Delhivery Logistics Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delhivery Logistics Bundle

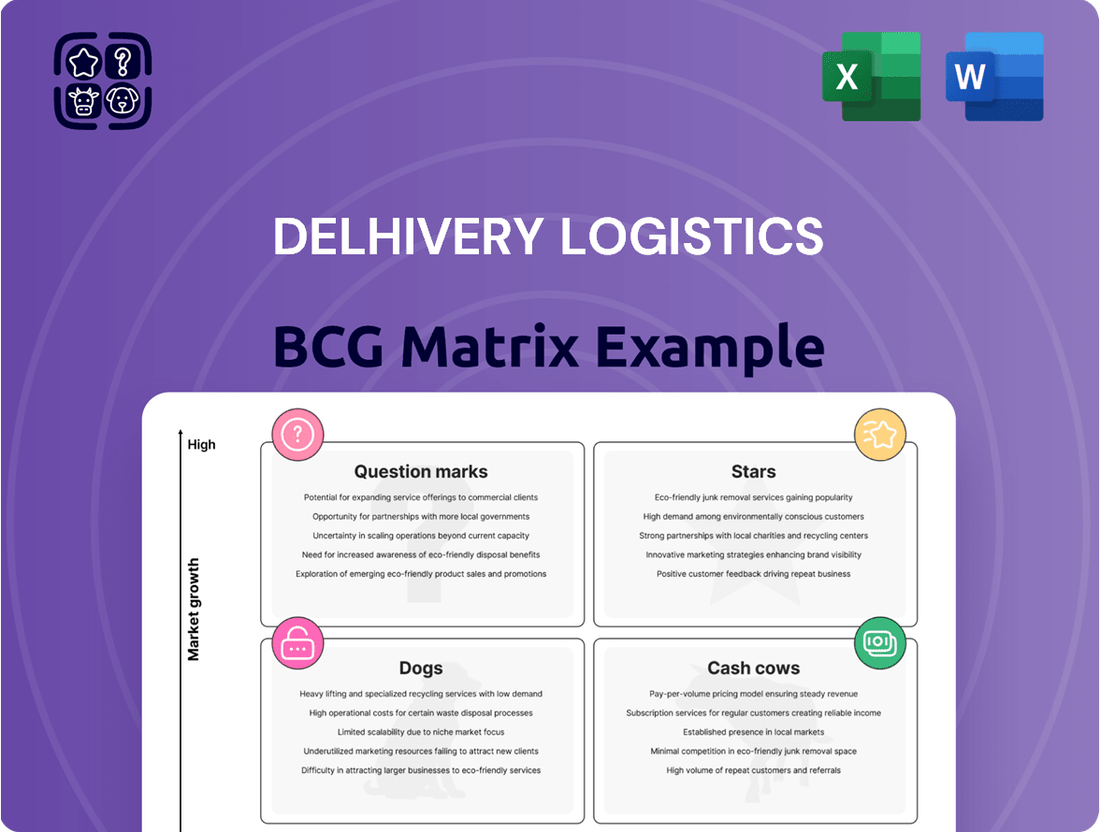

Delhivery's logistics operations present a dynamic landscape ripe for strategic analysis. Understanding where its services fall within the BCG Matrix—whether as Stars, Cash Cows, Dogs, or Question Marks—is crucial for informed decision-making.

This preview offers a glimpse into Delhivery's potential strategic positioning. To truly unlock the insights and develop actionable strategies for growth and resource allocation, dive deeper into the full BCG Matrix.

Purchase the complete report for a comprehensive breakdown, revealing the precise quadrant placements and providing data-backed recommendations to guide your investment and product development decisions.

Stars

Express Parcel Delivery is Delhivery's star performer, dominating India's booming e-commerce logistics. This segment is the company's revenue engine, fueled by the relentless growth of online shopping. In 2024, Delhivery's express parcel volumes continued to surge, reflecting its strong market position.

Delhivery's Part Truckload (PTL) services are a star in its BCG Matrix, showcasing impressive growth. Tonnage in this segment surged by almost 30% year-on-year in FY24, and continued its upward trajectory with 19.3% year-on-year growth in Q4 FY25. This robust expansion highlights PTL as a key revenue driver for the company.

The company has also focused on enhancing the financial performance of its PTL operations. By achieving service-level EBITDA profitability and significant margin expansion in Q4 FY25, Delhivery has demonstrated its ability to translate volume growth into improved profitability. This focus on operational efficiency is crucial for sustaining its market position.

