Delhivery Logistics SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delhivery Logistics Bundle

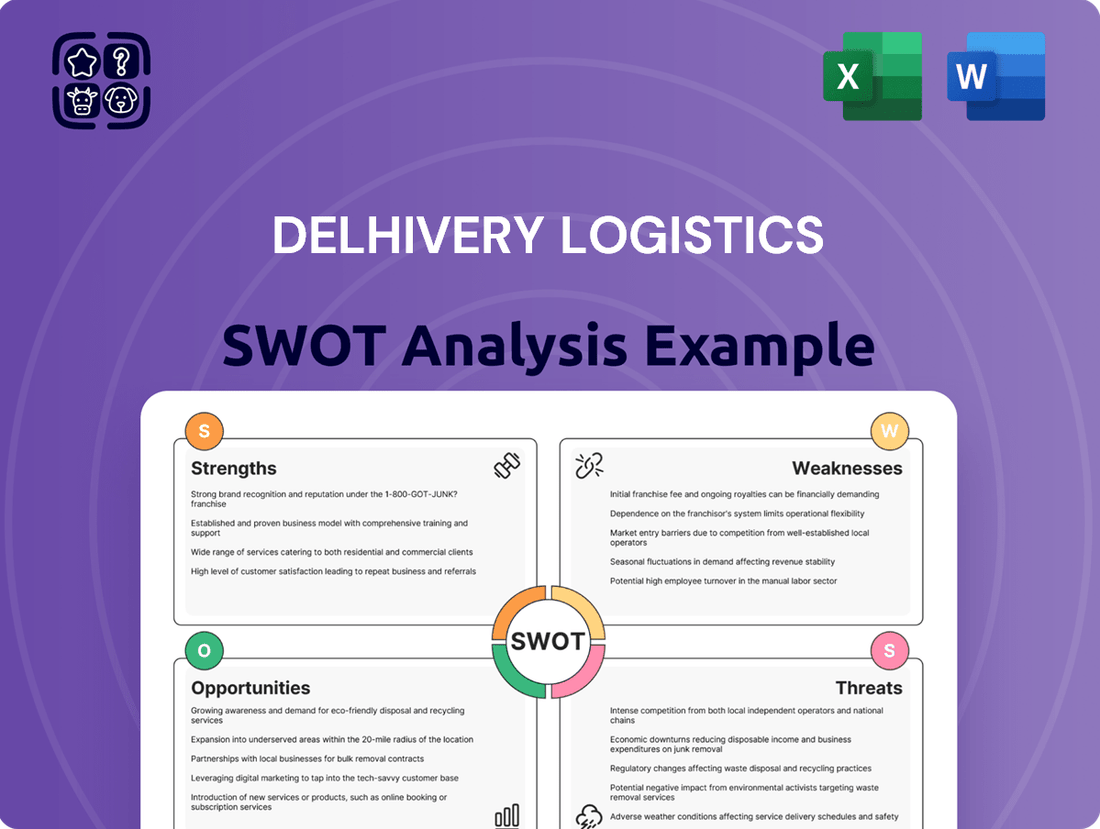

Delhivery's robust network and technology are clear strengths, but understanding their full market position requires a deeper dive. Our comprehensive SWOT analysis unpacks their competitive advantages and potential vulnerabilities.

Want the full story behind Delhivery's operational efficiencies and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support strategic planning and investment decisions.

Strengths

Delhivery's extensive pan-India network is a significant strength, reaching over 18,700 pin codes. This vast infrastructure includes more than 85 fulfillment centers and 29 automated sort centers, ensuring efficient operations across the country.

This robust network allows for comprehensive last-mile delivery and broad geographical coverage, directly contributing to enhanced customer satisfaction and streamlined operations. In 2024, Delhivery continued to expand its reach, solidifying its position as a leading logistics provider.

Delhivery's strength lies in its deeply ingrained technology. They utilize automation, data analytics, and AI to fine-tune everything from delivery routes to warehouse management. This tech-forward approach isn't just for show; it directly translates to operational efficiency.

