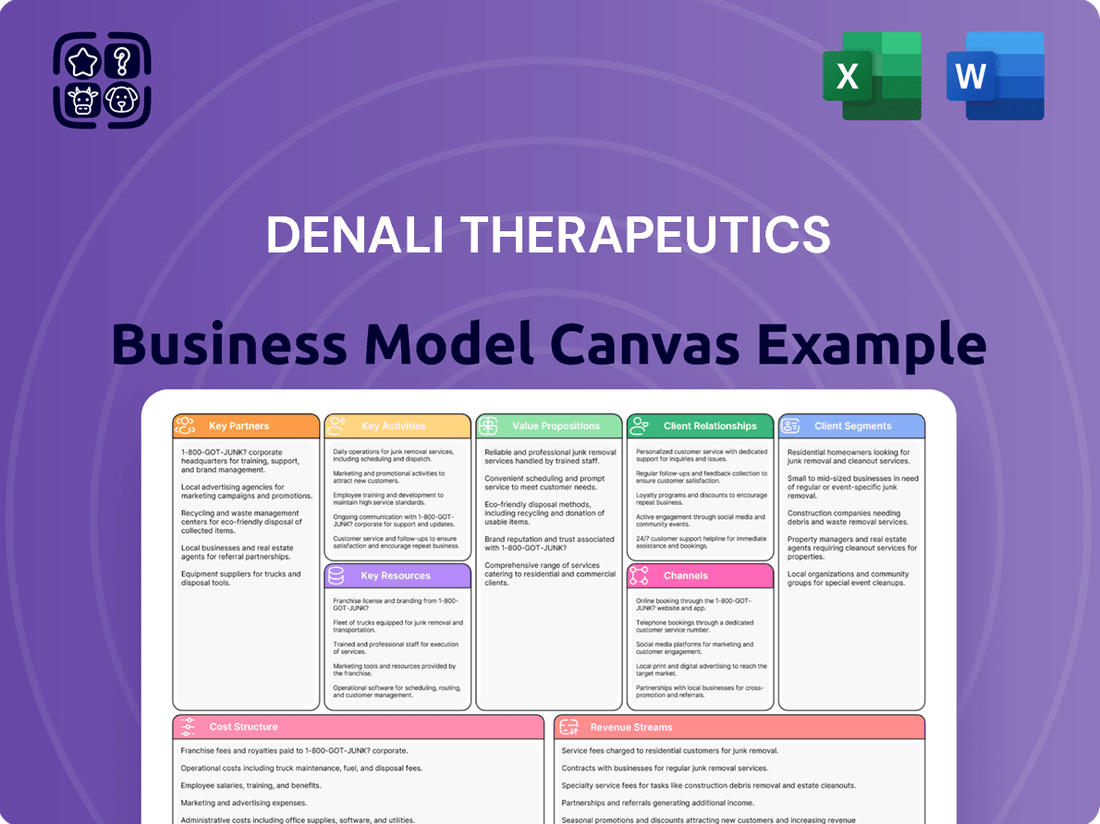

Denali Therapeutics Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Denali Therapeutics Bundle

Unlock the full strategic blueprint behind Denali Therapeutics's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Denali Therapeutics actively cultivates strategic alliances with leading pharmaceutical giants to advance its therapeutic pipeline. These collaborations are crucial for co-developing and co-commercializing promising drug candidates, effectively sharing the substantial risks inherent in drug development.

Notable partnerships include those with Biogen for Parkinson's disease and Takeda for Frontotemporal Dementia. For example, Denali and Biogen are jointly developing LRRK2 inhibitors, a key area for Parkinson's treatment. Takeda has also exercised its option to co-develop and co-commercialize DNL593, a potential therapy for Frontotemporal Dementia.

Denali Therapeutics actively partners with leading research institutions and innovative technology firms to bolster its drug discovery pipeline. A prime example is their multi-target collaboration with PharmEnable, leveraging PharmEnable's advanced AI drug discovery platform to pinpoint novel chemical compounds for difficult targets in neurodegenerative diseases. These strategic alliances are crucial for expediting the identification and refinement of promising therapeutic candidates.

Denali Therapeutics actively cultivates alliances with premier academic and scientific institutions. These collaborations are instrumental in enhancing their comprehension of neurodegenerative conditions and the intricate blood-brain barrier.

These partnerships are vital for tapping into pioneering research, confirming therapeutic targets, and reinforcing the scientific basis of Denali's drug development initiatives. For instance, their work with institutions like the University of California, San Francisco, has been foundational in understanding disease mechanisms.

This strategy of collaboration is central to Denali's biomarker-driven approach to therapeutic development, ensuring that their programs are grounded in robust scientific validation and the latest discoveries.

Contract Research and Manufacturing Organizations (CROs/CMOs)

Denali Therapeutics leverages Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) extensively to manage its broad preclinical and clinical pipeline. This strategic outsourcing is crucial for maintaining a flexible, lean operational model, enabling access to specialized scientific expertise and advanced infrastructure essential for intricate drug development processes and future commercialization.

These partnerships are vital for Denali to efficiently conduct a wide array of studies, from early-stage research to late-stage clinical trials. For instance, in 2024, the company continued to rely on its network of CROs to accelerate the pace of its discovery and development programs across its core therapeutic areas, including neurodegeneration and autoimmune diseases.

Simultaneously, CMOs play a critical role in ensuring the timely and scalable manufacturing of drug substances and finished products. This allows Denali to focus its internal resources on core scientific innovation and strategic decision-making, rather than on the capital-intensive aspects of manufacturing. While Denali has established its own large molecule manufacturing facility, the continued engagement with CMOs remains a cornerstone of its supply chain strategy to meet diverse production needs.

- CRO/CMO Reliance: Denali utilizes CROs for research studies and CMOs for drug manufacturing to support its extensive pipeline.

- Operational Efficiency: Outsourcing enables Denali to maintain a lean structure and access specialized expertise and infrastructure.

- Strategic Manufacturing: While building internal capacity, Denali continues to partner with CMOs for flexible and scalable production.

Patient Advocacy Organizations

Denali Therapeutics actively cultivates robust partnerships with patient advocacy organizations. These collaborations are crucial for ensuring Denali's drug development efforts are closely aligned with the real needs and perspectives of the patient communities they aim to serve. This patient-centric approach is a cornerstone of their strategy.

