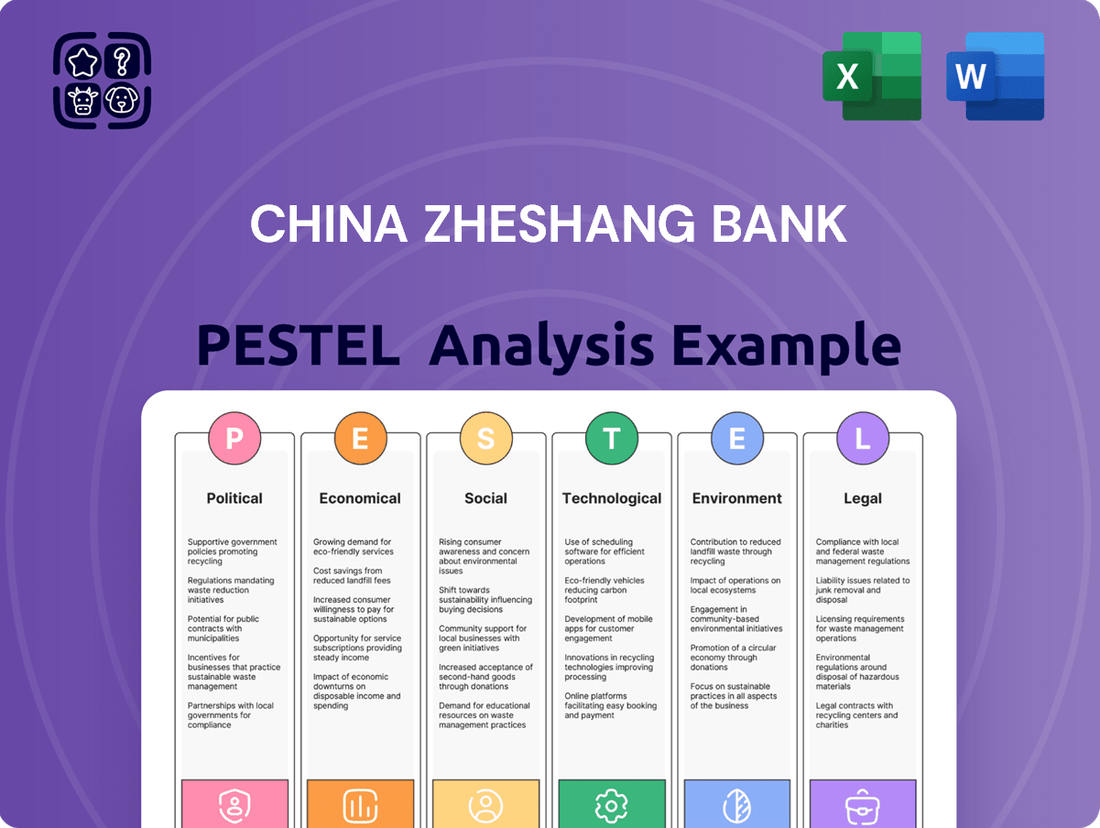

China Zheshang Bank PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Zheshang Bank Bundle

Unlock the strategic landscape surrounding China Zheshang Bank with our comprehensive PESTLE analysis. We delve into the critical political, economic, social, technological, legal, and environmental factors that are shaping its operational environment and future trajectory. Understand the regulatory shifts and economic headwinds that could impact its growth. Download the full version now to gain actionable intelligence and fortify your strategic planning.

Political factors

China's government is actively shaping its financial sector through robust policies, focusing on stability and controlled growth. In 2024 and extending into 2025, a key directive is enhancing the financial regulatory framework, aiming to mitigate systemic risks.

These policies also push for a higher degree of openness in the financial industry, encouraging international participation. A significant area of focus is the management of local government debt, with measures being implemented to contain potential fallout and ensure fiscal health.

Furthermore, the government is committed to stabilizing smaller and medium-sized financial institutions, recognizing their crucial role in the broader economic ecosystem. These initiatives reflect a strategic approach to building a more resilient and globally integrated financial system.

