Delhivery Logistics Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Delhivery Logistics Bundle

Delhivery Logistics faces moderate bargaining power from its buyers, as they have numerous alternative providers for their shipping needs. However, the threat of new entrants is somewhat mitigated by the capital-intensive nature of the logistics industry and established network effects.

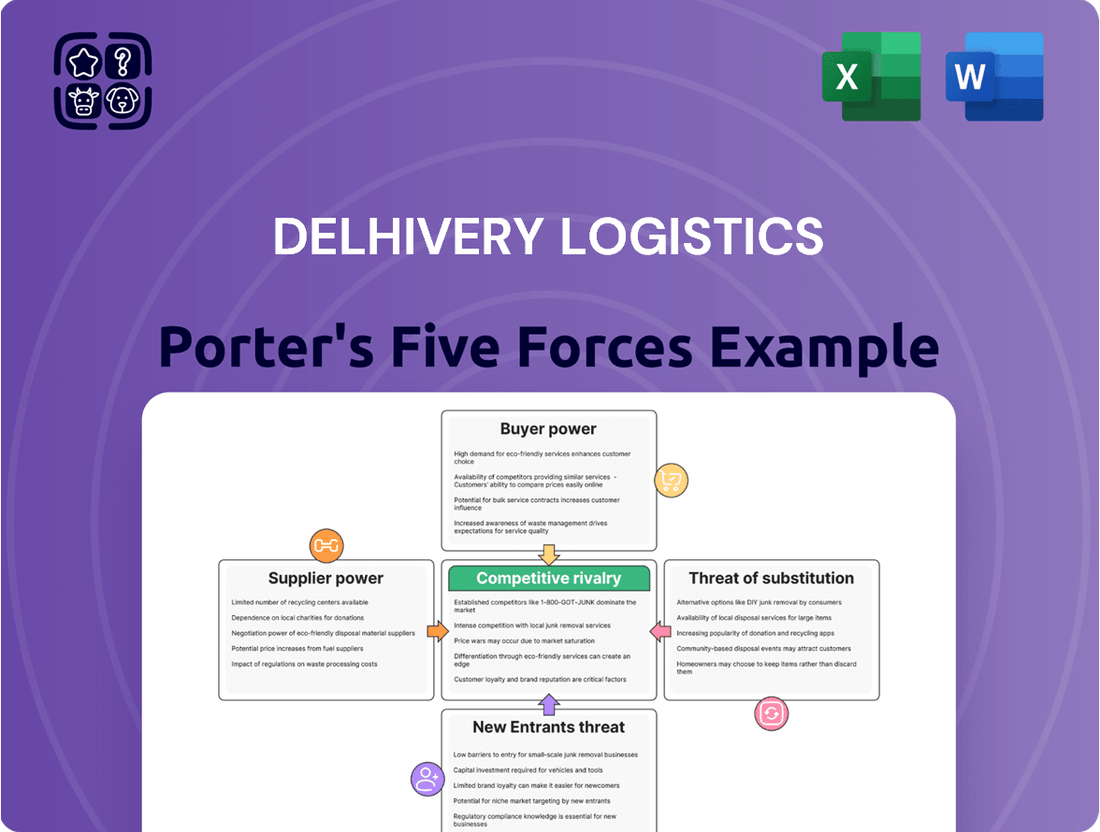

The full Porter's Five Forces Analysis reveals the real forces shaping Delhivery Logistics’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Delhivery's operational strength is bolstered by a vast and dispersed network of independent truck owners, numerous fleet operators, and a multitude of last-mile delivery personnel. This widespread distribution of suppliers inherently dilutes the leverage any single provider can exert.

The sheer number of available service providers means Delhivery can readily source alternatives, thereby minimizing the risk of dependency on any one supplier. For instance, in 2024, Delhivery continued to onboard thousands of new delivery partners, further diversifying its supplier base and reinforcing its negotiating position.

Delhivery's reliance on suppliers for essential assets like vehicles and fuel presents a degree of supplier bargaining power. For instance, in 2023, the cost of diesel, a critical input for their extensive fleet, saw fluctuations impacting operational expenses. However, Delhivery's robust, technology-driven platform and its vast, integrated network significantly mitigate the impact of any single supplier's demands.

