Deluxe PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deluxe Bundle

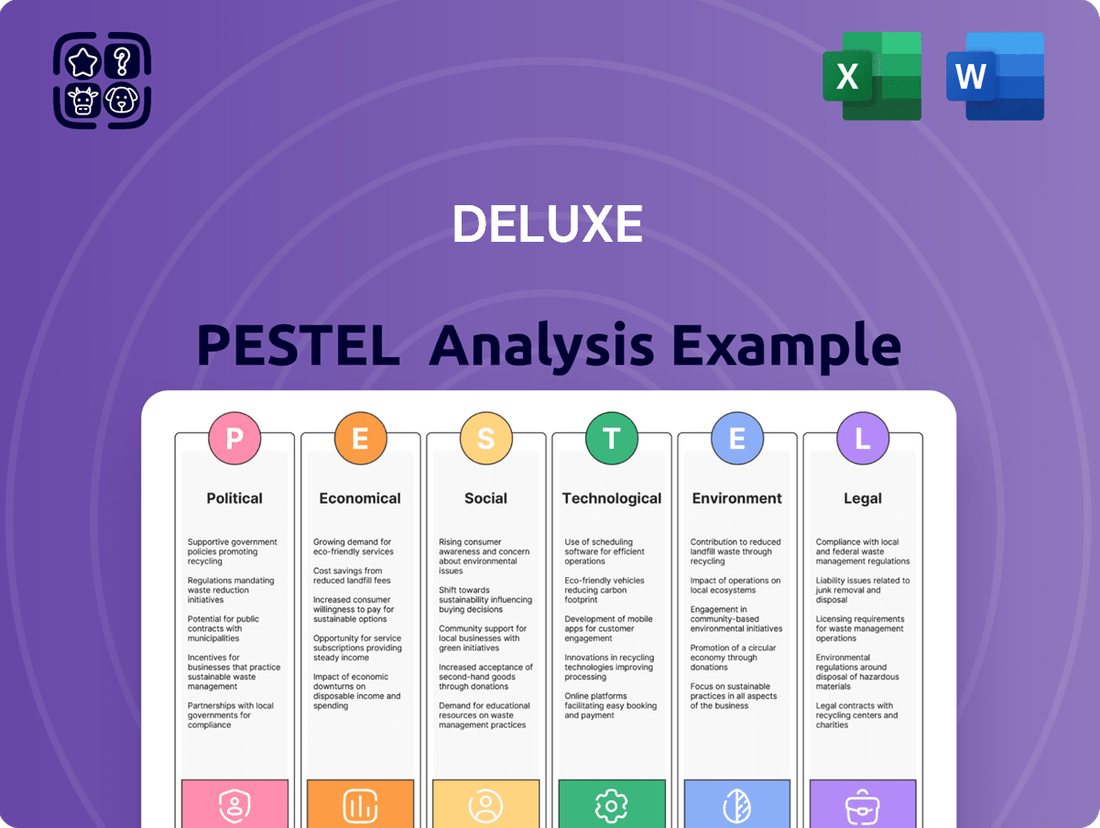

Navigate the complex external forces shaping Deluxe's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and technological advancements are creating both opportunities and challenges. Equip yourself with actionable intelligence to refine your strategies and secure a competitive advantage. Download the full PESTLE analysis today for a complete strategic roadmap.

Political factors

The government regulatory landscape presents a significant dynamic for Deluxe. For instance, the European Union's General Data Protection Regulation (GDPR), implemented in 2018, continues to shape data privacy practices globally, impacting how Deluxe handles customer information. Similarly, ongoing discussions around AI regulation, with potential frameworks emerging in 2024 and 2025, could influence the development and deployment of Deluxe's AI-driven financial solutions.

New regulations concerning cybersecurity and financial transactions necessitate continuous adaptation and investment. For example, the U.S. Cybersecurity and Infrastructure Security Agency (CISA) consistently updates its guidance, requiring companies like Deluxe to invest in robust security measures to protect sensitive financial data. These compliance efforts directly affect operational costs and the pace of innovation.

Deluxe's strategic focus on privacy and compliance within its AI platforms is a direct response to this evolving environment. By prioritizing secure solutions and transparent data handling, Deluxe aims to navigate the complexities of regulations like the California Consumer Privacy Act (CCPA), which grants consumers more control over their personal information, and to build trust with its clientele.

Deluxe's international footprint, spanning the US, Canada, and Europe, makes it highly susceptible to shifts in global trade policies and geopolitical stability. For instance, the ongoing renegotiation of trade frameworks or localized conflicts can disrupt supply chains and limit market access, directly impacting operational costs and revenue streams. The company's reliance on international suppliers and its presence in diverse markets mean that global economic sentiment, which saw a slight dip in Q1 2025 due to persistent inflation concerns, can indirectly influence its client base's spending power.

