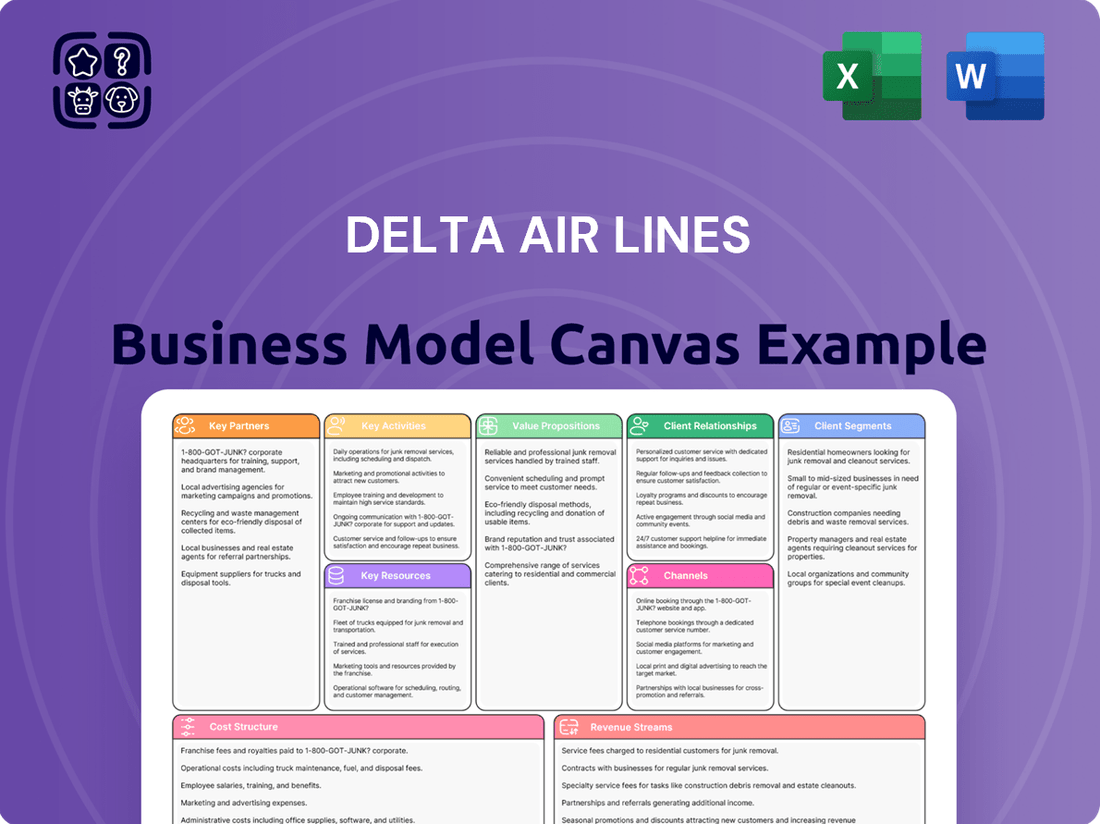

Delta Air Lines Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Air Lines Bundle

Unlock the strategic blueprint behind Delta Air Lines's success with our comprehensive Business Model Canvas. This in-depth analysis reveals how Delta leverages its key partnerships, customer relationships, and value propositions to dominate the airline industry. Discover the core activities and revenue streams that fuel their growth.

Ready to dissect Delta's winning strategy? Our full Business Model Canvas offers a detailed, section-by-section breakdown, showcasing their customer segments, cost structure, and key resources. Download the complete, professionally crafted document to gain actionable insights for your own business endeavors.

Partnerships

Delta Air Lines is a founding member of the SkyTeam alliance, a global network that significantly broadens its operational reach and customer accessibility. This alliance allows Delta to offer a more extensive route network than it could achieve alone, connecting passengers to a vast array of destinations worldwide.

Through strategic joint ventures, Delta enhances its service offerings and strengthens its market position. Key partnerships include those with Aeromexico, Air France-KLM, Korean Air, LATAM, Virgin Atlantic, and WestJet. These collaborations are crucial for providing customers with more travel options and smoother connections, especially across major international markets like North America, Transatlantic, and Transpacific regions.

Delta's strategic alliance with American Express forms the backbone of its SkyMiles loyalty program, driving significant income through co-branded credit cards. This partnership not only generates substantial revenue but also deepens customer engagement by offering exclusive benefits and pathways to earn elite status.

The financial impact of this collaboration is considerable, with American Express remuneration alone hitting a new high of $2 billion in the first quarter of 2025, underscoring the program's value.

Delta collaborates with tech giants like Google to refine customer offers across all touchpoints and boost operational effectiveness. This partnership is crucial for leveraging data to personalize experiences and streamline backend processes.

The airline is actively developing its New Distribution Capability (NDC) solution alongside key industry players such as Accelya, Airlines Reporting Corp., and the International Air Transport Association (IATA). This strategic move is designed to modernize how travel is booked and sold, aiming for a more integrated and enhanced digital journey for customers.

Maintenance, Repair, and Overhaul (MRO) Clients

Delta TechOps, Delta Air Lines' dedicated maintenance, repair, and overhaul (MRO) division, extends its specialized services beyond the airline's own vast fleet to a significant roster of third-party clients. This strategic diversification allows Delta to capitalize on its extensive technical capabilities and infrastructure.

Key partnerships in this MRO segment are crucial for revenue generation and operational efficiency. For example, Delta TechOps secured a notable 10-year contract with UPS Airlines to provide maintenance for the PW2037 engines powering their Boeing 757 fleet. Such agreements underscore the trust and reliability placed in Delta's MRO expertise by major aviation players.

- Delta TechOps' third-party MRO services contribute significantly to Delta Air Lines' overall revenue.

- Long-term contracts, like the one with UPS Airlines for PW2037 engine maintenance, demonstrate the value and demand for Delta's technical capabilities.

- Serving external clients allows Delta to optimize the utilization of its maintenance facilities and skilled workforce, thereby enhancing operational leverage.

