Deluxe Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deluxe Bundle

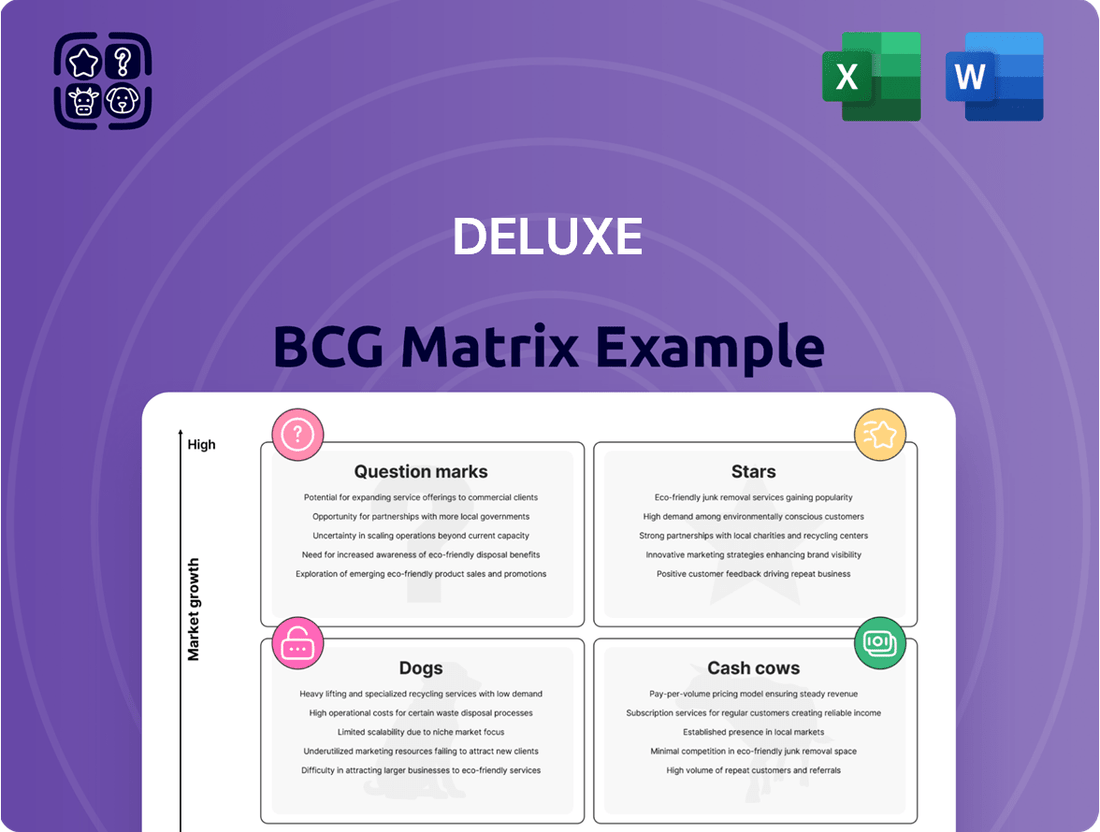

Unlock the full potential of your product portfolio with the comprehensive Deluxe BCG Matrix. This detailed analysis goes beyond simple categorization, offering actionable insights into your Stars, Cash Cows, Dogs, and Question Marks. Don't just understand your market position; strategize for growth and optimize your resource allocation. Purchase the full Deluxe BCG Matrix today for a complete roadmap to informed business decisions and a competitive edge.

Stars

Deluxe's Data Solutions segment is a standout performer, demonstrating remarkable growth with a 29.3% year-over-year revenue increase in the first quarter of 2025. This robust expansion is fueled by their sophisticated use of extensive data sets and artificial intelligence to deliver valuable marketing intelligence to clients.

Although Deluxe's leadership foresees a cooling of these rapid growth rates, the Data Solutions division is clearly positioned as a significant high-growth engine for the company. Its ability to translate complex data into actionable business insights underscores its strategic importance.

