Dekuple SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dekuple Bundle

Dekuple's strategic positioning is bolstered by its diversified business model and established market presence. However, understanding the nuances of its competitive landscape and potential regulatory shifts is crucial for navigating future growth.

Want the full story behind Dekuple's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Dekuple's digital marketing segment is a significant growth engine, evidenced by a 15.8% increase in gross margin in 2024. This sector now accounts for a substantial 65.6% of the company's total net sales, highlighting a successful strategic pivot towards high-demand digital services.

Dextreme's core strength lies in its deep expertise in data-driven marketing and AI leadership. The company excels at optimizing customer journeys by leveraging technology and specialized knowledge in customer relationship management. This focus allows them to create highly personalized and effective marketing strategies.

Their established leadership in Artificial Intelligence is a significant competitive advantage, directly supporting Dekuple's growth strategy. For instance, in 2023, Dekuple reported a 10% increase in marketing campaign effectiveness for clients utilizing their AI-powered personalization tools, demonstrating the tangible impact of this expertise.

Dekuple's strength lies in its extensive service portfolio, encompassing data analytics, marketing automation, loyalty programs, and media consulting. This broad offering allows them to provide a complete solution for client marketing needs.

Their omnichannel capabilities are a significant advantage, enabling businesses to connect with customers seamlessly across various touchpoints. This integrated approach is crucial for effective customer acquisition, engagement, and retention in today's fragmented market.

For instance, in 2023, Dekuple reported a 12% increase in revenue for its data and marketing services segment, highlighting the market's demand for such comprehensive solutions.

Strategic Acquisitions and European Expansion

Dekuple's strategic acquisition of companies like GUD.berlin, Ereferer, Selmore, DotControl, and After has been a key driver for its European expansion. These moves have not only broadened its service portfolio but also significantly bolstered its international footprint, especially within the European market. This aggressive acquisition strategy is central to Dekuple's ambition to establish itself as a leading European player in data marketing and communication.

These acquisitions are more than just expansion; they are about integrating specialized expertise that enhances Dekuple's overall offering. For instance, the acquisition of GUD.berlin in 2022 brought in strong capabilities in performance marketing and data analytics, complementing Dekuple's existing services. By strategically integrating these entities, Dekuple aims to create a more comprehensive and powerful data marketing ecosystem, positioning itself for sustained growth and market leadership.

- Strategic Acquisitions: Dekuple has acquired multiple companies, including GUD.berlin, Ereferer, Selmore, DotControl, and After, to bolster its expertise and market reach.

- European Expansion: These acquisitions are a direct strategy to strengthen Dekuple's presence and operations across key European markets.

- Enhanced Service Offerings: The integration of acquired companies broadens Dekuple's capabilities in areas like performance marketing and data analytics.

- Market Leadership Ambition: Dekuple aims to leverage these strategic moves to become a dominant force in the European data marketing and communication sector.

Robust Financial Health and Stable Shareholding

Dekuple demonstrated strong financial performance in 2024, achieving net sales of €218 million and a gross margin of €169 million. This robust financial health is underscored by a solid balance sheet, featuring nearly €55 million in shareholders' equity and €58 million in gross cash reserves.

This financial stability is further bolstered by a consistent shareholding structure. The presence of a stable family shareholding group ensures a long-term strategic perspective, providing the necessary stability for the group's sustained development and growth initiatives.

- 2024 Net Sales: €218 million

- 2024 Gross Margin: €169 million

- Shareholders' Equity: Nearly €55 million

- Gross Cash: €58 million

Dekuple's digital marketing segment is a powerful growth engine, accounting for 65.6% of total net sales in 2024, with a 15.8% increase in gross margin. The company's AI leadership, demonstrated by a 10% improvement in campaign effectiveness in 2023 using AI tools, provides a significant competitive edge. Their comprehensive service portfolio, including data analytics and media consulting, alongside strong omnichannel capabilities, allows for integrated customer engagement.

