Delta Air Lines PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Air Lines Bundle

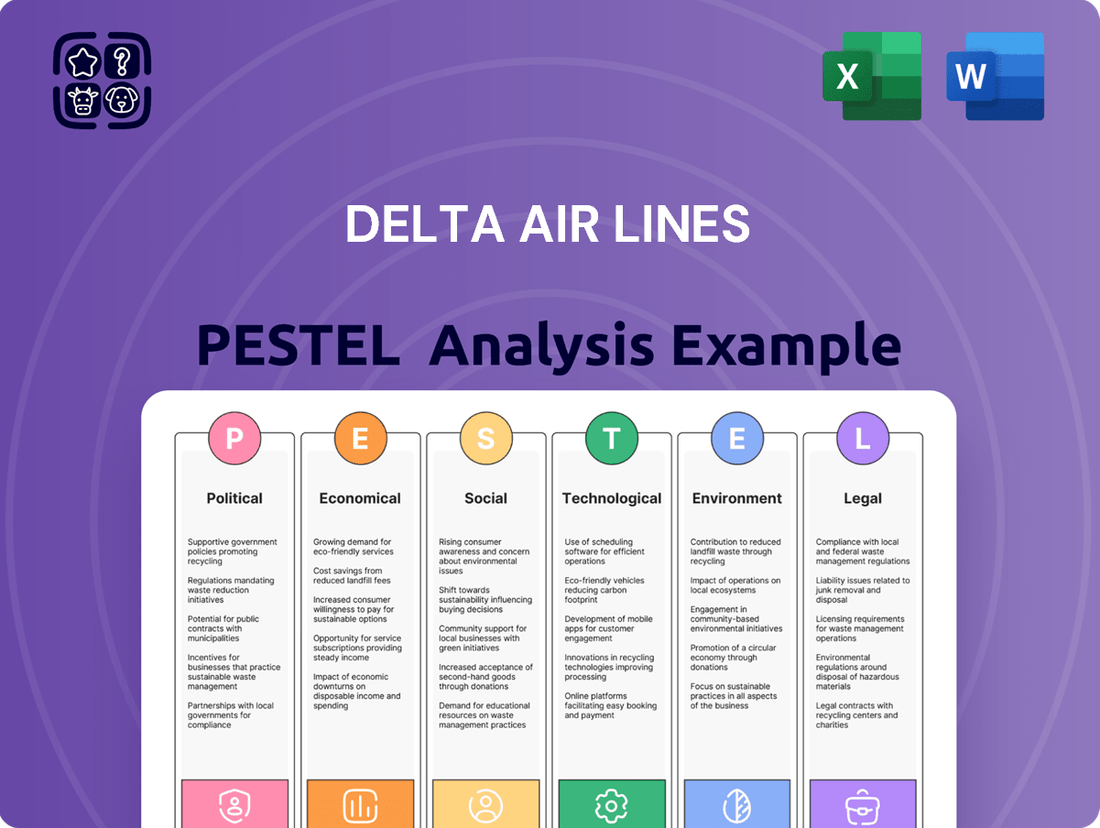

Navigate the complex external forces shaping Delta Air Lines's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors impacting the aviation giant. Gain a crucial competitive edge by leveraging these expert insights. Download the full analysis now to unlock actionable intelligence and refine your strategic planning.

Political factors

Delta Air Lines navigates a complex web of government regulations, with the Federal Aviation Administration (FAA) setting stringent safety and operational standards. For instance, the FAA's ongoing NextGen air traffic control modernization project, with significant investment continuing into 2024-2025, aims to improve efficiency but also requires substantial airline adaptation and investment.

Shifts in aviation policy, such as potential changes to airport slot allocations or new environmental regulations impacting emissions, directly affect Delta's ability to operate and grow. The airline industry's reliance on government infrastructure and policy makes it highly susceptible to these political winds.

Government decisions regarding public health, like travel advisories or quarantine requirements, have a profound impact. Following the COVID-19 pandemic, government responses continued to shape international travel patterns through 2024, influencing Delta's route profitability and passenger demand significantly.

Bilateral and multilateral air service agreements are crucial for Delta Air Lines, dictating its ability to fly to and from various countries. These agreements, like the Open Skies agreements, can significantly expand or limit Delta's international route network. For example, the ongoing discussions and potential revisions to existing air service agreements with key European partners in 2024 could impact Delta's transatlantic capacity and pricing strategies.

Changes in global trade relations or the renegotiation of these aviation pacts directly influence Delta's strategic planning. A more liberalized agreement might allow for increased frequencies or new destinations, boosting revenue potential. Conversely, protectionist measures could impose restrictions, forcing Delta to re-evaluate its international market presence and potentially cede market share to competitors operating under more favorable terms.