Sustainability and Operational Partners

Delta Air Lines actively cultivates key partnerships to advance its sustainability goals and enhance operational efficiency. These collaborations are crucial for scaling innovative solutions and meeting ambitious environmental targets.

In the realm of Sustainable Aviation Fuel (SAF), Delta partners with fuel producers such as Flint Hills Resources. This collaboration is vital for increasing the availability of SAF, a key component in Delta's strategy to reduce its carbon footprint. For instance, in 2023, Delta announced plans to purchase up to 450 million gallons of SAF from a joint venture between TPG Rise Fund and Northwest Renewables, aiming to significantly boost its SAF usage.

Furthermore, Delta collaborates with leading aerospace and research organizations like Boeing and NASA. A prime example is their involvement in the Sustainable Flight Demonstrator (X-66) program. This initiative focuses on developing and testing advanced, fuel-saving technologies designed to make aircraft more efficient, thereby contributing to lower emissions and operating costs. These partnerships are instrumental in driving technological advancements within the aviation industry.

- SAF Production Scaling: Partnerships with fuel producers like Flint Hills Resources are essential for increasing the supply of Sustainable Aviation Fuel.

- Technology Development: Collaborations with Boeing and NASA on programs like the X-66 Sustainable Flight Demonstrator aim to develop fuel-saving aircraft technologies.

- Environmental Commitment: These strategic alliances underscore Delta's dedication to reducing its environmental impact and achieving operational efficiencies through innovation.

Delta's key partnerships are vital for its global reach and customer loyalty. Its membership in the SkyTeam alliance and joint ventures with airlines like Aeromexico and Air France-KLM expand its network and enhance travel options. The significant revenue generated from its American Express co-branded credit cards, with American Express remuneration reaching $2 billion in Q1 2025, highlights the strength of this financial partnership.

Collaborations with tech companies such as Google improve customer experience and operational efficiency. Furthermore, partnerships with MRO providers like UPS Airlines for engine maintenance showcase Delta TechOps' expertise and generate additional revenue streams. These alliances are crucial for Delta's strategic growth and market competitiveness.

What is included in the product

This Delta Air Lines Business Model Canvas outlines its strategy for connecting global travelers through a vast network, leveraging a strong loyalty program and premium services to capture value from diverse customer segments.

It details Delta's operational efficiency, key partnerships, and cost structure, providing a clear framework for understanding its competitive advantages and revenue streams in the airline industry.

Delta Air Lines' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their core components, enabling quick identification of operational efficiencies and potential areas for improvement.

This structured approach allows Delta to effectively brainstorm and adapt strategies, relieving the pain of complex planning by condensing their entire airline operation into a digestible and shareable format.

Activities

Delta's core activity is managing its extensive scheduled passenger air transportation network, connecting millions of travelers across the globe. This involves meticulously planning and executing flights to diverse destinations on six continents, ensuring efficient routes and optimal capacity utilization to meet fluctuating passenger demand. In 2024, Delta operated over 4,000 flights daily, serving over 200 million passengers annually, highlighting the sheer scale of this key activity.

Delta Air Lines’ cargo air transportation services are a vital part of its operations, leveraging its vast global network to move freight and mail. This segment is a significant contributor to the airline's revenue diversification, demonstrating strong growth potential beyond its core passenger business.

In 2024, Delta Cargo has been actively enhancing its digital presence, notably through strategic collaborations with platforms like cargo.one. This move aims to streamline booking processes and expand reach, reflecting a commitment to modernizing its cargo sales capabilities and capturing a larger share of the evolving air freight market.

Delta TechOps is a cornerstone of Delta's operations, providing extensive maintenance, repair, and overhaul (MRO) services not only for Delta's vast fleet but also for external airline and aviation clients. This dual role highlights a significant revenue stream and operational efficiency driver.

Specializing in critical areas like engine overhauls, airframe structural integrity, and complex component services, TechOps ensures the airworthiness and longevity of aircraft. These specialized capabilities are vital for maintaining safety and operational readiness across the aviation sector.

Delta's strategic investments in its MRO capabilities have yielded tangible results, notably a reduction in maintenance-related flight cancellations. In 2023, Delta reported that its MRO segment generated $2.6 billion in revenue, with a growing portion coming from third-party contracts, demonstrating its expanding market presence and profitability.

Loyalty Program and Customer Experience Management

Delta's key activities center on managing and enhancing its SkyMiles loyalty program, a critical driver of customer retention and engagement. This involves strategic decisions on Medallion status tiers, Sky Club access rules, and the array of member perks designed to incentivize repeat business.

A significant focus is placed on elevating the customer journey through technological advancements. For instance, the Delta Sync App aims to provide a seamless digital experience, complemented by AI-powered support and ongoing improvements in operational areas like baggage tracking and in-cabin comfort.

- SkyMiles Program Management: Defining Medallion status tiers, Sky Club access, and member benefits to foster loyalty.

- Customer Experience Enhancement: Investing in technology like the Delta Sync App and AI assistants for a smoother travel experience.

- Operational Improvements: Continuously upgrading services such as baggage handling and cabin amenities.

Fleet Modernization and Sustainability Initiatives

Delta Air Lines is actively upgrading its fleet by introducing newer, more fuel-efficient aircraft, such as the Airbus A321neo, A330-900neo, and A350-1000, while phasing out older models. This modernization directly supports their sustainability goals by reducing fuel burn and emissions per passenger mile.

The airline is also committed to increasing its use of Sustainable Aviation Fuel (SAF), aiming for 10% SAF usage by 2030. In 2023, Delta announced a significant SAF purchase agreement with Disc-Aero, securing 7 million gallons for use in 2024, demonstrating tangible progress towards its environmental targets.

- Fleet Modernization: Acquisition of fuel-efficient aircraft like the A321neo, A330-900neo, and A350-1000.

- Sustainability Focus: Increased investment and utilization of Sustainable Aviation Fuel (SAF).

- Operational Efficiency: Optimizing flight paths and procedures to minimize fuel consumption.