With its strong performance, Delhivery has solidified its standing as the second-largest player by revenue in the PTL market. This competitive positioning, coupled with the industry's overall growth, suggests considerable potential for further market share gains in the coming periods.

Delhivery's focus on integrated logistics for D2C brands is a strategic move into a booming sector. In 2024, the D2C market in India was projected to reach significant growth, fueled by increasing internet penetration and evolving consumer preferences for personalized shopping experiences. Delhivery's ability to bundle express parcel delivery, warehousing, and freight services offers D2C businesses a streamlined operational framework.

By providing these end-to-end solutions, Delhivery empowers D2C brands to gain greater control over their supply chains and enhance customer satisfaction, a critical factor for loyalty in the competitive e-commerce space. This integrated approach is crucial as D2C brands aim to scale efficiently and manage the complexities of direct customer engagement.

Technology-Enabled Supply Chain Solutions

Delhivery's technology-enabled supply chain solutions are a cornerstone of its business, leveraging advanced automation and data analytics. These offerings are designed to streamline inventory management, order fulfillment, and network efficiency for clients across various sectors. The company's investment in technology is a key differentiator in the rapidly growing Indian logistics market.

The demand for efficient, tech-driven logistics is soaring. In 2024, the Indian logistics market was projected to reach USD 330 billion, with e-commerce growth being a significant catalyst. Delhivery's sophisticated platforms directly address this need.

- Optimization: Delhivery's tech solutions enhance operational efficiency through real-time tracking and route optimization.

- Data Analytics: The company utilizes data to predict demand, manage inventory, and improve delivery success rates, a critical factor in the competitive e-commerce landscape.

- Automation: Investment in automation, including sortation systems and warehouse robotics, boosts throughput and reduces errors.

- Market Position: These capabilities solidify Delhivery's standing as a leader in providing advanced logistics services in India.

Modern Warehousing and Fulfillment Facilities

Delhivery's modern warehousing and fulfillment facilities are a cornerstone of its business, reflecting a strong position in a rapidly growing market. The company boasts a substantial network, including over 85 fulfillment centers and 29 automated sort centers across India.

This extensive infrastructure directly addresses the surging demand for sophisticated warehousing and fulfillment services, driven by India's booming e-commerce and omnichannel retail sectors. These advanced facilities are critical for supporting the operational needs of these expanding businesses.

- High Market Share: Delhivery's vast network signifies a dominant presence in the warehousing and fulfillment segment.

- High Growth Potential: The increasing adoption of e-commerce and omnichannel strategies fuels significant growth in this service area.

- State-of-the-Art Infrastructure: Over 85 fulfillment centers and 29 automated sort centers provide advanced capabilities.

- Scalable Solutions: Continuous investment in expanding this infrastructure allows Delhivery to offer efficient and adaptable storage and processing.

Delhivery's Express Parcel Delivery and Part Truckload (PTL) services are its stars, exhibiting robust growth and market leadership. The company's integrated logistics for D2C brands and its technology-enabled supply chain solutions are also performing exceptionally well, capitalizing on India's booming e-commerce and digital transformation. These segments are driving significant revenue and solidifying Delhivery's position as a key player in the Indian logistics landscape.

| Segment | BCG Category | Key Performance Indicators (2024/FY25 Data) | Strategic Importance |

|---|---|---|---|

| Express Parcel Delivery | Star | Continued surge in volumes, dominant market position in e-commerce logistics. | Primary revenue engine, fueled by e-commerce growth. |

| Part Truckload (PTL) | Star | ~30% YoY tonnage growth in FY24; 19.3% YoY growth in Q4 FY25; service-level EBITDA profitability achieved in Q4 FY25. | Key revenue driver with improving profitability and strong market positioning. |

| Integrated Logistics for D2C Brands | Star | Capitalizing on projected significant D2C market growth in India; bundling express parcel, warehousing, and freight. | Strategic expansion into a high-growth sector, offering streamlined operations for D2C businesses. |

| Technology-Enabled Supply Chain Solutions | Star | Leveraging advanced automation and data analytics; demand driven by USD 330 billion Indian logistics market projected for 2024. | Key differentiator, enhancing efficiency and addressing growing demand for tech-driven logistics. |

| Modern Warehousing & Fulfillment | Star | Extensive network of over 85 fulfillment centers and 29 automated sort centers. | Supports booming e-commerce and omnichannel retail, offering scalable and efficient solutions. |

What is included in the product

Delhivery's Logistics BCG Matrix highlights strategic positioning of its services, guiding investment decisions.

