Denali Therapeutics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denali Therapeutics Bundle

Denali Therapeutics navigates a complex landscape shaped by intense rivalry and the significant threat of substitutes in the rare disease space. Understanding the leverage of powerful buyers and the potential influence of suppliers is crucial for grasping their strategic position. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Denali Therapeutics’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Denali Therapeutics depends on highly specialized raw materials, reagents, and intricate biological components for its cutting-edge therapeutic approaches, such as antibodies and protein therapeutics. The specialized nature of these inputs, especially those critical for blood-brain barrier penetration, often leads to a restricted pool of qualified suppliers, thereby enhancing their bargaining power.

The biopharmaceutical supply chain has experienced significant disruptions, as evidenced by recent years, underscoring the inherent vulnerability to shortages and delays impacting essential raw materials. For instance, the global shortage of certain cell culture media components in 2021-2022 significantly impacted drug development timelines across the industry, a challenge Denali would also face.

Suppliers offering proprietary technologies or specialized equipment for drug manufacturing, like Denali's Transport Vehicle (TV) platform, can wield considerable bargaining power. This reliance on unique assay kits and advanced manufacturing processes means Denali may face elevated costs and reduced operational flexibility. For instance, in 2024, the global biopharmaceutical contract manufacturing market was valued at approximately $180 billion, with specialized services commanding premium pricing.

The bargaining power of Contract Research and Manufacturing Organizations (CROs/CMOs) is a significant factor for Denali Therapeutics. Biotech firms like Denali frequently rely on these specialized external partners for critical research, development, and manufacturing processes. The intricate and heavily regulated nature of developing treatments for neurodegenerative diseases means that finding CROs/CMOs with the necessary expertise and adherence to compliance standards is not always straightforward.

This scarcity of highly qualified providers can translate into increased leverage for CROs/CMOs, allowing them to negotiate for more favorable pricing and contract terms. For instance, the global CRO market was valued at approximately $50 billion in 2023 and is projected to grow significantly, indicating robust demand for these services, which can bolster supplier power.

Skilled Labor and Scientific Talent

The biotechnology sector, particularly in niche areas like neurodegenerative diseases and blood-brain barrier research, relies on a concentrated group of highly skilled scientists and clinical professionals. This scarcity of specialized talent significantly enhances their bargaining power.

Competition for these experts can escalate labor costs and potentially delay critical project timelines for companies like Denali Therapeutics. The capacity to attract and retain top-tier scientific talent is therefore a pivotal factor in Denali's operational success and competitive edge.

- Talent Scarcity: The demand for specialized neuroscientists and drug developers often outstrips supply, giving these professionals leverage.

- Increased Labor Costs: In 2024, the average salary for a senior research scientist in biotech in major hubs like Boston or San Francisco could range from $150,000 to $200,000+, with signing bonuses and equity further driving up costs.

- Project Delays: A shortage of key personnel can lead to extended development cycles, impacting market entry and revenue generation.

- Retention Challenges: Companies must offer competitive compensation and compelling research opportunities to prevent talent from moving to rivals.

Intellectual Property and Licensing

Intellectual property (IP) held by suppliers can significantly influence their bargaining power. Companies possessing patents or exclusive licenses for crucial technologies, drug targets, or novel delivery systems essential for Denali's research and development pipeline can leverage this IP to dictate terms. This is particularly relevant in the biopharmaceutical sector where unique scientific breakthroughs are paramount.

The ability to negotiate favorable licensing agreements, royalty rates, and collaborative structures is directly tied to the uniqueness and indispensability of a supplier's IP. For instance, if a supplier holds a patent on a specific gene editing tool or a unique protein expression system that Denali requires, their leverage in negotiations increases substantially.

Denali Therapeutics' own innovative platform, designed to minimize reliance on external IP for its core delivery mechanisms, aims to mitigate this supplier power. However, the reality is that specific components or early-stage research tools might still necessitate the use of third-party intellectual property, thereby maintaining a degree of supplier influence.

- Key IP Holders: Identify critical suppliers holding patents on essential technologies or drug targets.

- Licensing Terms: Analyze the financial implications of licensing agreements, including royalties and upfront fees.

- Denali's IP Strategy: Evaluate how Denali's internal IP development can reduce dependence on external suppliers.