Deluxe's Merchant Services is a key player in the digital payments arena, focusing on expanding its market share. Despite a 1.3% growth in Q1 2025, the company is investing heavily to capture more of the transaction processing market.

The segment benefits from strong partnerships with financial institutions, enabling it to handle a significant annual payment volume. This positions Merchant Services as a crucial component of Deluxe's digital transformation strategy.

B2B Payments is a key driver of Deluxe's digital transformation, aiming to streamline and automate how businesses handle payments. This segment is well-positioned to capitalize on the growing shift to digital transactions between companies, further enhanced by Deluxe's integrated invoicing and reconciliation tools.

Deluxe anticipates a robust compound annual growth rate for its B2B Payments segment, projecting it to reach approximately 15% by 2026. This growth is supported by the increasing adoption of electronic payments and Deluxe's continued investment in its payment processing infrastructure.

Treasury Management Solutions

Treasury Management Solutions represent a significant growth area for Deluxe, tapping into a market expected to reach USD 6.6 billion by 2025. This segment is poised for robust expansion, with a projected compound annual growth rate (CAGR) of 13% through 2032.

Deluxe's strategic focus on treasury management is evident in its comprehensive suite of offerings. These solutions, including advanced cloud deployments, are engineered to bolster efficiency in cash flow, liquidity, and risk management for businesses and financial institutions alike.

- Market Growth: The Treasury Management market is projected to hit USD 6.6 billion by 2025, with a 13% CAGR expected through 2032.

- Deluxe's Role: Deluxe is actively participating in this expanding market with its treasury solutions.

- Key Offerings: The company provides cloud-based solutions for efficient cash flow, liquidity, and risk management.

- Strategic Alignment: This focus aligns with the increasing global demand for sophisticated financial technology.

Cloud-based Financial Technology

Cloud-based financial technology represents a significant growth area for Deluxe, driven by substantial investments in its data and payments divisions. This strategic focus aligns perfectly with the burgeoning global financial cloud market, projected to hit $55.17 billion by year-end 2024. The increasing reliance on cloud infrastructure is evident, with cloud adoption in treasury management alone seeing a notable increase of around 28% in 2024.

This move towards modern, scalable cloud infrastructure places Deluxe squarely within a high-growth market segment. The company's commitment here suggests a strong potential for future expansion and market leadership.

- Market Growth: Global financial cloud market expected to reach $55.17 billion by the end of 2024.

- Adoption Rate: Cloud deployment in treasury management increased by approximately 28% in 2024.

- Deluxe Investment: Significant capital allocation towards cloud services, especially in data and payments.

- Strategic Positioning: Leveraging cloud infrastructure for scalability and market expansion.

Stars in the BCG matrix represent business units with high market share in a high-growth market. These are the ideal segments for investment as they have the potential to generate significant future profits and cash flow. Deluxe's Data Solutions, with its 29.3% year-over-year revenue growth in Q1 2025, clearly fits this description. Similarly, B2B Payments, projected to grow at a robust 15% CAGR by 2026, and Treasury Management Solutions, benefiting from a market expected to reach $6.6 billion by 2025 with a 13% CAGR, also exhibit star-like characteristics.

| Segment | Market Growth | Deluxe's Position | Key Drivers | Outlook |

| Data Solutions | High | High Market Share (Implied) | AI, Big Data Analytics | Continued strong growth, potential to become Cash Cows |

| B2B Payments | High (15% CAGR by 2026) | Growing Market Share | Digitalization, Automation | Significant growth potential |

| Treasury Management Solutions | High ($6.6B market by 2025, 13% CAGR) | Active Participant | Cloud adoption, Efficiency needs | Poised for robust expansion |

What is included in the product

Detailed breakdown of products across BCG quadrants with strategic guidance.

The Deluxe BCG Matrix offers a clear, visual roadmap to identify underperforming units, relieving the pain of resource misallocation.