- 2024 SAF Commitment: Securing 7 million gallons of SAF for use in the current year.

Delta's key activities encompass managing its vast passenger and cargo air transportation networks, ensuring efficient operations and customer satisfaction. This includes meticulous flight planning, route optimization, and leveraging its global reach for freight services. Delta TechOps also plays a crucial role, providing essential maintenance, repair, and overhaul (MRO) services for both its fleet and external clients, contributing significantly to revenue and operational reliability.

| Key Activity | Description | 2024/Recent Data |

|---|---|---|

| Scheduled Passenger Air Transportation | Operating a global network of flights connecting millions of travelers. | Over 4,000 flights daily, serving over 200 million passengers annually. |

| Cargo Air Transportation | Leveraging the global network for freight and mail movement. | Strategic collaborations with platforms like cargo.one to enhance digital sales. |

| Maintenance, Repair, and Overhaul (MRO) | Providing MRO services for Delta's fleet and third-party clients. | 2023 revenue of $2.6 billion, with a growing share from third-party contracts. |

| Loyalty Program Management & Customer Experience | Enhancing the SkyMiles program and digital customer journey. | Focus on Delta Sync App, AI support, and operational improvements like baggage tracking. |

| Fleet Modernization & Sustainability | Acquiring fuel-efficient aircraft and increasing Sustainable Aviation Fuel (SAF) usage. | Secured 7 million gallons of SAF for 2024; ongoing fleet renewal with aircraft like A321neo. |

What You See Is What You Get

Business Model Canvas

The Delta Air Lines Business Model Canvas you are previewing is the exact document you will receive upon purchase. This comprehensive overview details Delta's core strategies, customer segments, value propositions, revenue streams, and cost structure, offering a transparent look at their operational blueprint. You'll gain full access to this complete, professionally formatted analysis, ready for your immediate use.

Resources

Delta Air Lines operates one of the globe's most extensive and contemporary aircraft fleets, featuring close to 1,000 mainline aircraft from manufacturers like Airbus and Boeing. This robust and varied fleet is instrumental in facilitating Delta's broad network, covering domestic, transcontinental, and extensive international flight paths.

The company's strategic commitment to ongoing fleet modernization is a cornerstone of its operational strategy. For instance, in 2024, Delta continued its aggressive fleet renewal program, taking delivery of new, fuel-efficient aircraft. This investment not only enhances operational efficiency, leading to lower fuel costs, but also significantly improves the passenger experience through enhanced comfort and amenities.

Delta's global network is a cornerstone, reaching over 300 destinations in more than 50 countries. This vast reach is supported by a robust hub infrastructure, with Hartsfield-Jackson Atlanta International Airport serving as its primary operational center.

In 2024, Delta continued to leverage its extensive network, facilitating efficient passenger and cargo movement through its strategically located hubs. This infrastructure is crucial for maintaining its competitive edge in the airline industry.

Delta's extensive team of over 100,000 employees forms the backbone of its operations. This includes highly trained pilots, dedicated flight attendants, and specialized mechanics within Delta TechOps, all contributing to the airline's reputation for safety and efficiency.

The expertise and commitment of Delta's human capital are directly linked to delivering exceptional customer experiences and maintaining operational integrity. As of the first quarter of 2024, Delta reported a total employee count of 100,167, highlighting the scale of this critical resource.

Strong Brand Recognition and Loyalty Program

Delta's strong brand recognition is a cornerstone of its business, translating into customer trust and a preference for its services. This established name is a valuable intangible asset in the competitive airline industry.

The SkyMiles loyalty program is a critical resource, boasting millions of active members. This program incentivizes repeat business and fosters deep customer loyalty through various tiers of benefits and rewards.

In 2024, Delta continued to invest in its brand and loyalty program, recognizing their ongoing importance for customer retention and market positioning. These efforts are designed to maintain and enhance their value.

- Brand Equity: Delta's brand name is consistently ranked among the most valuable in the airline sector, contributing to its premium pricing power.

- SkyMiles Membership: As of early 2024, SkyMiles had over 100 million members globally, demonstrating the program's extensive reach.

- Loyalty Program Revenue: The SkyMiles program generates significant revenue through co-branded credit card partnerships, estimated to be over $5 billion annually in recent years.

- Customer Retention: Data indicates that loyalty program members exhibit higher booking frequency and spend compared to non-members, underscoring the program's effectiveness.

Advanced Technology and Digital Platforms

Delta Air Lines heavily invests in advanced technology, recognizing it as a crucial resource. These investments include cutting-edge solutions like AI for predictive analytics, which helps optimize flight schedules and maintenance, and dynamic crew management to ensure operational efficiency. Furthermore, AI plays a role in personalizing customer interactions, aiming to enhance the overall travel experience.

The Fly Delta App is a prime example of their digital platform strategy, offering customers a seamless way to manage bookings, check-in, and access flight information. Delta also utilizes advanced baggage handling systems, such as RFID tracking, to improve reliability and reduce lost luggage incidents. Their robust in-flight Wi-Fi infrastructure is another key resource, providing connectivity and enhancing the customer journey.

In 2024, Delta continued to prioritize technology, with significant capital expenditures allocated to digital transformation initiatives. For instance, their ongoing investments in AI are designed to improve operational efficiency by an estimated 5-10% in key areas like crew scheduling and fuel management.

- AI-powered predictive analytics for operational optimization.

- Fly Delta App for enhanced customer engagement and self-service.

- Advanced baggage tracking systems (e.g., RFID) for improved reliability.

- In-flight Wi-Fi infrastructure to support customer connectivity.

