Deluxe Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Deluxe Bundle

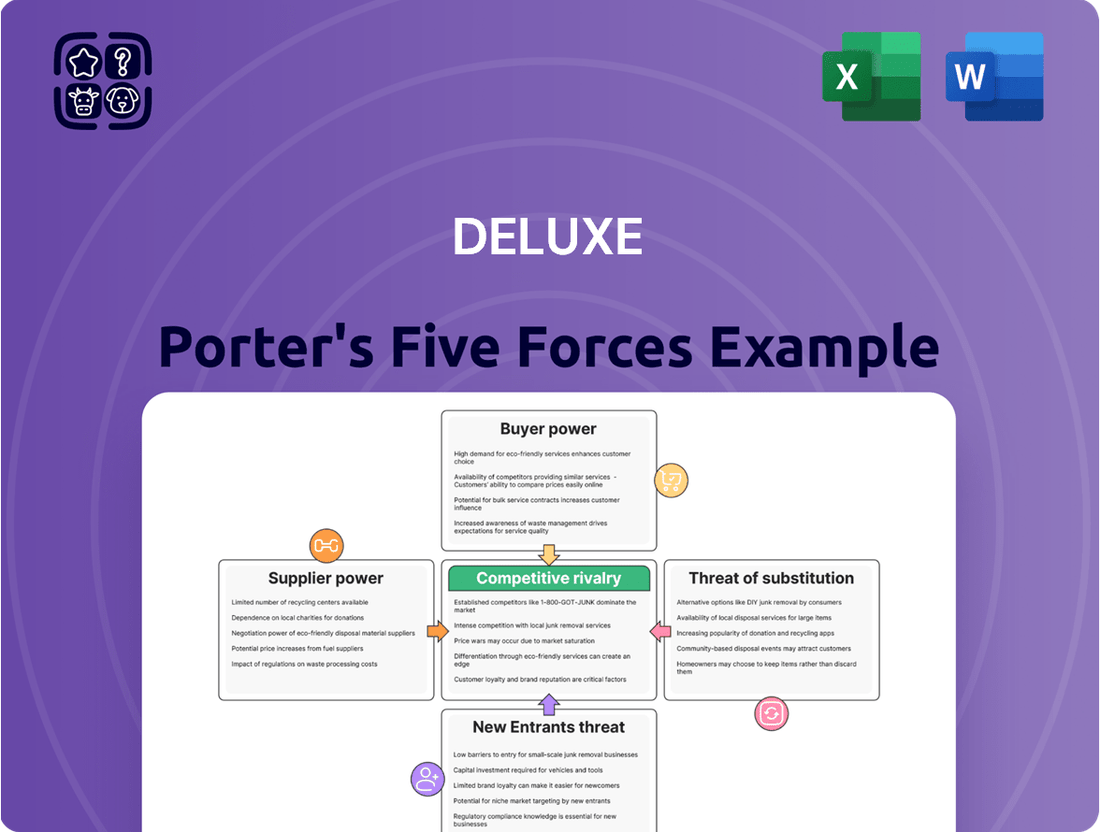

Deluxe faces intense competition, with significant threats from new entrants and powerful buyers. Understanding these dynamics is crucial for any business operating in their space.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Deluxe’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The concentration of suppliers for Deluxe's essential technology-enabled solutions, such as data-driven marketing platforms, cloud infrastructure, and treasury management software, directly impacts their bargaining power. If a small number of providers dominate the market for these critical inputs, they can exert significant influence, potentially driving up costs for Deluxe.

For instance, if Deluxe relies heavily on a few specialized cloud service providers, and these providers face limited competition, they can dictate terms and pricing more effectively. This concentration can lead to higher operational expenses for Deluxe if suppliers are able to charge premium rates due to their market position.

Deluxe's reliance on specialized inputs significantly influences supplier bargaining power. If Deluxe requires unique technologies or data crucial for its financial services, suppliers providing these inputs gain considerable leverage. For instance, if a key data analytics platform used by Deluxe is proprietary and has few alternatives, that supplier can command higher prices or more favorable terms.