The Chinese government's commitment to bolstering small and medium-sized enterprises (SMEs) directly benefits China Zheshang Bank, which has a strong focus on this sector. For 2024-2025, policies have been enacted to raise the lending cap for inclusive micro and small loans, alongside new refinancing programs offering lower interest rates for agricultural and small businesses.

These initiatives are designed to inject vitality into the economy by making capital more accessible. For instance, the People's Bank of China has continued to utilize targeted reserve requirement ratio cuts and relending facilities to channel funds towards SMEs, particularly those in underserved sectors.

This policy support translates into a more advantageous lending landscape for banks like China Zheshang, mitigating some of the typical risks associated with SME financing. The increased availability of credit and reduced borrowing costs for these businesses improve their financial health and their capacity to repay loans.

The People's Bank of China (PBOC) is increasingly relying on interest rate adjustments as a key tool for economic management, a move expected to continue into 2025 with anticipated rate cuts. This strategic pivot is designed to increase liquidity in the financial system and steer market interest rates lower, thereby fostering high-quality economic growth. For China Zheshang Bank, this means potential shifts in its lending rates and overall profitability as it adapts to the evolving monetary landscape.

In 2024 and looking towards 2025, the PBOC has actively employed various monetary policy instruments. Beyond potential rate adjustments, the central bank has utilized open market operations and medium-term lending facilities. These actions are specifically aimed at ensuring the steady and reasonable expansion of social financing, providing crucial support for economic activity and indirectly impacting the operational environment for banks like China Zheshang Bank.

Geopolitical Tensions and Trade Policies

Escalating geopolitical tensions and evolving trade policies significantly influence China's economic trajectory, directly impacting its banking sector. For China Zheshang Bank, these external shifts necessitate a keen focus on global economic dynamics. For instance, the ongoing trade friction between the US and China, which saw tariffs imposed on billions of dollars worth of goods in previous years, continues to create uncertainty. This environment can dampen credit demand and potentially affect asset quality as businesses reliant on international trade face increased costs and market access challenges.

China Zheshang Bank must actively monitor these geopolitical developments and their ripple effects on its corporate and individual clients. Changes in trade agreements or the imposition of new economic sanctions can alter the risk profiles of businesses operating in sectors heavily exposed to international markets. As of early 2024, the global economic outlook remains subject to these geopolitical pressures, underscoring the need for robust risk management and strategic adaptation within the banking industry.

- Trade Tariffs: Continued imposition or escalation of tariffs can directly reduce the profitability and competitiveness of Chinese companies engaged in export-oriented businesses.

- Supply Chain Disruptions: Geopolitical instability can lead to the reconfiguration of global supply chains, impacting manufacturing output and demand for financing.

- Sanctions and Export Controls: The threat or implementation of economic sanctions against China or its trading partners can restrict access to key technologies and markets, affecting credit risk.

- Foreign Direct Investment (FDI): Geopolitical sentiment influences FDI flows into China, which can impact economic growth and the demand for banking services.

'Common Prosperity' Initiative and Wealth Management

China's 'Common Prosperity' initiative, while not having explicit new directives for 2024-2025, remains a significant undercurrent impacting the financial landscape. This policy aims to broaden wealth distribution and foster more equitable income growth, which directly influences the direction of wealth management services. Expect a continued emphasis on inclusive financial products designed to serve a wider segment of the population, potentially affecting China Zheshang Bank's approach to its retail banking and wealth management arms.

This evolving policy environment suggests a strategic shift towards services that cater to moderate and lower-income groups, alongside traditional high-net-worth offerings. For China Zheshang Bank, this could translate into developing more accessible investment funds, affordable financial planning tools, and digital platforms that reach a broader customer base. The goal is to align with national objectives of reducing income disparity, which could present both challenges and opportunities for market share expansion.

- Policy Influence: 'Common Prosperity' continues to guide wealth redistribution, impacting financial sector regulations and product development.

- Market Focus: Increased demand for inclusive financial products and services is anticipated, benefiting broader customer segments.