| Metric | 2024 Value | Significance |

|---|---|---|

| Digital Marketing Sales Contribution | 65.6% | Dominant segment driving growth |

| Digital Marketing Gross Margin Growth | 15.8% | Indicates strong profitability in digital |

| AI Campaign Effectiveness Improvement | 10% (2023) | Demonstrates tangible benefits of AI expertise |

| Net Sales | €218 million | Robust overall financial performance |

What is included in the product

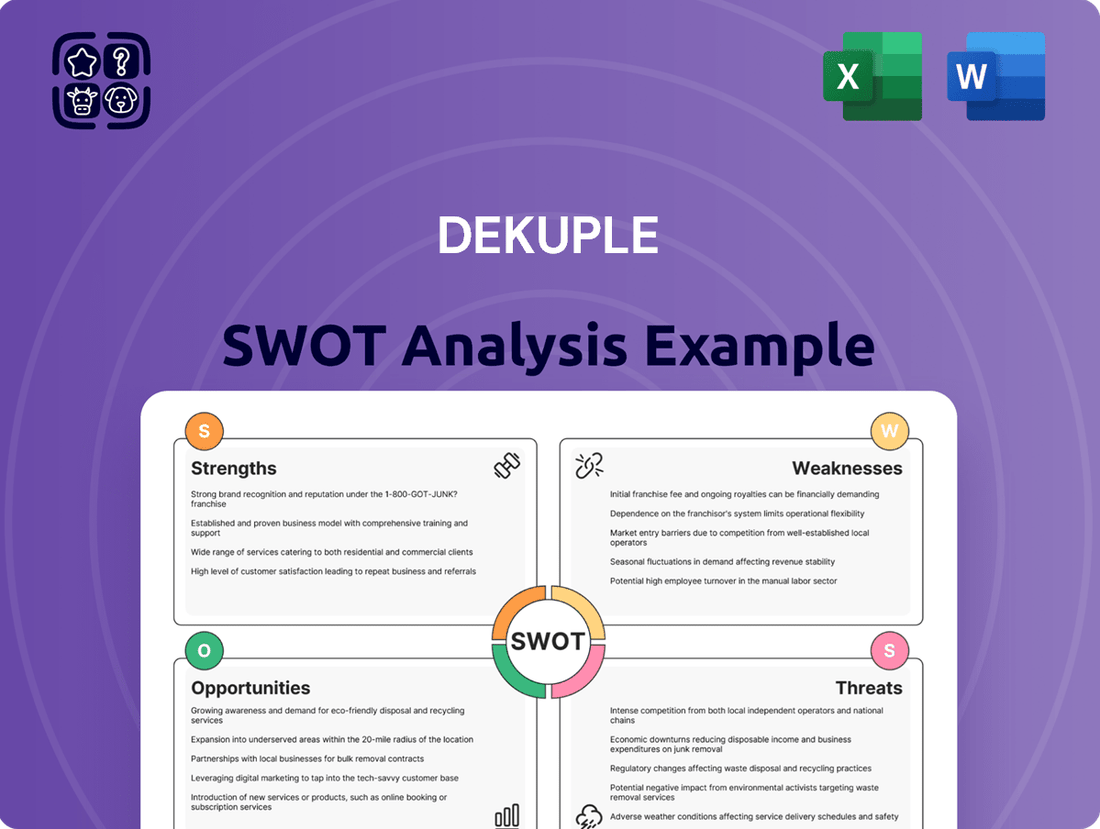

Analyzes Dekuple’s competitive position through key internal and external factors, highlighting its strengths in data-driven marketing and opportunities for market expansion, while also addressing weaknesses in integration and threats from evolving regulations.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities for growth.

Weaknesses

Despite a positive trajectory in sales and gross margin, Dekuple experienced a dip in its net income attributable to the Group. In 2024, this figure stood at €10.1 million, a notable decrease from the €12.4 million reported in 2023. This reduction, occurring alongside increased investment, signals that the company might be facing challenges in managing operational expenses or that certain investments are not yet yielding the expected profitability.

Dekuple's significant reliance on B2B digital marketing, which accounted for 65.6% of its consolidated net sales in 2023, presents a notable weakness. This heavy dependence means that any downturn or intensified competition within this specific sector could have a disproportionately negative effect on the company's overall financial performance and growth trajectory.

