De'Longhi SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

De'Longhi Bundle

De'Longhi's strong brand recognition and innovative product development are key strengths, but the company faces intense competition and potential supply chain disruptions. Understanding these dynamics is crucial for strategic planning.

Want the full story behind De'Longhi's market position, including detailed opportunities and threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

De'Longhi has showcased impressive financial strength, with net revenues climbing 11% to €1.58 billion in the first half of 2025. This robust performance is further evidenced by a 9.8% increase in net profit, reaching €116.6 million during the same period.

The company's growth trajectory is further solidified by a 14% surge in total revenue for the entirety of 2024. Looking ahead, De'Longhi has boosted its fiscal year 2025 outlook, now anticipating revenue growth in the range of 6.0% to 8.0%, underscoring sustained market momentum and effective strategic execution.

De'Longhi's position as a global leader in coffee machines, serving both home and professional markets, is a significant strength. This leadership is underpinned by the fact that coffee-related products generate a substantial 65% of the company's total revenue.

This strong reliance on the coffee segment, within a market estimated at around €3 billion and experiencing continuous growth, offers De'Longhi a robust and reliable source of income. It demonstrates a clear focus and successful penetration in a key, expanding industry.

De'Longhi's strength lies in its robustly diversified product portfolio, extending well beyond its renowned coffee machines. The company boasts a comprehensive range of kitchen and home comfort appliances, including air conditioners, heaters, toasters, kettles, and food processors. This breadth of offerings, marketed under well-established brands such as Nutribullet, Kenwood, and Braun, effectively mitigates risks associated with over-reliance on any single product category, ensuring resilience across different market segments.

Commitment to Innovation and Design

De'Longhi shows a serious dedication to coming up with new ideas. Over the past five years, they've put more than €300 million into research and development, which has led to some really well-received products. This focus on innovation keeps their offerings fresh and exciting for consumers.

Their 'Made by De'Longhi' approach is key here. It blends understanding what customers want with top-notch design and manufacturing. This ensures their products don't just look good but also perform exceptionally well, maintaining a competitive edge in the market.

- Significant R&D Investment: Over €300 million invested in R&D in the last five years.

- Award-Winning Products: Consistent recognition for product innovation and quality.

- Consumer-Centric Design: Integration of consumer insights into product development.

- Product Line Expansion: Successful launches in coffee machines, food prep, and home care.

Robust Global Presence and Marketing

De'Longhi's robust global presence is a significant strength, with products distributed in over 120 markets worldwide. This extensive reach is complemented by a strong global marketing strategy.

The company actively enhances its brand visibility through high-impact activations at key industry events. Furthermore, De'Longhi invests in global advertising campaigns, including a prominent upcoming coffee campaign featuring Brad Pitt, which is expected to further boost brand recognition and appeal.

This widespread distribution and impactful marketing effort are crucial for driving ongoing international expansion and fostering strong brand loyalty among consumers across diverse regions.

- Global Reach: Distribution in over 120 countries.

- Marketing Investment: High-impact event activations and global advertising.

- Brand Enhancement: Upcoming Brad Pitt coffee campaign to increase visibility.

- Expansion Support: Extensive network facilitates continued market growth.

De'Longhi's financial performance demonstrates considerable strength, with net revenues increasing by 11% to €1.58 billion in the first half of 2025, and net profit rising by 9.8% to €116.6 million. The company's total revenue saw a 14% increase in 2024, and it anticipates 6.0% to 8.0% revenue growth for fiscal year 2025.

The company's dominant position in the global coffee machine market, which accounts for 65% of its revenue, is a key strength. This focus on a growing market, estimated at €3 billion, provides a stable and substantial income stream.

De'Longhi benefits from a broad product portfolio beyond coffee machines, including kitchen and home comfort appliances marketed under strong brands like Nutribullet, Kenwood, and Braun, which diversifies revenue streams and mitigates risk.