These vital partnerships play a significant role in shaping clinical trial designs, making them more relevant and efficient for patients. Furthermore, they are instrumental in improving patient recruitment for these trials, a common challenge in the pharmaceutical industry. In 2023, Denali highlighted its ongoing engagement with various patient groups as a key element in advancing its pipeline programs.

These collaborations also facilitate the development of essential patient support services, ensuring that individuals participating in trials and those who may eventually benefit from Denali's therapies have access to the resources they need. This commitment underscores a dedication to not just developing treatments, but also supporting the entire patient journey.

- Patient-Centric Design: Partnerships ensure clinical trials and therapies address patient needs directly.

- Enhanced Recruitment: Advocacy groups assist in identifying and enrolling eligible participants for trials.

- Support Services Development: Collaboration aids in creating valuable resources for patients and their families.

- Pipeline Alignment: Patient feedback guides Denali's research and development priorities.

Denali Therapeutics' key partnerships are foundational to its mission of developing therapies for neurodegenerative diseases. These alliances span major pharmaceutical companies, academic institutions, and patient advocacy groups, each contributing unique strengths to the drug development lifecycle. The company's collaborations with leaders like Biogen and Takeda are crucial for sharing risks and resources in advancing complex therapeutic programs, such as those targeting Parkinson's disease and Frontotemporal Dementia.

Furthermore, Denali leverages partnerships with Contract Research Organizations (CROs) and Contract Manufacturing Organizations (CMOs) to enhance operational efficiency and access specialized expertise. This outsourcing model allows Denali to maintain agility and focus on its core scientific innovation, while ensuring robust support for its preclinical and clinical pipeline. In 2024, these strategic relationships remained critical for accelerating research and development timelines across its diverse portfolio.

The company also actively engages with patient advocacy organizations. These collaborations ensure that Denali's development efforts remain patient-centric, aiding in clinical trial design, recruitment, and the development of essential patient support services. This patient-focused approach is vital for aligning research with the needs of the communities Denali aims to serve.

What is included in the product

Denali Therapeutics' business model focuses on developing therapies for neurodegenerative diseases by leveraging its proprietary technology platforms and strategic partnerships, targeting patients with conditions like Parkinson's and ALS.

The company's model emphasizes collaboration with pharmaceutical giants for co-development and commercialization, aiming to de-risk its pipeline and access broader markets to deliver innovative treatments.

Denali Therapeutics' Business Model Canvas acts as a pain point reliever by clearly mapping its innovative approach to developing therapies for neurodegenerative diseases, offering a structured solution to the complex challenges faced by patients and the healthcare system.

This canvas provides a concise, one-page snapshot of how Denali addresses the pain of untreatable neurological conditions through its unique technology platforms and strategic partnerships.

Activities

Denali Therapeutics' central operation revolves around the meticulous research and development of innovative treatments for debilitating neurodegenerative and lysosomal storage diseases. This foundational activity encompasses identifying targets with strong genetic backing and designing a wide array of therapeutic approaches, such as antibodies, small molecules, and protein-based drugs.

A key aspect of their R&D is engineering these therapies to efficiently penetrate the blood-brain barrier, a critical hurdle for treating neurological conditions. For instance, in 2024, Denali continued to advance its pipeline, with a significant focus on its proprietary Transport IP technology designed to facilitate brain penetration. Their lead program targeting Parkinson's disease, DNL201, has shown promising preclinical results, with clinical trials ongoing.

Denali Therapeutics dedicates substantial resources to moving its diverse pipeline of potential therapies from early lab research into human testing. This encompasses their innovative Enzyme Transport Vehicle (ETV), Oligonucleotide Transport Vehicle (OTV), and Antibody Transport Vehicle (ATV) platforms. For instance, their program targeting Hunter syndrome, tividenofusp alfa, is nearing the critical regulatory submission stage, highlighting the tangible progress in advancing these preclinical and clinical programs.

Denali Therapeutics' core activity revolves around the ongoing innovation and enhancement of its proprietary Transport Vehicle (TV) platform. This technology is specifically engineered to address the significant hurdle of transporting large therapeutic molecules across the blood-brain barrier, a crucial step for effectively treating diseases affecting the central nervous system.

This continuous development directly fuels the expansion of Denali's therapeutic pipeline, allowing them to explore and advance treatments for a wider range of neurological conditions. For instance, their progress in 2024 with the TV platform is central to advancing their lead programs in areas like Alzheimer's and Parkinson's disease.

Regulatory Submissions and Commercial Readiness

As Denali's therapeutic programs advance, a critical focus shifts to regulatory submissions and ensuring commercial readiness. This involves meticulously preparing and filing Biologics License Applications (BLAs) with regulatory bodies such as the U.S. Food and Drug Administration (FDA). For instance, as of early 2024, Denali has been actively progressing its lead programs, including those targeting neurodegenerative diseases, through various stages of clinical development, with the aim of future regulatory submissions.

Simultaneously, Denali undertakes comprehensive pre-launch preparations to facilitate a smooth market entry for any potential approvals. This strategic work includes engaging with healthcare providers to educate them on new therapies and initiating discussions with payers to secure market access and reimbursement. Building out dedicated commercial teams is also paramount to effectively launch and support new products.

- Regulatory Filings: Preparing and submitting BLAs to agencies like the FDA for advancing pipeline candidates.

- Market Access: Engaging with payers and healthcare providers to ensure patient access to potential therapies.

- Commercial Infrastructure: Establishing sales, marketing, and medical affairs teams in anticipation of product launches.

- Program Advancement: Denali's ongoing clinical trials for conditions like ALS and Parkinson's disease are key drivers for these activities.

Biomarker Discovery and Utilization

Denali Therapeutics places significant emphasis on biomarker discovery and their integration into the drug development pipeline. This strategy is crucial for refining clinical trial design and confirming that their investigational therapies are engaging their intended targets and pathways within the body. By leveraging biomarkers, Denali aims to gain a clearer understanding of a drug's potential efficacy and how specific patient populations might respond, thereby streamlining the entire clinical development process.