Dekuple's magazine segment faced significant headwinds in 2024, with a notable 6.7% drop in gross margin. This downturn was accompanied by a shrinking active open-ended subscription portfolio, indicating a potential loss of customer engagement and revenue streams within this core area.

While the insurance division showed promise, its strong performance in 2024 was heavily concentrated on complementary health insurance through an innovative marketing strategy. This reliance on a niche market could represent a vulnerability, as success in this specific area might not easily translate to broader insurance product lines or market segments.

Potential for Integration Challenges with Acquisitions

Dekuple's aggressive acquisition strategy, a key driver for its growth, presents a significant weakness in the form of potential integration challenges. Successfully absorbing new companies, with their diverse cultures, IT systems, and operational workflows, is a complex undertaking. For instance, in 2023, Dekuple completed several acquisitions, and the subsequent integration process will require substantial management attention and financial resources, potentially impacting the efficiency of existing operations if not managed effectively.

These integration hurdles can manifest in several ways:

- Cultural Clashes: Merging distinct corporate cultures can lead to employee resistance and reduced productivity.

- Technological Incompatibility: Integrating disparate IT infrastructures and software systems can be costly and time-consuming.

- Operational Disruptions: Synergies may be delayed or unrealized if operational processes are not smoothly harmonized.

- Resource Diversion: Management focus and capital may be diverted from core business development to manage integration complexities.

Sensitivity to Economic Uncertainty

Dekuple's reliance on marketing services makes it particularly vulnerable to economic downturns. In 2024, the company's CEO noted the challenging economic climate, characterized by political and fiscal uncertainty, which prompted businesses to scale back their marketing expenditures. This directly impacts Dekuple's revenue streams as clients become more hesitant to invest in advertising and promotional activities during uncertain times.

This sensitivity can be quantified by observing the correlation between macroeconomic indicators and Dekuple's financial performance. For instance, a slowdown in GDP growth or a rise in inflation could lead to reduced client budgets, directly affecting Dekuple's top line. The company's ability to navigate these economic headwinds will be crucial for maintaining stable growth and profitability.

- Economic Sensitivity: Dekuple's business model is inherently tied to client marketing budgets, which are often among the first to be cut during economic uncertainty.

- 2024 Challenges: The CEO's comments in 2024 highlighted a cautious business environment, directly impacting demand for Dekuple's services.

- Impact on Investment: When businesses face economic instability, they tend to reduce discretionary spending, including marketing, which can significantly affect Dekuple's revenue.

Dekuple's net income attributable to the Group saw a decline in 2024, falling to €10.1 million from €12.4 million in 2023. This decrease, occurring alongside increased investment, suggests potential difficulties in managing operational expenses or a lag in investment returns.

The company's substantial reliance on B2B digital marketing, representing 65.6% of consolidated net sales in 2023, makes it vulnerable to sector-specific downturns or heightened competition. Furthermore, the magazine segment experienced a 6.7% drop in gross margin in 2024, coupled with a shrinking subscriber base, indicating challenges in customer engagement.

Dekuple's aggressive acquisition strategy, while a growth driver, poses integration risks. Merging diverse company cultures, IT systems, and operations can be complex and resource-intensive, potentially disrupting existing business efficiency if not managed effectively.

The company's dependence on marketing services exposes it to economic volatility. In 2024, the CEO noted a challenging economic climate with political and fiscal uncertainty, leading businesses to reduce marketing expenditures, directly impacting Dekuple's revenue streams.

| Metric | 2023 | 2024 | Change |

|---|---|---|---|

| Net Income Attributable to Group (€M) | 12.4 | 10.1 | -18.5% |

| B2B Digital Marketing % of Sales | 65.6% | N/A | N/A |

| Magazine Gross Margin | N/A | -6.7% | N/A |

What You See Is What You Get

Dekuple SWOT Analysis

This is the actual Dekuple SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing the real content that will be yours after checkout.