It offers tailored insights into which services to invest in, hold, or divest for optimal growth.

Delhivery's Logistics BCG Matrix analysis offers a clear view of its business units, simplifying strategic decisions and alleviating the pain of resource allocation.

Cash Cows

Delhivery's extensive pan-India network, reaching over 18,700 pin codes and serving more than 33,000 businesses, is a clear cash cow. This vast operational footprint ensures consistent revenue generation through sheer scale and a broad customer base, forming the bedrock of its business.

The established infrastructure requires relatively low incremental investment to maintain and leverage, especially when compared to expanding into new territories. This efficiency allows Delhivery to capitalize on its existing reach, solidifying its position as a stable revenue generator.

Delhivery's core B2B enterprise logistics services represent a significant Cash Cow. These long-standing transportation contracts with large enterprise clients are mature, providing stable and predictable cash flow. In FY24, Delhivery reported a consolidated revenue of ₹8,238 crore, with a substantial portion likely stemming from these established B2B relationships.

Delhivery's Payment Collection and Processing Services, particularly its Cash-on-Delivery (COD) operations, represent a classic cash cow. COD is still the dominant payment preference for a significant portion of Indian e-commerce, estimated to be around 50% of online transactions in 2024. This consistent demand ensures a reliable revenue stream for Delhivery through transaction fees.

While not a high-growth segment, the sheer volume of transactions processed makes this a stable and predictable income source. In 2023, Delhivery processed over 200 million cash collections, highlighting the scale and ongoing relevance of this service in the Indian market. This steady cash generation underpins the company's financial stability.

Basic Last-Mile Delivery (Tier 1 City Operations)

In Delhi's highly saturated Tier 1 market, Delhivery's basic last-mile delivery operations are a prime example of a cash cow. The express parcel segment has matured, meaning while volumes are substantial, growth is likely slower than in newer regions. These operations benefit from existing, optimized infrastructure and efficient processes, generating steady revenue without requiring significant new capital outlays.

These established networks in Tier 1 cities are crucial for Delhivery's financial stability. They represent a mature business segment that generates consistent cash flow, allowing the company to fund investments in other areas of its portfolio. For instance, Delhivery reported a significant increase in its parcel volumes in the fiscal year ending March 31, 2024, with its overall volumes reaching 2.7 billion parcels, underscoring the strength of its core delivery services.

- Stable Revenue Generation: These operations consistently bring in revenue due to high demand in established urban centers.

- Optimized Infrastructure: Existing networks and processes minimize the need for substantial new investment, leading to high profitability.

- Market Maturity: While growth may be moderate, the sheer volume in Tier 1 cities ensures a reliable cash flow stream.

- Contribution to Overall Business: The cash generated here supports expansion and innovation in other, higher-growth segments of Delhivery's business.

Reverse Logistics and Returns Management

As e-commerce continues its upward trajectory, becoming a fundamental aspect of how consumers shop, the efficient handling of product returns, known as reverse logistics, has transformed into a standard and essential service offering. Delhivery's robust infrastructure and expertise in managing these returns generate a steady and predictable revenue stream from clients who rely on this continuous support.

This mature service not only contributes to Delhivery's stable operational performance but also significantly boosts customer satisfaction, positioning returns management as a reliable cash-generating segment within its overall business portfolio. For instance, in the fiscal year 2023-24, Delhivery reported a substantial increase in its parcel volumes, with a significant portion attributed to the growing e-commerce sector and the associated returns. The company's focus on optimizing its reverse logistics network has been a key driver in maintaining profitability in this segment.

- Consistent Revenue: Returns management provides a predictable income source due to the ongoing nature of e-commerce transactions.

- Customer Retention: Efficiently handling returns enhances customer loyalty and satisfaction, indirectly supporting revenue growth.

- Operational Efficiency: Delhivery's established processes in reverse logistics ensure cost-effectiveness and smooth operations.

- Market Demand: The increasing volume of e-commerce sales directly translates to higher demand for returns management services.

Delhivery's extensive pan-India network, reaching over 18,700 pin codes, forms a significant cash cow. This broad operational footprint ensures consistent revenue generation through sheer scale and a wide customer base, underpinning its financial stability.

The established infrastructure requires relatively low incremental investment to maintain and leverage, especially compared to expanding into new territories. This efficiency allows Delhivery to capitalize on its existing reach, solidifying its position as a stable revenue generator.