Significant investment in innovation, with over €300 million allocated to R&D over the past five years, has resulted in well-received products and maintains a competitive edge through consumer-centric design and manufacturing excellence.

| Financial Metric | H1 2025 | FY 2024 | FY 2025 Outlook |

|---|---|---|---|

| Net Revenue | €1.58 billion (+11%) | (Data not specified for full year 2024) | 6.0% - 8.0% growth |

| Net Profit | €116.6 million (+9.8%) | (Data not specified for full year 2024) | (Data not specified) |

| Coffee Segment Revenue Share | 65% | (Data not specified) | (Data not specified) |

What is included in the product

Delivers a strategic overview of De'Longhi’s internal and external business factors, highlighting its brand strength and innovation potential against market competition and economic shifts.

Uncovers De'Longhi's competitive edge and potential pitfalls for proactive market navigation.

Weaknesses

De'Longhi's operations are vulnerable to significant macroeconomic shifts. Global events like geopolitical instability, coupled with elevated interest rates and soaring energy and shipping expenses, create a challenging operating environment. These conditions directly dampen consumer spending power, particularly for discretionary items like home appliances.

The home appliance sector, in particular, experienced a noticeable slowdown in demand during 2024 due to these economic pressures. This can translate into lower sales volumes and squeezed profit margins for De'Longhi, as consumers become more cautious with their expenditures.

De'Longhi faces significant risks from evolving global trade dynamics, particularly concerning tariffs. The company has projected a substantial €50 million impact for 2025 due to anticipated U.S. tariffs alone.

While De'Longhi is actively exploring strategies like price adjustments and cost optimization to counter these trade barriers, their implementation introduces operational complexities. These tariffs can also directly challenge De'Longhi's ability to maintain competitive pricing in crucial international markets, potentially impacting sales volume and profitability.

De'Longhi's working capital absorption presented a notable weakness, contributing to a decline in its net financial position from the close of 2024 to the mid-point of 2025. This trend suggests that a substantial portion of cash was tied up in day-to-day operations or distributed to shareholders.

Specifically, the absorption of working capital, alongside shareholder remuneration, led to a reduction in De'Longhi's net financial position. For instance, if the net financial position was €500 million at the end of 2024 and fell to €450 million by June 2025, this €50 million decrease highlights the impact of these cash outflows.

High Dependence on Coffee Segment

De'Longhi's significant reliance on its coffee segment, which represented approximately 65% of its total revenue as of the first half of 2024, presents a notable weakness. While coffee appliance sales have been robust, this high concentration leaves the company susceptible to market fluctuations within this specific category.

Potential risks include shifts in consumer tastes away from coffee, intensified competition from both established brands and emerging players in the coffee machine market, or unforeseen disruptions in the coffee appliance supply chain. For instance, a major raw material shortage or a significant increase in shipping costs specifically impacting coffee machine components could disproportionately affect De'Longhi's overall financial performance.

- Revenue Concentration: The coffee segment accounted for roughly 65% of De'Longhi's revenue in H1 2024.

- Market Vulnerability: High dependence on coffee makes the company susceptible to changes in consumer preferences and market trends within that sector.

- Competitive Pressure: Increased competition in the coffee appliance market could erode market share and profitability.

- Supply Chain Risks: Disruptions in the supply chain for coffee machine components could significantly impact production and sales.

Uneven Performance Across Geographies

De'Longhi's performance isn't uniform globally. For instance, in the third quarter of 2024, the Asia Pacific region saw a dip in its like-for-like revenues. This unevenness extends to specific sectors, as the company also faced challenges in the Chinese professional coffee market during that same period.

These regional discrepancies underscore a key weakness: the need for more nuanced market approaches.

- Asia Pacific Revenue Decline: Like-for-like revenues in the Asia Pacific region decreased in Q3 2024.

- China Market Struggles: The professional coffee sector in China experienced difficulties in Q3 2024.

- Need for Tailored Strategies: Regional performance variations necessitate customized plans for each market.

De'Longhi's significant reliance on its coffee segment, which represented approximately 65% of its total revenue in H1 2024, creates a key vulnerability. This concentration exposes the company to shifts in consumer preferences and intensified competition within the coffee appliance market, potentially impacting overall financial performance.