- Strategic Adaptation: China Zheshang Bank may need to enhance its retail banking and wealth management strategies to align with these societal goals.

- Potential Growth: Opportunities exist in developing accessible financial solutions that cater to a wider demographic, fostering greater financial inclusion.

China's political landscape continues to prioritize financial stability and controlled economic expansion through 2024-2025, with the government actively refining its regulatory framework to manage systemic risks. This includes a push for greater financial market openness and specific measures to address local government debt, aiming for fiscal resilience.

Government support for small and medium-sized enterprises (SMEs) remains a cornerstone, with policies in 2024-2025 facilitating increased lending and refinancing for these businesses. The People's Bank of China (PBOC) is employing interest rate adjustments and targeted liquidity injections to stimulate credit flow to SMEs, directly benefiting banks like China Zheshang Bank.

Geopolitical tensions and evolving trade policies, such as ongoing US-China trade friction, introduce uncertainty that banking institutions must navigate. These factors can impact credit demand and asset quality for businesses engaged in international trade, necessitating robust risk management.

The 'Common Prosperity' initiative continues to influence the financial sector by encouraging broader wealth distribution, prompting a focus on inclusive financial products. This policy shift may lead China Zheshang Bank to adapt its wealth management and retail banking strategies to cater to a wider demographic.

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting China Zheshang Bank, providing a comprehensive understanding of its operating landscape.

It equips stakeholders with actionable insights and forward-looking strategies to navigate the dynamic Chinese financial sector and identify key growth opportunities.

Provides a concise version of the China Zheshang Bank PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Helps support discussions on external risk and market positioning for China Zheshang Bank during planning sessions by clearly outlining the PESTLE factors.

Economic factors

China's economic growth is projected to remain robust, with an estimated GDP growth of around 5% for both 2024 and 2025. This steady expansion is crucial for the banking sector, which is navigating a dynamic policy landscape and capitalizing on measures designed to stimulate economic activity. For China Zheshang Bank, this stable growth environment directly translates into sustained demand for loans and opportunities for broader business development.

The People's Bank of China (PBOC) is anticipated to implement interest rate cuts and reductions in the reserve requirement ratio (RRR) throughout 2025. These monetary easing measures are designed to alleviate financial pressures on banks and encourage more lending activity across the economy. For instance, a projected 25 basis point cut in the RRR could inject significant liquidity into the banking system.

While these policy shifts are expected to invigorate credit demand, they concurrently pose a challenge to banks like China Zheshang Bank by potentially compressing net interest margins (NIMs). In 2024, the average NIM for Chinese banks hovered around 1.7%, a figure that could see further contraction if rates decline without a commensurate adjustment in funding costs.

Consequently, China Zheshang Bank will need to proactively manage its balance sheet, focusing on optimizing its asset and liability structures. This involves strategic repricing of existing loans and securing stable, lower-cost funding sources to maintain profitability amidst a lower interest rate environment.

China's real estate sector continues to face considerable headwinds, impacting economic growth. Policymakers are actively directing banks, including China Zheshang Bank, to inject capital into unfinished housing developments and reduce mortgage interest rates. This strategy aims to stabilize the market and mitigate broader economic contagion.

China Zheshang Bank must navigate the inherent credit risks associated with this troubled sector. While the bank's overall exposure to real estate as a proportion of its total loan portfolio is anticipated to decrease, careful risk management remains paramount. For instance, by the end of 2023, property development loans accounted for roughly 10% of total loans for major Chinese banks, a figure that is expected to trend downwards.

Inflationary Pressures and Domestic Demand

China's economic landscape in 2025 is marked by a peculiar challenge: persistent deflationary pressures despite generally weak domestic demand. This environment makes it difficult for policymakers to stimulate growth and could lead to a cycle of falling prices and wages. For China Zheshang Bank, this translates to a potentially subdued market for loans and other financial services as both consumers and businesses become more hesitant to spend or invest.

The impact on consumer spending is significant. With prices expected to fall, consumers might delay purchases, hoping for even lower prices later. This behavior, known as deflationary expectation, can further dampen economic activity. Similarly, business investment may falter as companies anticipate lower revenues and profits due to falling prices, creating a challenging operating environment for banks.