Government initiatives aimed at bolstering small businesses, such as tax credits for technology adoption or grants for digital transformation, directly impact the market for Deluxe's services. For instance, the U.S. Small Business Administration's programs, like the SCORE mentorship network and various loan guarantees, foster an environment where small businesses are more likely to invest in solutions that enhance their operational efficiency, a core offering of Deluxe.

In 2024, federal agencies continued to allocate significant resources towards small business development. The U.S. government's commitment to supporting small businesses through programs like the Employee Retention Credit (though its primary claim period ended earlier, its impact on cash flow and subsequent investment in technology persisted into 2024) and the ongoing efforts to streamline access to capital can translate into increased demand for Deluxe's payment processing and cloud-based marketing tools as these businesses expand.

Policies that promote digital infrastructure and cybersecurity for small and medium-sized enterprises (SMEs) are particularly beneficial for Deluxe. As of early 2025, many governments are still emphasizing digital resilience, encouraging investments in secure payment gateways and cloud services, which are central to Deluxe's value proposition for this segment.

Fiscal and Monetary Policies

Government fiscal policies and central bank monetary policies significantly influence Deluxe's operating environment and the financial health of its clients. For instance, the Federal Reserve's actions on interest rates directly impact borrowing costs for businesses and consumers, affecting spending and investment decisions. Deluxe itself noted in its 2024 outlook that macroeconomic uncertainty, including inflation and interest rate volatility, could impact its performance.

Rising inflation and the subsequent monetary policy responses, such as interest rate hikes, can dampen discretionary spending and business investment. This trend may particularly affect Deluxe's segments reliant on robust economic activity and consumer confidence. As of early 2024, inflation remained a concern in many developed economies, prompting central banks to maintain tighter monetary stances, which could create headwinds for growth.

- Inflationary Pressures: Persistent inflation can erode purchasing power, impacting Deluxe's clients' ability to spend on services and technology.

- Interest Rate Environment: Higher interest rates increase the cost of capital for businesses, potentially leading to reduced investment and slower adoption of new financial technologies.

- Government Spending: Fiscal stimulus or austerity measures can directly influence the economic conditions for Deluxe's client base, affecting demand for its offerings.

Political Stability and Business Confidence

Deluxe's business is significantly impacted by political stability, which directly shapes client confidence. In regions with robust political stability, businesses tend to feel more secure, leading to increased investment in Deluxe's solutions. For example, a stable political climate in the United States, a key market for Deluxe, encourages businesses to adopt new technologies and services for efficiency and growth.

Conversely, political volatility can create a ripple effect of caution. When political landscapes are uncertain, businesses often pull back on discretionary spending, delaying decisions on crucial investments. This hesitancy directly affects Deluxe's sales pipeline and revenue projections.

The 2024 US election cycle, for instance, might introduce a period of heightened political uncertainty, potentially influencing corporate spending patterns. Companies may adopt a wait-and-see approach to major technology upgrades or service expansions until the political outlook becomes clearer.

- Global Political Stability: Deluxe operates in diverse global markets, making it susceptible to varying levels of political stability.

- Business Confidence Metrics: Tracking indices like the Conference Board's Business Confidence Index can offer insights into how political events are affecting corporate investment decisions.

- Impact on Technology Spending: Political stability often correlates with increased business investment in digital transformation and efficiency tools, areas where Deluxe excels.

- Regulatory Environment: Changes in government policy and regulations stemming from political shifts can create both opportunities and challenges for Deluxe's service offerings.

Government policies directly influence Deluxe's operational landscape, from data privacy mandates like GDPR and CCPA to cybersecurity regulations enforced by agencies like CISA. Emerging AI regulations in 2024-2025 could also shape Deluxe's product development, necessitating ongoing compliance investments that impact costs and innovation timelines.

Government support for small businesses, including tax credits and digital transformation grants, creates favorable market conditions for Deluxe's efficiency-enhancing services. As of early 2025, continued emphasis on digital resilience by governments encourages investment in secure payment gateways and cloud services, core to Deluxe's offerings.

Fiscal and monetary policies, particularly inflation and interest rate decisions by central banks, significantly affect Deluxe's clients' spending and investment capacity. The 2024 outlook for Deluxe highlighted macroeconomic uncertainty, including inflation and interest rate volatility, as potential performance impacts.