The bargaining power of suppliers for Denali Therapeutics is significant due to the specialized nature of its research and development inputs. Suppliers of unique reagents, proprietary technologies, and specialized manufacturing equipment can command higher prices and dictate terms, especially when alternatives are scarce. This is further amplified by the limited pool of qualified Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) capable of handling complex neurodegenerative disease research, a sector where specialized expertise is at a premium.

The scarcity of highly specialized talent in fields like neurobiology and advanced drug delivery also empowers suppliers, whether they are individual experts or specialized service providers. Companies must compete for this talent, leading to increased labor costs and potential project delays for Denali. For instance, in 2024, the demand for gene therapy specialists saw average salaries rise by 15-20% in key biotech hubs.

Intellectual property (IP) held by suppliers presents another avenue of power. Companies possessing patents on essential drug targets or novel delivery systems can leverage this IP to negotiate favorable licensing agreements, impacting Denali's operational costs and strategic flexibility. The biopharmaceutical sector's reliance on innovation means that critical IP holders often have substantial leverage.

| Factor | Impact on Denali | Supporting Data/Example |

| Specialized Inputs | Increased cost and reduced flexibility | Limited suppliers for blood-brain barrier penetration components |

| CRO/CMO Reliance | Higher service fees and potential delays | Global CRO market valued at ~$50 billion in 2023, with strong demand for specialized services |

| Talent Scarcity | Elevated labor costs and retention challenges | Senior research scientist salaries in biotech hubs reaching $150k-$200k+ in 2024 |

| Proprietary IP | Negotiation leverage for licensing terms | Patents on gene editing tools or protein expression systems |

What is included in the product

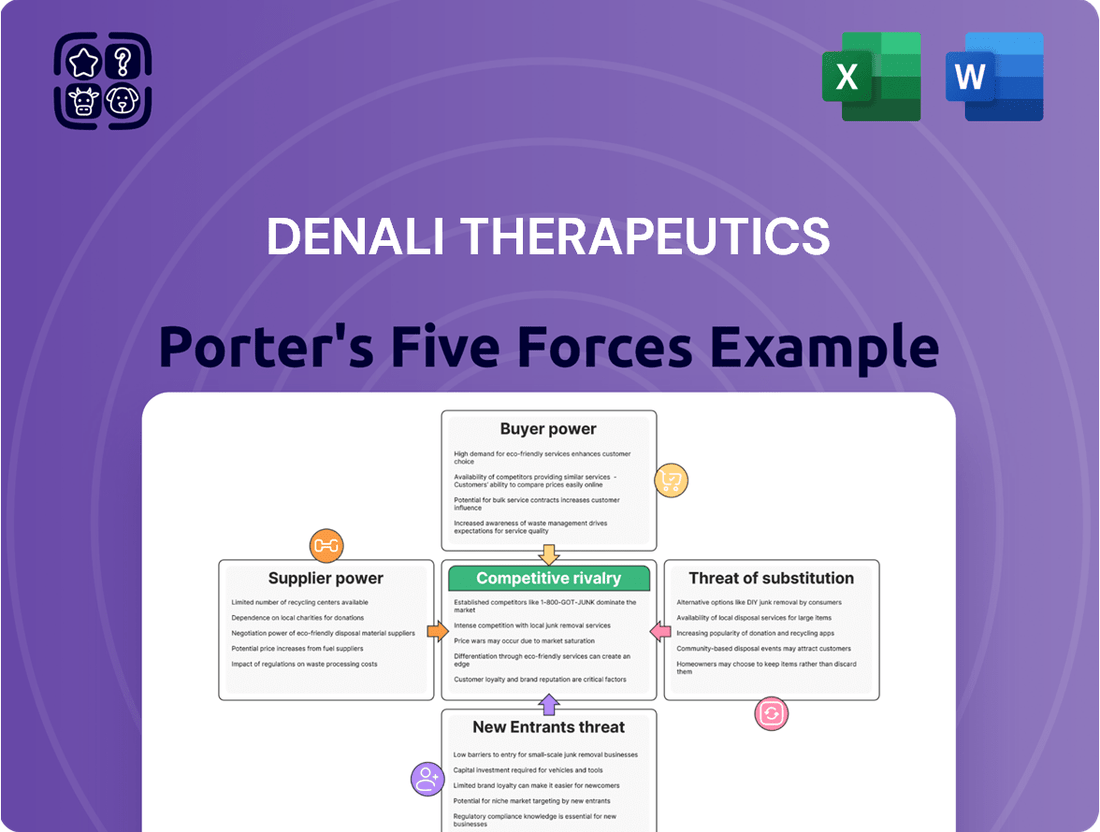

This Porter's Five Forces analysis for Denali Therapeutics examines the competitive intensity within the biotechnology sector, focusing on the company's unique position and the external factors influencing its profitability and growth potential.