Delta's management must stay acutely aware of diplomatic shifts and trade policy developments. For instance, monitoring the progress of trade negotiations between the United States and China in 2024-2025 is vital, as any changes to aviation clauses within those broader agreements could directly affect Delta's Asia-Pacific operations, a key growth area for the airline.

Global political stability profoundly influences air travel demand and operational viability for Delta Air Lines, given its extensive international network. Heightened international tensions and regional conflicts directly impact passenger confidence and bookings, as seen with the ongoing geopolitical shifts affecting travel patterns in Eastern Europe and the Middle East.

Political unrest or conflicts can force route closures, increase operational costs due to enhanced security measures, and disrupt supply chains for aircraft maintenance and parts. For instance, the conflict in Ukraine has led to airspace closures and rerouting, adding significant operational complexity and cost for carriers operating in affected regions.

Delta must continuously assess geopolitical risks to ensure the safety of its operations and crew, a crucial factor in maintaining customer trust. The company's 2024 strategy, like those of its peers, includes robust contingency planning for such events, aiming to mitigate disruptions and maintain service continuity where feasible.

Government Subsidies and Support

Government subsidies and support programs significantly impact airlines like Delta, particularly during economic shocks. For instance, the U.S. government provided substantial aid to the airline industry through the CARES Act in 2020, totaling $54 billion, which included payroll support and loans. While this offered a lifeline, it often came with stipulations regarding stock buybacks, executive compensation, and operational adjustments.

These government interventions, while crucial for stability, can impose constraints on an airline's strategic flexibility. Conditions attached to aid packages might dictate fleet decisions, labor negotiations, or even influence environmental targets, shaping Delta's operational landscape. The ongoing evolution of such support, including potential future stimulus or regulatory changes, remains a key political variable for the industry's financial trajectory.

- CARES Act 2020: $54 billion in U.S. government aid to the airline industry.

- Conditional Support: Aid often linked to operational, labor, and environmental commitments.

- Economic Sensitivity: Government assistance is more likely during economic downturns and crises.

- Strategic Influence: Subsidies can shape long-term operational and financial decisions for airlines like Delta.

Taxation Policies on Aviation

Changes in government taxation policies, such as fuel taxes, carbon taxes, or corporate income taxes, directly influence Delta Air Lines' operating expenses and overall profitability. For instance, a hike in fuel taxes could significantly increase costs, impacting ticket prices and passenger demand.

Policy shifts focused on environmental sustainability, like escalating carbon emission levies, may compel Delta to adapt its operational strategies and invest more heavily in greener technologies. As of early 2024, discussions around a potential US federal carbon tax continue, which could add substantial costs for airlines if implemented.

The stability and predictability of tax regimes are vital for Delta's long-term financial planning and investment decisions. Uncertainty in tax policies can deter necessary capital expenditures in fleet modernization or sustainable aviation fuel (SAF) development.

Key taxation considerations for Delta include:

- Fuel Tax Impact: Fluctuations in fuel excise taxes directly affect operating costs. For example, a 10% increase in a specific state's aviation fuel tax could add millions to Delta's annual expenses.

- Carbon Tax Potential: The introduction or increase of carbon taxes, as seen in some international markets, could force Delta to incur significant new costs, potentially impacting its competitive pricing. For 2023, Delta's fuel expense was approximately $11.8 billion.

- Corporate Income Tax Rates: Changes in general corporate income tax rates, such as the US federal rate, directly affect Delta's net income and its ability to reinvest profits. Delta reported a net income of $4.1 billion for 2023.

Government regulations, particularly from the FAA, dictate Delta's safety and operational standards, with ongoing investments in air traffic control modernization continuing into 2024-2025. Policy shifts regarding airport slots or emissions directly influence Delta's growth, while public health directives continue to shape international travel demand, impacting route profitability as seen throughout 2024.

International air service agreements are critical for Delta's global reach, with potential revisions to agreements with European partners in 2024 impacting transatlantic capacity. Geopolitical stability is paramount, as regional conflicts in 2024, such as those affecting Eastern Europe and the Middle East, directly influence passenger confidence and bookings, increasing operational costs and forcing route adjustments.

Government subsidies, like the $54 billion CARES Act aid in 2020, provide crucial lifelines but often come with operational and financial stipulations. Taxation policies, including potential carbon taxes discussed in early 2024, directly affect operating expenses; for instance, Delta's fuel expenses were approximately $11.8 billion in 2023, and changes in corporate tax rates impact its net income, which was $4.1 billion in 2023.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting Delta Air Lines, examining political, economic, social, technological, environmental, and legal influences.

It offers actionable insights for strategic decision-making by identifying key trends and their potential effects on Delta's operations and market position.

A clear, actionable summary of Delta's PESTLE analysis, presented in an easily digestible format, removes the pain of sifting through complex data, enabling faster strategic decision-making.