Political stability is a key driver of business confidence and investment in Deluxe's solutions. The 2024 US election cycle, for example, may introduce a period of uncertainty that influences corporate technology spending decisions, potentially creating a wait-and-see approach for clients.

| Political Factor | Impact on Deluxe | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Regulatory Compliance (Data Privacy & AI) | Increased operational costs, potential for new product development opportunities. | Ongoing discussions around AI regulation frameworks in 2024-2025; continued enforcement of GDPR/CCPA. |

| Government Support for SMEs | Increased demand for Deluxe's efficiency and digital transformation tools. | Continued government focus on digital resilience and SME growth initiatives into early 2025. |

| Monetary Policy (Interest Rates & Inflation) | Potential dampening of client spending and investment due to higher borrowing costs and reduced purchasing power. | Persistent inflation concerns in developed economies as of early 2024, leading central banks to maintain tighter monetary stances. |

| Political Stability & Elections | Varied impact based on region; potential for cautious corporate spending during periods of uncertainty. | The 2024 US election cycle noted as a potential driver of heightened political uncertainty influencing corporate spending patterns. |

What is included in the product

The Deluxe PESTLE Analysis provides a comprehensive examination of how external macro-environmental factors impact the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions, offering actionable insights for strategic decision-making.

The Deluxe PESTLE Analysis offers a structured framework that simplifies complex external factors, reducing the cognitive load and anxiety associated with strategic planning by providing clarity and actionable insights.

Economic factors

Inflationary pressures are a significant concern for Deluxe, as evidenced by their acknowledgement of medical benefit cost headwinds. These rising costs can directly impact Deluxe's operating expenses. For instance, the US Consumer Price Index (CPI) saw a notable increase in early 2024, with some categories experiencing accelerated growth, potentially mirroring the cost pressures Deluxe faces.

Rising interest rates, a common response to inflation, also present challenges. Higher rates can make it more expensive for Deluxe's small business clients to borrow money, potentially slowing their growth and reducing their need for Deluxe's services. Furthermore, increased borrowing costs can affect Deluxe's own investment decisions and access to capital.

The potential for reinflation in the economy, as noted by Deluxe, could exacerbate these issues. If inflation remains persistently high, it may strain the financial health of their customer base, impacting their ability to pay for services and potentially leading to increased credit risk for Deluxe.

Deluxe's legacy print business, a cornerstone for years, is facing a persistent secular decline. This trend is driven by the widespread adoption of digital payment solutions by businesses, which is naturally reducing the demand for traditional printed checks and related materials. While this segment still offers stable cash flows, its diminishing revenue share underscores the critical need for robust expansion in Deluxe's other business areas to offset this ongoing contraction.

In the first quarter of 2025, the print segment experienced a 4% decrease in revenue compared to the same period in 2024. Projections indicate that this segment will likely continue to see revenue declines in the low to mid-single-digit range for the foreseeable future, reinforcing the strategic imperative for diversification and growth in newer, digital-focused offerings.

Deluxe's strategic pivot towards its Payments and Data segments is yielding significant results, with these areas identified as core growth engines. This focus is crucial as the company navigates a changing business landscape.

The Data segment, in particular, demonstrated impressive momentum, reporting a substantial 29% revenue increase in the first quarter of 2025. This surge was largely fueled by strong demand from financial institutions seeking advanced data solutions.

Looking ahead, Deluxe anticipates continued expansion within both Payments and Data. This growth is strategically positioned to counterbalance the ongoing decline observed in the company's legacy print business, signaling a successful transformation.

Macroeconomic Uncertainty and Consumer Spending

Broad macroeconomic uncertainty, including inflation and interest rate fluctuations, can significantly dampen consumer sentiment and lead to reduced discretionary spending. This directly impacts businesses like Deluxe, particularly in areas like promotional products where demand can be sensitive to economic headwinds.

Deluxe has explicitly acknowledged this challenge, noting ongoing demand softness in its shorter-cycle discretionary branded promotional products segment. For instance, in Q1 2024, the company observed continued softness in this specific area, impacting its overall revenue trajectory despite resilience in other segments.

- Consumer Sentiment: Fluctuations in consumer confidence, often tied to inflation and employment outlooks, directly influence spending on non-essential goods and services.

- Discretionary Spending: Economic uncertainty typically causes consumers to prioritize essential purchases, cutting back on items like branded promotional products.

- Revenue Impact: Softness in discretionary spending segments can lead to slower revenue growth for companies like Deluxe, particularly affecting their promotional products division.

- Resilience Factors: While some segments face pressure, Deluxe's other offerings, potentially those tied to essential business services, may exhibit greater resilience during uncertain economic periods.

Free Cash Flow and Debt Reduction

Deluxe has demonstrated a robust improvement in its free cash flow generation and a notable reduction in its net debt. This financial strengthening is a key economic factor, providing the company with greater flexibility and capital for its ongoing transformation efforts and to sustain shareholder returns. The company's ability to convert earnings into cash has visibly improved, directly impacting its financial resilience.

