Dekuple Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Dekuple Bundle

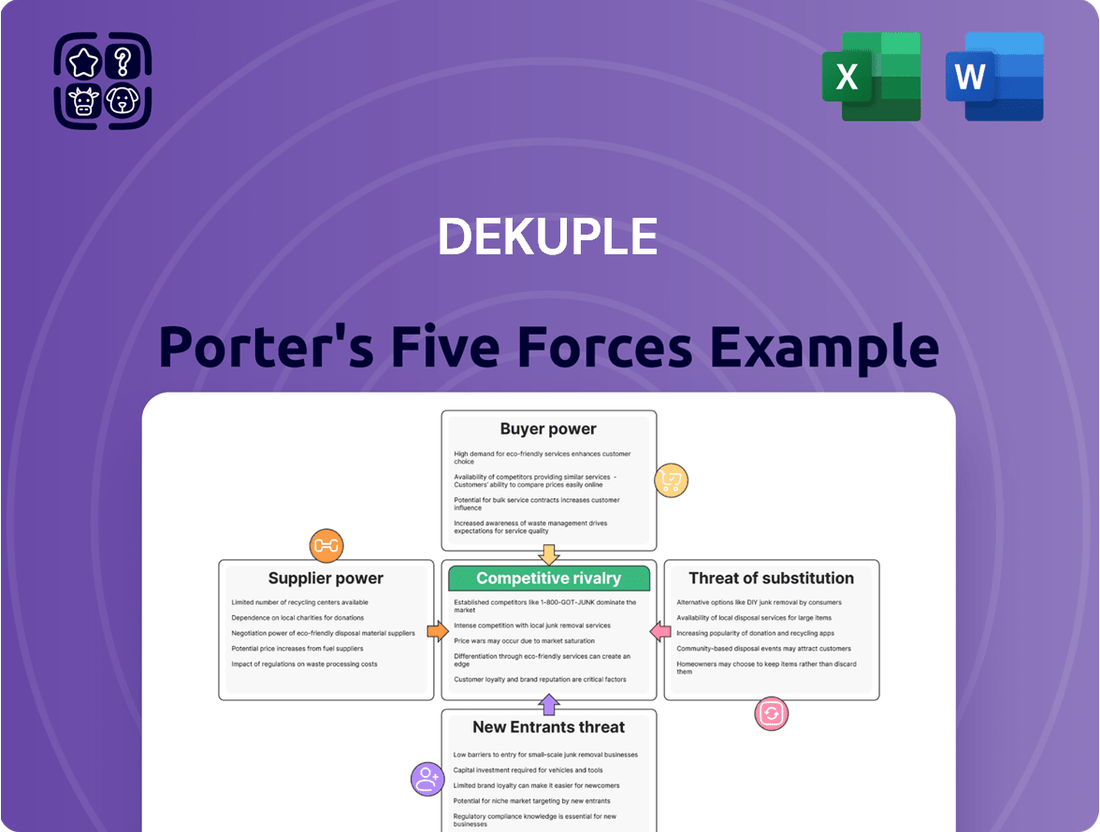

Understanding Dekuple's competitive landscape is crucial for any strategic decision. Our Porter's Five Forces analysis breaks down the market's inherent pressures, revealing the true dynamics at play.

This brief overview highlights the core forces influencing Dekuple, but the full analysis provides a comprehensive, data-driven framework. Unlock actionable insights into buyer power, supplier leverage, and the threat of substitutes to gain a competitive edge.

Ready to move beyond the basics? Get a full strategic breakdown of Dekuple’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Supplier concentration significantly impacts Dekuple's bargaining power. If Dekuple relies on a limited number of providers for essential services like data analytics platforms or specialized marketing software, these suppliers hold considerable sway. For instance, if only two major data providers offer the unique datasets Dekuple requires, those providers can dictate terms and pricing, potentially increasing Dekuple's operational costs.

The uniqueness of Dekuple's supplier offerings significantly influences supplier bargaining power. If Dekuple relies on suppliers providing highly specialized or proprietary technology, like unique data analytics platforms or exclusive content licensing, these suppliers gain considerable leverage. For instance, if a key software provider for Dekuple's marketing automation tools has no close substitutes, their ability to dictate terms, including pricing and service level agreements, increases substantially.