Delta's key resources include its extensive and modern aircraft fleet, a vast global network supported by strategic hubs, a dedicated workforce of over 100,000 employees, strong brand equity, and a highly successful loyalty program, SkyMiles. Additionally, significant investments in advanced technology, including AI and digital platforms like the Fly Delta App, are crucial for operational efficiency and customer experience.

| Key Resource | Description | 2024 Data/Significance |

| Aircraft Fleet | Nearly 1,000 mainline Airbus and Boeing aircraft. | Modern, fuel-efficient fleet driving operational savings and customer comfort. |

| Global Network & Hubs | Over 300 destinations in 50+ countries; Hartsfield-Jackson Atlanta is primary hub. | Facilitates efficient passenger and cargo movement, maintaining competitive edge. |

| Human Capital | Over 100,000 employees (as of Q1 2024). | Highly trained personnel ensure safety, efficiency, and exceptional customer service. |

| Brand Equity & SkyMiles | Strong brand recognition; SkyMiles with over 100 million members (early 2024). | Drives customer trust, loyalty, and significant revenue through co-branded partnerships (estimated $5B+ annually). |

| Technology & Digital Platforms | AI for analytics, Fly Delta App, RFID baggage tracking, in-flight Wi-Fi. | Investments in digital transformation aim for 5-10% operational efficiency gains in areas like crew scheduling. |

Value Propositions

Delta Air Lines provides customers with exceptional access to a vast global network, reaching hundreds of destinations across all six inhabited continents. This extensive connectivity, bolstered by strategic airline alliances, offers unparalleled convenience and flexibility for both leisure and business travelers looking for a wide array of travel choices.

Delta Air Lines enhances the travel experience by investing in cabin upgrades, including comfortable seating and premium amenities. For example, in 2024, Delta continued its rollout of Delta Premium Select, offering more legroom and enhanced service.

Free, high-speed Wi-Fi is a key offering for SkyMiles members on a significant portion of their domestic and transatlantic routes. This commitment to connectivity aims to make journeys more productive and enjoyable, especially for business travelers.

Customers highly value Delta's unwavering commitment to reliability, consistently demonstrated through industry-leading on-time performance and minimal flight cancellations. In 2023, Delta reported an impressive mainline on-time performance of 83.9%, a key driver of customer loyalty.

Delta achieves this operational excellence through strategic investments in staffing, advanced technologies such as RFID baggage tracking, and proactive communication strategies during irregular operations. This focus ensures a dependable and efficient travel experience for passengers.

This dedication to smooth operations fosters significant customer trust and satisfaction, reinforcing Delta's reputation as a preferred carrier. For instance, Delta's customer satisfaction scores often rank among the highest in the airline industry.

Rewarding Loyalty Program Benefits

Delta's SkyMiles program is a cornerstone of its customer loyalty strategy, offering substantial value to frequent flyers. Members can earn and redeem miles for flights, upgrades, and other travel experiences. In 2024, Delta continued to enhance these benefits, aiming to solidify its position as a preferred airline for its most loyal customers.

The program's tiered Medallion status provides increasingly attractive perks, such as complimentary upgrades, priority boarding, and waived baggage fees. These tangible rewards directly incentivize repeat business. For instance, Medallion members often receive preferential treatment, making their travel experience smoother and more cost-effective.

Exclusive access to Delta Sky Club lounges is another significant draw for top-tier members. These lounges offer a premium environment with amenities like complimentary food and beverages, Wi-Fi, and business facilities. This creates a differentiated experience, fostering a deeper connection with the brand.

- SkyMiles Program: Earn and redeem miles for flights and travel rewards.

- Medallion Status: Offers benefits like upgrades, waived fees, and priority services.

- Sky Club Lounges: Provides exclusive access to premium airport lounges for elite members.

Commitment to Sustainability and Responsible Travel

Delta Air Lines appeals to travelers prioritizing environmental responsibility by actively investing in a more sustainable future for aviation. This commitment is demonstrated through substantial investments in Sustainable Aviation Fuel (SAF), aiming to reduce the carbon footprint of flights. In 2024, Delta announced plans to invest up to $100 million in SAF development and procurement, a significant step towards its goal of replacing 10% of its jet fuel consumption with SAF by 2030.

The airline also focuses on minimizing waste onboard, with initiatives like reducing single-use plastics, which resonates with eco-conscious consumers. Furthermore, Delta is continuously working to improve the fuel efficiency of its fleet. By the end of 2024, Delta expects to have retired its remaining Boeing 757 and 767 aircraft, replacing them with more fuel-efficient models like the Airbus A321neo and A330neo, contributing to a projected 20% improvement in fuel efficiency for these routes.

- Commitment to SAF: Delta's investment in Sustainable Aviation Fuel aims to significantly lower emissions.

- Waste Reduction: Efforts to cut down on single-use plastics onboard cater to environmentally aware passengers.

- Fleet Modernization: Replacing older, less efficient aircraft with newer models enhances fuel economy.

- Customer Impact: Choosing Delta allows passengers to align their travel choices with sustainability values.

Delta Air Lines' value proposition centers on delivering a superior travel experience through its extensive global reach and commitment to customer comfort. This includes offering a vast network of destinations, enhanced cabin experiences with upgrades like Premium Select, and essential amenities such as high-speed Wi-Fi. The airline's focus on operational reliability, evidenced by strong on-time performance, further solidifies its appeal to travelers seeking dependable service.

The loyalty program, SkyMiles, is a significant value driver, rewarding frequent flyers with tiered Medallion status benefits and exclusive access to Sky Club lounges. This tiered system incentivizes repeat business by offering tangible perks like upgrades and waived fees, fostering a strong connection with its most valued customers.

Delta also appeals to environmentally conscious travelers through its substantial investments in Sustainable Aviation Fuel (SAF) and fleet modernization. By prioritizing SAF and retiring older aircraft for more fuel-efficient models, Delta demonstrates a commitment to reducing its environmental impact, aligning with the values of a growing segment of the traveling public.

| Value Proposition | Key Features | Customer Benefit | 2024 Data/Initiative |

|---|---|---|---|

| Global Network & Connectivity | Extensive routes, strategic alliances | Unparalleled convenience and choice | Continued expansion of international routes |

| Enhanced Travel Experience | Cabin upgrades, premium amenities, Wi-Fi | Comfortable and productive journey | Rollout of upgraded cabin interiors |

| Operational Reliability | Industry-leading on-time performance | Dependable and stress-free travel | Maintaining high on-time performance metrics |

| Customer Loyalty Program | SkyMiles, Medallion Status, Sky Club access | Valuable rewards and exclusive perks | Enhancements to SkyMiles program benefits |

| Sustainability Commitment | SAF investment, fleet modernization | Alignment with environmental values | Increased investment in Sustainable Aviation Fuel |

Customer Relationships

Delta cultivates deep customer loyalty through its tiered SkyMiles Medallion program, rewarding frequent flyers with increasing benefits and personalized recognition. This system encourages repeat business by offering exclusive perks, such as upgrades and dedicated service, to elite members, thereby strengthening the customer bond.