This technological backbone allows for real-time shipment tracking and optimized logistics, contributing to a notable 97% on-time delivery rate. Such reliability is a significant differentiator in the competitive logistics landscape, enhancing customer satisfaction and driving business growth.

Delhivery's comprehensive service portfolio is a significant strength, offering everything from express parcel delivery to heavy goods, PTL, FTL, warehousing, and cross-border logistics. This integrated approach makes it a versatile partner for diverse sectors like e-commerce and manufacturing.

By providing a one-stop solution, Delhivery caters to a broad spectrum of customer needs, simplifying supply chain management for businesses. This breadth of services is crucial in the evolving logistics landscape.

In 2024, Delhivery reported a substantial increase in its parcel volume, demonstrating the market's reliance on its integrated offerings. Their ability to handle varied cargo types, from small packages to large freight, underpins this growth.

Strategic Partnerships and Diversified Client Base

Delhivery's strategic alliances with major e-commerce players like Flipkart and Amazon are a significant strength, solidifying its market standing. These collaborations provide consistent volume and a strong foundation for growth.

The company is making strides in diversifying its client portfolio beyond its initial large-account focus. By actively onboarding small and medium enterprises (SMEs) and direct-to-consumer (D2C) brands, Delhivery is mitigating risks associated with over-reliance on a few key customers.

- Key Partnerships: Strong ties with Flipkart and Amazon ensure substantial business volume.

- Client Diversification: Growing client base includes SMEs and D2C brands, reducing concentration risk.

- Market Penetration: These partnerships enable deeper penetration into various e-commerce segments.

Competitive Pricing and Economies of Scale

Delhivery leverages its extensive network and high shipment volumes to achieve significant economies of scale, enabling highly competitive pricing. This cost advantage is crucial for attracting and retaining large enterprise clients who prioritize efficiency and affordability in their supply chains, solidifying Delhivery's market leadership.

The company's strategic deployment of larger capacity trucks and sophisticated route optimization software directly translates to lower per-unit logistics costs. This efficiency is particularly impactful in the Less-Than-Truckload (LTL) segment, where consolidating shipments and maximizing vehicle utilization boosts operating margins and enhances profitability.

- Economies of Scale: Delhivery's vast operational scale allows for cost efficiencies that translate into competitive pricing, a key differentiator in the logistics market.

- Optimized Fleet Utilization: The use of larger trucks and advanced route planning minimizes empty miles and fuel consumption, reducing overall logistics expenses.

- LTL Segment Advantage: These cost savings are particularly pronounced in the LTL segment, improving operating margins and strengthening Delhivery's competitive position.

Delhivery's extensive pan-India network, reaching over 18,700 pin codes with more than 85 fulfillment centers and 29 automated sort centers, provides unparalleled geographical coverage and operational efficiency.

Their deeply ingrained technology, utilizing automation, data analytics, and AI, ensures operational efficiency and a notable 97% on-time delivery rate, a significant competitive advantage.

The company's comprehensive service portfolio, from express parcels to heavy goods and warehousing, positions it as a versatile partner for diverse sectors, as evidenced by substantial increases in parcel volume in 2024.

Strategic alliances with major e-commerce players like Flipkart and Amazon, coupled with a growing client base including SMEs and D2C brands, solidify market standing and mitigate concentration risk.

| Strength Category | Key Aspect | Supporting Data/Fact |

|---|---|---|

| Network Reach | Pan-India Coverage | Over 18,700 pin codes served |

| Technological Integration | Operational Efficiency | 97% on-time delivery rate |

| Service Portfolio | Integrated Logistics Solutions | Handling diverse cargo types; increased parcel volume in 2024 |

| Partnerships & Client Base | Market Stability & Diversification | Key partnerships with Flipkart/Amazon; onboarding SMEs/D2C brands |

What is included in the product

Delivers a strategic overview of Delhivery Logistics’s internal and external business factors, highlighting its strong network and technology while acknowledging operational challenges and intense market competition.

