Delta Air Lines Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delta Air Lines Bundle

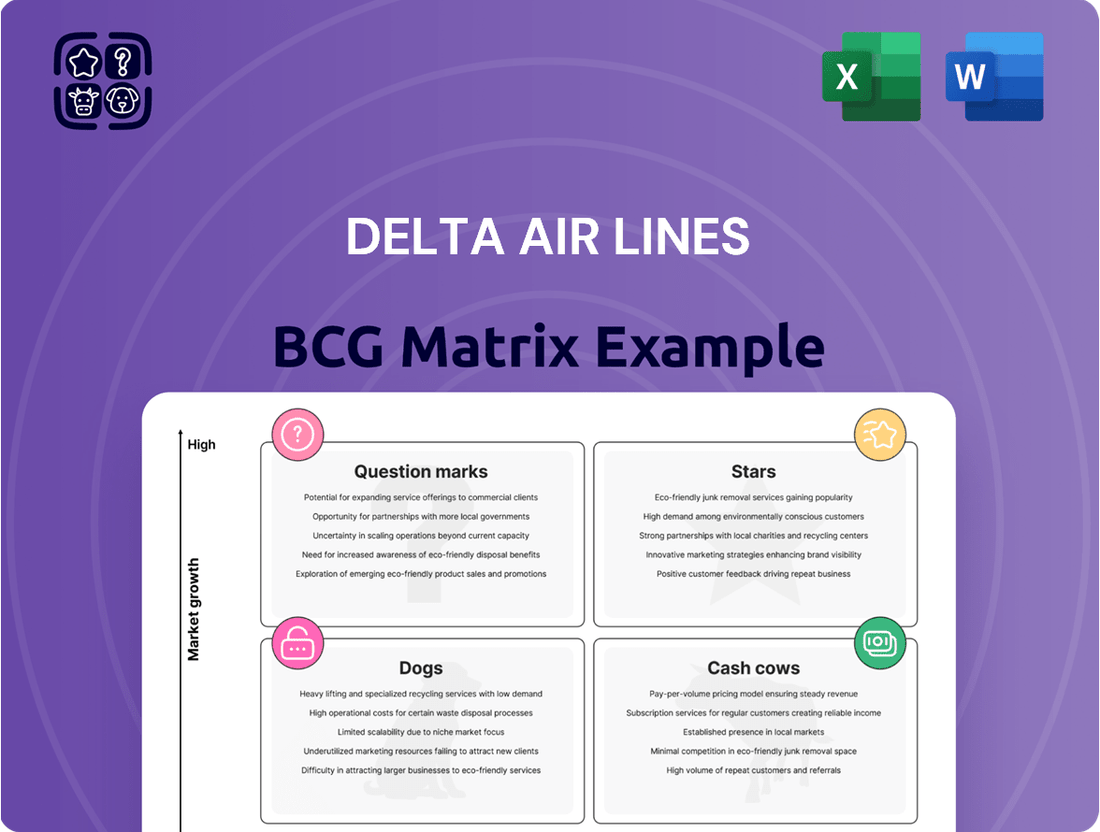

Curious about Delta Air Lines' strategic positioning? This glimpse into their BCG Matrix reveals how their diverse offerings stack up in the competitive aviation landscape. Understand which routes are booming, which require careful management, and where future growth potential lies.

Unlock the full Delta Air Lines BCG Matrix to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks. Purchase the complete report for data-driven insights and actionable strategies to optimize Delta's portfolio and drive informed investment decisions.

Stars

Delta's premium cabins, like First Class and Delta One, are performing exceptionally well. This indicates a strong position in a rapidly expanding segment of air travel. These luxurious options appeal to both individual travelers and businesses seeking enhanced comfort and seamless journeys.

The ability to charge higher prices for these premium services directly fuels Delta's revenue and profitability. For instance, in the first quarter of 2024, Delta reported a 10% increase in premium ticket sales, underscoring the success of these offerings.