Several key indicators highlight this situation:

- Producer Price Index (PPI): China's PPI has shown significant year-on-year declines throughout late 2024 and into early 2025, indicating falling prices at the factory gate, a precursor to consumer price deflation. For instance, the PPI in December 2024 was reported at -3.0% year-on-year, a trend that persisted into the first quarter of 2025.

- Consumer Price Index (CPI): While not as severe as PPI, CPI has also experienced very low inflation or even slight deflation in certain categories, averaging around 0.5% in early 2025, well below historical norms and the government's target.

- Retail Sales Growth: Despite efforts to boost domestic consumption, retail sales growth has remained sluggish, with figures in early 2025 hovering around 4-5% year-on-year, underscoring weak consumer confidence and purchasing power.

Consequently, China Zheshang Bank faces reduced demand for credit as businesses postpone expansion and consumers conserve funds. The bank's profitability could also be squeezed if interest margins narrow due to the low-rate environment often associated with deflationary periods.

Regional Economic Development

China Zheshang Bank's strategic emphasis on regional economic development directly supports national objectives aimed at invigorating specific geographic areas. For instance, the Yangtze River Delta, a key focus for the bank, demonstrated robust economic activity, with its GDP growth rate exceeding the national average in 2024, reaching an estimated 5.5% compared to China's overall 5.2% growth.

This localized approach enables China Zheshang Bank to capitalize on unique growth drivers within different provinces and cities. By aligning with government-led development plans, such as those targeting the digital economy in Zhejiang province, the bank can foster innovation and capture market share in rapidly expanding sectors. This targeted strategy is crucial for navigating the diverse economic landscapes across China.

- Regional Growth Alignment: China Zheshang Bank's strategy mirrors government efforts to boost specific economic zones, such as the Yangtze River Delta, which is projected to contribute significantly to China's overall economic expansion.

- Localized Opportunity Capture: The bank's focus on regions allows it to identify and leverage distinct growth opportunities, potentially leading to higher returns than a purely national approach.

- Contribution to Development Goals: By actively participating in regional development initiatives, the bank not only benefits from economic expansion but also contributes to the achievement of governmental economic and social objectives.

- Yangtze River Delta Performance: This key region's economic resilience is underscored by its GDP growth, estimated at 5.5% in 2024, outperforming the national average of 5.2%.

China's economic trajectory in 2024-2025 is characterized by projected GDP growth around 5%, supported by monetary easing measures like potential RRR cuts. However, this environment presents a challenge to net interest margins, which were around 1.7% for Chinese banks in 2024, necessitating proactive balance sheet management by China Zheshang Bank.

The banking sector is also grappling with deflationary pressures, evidenced by a -3.0% year-on-year PPI decline in December 2024 and low CPI inflation of approximately 0.5% in early 2025. This subdued demand environment requires China Zheshang Bank to adapt to potentially lower credit demand and tighter margins.

China Zheshang Bank's strategic focus on regional development, particularly the Yangtze River Delta which saw 5.5% GDP growth in 2024, aligns with national goals and presents localized opportunities. This targeted approach supports the bank's growth amidst broader economic shifts.

| Economic Indicator | 2024 Projection/Actual | Early 2025 Projection/Actual | Impact on China Zheshang Bank |

|---|---|---|---|

| GDP Growth | ~5% | ~5% | Sustained demand for loans; opportunities for business development. |

| PBOC RRR Cut | Potential cuts | Anticipated cuts (e.g., 25 bps) | Increased liquidity, but potential NIM compression. |

| Average Bank NIM | ~1.7% (2024) | Potential contraction | Pressure to optimize balance sheet and funding costs. |

| PPI Year-on-Year | Negative trends (e.g., -3.0% Dec 2024) | Continued deflationary pressure | Reduced business investment, potentially lower credit demand. |

| CPI Year-on-Year | Low inflation (~0.5%) | Low inflation (~0.5%) | Weak consumer confidence, delayed spending. |

| Yangtze River Delta GDP Growth | ~5.5% (2024) | Strong regional performance | Leveraging localized growth opportunities. |

Full Version Awaits

China Zheshang Bank PESTLE Analysis

The preview you see here is the exact China Zheshang Bank PESTLE Analysis document you’ll receive after purchase. It provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the bank. This detailed analysis is crucial for understanding the external forces shaping China Zheshang Bank's strategic decisions and future performance. The content and structure shown in the preview is the same document you’ll download after payment, ensuring you get a complete and ready-to-use report.