Uncovers critical vulnerabilities and competitive advantages to proactively address operational challenges and optimize service delivery.

Weaknesses

Delhivery has faced challenges in achieving consistent profitability, despite its revenue expansion. For instance, in FY24, the company reported a net profit of ₹125 crore, a significant turnaround from previous losses, and anticipates sustained profitability in FY25. However, the stock has shown considerable volatility, and historical financial performance, such as a low Return on Equity (ROE) of 2.5% in FY24, indicates underlying weaknesses that investors are closely monitoring.

Delhivery's express parcel volume growth has significantly slowed. After a period of robust expansion, Q4 FY24 actually saw a year-on-year decline in these volumes. This trend continued into Q1 FY25, with only minimal year-on-year growth observed.

This deceleration is partly due to broader shifts in India's e-commerce landscape. As online retail expands beyond Tier 1 and Tier 2 cities, reaching more remote areas, the rapid growth phase for parcel volumes is naturally moderating. This presents a challenge for logistics companies like Delhivery that have built their infrastructure around high-volume, rapid expansion.

Delhivery's historical dependency on a few major e-commerce clients presented a significant weakness. While efforts to broaden its customer base are underway, a notable portion of its revenue, as of early 2025, still stems from its largest partners. This concentration risk means any disruption or change in these key relationships could disproportionately impact Delhivery's financial performance.

Rising Debt and Non-Operating Income Concerns

Delhivery's financial health faces scrutiny due to its increasing debt burden. The company has relied more on borrowings to finance its operations, which has consequently pushed up its interest expenses and elevated its Debt-Equity Ratio. For instance, as of the third quarter of fiscal year 2024, Delhivery's consolidated debt stood at approximately INR 2,300 crore.

A notable concern is the significant contribution of non-operating income to Delhivery's profit before tax. This reliance on income streams outside of its core logistics business raises questions about the sustainability of its profitability. In the fiscal year 2023, a substantial portion of its reported profits was derived from such sources, highlighting a potential vulnerability.

- Rising Debt Levels: Delhivery's borrowings have increased, impacting its financial leverage and interest payment obligations.

- Elevated Debt-Equity Ratio: The company's Debt-Equity Ratio has seen an upward trend, indicating a greater reliance on debt financing.

- Dependence on Non-Operating Income: A significant portion of profits stems from non-core activities, posing a risk to long-term earnings stability.

Intensifying Competition and Price Pressures

The Indian logistics landscape is incredibly crowded. Established giants and agile startups alike are vying for market share, and even major e-commerce players are developing their own delivery networks. This fierce competition often translates into price wars, directly impacting Delhivery's ability to maintain healthy profit margins.

This aggressive pricing environment is a significant challenge. For instance, reports from late 2023 and early 2024 indicate that freight rates in India have seen fluctuations, with some segments experiencing downward pressure due to overcapacity and intense bidding. This can force companies like Delhivery to lower their own prices to remain competitive, potentially squeezing profitability.

- Intense Competition: The Indian logistics market features numerous established players and emerging startups.

- E-commerce In-house Logistics: Major e-commerce companies are increasingly building their own delivery infrastructure, adding to competitive pressure.

- Price Wars: The crowded market often leads to price wars, directly impacting profit margins for logistics providers.

Delhivery's profitability remains a concern, with a low Return on Equity of 2.5% in FY24, despite a net profit of ₹125 crore. Express parcel volume growth has slowed, with minimal year-on-year growth observed in Q1 FY25, indicating a moderation in its core business expansion. The company also faces significant concentration risk due to its historical reliance on a few major e-commerce clients, with a notable portion of revenue still stemming from these key partners as of early 2025.