Economic factors

Fuel price volatility is a significant concern for Delta Air Lines, as jet fuel represents a substantial portion of its operating expenses. Fluctuations in oil prices, driven by factors like geopolitical tensions and global supply, directly impact Delta's bottom line. For instance, in 2023, Delta reported fuel costs of approximately $13.7 billion, highlighting its sensitivity to these market swings.

The airline industry's reliance on petroleum-based fuels makes it particularly vulnerable to disruptions in energy markets. Rapid increases in fuel prices, such as those seen periodically due to international conflicts or production cuts, can squeeze profit margins if not effectively managed. Delta's strategic use of fuel hedging contracts is crucial for mitigating some of this financial risk, aiming to lock in prices and provide greater cost predictability.

Delta's capacity to absorb or pass on higher fuel costs to its customers is a key determinant of its competitive standing and financial health. If fuel prices surge and Delta cannot adequately increase ticket prices without losing market share, its profitability will suffer. Conversely, periods of lower fuel prices can provide a significant boost to earnings, as observed in some quarters of 2023 where fuel costs were lower than anticipated.

Delta Air Lines' financial performance is intrinsically tied to global economic expansion and the willingness of consumers to spend on travel. As the global economy strengthens, we see a natural uptick in both business and leisure travel demand. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight acceleration from 2023, signaling a more favorable environment for airlines.

During economic upswings, individuals and corporations are more likely to allocate resources towards air travel, directly benefiting Delta's passenger volumes and revenue. This increased demand allows airlines to implement more effective yield management strategies, potentially leading to higher ticket prices and improved profitability.

Conversely, economic slowdowns or recessions present significant headwinds. Reduced disposable income and corporate budget cuts often translate to decreased travel spending. For example, a significant global recession could see passenger numbers drop, forcing Delta to adjust capacity and pricing to mitigate losses, impacting its overall network performance.

Delta Air Lines, as a global carrier, is significantly exposed to exchange rate fluctuations. A stronger US dollar can reduce the value of foreign earnings when repatriated, while a weaker dollar can increase the cost of operations and debt held in foreign currencies.

For instance, in the first quarter of 2024, Delta reported foreign currency headwinds impacting its pre-tax income by $10 million, highlighting the immediate financial impact of these movements. Managing these currency risks through hedging strategies is crucial for maintaining profitability and financial stability.

Interest Rates and Capital Access

Delta Air Lines, like many large carriers, needs significant capital for fleet upgrades, route expansion, and airport facility improvements. This often means taking on debt. For instance, in Q1 2024, Delta reported total debt of $21.7 billion, highlighting its reliance on borrowing.

Fluctuations in interest rates directly impact the cost of this debt. Higher rates make borrowing more expensive, potentially delaying or scaling back major capital expenditures. Conversely, lower rates can make investments more attractive.

Access to credit markets on favorable terms is crucial for Delta's strategic growth and overall financial health. The ability to secure loans at competitive rates directly influences the profitability and sustainability of its long-term plans.

- Fleet Modernization Costs: Delta's ongoing investment in newer, more fuel-efficient aircraft, such as the Airbus A321neo, requires substantial upfront capital.

- Impact of Federal Reserve Policy: Changes in the Federal Reserve's benchmark interest rate directly influence the cost of Delta's variable-rate debt and the terms for new issuances.

- Debt Financing Landscape: In early 2024, the airline industry faced a challenging debt market, with higher borrowing costs impacting capital access for major players like Delta.

- Strategic Investment Decisions: Interest rate levels are a key consideration when Delta evaluates the financial viability of expanding its network or upgrading its airport infrastructure.

Competitive Market Dynamics and Pricing Pressure

The airline industry is a battleground of intense competition, with legacy carriers and nimble low-cost airlines constantly vying for passenger attention. Delta must remain agile, constantly tweaking its pricing, loyalty programs, and service to win and keep customers. This competitive pressure is amplified by economic shifts, as travelers become more budget-conscious during economic slowdowns, directly affecting Delta's revenue generation metrics like revenue per available seat mile.

In 2024, the airline sector continues to grapple with this dynamic. For instance, the average domestic airfare in the U.S. saw fluctuations throughout the year, influenced by fuel costs and competitive pricing actions. Delta's strategy often involves balancing premium offerings with competitive fares on key routes to mitigate the impact of price wars.

- Delta faces pressure from both established airlines and budget carriers, necessitating flexible pricing strategies.

- Economic downturns heighten consumer price sensitivity, directly impacting revenue metrics like yield.

- Adaptability in service offerings and loyalty programs is crucial for customer retention in this competitive landscape.

- The ongoing battle for market share means continuous evaluation of pricing against competitors' moves.