The program's enhancements for 2024-2025 focused on streamlining the path to status while ensuring continued value for their most dedicated customers. For instance, Delta reported a significant increase in Medallion members in 2024, with millions achieving elite status, underscoring the program's effectiveness in driving engagement and retention.

Delta Air Lines leverages advanced technology, notably AI and its Delta Sync App, to craft highly personalized digital interactions. This focus on tailored content and recommendations, informed by a traveler's history, aims to create a more engaging and convenient experience.

The airline's virtual assistants are designed to manage intricate customer inquiries, further enhancing the personalized touch. In 2024, Delta reported significant engagement with its digital platforms, with millions of active users on the Delta Sync App, underscoring the value customers place on these customized digital touchpoints.

Delta Air Lines prioritizes dedicated customer service by increasing staffing and resources across phone, online chat, and airport assistance to minimize wait times. In 2024, they continued to invest in training for their customer service representatives, aiming for more efficient and empathetic issue resolution.

Exclusive Lounge Access and Amenities

Delta Air Lines cultivates strong relationships with its most valuable customers by offering exclusive access to its Sky Club lounges. These lounges serve as a premium sanctuary, providing a comfortable and amenity-rich environment for eligible travelers. While access criteria have seen recent adjustments, the Sky Club remains a critical element in delivering an elevated experience to loyal customers and elite members.

For instance, in 2024, Delta continued to invest in its lounge network, recognizing its importance in customer retention and satisfaction. These spaces offer benefits such as complimentary food and beverages, Wi-Fi, and a quiet place to work or relax, directly enhancing the overall travel journey for premium passengers.

- Exclusive Airport Environment: Sky Clubs provide a distinct advantage over general airport terminals, offering a more serene and productive atmosphere.

- Loyalty Program Integration: Access is often tied to premium cabin bookings, Delta SkyMiles Medallion status, or specific co-branded credit cards, reinforcing the value of loyalty.

- Enhanced Service Touchpoint: Lounges act as a direct channel for Delta to provide superior customer service and gather feedback from its most frequent flyers.

Proactive Communication and Disruption Management

Delta Air Lines prioritizes transparent and proactive communication, especially when operational disruptions like delays or cancellations occur. The airline leverages real-time updates and digital notifications to keep passengers informed throughout their journey.

This commitment to keeping customers in the loop helps to alleviate anxiety and showcases Delta's dedication to effectively managing unforeseen events. For instance, in 2023, Delta reported a significant improvement in on-time performance, with approximately 83.7% of flights arriving within 15 minutes of their scheduled time, demonstrating their efforts in managing disruptions.

- Proactive Notifications: Delta utilizes its mobile app and email to send immediate alerts regarding flight status changes.

- Digital Tools: Real-time flight tracking and updated gate information are readily available through Delta's digital platforms.

- Disruption Management: The airline focuses on providing clear information and rebooking options during irregular operations.

- Customer Feedback: Delta actively monitors customer feedback to refine its communication strategies during disruptions.

Delta’s customer relationships are built on a foundation of loyalty programs and personalized digital experiences. The SkyMiles Medallion program, a cornerstone of their strategy, incentivizes repeat business through tiered benefits and exclusive perks, fostering a strong connection with frequent flyers. In 2024, Delta saw millions of members achieve elite status, highlighting the program's success in driving engagement.

Leveraging technology like the Delta Sync App and AI, Delta offers tailored digital interactions, enhancing convenience and personalization for travelers. The airline also emphasizes robust customer service, investing in staffing and training to ensure efficient issue resolution, with significant engagement reported on their digital platforms in 2024.

Delta’s Sky Club lounges serve as a key touchpoint for its most valued customers, offering a premium airport experience. Access to these lounges is often linked to loyalty status or premium bookings, reinforcing the value of their tiered programs. Continued investment in these lounges in 2024 underscores their importance in customer retention and satisfaction.

Proactive and transparent communication during disruptions is another critical aspect, with Delta using digital channels to provide real-time updates. This approach aims to reduce passenger anxiety and improve their overall journey, building trust and reinforcing customer relationships. In 2023, Delta achieved strong on-time performance, with approximately 83.7% of flights arriving within 15 minutes of schedule.

Channels

Delta.com and the Fly Delta mobile app are the core digital touchpoints for Delta Air Lines, facilitating everything from initial flight searches and bookings to post-flight engagement. These platforms are crucial for managing reservations, checking in, and accessing digital boarding passes, streamlining the passenger experience. In 2024, Delta reported significant digital engagement, with millions of active users on its mobile app, reflecting its importance in customer interaction and revenue generation.

Delta Air Lines leverages Global Distribution Systems (GDS) like Amadeus, Sabre, and Travelport to make its flight inventory and pricing accessible to travel agents globally. In 2024, GDS continued to be a significant channel, though the industry is shifting. This broad reach is crucial for capturing bookings from a diverse clientele who rely on travel advisors.

Online Travel Agencies (OTAs) such as Expedia, Booking.com, and Priceline also play a vital role in Delta's distribution strategy, offering a direct-to-consumer channel. These platforms provide extensive visibility, allowing Delta to connect with a vast online travel market. The commission structures and marketing reach of OTAs are key considerations for Delta's channel management.