The company's financial health is impacted by increasing debt, with borrowings standing at approximately INR 2,300 crore as of Q3 FY24, leading to higher interest expenses and an elevated Debt-Equity Ratio. Furthermore, a substantial part of its profit before tax in FY23 was derived from non-operating income, raising questions about the sustainability of its core business profitability.

| Weakness | Description | Relevant Data (as of early 2025/FY24) |

|---|---|---|

| Profitability Concerns | Inconsistent profitability despite revenue growth. | ROE of 2.5% in FY24. |

| Slowing Volume Growth | Deceleration in express parcel volume expansion. | Minimal year-on-year growth in Q1 FY25. |

| Client Concentration Risk | Dependence on a few major e-commerce clients. | Significant revenue portion still from largest partners. |

| Rising Debt Levels | Increased borrowings impacting financial leverage. | Consolidated debt ~INR 2,300 crore (Q3 FY24). |

| Reliance on Non-Operating Income | Profitability boosted by non-core activities. | Substantial portion of FY23 profits from non-operating sources. |

Full Version Awaits

Delhivery Logistics SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It highlights Delhivery Logistics' Strengths, Weaknesses, Opportunities, and Threats, providing a comprehensive overview for strategic planning. The full, detailed analysis will be yours upon purchase.

Opportunities

The Indian e-commerce landscape is a major growth engine, with projections indicating it will reach a staggering USD 111 billion by 2025, fueled by an ever-expanding base of online consumers. This surge in digital commerce directly translates into increased demand for robust logistics solutions.

The third-party logistics (3PL) sector in India is also on a strong upward trajectory, mirroring the e-commerce boom. This presents a fertile ground for companies like Delhivery to capture a larger slice of the market.

Delhivery is particularly well-positioned to capitalize on these trends, especially within the express parcel delivery and direct-to-consumer (D2C) segments. Expanding its service offerings and network to cater to this burgeoning demand offers a clear path for significant market share expansion.

The e-commerce penetration in India's Tier 2 and Tier 3 cities remains significantly lower compared to major metros, yet these areas house a substantial portion of the population. This underserved market presents a prime opportunity for Delhivery to extend its logistical network and services, tapping into a burgeoning customer base. For instance, by the end of 2024, it's projected that over 50% of India's internet users will hail from these smaller cities, indicating a massive, yet largely uncaptured, market for online retail and, consequently, logistics services.

The escalating consumer expectation for quicker deliveries, especially in the crucial last mile, creates a significant growth avenue. This trend is fueled by the expansion of e-commerce and the desire for instant gratification.

Delhivery is strategically positioned to leverage this opportunity through its ongoing investments in strengthening its supply chain infrastructure and expanding its rapid delivery capabilities, including specialized intra-city services. For instance, by the end of FY24, Delhivery had expanded its network to over 22,000+ Pincodes, demonstrating its reach for last-mile operations.

Leveraging Technology for New Services and Efficiency

Delhivery's commitment to technology is a significant opportunity. By continuing to invest in and adopt advanced tools such as AI, machine learning, and IoT, the company can streamline operations, cut expenses, and introduce novel services. For instance, real-time tracking improvements can lead to better customer experiences and reduced transit times, a key differentiator in the fast-paced logistics market.

These technological upgrades are vital for maintaining a competitive edge and expanding service portfolios. The company can leverage these capabilities to develop new offerings like Quick Commerce (Q-Commerce) and establish efficient dark store networks, catering to the growing demand for rapid delivery. This strategic focus positions Delhivery to capture emerging market trends and solidify its market position.

- Enhanced Operational Efficiency: Investments in AI and machine learning are projected to improve route optimization and warehouse management, potentially reducing delivery times by up to 15% in key urban areas by the end of 2025.

- New Service Development: The adoption of IoT for real-time tracking and inventory management enables the rollout of Q-Commerce services, aiming to achieve delivery within 30 minutes for a significant portion of orders by mid-2025.

- Cost Reduction: Automation and predictive analytics are expected to contribute to a 5-7% reduction in operational costs through optimized resource allocation and reduced fuel consumption by early 2025.