Economic factors significantly influence Delta Air Lines' performance, with global growth projections directly impacting travel demand. The IMF's forecast of 3.2% global growth for 2024 suggests a supportive environment for increased passenger volumes and revenue. Conversely, economic downturns can lead to reduced consumer spending on travel, forcing Delta to adjust capacity and pricing strategies to mitigate potential losses.

Full Version Awaits

Delta Air Lines PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Delta Air Lines PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the airline's operations and strategic planning.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain immediate access to an in-depth examination of how global trends and regulations shape Delta's competitive landscape and future growth opportunities.

The content and structure shown in the preview is the same document you’ll download after payment. It provides actionable insights into market dynamics, consumer behavior, and regulatory challenges, essential for understanding Delta's strategic positioning.

Sociological factors

Consumer travel preferences are in constant flux, with a growing emphasis on sustainable travel options, highly personalized experiences, and flexible booking policies. For instance, a 2024 survey indicated that over 60% of travelers consider sustainability when choosing an airline.

Delta Air Lines needs to respond by adjusting its service offerings, cabin designs, and digital interfaces to align with these evolving demands. This includes appealing to leisure travelers looking for good value and business travelers who prioritize speed and comfort.

In 2024, Delta reported a significant increase in demand for premium economy seats, reflecting a desire for enhanced comfort, even among leisure travelers. Staying attuned to these shifts is crucial for retaining customer loyalty and market share.

Global demographic shifts, such as an aging population in developed nations and a growing middle class in emerging economies, directly impact air travel demand. For instance, by 2025, the global population is projected to exceed 8 billion, with a significant portion of this growth concentrated in Asia and Africa, creating new travel markets for airlines like Delta.

Urbanization trends also play a crucial role, as more people moving to cities often leads to increased business and leisure travel. In 2024, over 57% of the world's population lives in urban areas, a figure expected to rise, potentially boosting demand for connecting flights and services between major metropolitan hubs that Delta serves.

Delta must adapt its network and services to these evolving demographics. As the global middle class expands, reaching an estimated 5.4 billion people by 2030, this segment represents a significant opportunity for increased passenger volume, requiring tailored offerings and accessible pricing strategies.

Public perception of health and safety is a critical driver for air travel demand. Following global health events, travelers are more attuned to airline safety measures. Delta Air Lines' commitment to rigorous cleaning protocols and clear communication about these practices directly influences passenger confidence. For instance, in 2023, Delta reported a significant increase in passenger satisfaction scores, with many citing the airline's visible safety efforts as a key factor.

Labor Relations and Workforce Dynamics

Delta Air Lines relies heavily on its employees, from pilots to ground crews. The airline's success hinges on maintaining positive labor relations and ensuring a steady supply of skilled workers. In 2024, Delta's approximately 95,000 employees are a vital asset, and managing their needs is paramount.

Labor relations are a significant sociological consideration. Ongoing negotiations with unions, such as those representing Delta's pilots and flight attendants, can impact operational costs and service continuity. The availability of qualified personnel, particularly in specialized roles, also presents a continuous challenge.

Employee morale, fair compensation, and safe working conditions are directly linked to Delta's performance. For instance, high employee morale can translate to better customer service and reduced operational disruptions. In 2023, Delta reported a significant increase in profit sharing for its employees, a move aimed at boosting morale and retention.

- Skilled Workforce Dependency: Delta's operations, including flight safety and customer experience, are directly tied to the performance of its pilots, flight attendants, and ground staff.

- Unionized Workforce: A substantial portion of Delta's workforce is unionized, making labor relations and collective bargaining critical for operational stability.

- Employee Morale and Retention: Factors like compensation, benefits, and working conditions significantly impact employee morale, which in turn affects service quality and the airline's ability to retain talent.

- Talent Availability: The airline industry faces ongoing challenges in attracting and retaining qualified personnel, especially pilots and mechanics, creating a competitive labor market.

Social Media and Brand Reputation

The pervasive influence of social media means that customer experiences, both positive and negative, can rapidly shape Delta's brand reputation. In 2024, airlines are increasingly scrutinized online, with platforms like X (formerly Twitter) and Instagram becoming key battlegrounds for public perception. A single viral complaint can reach millions, impacting booking decisions far more than traditional advertising.

Online reviews and influencer opinions significantly impact public perception. For instance, a study in early 2025 indicated that over 70% of travelers consider online reviews before booking flights. Delta must actively manage its online presence, engaging with customers on social platforms and responding effectively to feedback to protect and enhance its brand image.

- Social Media Reach: Delta's official social media channels boast millions of followers across platforms like X, Instagram, and Facebook, making them powerful tools for direct customer engagement and brand messaging.

- Customer Sentiment Monitoring: Advanced analytics tools are employed by Delta to track brand mentions and sentiment across social media, allowing for rapid response to emerging issues.

- Influencer Marketing: Collaborations with travel influencers in 2024 and 2025 have been utilized to showcase new routes and services, reaching a broader, engaged audience.

