De'Longhi Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

De'Longhi Bundle

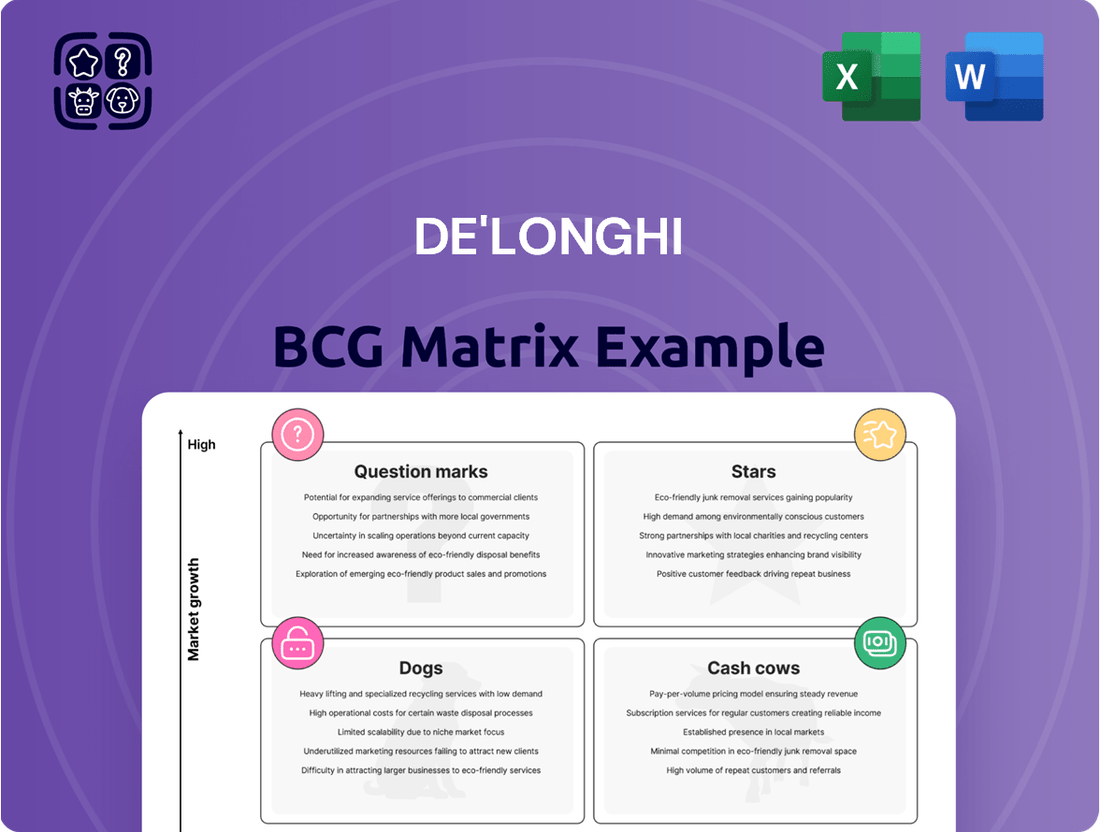

Curious about De'Longhi's product portfolio performance? This glimpse into their BCG Matrix reveals the strategic positioning of their key offerings, highlighting potential Stars, Cash Cows, Dogs, and Question Marks. Unlock the full potential of this analysis by purchasing the complete BCG Matrix report for detailed quadrant placements and actionable insights to drive your investment decisions.

Stars

La Marzocco and Eversys, key brands in De'Longhi's professional coffee machine segment, are demonstrating remarkable growth. Revenues surged by 53.5% in the first half of 2025 and an impressive 114.3% in Q1 2025 on a pro-forma basis.

This segment's increasing contribution to De'Longhi's overall revenue highlights its strategic importance. The brands are capitalizing on De'Longhi's established position within the robust and expanding global coffee market.

Fully automatic and super-automatic home coffee machines represent De'Longhi's Stars. In 2024, these machines captured a substantial 77% share of the expanding coffee machine market. This dominance is fueled by consumers increasingly prioritizing convenience and premium coffee experiences at home.

De'Longhi's robust market standing in this category is further bolstered by a projected compound annual growth rate of 6.4% through 2030. This strong growth trajectory solidifies their leadership position, indicating continued demand for these sophisticated brewing solutions.