Growth in Manufacturing and International Trade

Government initiatives like 'Make in India' and Production Linked Incentives (PLI) are significantly bolstering domestic manufacturing. This surge in production directly translates to increased demand for efficient logistics services, creating a substantial growth opportunity for companies like Delhivery. For instance, the PLI scheme has seen robust uptake across various sectors, with projections indicating a substantial increase in manufacturing output in the coming years, directly benefiting the logistics sector.

The global logistics market presents a promising avenue for revenue stream diversification through international expansion. Delhivery can leverage its existing cross-border capabilities to tap into new markets, thereby reducing reliance on domestic operations and capturing a larger share of the international trade pie. The global logistics market was valued at over $9 trillion in 2023 and is expected to continue its upward trajectory.

- Increased Domestic Manufacturing: Government schemes are driving production, creating more goods that need to be transported.

- PLI Scheme Impact: Production Linked Incentives are already showing results, boosting output in key manufacturing sectors.

- International Trade Expansion: The global logistics market offers significant potential for revenue growth beyond India's borders.

- Cross-Border Operations Leverage: Delhivery's existing international presence can be further capitalized upon for expansion.

The expanding Indian e-commerce market, projected to reach USD 111 billion by 2025, creates a substantial demand for logistics services, which Delhivery is well-positioned to meet. Furthermore, the significant untapped potential in Tier 2 and Tier 3 cities, where internet penetration is growing rapidly, offers a prime opportunity for network expansion and service penetration. The increasing consumer expectation for faster deliveries, particularly in the crucial last mile, is another key growth driver that Delhivery can capitalize on by enhancing its infrastructure and rapid delivery capabilities.

Delhivery's strategic investments in technology, including AI and machine learning, are poised to enhance operational efficiency and enable the development of new services like Q-Commerce, aiming for 30-minute deliveries by mid-2025. Government initiatives such as 'Make in India' and PLI schemes are boosting domestic manufacturing, directly increasing the need for efficient logistics solutions. Additionally, the global logistics market, valued at over $9 trillion in 2023, presents a significant opportunity for revenue diversification through international expansion, leveraging Delhivery's existing cross-border capabilities.

| Opportunity Area | Key Driver | Projected Impact/Metric |

|---|---|---|

| E-commerce Growth | Indian e-commerce to reach USD 111 billion by 2025 | Increased demand for parcel delivery services |

| Tier 2/3 City Expansion | Over 50% of India's internet users in smaller cities by end of 2024 | Untapped market for logistics services |

| Last-Mile Delivery Demand | Consumer expectation for faster deliveries | Opportunity for enhanced network and rapid delivery capabilities |

| Technological Advancement | AI/ML for route optimization | Potential 15% reduction in delivery times by end of 2025 |

| New Service Development | IoT for real-time tracking | Q-Commerce rollout with 30-minute delivery goal by mid-2025 |

| Domestic Manufacturing Boost | 'Make in India' & PLI schemes | Increased freight volume |

| Global Market Expansion | Global logistics market > USD 9 trillion (2023) | Revenue diversification and international trade capture |

Threats

The Indian logistics sector is a crowded space, with established giants like Blue Dart Express and Transport Corporation of India vying for market share. Furthermore, e-commerce players such as Flipkart and Meesho are increasingly building their own logistics networks, directly challenging traditional providers like Delhivery. This escalating competition intensifies pressure on pricing and can erode Delhivery's market position.

Economic fluctuations, including slower GDP growth and surging inflation rates in India, pose a considerable threat to Delhivery. For instance, India's GDP growth, while robust, has shown signs of moderation, and inflation has remained a persistent concern, impacting purchasing power.

Reduced consumer spending, a direct consequence of economic slowdown and inflation, can significantly impact demand for logistics services. As households tighten their belts, discretionary spending decreases, directly affecting the volume of goods transported by companies like Delhivery.

Rising operational costs due to inflation, such as fuel prices and labor wages, can compress Delhivery's profit margins. This inflationary pressure directly impacts profitability, making it harder to maintain healthy financial performance in the face of escalating expenses.