The company also faces challenges with uneven global performance, as evidenced by a dip in like-for-like revenues in the Asia Pacific region during Q3 2024, alongside difficulties in the Chinese professional coffee market. These regional disparities highlight the need for more tailored market strategies to address varying economic conditions and consumer demands.

| Weakness | Description | Impact |

| Revenue Concentration | Coffee segment accounted for ~65% of revenue (H1 2024). | Susceptibility to coffee market trends and competition. |

| Regional Performance | Asia Pacific revenue declined (Q3 2024); China professional coffee market struggled. | Requires customized market approaches; potential for localized downturns. |

Same Document Delivered

De'Longhi SWOT Analysis

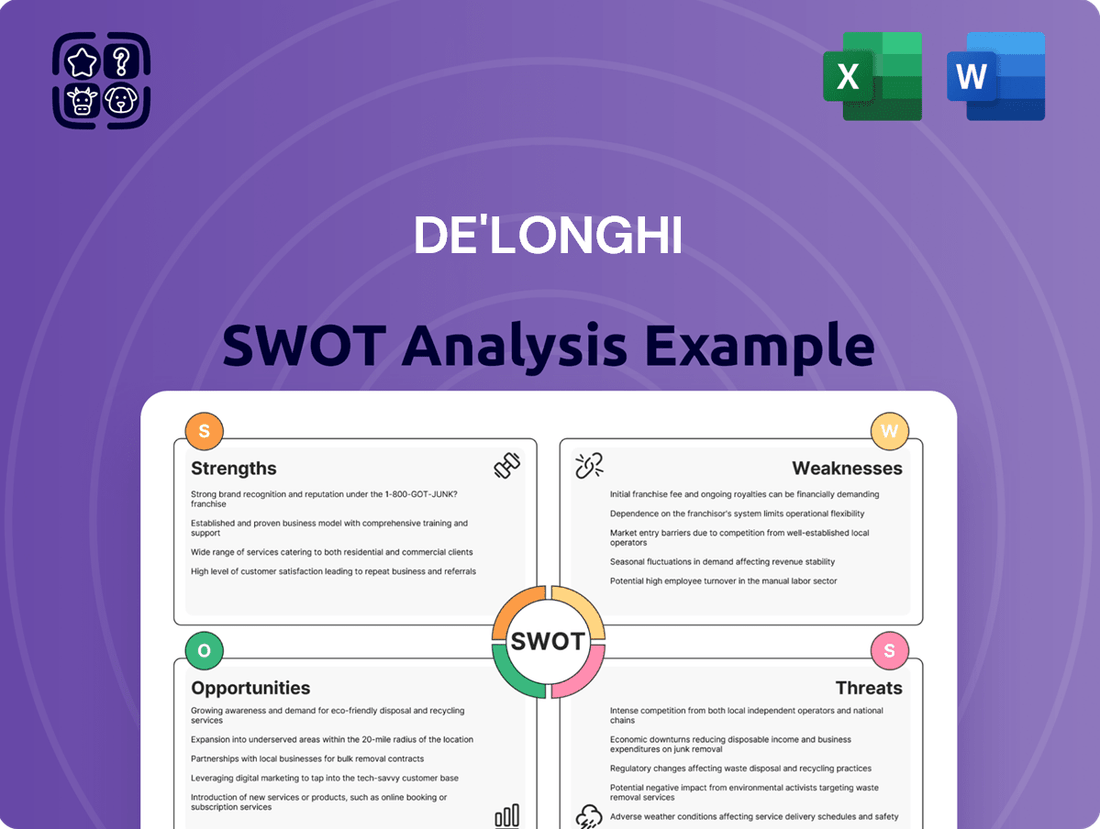

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, providing a comprehensive understanding of De'Longhi's strategic position.

This is a real excerpt from the complete document, showcasing the professional quality and structure you can expect. Once purchased, you’ll receive the full, editable version of the De'Longhi SWOT analysis.