Key financial highlights from recent periods underscore this positive trend. For instance, Deluxe reported a significant year-over-year expansion in its operating cash flow, a testament to improved operational efficiency and working capital management. Concurrently, the company actively reduced its net debt, enhancing its balance sheet and lowering financial risk.

- Improved Free Cash Flow: Deluxe's focus on operational efficiency has led to a stronger ability to generate free cash flow.

- Net Debt Reduction: Strategic debt management has resulted in a lower net debt position, bolstering financial stability.

- Capital for Investment: Enhanced cash flow and reduced debt provide capital crucial for funding strategic initiatives and growth opportunities.

- Dividend Support: The solid financial footing supports the company's commitment to dividend payments, reflecting confidence in sustained performance.

Deluxe is navigating an economic landscape characterized by persistent inflation and rising interest rates. These factors directly influence their operating costs and the borrowing capacity of their small business clients. The potential for continued inflation, as acknowledged by Deluxe, poses a risk to customer financial health and increases credit risk.

The company's legacy print business continues its secular decline, with revenue decreasing by 4% in Q1 2025 compared to the prior year, and further low to mid-single-digit declines are expected. Conversely, Deluxe's Payments and Data segments are experiencing robust growth, with the Data segment alone seeing a 29% revenue increase in Q1 2025, driven by demand from financial institutions.

Macroeconomic uncertainty, including inflation and interest rate shifts, has led to observed demand softness in Deluxe's discretionary promotional products segment, impacting revenue trajectory. Despite these challenges, Deluxe has significantly improved its free cash flow generation and reduced net debt, enhancing financial flexibility for strategic initiatives.

| Segment | Q1 2025 Revenue Change (YoY) | Key Driver |

|---|---|---|

| -4% | Digital payment adoption | |

| Data | +29% | Demand from financial institutions |

| Promotional Products | Softness observed | Consumer discretionary spending |

Full Version Awaits

Deluxe PESTLE Analysis

The preview shown here is the exact Deluxe PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

What you’re previewing here is the actual file, offering a comprehensive breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors impacting your business.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing actionable insights for strategic planning.

Sociological factors

Societal preferences are rapidly moving away from traditional paper-based transactions toward digital and cloud-based solutions. This seismic shift directly impacts businesses like Deluxe, whose legacy print operations are being challenged by this trend.

Deluxe is proactively addressing this by transforming into a payments and data company, prioritizing digital offerings for small businesses and financial institutions. This strategic pivot is a direct response to evolving customer demands, with digital payment adoption accelerating significantly. For instance, in 2024, small businesses are increasingly relying on digital invoicing and payment platforms, with reports indicating a 15% year-over-year increase in adoption for cloud-based accounting software among SMEs.

The evolving workforce landscape, particularly the surging demand for tech and data analytics skills, directly impacts Deluxe's approach to hiring and keeping talent. As a company with nearly 5,000 U.S. employees, Deluxe recognizes that attracting and retaining a skilled workforce is paramount to its continued success as a technology provider.

Deluxe's commitment to fostering positive employee relations and cultivating a diverse, supportive culture is a strategic response to these workforce shifts. This focus aims to build a stable and adaptable team capable of meeting the complex needs of the modern business environment.

Societal expectations for corporate social responsibility (CSR) and community involvement are increasingly shaping how companies like Deluxe operate, directly impacting their brand reputation and how stakeholders perceive them. This growing emphasis means that a company's commitment to social good is no longer a secondary consideration but a core element of its identity.

Deluxe actively demonstrates its commitment through tangible actions, exemplified by its annual ESG report and the significant financial support provided by its Foundation. In 2024 alone, the Deluxe Foundation awarded over $1 million in grants. These grants are strategically directed towards crucial areas such as financial literacy, education, entrepreneurship, and empowerment, reflecting a deep understanding of community needs and a desire to foster positive change.

Furthermore, Deluxe cultivates a culture of giving back by actively encouraging and supporting employee volunteerism. This dual approach—institutional support through the Foundation and individual engagement through employee volunteering—reinforces Deluxe's dedication to being a responsible corporate citizen and a positive force within the communities it serves.

Demand for Integrated and Simplified Solutions

Businesses and financial institutions are actively looking for solutions that combine multiple functions into one easy-to-use package, cutting down on the complexity of managing finances. This shift is driven by a desire for greater operational efficiency and a smoother user experience across all business activities.

Deluxe's strategic direction, particularly its 'One Deluxe' approach and offerings like Receivables360+, directly addresses this societal demand. These initiatives are designed to deliver unified platforms that simplify intricate financial processes, making them more accessible and manageable for a wide range of users.