The preview below is taken directly from the full Dekuple SWOT report you'll get. Purchase unlocks the entire in-depth version, allowing you to leverage all insights.

This preview reflects the real Dekuple SWOT analysis document—professional, structured, and ready to use. The complete version becomes available after checkout.

Opportunities

Dekuple is well-positioned to capitalize on the accelerating digitalization and datafication of businesses expected through 2025. This trend directly fuels demand for their core data marketing and communication services as companies across sectors prioritize data-driven strategies for expansion and customer engagement.

The increasing reliance on data analytics by businesses presents a substantial growth avenue for Dekuple. For instance, the global big data and business analytics market was projected to reach $312.1 billion in 2024, highlighting the immense value companies place on data insights, a trend Dekuple can leverage.

Dekuple's strategic roadmap, 'Ambition 2025', explicitly targets a leading position in the European data marketing and communication sector. This ambition translates into tangible opportunities for growth through both acquiring complementary businesses and fostering organic expansion within its core French market and throughout the broader European landscape.

The company is actively pursuing a dual strategy of targeted acquisitions and organic growth to solidify its European presence. This approach is designed to capitalize on market fragmentation and achieve scale, with a clear objective to become a dominant player in data-driven marketing solutions across the continent.

Beyond Europe, Dekuple is exploring significant international expansion, with specific attention on markets such as China and North America. These regions represent substantial untapped potential for the company's expertise in data marketing, offering avenues for diversification and accelerated revenue growth in the coming years.

Dekuple's strategic investments in Artificial Intelligence, notably through their AI Factories, are a significant opportunity. This focus allows them to tap into the growing market for AI-driven marketing, a sector projected for substantial growth through 2025. By enhancing their technological capabilities, Dekuple can unlock innovative service lines and streamline operations.

Expanding Consulting Activities

The sustained growth in Dekuple's consulting activities, notably through its subsidiary Converteo, presents a significant opportunity. Converteo is a prominent force in data and digital strategy consulting, a sector experiencing robust demand.

Expanding these high-value services offers a clear path to deepening client relationships and generating higher-margin revenues. This strategic focus can solidify Dekuple's position as a comprehensive partner for businesses navigating the digital landscape.

- Converteo's established expertise in data and digital strategy

- Potential for increased cross-selling of consulting services alongside existing offerings

- Leveraging consulting to drive adoption of Dekuple's broader platform solutions

- Capitalizing on the growing market need for data-driven business transformation

Platformization of Services

Dekuple is leveraging its technological prowess to transform its offerings through platformization. This strategic move aims to build scalable solutions that enhance operational efficiency and unlock new avenues for revenue generation. By adopting a platform-centric model, the company can tap into subscription-based services and expand its market footprint significantly.

This strategy is particularly relevant in the current market landscape where digital integration is paramount. For instance, in 2024, the digital advertising market alone was projected to reach over $600 billion globally, highlighting the immense potential for platform-based services to capture a share of this expanding digital economy. Dekuple's platformization efforts are designed to capitalize on this trend.

The benefits of this approach are multifaceted:

- Scalability: Platform models allow for rapid expansion without a proportional increase in costs, enabling Dekuple to serve a larger customer base efficiently.

- New Revenue Streams: Subscription models and marketplace functionalities can create recurring revenue and open doors to previously untapped markets.

- Enhanced Customer Value: Integrated services on a single platform can offer a more seamless and valuable experience for clients, fostering loyalty.

- Innovation Acceleration: A platform architecture can simplify the integration of new technologies and services, speeding up the innovation cycle.

Dekuple is poised to benefit from the growing demand for data-driven marketing solutions, with the global big data and business analytics market expected to reach $312.1 billion in 2024. The company's 'Ambition 2025' strategy targets European leadership through acquisitions and organic growth, aiming to capitalize on market fragmentation. Furthermore, Dekuple's investments in AI, particularly its AI Factories, position it to capture the expanding AI-driven marketing sector.