You’re viewing a live preview of the actual SWOT analysis file, giving you confidence in the content. The complete version, detailing De'Longhi's Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

Opportunities

The household appliance market is rapidly shifting towards smart and connected devices, with a growing adoption rate in homes globally. This trend offers De'Longhi a significant opportunity to enhance its product lines with advanced features and seamless integration into popular smart home ecosystems, catering to consumer desires for greater convenience and efficiency.

The global household appliance market is on a strong upward trajectory, expected to grow from $671.66 billion in 2024 to $729.08 billion in 2025. This significant expansion, fueled by trends like increased home improvement projects and a rising global middle class, presents De'Longhi with substantial opportunities to capture a larger market share.

De'Longhi can leverage this market growth to introduce innovative products and expand its reach into emerging economies where demand for quality appliances is rising. The increasing consumer focus on energy efficiency and smart home technology within this expanding market also offers a clear avenue for product differentiation and sales growth.

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. This trend presents a substantial opportunity for De'Longhi to leverage its existing sustainability initiatives. For instance, the company's commitment to 'Near Term' and 'Net Zero' targets, alongside certifications for carbon neutrality on specific products, directly addresses this growing consumer preference.

Leveraging E-commerce and Direct-to-Consumer (D2C) Channels

The accelerating shift towards online shopping presents De'Longhi with a prime opportunity to expand its market reach and potentially boost profitability by streamlining its supply chain. By focusing on e-commerce, the company can bypass traditional retail markups, leading to improved margins.

Developing robust direct-to-consumer (D2C) strategies allows De'Longhi to cultivate deeper connections with its customer base and gather crucial insights into purchasing behaviors and preferences. This direct engagement is invaluable for future product development and targeted marketing efforts.

- E-commerce Growth: Global e-commerce sales are projected to reach $8.1 trillion by 2024, underscoring the vast potential for De'Longhi to capture market share online.

- D2C Benefits: Companies with strong D2C models often report higher customer lifetime value and greater control over brand messaging.

- Data Insights: Direct sales channels provide rich data for personalization, leading to more effective marketing campaigns and product innovation.

- Margin Improvement: Eliminating intermediaries in the sales process can lead to a healthier profit margin for each unit sold.

Strategic Acquisitions and Partnerships

De'Longhi's history shows a strong ability to successfully integrate acquired companies. For example, the acquisitions of La Marzocco and Eversys have been instrumental in driving substantial growth within its professional division. This track record suggests a strategic advantage in pursuing further acquisitions.

Looking ahead to 2024 and 2025, continued strategic acquisitions present a significant opportunity. The focus should be on high-growth segments within both the coffee machine market and the broader kitchen appliance industry. By targeting these areas, De'Longhi can effectively diversify its brand portfolio and expand its overall market presence.

- Acquisition Success: Integration of La Marzocco and Eversys boosted the professional division's growth.

- Market Expansion: Further acquisitions can diversify brand portfolio and market reach.

- Growth Focus: Targeting high-growth areas in coffee and kitchen appliances is key.

The increasing consumer demand for smart home integration and connected appliances presents a significant avenue for De'Longhi. As the global smart home market is projected to reach $157.4 billion by 2024, the company can capitalize on this by enhancing its product offerings with advanced features and seamless connectivity.

The broader household appliance market is experiencing robust growth, with an estimated expansion from $671.66 billion in 2024 to $729.08 billion in 2025. This upward trend, driven by factors like increased home improvement activities and a growing global middle class, offers De'Longhi substantial opportunities to increase its market share.

De'Longhi's proven success in integrating acquired companies, such as La Marzocco and Eversys, highlights a strategic advantage for future growth. By continuing to pursue strategic acquisitions in high-growth segments of the coffee and kitchen appliance markets, De'Longhi can effectively diversify its brand portfolio and broaden its overall market reach through 2024-2025.

Threats

The small domestic appliance market is incredibly crowded, with a multitude of global and local players vying for consumer attention. This intense competition often forces companies like De'Longhi to engage in aggressive pricing strategies, which can squeeze profit margins. For example, in 2024, the global small domestic appliance market was valued at approximately $240 billion, with growth projected to continue, further intensifying the competitive environment.