- Demand for Simplification: Surveys in 2024 indicated that over 70% of small to medium-sized businesses prioritize solutions that reduce administrative burden.

- Integrated Platforms: The market for integrated financial management software is projected to grow by 12% annually through 2025.

- User Experience Focus: Companies are increasingly investing in UX/UI design, recognizing its impact on customer adoption and retention, with Deluxe's solutions aiming to capitalize on this trend.

- Efficiency Gains: Early adopters of streamlined financial solutions report an average reduction of 15% in processing times for key financial operations.

Changing Demographics of Business Owners

The landscape of business ownership is shifting, with younger, digitally native entrepreneurs increasingly entering the market. This demographic, comfortable with technology and digital solutions, influences the demand for services and marketing strategies. For instance, by 2024, it's projected that over 40% of small businesses will be owned by individuals under 40, a significant increase from previous decades.

Fintech companies are adapting by incorporating elements like gamification and engaging content to appeal to this new wave of business owners who value financial literacy and independence. Deluxe needs to recognize this trend and adjust its product development and outreach to align with the preferences of these emerging entrepreneurs.

Key considerations for Deluxe include:

- Digital-First Offerings: Developing user-friendly, mobile-accessible platforms that cater to the expectations of a digitally native user base.

- Financial Education Content: Providing accessible resources and tools that empower younger business owners to manage their finances effectively.

- Personalized Marketing: Employing data-driven, targeted marketing campaigns that speak to the specific needs and values of diverse demographic groups.

Societal shifts toward digital solutions and integrated financial platforms are reshaping how businesses operate, directly influencing Deluxe's strategic direction. The increasing demand for simplified, user-friendly financial tools and the rise of digitally native entrepreneurs are key drivers.

Deluxe's focus on digital offerings, such as Receivables360+, and its commitment to financial education and personalized marketing are crucial responses to these evolving societal expectations. By 2024, small businesses are increasingly adopting cloud-based accounting software, with a projected 15% year-over-year increase in adoption.

Furthermore, the growing emphasis on corporate social responsibility and community involvement, evidenced by Deluxe's Foundation grants totaling over $1 million in 2024, reinforces its brand reputation and stakeholder perception.

| Societal Factor | Trend | Impact on Deluxe | Data Point (2024/2025) |

|---|---|---|---|

| Digital Transformation | Shift from paper to digital/cloud solutions | Drives demand for Deluxe's digital payment and data services | 15% YoY increase in cloud accounting software adoption by SMEs |

| Demand for Integration | Preference for unified, easy-to-use financial management | Supports Deluxe's 'One Deluxe' strategy and integrated platforms | 70% of SMEs prioritize solutions reducing administrative burden |

| Emerging Entrepreneurship | Rise of younger, digitally native business owners | Requires digital-first offerings and financial education content | Over 40% of small businesses projected to be owned by individuals under 40 |

| CSR Expectations | Increased focus on corporate social responsibility | Enhances brand reputation and stakeholder engagement | Deluxe Foundation awarded over $1 million in grants in 2024 |

Technological factors

The swift evolution of Artificial Intelligence, especially generative AI, offers Deluxe substantial avenues to refine its data-centric offerings and boost operational effectiveness. These advancements are key to unlocking new efficiencies and competitive advantages.

Deluxe’s strategic move in 2025 with the launch of DAX, an AI-powered assistant, and a generative AI enterprise platform underscores its commitment to leveraging this technology. These tools are designed to streamline decision-making processes and provide robust mitigation strategies against macroeconomic uncertainties.

The integration of AI, including generative capabilities, is foundational for Deluxe's future innovation pipeline, promising enhanced product development and service delivery in the dynamic market landscape.

The expansion of cloud services is a cornerstone of Deluxe's strategic evolution. By migrating its operations to the cloud, Deluxe is enhancing its ability to deliver technology solutions with greater scalability, flexibility, and efficiency, crucial for its transformation into a digital payments and data powerhouse.

This strategic shift aligns with a broader market trend. Worldwide spending on public cloud services is projected to experience significant growth, with forecasts indicating a doubling by 2028. This robust growth underscores the increasing reliance on cloud infrastructure across industries, providing a fertile ground for Deluxe's digital offerings.

The FinTech sector is booming, with innovations like real-time payments and embedded finance constantly reshaping how businesses operate. This rapid evolution directly influences companies like Deluxe, which are deeply involved in financial transactions.

Deluxe is strategically adapting to this digital shift, prioritizing its business-to-business payment solutions and merchant services. This focus allows them to tap into the significant growth opportunities presented by new payment technologies and the increasing demand for digital financial tools.

The company's scale is substantial; Deluxe processes an impressive volume of over $2 trillion in payments annually. This vast transaction throughput underscores their critical role in the modern payment ecosystem and their capacity to leverage ongoing technological advancements.