Threats

The marketing technology sector is a crowded space, with many companies offering comparable tools for data-driven marketing, automation, and customer relationship management. This intense rivalry can indeed squeeze profit margins and challenge Dekuple's ability to grow its market share. For instance, in 2024, the MarTech market was valued at approximately $115 billion, with projections suggesting continued rapid growth, meaning more new entrants are likely to emerge.

A challenging economic climate, marked by political and fiscal uncertainty, often prompts companies to scale back their marketing expenditures. This cautious stance on advertising and promotional activities can directly affect Dekuple's top-line growth and overall profitability.

For instance, if major European economies, where Dekuple has significant operations, experience a slowdown in 2024, as projected by many economic forecasts, businesses may cut marketing budgets by 5-10% or more. This reduction in client spending on marketing services would directly impact Dekuple's revenue streams.

The increasing stringency of data privacy regulations, such as the GDPR and similar frameworks globally, presents a significant challenge for Dekuple. In 2024, the global cost of data breaches reached an average of $4.73 million, a trend that underscores the financial implications of non-compliance.

Failure to adhere to these evolving rules, or experiencing a data breach, could result in substantial financial penalties, severe reputational harm, and a critical erosion of customer trust. This is especially pertinent for Dekuple, given its core business relies heavily on data utilization for targeted marketing campaigns.

Rapid Technological Advancements and Disruption

The digital marketing landscape is evolving at an unprecedented speed, driven by innovations in areas like artificial intelligence and marketing automation. For Dekuple, this rapid technological advancement presents a significant threat. Companies failing to integrate new tools or adapt to emerging platforms risk falling behind. For instance, the increasing sophistication of AI in personalized advertising, a sector Dekuple operates within, requires constant investment in R&D to remain competitive.

Competitors leveraging disruptive technologies can quickly gain market share. Dekuple must therefore maintain a proactive stance on technology adoption. A failure to do so could lead to a diminished competitive edge, impacting its ability to attract and retain clients in a crowded market. The company's strategic planning must prioritize continuous innovation to counter this threat.

- AI Integration: The growing reliance on AI for data analysis and campaign optimization necessitates ongoing investment in AI capabilities.

- Marketing Automation: Competitors are increasingly adopting advanced marketing automation tools, creating pressure for Dekuple to enhance its own offerings.

- Emerging Platforms: New digital channels and advertising formats require swift adaptation to avoid obsolescence.

- Disruptive Solutions: The emergence of entirely new business models or technologies that bypass traditional marketing channels poses a direct threat to Dekuple's core services.

Reliance on Key Personnel and Talent Retention

Dekuple's operational strength hinges on its substantial workforce, boasting over 1,000 engineers, consultants, and marketing experts. This reliance makes the retention of these highly skilled individuals a critical factor for continued success.

The current market landscape presents a significant challenge, characterized by intense competition for top talent in specialized fields such as data science, artificial intelligence, and marketing technology. This competitive environment directly impacts Dekuple's ability to retain its key personnel.

Furthermore, the escalating demand for these in-demand skills can inevitably drive up operational costs as the company may need to offer more attractive compensation and benefits packages to secure and keep its valuable employees. This could potentially affect profit margins if not managed effectively.

Key concerns regarding talent include:

- High dependency on specialized knowledge: The company's success is tied to the expertise of its engineers and marketing professionals.

- Intense competition for talent: The data science and AI sectors are experiencing a talent war, making retention difficult.

- Rising labor costs: Increased competition for skilled workers could lead to higher salary and benefit expenses for Dekuple.

The MarTech sector's intense competition, with an estimated $115 billion market value in 2024, pressures Dekuple's profit margins and market share growth. Economic downturns, as seen in potential European slowdowns in 2024, can lead businesses to cut marketing spend by 5-10% or more, directly impacting Dekuple's revenue. Evolving data privacy regulations, with global breach costs averaging $4.73 million in 2024, pose significant financial and reputational risks if not meticulously followed.

SWOT Analysis Data Sources

This Dekuple SWOT analysis is built upon a robust foundation of verified financial reports, comprehensive market intelligence from leading industry analysts, and insightful expert commentary. These dependable data sources ensure the analysis is accurate, relevant, and strategically sound.