Instantly visualize competitive pressures with a dynamic Porter's Five Forces analysis, enabling Denali Therapeutics to pinpoint and address key pain points in their drug development pipeline.

Customers Bargaining Power

Healthcare providers and institutions, like hospitals and clinics, are the primary customers for Denali's therapies. Large hospital networks, due to their significant purchasing power, can negotiate aggressively on pricing, especially when considering the cost-effectiveness and patient outcomes of new treatments. For instance, in 2024, hospital systems continued to prioritize value-based care models, scrutinizing the total cost of ownership for any new drug or therapy.

Payers, including insurance companies and government health programs like Medicare and Medicaid, wield considerable bargaining power. These entities dictate reimbursement rates and what drugs are covered, directly influencing patient access and a therapy's market viability. Denali Therapeutics must prove the substantial clinical benefit and economic value of its treatments to negotiate favorable terms, especially for its innovative, potentially high-priced therapies.

Patient advocacy groups are becoming a significant force, particularly in rare and neurodegenerative diseases where Denali Therapeutics operates. These groups, representing individuals with conditions like Hunter syndrome, can sway regulatory bodies and influence public opinion, indirectly impacting Denali's market access and pricing strategies.

The collective voice of patients and their advocates is increasingly heard by payers and policymakers. For instance, the strong advocacy surrounding rare genetic disorders often leads to greater pressure for insurance coverage and faster drug approvals, a dynamic Denali is likely to leverage for its investigational therapies.

Prescribing Physicians

Prescribing physicians, especially specialists in fields like neurology and rare genetic diseases, hold significant sway in determining the success of Denali Therapeutics' treatments. Their choices are heavily shaped by the evidence presented in clinical trials, including how well a drug works and its safety. For instance, in 2024, the focus on real-world evidence alongside trial data is intensifying, meaning physicians will scrutinize long-term outcomes and patient-reported benefits more closely.

Denali's strategy must therefore center on effectively communicating the value proposition of its therapies to these medical professionals. This involves providing clear, compelling data on efficacy and safety, alongside practical information regarding administration and patient management. A physician's confidence in a new therapy directly translates to its adoption rate in the market.

- Physician Influence: Specialists are critical gatekeepers for Denali's drug approvals and prescriptions.

- Data-Driven Decisions: Clinical trial results, efficacy, and safety data are paramount in influencing physician prescribing habits.

- Market Uptake Driver: Denali's success hinges on its capacity to educate and persuade physicians about the benefits of its therapies.

Competitive Treatment Options and Clinical Alternatives

As Denali Therapeutics' innovative therapies move toward market entry, potential customers, including patients and healthcare providers, will inevitably benchmark them against established treatments. This comparison extends to existing medications, even those used off-label, and supportive care regimens that might offer some symptomatic relief. The bargaining power of customers is significantly influenced by the breadth and efficacy of these competitive treatment options.

The presence of alternative therapeutic pathways, even if they don't directly overcome the blood-brain barrier challenge that Denali aims to address, grants customers leverage. For instance, in 2024, the market for neurodegenerative disease treatments saw continued use of symptomatic treatments and supportive care, which, while not curative, represent viable alternatives for patients managing their conditions. This availability of choices directly impacts Denali's ability to set premium pricing for its novel therapies.

- Alternative Therapies: Patients and payers evaluate Denali's products against existing drugs, off-label uses, and supportive care.

- Pricing Power: The availability of these alternatives can limit Denali's capacity to dictate prices for its new treatments.

- Market Dynamics: In 2024, the competitive landscape for neurological treatments remained robust, with established options posing a significant benchmark.