Data Analytics and Business Intelligence

The increasing reliance on data analytics and business intelligence for precise marketing and smarter choices directly fuels the need for Deluxe's data-driven solutions. This trend is a significant technological driver for Deluxe's growth.

Deluxe utilizes its vast data holdings and sophisticated analytical tools to assist clients in customer acquisition and expanding sales through highly focused marketing efforts. Their expertise in this area is particularly strong within the financial sector.

In 2023, Deluxe reported that its data segment revenue grew by 11% year-over-year, demonstrating the strong market demand. This segment is recognized as a leader, especially among financial institutions seeking to optimize their customer engagement strategies.

- Data-Driven Marketing: Businesses are increasingly investing in analytics to personalize customer interactions and improve campaign ROI.

- Informed Decision-Making: Advanced business intelligence tools are becoming critical for strategic planning and operational efficiency.

- Financial Sector Demand: Financial institutions are key adopters of data analytics for risk management, fraud detection, and customer segmentation.

- Deluxe's Position: Deluxe's leadership in providing these solutions highlights the technological shift towards data-centric business operations.

Cybersecurity and Fraud Prevention Technologies

The escalating complexity of cyber threats and fraudulent activities demands ongoing investment in advanced security solutions for Deluxe's product suite. Businesses are increasingly prioritizing fraud recovery, but the proactive integration of fraud detection and comprehensive risk management remains paramount.

Deluxe's platforms are essential for safeguarding financial transactions, with a growing emphasis on real-time threat intelligence. For instance, the global cybersecurity market was projected to reach over $230 billion in 2024, highlighting the significant resources dedicated to this area. This trend underscores the need for Deluxe to continually enhance its offerings to counter evolving digital risks.

- Increased Sophistication of Threats: Cybercriminals are employing more advanced techniques, necessitating continuous upgrades to Deluxe's security protocols.

- Shift to Proactive Defense: The focus is moving from reactive fraud recovery to proactive prevention and detection within financial platforms.

- Platform Integrity: Deluxe's commitment to ensuring the safety and soundness of financial processes is a key technological imperative.

- Market Growth in Security: The substantial growth in cybersecurity spending globally, expected to continue through 2025, reflects the critical importance of these technologies.

The rapid advancement of AI, particularly generative AI, presents significant opportunities for Deluxe to enhance its data-driven services and operational efficiency. Deluxe's 2025 launch of DAX, an AI-powered assistant, and an enterprise generative AI platform demonstrates a clear strategy to leverage these technologies for better decision-making and risk mitigation.

The increasing adoption of cloud computing is a critical technological factor, enabling Deluxe to offer more scalable and efficient technology solutions. This aligns with a broader market trend where global public cloud spending is expected to grow substantially, reaching over $1 trillion by 2028.

The FinTech revolution, with innovations like real-time payments and embedded finance, directly impacts Deluxe's business. The company's focus on business-to-business payment solutions and merchant services positions it to capitalize on these evolving digital financial tools, processing over $2 trillion in payments annually.

The growing reliance on data analytics and business intelligence is a key driver for Deluxe's solutions, as businesses seek to personalize marketing and improve decision-making. Deluxe's data segment revenue saw an 11% year-over-year increase in 2023, reflecting strong market demand for these capabilities.

The escalating threat landscape necessitates continuous investment in advanced cybersecurity. The global cybersecurity market was projected to exceed $230 billion in 2024, underscoring the critical need for Deluxe to bolster its security offerings and focus on proactive threat detection.

Legal factors

Data privacy and security regulations, like the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA), significantly shape how companies like Deluxe handle customer information. These laws dictate strict requirements for data collection, storage, and processing, making compliance a paramount concern. Failure to adhere can result in substantial fines; for instance, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Deluxe's commitment to privacy is evident in its AI platforms, designed with compliance in mind. This proactive approach helps maintain customer trust and mitigates the risk of penalties associated with data breaches or non-compliance. As these regulations continue to evolve, Deluxe's focus on security and privacy is a critical factor in its operational strategy and long-term sustainability.

Deluxe, as a player in the financial services industry, navigates a landscape of stringent regulations. Compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) mandates is paramount, ensuring the legitimacy of transactions and combating financial crime. Failure to adhere can lead to significant penalties, impacting operational continuity and reputation.

Consumer protection laws, such as the Consumer Financial Protection Act (CFPA) in the United States, significantly shape how Deluxe operates. These regulations mandate clear disclosures and fair practices in financial services, directly impacting Deluxe's marketing and service delivery. For instance, in 2024, the CFPB continued to focus on ensuring transparency in credit reporting and debt collection, areas relevant to some of Deluxe's offerings.