This biomarker-centric methodology is a cornerstone of Denali's research and development efforts. For instance, in their pursuit of treatments for neurodegenerative diseases, Denali has actively sought biomarkers that can indicate target engagement and downstream effects in conditions like Alzheimer's and Parkinson's disease. This allows for more informed go/no-go decisions during clinical studies, potentially reducing costs and timelines.

The utilization of biomarkers allows Denali to:

- Enhance Precision in Clinical Trials: By identifying specific biological markers, Denali can select patient populations most likely to benefit from their therapies, increasing the probability of success.

- Demonstrate Target Engagement: Biomarkers provide objective evidence that the drug is interacting with its intended biological target, a critical step in validating a drug's mechanism of action.

- Optimize Dosing and Efficacy: Measuring biomarker changes can help determine the optimal dose of a drug and assess its impact on disease pathways, leading to more efficient development.

- Support Regulatory Submissions: Robust biomarker data can strengthen regulatory filings by providing clear evidence of a drug's biological activity and potential therapeutic benefit.

Denali Therapeutics' key activities center on pioneering the development of novel therapies for neurodegenerative diseases and lysosomal storage disorders through rigorous research and development. This involves leveraging their proprietary Transport Vehicle (TV) platform, designed to overcome the blood-brain barrier challenge, a critical step for neurological treatments.

A significant focus is placed on advancing their pipeline, which includes programs targeting Parkinson's disease and Hunter syndrome, with ongoing clinical trials and nearing regulatory submission stages. For instance, in 2024, Denali continued to make progress with its lead programs, demonstrating the tangible movement of potential therapies from preclinical to clinical development.

Furthermore, Denali actively engages in biomarker discovery to enhance the precision of clinical trials, ensuring target engagement and optimizing therapeutic development. This data-driven approach is crucial for strengthening regulatory submissions and demonstrating the biological activity of their investigational drugs, as seen in their work with Alzheimer's and Parkinson's disease candidates.

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is an exact replica of the document you will receive upon purchase. This comprehensive overview details Denali Therapeutics' strategic approach, including their key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams. You'll gain full access to this professionally structured and informative canvas, ready for your analysis and application.

Resources

Denali's core strength lies in its proprietary Transport Vehicle (TV) platform, a suite of technologies including Enzyme Transport Vehicle (ETV), Oligonucleotide Transport Vehicle (OTV), and Antibody Transport Vehicle (ATV). This innovative technology is engineered to overcome the significant challenge of the blood-brain barrier, a critical step for treating neurodegenerative diseases.

This TV platform is the bedrock of Denali's entire therapeutic pipeline, setting their strategy apart in the competitive landscape. It's designed to facilitate the delivery of diverse therapeutic molecules directly into the brain, addressing a long-standing unmet medical need. For instance, Denali has advanced its ATV program targeting Parkinson's disease, with clinical trials underway, showcasing the platform's real-world application.

Denali Therapeutics boasts a strong intellectual property portfolio, encompassing patents for its drug candidates, platform technologies, and their applications. This collection of intellectual property is fundamental to their competitive edge, safeguarding their novel approaches to tackling challenging neurodegenerative diseases.

This robust IP is vital for solidifying Denali's market standing and ensuring its future revenue generation. For instance, as of early 2024, Denali has actively pursued patent protection for its lead programs like DNL788 (satsuma) and DNL747 (tavneos), underscoring the strategic importance of this asset class.

Denali Therapeutics’ scientific and clinical expertise is a cornerstone of their business model. They boast profound knowledge in neurodegeneration biology, the intricate blood-brain barrier, and the complex process of drug development. This deep understanding allows them to tackle challenging therapeutic areas effectively.

The company’s strength lies in its human capital. Denali's team is composed of seasoned scientists and clinicians who have a demonstrated history of successfully advancing intricate therapeutic programs. Their collective experience spans from initial discovery phases all the way through to clinical stages, underscoring their rigorous scientific approach.

Financial Capital

Denali Therapeutics relies on substantial financial capital to fuel its ambitious research and development pipeline. This includes significant holdings in cash, cash equivalents, and marketable securities, which are essential for covering the high costs associated with drug discovery and clinical trials.

As of the close of business on December 31, 2024, Denali reported approximately $1.19 billion in cash and cash equivalents and marketable securities. This substantial financial reserve provides a robust cash runway, enabling the company to sustain its operations and pursue future commercialization strategies.

- Financial Strength: Approximately $1.19 billion in cash, cash equivalents, and marketable securities as of December 31, 2024.

- Operational Funding: This capital is crucial for funding extensive and costly research and development activities.

- Pre-Commercial Viability: Essential for a biotech company that has not yet reached commercialization.

- Strategic Flexibility: Provides the necessary resources to advance clinical programs and explore strategic partnerships.

Manufacturing and Research Facilities

Denali Therapeutics operates specialized research and manufacturing facilities, a critical component of its business model. These sites are vital for producing the necessary drug supplies for both early-stage preclinical studies and later-stage clinical trials, as well as for potential future commercialization. This in-house capability allows Denali to maintain stringent quality control and ensure a more reliable supply chain for its innovative therapies.

A prime example of this investment is Denali's large molecule manufacturing facility located in Salt Lake City, Utah. This facility underscores the company's commitment to controlling the entire production process, from research to manufacturing. By owning and operating these specialized assets, Denali enhances its operational efficiency and its ability to bring novel treatments to patients.

- In-house Manufacturing: Denali's Salt Lake City facility is key for producing drug supplies.

- Quality Control: Direct oversight of manufacturing ensures high standards.

- Supply Chain Reliability: Internal production reduces dependency on external partners.

- Scalability: Facilities are designed to support clinical trials and future commercial demand.

Denali's key resources include its proprietary Transport Vehicle (TV) platform, a robust intellectual property portfolio, and deep scientific and clinical expertise in neurodegenerative diseases. These are complemented by substantial financial capital and specialized research and manufacturing facilities.

The company’s financial strength is demonstrated by its cash reserves, which are critical for funding its extensive R&D activities and supporting its pre-commercialization status. This financial backing provides strategic flexibility for advancing clinical programs and exploring partnerships.