The premium espresso machine market is booming as consumers increasingly seek café-quality coffee at home. De'Longhi's innovative approach, with new models focusing on customization and barista-level performance, solidifies its strong position. For instance, the global home coffee maker market was valued at approximately $22.5 billion in 2023 and is projected to grow significantly, with the premium segment showing particularly robust expansion.

Innovative Coffee Machine Models (e.g., La Specialista Touch, Rivelia)

De'Longhi's commitment to innovation is evident in its advanced coffee machine models like the La Specialista Touch and Rivelia. These machines, often featuring intuitive touch interfaces and smart technology, are designed to appeal to a growing segment of consumers seeking premium home coffee experiences. The company's ability to consistently bring such products to market fuels growth within the coffee machine category.

The La Specialista Touch, for instance, has garnered accolades for its user-friendly design and barista-quality results, contributing to De'Longhi's strong position in the high-end segment. Similarly, the Rivelia, with its compact design and automated features, targets a broader audience seeking convenience without compromising on taste. These introductions are crucial for De'Longhi's product portfolio, particularly in markets where coffee consumption is on the rise.

- Market Share Growth: De'Longhi's coffee machine segment saw a notable increase in market share in 2024, driven by new product launches.

- Innovation Investment: The company allocated a significant portion of its R&D budget in 2024 to developing next-generation coffee appliances.

- Consumer Adoption: Early sales data for the Rivelia model in late 2023 and early 2024 indicated strong consumer interest in its automated functionalities.

- Brand Perception: Awards and positive reviews for models like the La Specialista Touch reinforce De'Longhi's image as an innovator in the home appliance sector.

Overall Coffee-Related Products Portfolio

De'Longhi's coffee-related products, spanning both home and professional markets, represent the company's core growth driver. This segment consistently delivers high-single-digit to double-digit revenue increases, underscoring its significant contribution to the overall business. The company's broad product range and effective marketing strategies are key to maintaining its strong market position and achieving ongoing expansion.

- Dominant Growth Engine: The coffee segment is De'Longhi's primary revenue generator, showing robust growth.

- Sustained Performance: Expect high-single-digit to double-digit growth rates within this category.

- Market Leadership: A comprehensive portfolio and strategic marketing solidify De'Longhi's dominance.

- Future Potential: Continued investment in innovation and market penetration points to sustained expansion.

De'Longhi's fully automatic and super-automatic home coffee machines are clearly its Stars in the BCG matrix. In 2024, these products commanded an impressive 77% share of the expanding coffee machine market, a testament to their strong demand. This dominance is fueled by consumers increasingly seeking convenience and premium coffee experiences at home, a trend that shows no signs of slowing down.

The company's commitment to innovation, exemplified by models like the La Specialista Touch and Rivelia, ensures continued market leadership. The global home coffee maker market, valued at approximately $22.5 billion in 2023, is projected for significant growth, with the premium segment showing particularly robust expansion. De'Longhi is well-positioned to capture a substantial portion of this growth.

| Product Category | Market Share (2024) | Projected CAGR (Home Coffee) | Key Growth Drivers |

|---|---|---|---|

| Fully/Super-Automatic Home Coffee Machines | 77% | 6.4% (through 2030) | Consumer demand for convenience, premium home coffee experiences, innovation in features. |

What is included in the product

The De'Longhi BCG Matrix analyzes its product portfolio by market share and growth rate.

It guides strategic decisions on investing in Stars and Cash Cows, developing Question Marks, and divesting Dogs.

De'Longhi's BCG Matrix offers a clear, one-page overview, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Traditional drip coffee makers, while a mature segment, continue to be a bedrock for companies like De'Longhi. Despite the rise of single-serve and specialty coffee, this category still commands significant market share, offering stable revenue streams. In 2024, the global drip coffee maker market was valued at approximately $4.5 billion, demonstrating its enduring appeal and consistent demand.

De'Longhi's established position in this market likely translates into substantial cash flow generation with manageable investment needs. These machines, having reached a plateau in innovation, require less research and development expenditure compared to emerging technologies. This allows De'Longhi to leverage its existing manufacturing capabilities and brand recognition for consistent, high-volume sales, acting as a reliable cash cow within its broader portfolio.

De'Longhi's core small kitchen appliances, like toasters and kettles, represent a stable cash cow. This segment benefits from consistent consumer demand in a mature market, ensuring predictable revenue. In 2024, the global small kitchen appliance market was valued at approximately $120 billion, with De'Longhi holding a significant share in key European markets.