Deluxe's bargaining power of suppliers is significantly influenced by switching costs. If Deluxe faces substantial expenses, like integrating new software systems or retraining staff for a different supplier's platform, it becomes more difficult and costly to change providers. This would give suppliers more leverage.

For instance, if Deluxe relies on a highly specialized, proprietary system from a supplier that requires extensive data migration and validation, the costs to switch could be in the millions. In 2024, many businesses reported significant IT integration costs, often exceeding 10-15% of the initial project budget when switching core operational software. These high switching costs empower suppliers by making it less feasible for Deluxe to seek alternative sourcing, thus solidifying the supplier's pricing power.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Deluxe's business operations represents a significant concern. If a supplier possesses the capability and resources to directly offer the same products or services that Deluxe provides, their leverage in negotiations naturally escalates. This scenario could lead to increased costs for Deluxe or even a loss of market share if the supplier proves to be a formidable competitor.

For example, in the digital printing and marketing services sector where Deluxe operates, a paper supplier or a software provider could potentially develop their own end-to-end solutions, bypassing Deluxe entirely. This potential for forward integration by key suppliers necessitates proactive strategies from Deluxe to mitigate such risks.

Deluxe must therefore focus on cultivating robust, long-term relationships with its existing suppliers. Diversifying its supplier base is also a crucial tactic to reduce reliance on any single provider and to create a more resilient supply chain. As of 2024, companies in the business services sector are increasingly exploring vertical integration to gain greater control over their value chains, underscoring the relevance of this threat.

- Supplier Forward Integration: The risk that suppliers may enter Deluxe's market as direct competitors.

- Impact on Bargaining Power: Suppliers capable of offering Deluxe's solutions gain increased leverage.

- Strategic Responses: Maintaining strong supplier relationships and diversifying the supplier base are key.

Importance of Deluxe to Suppliers

The significance of Deluxe as a customer directly impacts its suppliers' bargaining power. When Deluxe accounts for a substantial percentage of a supplier's total sales, that supplier is likely to be more accommodating when negotiating pricing, delivery schedules, and other terms. This is because losing Deluxe as a client could significantly harm the supplier's financial stability.

Conversely, if Deluxe represents only a minor portion of a supplier's revenue, the supplier has less incentive to offer favorable terms. In such scenarios, the supplier's overall business is not heavily reliant on Deluxe, giving them more leverage in negotiations. This dynamic highlights how Deluxe's purchasing volume can shift the balance of power.

- Supplier Dependence: If a supplier's business is heavily concentrated with Deluxe, they possess less bargaining power.

- Customer Concentration: Deluxe's ability to negotiate favorable terms increases if it represents a large share of a supplier's customer base.

- Market Dynamics: For instance, in 2024, many smaller technology suppliers serving the financial services sector experienced increased demand, potentially reducing their reliance on any single large client like Deluxe.

The bargaining power of suppliers for Deluxe is shaped by several factors. High switching costs for Deluxe, such as the expense and effort involved in migrating to new software or retraining staff, empower suppliers by making it harder for Deluxe to change providers. For example, in 2024, businesses reported IT integration costs often exceeding 10-15% of project budgets when switching core operational software, directly benefiting suppliers.

Furthermore, if Deluxe constitutes a significant portion of a supplier's revenue, the supplier is more likely to offer favorable terms to retain Deluxe as a client. Conversely, if Deluxe is a small customer, the supplier holds more leverage. In 2024, many smaller technology suppliers in the financial services sector saw increased demand, potentially reducing their dependence on large clients like Deluxe and strengthening their negotiating position.

| Factor | Description | Impact on Deluxe |

|---|---|---|

| Switching Costs | High costs for Deluxe to change suppliers (e.g., integration, retraining). | Strengthens supplier bargaining power. |

| Customer Concentration | Deluxe's share of a supplier's total sales. | If high, supplier has less power; if low, supplier has more power. |

| Supplier Forward Integration | Suppliers entering Deluxe's market as competitors. | Increases supplier leverage and potential for competition. |

What is included in the product

This Deluxe Porter's Five Forces Analysis provides a comprehensive examination of the competitive landscape, detailing the intensity of rivalry, the power of buyers and suppliers, the threat of new entrants, and the impact of substitutes on Deluxe's market position.