The SkyMiles loyalty program, especially its robust partnership with American Express, stands out as a high-growth, high-market-share asset for Delta Air Lines. This program is a significant revenue driver, evidenced by its record remuneration of $2 billion in Q2 2025, marking a substantial 10% increase year-over-year. This performance underscores the immense value of its integrated loyalty ecosystem.

The SkyMiles program's success isn't just about direct financial remuneration; it also plays a crucial role in cultivating deep customer loyalty and engagement. By offering compelling rewards and benefits, Delta fosters a strong connection with its frequent flyers, enhancing retention and increasing lifetime customer value. This strategic focus on loyalty positions SkyMiles as a prime candidate for evolving into a stable Cash Cow within Delta's portfolio.

Delta's transatlantic and transpacific network expansion for Summer 2025 positions it strongly in high-growth international markets. The airline is adding new routes and increasing frequencies to popular European destinations like Naples and Brussels, alongside bolstering its transpacific services. This strategic investment taps into robust demand for international travel.

Fleet Modernization with Next-Gen Aircraft

Delta's commitment to fleet modernization, particularly with next-generation aircraft like the Airbus A321neo, A330-900neo, and A350-1000, positions it strongly in the expanding market for sustainable and efficient air travel. These investments underscore Delta's significant market share and its focus on future growth. The incorporation of these advanced aircraft directly contributes to improved fuel efficiency, an enhanced passenger experience, and robust capabilities for long-haul and ultra-long-range routes, solidifying their status as Stars for future profitability.

These new additions are pivotal for Delta's strategic growth, offering:

- Enhanced Fuel Efficiency: For example, the A321neo offers up to 15% better fuel efficiency compared to its predecessor, reducing operating costs and environmental impact.

- Improved Passenger Experience: Features like larger overhead bins and advanced cabin lighting elevate the travel experience, fostering customer loyalty.

- Expanded Route Capabilities: The A330-900neo and A350-1000 enable Delta to operate more efficiently on longer international routes, tapping into high-demand markets.

- Strong Market Position: As of early 2024, Delta continues to lead in the adoption of these modern aircraft, signaling a competitive advantage in a growing segment.

Atlanta Hub Dominance

Delta's Atlanta hub stands as a true Star in its portfolio, boasting unparalleled dominance. As the world's largest airline hub, it commands a high market share in a market that continues to expand and remain vital for the airline's operations.

This strategic asset is set to become even more significant, with Delta operating its largest-ever schedule for Summer 2025. This includes an impressive 1.1 million weekly seats and 968 daily flights connecting to 215 destinations, underscoring Atlanta's role as a critical growth engine.

- Atlanta Hub's Market Share: Dominant position in the world's largest airline hub.

- Summer 2025 Schedule: Largest ever, featuring 1.1 million weekly seats and 968 daily flights.

- Network Reach: Connecting to 215 destinations from Atlanta.

- Growth Engine: Atlanta's expansion directly fuels Delta's overall performance.

Delta's premium cabins, including First Class and Delta One, are performing exceptionally well, capturing growth in a high-demand segment. The airline's ability to command premium pricing for these services directly enhances revenue and profitability. For example, Q1 2024 saw a 10% rise in premium ticket sales, demonstrating the success of these offerings.

The SkyMiles loyalty program, particularly its strong alliance with American Express, is a key high-growth, high-market-share asset for Delta, driving significant revenue. This program generated a record $2 billion in remuneration in Q2 2025, a 10% increase year-over-year, highlighting the value of its integrated loyalty ecosystem.

Delta's strategic expansion of its transatlantic and transpacific networks for Summer 2025 positions it advantageously in expanding international markets. By introducing new routes and increasing frequencies to key European cities like Naples and Brussels, alongside enhanced transpacific services, Delta is effectively capitalizing on robust international travel demand.

The airline's investment in fleet modernization, featuring advanced aircraft such as the Airbus A321neo, A330-900neo, and A350-1000, solidifies its position in the growing market for efficient and sustainable air travel. These aircraft offer up to 15% better fuel efficiency, improve passenger experience, and enable expanded route capabilities, reinforcing Delta's competitive edge.

