De'Longhi Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

De'Longhi Bundle

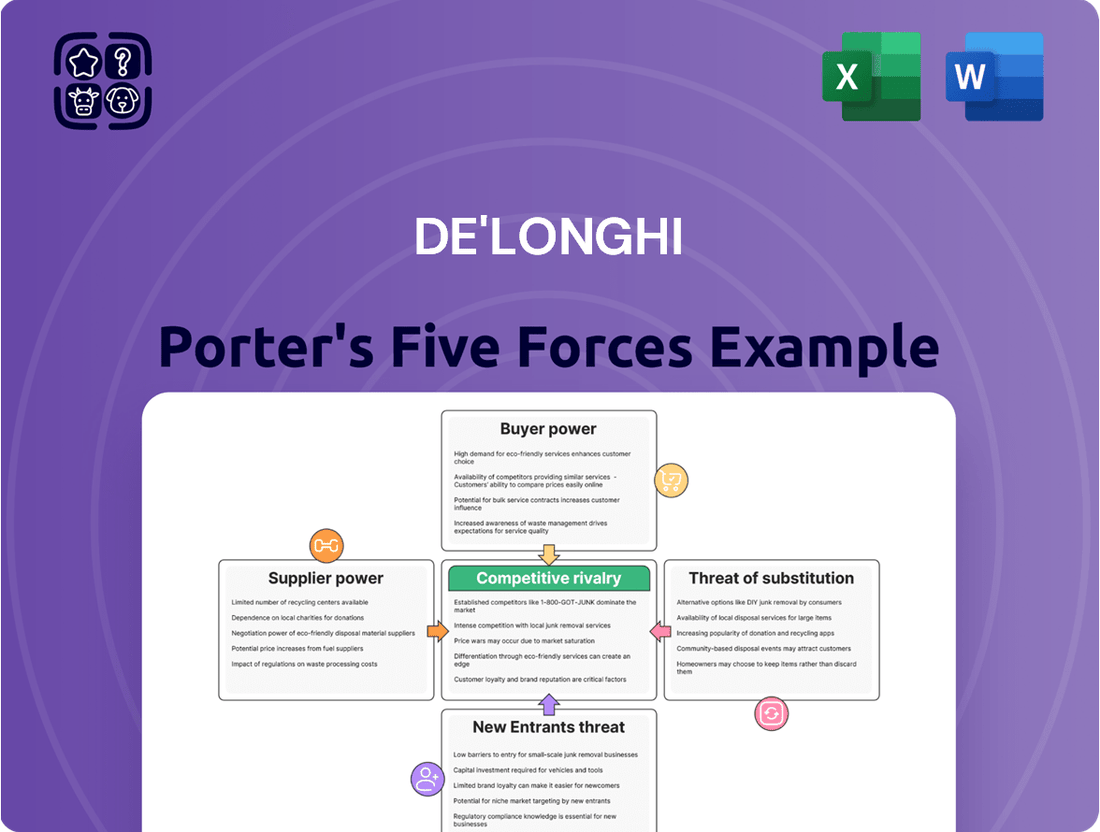

De'Longhi faces significant competitive pressures, with moderate buyer power and a constant threat from substitutes in the home appliance market. Understanding the intensity of rivalry among existing players is crucial for their strategic positioning.

The complete report reveals the real forces shaping De'Longhi’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

De'Longhi sources a wide array of materials, from basic plastics and metals to specialized electronic components and critical parts like coffee machine pumps and air conditioner compressors. The concentration of these specialized suppliers, particularly for proprietary components, significantly amplifies their bargaining power.

When De'Longhi faces a limited number of suppliers for essential, specialized parts, those suppliers can dictate terms. For instance, if a unique pump technology for their high-end coffee machines is only available from one or two manufacturers, De'Longhi’s ability to negotiate pricing or supply terms is severely constrained.

This reliance on a few specialized vendors directly affects De'Longhi's operational costs and profitability. In 2024, global supply chain disruptions, including shortages of semiconductors and specialized electronic components, have already demonstrated how supplier concentration can lead to increased input costs and production delays for many manufacturers in the home appliance sector.