Delta is actively investing in its New Distribution Capability (NDC) solution, aiming to offer more personalized content and direct booking experiences. This strategic move seeks to bypass traditional intermediaries and foster stronger direct relationships with customers, potentially leading to improved revenue and customer loyalty by 2025.

Airport facilities, encompassing check-in counters, kiosks, and gate areas, are fundamental physical channels for Delta's customer engagement. These touchpoints facilitate essential travel processes and direct customer interaction.

Delta's customer service desks at airports offer crucial in-person support for ticketing, rebooking, and problem resolution. In 2024, Delta continued to invest in enhancing these airport service points to improve passenger experience.

Delta Sky Club Lounges

Delta Sky Club lounges function as a premium channel, directly enhancing the customer experience for eligible travelers. These spaces offer a sanctuary with complimentary food, premium beverages, and reliable Wi-Fi, significantly elevating the perception of value for Delta's frequent flyers and premium cabin passengers.

In 2024, Delta continued to invest in its Sky Club network, with plans for expansion and renovation to accommodate growing demand. For instance, the airline opened a new, larger Sky Club at Los Angeles International Airport (LAX) in early 2024, reflecting a strategic focus on key hubs.

- Premium Customer Experience: Lounges provide a comfortable, exclusive environment, improving customer satisfaction and loyalty.

- Ancillary Revenue Potential: While primarily a loyalty perk, lounge access can be bundled with premium tickets or offered via credit card partnerships, contributing indirectly to revenue streams.

- Brand Differentiation: A well-appointed lounge network serves as a tangible differentiator in the competitive airline industry, attracting and retaining high-value customers.

- Operational Efficiency: Lounges can offer dedicated check-in and customer service desks, potentially streamlining operations for premium passengers.

Corporate Sales and Partnerships

Delta Air Lines actively cultivates corporate sales and partnerships through dedicated direct sales teams and specialized booking platforms. These channels are designed to meet the specific requirements of business travelers and organizations, providing customized travel arrangements, negotiated pricing, and thorough account oversight. For instance, in 2023, Delta reported significant revenue from its corporate travel segment, underscoring the importance of these direct relationships.

Strategic alliances further enhance Delta's reach and customer value. Partnerships, such as the collaboration with Uber, allow SkyMiles members to earn miles on ground transportation, thereby expanding earning opportunities and strengthening customer loyalty. These types of collaborations are crucial for Delta's ecosystem, driving engagement beyond just air travel.

- Dedicated corporate sales teams offer tailored solutions and negotiated rates.

- Specialized booking platforms streamline travel management for business clients.

- Strategic partnerships, like with Uber, create additional earning channels for loyalty members.

- Corporate sales and partnerships are a vital component of Delta's revenue diversification strategy.

Delta Air Lines utilizes a multi-channel approach to reach its customers, blending digital, intermediary, and direct physical interactions. The airline's robust digital presence via Delta.com and the Fly Delta app serves as a primary engagement hub, facilitating bookings, check-ins, and loyalty program management. In 2024, these digital platforms saw millions of active users, highlighting their critical role in customer interaction and revenue generation.

Intermediary channels, including Global Distribution Systems (GDS) and Online Travel Agencies (OTAs), remain significant for broad market access, connecting Delta with a diverse customer base that utilizes travel advisors and third-party booking sites. Delta is also actively developing its New Distribution Capability (NDC) to foster more direct and personalized customer relationships by 2025.

Physical channels at airports, such as check-in counters, kiosks, and customer service desks, provide essential in-person support and transaction points. Premium physical channels like the Delta Sky Club lounges enhance the customer experience for eligible travelers, offering amenities and services that contribute to brand loyalty and perceived value. The airline continued to invest in its Sky Club network in 2024, opening a new facility at LAX.

Direct sales efforts target the corporate travel segment, with dedicated teams and platforms offering tailored solutions and negotiated rates, a segment that showed strong revenue contribution in 2023. Strategic alliances, such as partnerships with ride-sharing services, further extend Delta's ecosystem, creating additional value and engagement opportunities for SkyMiles members.

| Channel Type | Key Platforms/Methods | 2024/Recent Data/Focus | Strategic Importance |

|---|---|---|---|

| Digital | Delta.com, Fly Delta App | Millions of active users in 2024; continuous feature updates. | Core for customer engagement, bookings, and loyalty; direct revenue. |

| Intermediary | GDS (Amadeus, Sabre), OTAs (Expedia) | Continued reliance on GDS, though NDC is a growing focus. | Broad market reach, access to diverse customer segments. |

| Direct (Physical) | Airport Facilities, Sky Clubs | Investment in Sky Club expansion (e.g., LAX opening 2024). | Essential for travel processes and premium customer experience. |

| Direct (Sales) | Corporate Sales Teams, Partnerships | Strong 2023 revenue from corporate travel; Uber partnership for loyalty. | Targeted revenue streams, customer retention through added value. |

| New Development | NDC (New Distribution Capability) | Strategic investment for personalized content and direct booking by 2025. | Bypassing intermediaries, fostering stronger direct customer relationships. |

Customer Segments

Leisure travelers, seeking vacations and personal getaways, form a significant customer base for Delta Air Lines. This group prioritizes value, looking for competitive fares and convenient flight times that align with their travel plans. In 2024, Delta continued to offer a spectrum of choices, from basic economy fares designed to attract price-sensitive individuals to more premium options for those desiring enhanced comfort, reflecting the diverse needs within this segment.

Business travelers, including corporate employees and entrepreneurs, represent a crucial customer segment for Delta Air Lines. This group prioritizes efficiency, flexibility, and premium amenities like Wi-Fi and lounge access. In 2024, Delta continued to focus heavily on corporate sales to capture this valuable market.

Delta's premium and high-value customers are those who consistently book Delta One, First Class, or Delta Comfort+. These travelers prioritize enhanced comfort, superior service, and exclusive perks, and they are willing to pay a premium for these benefits, making them a vital revenue stream for the airline.

In 2024, Delta reported strong performance in its premium cabins. For instance, the airline's premium product revenue, which includes Delta One and First Class, saw significant growth, contributing substantially to its overall financial results. This segment values personalized attention, such as dedicated check-in lines, lounge access, and elevated in-flight dining.