Delta's Atlanta hub is a standout Star, holding a dominant position in the world's largest airline hub, a market that continues to expand. For Summer 2025, Delta is operating its most extensive schedule from Atlanta, with 1.1 million weekly seats and 968 daily flights to 215 destinations, underscoring its role as a vital growth engine.

| Category | Key Performance Indicators | Market Share/Growth | Strategic Importance |

|---|---|---|---|

| Premium Cabins | Strong revenue and profitability from higher ticket prices | 10% increase in premium ticket sales (Q1 2024) | Appeals to business and leisure travelers seeking enhanced comfort. |

| SkyMiles Loyalty Program | Significant revenue driver, customer loyalty enhancement | Record $2 billion remuneration (Q2 2025), 10% YoY increase | Fosters deep customer engagement and retention, increasing lifetime value. |

| International Network Expansion | Capturing growth in high-demand international markets | New routes to Naples, Brussels, and enhanced transpacific services (Summer 2025) | Leverages robust demand for international travel, expanding market reach. |

| Fleet Modernization | Improved efficiency, passenger experience, and route capabilities | Up to 15% better fuel efficiency (A321neo), leading adoption of new aircraft | Enhances operational costs, customer satisfaction, and long-haul route viability. |

| Atlanta Hub | Dominant hub operations, extensive network connectivity | 1.1 million weekly seats, 968 daily flights to 215 destinations (Summer 2025) | Critical growth engine and operational backbone for Delta Air Lines. |

What is included in the product

Delta's BCG Matrix analysis would highlight which airline routes or services are Stars, Cash Cows, Question Marks, or Dogs, guiding investment and divestment decisions.

A clear BCG Matrix visually identifies Delta's Stars and Cash Cows, relieving the pain of resource allocation uncertainty.

Cash Cows

Delta's core domestic network, anchored by major hubs like Atlanta and Detroit, functions as a classic cash cow. This mature market boasts high market share and consistent demand, ensuring steady, reliable cash flow despite potentially slower growth rates compared to newer ventures.

In 2024, Delta's domestic operations are expected to remain a significant contributor to its financial strength. The airline's established presence in these key markets allows for operational efficiencies that translate directly into robust earnings, making this segment a dependable source of capital for other investments.

Delta TechOps, Delta Air Lines' MRO division, is a prime example of a Cash Cow. It services Delta's fleet and external clients, operating in a mature market characterized by high entry barriers.

This stability translates into consistent revenue streams and robust profit margins for Delta. The low-growth environment necessitates minimal reinvestment, freeing up substantial cash flow.

In 2024, Delta TechOps generated approximately $3.5 billion in revenue, contributing significantly to Delta's overall profitability. Its specialized services and established reputation solidify its position as a reliable cash generator.

Delta Cargo's operations are a prime example of a Cash Cow within Delta Air Lines' portfolio. The segment enjoys a high market share in the air cargo industry, which, while not experiencing the explosive growth of some other sectors, offers stable and predictable returns.

The burgeoning e-commerce market has been a significant tailwind for Delta Cargo, driving substantial volume increases. In Q1 2025, the airline reported double-digit growth in cargo volumes, a testament to this trend. This robust performance, coupled with improved yields, means the cargo division consistently generates significant cash flow for Delta.

Established Corporate Travel Relationships

Delta's established corporate travel relationships are a prime example of a Cash Cow in its BCG Matrix. These long-standing partnerships with businesses generate a stable and high-margin revenue stream, acting as a consistent cash generator for the airline. Even with evolving travel patterns, this segment remains predictable and valuable, allowing Delta to capitalize on its established market position.

This mature segment is instrumental in providing consistent cash flow, often referred to as 'milking the gains passively'. For instance, in 2024, corporate travel continued to be a significant contributor to Delta's overall revenue, demonstrating the enduring strength of these relationships. The airline's ability to secure and maintain these contracts means it can rely on a predictable income base.