The prices of essential raw materials like steel, aluminum, and plastics are constantly shifting due to global market dynamics. In 2023, the London Metal Exchange saw significant fluctuations in aluminum prices, impacting manufacturing costs across various industries. This volatility allows suppliers to exert more influence over manufacturers such as De'Longhi.

Suppliers can readily pass on these fluctuating costs, thereby strengthening their bargaining position. For instance, disruptions in the global steel supply chain in late 2023, partly due to energy price surges in Europe, directly translated into higher input costs for appliance makers.

External factors such as geopolitical tensions or unforeseen supply chain interruptions can amplify this supplier power. Events like the ongoing trade disputes or regional conflicts can create scarcity, giving suppliers even more leverage to dictate terms and prices to companies like De'Longhi.

De'Longhi's reliance on suppliers for advanced technology, particularly for features like smart connectivity and sophisticated brewing mechanisms, grants these suppliers significant leverage. For instance, a supplier holding patents for a unique coffee grinding system or an AI-driven user interface could command higher prices, impacting De'Longhi's cost of goods sold.

Switching Costs for De'Longhi

Switching suppliers for critical components presents significant challenges for De'Longhi. These challenges include the costs and time required for re-tooling manufacturing lines, implementing new quality control protocols, and navigating the complexities of renegotiating supply agreements. These hurdles naturally increase the bargaining power of De'Longhi's existing suppliers.

High switching costs mean De'Longhi is incentivized to maintain stable relationships with its current suppliers to avoid operational disruptions and unexpected expenses. This reliance on established relationships strengthens the suppliers' position in negotiations. For instance, if a key component supplier for De'Longhi's popular espresso machines were to significantly increase prices, De'Longhi might find it prohibitively expensive to find and onboard an alternative supplier quickly.

- High Retooling Expenses: De'Longhi may face substantial capital expenditure to adapt its production machinery for new components.

- Quality Assurance Investment: Ensuring the quality and consistency of components from a new supplier requires rigorous testing and validation, adding to the switching burden.

- Contractual Obligations: Existing long-term contracts with suppliers can impose penalties or significant negotiation hurdles for early termination.

Backward Integration Potential

The potential for backward integration by De'Longhi's suppliers, particularly for complex components, could significantly shift the bargaining power. If a major supplier possessed the capability and inclination to manufacture De'Longhi's final appliances, it would create a substantial threat.

Conversely, De'Longhi's own capacity for backward integration into producing critical components could also alter the dynamic. However, for many specialized parts integral to De'Longhi's product lines, this backward integration is often not a practical or economically viable strategy, thereby preserving a degree of supplier leverage.

- Supplier Backward Integration: The threat of suppliers moving into appliance manufacturing is generally low for De'Longhi's specialized components.

- De'Longhi's Backward Integration: De'Longhi's ability to produce key components internally is limited by technical complexity and cost.

- Component Specialization: The highly specialized nature of many parts used in De'Longhi appliances makes direct backward integration by suppliers or De'Longhi itself challenging.

- Market Dynamics: In 2024, the global supply chain for small appliances remains intricate, with many suppliers focusing on niche components, thus maintaining their bargaining power due to specialized expertise.

De'Longhi's bargaining power with suppliers is moderate, influenced by the specialized nature of many components and the costs associated with switching. Suppliers of proprietary technologies, such as advanced coffee machine pumps or unique air conditioning compressors, hold significant leverage due to limited alternatives and high switching costs for De'Longhi. For example, the reliance on a few manufacturers for critical electronic components, exacerbated by global shortages in 2024, directly increases supplier pricing power.

The concentration of suppliers for specialized parts, coupled with De'Longhi's substantial investment in retooling and quality assurance for new vendors, reinforces supplier influence. This dynamic means suppliers can more readily pass on increased raw material costs, as seen with steel and aluminum price volatility in 2023, impacting De'Longhi's cost of goods sold.