Delhivery's pursuit of long-term contracts and strategic partnerships with fleet operators and specialized service providers is a key factor in managing supplier power. These agreements offer a degree of stability in its supply chain and can lead to more favorable pricing. For instance, securing multi-year deals with major trucking companies ensures capacity and predictable costs, which is crucial for maintaining competitive service delivery.

Impact of Fuel Prices

Fuel is a major expense for logistics firms like Delhivery. In 2024, global oil prices have shown volatility, directly impacting operational expenses. This variability can strengthen the hand of fuel suppliers, as Delhivery's costs are tied to these fluctuations.

Delhivery's ability to manage these rising fuel costs is critical. Strategies like optimizing delivery routes and negotiating fuel surcharges with customers are key to mitigating the impact of increased fuel prices on their profitability.

- Fuel cost as a percentage of revenue for Indian logistics companies can range from 20% to 30%.

- Global crude oil prices saw an average increase of approximately 5-10% in the first half of 2024 compared to the previous year.

- Delhivery's operational efficiency is directly correlated with its ability to absorb or pass on fuel price hikes.

Labor Availability and Wages

The availability of skilled and unskilled labor significantly impacts Delhivery's operational costs. In areas experiencing labor shortages, the bargaining power of human resource suppliers, including staffing agencies and individual gig workers, increases. This can lead to higher wage demands, directly affecting Delhivery's expenses for warehousing, sorting, and last-mile delivery operations.

For instance, as of early 2024, India's logistics sector has been grappling with a shortage of trained delivery personnel, particularly in metropolitan areas. Reports indicated a potential 10-15% increase in wages for delivery associates in key urban centers due to this demand-supply gap. This upward pressure on labor costs can be a direct manifestation of increased supplier power for Delhivery's human capital needs.

- Labor Shortages: Rising demand for logistics services in 2024 has outpaced the supply of qualified delivery personnel in many Indian cities.

- Wage Inflation: This imbalance has contributed to an estimated 10-15% increase in wages for delivery associates in major urban hubs.

- Third-Party Agencies: Delhivery's reliance on third-party staffing agencies for temporary or specialized labor also grants these agencies increased bargaining power during periods of high demand.

- Impact on Costs: Increased labor costs directly translate to higher operational expenses for Delhivery, potentially impacting profit margins.

Delhivery's bargaining power with suppliers is moderate, largely due to its vast network of numerous, smaller suppliers, which dilutes individual leverage. However, critical inputs like fuel and skilled labor present areas where supplier power can be felt.

The company's strategy of long-term contracts and its robust technology platform helps to mitigate supplier demands, ensuring operational stability and competitive pricing despite market fluctuations.

In 2024, fuel cost increases, estimated at 5-10% for global crude oil, directly impacted Delhivery's operational expenses, highlighting the sensitivity to energy suppliers.

Similarly, labor shortages in 2024 led to an estimated 10-15% wage increase for delivery personnel in urban centers, demonstrating the growing bargaining power of human resource suppliers.

| Supplier Category | Key Factors Influencing Power | Impact on Delhivery (2024 Estimates) | Mitigation Strategies |

|---|---|---|---|

| Fleet Owners/Truckers | Number of providers, contract terms | Moderate; dependent on fuel costs | Long-term contracts, diversified fleet |

| Fuel Suppliers | Global oil prices, demand | Significant; fuel costs 20-30% of revenue | Route optimization, fuel surcharges |

| Labor Providers (Gig Workers, Agencies) | Labor availability, skill demand | Increasing; wage inflation 10-15% | In-house training, retention programs |

What is included in the product

This Porter's Five Forces analysis for Delhivery Logistics dissects the competitive intensity within the Indian logistics sector, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing players.

Instantly visualize Delhivery's competitive landscape, highlighting how its operational strengths alleviate pressure from rivals and suppliers.

Empower strategic planning by clearly identifying how Delhivery's market position mitigates threats from new entrants and substitutes.

