and potential loss of competitive advantage due to compromised intellectual assets.

Product Liability and Litigation Risks

The development and commercialization of innovative therapies, like those pursued by Denali Therapeutics, inherently expose the company to significant product liability and litigation risks. These risks stem from potential adverse events experienced by patients, challenges to efficacy claims made for their drugs, and any perceived manufacturing defects that could lead to harm. For instance, in 2023, the pharmaceutical industry continued to see substantial settlements and judgments related to product liability, underscoring the financial and reputational impact of such cases.

Denali must therefore maintain robust risk management protocols and ensure rigorous legal preparedness to address these potential challenges proactively. This includes meticulous clinical trial data collection, transparent communication regarding drug safety profiles, and adherence to stringent manufacturing quality standards. The company’s ability to effectively navigate these legal complexities is crucial for its long-term sustainability and investor confidence.

- Potential for lawsuits arising from unforeseen side effects or treatment failures.

- Scrutiny of marketing and efficacy claims to prevent misleading information.

- Need for stringent quality control in manufacturing to avoid product defects.

- Industry trend of significant financial settlements in product liability cases.

Denali Therapeutics operates under stringent regulatory frameworks governing drug development, clinical trials, and market approval, primarily overseen by bodies like the FDA and EMA. Intellectual property law is paramount, protecting their research and development investments through patents, which are crucial for market exclusivity and recouping R&D costs. The company also faces significant product liability risks, necessitating robust quality control and risk management to mitigate potential litigation from adverse patient outcomes.

Environmental factors

The biopharmaceutical sector, including Denali Therapeutics, is under growing pressure to embrace sustainable manufacturing. This means adopting greener technologies and minimizing waste in the production of vital therapies.

For instance, the industry is seeing a significant push towards reducing its carbon footprint. A 2024 report indicated that pharmaceutical companies are investing more in renewable energy sources for their manufacturing plants, with some aiming for 100% renewable energy by 2030. Denali's commitment to these practices will be crucial for its long-term operational efficiency and public perception.

Optimizing energy consumption is another key area. Many biopharma firms are implementing advanced process controls and utilizing more energy-efficient equipment. This focus on sustainability not only addresses environmental concerns but can also lead to cost savings, a critical factor for companies like Denali navigating the competitive landscape.

The manufacturing of advanced biologics, like those Denali Therapeutics develops, inherently produces substantial waste streams, a significant portion of which is plastic derived from single-use manufacturing systems. These systems, while offering flexibility and reducing contamination risk, contribute to the growing challenge of plastic waste in the pharmaceutical sector. For instance, the biopharmaceutical industry's plastic waste is projected to reach 300,000 metric tons annually by 2030, highlighting the scale of this environmental concern.

Denali must proactively integrate robust waste management and disposal protocols to mitigate its environmental impact. This includes exploring options for recycling, proper incineration of hazardous biological waste, and potentially investing in more sustainable materials for their manufacturing processes. Companies in this space are increasingly being held accountable for their waste generation, with regulatory bodies and investors paying closer attention to sustainability practices.

Biopharmaceutical production demands significant energy, impacting the carbon footprint of companies like Denali Therapeutics. As Denali scales its operations, from early-stage research to potential large-scale manufacturing, managing energy consumption and reducing greenhouse gas emissions becomes crucial. This aligns with increasing global pressure for environmental sustainability and anticipated regulatory shifts in the sector.

For instance, the pharmaceutical industry's overall energy use contributes substantially to global emissions. While specific figures for Denali's current footprint aren't publicly detailed, industry benchmarks suggest that energy-intensive processes like sterile filtration, purification, and climate control in labs and manufacturing sites are major contributors. By 2024, many biopharma firms are setting ambitious targets for renewable energy adoption, aiming to power a significant portion of their operations with sources like solar and wind to mitigate their environmental impact.

Supply Chain Environmental Impact

Denali Therapeutics faces scrutiny regarding the environmental footprint of its global supply chain, encompassing everything from the acquisition of raw materials to the final delivery of its innovative therapies. This impact is a critical factor in assessing the company's overall sustainability.

The biopharmaceutical industry, including companies like Denali, is increasingly focusing on supply chain transparency and ethical sourcing practices. Reducing the carbon footprint across the entire value chain, from manufacturing to logistics, is a growing priority for stakeholders and regulators alike.

For instance, the transportation of temperature-sensitive biologics often requires significant energy for refrigeration, contributing to emissions. Companies are exploring more sustainable packaging and cold chain solutions.

- Global logistics for biopharmaceuticals can contribute to significant greenhouse gas emissions, with estimates suggesting the sector's carbon footprint is substantial.

- Denali's commitment to reducing waste in packaging and optimizing shipping routes directly impacts its environmental performance.

- The sourcing of specialized raw materials, often from various global locations, necessitates careful consideration of transportation impacts and supplier environmental standards.

Climate Change and Resource Scarcity

Climate change and the increasing scarcity of resources present potential indirect risks for Denali Therapeutics. Disruptions in supply chains due to extreme weather events could impact the availability and cost of critical raw materials needed for drug development and manufacturing. For example, a drought affecting agricultural regions might increase the price of plant-derived compounds used in some research.

Furthermore, evolving environmental regulations driven by climate concerns could necessitate changes in Denali's operational practices or increase compliance costs. Companies are increasingly expected to demonstrate sustainability in their operations, which could influence investment decisions and partnerships. Adapting to these long-term environmental shifts is essential for sustained operational resilience and strategic advantage.

- Supply Chain Vulnerability: Extreme weather events, amplified by climate change, can disrupt the sourcing of specialized chemicals and biological materials.

- Regulatory Landscape: Anticipated stricter environmental regulations may require significant investment in greener manufacturing processes and waste management.

- Operational Costs: Resource scarcity, particularly for water or energy, could lead to increased operational expenditures for Denali's research facilities.

The biopharmaceutical sector, including Denali Therapeutics, faces increasing pressure to adopt sustainable practices, particularly concerning waste generation from single-use manufacturing systems. The industry's plastic waste is projected to reach 300,000 metric tons annually by 2030, underscoring the need for robust waste management and the exploration of sustainable materials.

Energy consumption is another critical environmental factor. Biopharmaceutical production is energy-intensive, contributing to companies' carbon footprints. By 2024, many firms are setting targets for renewable energy adoption, aiming to power operations with sources like solar and wind to mitigate environmental impact and potentially reduce operational costs.

Climate change presents indirect risks through potential supply chain disruptions due to extreme weather, impacting raw material availability and cost. Evolving environmental regulations could also necessitate operational changes and increase compliance expenses, requiring companies like Denali to adapt for long-term resilience.

| Environmental Factor | Impact on Denali Therapeutics | Industry Trend/Data (2024-2025) |

| Waste Generation | Increased costs for disposal, potential reputational damage | Biopharma plastic waste projected to reach 300,000 metric tons annually by 2030 |

| Energy Consumption & Carbon Footprint | Higher operational costs, regulatory scrutiny | Increased investment in renewable energy sources for manufacturing plants; some aim for 100% renewable energy by 2030 |

| Supply Chain & Climate Change | Risk of raw material shortages, increased logistics costs | Growing focus on supply chain transparency and ethical sourcing; exploration of sustainable packaging and cold chain solutions |

PESTLE Analysis Data Sources

Our PESTLE analysis for Denali Therapeutics is built on a comprehensive review of data from leading financial news outlets, scientific journals, and regulatory bodies. We incorporate insights from market research firms specializing in biotechnology and pharmaceutical trends, alongside government reports on healthcare policy and funding.