Delhivery's core B2B enterprise logistics services represent a significant Cash Cow. These mature, long-standing transportation contracts provide stable and predictable cash flow. In FY24, Delhivery reported consolidated revenue of ₹8,238 crore, with a substantial portion likely from these established B2B relationships.

| Segment | BCG Category | Key Characteristics | FY24 Revenue Contribution (Est.) |

| Pan-India Network Reach | Cash Cow | Vast operational footprint, broad customer base, consistent revenue generation. | High |

| B2B Enterprise Logistics | Cash Cow | Mature, long-standing contracts, stable and predictable cash flow. | Significant |

| Payment Collection & Processing (COD) | Cash Cow | Dominant payment preference in e-commerce, high transaction volumes, reliable revenue stream. | Steady |

| Tier 1 Last-Mile Delivery | Cash Cow | Matured market, substantial volumes, optimized infrastructure, steady revenue. | Reliable |

| Reverse Logistics | Cash Cow | Essential service, robust infrastructure, steady and predictable revenue stream. | Consistent |

What You See Is What You Get

Delhivery Logistics BCG Matrix

The Delhivery Logistics BCG Matrix preview you see is the definitive document you will receive upon purchase, offering a comprehensive strategic overview of their business units. This report is fully formatted and ready for immediate use, providing actionable insights without any watermarks or demo content. You can confidently expect the exact same analysis and professional design to be delivered to you, enabling swift integration into your strategic planning and decision-making processes.

Dogs

Delhivery's Full Truckload (FTL) services faced a significant downturn in Q4 FY25, with revenue dropping 5.6% sequentially and 13.2% compared to the previous year. This persistent decline suggests a weak competitive standing and a shrinking market presence in this segment.

The sustained negative growth trajectory for FTL, if unaddressed by strategic adjustments or a market upturn, positions it as a potential 'Dog' within Delhivery's logistics portfolio. Such a classification implies the segment consumes resources without generating sufficient returns or contributing to the company's overall expansion goals.

Delhivery's focus on contract renegotiation highlights the presence of older, less profitable customer agreements. These underperforming contracts, characterized by low yields or outright losses, represent a drag on profitability. For instance, if a significant portion of their renegotiation efforts in 2024 was driven by contracts signed during a period of intense competition, these would fall into this category.

These low-yield segments demand strategic attention; they might be shedding these contracts or actively repricing them to improve financial performance. In 2024, if Delhivery reported a reduction in the number of such legacy contracts, it would indicate progress in this area, freeing up resources for more lucrative business.

Segments experiencing intense price wars, like express parcel delivery in India's highly competitive logistics landscape, often fall into the Dogs category of the BCG Matrix. Delhivery, like its peers, navigates this environment where aggressive pricing from multiple players, including traditional couriers and newer entrants, can severely erode profit margins. For instance, reports from 2024 indicated a significant increase in operational costs for logistics companies due to fuel price volatility and labor expenses, further exacerbating margin pressure in these price-sensitive segments.

Niche or Specialized Services Lacking Scale

Delhivery's ventures into highly specialized or niche logistics services that haven't yet achieved significant scale could be categorized as Dogs in the BCG Matrix. These services might include highly specific cold chain solutions for particular pharmaceuticals or bespoke freight forwarding for niche industries. While potentially offering higher margins, their limited market penetration and slower growth rates mean they may not contribute substantially to overall revenue or cash flow. For instance, if Delhivery launched a specialized last-mile delivery service for high-value, fragile electronics in a limited geographic area, and that market is not expanding rapidly, it would fit this description.

These niche offerings may struggle to achieve economies of scale, making it difficult to leverage Delhivery's extensive network efficiencies. The market for these specialized services might not be experiencing rapid growth, thus limiting their potential for significant revenue generation or positive cash flow. This can lead to a situation where these services consume resources without yielding proportional returns, a classic characteristic of a Dog in the BCG Matrix.

For example, consider a hypothetical specialized logistics service for antique furniture transportation. While it caters to a specific need, the market size is inherently limited, and growth might be slow. If Delhivery invested in dedicated infrastructure and personnel for this service, but it only handled a small volume of shipments annually, it would likely fall into the Dog quadrant. In 2024, such a service might represent less than 0.5% of Delhivery's total revenue, with minimal profit contribution.

Key characteristics of these niche services as Dogs:

- Limited Market Share: These services operate in small, specialized segments with few customers.

- Slow Market Growth: The overall demand for these niche services is not expanding quickly.

- Low Profitability: Difficulty in achieving scale often leads to lower profit margins or even losses.