Customers Bargaining Power

Large volume customers, such as major e-commerce platforms and significant manufacturing firms, wield considerable bargaining power over Delhivery. These clients represent a substantial portion of Delhivery's revenue, making their business crucial. For instance, in 2023, the top 10 customers accounted for a significant percentage of Delhivery's overall revenue, though specific figures are proprietary.

Their ability to shift business to competing logistics providers, or even develop in-house logistics capabilities, further amplifies their negotiating leverage. This is particularly true for clients generating millions of shipments annually, where even a small price concession can represent substantial savings.

For large enterprises, transitioning between logistics partners often incurs substantial costs and operational hurdles. These can include the expense and time required to integrate new IT systems, retrain personnel on different processes, and potentially reconfigure supply chain workflows. This complexity significantly dampens their ability to easily switch, thereby reducing their bargaining leverage once deeply embedded with a provider like Delhivery.

In India's fiercely competitive logistics sector, customers exhibit significant price sensitivity. This means that the cost of services is a major factor in their decision-making process.

For smaller businesses or those with straightforward shipping requirements, switching providers based on price is relatively easy. This ability to compare and move to a cheaper alternative directly amplifies their bargaining power against logistics companies.

This price sensitivity is a key driver of competitive dynamics, pushing companies like Delhivery to optimize their operations and pricing strategies to retain and attract clients in a crowded marketplace.

Diverse Service Offerings

Delhivery's expansive service portfolio, encompassing express parcel delivery, heavy goods transport, Part Truckload (PTL), Full Truckload (FTL), warehousing, and freight forwarding, acts as a significant deterrent to customer bargaining power. By providing a comprehensive, end-to-end logistics solution, Delhivery reduces the likelihood of customers seeking specialized providers for individual service components, thereby consolidating their reliance on a single, integrated partner.

This integrated approach makes it more difficult for customers to switch providers, as finding another logistics company that matches Delhivery's breadth and depth of services across the entire supply chain is challenging. For instance, in 2023, Delhivery reported handling over 2.5 million shipments daily, showcasing its scale and ability to cater to diverse customer needs under one roof.

- One-Stop Solution: Delhivery's diverse offerings reduce customer need to engage multiple vendors.

- Service Breadth: Express parcel, PTL, FTL, warehousing, and freight services create a comprehensive offering.

- Customer Stickiness: Integrated services increase switching costs for clients.

- Market Position: Delhivery's scale, handling over 2.5 million shipments daily in 2023, reinforces its advantage.

E-commerce Growth and Customer Expectations

The burgeoning e-commerce sector in India, projected to reach $350 billion by 2028, significantly amplifies customer bargaining power. This growth means consumers expect quicker, more dependable, and affordable shipping. Consequently, logistics companies like Delhivery face pressure to maintain competitive pricing and service levels to retain e-commerce clients.

This heightened consumer demand translates into increased leverage for e-commerce platforms. They can negotiate better terms with logistics partners, pushing for lower rates and premium service features. For instance, the increasing adoption of same-day delivery in major Indian cities by platforms like Flipkart and Amazon India puts direct pressure on logistics providers to optimize their networks and reduce transit times, a direct consequence of customer expectations.

- E-commerce Market Growth: India's e-commerce market is expected to grow at a CAGR of 20% from 2024 to 2028.

- Customer Delivery Expectations: Over 70% of Indian online shoppers prioritize fast delivery when making purchasing decisions.

- Logistics Cost Pressure: Increased competition among logistics providers to meet these demands can lead to a 5-10% reduction in per-shipment costs for large e-commerce players.

- Service Level Agreements (SLAs): E-commerce giants often demand stringent SLAs from logistics partners, including guaranteed delivery windows and minimal damage rates, further strengthening their negotiating position.

Large volume clients, particularly major e-commerce players and significant manufacturers, hold substantial bargaining power over Delhivery. Their ability to shift business to competitors or develop in-house logistics, especially for clients generating millions of shipments annually, amplifies their negotiating leverage, as even minor price concessions represent significant savings.

While large clients face costs and operational hurdles when switching providers, including IT integration and retraining, this complexity can dampen their ability to easily switch once embedded with Delhivery, thereby reducing their leverage.