The bargaining power of customers for Denali Therapeutics is substantial, driven by sophisticated payers and influential healthcare providers. In 2024, healthcare systems and insurance providers continued to demand robust evidence of cost-effectiveness and superior patient outcomes before adopting new therapies, directly impacting Denali's pricing flexibility. Furthermore, the availability of existing treatments, even those offering only symptomatic relief, provides a benchmark that limits Denali's ability to command premium prices for its innovative solutions.

| Customer Segment | Bargaining Power Factor | 2024 Market Observation |

|---|---|---|

| Healthcare Providers (Hospitals) | Purchasing Volume & Value-Based Care Focus | Prioritized total cost of ownership and patient outcomes. |

| Payers (Insurers, Government) | Reimbursement & Coverage Decisions | Dictated market access through stringent value assessments. |

| Physicians (Specialists) | Prescribing Influence & Data Scrutiny | Emphasized real-world evidence and long-term efficacy. |

What You See Is What You Get

Denali Therapeutics Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Denali Therapeutics, detailing the competitive landscape and strategic positioning of the company within the biotechnology sector. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, providing in-depth insights into the threats of new entrants, the bargaining power of buyers and suppliers, the intensity of competitive rivalry, and the threat of substitute products.

Rivalry Among Competitors

The neurodegenerative disease drug market is intensely competitive, with many pharmaceutical and biotech firms pouring resources into R&D. Companies like Biogen, Eli Lilly, and Roche are major players, but numerous smaller, specialized biotech companies are also developing innovative therapies for conditions such as Alzheimer's, Parkinson's, and ALS.

Developing treatments for neurodegenerative diseases is a costly and lengthy endeavor, with many clinical trials failing. This high risk and expense intensifies competition as companies race to be the first to market with a successful therapy and recover their substantial investments. Denali Therapeutics' significant research and development spending, often running into hundreds of millions of dollars annually, underscores this challenging environment.

Denali Therapeutics' primary competitive edge is its Transport Vehicle (TV) platform, engineered to traverse the blood-brain barrier (BBB). This focus on BBB penetration is a key differentiator in the neurodegenerative disease space.

However, the landscape is becoming more crowded as competitors also pursue BBB crossing technologies. Companies are exploring diverse methods such as antibody-based delivery, nanoparticle systems, and extracellular vesicles to achieve brain penetration. This escalating investment in BBB delivery strategies fuels a more intense rivalry for innovative and effective solutions.

Pipeline Depth and Strategic Partnerships

Companies that boast a wide array of development candidates and robust strategic alliances tend to hold a significant advantage in the competitive landscape. Denali Therapeutics exemplifies this, possessing a diverse pipeline and forging collaborations with industry giants such as Biogen and Takeda.

These partnerships are instrumental in de-risking development efforts and amplifying market access for Denali's innovative therapies. For instance, Denali's collaboration with Biogen on certain neurodegenerative disease programs highlights the synergistic potential of such alliances.

The ongoing success of these strategic collaborations, coupled with the consistent progression of its internal pipeline, are paramount for Denali to maintain and enhance its competitive standing. As of early 2024, Denali's pipeline included over a dozen programs targeting various neurodegenerative diseases, with several in mid-to-late stage clinical trials.

- Denali's diverse pipeline: Encompasses programs for Alzheimer's disease, Parkinson's disease, ALS, and other neurodegenerative conditions.

- Key strategic partnerships: Include collaborations with Biogen, Takeda, and Sanofi, providing significant financial and scientific resources.

- Risk mitigation: Diversified pipeline and external partnerships help offset the inherent risks associated with drug development.

- Market reach expansion: Collaborations facilitate broader access to patient populations and geographical markets.

Intellectual Property and Regulatory Approvals

Intellectual property (IP) protection is a cornerstone of competitive rivalry in the biopharmaceutical sector. Denali Therapeutics, like its peers, relies heavily on patents for its novel drug candidates and proprietary platform technologies, such as its Transport Vehicle (TV) platform. This IP shields its innovations from direct imitation, allowing for a period of market exclusivity.

The regulatory landscape significantly shapes competitive dynamics. Companies vie for expedited review processes and designations like Breakthrough Therapy, which can dramatically shorten the time to market. For instance, Denali's tividenofusp alfa received Breakthrough Therapy Designation from the FDA, a crucial step that signals potential for faster patient access and a competitive edge over rivals developing similar treatments.