- Resource Drain: They may require dedicated resources without generating sufficient returns to justify the investment.

Outdated or Non-Integrated Operational Processes

Outdated or non-integrated operational processes represent a significant challenge for Delhivery, particularly in a rapidly evolving logistics landscape. These areas, where technology adoption lags, can become bottlenecks, increasing operational costs and reducing efficiency. For instance, if certain fulfillment centers still rely heavily on manual sorting or tracking, this directly impacts delivery speed and accuracy compared to automated hubs.

These less optimized segments may struggle to maintain profitability and a competitive edge. Areas that haven't fully embraced Delhivery's advanced technological integration, such as AI-powered route optimization or automated warehousing, can become a drag on overall performance. This divergence in operational maturity creates a disparity in service quality and cost-effectiveness across different parts of the business.

- Inefficiency Impact: Manual processes can lead to an estimated 10-15% increase in handling time per package compared to automated systems.

- Cost Implications: Reliance on older methods can inflate labor costs and increase the potential for errors, impacting margins.

- Competitive Disadvantage: Competitors leveraging full automation can offer faster delivery times and lower prices, putting pressure on Delhivery's market share in affected segments.

- Integration Gaps: In 2023, Delhivery reported that while a significant portion of their network was digitized, some smaller, regional operations still required further integration with their central technology platform.

Delhivery's Full Truckload (FTL) services, experiencing a revenue decline of 13.2% year-over-year in Q4 FY25, are exhibiting characteristics of a 'Dog' in the BCG Matrix. This persistent underperformance suggests a weak competitive position and a shrinking market presence, consuming resources without contributing significantly to growth.

Segments characterized by intense price wars, such as express parcel delivery, also fall into the 'Dog' category. In 2024, aggressive pricing by competitors, coupled with rising operational costs like fuel and labor, severely squeezed profit margins in these sensitive areas.

Niche or specialized logistics services that haven't achieved scale, like hypothetical bespoke freight for specific industries, can also be Dogs. Despite potentially higher margins, their limited market penetration and slow growth rates in 2024 meant they contributed minimally to revenue or cash flow, often requiring dedicated resources without commensurate returns.

Outdated operational processes, such as manual sorting in fulfillment centers, create inefficiencies and increase costs, positioning these areas as Dogs. These segments, lagging in technology adoption, face a competitive disadvantage against more automated rivals, as evidenced by reports in 2023 highlighting integration gaps in some regional operations.

| Segment | BCG Category | Key Challenges | FY25 Q4 Performance | 2024 Market Context |

| Full Truckload (FTL) | Dog | Weak competitive standing, shrinking market | Revenue down 13.2% YoY | Intense price competition, rising operational costs |

| Express Parcel Delivery | Dog | Price wars, margin erosion | (Implied pressure from market) | Aggressive pricing, fuel and labor cost increases |

| Niche Specialized Services | Dog | Low scale, slow growth, resource drain | (Low revenue contribution) | Limited market penetration, difficulty achieving economies of scale |

| Outdated Operational Processes | Dog | Inefficiency, higher costs, competitive disadvantage | (Impacts overall profitability) | Lagging technology adoption, manual processes |

Question Marks

Delhivery's Rapid Commerce, launched in January 2025, is positioned to capitalize on the burgeoning quick commerce sector by offering deliveries within two hours. This service is aimed at direct-to-consumer (D2C) and e-commerce brands seeking ultra-fast fulfillment.

While the market for sub-2-hour delivery is experiencing significant growth, Delhivery is a new entrant in this specific segment. Its current market share is nascent compared to established quick commerce players, indicating it's a developing offering within the broader logistics landscape.

To gain traction and establish long-term viability, Rapid Commerce necessitates substantial investment in building out a network of dark stores and enhancing last-mile delivery infrastructure. This strategic investment is crucial for capturing a meaningful share of the competitive quick commerce market.

Delhivery Direct, launched in June 2025, signifies Delhivery's move into the fast-paced intracity on-demand delivery sector, aiming to capture the growing demand for same-day deliveries. This segment is characterized by intense competition from players like Uber and Rapido, presenting a significant challenge for Delhivery's initial low market share.

To achieve substantial market traction and profitability, Delhivery Direct will necessitate considerable investment in scaling its operations and building a robust network. The potential for high growth in urban same-day delivery services makes this a strategic, albeit demanding, expansion for Delhivery.

Delhivery's expansion into cross-border Less than Container Load (LCL) services, reaching over 120 countries, taps into a significant growth avenue for Indian businesses engaging in international trade. This strategic move aims to simplify global shipping, offering a valuable service for smaller shipments that don't fill an entire container.