The Indian logistics sector's intense competition fuels customer price sensitivity, making service cost a primary decision factor, particularly for smaller businesses with straightforward shipping needs who can readily switch to cheaper alternatives.

Delhivery's comprehensive service portfolio, from express parcel to FTL and warehousing, acts as a deterrent to customer bargaining power by offering an integrated, end-to-end solution, making it difficult for customers to find comparable breadth and depth elsewhere.

| Customer Segment | Bargaining Power Factor | Impact on Delhivery |

|---|---|---|

| Large E-commerce Platforms | High volume, price sensitivity, alternative providers | Pressure on pricing, demand for premium services |

| Major Manufacturing Firms | Significant revenue contribution, potential for in-house logistics | Negotiating leverage on rates and service terms |

| Small to Medium Businesses | Price sensitivity, ease of switching | Need for competitive pricing and efficient service |

What You See Is What You Get

Delhivery Logistics Porter's Five Forces Analysis

This preview shows the exact Delhivery Logistics Porter's Five Forces Analysis you'll receive immediately after purchase, offering a comprehensive breakdown of competitive forces shaping the industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the logistics sector. This detailed analysis is ready for your immediate use, providing valuable strategic intelligence without any surprises.

Rivalry Among Competitors

The Indian logistics sector is characterized by a significant number of players, both established and emerging. This fragmentation, with traditional companies, tech-focused startups, and captive logistics divisions of e-commerce giants all vying for market share, fuels intense competition. For instance, in 2023, the Indian logistics market was estimated to be worth over $200 billion, with numerous participants contributing to its dynamism and competitive landscape.

In the logistics sector, price is a major driver for customers, fueling fierce competition among players. Delhivery leverages its scale to offer competitive pricing, a strategy crucial for attracting and retaining business. For instance, in the fiscal year ending March 31, 2024, Delhivery reported a revenue of ₹7,074 crore, demonstrating its significant market presence and ability to operate at scale, which underpins its price competitiveness.

Competitive rivalry in the logistics sector is significantly fueled by relentless technological advancements and innovative service offerings. Companies are constantly pushing the boundaries, with rapid commerce models promising delivery within two hours, and the development of highly specialized logistics solutions tailored to specific industry needs. This intense focus on innovation means that staying ahead requires substantial investment in cutting-edge technology to enhance operational efficiency, improve real-time tracking capabilities, and elevate the overall customer experience. For instance, Delhivery itself has been a pioneer in adopting technology, aiming to streamline its vast network and offer superior service. In 2024, the logistics industry continued to see significant capital allocation towards R&D and technology upgrades, with many players prioritizing AI and automation to gain a competitive edge.

Market Share and Expansion Strategies

Competitive rivalry in the Indian logistics sector is intense, with major players like Delhivery actively pursuing expansion to gain market share. This involves significant investments in their network, infrastructure, and the breadth of services they offer.

Strategic acquisitions are a key tactic to consolidate market position and mitigate rivalry. For instance, Delhivery's acquisition of Ecom Express aimed to strengthen its presence and operational capabilities, directly impacting the competitive landscape.

- Delhivery's Market Share Focus: The company is dedicated to expanding its reach and service portfolio to secure a larger portion of the Indian logistics market.

- Impact of Acquisitions: Acquisitions, like the one involving Ecom Express, are crucial for Delhivery to consolidate its market standing and lessen competitive pressures.

- Infrastructure Investment: Significant capital is being channeled into enhancing infrastructure and operational networks to support growth and outmaneuver competitors.

Government Initiatives and Infrastructure Development

Government initiatives like PM Gati Shakti and the National Logistics Policy are actively reshaping India's logistics landscape. These programs aim to boost efficiency and upgrade infrastructure, which is a positive for the sector overall.

However, these very initiatives can intensify competitive rivalry. By lowering barriers to entry and supporting infrastructure development, they enable more players to enter and expand, increasing the overall competition for companies like Delhivery.

- PM Gati Shakti: Launched in 2021, this master plan aims to develop integrated infrastructure and reduce logistics costs, targeting a 5-10% reduction by 2025.