Switching costs for Dekuple, a digital marketing and customer engagement company, can be a significant factor in its supplier relationships. If Dekuple were to switch from one technology platform or service provider to another, it might face substantial expenses. These could include the cost of integrating new software systems, migrating data, and potentially retraining its employees on new processes or tools.

For instance, if Dekuple relies heavily on a proprietary customer data platform from a specific supplier, moving to a new platform could involve complex data mapping and validation, which is time-consuming and costly. High switching costs empower existing suppliers, as Dekuple might be hesitant to incur these expenses, giving the current supplier more leverage in negotiations.

Threat of Forward Integration by Suppliers

The threat of Dekuple's suppliers integrating forward into the marketing technology or CRM market is a significant consideration. If suppliers, particularly those providing essential data or technology platforms, possess the capabilities and capital, they could potentially launch their own competing services. This would directly challenge Dekuple's core business, forcing them to negotiate more favorable terms to retain their supplier relationships and avoid direct competition.

For instance, a data analytics provider to Dekuple might have the expertise to offer its own customer insights platform. Similarly, a software development firm that builds components of Dekuple's technology stack could decide to market a full-fledged CRM solution. Such moves are more likely if suppliers see substantial untapped profit potential in Dekuple's market and possess the necessary resources and market knowledge. Dekuple's reliance on specialized technology or data could increase this threat if few alternative suppliers exist.

- Supplier Capability Assessment: Evaluating if key suppliers have the technological infrastructure, financial backing, and market understanding to launch competing marketing technology or CRM solutions.

- Market Attractiveness for Suppliers: Analyzing the profitability and growth potential of Dekuple's operating markets to gauge supplier interest in direct entry.

- Potential Competitive Impact: Understanding how a supplier's forward integration could affect Dekuple's market share, pricing power, and customer retention.

- Mitigation Strategies: Developing strategies such as diversifying the supplier base or securing long-term contracts to reduce dependence and the risk of supplier competition.

Importance of Dekuple to Suppliers

The significance of Dekuple's business to its suppliers is a key factor in assessing supplier bargaining power. If Dekuple represents a substantial portion of a supplier's overall revenue, that supplier might be more amenable to negotiating favorable terms and pricing. For instance, if a critical component supplier derives over 20% of its annual sales from Dekuple, they would likely prioritize maintaining that relationship.

Conversely, if Dekuple is a minor client for a supplier, the supplier holds considerably more leverage. In such scenarios, a supplier might be less inclined to offer discounts or special concessions, as losing Dekuple's business would have a minimal impact on their financial performance. This dynamic plays out across various supplier relationships, from technology providers to marketing agencies.

Analyzing Dekuple's supplier base in 2024 reveals that while some niche providers might be heavily reliant, the broader supplier ecosystem likely offers Dekuple some degree of purchasing power. For example, if Dekuple sources a significant portion of its digital advertising from a few large platforms, those platforms might have greater leverage. However, if Dekuple can diversify its sourcing, its individual bargaining power increases.

- Supplier Dependence: Assess the percentage of a supplier's revenue generated by Dekuple. A higher percentage typically means greater supplier willingness to negotiate.

- Dekuple's Client Size: Evaluate Dekuple's standing as a client for its suppliers. Being a large client enhances Dekuple's negotiating position.

- Market Concentration: Consider the concentration within Dekuple's supplier markets. Less concentrated markets generally offer Dekuple more options and thus more power.

- Contractual Terms: Review existing contracts for clauses that might influence bargaining power, such as volume commitments or exclusivity agreements.

The bargaining power of suppliers for Dekuple is influenced by several factors, including supplier concentration, the uniqueness of their offerings, and Dekuple's switching costs. If Dekuple relies on a few key providers for essential services, those suppliers gain significant leverage, especially if their offerings are highly specialized and difficult to substitute. For instance, in 2024, the digital marketing landscape saw continued consolidation among data analytics providers, potentially increasing the bargaining power of dominant players if Dekuple's reliance on them is high.

High switching costs can also empower suppliers, making Dekuple hesitant to change providers due to the expense and complexity of integration. This was evident in the growing sophistication of marketing automation platforms, where deep integration with existing CRM systems often meant substantial costs for migration. Furthermore, the threat of suppliers integrating forward into Dekuple's market, offering similar services directly, could also shift the power balance, forcing Dekuple into more favorable negotiations.

