Dekuple Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dekuple Bundle

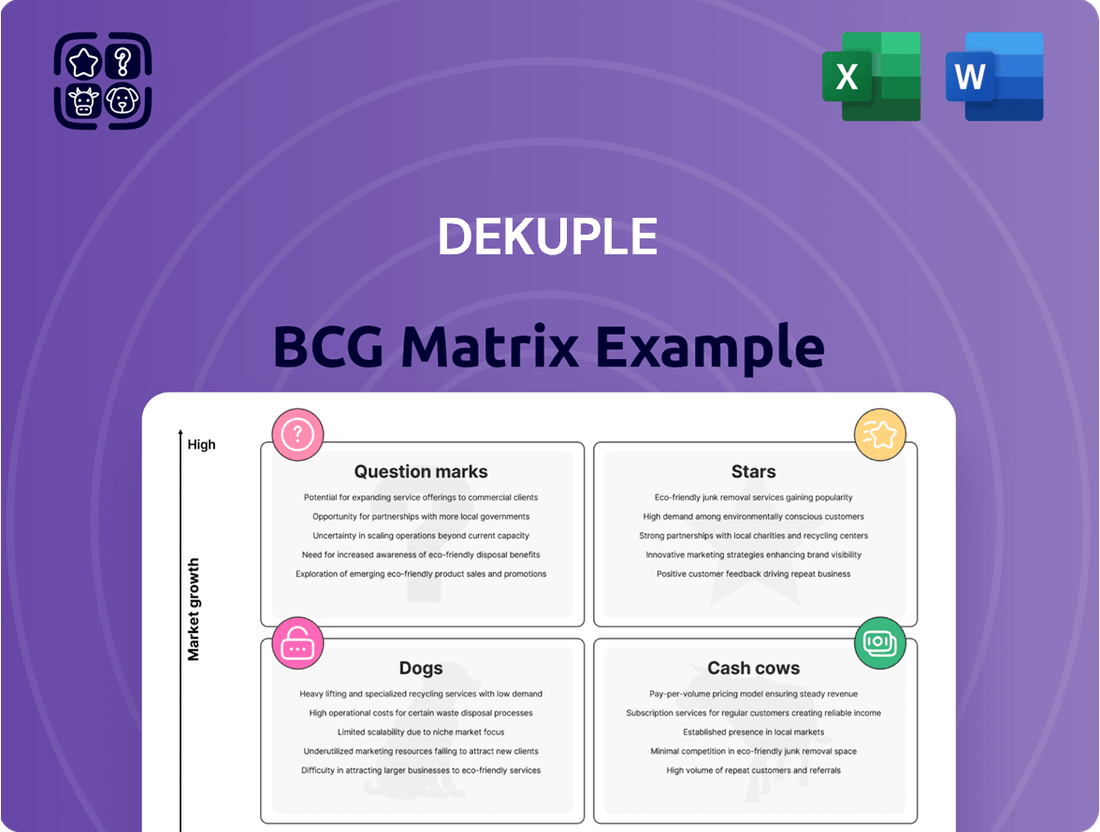

Unlock the full potential of your product portfolio with the complete Dekuple BCG Matrix. This essential tool categorizes your offerings into Stars, Cash Cows, Dogs, and Question Marks, providing a clear roadmap for strategic allocation of resources and future investments. Don't just guess where your business is headed; know it with precise, data-driven insights.

Gain a comprehensive understanding of your market position and identify opportunities for growth and divestment by purchasing the full Dekuple BCG Matrix. This detailed report offers actionable strategies to optimize your product mix and drive sustainable success.

Stars

D সিদ্ধান্তeKuple's digital marketing activities are a clear Star in its BCG Matrix. This segment generated a substantial 65.6% of consolidated net sales in 2024, a significant jump from 36.5% in 2020, highlighting its dominance and growth trajectory.

The segment's financial performance is equally impressive, with a robust 15.8% year-on-year increase in gross margin. This strong profitability underpins its Star status.

D সিদ্ধান্তeKuple's strategic focus, outlined in its 'Ambition 2025' plan, targets European leadership in data marketing, with digital marketing expansion being a cornerstone. This strategic alignment reinforces its position as a high-growth, high-market-share Star.