The threat of backward integration by suppliers is generally low for De'Longhi's highly specialized components, but De'Longhi's own ability to integrate backward is also limited by technical complexity and cost. This balance maintains a degree of power for specialized component suppliers in the intricate global supply chain for small appliances in 2024.

| Factor | Impact on De'Longhi's Bargaining Power | 2024 Context/Example |

| Supplier Concentration (Specialized Parts) | Decreases De'Longhi's power | Limited suppliers for advanced coffee machine pumps |

| Switching Costs (Retooling, QA) | Decreases De'Longhi's power | High capital expenditure for new component integration |

| Raw Material Price Volatility | Increases supplier power | Aluminum price fluctuations on London Metal Exchange (2023) |

| Supplier Backward Integration Threat | Low threat to De'Longhi | Suppliers unlikely to enter appliance manufacturing |

What is included in the product

This analysis delves into the competitive forces impacting De'Longhi, examining the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Instantly visualize De'Longhi's competitive landscape with a clear, one-sheet summary of all five forces—perfect for quick strategic decision-making.

Customers Bargaining Power

Customers in the small domestic appliance market, especially for simpler items like kettles and toasters, are often very sensitive to price. The sheer number of brands offering similar products allows consumers to easily shop around and pick the cheapest option, which naturally boosts their bargaining power.

For instance, in 2023, the global small kitchen appliance market saw intense competition, with price promotions being a common strategy to attract budget-conscious buyers. This ease of comparison for basic appliances directly translates to increased customer leverage.

While brand loyalty and the perceived value of premium products, such as De'Longhi's espresso machines, can somewhat lessen this price sensitivity, the fundamental ability of customers to switch to a competitor based on cost remains a significant factor.

The appliance market, including De'Longhi's segment, is characterized by a wide availability of substitutes. For instance, in the coffee machine market alone, consumers can choose from drip coffee makers, French presses, pour-over devices, and pod-based systems, in addition to De'Longhi's espresso machines. This abundance of alternatives, often at varying price points and with different functionalities, means customers are not reliant on any single manufacturer.

The rise of online platforms and review sites has dramatically increased information transparency for De'Longhi's customers. In 2024, consumers increasingly rely on detailed product comparisons and peer reviews to make purchasing decisions, giving them significant leverage. For instance, a study found that over 90% of consumers read online reviews before making a purchase, directly impacting brand loyalty and pricing power.

Low Switching Costs for Consumers

For many small domestic appliances, consumers face very low switching costs. This means they can easily move from one brand to another without incurring significant financial penalties or requiring substantial effort. For instance, a consumer looking to replace a coffee maker can readily switch from a De'Longhi model to a competitor's product without losing any prior investment or facing complex setup procedures.

The absence of long-term contracts or brand-specific investments further amplifies this low switching cost. Consumers are not locked into a particular brand for their kitchen appliances, allowing them the freedom to shop around for the best price, features, or brand reputation for their next purchase. This ease of transition directly impacts De'Longhi's pricing power and market share.

- Low Switching Costs: Consumers can easily switch between brands of small domestic appliances without significant financial or effort-based barriers.

- No Long-Term Commitments: Purchases of items like coffee makers or toasters typically do not involve contracts that tie customers to a specific brand.

- Consumer Choice: This flexibility empowers consumers to readily explore alternatives based on price, innovation, or brand loyalty, increasing competitive pressure on De'Longhi.

- Market Dynamics: In 2024, the appliance market continues to see a high volume of unit sales for small domestic appliances, where brand loyalty can be fluid due to these low switching costs.

Power of Retailers and Distribution Channels

The bargaining power of customers, particularly through large retailers and e-commerce platforms, significantly impacts manufacturers like De'Longhi. These powerful intermediaries, with their direct access to millions of consumers, can dictate terms, influencing pricing and promotional strategies. For instance, major retailers often leverage their sales volume to negotiate favorable margins, effectively channeling customer demand and its inherent power back to the manufacturer.

This indirect customer power, exerted through distribution channels, can force companies to offer competitive pricing and promotional deals to secure shelf space and visibility. In 2024, the dominance of online marketplaces and large brick-and-mortar chains means that De'Longhi must remain highly attuned to the demands of these powerful partners. Their ability to consolidate consumer purchasing power makes them formidable negotiators.