- Crisis Communication: Social media plays a critical role in Delta's crisis communication strategy, enabling swift dissemination of information during disruptions.

Societal values are shifting, with a greater emphasis on personalized travel experiences and flexible booking options, as evidenced by a 2024 survey showing over 60% of travelers prioritizing sustainability. Delta's strategy must incorporate these evolving preferences, catering to both budget-conscious leisure travelers and those seeking comfort and speed, like the increasing demand for premium economy seats observed in 2024.

Demographic changes, such as a growing global middle class projected to reach 5.4 billion by 2030 and increasing urbanization, create new travel markets and demand for connectivity. Delta must adapt its network and services to capitalize on these trends, ensuring tailored offerings and accessible pricing strategies to serve a diverse and expanding passenger base.

Public health and safety perceptions remain paramount, with rigorous cleaning protocols and clear communication, like Delta's visible safety efforts in 2023 that contributed to increased passenger satisfaction, directly influencing passenger confidence and travel decisions.

Technological factors

Delta Air Lines is significantly impacted by ongoing innovations in aircraft design, materials, and engine technology. These advancements directly influence operational costs and the company's environmental footprint. For instance, the introduction of more fuel-efficient aircraft, like the Airbus A321neo, can reduce fuel consumption by up to 15% compared to older models.

Investing in these new, more fuel-efficient aircraft models is crucial for Delta, as it directly lowers operating expenses and aids in meeting increasingly stringent sustainability targets. By reducing fuel burn, Delta can improve its bottom line and also contribute to lower carbon emissions, a key factor for environmentally conscious consumers and investors.

To remain competitive and environmentally responsible, Delta must continuously evaluate and integrate these technological advancements into its fleet strategy. This includes considering the lifecycle costs of new aircraft, the availability of sustainable aviation fuels, and the potential for future technological disruptions in air travel.

Delta's commitment to digital transformation is evident in its customer experience enhancements. In 2024, the airline continued to invest heavily in its mobile app, which saw a significant increase in usage for booking, check-in, and managing travel itineraries. This focus on digital touchpoints aims to provide a seamless and personalized journey for every passenger.

The airline is actively deploying technologies like biometric boarding at select airports, aiming to reduce wait times and improve security efficiency. Furthermore, Delta's in-flight entertainment systems are increasingly offering personalized content recommendations, reflecting a growing trend in leveraging data to cater to individual passenger preferences. These advancements are critical for staying competitive in an era where digital convenience is paramount for travelers.

Delta Air Lines is increasingly integrating Artificial Intelligence (AI) and big data analytics to refine its operations. These technologies are pivotal for optimizing dynamic pricing strategies, ensuring competitive fares while maximizing revenue. For instance, in 2024, airlines continued to see significant revenue uplift from sophisticated pricing algorithms that adjust in real-time based on demand, seasonality, and competitor pricing.

Predictive maintenance, powered by AI, allows Delta to anticipate aircraft component failures before they occur. This proactive approach, which analyzes vast amounts of sensor data from aircraft, helps minimize costly flight disruptions and enhances safety. By reducing unscheduled maintenance, Delta can improve aircraft utilization and on-time performance, key metrics for customer satisfaction and operational efficiency.

Furthermore, AI and data analytics are transforming route planning and personalized marketing efforts. By analyzing passenger booking patterns, travel preferences, and market demand, Delta can optimize its network for greater profitability and customer convenience. In 2025, personalized offers and loyalty program enhancements driven by deep customer data insights are expected to be a major differentiator, fostering stronger customer relationships and driving repeat business.

Sustainable Aviation Fuels (SAFs) and Electric/Hybrid Aircraft

The aviation industry is undergoing a significant technological transformation with the rise of Sustainable Aviation Fuels (SAFs) and the development of electric and hybrid aircraft. These innovations are key to decarbonizing air travel and meeting stringent environmental goals. Delta Air Lines is actively investing in SAFs, aiming for 10% of its fuel consumption to be SAF by 2030, a commitment that underscores the growing importance of these greener alternatives.

The airline is also closely watching advancements in electric and hybrid propulsion systems, which promise to further reduce emissions and noise pollution. This strategic focus on alternative technologies is vital for Delta to remain competitive and compliant with evolving regulations and customer expectations for sustainable travel.

- SAF Adoption: Delta aims for 10% SAF usage by 2030, aligning with industry-wide decarbonization efforts.

- Technological Advancements: Monitoring progress in electric and hybrid aircraft propulsion is crucial for future fleet planning.

- Environmental Impact: These technologies are central to achieving net-zero carbon emissions targets in aviation.