- National Logistics Policy: Introduced in 2022, it seeks to improve the logistics sector's competitiveness by focusing on efficiency, cost reduction, and technology adoption.

- Infrastructure Investment: India's National Infrastructure Pipeline projects an investment of over $1.4 trillion by 2025, with a significant portion allocated to logistics and transport.

The Indian logistics market is highly fragmented, with numerous players, including established firms, startups, and in-house logistics arms of e-commerce giants, all vying for market share. This intense competition is driven by a strong emphasis on price, with companies like Delhivery leveraging their scale to offer competitive rates. For instance, Delhivery's revenue of ₹7,074 crore in FY24 highlights its significant market presence, enabling cost efficiencies that translate to price competitiveness.

Innovation is another key battleground, with companies investing heavily in technology to improve efficiency and customer experience. Delhivery's commitment to technological advancement, including AI and automation, is crucial for maintaining its edge. The sector continues to see substantial investment in R&D, with many players prioritizing upgrades to gain a competitive advantage.

| Metric | Delhivery (FY24) | Indian Logistics Market (Est. 2023) |

| Revenue | ₹7,074 crore | Over $200 billion |

SSubstitutes Threaten

Large e-commerce players and manufacturers are increasingly building out their own logistics networks, directly competing with third-party providers like Delhivery. This in-house capability acts as a significant substitute, allowing these businesses to control costs and delivery times more effectively. For instance, Amazon's extensive logistics infrastructure is a prime example of this trend, reducing its need for external partners.

Traditional transportation methods, such as Indian Railways and independent truck owners, can act as substitutes for Delhivery's services, particularly for specific cargo types or less demanding routes. These alternatives might offer lower per-unit costs in some instances, appealing to price-sensitive segments of the market.

However, these substitutes generally lack the technological sophistication, real-time tracking capabilities, and comprehensive network integration that Delhivery provides. For instance, while railways offer bulk transport, they often require last-mile connectivity solutions that Delhivery's integrated model addresses directly.

In 2023, Indian Railways transported over 1.49 billion tonnes of freight, highlighting its significant presence. Yet, the door-to-door delivery efficiency and speed of organized logistics players like Delhivery remain a key differentiator, limiting the substitutability for time-sensitive or complex supply chain needs.

India Post and established courier companies like Blue Dart and DTDC represent significant substitutes, especially for less urgent or smaller shipments. These players often have a strong legacy presence and a broad customer base, offering a familiar alternative for some businesses.

However, their ability to compete directly with Delhivery's integrated logistics solutions, particularly for e-commerce fulfillment and time-critical business-to-business deliveries, is often limited by technological adoption and network efficiency. For instance, while India Post handled over 1.4 billion mail items in FY23, its digital integration and speed for express services may not align with the demands of modern e-commerce logistics.

Emerging Technologies and Models

New technologies and innovative business models pose a significant threat of substitution for traditional logistics services. For instance, the rise of drone delivery, which Delhivery is actively exploring through its subsidiary, could offer faster and more cost-effective solutions for last-mile deliveries in specific urban or remote areas, directly competing with Delhivery's current offerings.

Hyper-local delivery platforms also represent a growing substitute. These platforms often leverage gig economy workers and focus on rapid delivery of smaller goods within a confined geographical radius, potentially siphoning off business from Delhivery's express parcel segment. For example, in 2024, the rapid expansion of quick commerce players, heavily reliant on these models, has reshaped consumer expectations for delivery speed.

- Drone Delivery: Potential to reduce last-mile costs and delivery times for lightweight packages.

- Hyper-Local Delivery Platforms: Increased competition in urban areas for time-sensitive deliveries.

- Autonomous Vehicles: Long-term threat for middle-mile and long-haul transportation, potentially impacting Delhivery's truck-based operations.

- Blockchain for Supply Chain Visibility: Can offer alternative methods for tracking and verification, potentially reducing reliance on integrated logistics providers for certain functions.