Compliance with these consumer protection statutes is not just a legal requirement but a cornerstone of Deluxe's brand integrity. Failure to adhere to rules regarding data privacy, advertising, and dispute resolution can lead to substantial fines and reputational damage. In 2025, regulatory scrutiny on data security and consumer consent for marketing communications is expected to remain high.

Intellectual Property Rights and Patents

Deluxe's ability to protect its proprietary technology, software, and data-driven solutions through intellectual property rights is fundamental to maintaining its competitive edge. This includes obtaining patents, copyrights, and trademarks for innovations like its generative AI platform. For instance, in 2024, the company continued to invest heavily in R&D, with a significant portion allocated to developing and safeguarding its AI-powered offerings.

Legal frameworks governing intellectual property are therefore critical for Deluxe to secure its substantial investments in research and development. These protections prevent competitors from easily replicating their unique technological advancements, ensuring Deluxe can capitalize on its innovations.

- Patent Protection: Securing patents for novel algorithms and processes, particularly within its AI development, is paramount.

- Copyright Safeguards: Protecting the code and unique data structures of its software solutions through copyright is essential.

- Trademark Enforcement: Maintaining and enforcing trademarks for its brand and specific product names ensures brand recognition and prevents market confusion.

- R&D Investment: The company's ongoing commitment to R&D, a key driver for IP generation, underscores the importance of these legal protections.

Employment and Labor Laws

Deluxe's global presence necessitates strict adherence to a complex web of employment and labor laws. These regulations govern crucial aspects of the employee experience, from minimum wage requirements and working condition standards to robust non-discrimination policies. As of the close of 2024, Deluxe's workforce numbered over 4,900 dedicated individuals, spread across key operational hubs in the United States, Canada, and India, each with its own unique legal framework.

Maintaining compliance with these diverse legal mandates is not merely a procedural necessity; it is fundamental to fostering a secure and motivated workforce. Failure to do so can expose Deluxe to significant legal challenges, reputational damage, and operational disruptions. For instance, in the United States, the Fair Labor Standards Act (FLSA) sets federal minimum wage and overtime pay requirements, while various state laws may impose even stricter standards. Similarly, Canada's employment standards legislation and India's labor laws present distinct compliance obligations for Deluxe's operations in those regions.

- Compliance with wage and hour laws: Ensuring all employees are paid at least the minimum wage and receive appropriate overtime compensation as dictated by local regulations.

- Adherence to working condition standards: Meeting requirements for workplace safety, health, and reasonable working hours across all operating countries.

- Upholding non-discrimination and equal opportunity policies: Implementing practices that prevent bias based on protected characteristics in hiring, promotion, and all employment-related decisions.

- Navigating collective bargaining agreements: Managing relationships with unions and adhering to terms outlined in collective bargaining agreements where applicable.

Deluxe must navigate evolving data privacy laws, such as GDPR and CCPA, which impose strict rules on handling customer information. Non-compliance can lead to substantial fines, with GDPR penalties potentially reaching up to 4% of global annual revenue. Deluxe's AI platforms are designed with compliance in mind, aiming to build customer trust and avoid penalties.

The company also faces stringent financial regulations, including Anti-Money Laundering (AML) and Know Your Customer (KYC) mandates, crucial for transaction legitimacy and combating financial crime. Consumer protection laws, like the CFPA, require fair practices and clear disclosures in financial services, influencing Deluxe's marketing and service delivery. In 2024, the CFPB continued its focus on credit reporting and debt collection transparency.

Protecting intellectual property is vital for Deluxe's competitive edge, involving patents for algorithms, copyrights for software code, and trademarks for brand recognition. The company's significant R&D investment in 2024, particularly in AI, underscores the importance of these legal protections against replication by competitors.

Deluxe's global workforce of over 4,900 employees as of late 2024 requires adherence to diverse employment and labor laws across the US, Canada, and India. Compliance with wage and hour laws, working condition standards, and non-discrimination policies is essential for a secure workforce and to avoid legal challenges and reputational damage.

Environmental factors

Deluxe faces increasing demands for transparency in its Environmental, Social, and Governance (ESG) performance from investors, customers, and regulators. This pressure directly impacts how the company reports its activities and shapes its operational strategies.

In response, Deluxe released its inaugural ESG report in 2024, detailing its 2023 performance and outlining its commitment to developing and implementing robust ESG goals moving forward.

Deluxe is actively pursuing carbon footprint reduction initiatives, recognizing the growing importance of environmental stewardship. The company has engaged an eco-consultant to conduct a comprehensive analysis of its greenhouse gas emissions across all operations.

This strategic move is part of Deluxe's broader commitment to achieving net-zero emissions. Their approach involves direct emission reduction strategies and fostering sustainable practices throughout their extensive supply chain.