Cybersecurity and Data Protection

Cybersecurity and data protection are paramount for Delta Air Lines, given its extensive reliance on digital platforms for everything from flight operations to customer bookings. The airline industry, handling vast amounts of personal and financial data, is a prime target for cyberattacks. In 2023, the aviation sector globally saw a significant increase in cyber threats, with ransomware and data breaches being major concerns.

Delta's commitment to robust cybersecurity is therefore not just a matter of compliance but a critical component of maintaining operational continuity and safeguarding passenger trust. Breaches could lead to substantial financial penalties, reputational damage, and disruption of services, impacting millions of travelers.

To counter these evolving risks, Delta continuously invests in advanced security technologies and protocols. This includes sophisticated threat detection systems, data encryption, and regular security audits. For instance, in 2024, many leading airlines are enhancing their security posture by adopting AI-driven threat intelligence platforms to proactively identify and neutralize potential cyber threats before they can impact operations or customer data.

- Increased Cyber Threats: The aviation sector experienced a notable rise in cyberattacks in 2023, with data breaches and ransomware posing significant risks.

- Data Protection Imperative: Protecting sensitive passenger information and ensuring the integrity of operational systems are crucial for maintaining customer trust and avoiding severe financial and reputational damage.

- Continuous Investment: Delta's ongoing investment in advanced security technologies, including AI-powered threat detection, is essential to mitigate the ever-evolving landscape of cyber risks.

Technological advancements are reshaping Delta's operations and customer experience. The airline's investment in more fuel-efficient aircraft, such as the Airbus A321neo, directly reduces operational costs and environmental impact, with these models offering up to a 15% fuel saving over older aircraft.

Delta is leveraging AI and big data analytics for dynamic pricing and predictive maintenance, aiming to optimize revenue and minimize disruptions. For example, AI-driven pricing algorithms are crucial for adjusting fares in real-time based on demand, while predictive maintenance enhances aircraft reliability and on-time performance.

The airline is also prioritizing cybersecurity, investing in advanced threat detection systems to protect vast amounts of passenger data and ensure operational continuity, especially given the significant increase in cyber threats faced by the aviation sector in 2023.

Furthermore, Delta's focus on digital transformation, including its mobile app and biometric boarding initiatives, aims to enhance customer convenience and operational efficiency, reflecting a broader industry trend towards personalized digital travel experiences.

Legal factors

Delta Air Lines operates under stringent antitrust and competition laws, which are crucial for maintaining a fair marketplace and preventing monopolistic practices. These regulations directly impact Delta's ability to pursue growth through mergers, acquisitions, or strategic partnerships, as each potential deal faces intense scrutiny from regulatory bodies. For instance, the U.S. Department of Justice and the Department of Transportation closely monitor airline industry consolidation to ensure consumer benefits are preserved.

Delta Air Lines operates under a complex web of passenger rights regulations that dictate how it handles disruptions. These rules, which differ significantly across regions like the United States, Europe, and Canada, cover compensation for delays, cancellations, and denied boarding, as well as baggage liability limits. For instance, the U.S. Department of Transportation mandates specific compensation for overbooked flights, and in 2023, airlines paid out over $200 million in refunds for significantly delayed or canceled flights, impacting carriers like Delta.

Compliance with these passenger rights directly shapes Delta's operational procedures and customer service strategies, influencing everything from staffing levels during peak travel times to the communication protocols for flight changes. Failure to adhere to these mandates can result in substantial fines and damage to the airline's reputation. For example, the EU's Regulation (EC) No 261/2004 allows passengers to claim up to €600 for significant flight delays or cancellations, a financial consideration Delta must factor into its risk management and operational planning.

Delta Air Lines operates under a stringent framework of federal and state labor laws, dictating everything from minimum wage and overtime to workplace safety and anti-discrimination. Navigating these regulations is a constant operational requirement.

With a significant portion of its employees represented by unions, including the International Association of Machinists and Aerospace Workers (IAM) for mechanics and the Air Line Pilots Association (ALPA) for pilots, Delta is deeply involved in collective bargaining. These negotiations, which can span months or even years, directly impact labor costs and operational flexibility. For instance, recent contract discussions in 2024 with its pilots aimed to secure improved compensation and working conditions.

Maintaining compliance with labor statutes and fostering constructive relationships with its unions are paramount for Delta's operational continuity. Disputes or prolonged negotiations can lead to disruptions, impacting flight schedules and financial performance, as seen in past labor actions across the airline industry.

Data Privacy and Protection Regulations

Delta Air Lines, like all major corporations, navigates a complex web of data privacy and protection regulations. The General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) are prime examples, imposing strict requirements on how Delta collects, processes, and stores customer data. Failure to comply can result in substantial financial penalties; for instance, GDPR fines can reach up to 4% of global annual revenue or €20 million, whichever is higher.