- Retailer Dominance: Large retail chains and online platforms act as gatekeepers, wielding considerable influence over product placement and pricing.

- Price Pressure: The ability of these intermediaries to compare and aggregate consumer preferences can lead to downward pressure on manufacturer prices.

- Promotional Demands: Retailers often require manufacturers to contribute to marketing and promotional activities to ensure product visibility, impacting profit margins.

- Channel Control: De'Longhi's success is partly dependent on maintaining strong relationships with these powerful distribution channels, which control direct access to the end consumer.

Customer bargaining power is substantial in the small domestic appliance market due to low switching costs and readily available substitutes. Consumers can easily compare prices and features online, with data from 2024 indicating over 90% of consumers consult reviews before purchasing. This transparency empowers buyers, making them less sensitive to brand loyalty for simpler items.

The influence of powerful retailers and e-commerce platforms further amplifies customer leverage. These intermediaries can negotiate favorable terms, impacting De'Longhi's pricing and promotional strategies. For instance, major retailers often demand significant contributions to marketing to secure prominent placement, directly channeling consumer demand and its power.

| Factor | Impact on De'Longhi | Supporting Data (2024 Estimates/Trends) |

|---|---|---|

| Price Sensitivity | High for basic appliances | Consumers increasingly prioritize value, with price comparison tools widely used. |

| Availability of Substitutes | Significant | The market offers numerous brands and product types (e.g., various coffee makers). |

| Switching Costs | Low | Minimal financial or effort barriers to changing brands for small appliances. |

| Information Transparency | High | Online reviews and comparison sites empower informed purchasing decisions. |

| Retailer Power | Considerable | Major retailers and online platforms dictate terms, influencing manufacturer strategies. |

Same Document Delivered

De'Longhi Porter's Five Forces Analysis

This preview shows the exact De'Longhi Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive document details the competitive landscape for De'Longhi, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. You'll gain actionable insights into De'Longhi's strategic positioning and potential challenges.

Rivalry Among Competitors

The small domestic appliance market, a vibrant sector including kitchen gadgets and home comfort items, is teeming with competition from both global powerhouses and localized brands. De'Longhi navigates this crowded space alongside established names such as Philips, Bosch, Siemens, Electrolux, and Breville, as well as niche specialists and newer direct-to-consumer entrants. This intense rivalry drives a continuous cycle of product development and robust marketing campaigns.

Competitive rivalry in the home appliance sector, especially for products like espresso machines, is intense and largely fueled by a relentless pursuit of product differentiation and innovation. Companies are constantly vying to introduce new models with enhanced design, cutting-edge technology such as smart connectivity and improved energy efficiency, and superior perceived quality. This creates a perpetual race where significant investment in research and development is crucial for capturing consumer attention and maintaining market leadership.

The appliance market, especially for less differentiated products, frequently sees intense competition through aggressive pricing and promotional activities. This dynamic can lead to price wars, squeezing profit margins for all players. For instance, in 2024, many consumer electronics retailers reported increased reliance on promotional sales, with average discounts reaching 15-20% during peak shopping seasons, impacting overall industry profitability.

Brand Strength and Marketing Spend

Competitive rivalry in the home appliance sector is intense, with major players like De'Longhi investing heavily in brand strength and marketing. Companies pour significant resources into advertising campaigns, sponsorships, and digital marketing to capture consumer attention and market share. For instance, in 2023, the global advertising spend for major home appliance brands reached billions of dollars, reflecting the high stakes involved in building brand recognition and loyalty.

De'Longhi, like its competitors, must continually reinforce its brand image, emphasizing perceived quality and unique selling propositions to differentiate itself. A strong brand not only helps in commanding premium pricing but also cultivates enduring customer loyalty, which is crucial for sustained growth in a saturated market.

- Brand Investment: Competitors allocate substantial budgets to advertising and brand building to gain market share.

- Differentiation: Companies focus on reinforcing brand image, quality perception, and unique selling points.