Cash Cows

Deluxe's legacy check printing business, despite a secular decline in check usage, remains a substantial revenue driver. In 2024, it represented about 33.1% of the company's total revenue and a significant 54% of its print segment. This segment commands a high market share within a mature, albeit shrinking, market.

The enduring strength of this segment lies in its ability to generate consistent and robust cash flow. This stable income stream is crucial for Deluxe's ongoing efforts to pivot and invest in its transformation towards digital payments and data services.

Business forms and accessories, a significant part of Deluxe's print segment, operate as a Cash Cow. This mature product line, despite experiencing revenue declines, maintains a strong market share within its specific niche, continuing to be a reliable contributor to the company's cash flow.

This segment benefits from a loyal, long-standing customer base that still relies on these essential business materials. For instance, in 2023, Deluxe reported that its print segment, which includes these forms, generated $587.6 million in revenue, demonstrating its continued, albeit declining, relevance and cash-generating ability.

Promotional products, a segment integrated with Deluxe's print services, operate within a mature market where the company enjoys a robust market share. This business, despite facing potential shifts due to economic cycles, reliably contributes significant cash flow to Deluxe. In 2023, Deluxe reported that its promotional products segment, alongside its broader marketing and promotional services, saw steady demand, contributing to overall revenue stability.

Established Financial Institution Relationships

Deluxe's extensive network, built on relationships with over 4,000 financial institutions, serves as a bedrock for its cash cow status. This deep integration means a consistent demand for its diverse service portfolio, from legacy print solutions to emerging digital products.

These entrenched partnerships represent a significant competitive advantage, ensuring a predictable revenue stream. In 2024, Deluxe continued to leverage these relationships, which are crucial for maintaining its market position and profitability in established segments.

- Stable Revenue Base: Over 4,000 financial institution relationships provide a consistent and reliable revenue stream.

- Diversified Offerings: These relationships support both traditional print services and newer digital solutions.

- Market Entrenchment: Long-standing partnerships create a barrier to entry for competitors.

- Profitability Driver: The predictable business from these institutions is a key contributor to Deluxe's cash cow designation.

Print Business as Funding Source

Deluxe's established print business functions as a significant cash cow, consistently generating substantial revenue. In 2024, this legacy segment continued to be a primary funding source, enabling the company to invest heavily in its strategic shift towards digital services. This financial stability from print is crucial for fueling innovation and expansion in the payments and data solutions sectors.

The robust cash flow from print operations acts as the financial bedrock for Deluxe's transformation efforts. This allows for aggressive investment in research and development, as well as acquisitions, to bolster its position in higher-growth digital markets. The deliberate strategy ensures that the company can pursue its digital pivot without compromising its existing operations or financial health.

- Print revenue remains a core contributor to overall cash generation.

- Cash flow from print is strategically allocated to fund digital transformation initiatives.

- This financial leverage supports investment in new technologies and market expansion.

Deluxe's legacy print operations, particularly its check printing and business forms segments, are firmly established as cash cows. These mature businesses, while facing secular declines, still hold significant market share and generate consistent, robust cash flow. This reliable income stream is vital for funding Deluxe's strategic pivot towards digital payment solutions and data services.

In 2023, Deluxe's print segment, which encompasses these cash cow businesses, generated $587.6 million in revenue. This demonstrates their continued, albeit declining, relevance and their critical role in the company's overall financial health and investment capacity.

The company's extensive network of over 4,000 financial institution relationships underpins the cash cow status of its print offerings. These entrenched partnerships ensure a predictable demand for both legacy print products and newer digital solutions, creating a significant competitive advantage and a stable revenue base.

| Segment | Market Position | Cash Flow Contribution | Strategic Role |

|---|---|---|---|

| Check Printing | High Market Share (Mature Market) | Significant & Stable | Funds Digital Transformation |

| Business Forms & Accessories | Strong Niche Market Share | Consistent Contributor | Supports Core Operations |

| Promotional Products | Robust Market Share | Reliable Cash Flow | Aids Revenue Stability |

Delivered as Shown

Deluxe BCG Matrix

The preview you see showcases the complete and polished Deluxe BCG Matrix, identical to the file you will receive immediately after purchase. This means no watermarks, no placeholder text, and no missing sections—just a fully developed strategic tool ready for your immediate application. You're getting the exact, professionally formatted document designed to provide deep insights into your product portfolio's strategic positioning. This is your direct path to actionable market analysis.