Denali’s specialized facilities, like the Salt Lake City manufacturing site, are vital for producing drug supplies, ensuring quality control, and maintaining supply chain reliability. These assets are designed to support both current clinical trial needs and future commercial demand.

| Key Resource Category | Specific Asset/Capability | Significance | 2024 Data Point |

|---|---|---|---|

| Technology Platform | Transport Vehicle (TV) Platform (ETV, OTV, ATV) | Enables drug delivery across the blood-brain barrier for neurodegenerative diseases. | Core technology underpinning all pipeline programs. |

| Intellectual Property | Patents for drug candidates and platform technologies | Safeguards novel approaches and secures market position. | Active protection for lead programs like DNL788 and DNL747 (early 2024). |

| Human Capital | Scientific and Clinical Expertise | Deep knowledge in neurodegeneration, blood-brain barrier, and drug development. | Team of seasoned scientists and clinicians with a history of advancing programs. |

| Financial Resources | Cash, Cash Equivalents, and Marketable Securities | Funds R&D, clinical trials, and operational expenses. | Approximately $1.19 billion as of December 31, 2024. |

| Physical Assets | Specialized Research and Manufacturing Facilities | Supports drug production for preclinical studies, clinical trials, and potential commercialization. | Large molecule manufacturing facility in Salt Lake City, Utah. |

Value Propositions

Denali's core value is its proprietary technology designed to overcome the blood-brain barrier (BBB), a critical hurdle for brain-targeted therapies.

This enhanced BBB penetration allows for direct delivery of therapeutic agents to the central nervous system, addressing the underlying pathology of neurodegenerative diseases.

This capability is crucial for developing treatments for conditions like Alzheimer's and Parkinson's, where conventional drugs struggle to reach affected brain tissue.

In 2024, Denali continued to advance its pipeline, with several drug candidates targeting these neurological disorders showing promising preclinical and early clinical data, underscoring the real-world application of their BBB penetration technology.

Denali Therapeutics focuses on developing precision medicines for debilitating neurodegenerative and lysosomal storage diseases like Parkinson's, Alzheimer's, ALS, and Hunter syndrome. Their strategy centers on genetically validated targets, aiming to alter disease progression rather than just palliate symptoms.

This targeted approach is designed to deliver significant clinical improvements for patients. For instance, in 2024, Denali continued advancing its pipeline candidates, with several programs showing promising preclinical data, underscoring the potential for meaningful patient impact.

Denali Therapeutics leverages its Transport Vehicle platform to explore a wide array of therapeutic modalities. This includes antibodies, small molecules, and protein therapeutics, offering a versatile approach to disease treatment.

This broad strategy allows Denali to target diverse disease pathologies effectively. It also provides crucial flexibility in tailoring treatments to the specific needs of different conditions, maximizing the potential for positive patient outcomes.

In 2024, Denali continued to advance its pipeline across these modalities, with significant progress reported in its programs targeting neurodegenerative diseases. The company's commitment to this diverse approach underscores its aim to address a wide spectrum of unmet medical needs.

Potential for Accelerated Regulatory Approval

Denali Therapeutics actively pursues accelerated regulatory approval pathways for its therapeutic candidates. This strategy is exemplified by the U.S. Food and Drug Administration's (FDA) granting of Breakthrough Therapy Designation to tividenofusp alfa for the treatment of Hunter syndrome.

This designation signifies that the FDA has determined the drug candidate may demonstrate substantial improvement over available therapy on one or more clinically significant endpoints. This commitment to expedited development, underpinned by strong clinical evidence and proactive engagement with regulatory agencies, aims to shorten the timeline to market. By doing so, Denali seeks to deliver vital treatments to patients more rapidly.

- Accelerated Pathways: Denali targets expedited regulatory routes for select programs.

- Breakthrough Designation: Tividenofusp alfa received FDA Breakthrough Therapy Designation for Hunter syndrome.

- Reduced Time to Market: This focus aims to significantly cut the time required to bring therapies to patients.

- Patient Benefit: The ultimate goal is to provide much-needed treatments to patients sooner.

Biomarker-Driven Development for Patient Benefit

Denali's commitment to biomarker-driven development is central to its strategy, aiming to ensure that therapies reach the patients who will benefit most. This rigorous scientific approach integrates biomarker discovery and utilization across all stages of drug development.

By deeply understanding target engagement and pathway modulation through biomarkers, Denali enhances the potential for more effective treatments and advances personalized medicine. This focus directly translates to maximizing the probability of clinical success and ultimately delivering greater patient benefit.

- Biomarker Integration: Denali embeds biomarker discovery and validation throughout its R&D pipeline.

- Enhanced Understanding: Biomarkers provide critical insights into drug mechanism of action and patient response.

- Personalized Medicine: This approach facilitates the identification of patient subgroups most likely to respond to treatment.

- Improved Clinical Success: By guiding development with robust biomarker data, Denali aims to increase the likelihood of positive clinical outcomes and patient benefit.

Denali Therapeutics offers a unique value proposition centered on its advanced drug delivery technology, specifically designed to overcome the blood-brain barrier. This allows for targeted therapies to reach the central nervous system effectively, addressing the root causes of neurodegenerative and lysosomal storage diseases. Their approach focuses on genetically validated targets, aiming for disease modification rather than symptom management, with a commitment to accelerating the delivery of these innovative treatments to patients.

In 2024, Denali continued to demonstrate the power of its Transport Vehicle platform, which supports a diverse range of therapeutic modalities including antibodies and small molecules. The company's pipeline advanced significantly, with several programs showing promising preclinical data, highlighting the potential for broad application across various neurological conditions. This versatility allows Denali to tailor treatments to specific patient needs, increasing the likelihood of positive outcomes.

Denali's strategic focus on biomarker-driven development further refines its value proposition. By integrating biomarker discovery and validation throughout the research and development process, the company enhances its understanding of drug mechanisms and patient responses. This rigorous approach aims to identify patient subgroups most likely to benefit from their therapies, thereby improving clinical success rates and delivering greater patient value.