- Customer Loyalty: A strong brand enables premium pricing and fosters long-term customer relationships.

Global Market Presence and Expansion Strategies

Competitive rivalry in the home appliance sector is fierce, with many players operating globally. These companies are continuously expanding into new territories, utilizing established international distribution channels to reach a wider customer base. This widespread presence means that De'Longhi faces direct competition not only in its home markets but also in burgeoning economies where other global brands are also vying for market share.

The intense competition is evident in market dynamics. For instance, in 2024, major appliance manufacturers reported varying degrees of international sales growth. Whirlpool, a significant competitor, saw its international segment contribute substantially to its overall revenue, highlighting the importance of global reach. Similarly, Electrolux has been actively investing in emerging markets, aiming to capture a larger share of their growing middle class.

- Global Competitors: Major players like Whirlpool, Electrolux, and Samsung are actively expanding their global footprint.

- Market Expansion: Competitors are focusing on emerging economies in Asia and Latin America for growth opportunities.

- Distribution Networks: Leveraging established international distribution networks is a key strategy for gaining market share.

- Intensified Rivalry: De'Longhi faces heightened competition as global brands vie for dominance in both developed and developing markets.

The competitive landscape for De'Longhi is characterized by intense rivalry, driven by numerous global and local players vying for market share. This dynamic forces companies to constantly innovate and invest heavily in marketing to stand out. The pressure to differentiate through product features, design, and brand perception is a constant theme in this sector.

Aggressive pricing and promotional activities are common tactics used by competitors, especially for less differentiated products, leading to potential margin erosion. For example, in 2024, a significant portion of consumer electronics sales were driven by discounts, with some retailers reporting average promotional markdowns of up to 20% during key sales periods.

Global expansion is another key battleground, with competitors like Whirlpool and Electrolux actively increasing their presence in emerging markets to capture new customer bases. This broad geographic competition means De'Longhi faces challenges not only in established markets but also in rapidly growing economies.

| Competitor | Key Strategy | 2023/2024 Focus |

|---|---|---|

| Philips | Product innovation and brand marketing | Smart home integration, energy efficiency |

| Bosch/Siemens | Quality and durability, strong distribution | Expansion in emerging markets, premium segment |

| Electrolux | Global reach and diverse portfolio | Investment in Asia-Pacific, sustainability initiatives |

| Breville | Premium design and advanced features | Targeting niche markets, influencer collaborations |

SSubstitutes Threaten

For De'Longhi's coffee machine business, the threat of substitutes is significant. Consumers can opt for instant coffee, a much cheaper and quicker alternative, or choose coffee pods from competing systems like Nespresso or Keurig, which offer convenience but may not align with De'Longhi's specific machine types. Furthermore, the readily available option of purchasing coffee from cafes and coffee shops presents a direct substitute, bypassing the need for home brewing altogether.

In the realm of home comfort appliances, such as air conditioners and heaters, De'Longhi faces substitutes that address the core need for temperature regulation. Central HVAC systems, while a larger investment, offer a comprehensive solution. More immediate substitutes include portable fans for cooling and blankets or electric throws for heating, all fulfilling the basic requirement without relying on De'Longhi's specialized equipment.

The threat of manual or low-tech alternatives remains a factor for De'Longhi, particularly in the coffee maker segment. Consumers seeking a more hands-on approach or a lower initial investment might choose methods like French presses or pour-over coffee makers. These alternatives bypass the need for electricity and complex machinery, offering a simpler user experience and often a lower price point. For example, the global market for manual coffee makers, while smaller than electric, still represents a significant segment, with many consumers valuing the ritual and perceived control over the brewing process.

The increasing sophistication and multi-functionality of kitchen appliances pose a significant threat of substitution for De'Longhi. For instance, advanced food processors and stand mixers now offer an array of attachments, capable of tasks previously requiring dedicated machines like blenders or pasta makers. This consolidation of function in a single appliance can lead consumers to opt for one versatile unit rather than purchasing several specialized De'Longhi products, potentially impacting sales of individual product lines.