Dekuple's significance as a client to its suppliers is a crucial determinant of supplier power. If Dekuple represents a substantial portion of a supplier's revenue, the supplier is more likely to offer favorable terms. Conversely, if Dekuple is a minor client, the supplier has more leverage. In 2024, while Dekuple likely held some negotiation power due to its size in certain segments, its reliance on specialized technology from a concentrated supplier base could still present challenges.

| Factor | Impact on Dekuple | 2024 Context/Example |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Consolidation in data analytics providers could give dominant players more leverage. |

| Uniqueness of Offerings | Proprietary or specialized offerings enhance supplier power. | Unique marketing automation features or exclusive data sets can increase supplier negotiation strength. |

| Switching Costs | High costs empower existing suppliers. | Complex integration of new software or data migration can deter Dekuple from switching. |

| Supplier Forward Integration Threat | Potential competition from suppliers can shift power. | Data providers entering the customer insights market could pressure Dekuple. |

| Dekuple's Significance to Supplier | Dekuple being a major client reduces supplier power. | If Dekuple accounts for a significant percentage of a supplier's revenue, negotiation terms are likely more favorable. |

What is included in the product

This analysis dissects the competitive landscape for Dekuple, examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Instantly identify and quantify competitive pressures with a visual, interactive dashboard, making strategic adjustments straightforward.

Customers Bargaining Power

Dekuple serves a broad client base, working with over 500 brands, which generally dilutes individual customer concentration. However, the presence of major groups within this portfolio means that a few significant clients could still wield considerable influence. If these key accounts represent a disproportionate share of revenue, they gain leverage to negotiate better terms, potentially impacting Dekuple's pricing and service offerings.

Customer switching costs for Dekuple are a key factor in understanding their bargaining power. If clients can easily move to another marketing technology or CRM provider with minimal effort or expense, their power increases significantly. For instance, if Dekuple's services are easily integrated with existing systems and data migration is straightforward, clients are less tethered.

In 2024, the digital marketing landscape continues to offer a plethora of readily available alternative solutions. Many competitors offer comparable services with flexible contract terms, further reducing the perceived risk and cost of switching for Dekuple's clients. This ease of access to alternatives directly amplifies customer bargaining power.

Dékup's customers exhibit varying degrees of price sensitivity. In the digital advertising and marketing sector, where Dekuple operates, price is a significant factor, particularly for smaller businesses or those with tighter marketing budgets. Many clients can readily compare service costs and features across multiple providers.

The competitive landscape for digital marketing services in 2024 is robust, with numerous agencies and platforms vying for market share. This intense competition inherently heightens customer price sensitivity, as alternatives are readily available and often competitively priced. For instance, a business looking for social media management might find dozens of options at different price points.

When customers are highly price-sensitive, their bargaining power increases substantially. They can more easily switch to a competitor if Dekuple's pricing is perceived as too high, or they may demand discounts or better terms. This dynamic forces Dekuple to carefully consider its pricing strategies to remain competitive while ensuring profitability.

Availability of Substitute Solutions for Customers

The availability of substitute solutions significantly impacts Dekuple's customer bargaining power. Customers can opt for in-house marketing departments, which offers greater control and potentially lower direct costs, especially for larger enterprises with established marketing teams.

Furthermore, numerous alternative marketing technology groups and agencies exist, each offering specialized services or different pricing models. This competitive landscape means customers can readily switch providers if Dekuple's offerings don't meet their evolving needs or budget constraints. In 2024, the MarTech landscape continued to fragment, with an estimated over 11,000 MarTech vendors globally, providing ample choices for businesses seeking to manage their marketing efforts.

The bargaining power of Dekuple's customers is amplified by the sheer volume of alternatives available.

- In-house Marketing Departments: Businesses can build and manage their own marketing teams, reducing reliance on external agencies.

- Alternative MarTech Providers: A vast array of marketing technology companies offer specialized tools and platforms.

- Other Digital Agencies: Numerous marketing and advertising agencies compete for clients, offering diverse service packages and pricing.

Threat of Backward Integration by Customers

The threat of backward integration by Dekuple's customers is a significant factor in their bargaining power. If Dekuple's clients, particularly larger ones, possess the resources and expertise, they might consider developing their own in-house marketing technology and Customer Relationship Management (CRM) systems. This would directly reduce their dependence on Dekuple's services.