- Intellectual Property: Denali's competitive strength is bolstered by patents covering its lead drug candidates and its TV platform, safeguarding its innovations.

- Regulatory Advantage: Securing designations like FDA Breakthrough Therapy for tividenofusp alfa accelerates development and offers a significant head start in the market.

- Market Exclusivity: Early regulatory approvals and strong IP protection allow companies to capture market share before competitors can enter with similar therapies.

The competitive rivalry in the neurodegenerative disease space is fierce, with numerous companies like Biogen, Eli Lilly, and Roche actively developing treatments. Denali Therapeutics differentiates itself with its TV platform for blood-brain barrier penetration, but other firms are also investing heavily in similar technologies, intensifying the race for innovative solutions.

Denali's strategy of building a diverse pipeline and forming strategic alliances, such as its collaboration with Biogen for certain neurodegenerative disease programs, helps mitigate risk and expand market reach. As of early 2024, Denali had over a dozen programs in development, with several in advanced clinical stages, underscoring the breadth of its competitive efforts.

Intellectual property and regulatory advantages are critical. Denali's patent protection for its TV platform and drug candidates, alongside designations like FDA Breakthrough Therapy for tividenofusp alfa, provides a significant competitive edge by enabling market exclusivity and faster patient access.

| Key Competitors in Neurodegenerative Diseases | Key Development Focus | Denali's Differentiator/Strategy |

|---|---|---|

| Biogen | Alzheimer's, Parkinson's | TV platform for BBB penetration, collaborations |

| Eli Lilly | Alzheimer's | Broad R&D, significant investment |

| Roche | Alzheimer's, Parkinson's | Extensive pipeline, established market presence |

| Denali Therapeutics | Alzheimer's, Parkinson's, ALS | TV platform, diverse pipeline, strategic partnerships (Biogen, Takeda) |

SSubstitutes Threaten

The threat of substitutes for Denali Therapeutics' potential disease-modifying therapies is significant, particularly from conventional symptomatic treatments. These existing treatments, widely available and often more affordable, manage symptoms of neurodegenerative diseases without altering the disease's progression. For instance, treatments for Parkinson's disease, like levodopa, focus on dopamine replacement, offering symptom relief but not a cure. The global market for Parkinson's disease drugs alone was valued at approximately $5.5 billion in 2023, highlighting the established nature of these symptomatic approaches.

Non-pharmacological approaches, including diet, exercise, and cognitive therapy, represent significant substitutes for pharmaceutical interventions, especially in the early stages of neurodegenerative diseases or as supplementary treatments. These lifestyle modifications, while not offering cures, can impact patient and physician choices concerning the timing and necessity of drug therapies.

While Denali Therapeutics' proprietary Transport Vehicle (TV) platform offers a significant advantage in blood-brain barrier (BBB) penetration, the threat of substitutes remains a key consideration. Competitors and research bodies are actively exploring alternative methods for delivering drugs directly to the brain. These include intrathecal administration, focused ultrasound, and advanced nanoparticle technologies, all of which could bypass the need for Denali's specific BBB crossing mechanism.

Gene Therapies and Cell-Based Therapies

Gene therapies and cell-based therapies, including stem cell treatments, are emerging as significant substitutes for traditional drugs treating neurodegenerative diseases. These advanced approaches aim to fix genetic issues or replace faulty cells, offering a fundamentally different treatment path. For instance, the global gene therapy market was valued at approximately $8.2 billion in 2023 and is projected to grow substantially, indicating a strong shift towards these innovative modalities.

These therapies present a long-term substitution threat to companies like Denali Therapeutics, even as Denali itself explores advanced treatment methods. The potential for curative outcomes, rather than just symptom management, makes them highly attractive. By 2024, several gene therapies have received regulatory approval for various conditions, demonstrating their increasing viability and market acceptance.

- Market Growth: The gene therapy market is experiencing rapid expansion, with forecasts suggesting continued strong growth through 2030.

- Therapeutic Potential: These therapies offer the possibility of addressing the root cause of diseases, a key differentiator from many conventional treatments.

- Investment Trends: Significant venture capital and pharmaceutical investment is flowing into gene and cell therapy companies, underscoring their perceived future importance.