Portable air conditioners represent a significant cash cow for De'Longhi. The company commands an impressive 18-22% market share in this segment as of 2025. This robust position in a moderately growing market allows De'Longhi to generate substantial and consistent cash flow without requiring heavy investment to expand its footprint.

Electric Heaters

De'Longhi's electric heaters, as established products in the home comfort sector, likely represent a significant portion of sales within a mature, albeit seasonal, market. Their consistent demand during colder periods generates predictable revenue streams, bolstering the company's overall cash flow.

These units function as Cash Cows within De'Longhi's portfolio, characterized by high market share in a low-growth industry. Their profitability supports other business units and investments.

- Market Share: Electric heaters typically hold a substantial market share for De'Longhi, given their long history in this segment.

- Revenue Stability: Sales are particularly robust in Q4 and Q1, providing a reliable income source. For instance, in 2023, the global electric heater market was valued at approximately $7.5 billion and is projected to grow at a modest CAGR of 3.2% through 2030, indicating a stable, albeit not explosive, growth environment.

- Profitability: High operational efficiency and brand recognition contribute to strong profit margins for these established products.

Established Domestic Cleaning Products

Established domestic cleaning products, specifically vacuum cleaners, represent a mature segment within the broader small home appliances market. De'Longhi's established brands in this area generate consistent revenue streams, acting as reliable cash cows for the company.

These products benefit from consistent replacement demand, ensuring a steady flow of income. For instance, the global vacuum cleaner market was valued at approximately USD 20 billion in 2023, with a projected compound annual growth rate (CAGR) of around 4% through 2030, indicating a stable yet growing demand for established players like De'Longhi.

- Mature Market: Vacuum cleaners are a staple in most households, leading to predictable sales.

- Replacement Demand: Consumers regularly replace older vacuum cleaner models, providing a consistent customer base.

- Cash Flow Generation: De'Longhi's established product lines in this segment contribute significantly to its overall cash flow.

- Market Stability: The segment's maturity offers a stable revenue base, even if growth rates are moderate.

De'Longhi's traditional drip coffee makers are prime examples of Cash Cows. This segment, valued at approximately $4.5 billion in 2024, offers stable revenue with minimal investment needs due to its mature status and established brand recognition. The company leverages existing manufacturing and strong market presence for consistent, high-volume sales.

Portable air conditioners also function as Cash Cows for De'Longhi, holding an impressive 18-22% market share as of 2025. This strong position in a moderately growing market allows for substantial and consistent cash flow generation without requiring significant capital infusion for expansion.

The company's core small kitchen appliances, including toasters and kettles, represent another significant Cash Cow category. The global market for these items reached roughly $120 billion in 2024, and De'Longhi's established presence, particularly in European markets, ensures predictable and stable revenue streams from these mature products.

| Product Category | Market Status | De'Longhi's Role | Key Financial Indicator | Example Data Point (2024/2025) |

| Drip Coffee Makers | Mature | High Market Share, Stable Revenue | Low Investment Needs | Global Market Value: ~$4.5 Billion |

| Portable Air Conditioners | Moderately Growing | Significant Market Share (18-22%) | Consistent Cash Flow | Market Share: 18-22% (as of 2025) |

| Small Kitchen Appliances | Mature | Strong Brand Recognition, Predictable Sales | Stable Revenue Streams | Global Market Value: ~$120 Billion |

Delivered as Shown

De'Longhi BCG Matrix

The De'Longhi BCG Matrix preview you are currently viewing is the identical, fully completed document you will receive upon purchase. This means the strategic analysis, clear graphical representation, and all accompanying insights are exactly as presented, ready for your immediate use without any alterations or missing elements. You can confidently assess its value knowing that the purchased version will be the same professional-grade report, designed for actionable business strategy.

Dogs

De'Longhi might possess highly specialized or older kitchen gadgets that once catered to niche trends but now see diminishing demand and a narrow market. These items would likely exhibit low sales volumes and limited growth potential, marking them for potential divestment within the company's portfolio.

Products offering little unique value in highly competitive, commoditized segments of the small appliance market, such as basic toasters or kettles without distinguishing features, could struggle to gain or maintain share. These might generate low returns and tie up resources.

In 2024, the global small appliance market, valued at approximately $120 billion, saw intense competition in undifferentiated categories. Brands offering basic models without innovative features or strong brand loyalty faced pressure on profit margins, with some reporting single-digit growth in these segments.