The company's commitment to accelerated regulatory pathways, exemplified by the FDA's Breakthrough Therapy Designation for tividenofusp alfa for Hunter syndrome, underscores its dedication to bringing life-changing treatments to market swiftly. This focus on efficiency, coupled with strong clinical evidence, aims to reduce the time between discovery and patient access, a critical factor in treating debilitating diseases.

| Value Proposition Area | Key Offering | 2024 Highlights/Impact |

|---|---|---|

| Targeted CNS Delivery | Proprietary technology to penetrate the blood-brain barrier | Advancement of pipeline candidates targeting neurodegenerative diseases, demonstrating real-world application. |

| Precision Medicine | Focus on genetically validated targets for disease modification | Development of therapies aimed at altering disease progression for conditions like Parkinson's and Alzheimer's. |

| Therapeutic Modality Versatility | Transport Vehicle platform for diverse drug types (antibodies, small molecules) | Continued progress across multiple pipeline programs, addressing a wide spectrum of unmet medical needs. |

| Accelerated Development | Pursuit of expedited regulatory pathways | FDA Breakthrough Therapy Designation for tividenofusp alfa for Hunter syndrome, aiming for faster patient access. |

| Biomarker-Driven Strategy | Integration of biomarkers for enhanced understanding and patient selection | Improved probability of clinical success through identification of patient subgroups most likely to respond to treatment. |

Customer Relationships

Denali Therapeutics prioritizes patient-centric engagement, viewing patient communities and advocacy groups as vital partners in their drug development journey. They actively seek input from individuals and families impacted by neurodegenerative and lysosomal storage diseases.

This direct feedback loop is crucial; it shapes Denali's scientific strategies and the creation of patient support services. For instance, in 2024, Denali continued its collaborations with various patient advocacy groups, ensuring that the development of their investigational therapies for conditions like Parkinson's disease and ALS remained aligned with the lived experiences and unmet needs of patients.

Denali Therapeutics fosters deep collaborative partnerships with healthcare professionals, including neurologists and specialists. This engagement is vital for understanding unmet clinical needs and preparing the medical community for upcoming product launches. For instance, in 2024, Denali continued its ongoing dialogue with key opinion leaders in neurodegenerative diseases, sharing early clinical data and insights into their therapeutic approaches.

These relationships are built on a foundation of scientific exchange and medical education. Denali actively provides educational resources and shares scientific data related to their investigational therapies, ensuring healthcare providers are well-informed. This proactive approach in 2024 aimed to cultivate early awareness and understanding of their novel treatment modalities.

Crucially, these interactions establish essential feedback channels. By gathering insights from clinicians on their investigational therapies, Denali can refine development strategies and ensure that future treatments are aligned with practical clinical application. This feedback loop is fundamental for the successful adoption and appropriate use of new therapies once they reach the market.

Denali Therapeutics cultivates deep, long-term strategic alliances with major biopharmaceutical players like Biogen and Takeda. These collaborations are not just transactional; they involve shared risks and rewards in developing complex therapies, often through licensing agreements and joint commercialization plans. This approach underscores a significant mutual investment in advancing their shared pipeline.

In 2024, Denali's strategic alliances are crucial for its operational model, enabling it to leverage partners' expertise and resources. For instance, its collaboration with Biogen on Parkinson's disease therapies, which includes upfront payments and milestone potential, highlights the financial and developmental interdependence. These partnerships are designed to share the substantial costs and complexities inherent in bringing novel treatments to market.

Engagement with Regulatory Bodies

Denali Therapeutics actively engages with regulatory bodies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). This proactive approach involves consistent communication and seeking clarity on potential accelerated pathways for their investigational therapies.

The company prioritizes submitting thorough data packages and maintaining an open dialogue to navigate the intricate drug approval processes. For instance, in 2024, Denali continued its efforts to align with regulatory expectations for its lead programs, aiming to streamline the path to potential market authorization.

- Proactive Engagement: Denali fosters ongoing relationships with the FDA and EMA.

- Guidance Seeking: The company actively seeks regulatory guidance, particularly regarding accelerated approval pathways.

- Data Submission: Comprehensive data packages are regularly submitted to support their investigational products.

- Compliance Focus: Effective communication ensures adherence to complex regulatory requirements.

Investor and Shareholder Relations

Denali Therapeutics actively manages its investor and shareholder relationships through consistent and transparent communication. This involves detailed financial reporting, engaging investor calls, and informative presentations to keep stakeholders updated on the company's progress and strategic direction.

Maintaining strong ties with investors is crucial for Denali, a company heavily reliant on capital for its research and development endeavors. As of early 2024, Denali has secured significant funding rounds, demonstrating investor confidence in its pipeline and approach. For instance, in early 2024, the company announced a collaboration with Biogen that included an upfront payment and potential milestone payments, highlighting ongoing investor support.

- Transparent Financial Reporting: Denali provides quarterly and annual reports detailing its financial performance, R&D expenditures, and strategic outlook.

- Investor Calls and Presentations: The company regularly hosts conference calls and webcasts to discuss business updates, clinical trial progress, and financial results, offering opportunities for Q&A.

- Milestone Communication: Key achievements in drug development, such as successful preclinical results or initiation of clinical trials, are promptly communicated to the investment community.

- Building Confidence: This consistent engagement aims to foster trust and confidence, which is essential for securing the substantial and ongoing funding required for its capital-intensive scientific programs.

Denali Therapeutics cultivates patient-centric relationships, actively involving patient communities and advocacy groups in its drug development process. This ensures their investigational therapies for neurodegenerative diseases align with patient needs, as seen in their ongoing 2024 collaborations with patient groups.

Channels

Denali Therapeutics leverages a worldwide network of clinical trial sites as a crucial channel for its research and development efforts. These sites are essential for recruiting patients who have specific neurodegenerative and lysosomal storage diseases, enabling the company to test its experimental treatments.

These global locations are where the safety and effectiveness of Denali's therapies are rigorously evaluated, and vital data is collected. For instance, the COMPASS study, a Phase 2/3 trial focused on Hunter syndrome, utilized a broad range of international clinical trial sites.

Denali Therapeutics navigates the complex regulatory landscape by utilizing established pathways, most notably the Biologics License Application (BLA) process with the U.S. Food and Drug Administration (FDA). This structured approach is fundamental for gaining approval for their innovative drug candidates.

The company actively seeks designations such as Breakthrough Therapy and Fast Track from regulatory bodies. These designations are crucial for potentially expediting the review and approval timelines for their therapies, thereby enabling quicker patient access to potentially life-changing treatments.

These regulatory channels are not just procedural steps; they are critical enablers for market entry and ultimately, for realizing the commercial potential of Denali's therapeutic pipeline.