Dektuple positions its AI-Powered Marketing Solutions as a Stars category within the BCG Matrix, highlighting its significant investment in AI and technological prowess. The company actively develops AI Factories and utilizes AI to gain a competitive advantage, reflecting a strong commitment to innovation.

The market for AI-driven marketing technology, especially in personalization and automation, is seeing rapid expansion and substantial growth. This makes AI solutions a crucial component for sustained success in the evolving marketing landscape.

AI's capacity to refine personalization, streamline content generation, and provide real-time insights directly supports Dektuple's data-centric methodology. For instance, the global AI in marketing market was valued at approximately $15.8 billion in 2023 and is projected to reach $102.5 billion by 2030, growing at a CAGR of 30.1%. This robust growth underscores the strategic importance of Dektuple's focus in this area.

Omnichannel marketing is a significant growth driver expected to continue its upward trajectory through 2025. Customers now demand a consistent and unified brand experience, whether they're interacting online, in-store, or through mobile apps. This shift means businesses that successfully integrate their customer touchpoints are seeing substantial improvements in loyalty and revenue.

Companies that excel in omnichannel customer engagement are reporting markedly better results. For instance, studies indicate that businesses with strong omnichannel strategies can see up to a 91% higher customer retention rate compared to those with weaker approaches. Furthermore, these integrated strategies often lead to a 10% year-over-year increase in revenue.

Dekuple, as a marketing technology group, is strategically positioned to benefit from this burgeoning demand for omnichannel solutions. Their specialization in creating unified brand experiences across various channels directly addresses evolving consumer expectations. By offering integrated marketing technologies, Dekuple can help businesses bridge the gap between different customer touchpoints, making them a key player in this high-growth market segment.

Data-Driven Consulting Services

Dekuple's data-driven consulting services, notably through Converteo, are a key component of its growth strategy. In 2024, these services demonstrated robust financial health with a 9.8% increase in gross margin, reflecting strong demand for expertise in data analytics and digital transformation.

Converteo's impressive roster of over 400 expert consultants serves a significant portion of France's leading companies, with two-thirds of CAC40 firms relying on their guidance. This deep penetration into the market highlights the critical role of data-informed strategies for major corporations.

The strategic expansion of these consulting capabilities into new international markets, including the USA and Canada, further solidifies Dekuple's position as a leader in the consulting sector. This global reach is a testament to the scalability and effectiveness of their data-driven approach.

- Converteo's 2024 Gross Margin Growth: 9.8%

- Consultant Base: Over 400 experts

- Clientele: Two-thirds of CAC40 companies

- International Markets: USA and Canada

Strategic Digital Agency Acquisitions

Dektuple has been strategically acquiring digital marketing agencies to bolster its capabilities and reach. In 2024 and 2025, key acquisitions included GUD.Berlin in Germany, Ereferer for netlinking expertise, Coup de Poing focusing on B2B loyalty, and Selmore and DotControl in the Netherlands.

These moves are designed to enhance Dekuple's specialized service offerings, particularly in advertising strategy, automated netlinking, and B2B client loyalty programs. The integration of these agencies is a clear move to solidify Dekuple's standing in fast-growing digital market segments.

- GUD.Berlin (Germany): Strengthened advertising strategy capabilities.

- Ereferer: Enhanced automated netlinking services.

- Coup de Poing: Expanded B2B client loyalty solutions.

- Selmore & DotControl (Netherlands): Broadened international footprint and digital expertise.

Dektuple's AI-Powered Marketing Solutions are a prime example of a Star in the BCG Matrix. The company's significant investments in AI development, including AI Factories, position it at the forefront of a rapidly expanding market. The global AI in marketing sector, valued at approximately $15.8 billion in 2023, is projected to reach $102.5 billion by 2030, exhibiting a robust CAGR of 30.1%. This growth trajectory, coupled with Dektuple's data-centric approach and AI's ability to enhance personalization and automation, firmly establishes these solutions as a high-growth, high-market-share Star.