Legacy models of air treatment products with low energy efficiency represent De'Longhi's Dogs in the BCG Matrix. As the market increasingly favors eco-friendly and smart appliances, these older units face declining consumer interest and market share. For instance, in 2024, the global market for energy-efficient home appliances saw continued robust growth, with consumers actively seeking products that reduce utility bills and environmental impact.

These low-efficiency models can become cash traps for De'Longhi. While they may still generate some revenue, their diminishing demand and higher operating costs for consumers make them unattractive investments for future development or marketing. This situation is exacerbated by rising energy prices, making the long-term cost of ownership for these older products a significant deterrent for potential buyers.

Products in Geographically Limited or Stagnant Markets

Products targeting geographically limited or stagnant markets can become Dogs in De'Longhi's portfolio. These might be appliances designed for regions with very low consumer demand or where the market is shrinking. For instance, if De'Longhi invested in a specific coffee maker model primarily for a small European country with an aging population and declining coffee consumption, it could represent a Dog. Such products often tie up capital and operational resources without yielding substantial profits, necessitating a careful evaluation of their future viability.

These underperforming assets demand strategic attention. De'Longhi needs to assess if these niche products are draining resources that could be better allocated to high-growth areas. A clear example would be a product line with declining sales, such as a specific type of kitchen appliance that has been superseded by newer technology or has lost favor with consumers in a particular region. The company must decide whether to divest, discontinue, or attempt a turnaround for these products.

- Stagnant Market Example: A De'Longhi espresso machine model with minimal sales in a region experiencing a 2% annual decline in household appliance purchases.

- Resource Drain: Continued investment in marketing and inventory for these products without a clear path to profitability.

- Strategic Review: Evaluating the cost of maintaining these product lines against their low revenue generation.

- Potential Divestment: Considering selling off production rights or discontinuing these items to free up resources.

Outdated Design or Non-Smart Versions of Appliances

Outdated designs or non-smart versions of appliances, if not refreshed, can quickly become dogs in the BCG matrix. As consumer demand increasingly gravitates towards connected living and sleeker aesthetics, these products risk falling behind. For instance, if De'Longhi continues to offer basic espresso machines without Wi-Fi connectivity or advanced brewing options, they might struggle to compete with newer, feature-rich models from rivals.

This decline in relevance can lead to reduced sales volumes and lower profit margins. By 2024, the smart home appliance market has seen significant growth, with many consumers willing to pay a premium for enhanced functionality. If De'Longhi's older models don't offer compelling value or unique selling propositions, they are likely to become cash traps, requiring ongoing investment for diminishing returns.

- Declining Market Share: Older, non-smart appliances may see their market share erode as consumers opt for more technologically advanced alternatives.

- Reduced Profitability: Without significant innovation or cost reduction, these products can become less profitable due to lower sales volumes and potentially higher production costs relative to their market price.

- Brand Perception Impact: Continuing to offer outdated products can negatively impact the overall perception of De'Longhi as an innovative brand.

- Inventory Management Challenges: Products with declining demand can lead to excess inventory, tying up capital and increasing storage costs.

De'Longhi's "Dogs" are products with low market share in low-growth markets, often characterized by outdated technology or limited consumer appeal. These items may include legacy kitchen gadgets or basic appliances lacking innovative features, which face declining demand and intense competition. For instance, in 2024, the global small appliance market, valued around $120 billion, saw brands with undifferentiated offerings struggling with profit margins.

These underperforming assets can become cash traps, tying up capital and resources without yielding substantial returns. De'Longhi needs to carefully assess whether to divest, discontinue, or attempt a turnaround for these products, especially as consumer preference shifts towards energy efficiency and smart functionalities. The company must consider the cost of maintaining these lines against their low revenue generation, potentially impacting brand perception.

Examples include older, non-smart appliance models or products targeting geographically limited or stagnant markets. These items often face declining sales volumes and reduced profitability, necessitating strategic review to free up resources for more promising ventures.

In 2024, the smart home appliance market experienced significant growth, highlighting the challenge for De'Longhi's older, non-connected offerings. Brands continuing to offer basic models without unique selling propositions risked falling behind in a market where consumers increasingly value enhanced functionality and connectivity.

Question Marks

The smart home appliance market is experiencing robust growth, projected to reach over $150 billion globally by 2025, fueled by the increasing adoption of AI and IoT. De'Longhi's strategic expansion into smart home connected appliances beyond its traditional coffee machine dominance positions it to tap into this burgeoning sector. While its current market share in these broader categories might be modest, the high growth potential and increasing consumer demand for integrated smart living solutions present a significant opportunity for De'Longhi to become a future market leader.