Dogs

Deluxe's decision to exit its payroll and human resources services business in 2024 clearly signals this segment was viewed as a non-core asset. This move aligns with a strategy to divest units with limited growth potential and potentially a weak competitive position, a common practice for companies looking to optimize their business structure.

This divestiture directly addresses the "question mark" or "dog" categories in a BCG Matrix, where assets may consume significant resources but offer little return or strategic advantage. By shedding these underperforming operations, Deluxe aims to sharpen its focus on more promising areas of its business, thereby improving overall profitability and resource allocation efficiency.

Deluxe has been actively divesting smaller business units, a common strategy for companies focusing on core competencies. These divested entities likely represented 'Dogs' in a BCG matrix analysis, meaning they operated in low-growth markets with low relative market share. For instance, in 2023, Deluxe completed the sale of its Accounts Receivable (AR) automation business, a move aligning with its strategic pivot toward payments and data services.

This portfolio rationalization is crucial for optimizing resource allocation. By shedding these less strategic assets, Deluxe can redirect capital and management attention to higher-potential areas. The divestiture of its document management business in late 2022 further exemplifies this trend, freeing up resources and enhancing overall operational efficiency.

Within Deluxe's print business, certain niche offerings, like basic business cards or simple flyers, are highly commoditized. This means there's little to distinguish one provider from another, leading to fierce price wars. For example, the demand for standard printed invitations has seen a decline as digital alternatives become more prevalent.

These segments often represent a low market share for Deluxe and are unlikely to see significant growth. In 2024, the overall print advertising market, while showing some resilience in specialized areas, continued to face pressure from digital channels, with many traditional print services experiencing flat to negative growth.

Deluxe's strategy for these commoditized niches is typically to maintain operational efficiency and leverage existing customer relationships. The focus isn't on expanding these particular product lines but on ensuring they are profitable through streamlined processes and cost management, rather than investing heavily in innovation or market development.

Outdated Internal Technology Platforms

Deluxe's historical reliance on outdated internal technology platforms presented a significant drag on efficiency and innovation. These legacy systems, often redundant and costly to maintain, limited the company's agility in a rapidly evolving digital landscape. For instance, in 2023, a significant portion of IT spending was still allocated to maintaining these older systems, impacting the capital available for crucial digital upgrades.

The transition to modern, cloud-based infrastructure is a strategic imperative for Deluxe. This move addresses the inefficiencies of the past by consolidating and modernizing operations. By shedding the burden of legacy platforms, Deluxe can redirect resources towards developing and deploying advanced digital solutions, thereby enhancing its competitive edge.

- Legacy System Costs: Prior to its digital transformation, Deluxe likely incurred substantial operational costs maintaining multiple outdated and redundant internal technology platforms.

- Resource Reallocation: These inefficient internal platforms consumed resources that are now being strategically redirected towards modern cloud-based infrastructure and digital initiatives.

- Cloud Migration Progress: Deluxe has been actively rebuilding its operating infrastructure, with a stated goal of migrating all relevant systems to the cloud, a process that gained significant momentum in 2024.

- Competitive Advantage: Modernizing its technology stack is crucial for Deluxe to gain a competitive advantage, enabling faster innovation and improved service delivery in the digital economy.

Services with Persistent Unrecoverable Revenue Decline

Within Deluxe's broader print business, certain legacy services face persistent, unrecoverable revenue decline. These are segments where the market demand has fundamentally shifted, and investment for revival is unlikely to yield returns. For instance, traditional direct mail services, while still part of the offering, have seen consistent year-over-year revenue drops as digital marketing channels gain prominence.