Omnichannel marketing represents another significant Star for Dektuple. The increasing customer demand for seamless brand experiences across all touchpoints drives this segment's growth. Businesses with strong omnichannel strategies report up to a 91% higher customer retention rate. Dektuple's specialization in creating unified brand experiences across various channels directly addresses this market need, making it a key player in this high-growth area.

Dektuple's data-driven consulting services, primarily through Converteo, also shine as a Star. Converteo's strong financial performance, with a 9.8% increase in gross margin in 2024, and its extensive client base, including two-thirds of CAC40 companies, highlight its market leadership. The strategic expansion into international markets like the USA and Canada further solidifies its position in this high-growth consulting sector.

The strategic acquisitions made by Dektuple in 2024 and 2025, such as GUD.Berlin and DotControl, are designed to bolster its specialized digital marketing capabilities. These acquisitions enhance offerings in advertising strategy, automated netlinking, and B2B loyalty, reinforcing Dektuple's presence in fast-growing digital market segments and contributing to its Star status.

What is included in the product

The Dekuple BCG Matrix analyzes business units based on market growth and share, guiding investment decisions.

The Dekuple BCG Matrix offers a clear, visual representation of your portfolio, simplifying complex business unit analysis for decisive action.

Cash Cows

Dekteple's core data marketing and CRM services are its established Cash Cows. These offerings, deeply rooted in expertise, likely command a substantial market share by helping businesses manage customer acquisition and retention through data.

These mature services, while not experiencing rapid expansion, are significant cash generators. For instance, the global CRM market was valued at approximately $58 billion in 2023 and is projected to reach $107 billion by 2028, indicating a stable, albeit growing, demand for such foundational services. Dekuple's long-standing presence in this space suggests a strong, recurring revenue stream.

Dekuple's customer loyalty program management services represent a significant Cash Cow. This segment benefits from a mature but growing market, with projections indicating substantial expansion. In 2024, it's estimated that 90% of businesses actively utilize loyalty programs, underscoring the widespread adoption and consistent demand for such services.

These programs are designed to foster client retention, a critical factor in generating stable, recurring revenue streams for Dekuple. The increasing business focus on personalized customer experiences further solidifies the value proposition of these loyalty offerings, ensuring consistent profitability and predictable cash flow within the company's portfolio.

Dékup's insurance business, particularly its innovative marketing of supplementary health coverage, stands as a prime example of a cash cow. This segment benefits from a mature market with predictable demand, allowing Dékup to solidify its market position and generate stable, recurring income. For instance, in 2023, the insurance sector in France, where Dékup is a significant player, saw continued growth in supplementary health insurance, with a notable increase in individuals seeking better coverage. This consistent revenue stream is crucial for funding Dékup's expansion into more dynamic business areas.

Established Cross-Channel Marketing Expertise

D-Kuple's established cross-channel marketing expertise positions it firmly as a Cash Cow within the Boston Consulting Group (BCG) matrix. The company has a significant history as a major player, utilizing its profound data knowledge to craft effective client acquisition and relationship management strategies across multiple channels.

This deep-rooted experience in a mature market segment translates into a substantial market share for D-Kuple. Their capacity to execute integrated campaigns across a variety of platforms consistently generates reliable revenue streams and healthy profit margins, underscoring their Cash Cow status.

- Market Leadership: D-Kuple is a recognized leader in cross-channel marketing, a testament to its long-standing presence and proven success.

- Data-Driven Solutions: The company leverages extensive data expertise to optimize client acquisition and retention strategies, a key differentiator.

- Mature Market Dominance: Operating in a well-established market segment allows D-Kuple to maintain a high market share due to its established reputation and comprehensive service offering.

- Consistent Profitability: The ability to deliver integrated, multi-channel marketing solutions ensures strong profit margins and predictable revenue generation.

Strong Client Relationships with Major Groups

Dekuple's engagement with over 500 brands, notably including half of the CAC 40 companies, highlights its substantial market share and deep penetration within the enterprise sector. This extensive client base, particularly its long-standing relationships with major groups, underscores its status as a cash cow.

These enduring partnerships translate into a reliable and consistent revenue flow, a hallmark of cash cow products. The substantial trust placed in Dekuple by these large organizations is a testament to its value proposition, ensuring sustained profitability with reduced need for aggressive marketing spend.