Instantly identify and quantify competitive threats with a comprehensive, yet easily digestible, visual breakdown of each force.

Customers Bargaining Power

Customer concentration significantly impacts bargaining power. If a few major clients represent a large chunk of Deluxe's revenue, they can negotiate for lower prices or special terms, gaining leverage.

Deluxe's diverse customer base includes millions of small businesses, thousands of financial institutions, and hundreds of large brands, processing over $2 trillion in payments annually. This broad reach dilutes the power of any single customer.

The costs customers incur when moving from Deluxe's services to a competitor's are a significant determinant of their bargaining power. If these switching costs are low for data-driven marketing, cloud solutions, or treasury management, customers hold more sway. For instance, a business finding it simple and affordable to migrate its customer data and marketing automation tools to a rival platform would exert greater pressure on Deluxe regarding pricing and service terms.

Deluxe's customers, particularly small businesses, often have limited time and resources to thoroughly research pricing and compare solutions. This information asymmetry can reduce their bargaining power. However, as digital platforms evolve, customers gain more access to comparative data, increasing their price sensitivity. For instance, in 2024, small businesses increasingly leverage online review sites and comparison tools to evaluate service providers, including those offering marketing and payment solutions like Deluxe.

Threat of Backward Integration by Customers

The threat of backward integration by customers significantly impacts Deluxe's bargaining power. If customers can develop their own solutions, they have less need for Deluxe's services, giving them leverage to demand better terms.

For instance, a major bank could potentially build its own in-house treasury management systems if Deluxe’s current offerings are perceived as too expensive or lacking unique features. This capability reduces customer dependence on Deluxe.

- Customer Integration Threat: Customers may develop their own treasury management or payment processing solutions, diminishing reliance on Deluxe.

- Differentiation is Key: Deluxe's ability to offer unique, high-value services is crucial to deterring customer backward integration.

- Cost-Effectiveness Matters: If Deluxe's pricing is not competitive, larger customers might find it more economical to build their own capabilities.

Product Differentiation and Value Proposition

Deluxe's strategic shift towards becoming a payments and data company, with key growth areas in Merchant Services, B2B Payments, and Data Solutions, directly influences customer bargaining power. The more unique and difficult to replicate Deluxe's offerings are within these evolving segments, the less leverage customers possess to negotiate lower prices or demand more favorable terms.

For instance, if Deluxe's data analytics solutions provide proprietary insights that significantly enhance a client's business operations, customers are less likely to switch to a competitor for similar value. This differentiation creates a stronger value proposition, reducing the perceived substitutability of Deluxe's services.

In 2024, the emphasis on specialized data solutions and integrated payment processing platforms suggests that Deluxe aims to lock in customers through value-added services rather than competing solely on price. This strategy is crucial for mitigating customer bargaining power.

- Differentiation in Data Solutions: Deluxe's ability to offer unique data insights and analytics, especially within its Data Solutions segment, directly reduces customer power.

- Value Proposition in Payments: The integration and sophistication of its Merchant Services and B2B Payments platforms contribute to a strong value proposition, making it harder for customers to switch.

- Impact of Specialization: Highly specialized services are inherently less substitutable, giving Deluxe more pricing power and reducing customer leverage.

The bargaining power of Deluxe's customers is influenced by several factors. A broad customer base, like Deluxe's millions of small businesses and thousands of financial institutions, generally dilutes individual customer power. However, if a few large clients represent a significant portion of revenue, they gain leverage to negotiate lower prices. For example, while Deluxe processes over $2 trillion in payments annually, the concentration of revenue among its largest clients is a key consideration.

Switching costs are also critical; if it's easy and inexpensive for customers to move their data and operations to a competitor, they have more power. Information asymmetry, where customers lack easy access to comparative pricing and service data, can reduce their leverage, though this is diminishing with increased online comparison tools. In 2024, small businesses are increasingly using these tools, boosting their price sensitivity.