For instance, a major e-commerce platform or a large enterprise with substantial data analytics teams could potentially build proprietary tools to manage customer interactions and marketing campaigns. This capability significantly enhances their leverage in negotiations with Dekuple, as they have a viable alternative to outsourcing.

- Customer Integration Potential: Assess if Dekuple's client base, especially those with large marketing budgets and internal tech teams, could realistically replicate Dekuple's core offerings.

- Negotiating Leverage: Highlight how the credible threat of in-house development empowers customers to demand better pricing, terms, or service levels from Dekuple.

- Industry Trends: Consider if there's a broader industry trend of companies bringing marketing technology functions in-house, which would amplify this threat for Dekuple.

Dekuple's customers possess considerable bargaining power due to the abundance of readily available alternative solutions in the digital marketing sector. In 2024, the MarTech landscape featured over 11,000 vendors globally, offering a wide array of specialized tools and services. This intense competition, with numerous agencies and platforms vying for market share, directly amplifies customer price sensitivity and their ability to switch providers, impacting Dekuple's pricing strategies and service negotiations.

Full Version Awaits

Dekuple Porter's Five Forces Analysis

This preview shows the exact Dekuple Porter's Five Forces Analysis you'll receive immediately after purchase—no surprises, no placeholders. You'll gain a comprehensive understanding of the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Dekuple's industry. This professionally formatted document is ready for your immediate use and strategic decision-making.

Rivalry Among Competitors

The data-driven marketing and CRM landscape is highly competitive, featuring a substantial number of players. The sheer volume of solutions available, with over 14,000 MarTech products identified in 2024, indicates a crowded market. This proliferation means businesses often have many choices, intensifying the need for differentiation.

Within this vast MarTech ecosystem, Dekuple faces rivalry from both large, established enterprise software providers offering integrated CRM and marketing automation suites, and a multitude of smaller, specialized niche players. The relative sizes of these competitors vary significantly, from global giants with extensive resources to agile startups focusing on specific functionalities.

The marketing technology and CRM market is experiencing robust expansion. This high growth environment generally tempers competitive rivalry because there's enough room for all participants to thrive and capture new market share. For instance, the global CRM market is anticipated to reach an impressive $262.74 billion by 2032, demonstrating a compound annual growth rate of 12.6%.

Dekuple's competitive rivalry is influenced by its product and service differentiation. The company distinguishes itself through a strong emphasis on Artificial Intelligence and technological innovation, aiming to reduce direct price competition. This focus on advanced capabilities can create a unique value proposition for its clients.

By highlighting its leadership in AI and its technological expertise, Dekuple seeks to carve out a distinct market position. This strategy aims to make its offerings less substitutable, thereby mitigating the intensity of rivalry from competitors who may offer more commoditized services. For instance, in 2024, Dekuple continued to invest heavily in R&D for AI-driven solutions, a key differentiator in the digital services landscape.

Switching Costs for Customers

Switching costs for Dekuple's customers are a key factor in competitive rivalry. If it's easy and inexpensive for a customer to switch from Dekuple to another digital marketing or advertising service provider, then the rivalry among these companies will be much higher. This ease of switching means customers can readily jump to a competitor offering better pricing, more features, or a more appealing service package.

The digital advertising landscape, particularly in areas like performance marketing and media buying, often features relatively low switching costs for many clients. For instance, a business looking to change its search engine marketing agency might only need to transfer campaign data and access credentials, a process that can often be completed within a few days. This low barrier to entry for switching directly fuels intense competition as providers must constantly innovate and offer competitive pricing to retain their client base.

In 2024, the digital marketing sector continues to see a dynamic environment. Companies like Dekuple operate in a space where clients can pivot between platforms and service providers with relative ease. For example, a client dissatisfied with Dekuple's campaign performance might quickly shift budget towards a competitor like Publicis Groupe or WPP, especially if the competitor offers a more compelling introductory rate or a demonstrably superior return on ad spend. This constant pressure necessitates continuous service improvement and value demonstration.

- Low Switching Costs: Customers can easily move between digital marketing agencies or platforms without significant financial penalties or time investment.

- Intensified Rivalry: This ease of switching forces companies like Dekuple to compete aggressively on price, service quality, and innovation to retain clients.

- Client Retention Challenge: Providers must continually demonstrate value and superior performance to prevent clients from migrating to competitors offering better deals or perceived advantages.

- Market Dynamics: The digital advertising market, in particular, is characterized by rapid technological changes and evolving client needs, further lowering switching costs and increasing competitive pressure.