As Denali Therapeutics gears up for potential product launches, it's establishing dedicated direct commercial and medical affairs teams. These internal groups are crucial for directly connecting with healthcare providers, insurance companies, and patient advocacy groups.

These teams will disseminate vital information about Denali's therapies, work to ensure patient access to treatments, and ultimately support the successful adoption of approved products in the market. This direct engagement strategy is designed for highly targeted outreach.

For instance, in 2024, Denali continued to invest in building its internal commercial infrastructure, a necessary step given its pipeline advancements, including its lead program for Parkinson's disease. Such internal capabilities are key to effectively communicating complex scientific data and therapeutic benefits to the relevant stakeholders.

Strategic Partnerships for Commercialization

Denali Therapeutics strategically partners with companies like Biogen to leverage their established commercialization capabilities, particularly for programs like their Parkinson's disease therapy. This allows Denali to tap into extensive global sales, marketing, and distribution networks, accelerating market access and patient reach.

These collaborations are crucial for maximizing the commercial potential of Denali's innovative therapies. By outsourcing commercialization, Denali can concentrate its resources on its core competencies in drug discovery and early-stage development, ensuring a robust pipeline.

For instance, the partnership with Biogen on their Leqvio (inclisiran) program, which Denali has a stake in, highlights the success of such strategic alliances. While specific commercialization revenue figures for Denali from this partnership are often integrated into broader financial reports, the principle remains: leveraging partner expertise drives broader market penetration.

- Leveraging Partner Expertise Denali partners with established biopharmaceutical companies to access global sales, marketing, and distribution infrastructure.

- Focus on Core Strengths This strategy allows Denali to concentrate on its drug discovery and development pipeline, fostering innovation.

- Accelerated Market Access Strategic partnerships enable faster and wider patient access to Denali's therapies, especially in key international markets.

- Risk Mitigation Sharing commercialization responsibilities can reduce the financial and operational risks associated with bringing new drugs to market.

Scientific and Medical Conferences and Publications

Denali Therapeutics actively shares its scientific breakthroughs and clinical trial results at prestigious scientific and medical conferences. This is crucial for informing the global research community and establishing their expertise.

Publications in high-impact, peer-reviewed journals are a cornerstone of Denali's communication strategy. These publications serve to validate their findings and contribute to the collective knowledge in neuroscience. For instance, in 2024, Denali continued to present data from its ongoing clinical programs, including those for Parkinson's disease and ALS, at events like the Society for Neuroscience annual meeting.

These channels are vital for building Denali's reputation and generating interest in their innovative therapeutic platforms, particularly their Transport Nol-1 (TGN) technology. By showcasing progress and data, they attract potential collaborators and investors, solidifying their position in the biotech landscape.

- Dissemination of Scientific Findings: Denali presents research at key industry events, sharing progress on its drug candidates.

- Peer-Reviewed Publications: Findings are published in reputable scientific journals, enhancing credibility and scientific validation.

- Building Awareness: These channels inform the medical and scientific community about Denali's therapeutic approaches and pipeline advancements.

- 2024 Activity: Continued presentation of clinical data for neurodegenerative diseases at major scientific conferences, demonstrating pipeline progress.

Denali Therapeutics utilizes a multifaceted approach to channels, blending direct engagement with strategic partnerships. This includes leveraging global clinical trial sites for data collection and regulatory submissions, as well as building internal commercial and medical affairs teams for direct communication with healthcare stakeholders. Furthermore, Denali strategically partners with established biopharmaceutical companies to access their extensive commercialization capabilities, ensuring wider patient reach and market penetration for its therapies.

Customer Segments

Patients with neurodegenerative diseases, including Parkinson's, Alzheimer's, and Frontotemporal Dementia, represent a critical customer segment for Denali Therapeutics. These individuals face debilitating conditions with limited effective treatment options currently available, highlighting a significant unmet medical need.

Denali is focused on developing disease-modifying therapies that target the root causes and progression of these neurological disorders. The company's approach aims to offer more than just symptom management, seeking to fundamentally alter the course of these illnesses.

The prevalence of these diseases underscores the market opportunity. For instance, in 2024, it's estimated that over 6 million Americans are living with Alzheimer's disease, a number projected to rise significantly in the coming years. Similarly, Parkinson's disease affects approximately 1 million people in the United States, with about 60,000 new cases diagnosed annually.

Denali Therapeutics' core customer segment includes patients diagnosed with lysosomal storage diseases (LSDs), particularly Hunter syndrome (MPS II) and Sanfilippo syndrome Type A (MPS IIIA). These rare genetic disorders affect thousands globally, with Hunter syndrome impacting approximately 1 in 100,000 to 1 in 130,000 live male births worldwide.

The company's innovative Enzyme Transport Vehicle (ETV) programs are engineered to address both the systemic and neurological symptoms of these debilitating conditions. For instance, Denali's lead ETV product candidate, DNL310, is in late-stage clinical development for MPS II, showing promising results in improving enzyme activity and reducing disease markers.

Caregivers and families of patients with neurodegenerative diseases represent a vital, albeit indirect, customer segment for Denali Therapeutics. Their well-being and quality of life are profoundly impacted by the patient's condition, making them key stakeholders in the development of effective therapies.

Denali's mission to create breakthrough treatments directly addresses the immense physical, emotional, and financial strain these families endure. By advancing therapies for conditions like ALS and Parkinson's, Denali aims to reduce the burden of care and improve overall family well-being.

The company actively engages with patient advocacy groups, which often serve as crucial support networks for caregivers. These collaborations ensure that the needs and perspectives of families are considered throughout the drug development process, reflecting the significant role they play in patient care and treatment adherence.

Neurology Specialists and Healthcare Providers

Neurology specialists and healthcare providers, including neurologists and geneticists, form a critical customer segment for Denali Therapeutics. These professionals are instrumental in diagnosing and managing patients with neurodegenerative conditions and lysosomal storage diseases. Their role in prescribing and administering Denali's innovative therapies makes them key influencers in market adoption.

Denali actively engages this segment through educational initiatives and support programs. These efforts aim to ensure appropriate patient identification and treatment protocols for their advanced therapies. For instance, in 2024, Denali continued its focus on building relationships with key opinion leaders in neurology, fostering understanding of its pipeline candidates.