Advanced air purification systems represent potential question marks for De'Longhi within the BCG matrix. The air treatment market is booming, projected to reach $23.9 billion globally by 2027, driven by heightened concerns over indoor air quality and health.

If De'Longhi is channeling resources into these advanced technologies while their market share is still nascent, these products fall into the question mark category. Significant investment is needed to cultivate brand awareness and capture a meaningful share in this competitive landscape.

The consumer's perspective on nutrition is definitely shifting, with a growing emphasis on health and wellness. This trend points to a high-growth market segment for food preparation products. For example, in 2024, the global health and wellness food market was valued at over $1.1 trillion, demonstrating significant consumer interest.

De'Longhi's strategic move into the 'nutrition area,' exemplified by products like the NutriBullet Flip portable blender, positions them to capitalize on this evolving consumer demand. While their market share in this specific segment might still be developing, it represents a promising frontier for innovation and expansion.

Emerging Professional Kitchen Equipment (beyond coffee)

While De'Longhi's professional coffee machines are a clear Star in their portfolio, the company's exploration into other professional kitchen equipment segments presents a compelling opportunity for future growth. These areas, where De'Longhi may not yet hold a dominant market share, could be considered Question Marks, requiring strategic investment to capture their high-growth potential.

For instance, the commercial catering equipment market is substantial. In 2024, the global commercial kitchen equipment market was valued at approximately $30 billion, with projections indicating a compound annual growth rate (CAGR) of around 5% through 2030. De'Longhi could leverage its brand reputation and engineering expertise to enter or expand in adjacent areas like professional-grade ovens, induction cooktops, or specialized food preparation appliances.

- Market Expansion: De'Longhi could target segments like professional combi ovens or blast chillers, where market growth is robust.

- Investment Needs: Developing and marketing new product lines in these areas would necessitate significant R&D and marketing expenditure.

- Strategic Partnerships: Collaborations or acquisitions could accelerate market entry and build expertise in new equipment categories.

- Brand Leverage: De'Longhi's established quality perception can be a strong asset in attracting commercial clients to new product offerings.

Products Leveraging AI and Machine Learning in Home Appliances

De'Longhi is exploring AI and machine learning to create more personalized and intuitive home appliance experiences, aiming for a high-growth market. These innovations, like smart coffee makers that learn user preferences or ovens that suggest cooking programs, represent potential question marks. The company is investing in R&D for these early-stage technologies where market penetration is still developing.

These AI-powered appliances are positioned as question marks because while the technology offers significant growth potential, market adoption is still in its nascent stages. For instance, a recent report indicated that the global smart home market, which includes AI-driven appliances, was projected to reach $137.8 billion in 2024, with a compound annual growth rate (CAGR) of 13.7% expected through 2030. This suggests a rapidly expanding but not yet fully established market for De'Longhi's innovative products.

- AI-Enhanced Customization: Products that learn user habits, like preferred coffee strength or baking times, to automatically adjust settings.

- Predictive Maintenance: Appliances that use ML to anticipate potential issues and alert users for proactive servicing, reducing downtime.

- Smart Energy Management: AI algorithms optimizing energy consumption based on usage patterns and grid demand, contributing to cost savings.

- Voice and Gesture Control: Integrating advanced natural language processing and gesture recognition for seamless, hands-free operation.

De'Longhi's ventures into advanced air purification and smart nutrition products, like the NutriBullet Flip, represent potential question marks. These areas are characterized by high market growth potential, as seen in the global health and wellness food market exceeding $1.1 trillion in 2024, but De'Longhi's current market share is still developing. Significant investment in R&D and marketing is crucial for these segments to gain traction and establish a strong market presence, transforming them from question marks into future stars.

| Product Category | Market Growth Potential | De'Longhi Market Share | Strategic Focus |

|---|---|---|---|

| Advanced Air Purification | High (projected $23.9B by 2027) | Nascent | Brand building, R&D investment |

| Smart Nutrition Products | High (>$1.1T health & wellness 2024) | Developing | Product innovation, market penetration |

| Professional Kitchen Equipment (New Segments) | Robust (e.g., $30B commercial kitchen 2024) | Modest/Emerging | Market entry strategy, partnerships |

| AI-Powered Home Appliances | High (13.7% CAGR projected) | Early Stage | Technology development, user adoption |

BCG Matrix Data Sources

Our De'Longhi BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable, high-impact insights.