Despite the vast potential, this segment currently represents a smaller slice of Delhivery's revenue pie, overshadowed by its robust domestic network. In 2023, while specific LCL cross-border revenue figures for Delhivery weren't publicly detailed, the broader Indian logistics market for international freight forwarding saw substantial growth, indicating the underlying opportunity.

The global cross-border freight market is intensely competitive and already dominated by established players, placing Delhivery's LCL offering in the 'Question Mark' category of the BCG matrix. This classification stems from its currently low market share in this expansive arena, necessitating substantial investment to build scale and capture a meaningful position.

SaaS Product for Logistics (OS1 Business)

Delhivery's SaaS product for logistics, OS1 Business, is positioned as a Question Mark in the BCG Matrix. This new venture aims to provide clients with tools to manage their domestic and international logistics operations, representing a significant opportunity for a new, high-growth revenue stream.

While the potential is substantial, the market adoption and share for this relatively new offering are currently nascent. This necessitates continued strategic investment in product enhancement and aggressive market penetration to capture a larger share.

- Market Potential: The global logistics software market is projected to reach $100 billion by 2027, indicating a vast addressable market for Delhivery's SaaS solution.

- Investment Needs: Significant capital is required for ongoing research and development to enhance OS1 Business's features and functionalities, as well as for marketing and sales efforts to build brand awareness and acquire customers.

- Strategic Focus: Delhivery must focus on demonstrating clear value proposition and ROI to potential clients to drive adoption and establish a strong market presence in this competitive space.

- Growth Trajectory: Success in converting Question Marks into Stars depends on effectively scaling the SaaS offering, achieving significant market penetration, and building a loyal customer base.

Deep Penetration into Tier 2 and Tier 3 Cities (New Customer Acquisition)

Delhivery's push into Tier 2 and Tier 3 cities is a prime example of a Question Mark in its BCG Matrix. These areas represent a massive growth opportunity, with e-commerce penetration still relatively low compared to major metros, offering a vast pool of untapped customers. For instance, by the end of 2023, the number of internet users in India's smaller cities and rural areas was projected to surpass 500 million, indicating a substantial digital consumer base ready for e-commerce.

However, realizing this potential demands significant investment. Delhivery needs to build out new warehousing and sortation facilities, adapt last-mile delivery models for diverse urban and semi-urban landscapes, and potentially invest in customer awareness campaigns to drive e-commerce adoption. This strategic move requires substantial capital expenditure and operational expertise to overcome logistical challenges and build market share in these developing regions.

- Untapped Market Potential: Tier 2 and Tier 3 cities represent a significant portion of India's population, with growing disposable incomes and increasing internet penetration, creating a fertile ground for e-commerce growth.

- Infrastructure Investment: Expanding into these cities necessitates building new hubs, optimizing delivery routes, and potentially establishing localized micro-fulfillment centers to ensure efficient last-mile operations.

- Customer Acquisition Costs: Acquiring new customers in these markets may involve higher marketing and operational costs due to less established logistics networks and varying consumer behaviors.

- Scalability Challenges: While the potential is high, scaling operations efficiently across numerous smaller cities presents unique logistical and management complexities that need careful planning and execution.

Delhivery's cross-border LCL services, while tapping into a growing international trade market, currently hold a low market share. This segment requires substantial investment to build scale and compete with established global players, positioning it as a Question Mark.

The OS1 Business SaaS product is also a Question Mark, representing a new high-growth revenue stream with substantial market potential but currently nascent adoption. Continued investment in product development and aggressive marketing is crucial for its success.

Expansion into Tier 2 and Tier 3 cities presents a significant growth opportunity due to low e-commerce penetration. However, this requires substantial investment in infrastructure and adapting delivery models, making it a strategic but capital-intensive Question Mark.

| BCG Category | Delhivery Business Segment | Market Share | Market Growth | Investment Recommendation |

|---|---|---|---|---|

| Question Mark | Cross-Border LCL Services | Low | High | Invest to gain share or divest if unsustainable |

| Question Mark | OS1 Business (SaaS) | Nascent | High | Invest heavily to build market leadership |

| Question Mark | Tier 2/3 City Expansion | Low | High | Invest strategically to capture untapped demand |

BCG Matrix Data Sources

Our Delhivery Logistics BCG Matrix is built on robust data, integrating financial reports, market share analysis, and industry growth projections to accurately position each business unit.