De'Longhi's profitability is significantly impacted by the volatility of raw material prices, such as plastics and metals used in appliance manufacturing. For instance, global commodity markets in early 2024 saw continued upward pressure on key inputs, directly affecting production expenses. This sensitivity means that unexpected spikes in energy and transportation costs, a trend observed throughout 2023 and into 2024, can quickly erode profit margins.

These external cost pressures are a persistent industry-wide challenge, forcing companies like De'Longhi to consider strategic adjustments. Such pressures might necessitate price increases for consumers or require the company to find efficiencies in its production processes to maintain competitive pricing and profitability amidst these fluctuating operational expenses.

Consumer tastes are in constant flux, and the appliance sector is seeing a noticeable decline in brand loyalty. This means De'Longhi needs to stay agile, constantly updating its products, designs, and how it connects with customers to avoid losing them to rivals who might better capture evolving preferences.

For instance, a 2024 report indicated that over 60% of consumers are willing to switch brands for better value or features, highlighting the pressure on established names like De'Longhi to innovate and maintain relevance in a competitive landscape.

Potential for Supply Chain Disruptions

Global supply chains are still susceptible to various disruptions, such as geopolitical conflicts and unexpected events. For De'Longhi, this means that their manufacturing could be affected, leading to product availability delays and potentially higher shipping expenses, which would impact how smoothly they operate.

For instance, in 2023, the Suez Canal blockage highlighted how sensitive global trade routes are. While not directly impacting De'Longhi's primary operations, it serves as a stark reminder of the potential for widespread logistical challenges. The company's reliance on components sourced internationally exposes it to these vulnerabilities.

- Geopolitical Instability: Ongoing global tensions can disrupt shipping lanes and increase the cost of raw materials.

- Logistical Bottlenecks: Port congestion and transportation shortages can lead to significant delays in receiving components and delivering finished goods.

- Increased Costs: Supply chain disruptions often translate to higher freight charges and component prices, squeezing profit margins.

Rapid Technological Obsolescence

The relentless pace of technological advancement, especially in smart home integration and connected appliances, presents a significant risk of rapid product obsolescence for De'Longhi. Competitors are constantly innovating, and failing to keep up means falling behind.

To counter this, De'Longhi must commit to substantial and ongoing research and development. For instance, in 2023, the global smart home market was valued at approximately $115 billion and is projected to grow significantly, indicating a strong consumer demand for connected features. De'Longhi's R&D spending needs to be robust to ensure its offerings remain competitive and technologically relevant in this dynamic landscape.

- Technological Obsolescence: The rapid evolution of smart appliance technology can quickly render existing De'Longhi products outdated.

- R&D Investment Needs: Significant investment in R&D is crucial to stay ahead of competitors and integrate new features like AI-powered brewing or advanced connectivity.

- Market Relevance: Failure to innovate risks losing market share to more agile companies that can adapt faster to emerging technological trends.

De'Longhi faces intense competition in the crowded small domestic appliance market, with a global market valued at approximately $240 billion in 2024, leading to pressure on profit margins. Fluctuations in raw material prices, such as plastics and metals, alongside rising energy and transportation costs observed through 2023 and into 2024, directly impact production expenses and profitability.

The company must navigate evolving consumer preferences, as a 2024 report indicated over 60% of consumers are willing to switch brands for better value, necessitating continuous innovation and customer engagement. Furthermore, ongoing technological advancements, particularly in smart home integration, pose a risk of product obsolescence, requiring substantial R&D investment to maintain market relevance amidst a rapidly growing smart home market valued at $115 billion in 2023.

Supply chain vulnerabilities, including geopolitical instability and logistical bottlenecks, can lead to product availability delays and increased shipping expenses. The sensitivity of global trade routes, exemplified by events in 2023, highlights the potential for widespread disruptions affecting De'Longhi's reliance on international component sourcing.

SWOT Analysis Data Sources

This De'Longhi SWOT analysis is built upon a foundation of credible data, including company financial reports, comprehensive market research, and expert industry analysis to provide a robust strategic overview.