The threat of customers developing their own solutions (backward integration) also increases their bargaining power. If a large bank finds Deluxe's treasury management systems too costly or lacking unique features, it might consider building its own, thereby reducing its dependence and increasing its negotiation leverage. Deluxe's strategy to differentiate through specialized data solutions and integrated payment platforms aims to mitigate this by creating unique value propositions that are harder for customers to replicate internally or find elsewhere.

| Factor | Impact on Customer Bargaining Power | Deluxe's Position (as of 2024/near future) |

|---|---|---|

| Customer Concentration | High concentration of revenue from a few clients increases power. | Deluxe serves millions of SMBs and thousands of FIs, generally diluting individual power, but large clients remain a factor. |

| Switching Costs | Low switching costs empower customers. | Costs to migrate data and operations for services like marketing automation and treasury management are key; Deluxe aims to increase these through integration. |

| Information Asymmetry | Limited customer access to comparative data reduces power. | Increasingly mitigated by online comparison tools used by SMBs in 2024, enhancing price sensitivity. |

| Backward Integration Threat | Ability of customers to self-provide services increases power. | Large clients like banks could develop in-house solutions; Deluxe's differentiation in data and payments aims to counter this. |

| Product Differentiation | Unique, high-value services reduce customer power. | Deluxe's focus on proprietary data insights and integrated payment platforms aims to create strong value propositions, reducing substitutability. |

What You See Is What You Get

Deluxe Porter's Five Forces Analysis

The document you see here is the complete, professionally written Deluxe Porter's Five Forces Analysis, offering an in-depth examination of competitive forces. What you're previewing is precisely the same detailed analysis you'll receive, ready for immediate download and application after your purchase. This ensures you get the full, uncompromised version without any placeholders or modifications.

Rivalry Among Competitors

The competitive landscape for Deluxe is quite crowded, with a significant number of companies vying for market share in technology-enabled solutions. This includes well-known names like Vistaprint, Staples, and Shutterfly, alongside financial technology providers such as PayPal and Fiserv Inc.

Deluxe also faces competition from specialized printing and digital service providers like Cimpress Plc and Quad/Graphics Inc, as well as companies in adjacent sectors such as Intuit Inc and AvidXchange Holdings Inc. The sheer volume and varied offerings of these competitors directly intensify the rivalry Deluxe experiences.

The overall growth rate of the technology-enabled solutions market significantly influences competitive rivalry. In markets with slower growth or even contraction, companies often intensify their efforts to capture existing market share, leading to heightened competition.

Deluxe's business model presents a mixed picture regarding industry growth. While its foundational print business, a historical revenue driver, is facing a decline, the company is strategically shifting towards its payments and data services segments. These newer areas are demonstrably experiencing growth, which can temper the intensity of rivalry within those specific, expanding niches.

Deluxe's competitive rivalry is significantly influenced by how well its competitors can make their products and services stand out. When offerings are similar and easily replaceable, like many financial services, competition often boils down to price, which can squeeze profit margins.

Deluxe is actively working to counter this commoditization by transforming its business. The company is strategically shifting its focus towards payments and data services. This move aims to create more distinct value propositions and drive future growth on these specialized platforms, moving away from purely price-driven competition.

High Fixed Costs and Storage Costs

Industries burdened by substantial fixed costs, such as those in cloud computing and data management, often experience heightened competitive rivalry. Companies in these sectors are compelled to achieve high sales volumes to spread these significant overheads, leading to aggressive pricing and market share battles.

The infrastructure underpinning cloud services, including data centers, servers, and network equipment, represents a considerable fixed investment. For instance, major cloud providers like Amazon Web Services (AWS) and Microsoft Azure continually invest billions in expanding their global data center footprints. In 2023, AWS alone reported capital expenditures of over $40 billion, reflecting the immense fixed costs involved.

These high fixed costs create a strong incentive for companies to operate at or near full capacity. When demand fluctuates or new competitors enter, existing players may resort to price cuts to maintain utilization rates, thereby intensifying competition.

- High Fixed Costs Drive Volume Focus: Companies with significant investments in infrastructure must sell more to cover these costs, leading to competitive pressure.

- Infrastructure Investment Example: AWS and Microsoft Azure's substantial capital expenditures on data centers highlight the fixed cost burden in the cloud sector.

- Capacity Utilization Incentive: The need to maximize capacity utilization encourages aggressive strategies, including price competition, to maintain market share and profitability.