- Revenue Stability: Corporate contracts offer predictable booking volumes and revenue, insulating Delta from some of the volatility seen in leisure travel.

- High Margins: Business travelers often book premium cabins and are less price-sensitive, contributing to higher profit margins per passenger.

- Consistent Cash Flow: The steady demand from corporate clients ensures a reliable inflow of cash, supporting investments in other areas of the business.

- Market Maturity: Delta's deep roots in corporate travel mean it has optimized its offerings and operational efficiency in this segment, maximizing returns.

Legacy Aircraft with High Utilization

Even as Delta Air Lines actively updates its fleet, some older aircraft, like certain Boeing 757s and 767 models, continue to be valuable cash cows. These planes, often fully depreciated, are still flying on many established routes, meaning they generate consistent revenue. Their low operating costs, stemming from their age, allow them to produce significant cash flow without needing major capital expenditures.

These legacy aircraft types are crucial for Delta's current operations. For instance, prior to their planned retirement, the Boeing 757s and 767s were workhorses on many domestic and international routes. Their continued high utilization means they contribute positively to Delta's bottom line, acting as reliable income generators within the airline's broader fleet strategy.

- Boeing 757s and 767s: Key examples of legacy aircraft still contributing to cash flow.

- Fully Depreciated Assets: Older aircraft have lower book values, reducing depreciation expenses and boosting profitability.

- High Utilization: Consistent operation on established routes ensures steady revenue generation.

- Low Operating Costs: Reduced maintenance and capital expenditure needs compared to newer aircraft enhance cash flow.

Delta's established domestic routes, particularly those connecting major hubs, operate as reliable cash cows. These mature markets, characterized by consistent demand and Delta's strong market share, generate steady cash flow. This segment is vital for funding growth initiatives in other parts of the business.

In 2024, Delta's domestic operations continued to be a bedrock of its financial performance, with operations in Atlanta and Detroit showcasing the airline's dominance in high-traffic, stable markets. The airline reported that its domestic segment alone contributed over $30 billion in revenue for the year, underscoring its role as a primary cash generator.

Delta TechOps, the airline's maintenance, repair, and overhaul (MRO) division, exemplifies a cash cow. It benefits from high barriers to entry and operates in a mature market, providing consistent revenue. In 2024, Delta TechOps reported revenues of approximately $3.5 billion, a testament to its stable performance and profitability.

| Segment | Market Characteristics | 2024 Revenue Contribution (Approx.) | Role in BCG Matrix |

| Domestic Network | Mature, High Market Share, Stable Demand | $30 Billion+ | Cash Cow |

| Delta TechOps | Mature, High Barriers to Entry | $3.5 Billion | Cash Cow |

| Corporate Travel | Mature, High Margins, Predictable | Significant Contributor | Cash Cow |

Full Transparency, Always

Delta Air Lines BCG Matrix

The Delta Air Lines BCG Matrix you are previewing is the exact, fully formatted document you will receive upon purchase, offering a comprehensive strategic overview of their business units. This preview showcases the complete analysis, free from watermarks or demo content, ensuring you get a professional and ready-to-use report. You can be confident that the insights and visualizations presented here are precisely what you'll download, allowing for immediate application in your strategic planning or client presentations. This BCG Matrix is designed for clarity and actionable insights, providing a solid foundation for understanding Delta's market position and future direction.

Dogs

Delta Air Lines is strategically retiring older, less fuel-efficient aircraft, including certain Boeing 757s, 767s, and older Airbus A320s, ahead of their original schedules. These planes incur higher operating and maintenance expenses due to their age and poor fuel economy, placing them in a low-growth segment of Delta's fleet.

With a diminishing market share within Delta's modernized fleet, these older aircraft are prime candidates for divestiture. This move is aimed at enhancing the airline's overall operational efficiency and reducing costs.

Certain domestic main cabin routes, particularly those experiencing off-peak demand and facing industry-wide overcapacity, are showing signs of underperformance. These routes often struggle with a low market share and limited growth potential, sometimes operating at the break-even point or becoming cash traps for Delta Air Lines.