These "Dogs" in the Deluxe portfolio are characterized by their lack of strategic alignment with the company's future growth areas and their inability to generate substantial cash flow. The company must actively manage these segments to prevent them from becoming significant cash drains. In 2023, Deluxe reported a decline in its marketing and advertising segment revenue, partly attributable to the ongoing challenges in traditional print advertising.

- Traditional check printing: Facing secular decline due to digital payment adoption.

- Legacy direct mail services: Competition from digital marketing channels continues to erode revenue.

- Certain niche print advertising products: Demand has significantly diminished over time.

Dogs represent business units within Deluxe that operate in low-growth markets and have a low relative market share. These segments, such as traditional check printing and certain niche print advertising products, face declining demand due to shifts towards digital alternatives. Deluxe's strategy for these "Dogs" focuses on maintaining operational efficiency and cost management rather than significant investment or expansion.

The divestiture of non-core assets like the payroll and HR services in 2024, and the AR automation business in 2023, aligns with shedding these underperforming "Dog" categories. This portfolio rationalization allows Deluxe to redirect capital and management attention to higher-potential growth areas, improving overall resource allocation and profitability.

Legacy technology platforms also functioned as "Dogs," consuming resources with limited return due to inefficiencies and high maintenance costs. Deluxe's ongoing migration to cloud-based infrastructure in 2024 addresses these issues, modernizing operations and freeing up resources for digital innovation.

The print business, particularly commoditized offerings like basic business cards and flyers, exemplifies "Dog" characteristics. These segments experience intense price competition and flat to negative growth, as seen in the broader print advertising market's 2024 performance, necessitating a focus on streamlined operations.

| Business Segment | Market Growth | Relative Market Share | BCG Category | Deluxe Strategy |

|---|---|---|---|---|

| Traditional Check Printing | Low (Secular Decline) | Low | Dog | Operational Efficiency, Cost Management |

| Legacy Direct Mail Services | Low (Eroding from Digital) | Low | Dog | Operational Efficiency, Cost Management |

| Niche Print Advertising Products | Low (Diminished Demand) | Low | Dog | Operational Efficiency, Cost Management |

| Basic Business Cards/Flyers | Low (Commoditized) | Low | Dog | Streamlined Operations, Cost Management |

Question Marks

Deluxe's launch of DAX, a generative AI platform built on Deluxe.ai in 2025, positions it as a classic 'Question Mark' within the BCG matrix. This new venture targets the rapidly expanding generative AI market, a sector projected to reach hundreds of billions of dollars in value by the end of the decade, with some estimates suggesting the market could exceed $1.3 trillion by 2030 according to some industry analyses.

Given DAX's recent introduction in 2025, its current market share is understandably minimal, reflecting the early stages of its lifecycle. For DAX to transition from a Question Mark to a Star, it will require substantial strategic investment in research and development, coupled with aggressive marketing and sales efforts to capture significant market share in this competitive and fast-moving technology landscape.

New mobile payment applications like dlxPAY for merchants, designed to simplify on-the-go transactions, are positioned as question marks in Deluxe's BCG Matrix. The mobile payment sector is experiencing rapid expansion, but these are nascent products for Deluxe. Significant investment in marketing and user acquisition will be crucial for them to capture substantial market share and demonstrate enduring success.

Emerging integrated software partnerships are a key area for Deluxe, representing a strategic move to offer more comprehensive solutions. A notable example is the collaboration with Square 9, aiming for complete invoice-to-payment automation, addressing a clear market demand for streamlined financial processes.

These partnerships are designed to capitalize on the growing need for integrated platforms, but their ultimate impact on market share is still unfolding. Deluxe's investment in these ventures is crucial for their successful scaling and for proving their value proposition in a competitive landscape.