Durability and Repair of Existing Products

The durability and repairability of existing coffee machines present a significant threat to De'Longhi. Consumers increasingly opt to extend the life of their current appliances through repairs rather than investing in new models, especially if upgrades are incremental. This trend is supported by rising consumer awareness of sustainability and cost-saving measures. For instance, a 2024 survey indicated that over 60% of consumers consider repairability a key factor when purchasing home appliances, up from 45% in 2022.

When De'Longhi's current product lineup is perceived as robust and future models fail to offer truly innovative features or substantial improvements, the allure of a new purchase wanes. This can lead to a stagnation in sales as consumers find their existing machines perfectly adequate. The market for third-party repair services and readily available spare parts further strengthens this substitute threat, making it easier and more economical for consumers to maintain their current coffee makers.

- Consumer preference for repair over replacement is growing.

- Durability of existing De'Longhi models impacts upgrade cycles.

- Lack of compelling new features reduces the incentive to purchase.

- Availability of repair services and parts supports product longevity.

Shared Economy and Rental Services

While the shared economy and rental services are not yet a significant threat to De'Longhi's core business of small domestic appliances, they represent a potential substitute in specific contexts. For instance, the rise of co-working spaces or shared kitchen facilities equipped with high-quality coffee machines or blenders could diminish the demand for individual ownership, particularly among younger demographics or urban dwellers with limited space. This trend, though nascent, could see growth as consumers prioritize access over ownership for less frequently used or specialized appliances.

Consider the growing popularity of rental platforms for everything from tools to event equipment. While direct appliance rental is less common, the underlying principle of accessing goods as needed rather than owning them could extend to kitchen appliances. For example, a consumer might rent a high-end espresso machine for a special occasion rather than purchasing one, thereby bypassing De'Longhi's offerings. This is particularly relevant for niche or premium appliances where the cost of ownership might be a barrier.

The threat, while currently minor, is worth monitoring. For example, in 2023, the global rental market was valued at over $100 billion, indicating a strong consumer appetite for access-based consumption models. If this expands into small domestic appliances, it could present a new competitive landscape for De'Longhi, forcing a re-evaluation of product lifecycle and ownership models.

- Niche Substitution: Shared kitchen spaces or short-term rentals of specialized appliances can reduce the need for individual ownership.

- Growing Rental Market: The overall rental market's significant growth suggests a potential shift towards access over ownership.

- Urban & Younger Demographics: These groups, often facing space constraints and prioritizing experiences, may be early adopters of appliance rental.

The threat of substitutes for De'Longhi's coffee machines is multifaceted, ranging from instant coffee and competing pod systems to out-of-home consumption at cafes. In home comfort, alternatives like central HVAC or simple fans and blankets compete. Manual coffee makers and increasingly multi-functional kitchen appliances also present viable substitutes, offering simplicity or consolidated utility.

Consumer behavior is shifting, with a growing preference for repairing existing appliances over purchasing new ones, a trend amplified by sustainability concerns and cost-saving. For instance, a 2024 consumer survey revealed that over 60% of individuals consider repairability when buying appliances, a notable increase from 45% in 2022. This focus on longevity, coupled with the availability of third-party repair services and spare parts, directly challenges De'Longhi's sales cycles, especially when new models lack significant innovation.

The rise of the shared economy and rental services, while not yet a primary threat to De'Longhi's core small appliance business, poses a potential future challenge. Access-based consumption models could impact demand for individual ownership, particularly for less frequently used or specialized items, with younger and urban demographics being potential early adopters. The global rental market's substantial valuation, exceeding $100 billion in 2023, underscores a growing consumer willingness to rent rather than buy.

Entrants Threaten

Entering the small domestic appliance market, particularly with a diverse product range akin to De'Longhi's, necessitates considerable capital outlay. This includes setting up advanced manufacturing plants, investing heavily in ongoing research and development to innovate and stay competitive, and establishing robust global supply chains. For example, developing a new high-performance espresso machine can easily cost millions in R&D alone.