Exit Barriers

Companies in the marketing technology sector often face significant exit barriers. These can include highly specialized assets, like proprietary data platforms or unique software infrastructure, which have limited alternative uses outside the martech industry. High fixed costs associated with ongoing research and development, customer support, and maintaining cloud-based services also make it difficult to cease operations without substantial losses.

These substantial exit barriers mean that even when market conditions become challenging, companies may continue to operate, leading to intensified competition. For instance, a martech firm with millions invested in a specialized AI engine for campaign optimization might struggle to recoup its investment if it were to exit, thus it would likely continue to compete, potentially driving down prices or forcing others to innovate more aggressively.

- Specialized Assets: Martech firms often possess unique, non-transferable technology or data assets.

- High Fixed Costs: Significant ongoing investments in R&D, infrastructure, and talent create a financial disincentive to exit.

- Interdependence: Loyalty programs or integrated service offerings can make it hard to divest specific business units.

- Emotional Factors: Founders or management may have strong emotional ties to their creations, delaying exit decisions.

Dekuple operates in a crowded MarTech landscape, with over 14,000 products identified in 2024, leading to intense rivalry. This competition spans large enterprise providers and specialized niche players, forcing companies to differentiate through innovation, such as Dekuple's AI focus, to avoid commoditization and price wars.

The ease with which clients can switch between digital marketing service providers, often with minimal cost or effort, further fuels this rivalry. This low switching cost environment necessitates continuous value demonstration and competitive pricing to retain customers, as seen in the digital advertising sector where clients might quickly shift budgets to competitors offering better introductory rates or perceived superior returns.

Despite challenging market conditions, significant exit barriers, including specialized assets and high fixed costs in R&D and infrastructure, compel MarTech firms to remain operational, thus perpetuating intense competition. This situation can lead to price pressures and a constant drive for innovation among existing players.

| Key Competitor Type | Example Competitors | Competitive Intensity Factor |

| Large Enterprise Software Providers | Salesforce, Adobe, Oracle | Broad feature sets, established client bases, significant R&D budgets |

| Specialized Niche Players | HubSpot (CRM/Marketing Automation), Mailchimp (Email Marketing) | Focused functionality, agility, potentially lower price points |

| Digital Advertising Agencies | Publicis Groupe, WPP, Omnicom | Performance-driven, client retention reliant on ROI and service |

SSubstitutes Threaten

Substitute solutions present a significant threat if they offer a compelling price-performance trade-off. For Dekuple, this means evaluating how effectively traditional advertising agencies, in-house marketing departments, or even broad IT consulting firms can fulfill client needs at a lower cost. For instance, a company might find that a well-established advertising agency can deliver a comprehensive campaign for a fixed fee, potentially undercutting Dekuple's integrated digital solutions if the perceived value is similar.

The accessibility and cost-effectiveness of these substitutes are critical. If general IT consultants can bundle basic marketing technology services with their existing offerings at a reduced margin, it poses a direct challenge. In 2024, the market for digital transformation services, which often includes marketing technology, saw significant growth, with many firms expanding their capabilities. This broadens the competitive landscape for Dekuple, as clients may opt for a single, less specialized provider if the cost savings are substantial and the core needs are met.

Dekuple faces a moderate threat from substitutes, as customers can opt for more generalized IT solutions or build in-house capabilities instead of specialized MarTech services. This is particularly true for businesses with simpler marketing needs or those prioritizing cost control over specialized expertise.

The ease of adoption for substitutes plays a key role; many general IT providers offer broad solutions, and the perceived risk of switching from a specialized MarTech provider to an in-house team or a more generalized platform is often manageable for businesses. Brand loyalty to Dekuple, while present, might not be strong enough to completely deter a customer from exploring cost-effective alternatives, especially if the substitute offers comparable core functionalities.

For instance, a small to medium-sized business might find an all-in-one CRM with integrated marketing automation features a viable substitute for a dedicated MarTech stack. In 2024, the market for integrated business software continues to grow, with companies like Salesforce and HubSpot offering comprehensive solutions that can encompass many MarTech functions, potentially reducing the need for highly specialized, standalone services.

The threat of substitutes for Dekuple's data-driven marketing and CRM services is significant. Customers seeking to manage customer relationships and marketing campaigns can turn to a wide array of alternatives. These range from in-house manual data analysis and traditional direct mail campaigns to more accessible, albeit less specialized, generic software solutions. For instance, many businesses still rely on spreadsheets for customer data, a direct substitute for sophisticated CRM systems.