Exit Barriers

High exit barriers can significantly intensify competitive rivalry. When companies face substantial costs or difficulties in exiting a market, such as specialized assets that are hard to sell or long-term contracts that must be fulfilled, they tend to remain operational even when unprofitable. This persistence means more players continue to vie for market share, often leading to aggressive price competition and reduced profitability for everyone involved.

For instance, in the semiconductor manufacturing industry, the immense capital investment in fabrication plants (fabs) creates a very high exit barrier. Companies that have invested billions in these specialized facilities are unlikely to simply shut down if they become unprofitable, opting instead to continue production, which can depress prices across the sector.

- High Exit Barriers: Specialized assets, such as custom-built machinery or proprietary technology, make it difficult and costly for firms to leave a market.

- Long-Term Contracts: Existing contractual obligations, like supply agreements or service contracts, can obligate companies to remain in the market until these commitments are met.

- Continued Rivalry: When firms cannot exit easily, they may continue to compete aggressively, even in low-profitability environments, to recoup some of their sunk costs.

- Impact on Pricing: This sustained competition can lead to price wars and reduced profit margins for all participants in the industry.

Deluxe faces intense competition from a broad range of players, including established giants like Vistaprint and Staples, alongside fintech innovators such as PayPal and Fiserv. This diverse competitive set, encompassing specialized print providers like Cimpress and adjacent sector players like Intuit, intensifies rivalry, particularly as market growth moderates.

The company's strategic pivot towards payments and data services, while promising growth, means it must contend with established leaders in those fields. Success hinges on differentiating its offerings beyond price, a challenge amplified in markets where competitors can easily replicate services.

High fixed costs within the technology-enabled solutions sector, especially in cloud infrastructure and data management, compel companies to chase volume, often leading to aggressive pricing strategies. For example, substantial capital expenditures by cloud providers on data centers underscore the pressure to maintain high capacity utilization, directly impacting competitive dynamics.

Furthermore, high exit barriers in certain segments of Deluxe's operations can prolong competitive battles, even in less profitable periods. The need to recoup sunk costs can keep less efficient players in the market, sustaining price pressures and limiting overall profitability for all involved.

SSubstitutes Threaten

The threat of substitutes for Deluxe's offerings is considerable, especially as technology advances rapidly. Businesses can choose to manage marketing, cloud services, and treasury operations through in-house capabilities, readily available open-source software, or by engaging with entirely different service providers. This flexibility in adopting alternative solutions directly impacts Deluxe's market position.

A prime example of this substitute threat is the ongoing transition from paper checks to electronic payment systems. In 2024, the U.S. Treasury reported that electronic payments represented over 90% of all government payments, a stark contrast to the dominance of paper checks just a decade prior. This shift significantly erodes the demand for Deluxe's traditional check printing and related services, highlighting a critical area where substitutes are actively displacing established methods.

The attractiveness of substitutes for Deluxe's offerings hinges significantly on their price-performance trade-off. If alternative solutions provide similar or better functionality at a more competitive price point, the threat of substitution escalates considerably.

For instance, in Deluxe's data solutions segment, a wide array of data analytics and cybersecurity services directly compete. Many of these emerging competitors offer specialized tools that may present a more compelling value proposition for certain customer needs, potentially at a lower overall cost than Deluxe's integrated solutions.

The threat of substitutes for Deluxe is influenced by how easily and cheaply customers can switch to alternative solutions. If switching is simple and inexpensive, this threat is amplified. For instance, small businesses might find it increasingly easy to use free or low-cost online invoicing tools instead of Deluxe's more comprehensive offerings, especially if the perceived value of Deluxe's integrated services diminishes.

Customer Propensity to Substitute

Customer willingness to switch to alternatives is a key factor. As businesses digitize, they become more open to new solutions. Deluxe's focus on digital transformation and AI for data insights positions it to manage this shift.

The increasing adoption of cloud-based accounting software and fintech solutions presents a significant threat of substitutes for Deluxe's traditional offerings. Many small and medium-sized businesses are migrating to more agile and integrated platforms that offer a wider range of services beyond basic check printing and payment processing. For instance, the global accounting software market was valued at approximately $14.5 billion in 2023 and is projected to grow significantly, indicating a strong customer preference for digital solutions.