De'Longhi, like many established appliance manufacturers, benefits from significant brand recognition and deep-rooted customer loyalty. Decades of consistent product quality and marketing have fostered a strong sense of trust among consumers. For instance, De'Longhi reported a revenue of €3,263.2 million in 2023, underscoring its market presence and consumer demand.

Newcomers to the coffee machine and small appliance market face a considerable challenge in replicating this level of brand equity. They must invest heavily in marketing and product development to even begin to chip away at the loyalty enjoyed by brands like De'Longhi. This barrier means that while new entrants might offer innovative products, gaining significant market share requires overcoming a substantial psychological and financial hurdle with consumers.

Newcomers face significant hurdles in securing shelf space within major retail chains, both physical stores and online platforms. De'Longhi, like many established brands, benefits from decades of cultivating these relationships.

Existing players leverage their established distribution networks and logistics infrastructure, which often operate at a scale that allows for lower per-unit shipping costs. This makes it tough for new entrants to match the reach and cost-competitiveness of incumbent companies in the small appliance market.

Economies of Scale and Cost Advantages

De'Longhi, as an established player, leverages significant economies of scale in its operations. This translates to lower per-unit production costs, more favorable terms with suppliers due to bulk purchasing, and more efficient marketing spend across a wider customer base. For instance, in 2023, De'Longhi reported net sales of €2,459.3 million, indicating a substantial volume of production and procurement that smaller, new entrants would struggle to match.

These scale advantages create substantial cost barriers for potential new entrants. A new company entering the coffee machine market, for example, would face higher initial per-unit costs for manufacturing and marketing compared to De'Longhi. This cost disadvantage makes it challenging for newcomers to offer competitive pricing and capture market share quickly, thus deterring new entrants.

- Economies of Scale: De'Longhi benefits from lower production costs due to high sales volumes.

- Procurement Advantages: Bulk purchasing power allows for better supplier negotiations and reduced input costs.

- Marketing Efficiency: Spreading marketing expenses over a larger sales base makes it more cost-effective per unit.

- Cost Barrier: New entrants face higher per-unit costs, hindering their ability to compete on price.

Regulatory and Compliance Hurdles

The small domestic appliance sector faces a complex web of regulations. For instance, in the European Union, the Ecodesign Directive sets energy efficiency standards for many appliances. New entrants must invest significantly in research and development to ensure their products meet these stringent requirements, which can be a substantial barrier.

Navigating these compliance landscapes adds considerable cost and time to market entry. Obtaining certifications like CE marking in Europe or UL listing in North America involves rigorous testing and documentation. This process can delay product launches and increase initial capital outlays, making it tougher for smaller, less-resourced companies to compete.

- Safety Standards: Appliances must meet international safety standards to prevent electrical hazards and ensure user protection.

- Energy Efficiency: Regulations like the EU's Energy Star program mandate specific energy consumption levels, requiring advanced engineering.

- Environmental Regulations: Compliance with rules on materials sourcing, recyclability, and hazardous substances adds to product development complexity.

The threat of new entrants in the small domestic appliance market, particularly for brands like De'Longhi, is generally considered moderate. Significant capital is required for advanced manufacturing, R&D, and establishing global supply chains, with new coffee machine development alone costing millions. De'Longhi's strong brand recognition, built over decades, presents a substantial psychological and financial hurdle for newcomers aiming to gain consumer trust and market share.

Established players like De'Longhi benefit from economies of scale, leading to lower per-unit production and marketing costs. In 2023, De'Longhi reported net sales of €2,459.3 million, highlighting a production volume that new entrants would struggle to match, creating a significant cost disadvantage. Furthermore, navigating stringent regulations, such as the EU's Ecodesign Directive for energy efficiency and various safety certifications, adds considerable cost and time to market entry, further deterring new competitors.

Porter's Five Forces Analysis Data Sources

Our De'Longhi Porter's Five Forces analysis is built upon a foundation of comprehensive data, including financial reports from De'Longhi and its competitors, market research from firms like Euromonitor and Statista, and industry-specific trade publications.

We leverage publicly available information such as De'Longhi's annual reports and investor presentations, alongside data from market intelligence platforms and news archives, to thoroughly assess the competitive landscape.