Furthermore, the rise of affordable, user-friendly marketing automation platforms not specifically tailored for complex data integration presents another competitive substitute. While these might lack Dekuple's depth in data analytics, their lower cost and ease of adoption can attract smaller businesses or those with simpler needs. In 2024, the market for marketing automation software saw continued growth, with many new entrants offering tiered pricing models that make basic CRM functionalities accessible to a broader audience.

Technological Advancements in Substitutes

The threat of substitutes for Dekuple's services is amplified by rapid technological advancements. Emerging technologies offer alternative avenues for customer acquisition, engagement, and retention, potentially bypassing traditional marketing and customer relationship management channels. For instance, advancements in AI and automation, even outside the dedicated MarTech sector, can provide businesses with new ways to interact with their clientele.

Consider the swift pace of innovation. In 2024, the global MarTech market was valued at approximately $55.1 billion and is projected to grow significantly, indicating a strong demand for customer engagement solutions. However, this growth also fuels the development of disruptive technologies that could serve as substitutes. For example, decentralized identity solutions or advanced AI-powered customer service bots could reduce reliance on platforms like Dekuple's for certain functions.

- AI-driven Personalization: AI can now create highly personalized customer experiences across various touchpoints, potentially diminishing the need for integrated MarTech suites.

- Automation in Customer Service: Sophisticated chatbots and virtual assistants can handle a significant portion of customer inquiries, reducing the demand for traditional customer support services.

- New Engagement Platforms: Emerging social media platforms or metaverse-based engagement tools could offer alternative ways for brands to connect with consumers, shifting focus away from existing digital marketing channels.

- Data Analytics Tools: Standalone advanced analytics platforms can provide deep customer insights, potentially reducing the perceived value of integrated solutions that include analytics.

Relative Price of Substitutes

The relative price of substitutes is a critical factor in assessing their threat to Dekuple. If alternative solutions, even if less feature-rich, are substantially more affordable, they can attract customers away from Dekuple's offerings.

For instance, if Dekuple's comprehensive digital marketing suite costs €1,000 per month, and a competitor offers a basic social media management tool for €100 per month, the latter becomes a significant substitute, especially for smaller businesses with tighter budgets. This price disparity directly impacts Dekuple's market share.

- Cost Comparison: Dekuple's pricing needs to be benchmarked against a range of substitute services, from direct competitors to simpler, standalone solutions.

- Value Proposition: The perceived value of Dekuple's integrated services versus the lower cost of fragmented substitutes is key.

- Market Segmentation: Different customer segments will react differently to price. Budget-conscious clients are more susceptible to cheaper substitutes.

The threat of substitutes for Dekuple's integrated digital marketing and CRM services is moderate to significant. Clients can opt for less specialized IT consultants, in-house teams, or even simpler software solutions that meet basic needs at a lower cost. For example, in 2024, the growth of all-in-one business software like Salesforce and HubSpot, offering integrated marketing automation, presented a viable alternative to specialized MarTech stacks.

The key lies in the price-performance trade-off. If a substitute offers comparable core functionalities for substantially less, it poses a direct challenge. The accessibility and ease of adoption of these alternatives also play a crucial role, especially for businesses prioritizing cost control over specialized expertise.

Emerging technologies and standalone analytics tools can also act as substitutes, potentially reducing reliance on comprehensive suites. The global MarTech market, valued at around $55.1 billion in 2024, highlights demand, but also the potential for disruptive technologies to offer alternative customer engagement methods.

Dekuple's value proposition must clearly differentiate its integrated, data-driven approach from the more generalized or cost-effective substitutes available in the market.

Entrants Threaten

Entering the data-driven marketing and CRM sector, where Dekuple operates, demands substantial upfront capital. New entrants need significant investment for advanced technology infrastructure, including robust data processing capabilities and sophisticated analytics platforms. For instance, setting up a competitive cloud-based CRM system with AI-driven marketing automation can easily cost millions of dollars in initial development and ongoing maintenance.

The cost of acquiring and integrating vast datasets, essential for effective targeting and personalization, also presents a major financial hurdle. Companies must invest in data licensing, data cleaning, and secure storage solutions. In 2024, the average cost for a mid-sized enterprise to implement a comprehensive CRM and marketing automation suite, including data integration, often ranged from $50,000 to over $250,000 annually, making the initial capital outlay even more daunting for startups.