Unapproved or Off-Label Treatments

In areas with high unmet medical needs, patients and physicians may turn to unapproved treatments or off-label uses of existing drugs. This is often driven by desperation or compelling anecdotal evidence, bypassing formal regulatory pathways. For instance, in late 2023 and early 2024, discussions around potential off-label uses for certain neurological conditions intensified as patients sought any available relief.

These alternative approaches, while carrying inherent risks, can function as substitutes for Denali Therapeutics' potential approved therapies, particularly during the early stages of market entry or when new treatments are scarce and costly. The availability of these workarounds can dampen the urgency for patients to adopt newly approved, potentially expensive, options.

- Unapproved Treatments: Patients may seek experimental drugs not yet cleared by regulatory bodies, often through compassionate use programs or overseas availability.

- Off-Label Drug Use: Existing approved medications are prescribed for conditions other than those officially indicated, based on emerging research or anecdotal success.

- Market Impact: The presence of such substitutes can reduce the immediate demand and pricing power for novel therapies, especially in the initial launch phases.

- Risk vs. Reward: While patients accept higher risks, the perceived benefit of immediate symptom management can outweigh the wait for approved, potentially safer, alternatives.

The threat of substitutes for Denali Therapeutics' novel therapies is substantial, encompassing both established symptomatic treatments and emerging advanced modalities. Conventional treatments, like those for Parkinson's disease, which generated around $5.5 billion in 2023, offer symptom management but not disease modification, creating an accessible substitute. Furthermore, lifestyle interventions such as diet and exercise also serve as complementary or alternative approaches, influencing patient choices.

Advanced therapies like gene and cell-based treatments are rapidly gaining traction, representing a significant long-term substitution threat. The gene therapy market, valued at approximately $8.2 billion in 2023, is projected for robust growth, indicating a shift towards curative approaches. By 2024, several gene therapies have already secured regulatory approval, validating their therapeutic potential and market acceptance.

Alternative delivery methods for brain therapies, such as intrathecal administration and focused ultrasound, are also being developed by competitors, potentially bypassing the need for Denali's specific blood-brain barrier penetration technology. The availability of unapproved or off-label treatments, often driven by patient desperation, further complicates the landscape by offering immediate, albeit riskier, alternatives that can impact the adoption rate of new, potentially costly, therapies.

| Substitute Category | Examples | Market Context (2023/2024 Data) | Implication for Denali |

| Symptomatic Treatments | Levodopa (Parkinson's), other symptom relievers | Parkinson's drug market ~ $5.5 billion (2023) | Established, accessible, but do not alter disease progression. |

| Lifestyle/Non-Pharmacological | Diet, exercise, cognitive therapy | Widely adopted, low cost | Can influence treatment decisions, especially early stage. |

| Advanced Therapies | Gene therapy, cell therapy | Gene therapy market ~ $8.2 billion (2023); several approvals by 2024 | Offer curative potential, long-term threat, significant investment. |

| Alternative Delivery Methods | Intrathecal administration, focused ultrasound | Ongoing R&D by competitors | Potential to bypass Denali's TV platform. |

| Unapproved/Off-Label Use | Experimental drugs, off-label prescriptions | Increased discussions in late 2023/early 2024 | Can reduce urgency for novel therapies, especially if costly. |

Entrants Threaten

The threat of new entrants into the neurodegenerative disease biotechnology sector, where Denali Therapeutics operates, is significantly mitigated by extremely high capital requirements and extensive research and development (R&D) costs. Developing a new therapy from discovery through clinical trials and regulatory approval can cost billions of dollars and take over a decade. For instance, in 2023, Denali Therapeutics reported a net loss of $548.5 million, illustrating the substantial, ongoing financial investment needed even for established players.

The development and approval of new drugs, particularly for challenging areas like neurodegenerative diseases, face incredibly strict and time-consuming regulatory pathways. This creates a significant barrier for any new company trying to enter the market.

Newcomers often lack the deep understanding of regulatory requirements and the established connections that incumbent companies, such as Denali Therapeutics, possess. This makes the journey to market entry long and fraught with uncertainty. For instance, the U.S. Food and Drug Administration (FDA) approval process for new drugs can take many years, with some estimates suggesting an average of 7-10 years from discovery to market. While designations like Breakthrough Therapy can speed things up, they are not common, and the overall process remains a formidable hurdle.