- Key Decision-Makers: Neurologists and geneticists are the primary prescribers and administrators of Denali's treatments.

- Patient Identification: They are crucial for identifying patients who would benefit most from Denali's targeted therapies.

- Education and Support: Denali provides these professionals with essential information and resources regarding its drug candidates.

- Market Access: Engagement with this segment is vital for successful market penetration and uptake of Denali's products.

Biopharmaceutical Industry and Research Community

Denali Therapeutics serves a crucial customer segment within the biopharmaceutical industry and the broader research community. This includes established pharmaceutical giants, agile biotech startups, and academic institutions pushing the boundaries of neuroscience and drug delivery.

These organizations are keenly interested in Denali's proprietary technology platforms, particularly those focused on efficiently crossing the blood-brain barrier (BBB). For instance, Denali's Transport IP, a key component of its strategy, aims to enable the delivery of therapeutics to the central nervous system, a significant hurdle in treating neurological disorders. As of early 2024, the global biopharmaceutical market is valued in the trillions, with significant investment directed towards innovative drug delivery systems.

- Partnerships and Collaborations: Denali actively seeks partnerships with other biopharma companies to co-develop and commercialize its pipeline of therapies for neurodegenerative diseases like Parkinson's and ALS.

- Licensing Opportunities: Academic researchers and smaller biotech firms may license Denali's BBB-crossing technologies to advance their own drug discovery programs.

- Scientific Advancement: The broader research community benefits from the scientific data and insights generated by Denali's clinical trials and preclinical research, furthering the understanding of neurological diseases and their treatment.

- Market Validation: Successful clinical trial readouts from Denali, such as those anticipated for its lead Parkinson's program in 2024, provide strong validation for its technology and attract further industry interest.

Denali's primary customer segments are patients suffering from neurodegenerative diseases like Parkinson's and Alzheimer's, and rare genetic disorders such as lysosomal storage diseases (LSDs). These patient groups represent a significant unmet medical need, driving the demand for Denali's innovative, disease-modifying therapies. The company's focus on addressing the root causes of these debilitating conditions positions it to offer substantial value to these patient populations.

Caregivers and families of patients are also a crucial, indirect customer segment, as they are deeply involved in treatment decisions and patient well-being. Furthermore, neurology specialists and healthcare providers are key influencers and prescribers, requiring education and support to effectively utilize Denali's advanced treatment options. The broader biopharmaceutical and research community, including other companies and academic institutions, represents another segment interested in Denali's proprietary drug delivery technologies.

| Customer Segment | Description | Key Needs/Interests | Denali's Value Proposition | 2024 Relevance/Data Point |

|---|---|---|---|---|

| Patients with Neurodegenerative Diseases | Individuals with conditions like Alzheimer's, Parkinson's, ALS. | Effective treatments, disease modification, improved quality of life. | Disease-modifying therapies targeting root causes. | Over 6 million Americans living with Alzheimer's in 2024. |

| Patients with Lysosomal Storage Diseases (LSDs) | Individuals with rare genetic disorders like MPS II and MPS IIIA. | Systemic and neurological symptom relief, disease management. | ETV programs for targeted enzyme delivery. | Hunter syndrome affects ~1 in 100,000 live male births. |

| Caregivers and Families | Those supporting patients with these chronic conditions. | Reduced care burden, improved patient outcomes, emotional support. | Developing therapies that lessen disease progression and impact. | Patient advocacy groups are vital support networks. |

| Healthcare Providers (Neurologists, Geneticists) | Medical professionals diagnosing and treating these diseases. | Safe, effective, and easy-to-administer treatments; patient identification tools. | Providing clear clinical data and educational resources on pipeline candidates. | Denali focused on building KOL relationships in neurology in 2024. |

| Biopharma & Research Community | Other pharmaceutical companies, biotech firms, academic institutions. | Innovative drug delivery platforms, collaboration opportunities, scientific advancement. | Proprietary BBB-crossing technology, potential for partnerships and licensing. | Global biopharma market valued in trillions, with significant investment in drug delivery. |

Cost Structure

Research and Development (R&D) is the backbone of Denali Therapeutics' cost structure, reflecting the immense investment required for biopharmaceutical innovation. These expenses cover everything from the initial spark of drug discovery to the rigorous testing in preclinical studies and the extensive clinical trials necessary to bring new therapies to patients.

For the fiscal year ending December 31, 2024, Denali reported R&D expenses totaling $396.4 million. This significant outlay underscores the capital-intensive nature of developing novel treatments and highlights the company's commitment to advancing its pipeline of potential medicines.

Expenses for global clinical trials, encompassing patient recruitment, site management, and data collection, are a significant component of Denali Therapeutics' cost structure. These costs are particularly substantial as the company progresses programs like tividenofusp alfa toward regulatory submissions, such as a Biologics License Application (BLA).

As Denali prepares for potential commercial launches, the financial outlay for clinical trials and engagement with regulatory bodies escalates. For instance, in 2024, Denali reported substantial research and development expenses, a significant portion of which is allocated to these critical clinical and regulatory activities.

General and Administrative (G&A) expenses are the backbone of Denali Therapeutics' operational overhead. These costs encompass everything from the salaries of the dedicated administrative team to the essential legal counsel and the upkeep of corporate facilities. For the fiscal year ending December 31, 2024, Denali reported G&A expenses totaling $105.4 million.

Manufacturing and Supply Chain Costs

As Denali Therapeutics progresses towards commercializing its therapies, the expenses linked to producing drug supplies for clinical trials and anticipated market needs are escalating. This encompasses the cost of raw materials, intricate production processes, rigorous quality assurance, and the complex logistics of the supply chain. Notably, Denali has initiated manufacturing drug supply within its own dedicated facility.

In 2023, Denali reported research and development expenses of $596.9 million, a significant portion of which is attributable to manufacturing and supply chain activities as they scale up for potential commercial launches. The company's strategic decision to establish its own manufacturing capabilities aims to provide greater control over production timelines and costs.

- Raw Materials: Costs associated with sourcing active pharmaceutical ingredients (APIs) and other necessary components.

- Production Processes: Expenses related to the complex biological manufacturing, purification, and formulation of drug candidates.