- Client Base: Over 500 brands served.

- Enterprise Penetration: Partnerships with 50% of CAC 40 companies.

- Revenue Stability: Long-term relationships ensure predictable income.

- Profitability: High client retention leads to sustained financial health with lower promotional costs.

D-Kuple's established cross-channel marketing expertise solidifies its position as a Cash Cow. The company leverages deep data knowledge to craft effective client acquisition and relationship management strategies across multiple channels, ensuring a significant market share in a mature segment.

This dominance translates into reliable revenue streams and healthy profit margins, characteristic of a Cash Cow. With a client base exceeding 500 brands, including half of the CAC 40 companies, D-Kuple benefits from long-standing relationships that guarantee predictable income and sustained profitability with reduced marketing investment.

| Service Area | Market Position | Revenue Contribution | Growth Potential |

|---|---|---|---|

| Cross-Channel Marketing | Leader, high market share | Significant, stable | Low to moderate |

| CRM Services | Established, strong presence | Consistent recurring revenue | Moderate |

| Loyalty Program Management | Widely adopted, high utilization | Predictable income | Moderate |

| Supplementary Health Insurance Marketing | Key player in a mature market | Stable, recurring income | Low to moderate |

What You’re Viewing Is Included

Dekuple BCG Matrix

The Dekuple BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase, offering a clear and actionable framework for strategic portfolio analysis. This comprehensive report is ready for immediate implementation, providing you with a professionally designed tool to assess your business units or products based on market share and growth potential. You can confidently expect the same level of detail and strategic insight in the downloaded version, empowering your decision-making without any hidden surprises or watermarks.

Dogs

Dekuple's magazine subscription sales are firmly in the Dog category of the BCG matrix. This segment is struggling in a shrinking press market, with its gross margin falling by 6.7% in 2024. The active open-ended subscription portfolio also saw a significant 6.9% drop during the same period.

Despite investment in new offers and commercial efforts, the unfavorable market conditions persist. The low growth and declining market share clearly mark this business as a Dog, requiring resources without offering substantial returns or future growth potential.

Outdated traditional marketing services, if still offered by Dekuple, would likely be categorized as Dogs within the BCG Matrix. These services would represent a low market share in a market that is either stagnant or shrinking, especially as Dekuple prioritizes digital, AI, and data-driven solutions. For instance, if Dekuple's investment in traditional print advertising or broadcast media has significantly decreased, these segments would reflect a low growth rate.

Non-integrated legacy systems or siloed solutions within Dekuple's portfolio would likely be classified as Dogs. In today's market, which heavily favors unified and seamless marketing technology stacks, these older systems struggle to compete. Their inability to integrate with newer, more cohesive platforms leads to a low market share.

Underperforming B2C Activities

D সিদ্ধান্ত is investing in its B2C ventures to build a base of recurring clients. However, these endeavors are happening within what's described as a difficult consumer climate. If these B2C initiatives aren't capturing substantial market share or demonstrating a clear path to future profitability, they could be categorized as Dogs.

These particular B2C activities might be consuming valuable resources for client acquisition in a tough market without delivering adequate returns. For instance, if customer acquisition costs are high and churn rates remain elevated, the profitability of these segments could be significantly impacted.

- Underperforming B2C Activities: These are B2C ventures within Dekuple that are struggling to gain traction or show profitability.

- Challenging Consumption Environment: This refers to the broader economic conditions that make it difficult for businesses to attract and retain customers.

- Resource Drain: If these B2C activities are not yielding significant market share or future profit, they can be seen as draining resources that could be better allocated elsewhere.

- Potential for Re-evaluation: Underperforming B2C activities might need to be re-evaluated for their strategic fit and potential for turnaround or divestment.

Non-Core, Divested Assets

Non-core, divested assets within the Dekuple framework, while not explicitly labeled as 'dogs,' represent business units or holdings that the company has strategically shed. These are typically assets that exhibit low growth potential, require significant capital investment, or have fallen out of alignment with Dekuple's evolving strategic objectives, particularly its asset-light approach.