Adherence to these laws necessitates significant investment in robust data security infrastructure, transparent privacy policies readily accessible to customers, and secure data storage solutions. Delta's commitment to protecting passenger information is not just a legal obligation but also a critical component of maintaining customer trust and avoiding severe reputational damage. In 2023, data breaches continued to be a significant concern across industries, underscoring the importance of proactive compliance measures.

- GDPR Fines: Up to 4% of global annual revenue or €20 million.

- CCPA Impact: Grants California consumers rights regarding their personal data.

- Reputational Risk: Data breaches can severely damage customer trust and brand image.

- Investment in Security: Ongoing need for advanced data protection technologies and practices.

International Aviation Laws and Treaties

Delta's extensive international flight network means it must navigate a complex landscape of aviation laws and treaties. Key among these are agreements like the Montreal Convention, which governs passenger liability and compensation for incidents, and the Chicago Convention, which sets standards for international air navigation. These frameworks are critical for Delta to maintain its legal right to fly across borders and operate seamlessly in different countries.

Compliance with these international legal structures is not optional; it's fundamental to Delta's global operations. It ensures the airline maintains its legal standing in foreign jurisdictions, allowing it to secure and retain the necessary operational licenses for international routes. For instance, adherence to ICAO (International Civil Aviation Organization) standards, influenced by treaties, is vital for flight safety certifications worldwide.

Failure to comply with these international aviation laws can have significant repercussions. Penalties can range from substantial fines to the grounding of flights, leading to severe operational disruptions and damage to Delta's reputation. As of 2024, the International Air Transport Association (IATA) continues to emphasize the importance of harmonized international regulations to facilitate global air travel, underscoring the ongoing need for airlines like Delta to remain vigilant in their legal adherence.

- Montreal Convention: Governs passenger liability and compensation for international carriage by air.

- Chicago Convention: Establishes principles for international air navigation and the creation of ICAO.

- ICAO Standards: Critical for safety certifications and operational licenses in over 193 member states.

- IATA's Role: Continues to advocate for regulatory harmonization to support global aviation growth.

Delta Air Lines must navigate a complex legal environment, including antitrust laws that scrutinize mergers and acquisitions to prevent monopolies, ensuring fair competition within the airline industry.

Strict passenger rights regulations, varying by region, mandate compensation for delays and cancellations, influencing Delta's operational planning and customer service protocols.

Labor laws and union agreements significantly impact Delta's operational costs and flexibility, with ongoing negotiations, such as those with pilots in 2024, shaping employee relations and compensation.

Data privacy laws like GDPR and CCPA require substantial investment in security and transparent policies, with non-compliance leading to significant fines, underscoring the importance of protecting customer information.

Environmental factors

The airline sector, including Delta Air Lines, is under intense scrutiny to curb carbon emissions due to escalating climate change worries. Stricter regulations are being implemented globally, pushing companies to adapt.

Delta must comply with international frameworks like CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation), which aims to stabilize net carbon emissions from 2019 levels. For 2024, CORSIA will continue to be a key driver for emission management.

Achieving these emission reduction goals necessitates substantial financial commitments. Delta is investing in sustainable aviation fuels (SAFs), which are crucial for decarbonization, and is also modernizing its fleet with more fuel-efficient aircraft. These investments are vital to minimize environmental impact and steer clear of financial penalties associated with non-compliance.

Delta's operations are significantly impacted by noise pollution restrictions, especially around busy airports. These regulations often dictate flight times, particularly during nighttime hours, to reduce disturbance to nearby residents. For instance, many airports have curfews from 11 PM to 6 AM, directly affecting Delta's ability to schedule late-night or early-morning departures and arrivals.

To comply, Delta must invest in and utilize quieter aircraft technologies. The airline's fleet modernization efforts, including the introduction of newer, more fuel-efficient, and quieter models like the Airbus A220, are crucial in meeting these evolving environmental standards. These newer aircraft can significantly reduce noise footprints compared to older models, helping Delta maintain operational flexibility.

Failure to adhere to these noise limits can lead to substantial fines and strained community relations, potentially impacting airport access. Delta's commitment to noise abatement programs, which often involve adjusting flight paths and operational procedures, is essential for maintaining its social license to operate and ensuring long-term sustainability in its key markets.

Airlines, including Delta, produce significant waste from their operations, encompassing everything from passenger service items to maintenance byproducts. This waste stream is under growing regulatory pressure, pushing companies to adopt more sustainable practices.

Delta Air Lines, like its peers, is navigating stricter rules on waste management. These often include targets for recycling, phasing out single-use plastics, and ensuring proper disposal of potentially harmful materials. For instance, by the end of 2023, Delta reported diverting over 60% of its inflight waste from landfills through its various recycling and donation programs.

Effectively managing and reducing waste, alongside robust recycling initiatives, is becoming a core environmental imperative for Delta. The airline has set goals to reduce its overall waste generation by 25% by 2030 compared to a 2019 baseline, demonstrating a commitment to this area.