Expansion into New Digital Verticals

Deluxe is strategically venturing into new digital verticals, aiming to leverage its data solutions beyond its established financial services and small business segments. These emerging markets represent significant growth potential, with projections indicating substantial expansion in data analytics adoption across various industries. For instance, the global data analytics market was valued at approximately $27.9 billion in 2023 and is expected to reach $105.1 billion by 2030, showcasing the lucrative nature of these new territories.

- Market Exploration: Deluxe is targeting sectors like healthcare and e-commerce, where data-driven insights are increasingly critical for operational efficiency and customer engagement.

- Low Initial Share: Despite the high growth prospects, Deluxe anticipates a low initial market share in these new verticals as it establishes its presence and brand recognition.

- Investment Needs: Successful penetration will necessitate substantial investment in technology, talent acquisition, and tailored marketing campaigns to compete effectively.

- Strategic Focus: The company's approach involves developing specialized data products and services that address the unique challenges and opportunities within each new vertical.

Advanced Cybersecurity Service Offerings

Deluxe's advanced cybersecurity services, positioned within its data solutions segment, represent a potential star or question mark in the BCG matrix. While the overall cybersecurity market is experiencing robust growth, with projections indicating a global market size of over $372 billion by 2024, Deluxe's specific niche offerings may currently hold a smaller market share. This suggests they are in a high-growth industry but may require substantial investment to scale and compete effectively.

These specialized services, which could include areas like advanced threat detection, incident response, or cloud security solutions, are critical given the escalating threat landscape. For instance, cybercrime costs are estimated to reach $10.5 trillion annually by 2025, highlighting the immense demand for sophisticated protective measures. Deluxe's investment in these areas is crucial for future revenue generation, as they aim to capture a more significant portion of this expanding market.

- High-Growth Market: The global cybersecurity market is rapidly expanding, driven by increasing cyber threats and data breaches.

- Potential for Investment: Deluxe's advanced cybersecurity offerings likely require significant capital for technology development and talent acquisition to gain market traction.

- Niche Focus: These services target specific, often complex, cybersecurity needs, differentiating them from broader solutions.

- Strategic Importance: Investing in these advanced services is key for Deluxe to remain competitive and capitalize on the growing demand for specialized security expertise.

Question Marks, in the context of the Deluxe BCG Matrix, represent new ventures or products with low market share in high-growth industries. These are areas where Deluxe is investing but has not yet established a dominant position. Their success hinges on significant future investment to capture market share and potentially become Stars.

Deluxe's new generative AI platform, DAX, launched in 2025, is a prime example. The generative AI market is projected for massive growth, potentially exceeding $1.3 trillion by 2030. DAX's current minimal market share necessitates substantial investment in R&D and marketing to compete effectively.

Similarly, new mobile payment applications like dlxPAY are also classified as Question Marks. While the mobile payment sector is expanding rapidly, these are nascent offerings for Deluxe. Aggressive marketing and user acquisition strategies are vital for them to gain traction and prove their long-term viability.

Deluxe's exploration into new digital verticals, such as healthcare and e-commerce data solutions, also falls into the Question Mark category. Despite these markets showing significant growth potential, with the global data analytics market expected to reach $105.1 billion by 2030, Deluxe's initial share in these segments is low, requiring strategic investment to build presence.

| Product/Venture | Industry | Market Growth | Current Market Share | Investment Need |

|---|---|---|---|---|

| DAX (Generative AI) | Generative AI | Very High (>$1.3T by 2030 est.) | Minimal (New Launch) | High (R&D, Marketing) |

| dlxPAY (Mobile Payments) | Fintech/Mobile Payments | High | Low (Nascent) | High (Marketing, User Acquisition) |

| New Digital Verticals (Data Solutions) | Data Analytics/Various Sectors | High ($105.1B by 2030 est.) | Low (New Entrant) | High (Tech, Talent, Marketing) |

BCG Matrix Data Sources

Our Deluxe BCG Matrix leverages comprehensive market data, including financial performance, sales figures, and competitor analysis, to accurately position each business unit.