- Quality Control: Significant investment in testing and validation to ensure product safety and efficacy, a critical component for regulatory approval.

- Supply Chain Logistics: Costs for packaging, storage, and distribution of drug supplies, especially for temperature-sensitive biologics.

Intellectual Property and Licensing Costs

Denali Therapeutics incurs substantial costs in maintaining and protecting its intellectual property. This includes significant legal and administrative fees associated with filing, prosecuting, and defending its patent portfolio, which is vital for safeguarding its innovative drug candidates and platform technologies.

These expenses are essential for securing exclusive rights to their discoveries and preventing competitors from infringing upon their innovations. For instance, in 2023, Denali reported research and development expenses totaling $539.7 million, a significant portion of which is allocated to IP protection and potential in-licensing activities.

- Patent Prosecution and Maintenance: Ongoing fees for filing new patent applications globally and maintaining existing patents.

- Legal Fees: Costs associated with patent litigation, freedom-to-operate analyses, and trademark defense.

- In-licensing Agreements: Payments or royalties for rights to use external technologies or compounds, if applicable, which are critical for expanding their pipeline.

Denali Therapeutics' cost structure is heavily weighted towards Research and Development (R&D), with significant investments in clinical trials and manufacturing. General and Administrative (G&A) expenses represent a smaller but essential portion of the operational overhead. The company also incurs costs for intellectual property protection, crucial for safeguarding its innovations.

| Cost Category | FY 2024 ($ millions) | FY 2023 ($ millions) |

|---|---|---|

| Research and Development (R&D) | 396.4 | 596.9 |

| General and Administrative (G&A) | 105.4 | N/A |

Revenue Streams

Historically, Denali Therapeutics has relied heavily on collaboration and licensing agreements with major pharmaceutical companies as a core revenue driver. These partnerships typically involve upfront payments, ongoing research funding, and milestone payments tied to progress in drug development and regulatory approvals.

In 2023, Denali reported collaboration revenue of $330.5 million. However, this figure saw a decrease in 2024, largely influenced by the phasing and timing of specific research and development activities within these ongoing collaborations.

Future product sales represent Denali Therapeutics' primary anticipated revenue stream. The company is poised to transition into a commercial-stage enterprise with the expected U.S. launch of tividenofusp alfa for Hunter syndrome in late 2025 or early 2026.

This commercialization marks a significant shift, with product sales projected to become a recurring and substantial income source. Denali's pipeline advancements are key to unlocking this future revenue potential.

Denali Therapeutics is positioned to earn substantial milestone payments from its strategic partnerships. These payments are triggered as co-developed drug candidates achieve predefined clinical, regulatory, or commercial targets. For instance, as of early 2024, Denali's collaborations, such as the one with Biogen for Parkinson's disease therapies, are structured to unlock significant payments upon successful progression through clinical trials. This revenue stream offers a clear path for financial growth tied directly to pipeline advancement and the success of its partnered assets.

Cost-Sharing Arrangements

Denali Therapeutics engages in cost-sharing arrangements within its collaboration agreements. These partnerships allow Denali to share the financial burden of developing specific pipeline assets with its partners, effectively reducing its out-of-pocket research and development expenses. This strategy is crucial for managing cash flow and optimizing resource allocation across its diverse portfolio.

These arrangements function as an indirect revenue stream by offsetting R&D costs, thereby preserving capital. For instance, in 2023, Denali reported that its collaborations, which often include cost-sharing components, contributed significantly to its financial flexibility, allowing it to advance multiple programs simultaneously.

- Cost offsets: Partners contribute to R&D expenses, reducing Denali's direct spending on specific programs.

- Cash conservation: By sharing development costs, Denali retains more capital for other strategic initiatives or operational needs.

- Risk mitigation: Cost-sharing diversifies the financial risk associated with drug development, especially for early-stage or capital-intensive projects.

Equity Financing and Investments

Denali Therapeutics secures substantial capital through equity financing and strategic investments, which are vital for funding its research and development pipeline. While not a direct operational revenue, these capital infusions are critical for sustaining the company's long-term growth and advancing its therapeutic programs.

A prime example of this funding strategy occurred in February 2024, when Denali successfully raised approximately $500 million via a private investment in public equity (PIPE) financing. This significant influx of capital underscores investor confidence and provides Denali with the necessary resources to continue its innovative work in neurodegenerative diseases.

- Equity Financing Rounds: Denali raises capital through private placements and public offerings.

- Institutional Investor Support: Significant investments from major financial institutions bolster the company's financial standing.

- February 2024 PIPE Financing: A $500 million capital raise demonstrates strong market support.

- Pipeline Advancement: These funds are crucial for advancing Denali's drug development programs and operational needs.

Denali Therapeutics' revenue streams are primarily driven by collaborations, milestone payments, and future product sales. Collaboration revenue, while significant, can fluctuate based on R&D progress, as seen with a decrease in 2024 compared to $330.5 million in 2023. Milestone payments are a key component, triggered by successful clinical and regulatory advancements in partnered drug candidates.

The company anticipates a shift towards substantial revenue from product sales with the planned late 2025 or early 2026 U.S. launch of tividenofusp alfa. This transition to a commercial-stage entity is expected to generate recurring income, supported by its robust pipeline. Strategic financing, such as the $500 million PIPE financing in February 2024, also provides critical capital for pipeline advancement.

| Revenue Stream | Description | Key Data/Events |

|---|---|---|

| Collaboration Revenue | Upfront payments, research funding, and milestone payments from partnerships. | $330.5 million in 2023; decreased in 2024 due to R&D phasing. |

| Milestone Payments | Payments triggered by achieving clinical, regulatory, or commercial targets in collaborations. | Key driver tied to pipeline progression, e.g., Parkinson's therapies with Biogen. |

| Product Sales | Revenue from commercialized drugs. | Anticipated with tividenofusp alfa launch (late 2025/early 2026). |

| Equity Financing | Capital raised through equity. | $500 million PIPE financing in February 2024. |

Business Model Canvas Data Sources

The Denali Therapeutics Business Model Canvas is informed by extensive clinical trial data, intellectual property portfolios, and competitive landscape analyses. These sources provide a robust foundation for understanding patient needs, therapeutic potential, and market positioning.