SkyMiles Loyalty Program Members

SkyMiles Loyalty Program Members represent a cornerstone of Delta Air Lines' customer base. This segment encompasses a wide spectrum of travelers, from those who fly infrequently to the highly engaged Medallion elite members. Delta's strategy focuses on nurturing these relationships through personalized offers and exclusive perks, aiming to cultivate enduring brand loyalty and optimize customer lifetime value.

In 2024, Delta continued to emphasize the value proposition of SkyMiles. The program’s tiered structure, including Silver, Gold, Platinum, and Diamond Medallion status, incentivizes frequent flying by offering benefits such as upgrades, priority boarding, and bonus miles. This segmentation allows Delta to cater to diverse customer needs and spending habits, driving repeat business and increasing overall revenue per customer.

- Broad Reach: Encompasses millions of individuals globally, from casual travelers to the most frequent flyers.

- Tiered Benefits: Medallion status levels (Silver, Gold, Platinum, Diamond) offer escalating rewards and recognition.

- Personalized Engagement: Delta utilizes data analytics to deliver tailored promotions and communications, enhancing member experience.

- Revenue Driver: SkyMiles members contribute significantly to ticket sales, ancillary revenue, and co-branded credit card partnerships.

Cargo and MRO Service Customers

Delta Air Lines extends its services beyond passenger transport, catering to businesses and other airlines. Its cargo division provides efficient air freight solutions for a diverse range of goods, acting as a vital logistics partner for many companies. This segment is a key contributor to Delta's non-passenger revenue.

Delta TechOps, the airline's maintenance, repair, and overhaul (MRO) arm, serves a significant customer base of other airlines and aviation companies. They offer specialized services for aircraft maintenance, ensuring the airworthiness and operational efficiency of fleets. In 2024, Delta TechOps continued to secure and expand its MRO contracts, demonstrating its strong position in the aviation support market.

- Cargo Revenue Contribution: Delta's cargo operations generated $1.3 billion in revenue in 2023, highlighting its importance as a revenue stream.

- MRO Market Position: Delta TechOps is recognized as a leading provider in the global MRO market, servicing a wide array of aircraft types for various international carriers.

- Strategic Partnerships: The airline actively fosters relationships with businesses and other airlines, leveraging its extensive network and operational expertise to meet their specific cargo and MRO requirements.

Delta Air Lines serves a broad spectrum of customers, including leisure travelers seeking affordable vacations and business travelers prioritizing efficiency and premium services. The airline also caters to high-value customers who opt for premium cabins and members of its SkyMiles loyalty program, fostering repeat business through tiered benefits and personalized engagement.

Cost Structure

Fuel expenses are a major component of Delta's operating costs, significantly influencing profitability. In 2024, fuel costs represented a substantial portion of their overall expenses, directly tied to volatile global oil prices and exchange rates.

Delta actively works to control these expenditures. This includes investing in newer, more fuel-efficient aircraft as part of their fleet modernization, optimizing flight routes and operational procedures for better fuel burn, and increasing their commitment to Sustainable Aviation Fuel (SAF).

Personnel expenses, encompassing salaries, wages, benefits, and profit-sharing for its vast workforce, represent a significant cost driver for Delta Air Lines. In the first quarter of 2024, Delta reported total operating expenses of $11.6 billion, with personnel costs being a major component of this figure. The airline's commitment to its over 100,000 employees necessitates strategic management of human capital to ensure competitive compensation and foster development, directly impacting service quality and operational efficiency.

Delta's cost structure is heavily influenced by the substantial expenses of acquiring, leasing, and maintaining its expansive fleet. For 2024, capital expenditures for fleet modernization and maintenance are a primary driver, reflecting ongoing investments in new aircraft and the upkeep of existing ones.

These costs encompass depreciation of owned aircraft, lease payments for those acquired through operating leases, and significant outlays for its Maintenance, Repair, and Overhaul (MRO) division, Delta TechOps. In the first quarter of 2024, Delta reported approximately $1.2 billion in capital expenditures, with a significant portion allocated to fleet and facilities, underscoring the continuous investment in aircraft readiness and modernization.

Airport and Navigation Fees

Delta Air Lines faces significant expenses for airport and navigation services. These include landing fees, gate usage charges, terminal access, and air traffic control, which are essential for its global operations. For instance, in 2023, Delta's total operating expenses were $45.5 billion, with airport and navigation fees representing a substantial portion of these costs, varying based on the specific airport and flight path.

These fees are a direct consequence of Delta's extensive network and are critical for maintaining flight schedules and safety. The cost structure here is directly tied to the volume of flights and the specific airports served, making it a variable but unavoidable operational expenditure.

- Landing Fees: Charges levied by airports for each aircraft landing.

- Gate Rentals: Costs associated with occupying gates for passenger boarding and deplaning.

- Terminal Charges: Fees for using airport terminal facilities.

- Navigation Fees: Payments for air traffic control and route navigation services.

Sales, Marketing, and Distribution Costs

Delta Air Lines incurs significant expenses in attracting and retaining customers. These include costs for advertising campaigns, sales commissions paid to travel agencies, and the operational expenses associated with maintaining its digital booking platforms like Delta.com and the Fly Delta App. These expenditures are crucial for driving passenger volume and maintaining brand visibility in a competitive market.

Investments in digital channels and robust loyalty programs are also key components of Delta's sales, marketing, and distribution cost structure. For instance, in 2023, Delta reported approximately $4.7 billion in selling, general, and administrative expenses, which encompasses a substantial portion of these customer acquisition and retention efforts. These investments aim to enhance customer experience and encourage repeat business.

- Advertising and Promotion: Costs associated with brand building and direct marketing efforts.

- Sales Commissions: Payments to travel agents and other intermediaries for booking tickets.

- Digital Platform Operations: Expenses for maintaining and improving Delta.com and the Fly Delta App.

- Loyalty Program Costs: Investments in SkyMiles program benefits and member engagement initiatives.