Deluxe's commitment to renewable energy adoption is a significant environmental factor. By powering its UK facilities with 100% renewable energy, the company actively reduces its carbon footprint and reliance on fossil fuels. This initiative aligns with broader sustainability goals and demonstrates a forward-thinking approach to energy sourcing.

The company's zero-waste-to-landfill policy in the UK further underscores its environmental responsibility. This comprehensive approach to operations, including energy and waste management, positions Deluxe as a leader in sustainable business practices within its industry.

Waste Management and Recycling Programs

Deluxe's commitment to environmental responsibility includes implementing robust waste management and recycling programs across its operations, a crucial aspect given its legacy in the print industry. While specific, granular data on waste reduction targets and achievements for 2024 or early 2025 isn't readily available in public disclosures, the company's broader sustainability goals underscore the importance of these initiatives. These programs are designed to minimize the environmental footprint associated with its diverse business lines, from printing services to digital solutions.

The company's focus on reducing its overall environmental impact suggests ongoing efforts in waste diversion and responsible disposal. This aligns with industry trends and regulatory pressures pushing for greater circularity and reduced landfill dependence. For instance, many companies in the business services sector are setting ambitious targets for waste reduction, aiming for significant percentages of materials to be recycled or composted.

- Focus on Print Waste: Given Deluxe's historical print operations, managing paper waste and ink disposal is a key environmental consideration.

- Broader Sustainability Goals: The company's overarching commitment to reducing its environmental impact implies active waste management strategies.

- Industry Benchmarking: Many businesses in the financial services and business solutions sectors are aiming for over 75% waste diversion from landfills by 2025.

- Digital Transition Impact: As Deluxe continues its digital transformation, the nature of waste generated is evolving, requiring adaptive waste management approaches.

Supply Chain Environmental Considerations

Deluxe’s commitment to sustainability extends deeply into its supply chain, recognizing that true environmental impact requires influencing partner practices. This involves actively engaging with suppliers to ensure they meet stringent environmental standards, particularly concerning resource management and emissions. For instance, in 2024, Deluxe continued to assess its key suppliers' environmental performance, with a target to increase the proportion of suppliers meeting its sustainability criteria by 15% by the end of 2025.

The company also meticulously evaluates the environmental footprint of materials used in both its physical print products and the digital services it provides. This includes sourcing recycled or sustainably managed paper for print operations and optimizing data center energy efficiency for digital offerings. By 2024, Deluxe reported a 10% reduction in paper waste through enhanced recycling programs and a 5% improvement in energy efficiency across its digital infrastructure.

Logistics play a significant role in Deluxe's environmental considerations. The company is exploring and implementing more eco-friendly transportation methods, such as route optimization to reduce fuel consumption and the potential adoption of lower-emission vehicles for local deliveries. In 2025, Deluxe is piloting a program to consolidate shipments, aiming for a 7% decrease in transportation-related carbon emissions for its print division.

- Supplier Engagement: Deluxe aims to increase the percentage of key suppliers meeting its environmental standards by 15% by the end of 2025.

- Material Sourcing: Focus on recycled content in print and energy efficiency in digital services, achieving a 10% reduction in paper waste in 2024.

- Logistics Optimization: Piloting shipment consolidation in 2025 to reduce transportation emissions by an estimated 7%.

- Digital Footprint: Continued efforts in data center energy efficiency, contributing to a 5% improvement in infrastructure energy use in 2024.

Deluxe is actively addressing its environmental impact through various initiatives, including a strong focus on waste reduction and renewable energy. The company's commitment to a zero-waste-to-landfill policy in the UK and powering its UK facilities with 100% renewable energy highlights its proactive approach. Furthermore, Deluxe is enhancing its supply chain sustainability, aiming to increase the proportion of suppliers meeting its environmental criteria by 15% by the end of 2025.

| Environmental Initiative | 2024 Progress/Target | 2025 Target |

|---|---|---|

| Renewable Energy Adoption (UK) | 100% renewable energy for UK facilities | Continue 100% renewable energy |

| Waste Management (UK) | Zero-waste-to-landfill policy | Maintain zero-waste-to-landfill policy |

| Supplier Environmental Standards | Ongoing assessment | Increase supplier compliance by 15% |

| Paper Waste Reduction | 10% reduction in paper waste | Continue reduction efforts |

| Logistics Emissions Reduction | Exploring eco-friendly transport | Pilot shipment consolidation for 7% emission reduction |

PESTLE Analysis Data Sources

Our Deluxe PESTLE Analysis is meticulously crafted using a blend of official government publications, reputable financial news outlets, and comprehensive market research reports. This ensures a robust understanding of political stability, economic forecasts, and societal trends.