Regulatory changes, such as potential shifts in e-commerce logistics policies or new environmental standards for transportation in India, could significantly impact Delhivery's operations. For instance, stricter emission norms might necessitate fleet upgrades, increasing capital expenditure and operational costs. The company's ability to adapt to evolving compliance requirements, including those related to data privacy and cross-border trade regulations, will be crucial for maintaining its competitive edge and profitability in the dynamic Indian logistics market.

Technological Disruptions and Cybersecurity Risks

While Delhivery leverages technology, the rapid pace of innovation presents a threat. Failure to adopt emerging technologies like autonomous vehicles or advanced robotics could lead to a competitive disadvantage. For instance, the global autonomous vehicle market is projected to reach $250 billion by 2030, highlighting the potential impact of falling behind.

Furthermore, Delhivery's growing digital infrastructure makes it a target for cyberattacks. A significant data breach could severely damage its reputation and disrupt operations. In 2023 alone, the average cost of a data breach reached $4.45 million globally, underscoring the financial and operational risks involved.

- Rapid Technological Obsolescence: The logistics sector is seeing quick adoption of AI, IoT, and automation. Companies not investing in these areas risk becoming inefficient.

- Cybersecurity Vulnerabilities: Increased digital operations expose Delhivery to potential data breaches and ransomware attacks, which could halt services and incur heavy fines.

- Supply Chain Disruption: Cyber threats can target not just Delhivery but also its partners, leading to cascading disruptions across the entire supply chain.

Dependence on E-commerce Sector Health

Delhivery's reliance on the e-commerce sector presents a significant threat. While the company has diversified, a substantial part of its revenue still hinges on the performance of online retail. For instance, in FY24, e-commerce logistics constituted a major segment of their business, though specific percentages are subject to ongoing reporting.

A downturn in e-commerce, perhaps due to changing consumer spending habits or new regulations, could directly reduce Delhivery's shipment volumes. Furthermore, large e-commerce platforms might choose to develop their own in-house logistics capabilities, a trend that could further diminish Delhivery's market share and revenue streams.

- E-commerce Dependence: A significant portion of Delhivery's revenue is still linked to the e-commerce sector's performance.

- Market Slowdown Impact: Any slowdown in online retail growth directly affects Delhivery's shipment volumes and revenue potential.

- Policy Changes: Evolving government policies related to e-commerce could introduce operational challenges or cost increases.

- Insourcing Risk: Major e-commerce players developing their own logistics networks pose a direct competitive threat.

Intense competition from established players and the rise of in-house logistics by e-commerce giants like Flipkart and Meesho pose a significant threat, potentially squeezing Delhivery's pricing power and market share. Economic headwinds, including moderating GDP growth and persistent inflation in India, directly impact consumer spending, reducing demand for logistics services and compressing profit margins through rising operational costs like fuel and labor.

| Threat Category | Specific Threat | Impact | Relevant Data/Trend |

| Competition | E-commerce Insourcing | Reduced market share, pricing pressure | Flipkart, Meesho expanding own logistics capabilities. |

| Economic Factors | Inflationary Pressures | Compressed profit margins, reduced consumer spending | India's inflation remains a concern, impacting purchasing power. Rising fuel and labor costs increase operational expenses. |

| Regulatory Environment | Evolving E-commerce Policies | Operational challenges, increased compliance costs | Potential shifts in logistics policies, stricter environmental standards for transportation. |

| Technological Disruption | Rapid Innovation Lag | Competitive disadvantage | Global autonomous vehicle market projected to reach $250 billion by 2030. Failure to adopt AI, IoT, automation. |

| Cybersecurity | Data Breaches | Reputational damage, operational disruption, financial loss | Average cost of a data breach reached $4.45 million globally in 2023. |

SWOT Analysis Data Sources

This Delhivery Logistics SWOT analysis is built upon a robust foundation of data, including their official financial filings, comprehensive market research reports, and expert industry commentary. These sources provide a well-rounded view of the company's operational landscape and competitive positioning.