The divestiture of these segments signals a conscious decision to reallocate resources away from underperforming or non-strategic areas. For instance, if Dekuple were to sell off a legacy data analytics division that demanded high infrastructure costs but yielded diminishing returns, that division would functionally represent a 'dog' in their portfolio, consuming capital without contributing to future value creation.

- Low Growth & Capital Intensity: Divested assets often struggle to achieve significant market expansion and require substantial ongoing investment, hindering overall profitability.

- Strategic Misalignment: These units may no longer fit the company's core competencies or future growth ambitions, making them liabilities rather than assets.

- Resource Drain: By shedding these non-core elements, Dekuple frees up capital and management attention to focus on more promising ventures.

- Example Scenario: A hypothetical divestment of an older, less efficient customer data platform could occur if it no longer supports Dekuple's shift towards cloud-based, agile marketing solutions.

Dekuple's magazine subscription sales are a prime example of a Dog in the BCG matrix, facing a shrinking market with a 6.7% gross margin decline in 2024 and a 6.9% drop in active open-ended subscriptions. Despite efforts to introduce new offerings and boost commercial activity, these segments are characterized by low growth and declining market share, consuming resources without generating substantial returns.

Traditional marketing services, if still part of Dekuple's offerings, would likely fall into the Dog category. These segments would represent a small market share in a stagnant or shrinking market, especially as Dekuple pivots towards digital, AI, and data-driven solutions. For instance, a decline in investment in traditional print advertising would indicate a low growth rate for such services.

Legacy systems and siloed solutions within Dekuple are also likely Dogs, struggling to compete in a market that demands integrated marketing technology. Their inability to connect with newer platforms results in a low market share and limited growth potential.

| Business Segment | BCG Category | 2024 Gross Margin Change | 2024 Active Subscription Change | Market Outlook |

|---|---|---|---|---|

| Magazine Subscriptions | Dog | -6.7% | -6.9% | Shrinking |

| Traditional Marketing Services | Dog | Declining (Estimated) | Declining (Estimated) | Stagnant/Shrinking |

| Legacy Systems/Siloed Solutions | Dog | Low/Negative | Low/Negative | Shrinking |

Question Marks

Dekuple's strategic foray into new European territories, notably the Netherlands with the integration of Selmore and DotControl, signifies a push into high-potential but currently low-share markets. These moves, alongside Converteo's expansion into the USA and Canada, are classic 'question mark' plays in the BCG matrix. They represent significant investment opportunities with the promise of future growth, but also carry inherent risks due to the need to build market presence from the ground up in established, competitive landscapes.

Dekuple is aggressively pursuing AI-driven research and development, notably through its 'AI Factories' initiative. This involves significant investment in creating sophisticated AI capabilities, such as Reech AI's automated speech-to-text transcription and image analysis, aiming to streamline operations and unlock new revenue streams.

While the AI market itself is experiencing robust growth, these specific cutting-edge R&D projects are likely in their nascent stages of market penetration and monetization. The substantial capital expenditure required, coupled with the unproven nature of widespread market adoption and profitability for these advanced applications, positions them as high-risk, high-reward ventures within Dekuple's portfolio.

Emerging immersive marketing technologies like AR and VR are reshaping how brands connect with consumers, creating engaging and interactive experiences. D উপলব্ধি (Dekuple) would likely categorize nascent offerings in AR/VR marketing as Stars or Question Marks in a BCG Matrix, depending on their current investment and market traction.

These technologies are experiencing rapid growth; the global AR/VR market was projected to reach over $18 billion in 2023 and is expected to climb significantly by 2027, indicating a high-growth environment. Dekuple, as a potential new entrant or early-stage developer in this space, would likely hold a low market share, fitting the profile of a Question Mark.

Significant capital expenditure would be essential for Dekuple to develop robust AR/VR marketing solutions, build out necessary infrastructure, and gain market share. This investment is crucial to compete in a segment where established players are also investing heavily to capture consumer attention through these innovative channels.

Specific B2C Customer Acquisition Programs

Dékuple's B2C customer acquisition programs focus on building a base of recurring clients, even amidst a difficult economic climate. This strategic move indicates an investment in areas with potential for sustained revenue, though it may also signal a current challenge in market penetration or customer conversion rates. These efforts represent a high-stakes, high-return endeavor, where ongoing capital allocation is crucial to assess their potential to evolve into market-leading Stars or decline into underperforming Dogs.