- Digital Transformation: Businesses are increasingly adopting cloud-based platforms, making them more receptive to integrated financial services that can replace Deluxe's standalone products.

- Fintech Innovation: The rapid growth of fintech companies offering streamlined payment processing, digital invoicing, and automated bookkeeping presents direct competition.

- Customer Propensity: As companies embrace digital workflows, their operational processes are already adapted for new technologies, lowering the barrier to adopting substitute solutions.

- AI Integration: Deluxe's own leverage of AI for data insights can be seen as a response to the market's demand for more sophisticated, data-driven financial tools, which substitutes also aim to provide.

Technological Advancements

Ongoing technological advancements are a significant driver of substitute threats for Deluxe. Innovations in areas like artificial intelligence, blockchain, and automation continuously create new ways for customers to achieve their goals, potentially bypassing traditional payment processing and financial services. For instance, the rise of decentralized finance (DeFi) platforms built on blockchain technology offers alternative methods for transactions and financial management that could reduce reliance on established players like Deluxe.

Deluxe is actively addressing these evolving threats through strategic initiatives. The company is launching its generative AI platform, DAX, which aims to enhance decision-making processes and help mitigate macroeconomic risks for its clients. This proactive approach to integrating cutting-edge technology is crucial for maintaining competitiveness and offering value propositions that can counter the appeal of emerging substitutes.

- Technological Disruption: AI, blockchain, and automation are creating new substitute solutions for financial services.

- Deluxe's Response: Launch of DAX, a generative AI platform, to improve decision-making and manage risks.

- Market Impact: These advancements challenge traditional business models by offering alternative pathways for customers.

The threat of substitutes for Deluxe is significant due to the ease with which businesses can adopt alternative solutions for marketing, cloud services, and treasury operations. This includes in-house capabilities, open-source software, or entirely new service providers, directly impacting Deluxe's market standing.

The ongoing shift from paper checks to electronic payments, with over 90% of U.S. government payments being electronic in 2024, exemplifies how substitutes are actively displacing traditional services. This trend highlights a critical vulnerability for Deluxe's legacy offerings.

The price-performance ratio of substitutes is a key determinant of their threat level. If alternatives offer comparable or superior functionality at a lower cost, the pressure on Deluxe intensifies, particularly in segments like data solutions where specialized, cost-effective tools are emerging.

| Substitute Category | Example Solutions | 2024 Market Impact/Trend | Deluxe's Competitive Response |

|---|---|---|---|

| Payment Processing | Fintech payment gateways, digital wallets | Continued decline in paper check usage; 90%+ of US gov payments electronic in 2024 | Focus on digital payment solutions, integrated financial services |

| Data Analytics & Cybersecurity | Specialized SaaS platforms, cloud-based analytics | Growing demand for AI-driven insights; estimated $14.5B global accounting software market in 2023 | Leveraging AI (DAX platform) for data insights and risk mitigation |

| Marketing & Business Services | Digital marketing agencies, DIY online tools | Increased adoption of cloud-based CRM and marketing automation | Offering integrated marketing and cloud solutions |

Entrants Threaten

The capital required to enter markets for technology-enabled solutions, like data-driven marketing and cloud services, can be significant. This high investment acts as a barrier, lessening the threat from new competitors. For instance, building robust cloud infrastructure and scalable platforms, as Deluxe has done, demands substantial upfront funding.

Existing companies like Deluxe leverage significant economies of scale and scope, creating a formidable barrier for newcomers. This means larger, established firms can produce goods or services at a lower per-unit cost and offer a wider range of products, respectively, making it hard for new entrants to match their pricing or product diversity.

Deluxe's operational capacity, evidenced by its ability to process over $2 trillion in annual payment volume, highlights its massive scale. This sheer volume allows Deluxe to negotiate better terms with suppliers, invest more heavily in technology, and spread fixed costs across a larger output, all contributing to a cost advantage that new entrants would struggle to replicate.