Climate Change Impacts on Operations

Climate change presents significant operational challenges for Delta Air Lines. The increasing frequency and intensity of extreme weather events, such as hurricanes and severe thunderstorms, can lead to flight cancellations, delays, and rerouting, impacting punctuality and passenger satisfaction. For instance, the 2023 Atlantic hurricane season saw numerous disruptions across the southeastern United States, a key operational hub for Delta.

Rising sea levels pose a long-term threat to coastal airport infrastructure. Airports in low-lying areas may face increased risks of flooding, requiring substantial investment in protective measures and potentially impacting access and operations. Changes in atmospheric conditions, including altered jet streams, can also affect flight efficiency. Delta, like other carriers, must adapt to these shifts, which could lead to longer flight times and increased fuel consumption.

- Increased Turbulence: Reports indicate a rise in clear-air turbulence, leading to passenger discomfort and potential flight path adjustments.

- Airport Vulnerability: Coastal airports, critical for Delta's network, face heightened risks from sea-level rise and storm surges.

- Operational Adaptations: Delta is investing in predictive weather modeling and flexible scheduling to mitigate disruptions caused by climate-related events.

- Fuel Efficiency Goals: The airline continues to focus on fuel efficiency, partly driven by the need to manage costs associated with climate-influenced operational changes.

Public Pressure for Sustainable Practices and ESG Reporting

Delta Air Lines, like its peers, is navigating intense public and investor scrutiny regarding its environmental, social, and governance (ESG) performance. Stakeholders are not just looking for claims but for concrete evidence of sustainability, demanding transparent ESG reporting and measurable commitments to reducing its carbon footprint.

This pressure translates into a need for Delta to actively showcase its efforts in areas like fleet modernization for fuel efficiency and sustainable aviation fuel (SAF) adoption. For instance, Delta's commitment to investing in SAF aims to reduce lifecycle greenhouse gas emissions by at least 25% by 2030 compared to conventional jet fuel. This proactive stance is crucial for bolstering brand image, attracting a growing segment of environmentally aware travelers, and maintaining investor trust in a rapidly evolving market.

- Public Demand for Transparency: Consumers and investors are increasingly scrutinizing corporate environmental impact, pushing airlines to disclose detailed ESG metrics.

- Investor Confidence: Strong ESG performance is becoming a key factor for institutional investors, influencing capital allocation and company valuations.

- Brand Reputation: Demonstrating a genuine commitment to sustainability can differentiate Delta, fostering loyalty among environmentally conscious customers.

- Regulatory Alignment: Growing public pressure often precedes stricter environmental regulations, making proactive sustainability measures a strategic advantage.

Delta Air Lines faces significant environmental pressures, primarily concerning carbon emissions and operational sustainability. The airline industry is under a microscope to reduce its climate impact, with global regulations like CORSIA setting targets for stabilizing net carbon emissions from 2019 levels. Delta's strategy involves substantial investment in sustainable aviation fuels (SAFs) and fleet modernization with fuel-efficient aircraft to meet these mandates and avoid penalties.

Noise pollution regulations also directly affect Delta's flight scheduling, particularly at busy airports with nighttime curfews. To comply, the airline is investing in quieter aircraft technologies, such as the Airbus A220, which significantly reduce noise footprints. Effective waste management, including recycling and phasing out single-use plastics, is another critical focus, with Delta aiming to reduce overall waste generation by 25% by 2030 from a 2019 baseline.

Climate change itself poses operational risks, with increased extreme weather events causing delays and cancellations. Delta must also consider the long-term impact of rising sea levels on coastal airport infrastructure and adapt to altered atmospheric conditions that can affect flight efficiency. Public and investor scrutiny of ESG performance is intensifying, pushing Delta to demonstrate concrete sustainability efforts and transparent reporting to maintain brand reputation and investor confidence.

| Environmental Factor | Delta's Action/Challenge | Data/Target |

| Carbon Emissions | Investment in SAFs, fleet modernization | Aiming for 25% reduction in lifecycle GHG emissions from SAFs by 2030 (vs. conventional fuel) |

| Noise Pollution | Utilizing quieter aircraft, adjusting flight paths | Introduction of models like Airbus A220 |

| Waste Management | Recycling programs, reducing single-use plastics | Target: 25% reduction in waste generation by 2030 (vs. 2019 baseline) |

| Climate Change Impacts | Adapting to extreme weather, sea-level rise | Investing in predictive weather modeling, flexible scheduling |

| ESG Scrutiny | Transparent reporting, sustainability commitments | Public demand for detailed ESG metrics |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Delta Air Lines is built on a robust foundation of data from official government aviation authorities, international economic organizations, and leading industry research firms. This ensures comprehensive coverage of political stability, economic forecasts, technological advancements, and regulatory changes impacting the airline sector.