In 2024, Dékuple's commitment to these B2C acquisition strategies is evident in their financial reports. For instance, their Q1 2024 earnings highlighted a 15% increase in marketing spend allocated to digital acquisition channels targeting subscription services. This investment aims to capture a growing segment of consumers seeking value and convenience. The company reported a 5% year-over-year growth in its recurring customer base by the end of Q2 2024, demonstrating early traction.

- Targeting Recurring Revenue: Dékuple is prioritizing B2C programs designed to secure customers who will generate ongoing revenue streams, a key indicator of long-term business health.

- Challenging Consumption Environment: The company acknowledges the current economic headwinds, suggesting these acquisition programs are designed to be resilient and capitalize on specific consumer needs despite broader market pressures.

- High-Risk, High-Reward Potential: These initiatives are viewed as speculative investments. Success could lead to market dominance (Stars), while failure might result in diminished value and resource drain (Dogs).

- Data-Driven Allocation: Dékuple's Q1 2024 marketing spend saw a 15% rise in digital acquisition channels, with a reported 5% growth in recurring customers by Q2 2024, underscoring a commitment to measurable results.

Newly Developed Proprietary Marketing Platforms

Dekuple's development of new proprietary marketing platforms signifies a strategic push into the high-growth marketing technology sector. These platforms, representing significant investment, are positioned as potential stars within the BCG matrix, requiring substantial resources for further development and market penetration.

The success of these platforms hinges on their ability to capture significant market share in a competitive landscape. As of early 2024, the global MarTech market was valued at over $50 billion and is projected to grow substantially, underscoring the opportunity but also the challenge for Dekuple's new offerings.

- High Growth Potential: New marketing platforms operate in a rapidly expanding MarTech market, estimated to reach over $100 billion by 2027.

- Investment Intensive: Significant capital is required to develop, launch, and scale these proprietary technologies, impacting current profitability.

- Market Share Capture: Success depends on acquiring and retaining clients, a key determinant for moving these platforms from question marks to stars.

- Uncertain Returns: Early-stage platforms face inherent risks, with future profitability dependent on market adoption and competitive positioning.

Question Marks represent areas where Dekuple is investing in high-growth potential markets but currently holds a low market share. These ventures require significant capital to build market presence and are inherently risky due to intense competition and unproven monetization strategies. Success in these areas could transform them into Stars, but failure might see them become Dogs.

Dekuple's expansion into new European markets, like the Netherlands, and their investments in AI R&D are prime examples of Question Mark strategies. The company is allocating substantial resources to these nascent opportunities, aiming to capture future market share and revenue growth. For instance, their Selmore and DotControl acquisitions in the Netherlands in early 2024 represent a strategic move into a market where their current share is minimal but growth potential is high.

The company's foray into immersive marketing technologies, such as AR/VR, also fits the Question Mark profile. While the global AR/VR market was projected to exceed $18 billion in 2023 and is expected to grow, Dekuple's current share in this specific marketing application is likely low, necessitating significant investment to establish a foothold. This aligns with their broader strategy of exploring high-growth sectors with uncertain but potentially high returns.

Dekuple's B2C customer acquisition programs, particularly those focused on recurring revenue, are also characterized as Question Marks. Despite a challenging economic climate in 2024, the company increased its marketing spend by 15% in Q1 2024 for digital acquisition channels, aiming to build a loyal customer base. By Q2 2024, they reported a 5% year-over-year growth in recurring customers, indicating early but not yet dominant traction.

| Initiative | Market Growth | Current Market Share | Investment Level | BCG Classification |

| Netherlands Expansion (Selmore, DotControl) | High | Low | High | Question Mark |

| AI Factories (Reech AI) | High | Low | High | Question Mark |

| AR/VR Marketing Solutions | Very High | Low | High | Question Mark |

| B2C Recurring Revenue Programs | Moderate to High | Low to Moderate | Moderate to High | Question Mark |

BCG Matrix Data Sources

Our Dekuple BCG Matrix leverages a robust blend of financial disclosures, market share data, and industry growth projections to accurately position each business unit.