Dékupel, as a significant player in the digital marketing and data analytics space, likely benefits from substantial economies of scale. This means that as their operations grow, their cost per unit of service decreases. For instance, in 2023, Dékupel's investment in advanced data processing infrastructure allows them to handle vast amounts of client data more efficiently than a smaller, newer competitor could afford. This cost advantage in client acquisition and data management creates a significant barrier to entry.

New entrants to Dekuple's market face significant hurdles in securing access to crucial distribution channels. Established players like Dekuple have cultivated long-standing relationships with retailers, online platforms, and other intermediaries, making it difficult for newcomers to gain shelf space or visibility. For instance, in the digital advertising space where Dekuple operates, securing premium ad placements often requires existing partnerships and a proven track record, which new entrants typically lack.

Proprietary Technology and Expertise

Dekuple's significant investment in proprietary technology, particularly its AI-driven platforms and unique algorithms, creates a substantial barrier to entry. This technological moat makes it challenging for new competitors to quickly develop comparable capabilities. For instance, the company's focus on AI for data analysis and customer engagement, as highlighted in its 2024 strategy, requires considerable R&D expenditure and specialized talent that is not easily acquired.

The company's established expertise in areas like performance marketing and data analytics, honed over years of operation, also acts as a deterrent. New entrants would struggle to match Dekuple's accumulated knowledge and proven track record. In 2024, Dekuple continued to emphasize its data-centric approach, aiming to leverage advanced analytics to deliver superior results for its clients, a capability that requires time and experience to build.

- Proprietary AI Platforms: Dekuple's unique algorithms and AI-driven solutions are difficult for new entrants to replicate, requiring substantial R&D investment.

- Specialized Expertise: Years of experience in performance marketing and data analytics provide Dekuple with a knowledge base that new competitors cannot easily match.

- Technological Leadership: Dekuple's 2024 strategic focus on AI leadership underscores its commitment to developing and maintaining advanced technological capabilities.

Brand Identity and Customer Loyalty

Dekuple's strong brand identity and established customer loyalty present a significant barrier to new entrants. The company collaborates with over 500 brands, indicating a broad reach and a trusted reputation within its market. This extensive network makes it difficult for newcomers to attract clients who are already satisfied with Dekuple's offerings.

The loyalty of Dekuple's existing customer base is a critical factor in deterring new competition. When customers are deeply attached to a brand, they are less likely to switch to a new provider, even if the new entrant offers competitive pricing or features. This loyalty is often built through consistent service quality and perceived value.

New entrants face a considerable challenge in overcoming Dekuple's brand equity and customer retention strategies. To gain traction, they would need to invest heavily in marketing and brand building to even begin competing for market share. This investment, coupled with the need to replicate Dekuple's extensive partner network, makes the threat of new entrants relatively low.

- Brand Recognition: Dekuple's association with over 500 brands enhances its visibility and credibility.

- Customer Loyalty: Existing customer relationships are a strong defense against new market participants.

- Switching Costs: For customers, the effort and potential disruption involved in switching providers can be a deterrent.

- Market Penetration: Newcomers would need substantial resources to penetrate a market where Dekuple has a well-entrenched position.

The threat of new entrants into Dekuple's market is mitigated by significant capital requirements for technology and data acquisition, with CRM implementation costs in 2024 often exceeding $250,000 annually. Dekuple's economies of scale, driven by substantial investments in data processing infrastructure, further create a cost advantage that is difficult for newcomers to surmount. Additionally, established distribution channels and proprietary AI platforms, like those Dekuple focused on in 2024, represent substantial barriers that demand considerable R&D and specialized talent to replicate.

New entrants face considerable challenges in matching Dekuple's brand equity and customer loyalty, evidenced by its partnerships with over 500 brands. The switching costs for customers, coupled with Dekuple's established market penetration, require significant investment in marketing and brand building for any new competitor to gain traction. Consequently, the threat of new entrants is considered relatively low due to these combined deterrents.

Porter's Five Forces Analysis Data Sources

Our Dekuple Porter's Five Forces analysis leverages a comprehensive suite of data sources, including Dekuple's proprietary market intelligence, financial reports from publicly traded companies within the sector, and industry-specific trade publications.