Deluxe's strong brand loyalty and the significant switching costs associated with its integrated solutions act as a powerful deterrent to new entrants. Customers deeply embedded in Deluxe's ecosystem, often reliant on its established workflows and data management, perceive substantial financial and operational risks in migrating to a competitor. For instance, the complexity of migrating financial data and retraining staff can represent millions in costs, making loyalty a formidable barrier. Deluxe actively cultivates these deep customer relationships, further solidifying its position against potential challengers.

Access to Distribution Channels

Deluxe's ability to control access to its established distribution channels presents a significant barrier for potential new entrants. The company employs a sophisticated multi-channel strategy, reaching financial institutions, small and medium-sized businesses, and large global brands directly. This extensive network, built over years, makes it challenging for newcomers to secure comparable market reach and customer relationships.

Furthermore, Deluxe leverages strategic partnerships that further solidify its distribution advantage. These alliances provide access to customer bases and complementary services that new entrants would struggle to replicate quickly. For instance, in 2024, Deluxe continued to expand its partnerships within the fintech sector, integrating its solutions with emerging payment platforms, thereby deepening its market penetration.

- Established Distribution Networks: Deluxe's direct sales to financial institutions and businesses, coupled with its partnerships, create a formidable hurdle for new entrants seeking market access.

- Partner Ecosystem: The company's strategic alliances enhance its reach and offer integrated solutions, making it difficult for new competitors to gain traction.

- Customer Relationships: Years of service have fostered strong customer loyalty, which new entrants must overcome to establish their own distribution channels.

Regulatory and Legal Barriers

Regulatory and legal barriers significantly deter new entrants in the financial technology and data services space. Compliance with stringent data privacy laws, such as GDPR and CCPA, and evolving cybersecurity mandates demand substantial investment and expertise, which nascent companies may struggle to acquire. For instance, in 2024, the global regulatory technology market was valued at approximately $12.7 billion, highlighting the significant compliance overhead.

Deluxe's strategic focus on its DAX platform, which prioritizes privacy, compliance, and ethical AI, directly addresses these entry barriers. By embedding these principles into its core offerings, Deluxe positions itself favorably against potential competitors who may not have the resources or foresight to navigate complex regulatory landscapes. This proactive approach mitigates the threat of new entrants by increasing the cost and complexity of market entry.

- Regulatory hurdles: Navigating evolving data privacy and financial regulations is a significant cost and complexity factor.

- Licensing requirements: Obtaining necessary licenses in various jurisdictions can be time-consuming and capital-intensive.

- Compliance standards: Adhering to strict compliance standards, including those for AI and data security, requires ongoing investment and specialized knowledge.

- Deluxe's DAX platform: Its emphasis on privacy, compliance, and ethical AI acts as a deterrent to new competitors.

The threat of new entrants for Deluxe is generally moderate to low, primarily due to substantial barriers to entry. These include significant capital requirements for technology infrastructure and compliance, established economies of scale, strong brand loyalty, and high customer switching costs. Deluxe's extensive distribution networks and strategic partnerships further solidify its market position, making it difficult for newcomers to gain a foothold.

| Barrier Type | Impact on New Entrants | Deluxe's Advantage |

|---|---|---|

| Capital Requirements | High investment needed for technology and operations | Deluxe has established robust infrastructure, processing over $2 trillion in annual payment volume |

| Economies of Scale | New entrants struggle to match cost efficiencies | Deluxe leverages scale for lower per-unit costs and better supplier terms |

| Brand Loyalty & Switching Costs | Customers are hesitant to switch due to integration and data migration complexities | Deluxe fosters deep customer relationships and integrated solutions, making migration costly |

| Distribution Channels | Access to customers is challenging for new players | Deluxe has a direct sales force and strategic partnerships, including fintech integrations in 2024 |

| Regulatory Compliance | Navigating data privacy (e.g., GDPR, CCPA) and cybersecurity mandates is complex and costly | Deluxe's DAX platform prioritizes compliance, reducing risk for its customers and creating a higher bar for competitors |

Porter's Five Forces Analysis Data Sources

Our Deluxe Porter's Five Forces analysis is built on a robust foundation of data, incorporating proprietary market intelligence, extensive financial statement analysis, and insights from leading industry analysts. We also leverage government reports and trade association data to ensure a comprehensive and accurate assessment of competitive dynamics.