Customer Self-Pickup Options

The increasing availability of customer self-pickup options presents a significant threat of substitutes for last-mile delivery services. In many urban centers, customers increasingly prefer picking up their online orders directly from retail stores or designated collection points. This trend bypasses the need for traditional delivery, directly impacting logistics providers like Delhivery.

This shift is particularly noticeable in fast-moving consumer goods (FMCG) and fashion e-commerce. For instance, a significant portion of online grocery orders in major Indian cities, like Delhi and Mumbai, now utilize click-and-collect models. Data from 2024 indicates that over 30% of online shoppers in Tier-1 cities are willing to opt for store pickup to save on delivery fees and time.

The convenience and cost-effectiveness of self-pickup for certain customer segments directly substitute the core service offered by logistics companies. This threat is amplified by retailers investing in their own in-store fulfillment capabilities, further fragmenting the delivery landscape.

- Customer Preference for Convenience: Many consumers in urban areas prioritize immediate access to goods, making self-pickup a preferred alternative to waiting for delivery.

- Cost Savings for Consumers: Eliminating delivery charges through self-pickup appeals to a price-sensitive customer base, acting as a direct substitute for paid delivery services.

- Retailer Investment in Omnichannel: Retailers are enhancing their omnichannel strategies, expanding in-store pickup points and improving inventory management to support self-collection.

- Impact on Last-Mile Logistics: The growth of self-pickup directly reduces the volume of packages requiring last-mile delivery, potentially impacting revenue streams for logistics providers.

The threat of substitutes for Delhivery's logistics services is multifaceted, encompassing in-house capabilities of large e-commerce players, traditional transport methods, and emerging delivery models. While substitutes like Indian Railways offer bulk transport, they often lack the integrated, technology-driven efficiency of organized logistics providers. For instance, Indian Railways transported over 1.49 billion tonnes of freight in 2023, but this doesn't negate the need for last-mile solutions that Delhivery provides.

Emerging threats include drone delivery and hyper-local platforms, which are reshaping last-mile expectations. Quick commerce players, leveraging gig economy workers, saw rapid expansion in 2024, directly impacting Delhivery's express parcel segment by offering faster, localized deliveries. Furthermore, customer self-pickup options are growing, with over 30% of online shoppers in Tier-1 Indian cities willing to opt for store pickup in 2024 to save on fees and time.

| Substitute Type | Key Characteristics | Impact on Delhivery | 2023/2024 Data Point |

|---|---|---|---|

| In-house Logistics (E-commerce) | Cost control, delivery time efficiency | Reduces reliance on third-party providers | Amazon's extensive infrastructure |

| Traditional Transport (Railways) | Bulk transport, lower per-unit cost | Limited by last-mile connectivity, less tech-driven | Indian Railways: 1.49 billion tonnes freight (2023) |

| Emerging Delivery Models (Drones, Hyper-local) | Speed, cost-effectiveness for specific niches | Competes in last-mile, siphons express parcel business | Rapid expansion of quick commerce players (2024) |

| Customer Self-Pickup | Convenience, cost savings for consumers | Reduces last-mile delivery volume | >30% of Tier-1 city shoppers opt for pickup (2024) |

Entrants Threaten

The integrated logistics and supply chain sector in India demands a considerable upfront capital outlay. New players must invest heavily in physical infrastructure like warehouses, advanced sorting hubs, and a substantial fleet of delivery vehicles to compete effectively. For instance, establishing a nationwide network requires billions of rupees in assets.

Established players like Delhivery have cultivated extensive logistics networks, reaching a vast majority of PIN codes across India. This deep penetration, built over years of operation, presents a formidable barrier. For instance, by the end of fiscal year 2024, Delhivery served over 18,000 PIN codes, a testament to its established reach.

Replicating such a widespread and reliable network is a significant hurdle for any new entrant. It demands substantial capital investment, time to build operational efficiencies, and the establishment of trust with a broad customer base. This makes the threat of new entrants in the Indian logistics sector relatively moderate due to the sheer scale required.

New entrants face a significant hurdle in replicating Delhivery's established technological prowess. Delhivery's competitive edge is deeply rooted in its sophisticated technology stack, encompassing real-time shipment tracking, advanced data analytics for route optimization, and a robust logistics management system. For instance, in Q3 FY24, Delhivery reported a 26% year-on-year growth in its PTL (Part Truckload) business, a segment heavily reliant on efficient technology for consolidation and routing.