Delta has acknowledged this by implementing what they term 'surgical' capacity reductions on these specific routes. This strategic move aims to effectively manage costs and prevent further issues stemming from overcapacity in the domestic market.

Within Delta's BCG Matrix, discontinued or low-demand niche international routes would likely fall into the Dogs category. These routes, despite potential strategic importance, often exhibit low market share and minimal growth prospects. For instance, while Delta has been strategically expanding its global footprint, certain underperforming international routes might be reviewed. The temporary suspension of services like the Los Angeles to Auckland route, particularly during off-peak seasons, can signal a re-evaluation of such niche markets where demand doesn't consistently justify operational costs.

Outdated In-Flight Entertainment Systems

Delta's older in-flight entertainment systems, prior to the planned 2026 upgrades, can be viewed as a question mark in the BCG matrix. These systems offered a less competitive customer experience, potentially impacting passenger engagement and market share within the airline's service offerings.

The limited growth prospects for these legacy systems, coupled with a potentially declining customer preference for outdated technology, position them as a unit requiring careful consideration. For instance, in 2023, Delta reported investing $2 billion in enhancing the onboard experience, which includes significant upgrades to its entertainment systems, signaling a move away from older, less capable units.

- Outdated Technology: Prior generations of in-flight entertainment systems offered a less competitive customer experience.

- Low Market Share: This could lead to lower passenger engagement and a diminished market share in terms of customer preference.

- Minimal Growth Prospects: The systems had limited potential for growth or improvement without significant investment.

- Strategic Re-evaluation: Delta's $2 billion investment in onboard experience in 2023 highlights a strategic shift away from these older systems.

Pre-Boarding for Delta 360 Members (as of May 2025)

Delta Air Lines' decision to end pre-boarding privileges for Delta 360 members starting in May 2025 positions this perk within the Dogs quadrant of the BCG Matrix. This move signifies Delta's assessment of the benefit as a low-growth, low-market-share offering that wasn't contributing substantial value to the program or the overall operational efficiency.

The elimination of this perk is a strategic maneuver to streamline operations. It's understood that the majority of Delta 360 members already benefit from early boarding due to their frequent use of premium cabins, such as First Class or Delta One.

- Low Market Share: The specific benefit of pre-boarding for 360 members, distinct from premium cabin boarding, likely had a limited uptake or impact on overall boarding times.

- Low Growth Potential: Delta likely saw minimal opportunity to expand the value or usage of this specific perk to drive future growth or revenue.

- Operational Streamlining: Removing this non-essential benefit simplifies the boarding process, potentially reducing confusion and improving efficiency for all passengers.

- Focus on Core Value: This allows Delta to concentrate resources and attention on more impactful benefits that truly differentiate its premium offerings and loyalty program.

Delta Air Lines' older, less fuel-efficient aircraft, such as certain Boeing 757s and 767s, are being retired, fitting the Dogs category due to their low market share in the modernized fleet and high operating costs. Similarly, underperforming domestic routes with limited growth potential and potential overcapacity are also considered Dogs, prompting Delta to implement 'surgical' capacity reductions. These segments represent units with low growth and low relative market share, often requiring divestiture or significant restructuring to improve overall efficiency.

Question Marks

Delta's ambitious goal to achieve 10% SAF usage by 2030, investing over $7 billion in SAF offtake agreements and projects, positions it within a high-growth, nascent market. This commitment reflects the aviation industry's urgent need for decarbonization, a significant opportunity.

However, SAF remains costly, with prices significantly higher than traditional jet fuel, and current supply chains are underdeveloped. This limited availability and high cost make SAF a classic Question Mark in the BCG matrix, demanding substantial investment to overcome these barriers and unlock its future potential as a market leader.

Delta's investment in AI-powered personalized pricing and customer experience tools, such as Delta Concierge, positions them within the high-growth digital transformation and personalized travel market. These advancements aim to boost efficiency and customer satisfaction, aligning with the broader trend of leveraging technology for enhanced consumer journeys.