Delta's cost structure is heavily influenced by significant personnel expenses, encompassing over 100,000 employees. In Q1 2024, total operating expenses reached $11.6 billion, with labor costs being a major factor. The airline also faces substantial fleet-related costs, including aircraft acquisition, leasing, and maintenance, with Q1 2024 capital expenditures for fleet and facilities amounting to approximately $1.2 billion.

Fuel is another critical expense, directly impacted by volatile oil prices, with these costs representing a substantial portion of overall expenditures in 2024. Additionally, airport and navigation services, including landing fees and gate rentals, are unavoidable operational costs tied to flight volume and network reach. Selling, general, and administrative expenses, which include customer acquisition and retention efforts, totaled roughly $4.7 billion in 2023.

| Cost Category | Key Components | 2024 Impact/Notes |

| Personnel Expenses | Salaries, wages, benefits, profit-sharing | Major driver; Q1 2024 operating expenses $11.6B |

| Fleet Costs | Acquisition, leasing, maintenance, MRO | Q1 2024 CapEx ~$1.2B for fleet/facilities |

| Fuel Expenses | Volatile global oil prices | Substantial portion of overall expenses in 2024 |

| Airport & Navigation Services | Landing fees, gate rentals, air traffic control | Directly tied to flight volume and network |

| Sales, Marketing & Distribution | Advertising, commissions, digital platforms, loyalty programs | 2023 SG&A ~$4.7B |

Revenue Streams

Passenger ticket sales are the bedrock of Delta's revenue, encompassing everything from budget-friendly Basic Economy to luxurious Delta One suites. In 2024, Delta reported a significant portion of its revenue derived from these ticket sales, with premium cabin offerings showing particular strength, reflecting a continued demand for enhanced travel experiences.

Delta's partnership with American Express is a major contributor to its revenue, especially through the co-branded SkyMiles credit cards. This collaboration brings in significant remuneration from Amex for card usage and bringing in new cardholders.

This loyalty program revenue stream has seen impressive growth, reaching a new record of $2 billion in the first quarter of 2025, highlighting the success and financial impact of this strategic alliance.

Delta Air Lines generates revenue through its cargo services, moving freight and mail on both passenger flights and specialized cargo operations. This segment has demonstrated strong performance, with cargo operating revenue seeing a 14% increase in 2024 and a notable 32% jump in the fourth quarter of 2024. This growth underscores the increasing significance of cargo as a key revenue stream for the airline.

Maintenance, Repair, and Overhaul (MRO) Services

Delta TechOps is a significant revenue generator, offering maintenance, repair, and overhaul services. These services are provided not only to Delta's own extensive fleet but also to a growing base of third-party airline customers. This dual approach capitalizes on Delta's deep technical expertise and infrastructure.

The MRO segment is a key contributor to Delta's financial performance. For 2025, this division is projected to surpass $1 billion in annual revenue. This highlights the strong demand for Delta's specialized aviation maintenance capabilities in the market.

- Third-Party MRO Revenue: Delta TechOps generates revenue by servicing aircraft for other airlines.

- Fleet Support: Services are also provided for Delta's own large fleet of aircraft.

- Projected Growth: The MRO division is on track to exceed $1 billion in annual revenue by 2025.

- Technical Expertise: Revenue is driven by Delta's specialized technical skills and operational capabilities.

Ancillary Services and Other Revenue

Delta Air Lines generates substantial revenue beyond ticket sales through ancillary services like baggage fees, preferred seat selections, and in-flight purchases. These offerings allow passengers to customize their travel experience, driving additional income. For instance, in 2024, Delta reported significant earnings from these supplementary services, demonstrating their importance to the company's financial health.

Further diversification comes from Delta Vacations, which bundles flights with hotels and car rentals, providing a comprehensive travel solution. Additionally, aircraft charter services and specialized airline-related professional services contribute to Delta's varied income portfolio. These segments, while perhaps less visible than ticket sales, play a crucial role in bolstering Delta's overall revenue streams.

These ancillary and diversified revenue streams are critical for Delta's profitability and resilience.

- Baggage Fees: A consistent contributor, with fees varying based on destination and baggage count.

- Seat Selection: Passengers pay for preferred seating options, such as extra legroom or window seats.

- In-Flight Purchases: Sales of food, beverages, and Wi-Fi services during flights.

- Delta Vacations: Revenue generated from bundled travel packages.

Delta's revenue streams are diverse, extending beyond core passenger ticket sales to include lucrative partnerships, cargo operations, and maintenance services. The airline's strategic alliances, particularly with American Express, and its robust loyalty program, SkyMiles, generate substantial income. Furthermore, Delta TechOps, its maintenance, repair, and overhaul division, is a significant contributor, serving both Delta's fleet and a growing number of external clients.

| Revenue Stream | Description | 2024/2025 Data Point |

|---|---|---|

| Passenger Ticket Sales | Revenue from selling airline tickets across various fare classes. | Premium cabins showed strong demand in 2024. |

| Loyalty Program & Partnerships | Income from co-branded credit cards and loyalty program engagement. | SkyMiles partnership revenue reached a record $2 billion in Q1 2025. |

| Cargo Services | Revenue from transporting freight and mail. | Cargo operating revenue increased 14% in 2024, with a 32% jump in Q4 2024. |

| Delta TechOps (MRO) | Revenue from aircraft maintenance, repair, and overhaul services. | Projected to surpass $1 billion in annual revenue by 2025. |

| Ancillary Services | Income from baggage fees, seat selection, in-flight purchases, etc. | Significant earnings reported from these supplementary services in 2024. |

| Diversified Offerings | Revenue from Delta Vacations, charters, and professional services. | These segments bolster Delta's overall revenue portfolio. |

Business Model Canvas Data Sources

The Delta Air Lines Business Model Canvas is built upon a foundation of comprehensive market research, internal financial reports, and operational data. These sources provide the necessary insights into customer behavior, competitive landscapes, and cost structures to accurately map Delta's strategic approach.