Developing effective treatments for neurodegenerative diseases, particularly those that can cross the blood-brain barrier, demands incredibly specialized scientific knowledge, advanced technological platforms, and strong intellectual property. New companies entering this field would face substantial hurdles in building or obtaining these critical capabilities, acting as a significant deterrent.

Denali Therapeutics, for instance, benefits immensely from its proprietary Transport Vehicle (TV) platform. This unique technology is a key differentiator, providing a significant proprietary advantage that would be difficult and costly for newcomers to replicate, thereby raising the barrier to entry.

Established Player Advantages and Network Effects

Established players like Denali Therapeutics possess significant advantages due to their existing infrastructure and relationships. These include deep-seated connections with researchers, clinicians, patient advocacy groups, and crucial payer networks, which new entrants must painstakingly cultivate.

Furthermore, Denali benefits from its developed manufacturing capabilities, robust supply chain networks, and experienced commercial teams. Building these essential components from the ground up presents a substantial hurdle and a considerable time and capital investment for any new company entering the biopharmaceutical space.

- Established Relationships: Denali's existing ties with key stakeholders in the drug development and approval process offer a significant advantage over newcomers.

- Infrastructure and Networks: Access to established manufacturing, supply chains, and commercial teams reduces operational barriers for Denali.

- Barriers to Entry: New entrants face substantial challenges in replicating Denali's established infrastructure and stakeholder relationships, increasing the threat of new entrants.

Market Access and Reimbursement Challenges

Even with a product that has received regulatory approval, new companies entering the biopharmaceutical market, like Denali Therapeutics, face significant hurdles in achieving market access and securing favorable reimbursement from healthcare payers. Established companies often leverage existing relationships and a proven track record in navigating intricate reimbursement processes, creating a competitive advantage that makes it tough for new entrants to match on price or gain widespread patient access.

These market access and reimbursement challenges can significantly impact a new entrant's ability to generate revenue and achieve profitability. For instance, in 2024, the average time for a new drug to secure reimbursement coverage from major US commercial payers was approximately 12-18 months post-approval, a period during which the company incurs significant operational costs without substantial revenue. This delay can be even longer for novel therapies or those targeting rare diseases, where payer evidence requirements are more stringent.

- Reimbursement Delays: New entrants often face longer negotiation cycles with payers compared to established firms.

- Evidence Requirements: Payers increasingly demand robust real-world evidence (RWE) post-launch, which new entrants may struggle to generate quickly.

- Payer Relationships: Existing relationships between established biotechs and payers can create preferential access for their products.

- Pricing Pressure: New entrants might be forced to accept lower initial reimbursement rates to gain access, impacting early revenue streams.

The threat of new entrants for Denali Therapeutics is low, primarily due to the immense capital required for drug development and the lengthy, complex regulatory approval processes. These factors, combined with the need for specialized scientific expertise and established infrastructure, create substantial barriers to entry in the neurodegenerative disease biotechnology sector.

New companies must overcome significant hurdles in scientific innovation, intellectual property protection, and building robust R&D capabilities. Denali's proprietary TV platform, for example, represents a significant technological advantage that is difficult and costly for newcomers to replicate. The sheer scale of investment, exemplified by Denali's 2023 net loss of $548.5 million, underscores the financial commitment necessary, deterring many potential entrants.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Billions of dollars needed for R&D, clinical trials, and regulatory submissions. | Extremely High |

| Regulatory Hurdles | Lengthy FDA approval processes (average 7-10 years) and stringent data requirements. | Very High |

| Scientific Expertise | Need for specialized knowledge in neurobiology and proprietary technology platforms. | High |

| Intellectual Property | Protection of novel drug candidates and delivery systems. | High |

| Market Access & Reimbursement | Navigating payer negotiations and securing favorable reimbursement (12-18 months post-approval in 2024). | High |

Porter's Five Forces Analysis Data Sources

Our Denali Therapeutics Porter's Five Forces analysis is built upon a foundation of robust data, including Denali's SEC filings, investor presentations, and industry-specific market research reports. We also incorporate insights from scientific publications and clinical trial data to assess competitive intensity and potential threats.