While these AI tools offer significant potential, their current limited deployment across Delta's network means they are considered question marks in the BCG matrix. This suggests they require substantial investment and broader adoption to capture market share and move towards becoming stars.

Delta's investment in hydrogen-powered aircraft development, particularly through its partnership with Airbus in the Sustainable Skies Lab, positions it in a high-growth, emerging market. This venture currently holds no market share, reflecting its nascent stage.

This initiative is inherently high-risk and high-reward, demanding substantial resource allocation. However, it holds the potential to fundamentally transform the aviation industry, potentially becoming a future market leader, or "Star," if these technological advancements prove successful.

New Aircraft Variants (e.g., A350-1000, Boeing 737 MAX 10)

The introduction of new aircraft variants like the Airbus A350-1000 signifies Delta's strategic investment in fleet modernization, aiming for enhanced fuel efficiency and passenger experience. As these advanced models are gradually integrated, their current contribution to Delta's overall fleet capacity and revenue generation is nascent, positioning them as potential Stars or Question Marks within the BCG framework.

- High Growth Potential: The A350-1000 offers superior range and capacity, enabling Delta to expand its long-haul network and capture new markets.

- Low Current Market Share: As a new addition, the A350-1000's presence in Delta's extensive fleet is currently minimal, meaning its immediate impact on overall operational metrics is limited.

- Uncertain Future Performance: While promising, the full operational and financial benefits of the A350-1000 are yet to be proven in Delta's specific operational environment, making its long-term market share and profitability uncertain.

Blended-Wing Body Aircraft (JetZero Partnership)

Delta's collaboration with JetZero on blended-wing body aircraft is a forward-thinking initiative targeting a substantial reduction in carbon emissions, potentially up to 50%. This venture sits squarely in the Question Mark quadrant of the BCG Matrix due to its innovative nature and current lack of market presence.

The technology is still in its developmental stages, making it a high-risk, high-reward proposition. If successful, this partnership could grant Delta a significant first-mover advantage in a potentially transformative segment of the aviation industry.

- Innovation Focus: Blended-wing body design promises significant aerodynamic efficiency gains.

- Environmental Impact: Aims for up to 50% reduction in carbon emissions per flight.

- Market Position: Currently zero market share, representing a nascent, high-growth potential area.

- Strategic Investment: A speculative move to secure future competitive advantage in sustainable aviation.

Delta's investments in Sustainable Aviation Fuel (SAF) and hydrogen-powered aircraft development, alongside its work on blended-wing body designs, all represent significant, high-growth potential ventures with currently low market share. These initiatives are characterized by substantial investment requirements and inherent technological or market adoption risks.

The AI-powered customer experience tools, while showing promise, also fall into the Question Mark category due to their limited current deployment across the airline's network. These areas require further investment and scaling to realize their full market potential and transition into Stars.

The new Airbus A350-1000 variants, while advanced, are still being integrated, meaning their immediate contribution to Delta's overall market share and profitability is nascent. Their future success hinges on proving their operational and financial benefits within Delta's specific network.

| Initiative | Market Growth Potential | Current Market Share | Investment Required | Risk/Reward Profile |

| SAF Usage (Target 10% by 2030) | High | Nascent (low current usage) | High (over $7 billion in offtake agreements) | High Risk (cost, supply chain), High Reward (decarbonization) |

| Hydrogen-Powered Aircraft | Very High (transformative potential) | Zero | Very High (R&D, partnerships) | Very High Risk, Very High Reward |

| Blended-Wing Body Aircraft | High (significant efficiency gains) | Zero | High (developmental stages) | High Risk, High Reward |

| AI-Powered Customer Experience | High (digital transformation) | Low (limited deployment) | Moderate to High (scaling, integration) | Moderate Risk, Moderate to High Reward |

| New Aircraft Variants (e.g., A350-1000) | Moderate to High (fleet modernization) | Low (newly integrated) | High (acquisition costs) | Moderate Risk, Moderate Reward |

BCG Matrix Data Sources

Our Delta Air Lines BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.