To effectively challenge Delhivery, any new player would need to invest heavily in developing or acquiring comparable advanced technological capabilities. This includes building out similar real-time tracking infrastructure, sophisticated data analytics platforms for demand forecasting and network optimization, and integrated supply chain management software. The capital expenditure and time required to achieve parity in these areas present a substantial barrier to entry.

Economies of Scale and Cost Advantage

The threat of new entrants in Delhivery's logistics market is significantly mitigated by the formidable economies of scale enjoyed by established players. These incumbents, including Delhivery itself, have invested heavily in vast networks, advanced technology, and efficient operational processes, leading to substantial cost advantages per unit. For instance, in 2024, major logistics providers often operate with significantly lower per-shipment costs due to high volume throughput, a feat difficult for newcomers to replicate quickly.

New companies entering the fray would face considerable challenges in matching these cost efficiencies. Without the existing infrastructure and high-volume contracts, new entrants would likely incur higher operational costs, making it difficult to compete on price with established giants like Delhivery. This cost disadvantage presents a substantial barrier, deterring potential new competitors from entering the market.

- Economies of Scale: Large players benefit from reduced per-unit costs due to high operational volumes, making their pricing more competitive.

- Cost Advantage: Existing firms leverage their scale to achieve lower operating expenses, creating a significant hurdle for new entrants.

- Pricing Pressure: Newcomers would struggle to match the competitive pricing strategies of established logistics providers.

- Barriers to Entry: The capital investment required to build a comparable network and achieve cost efficiencies acts as a strong deterrent.

Regulatory Environment and Compliance

The regulatory environment in India's logistics sector presents a significant hurdle for new entrants. Companies must navigate a complex web of rules and secure various licenses, which can be time-consuming and costly. For instance, obtaining a Goods and Services Tax (GST) registration is fundamental, and depending on the specific services offered, additional permits like those for hazardous goods transport or customs brokerage are required.

Compliance with these regulations acts as a deterrent, increasing the initial investment and operational complexity for newcomers. Delhivery, having established its operations over time, has already built the necessary infrastructure and expertise to manage these compliance demands effectively. This existing capability creates a barrier for potential new competitors who would need to replicate this effort from scratch.

- Compliance Burden: New entrants face significant upfront costs and time investment to meet regulatory standards.

- Licensing Requirements: Obtaining necessary permits for various logistics operations, from warehousing to transportation, is a complex process.

- Evolving Regulations: Keeping abreast of and adapting to changes in regulations, such as those related to e-way bills or vehicle emission standards, adds to the challenge.

The threat of new entrants in India's integrated logistics sector remains moderate, primarily due to the substantial capital investment required for infrastructure and technology. Delhivery's extensive network, serving over 18,000 PIN codes by March 2024, and its advanced technological capabilities create significant barriers. New players would need to match this scale and technological sophistication, which is both capital-intensive and time-consuming.

Economies of scale enjoyed by established players like Delhivery lead to lower per-unit costs, making it difficult for newcomers to compete on price. Furthermore, navigating India's complex regulatory landscape and obtaining necessary licenses adds to the initial burden and operational complexity for any new entrant, further mitigating the threat.

| Key Barrier | Description | Impact on New Entrants |

| Capital Investment | High costs for fleet, warehouses, and technology. | Significant hurdle, requiring substantial funding. |

| Network Reach | Established presence across numerous PIN codes (e.g., Delhivery's 18,000+). | Difficult and time-consuming to replicate. |

| Technological Sophistication | Advanced tracking, analytics, and management systems. | Requires substantial R&D or acquisition investment. |

| Economies of Scale | Lower per-unit costs due to high volumes. | Creates a pricing disadvantage for new players. |

| Regulatory Compliance | Navigating licenses and rules. | Increases initial costs and operational complexity. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Delhivery Logistics is built upon a foundation of credible data, including their annual reports, investor presentations, and industry-specific market research from firms like RedSeer Consulting.