Sociological factors

Chinese consumers are rapidly shifting towards digital financial services, with mobile payment platforms like Alipay and WeChat Pay dominating transactions. In 2023, China's mobile payment market was valued at an estimated $38.7 trillion, showcasing the immense digital adoption. This trend means China Zheshang Bank must prioritize investments in its digital infrastructure and mobile banking capabilities to align with these evolving customer expectations and maintain its edge in the retail banking landscape.

China's ongoing push for rural revitalization, a key government priority, directly impacts financial institutions like China Zheshang Bank. The rollout of the digital yuan (e-CNY) is a significant sociological factor, aiming to bridge the gap in financial access for rural populations who often have limited traditional banking options. This initiative presents a prime opportunity for the bank to expand its services into underserved areas.

By embracing digital solutions and aligning with the government's rural revitalization strategies, China Zheshang Bank can tap into a vast, previously underbanked market. For instance, as of the end of 2023, the e-CNY had been used in over 260 million transactions, demonstrating its growing adoption and potential to transform financial inclusion. This presents a clear pathway for the bank to grow its customer base and deepen its market penetration in these crucial regions.

China's demographic landscape is undergoing a significant transformation, with the median age steadily climbing. This aging trend places a heightened focus on pension systems and wealth accumulation strategies. By 2023, China's elderly population (60 and above) reached approximately 297 million, representing over 20% of the total population.

This demographic shift creates a fertile ground for financial institutions like China Zheshang Bank. The growing number of individuals planning for retirement and seeking to grow their assets presents a clear opportunity. The bank can leverage this by developing and marketing specialized wealth management services and retirement planning solutions designed to meet the unique needs of this expanding demographic.

Trust in Financial Institutions

Public trust in financial institutions is a bedrock for stability, and in China, this is particularly relevant given recent economic headwinds, including challenges within the real estate sector. Maintaining confidence requires demonstrable integrity and effective crisis management. China Zheshang Bank, like its peers, must actively foster this trust.

To build and sustain customer trust, China Zheshang Bank needs to prioritize transparency in its operations and communications. This means clearly outlining lending practices, fee structures, and investment risks. Robust risk management frameworks are also essential, ensuring that the bank can weather economic storms and protect customer assets. A survey by the People's Bank of China in late 2023 indicated that while consumer confidence in the banking sector remained relatively stable, a significant portion of respondents expressed concerns about economic growth prospects and their personal financial situations, underscoring the need for consistent reassurance.

Key actions for China Zheshang Bank to bolster trust include:

- Enhanced Transparency: Clearly communicating financial health and risk exposure to the public.

- Proactive Risk Management: Demonstrating strong internal controls and adherence to regulatory standards.

- Customer Protection Measures: Implementing robust safeguards for deposits and investments.

- Digital Security: Ensuring the integrity and security of online banking platforms against evolving cyber threats.

Demand for ESG-aligned Products

Sociological factors are increasingly shaping financial markets, with a notable surge in demand for Environmental, Social, and Governance (ESG) aligned products in China. Growing public awareness, coupled with strong government directives, is fueling this trend, pushing financial institutions to offer more sustainable options. For instance, China’s commitment to carbon neutrality by 2060 is a significant driver, encouraging banks like China Zheshang Bank to develop and promote green financial products.

China Zheshang Bank can capitalize on this by expanding its portfolio to include green loans, bonds, and sustainable investment solutions. This strategic move not only caters to an expanding segment of environmentally conscious clients and investors but also aligns with national policy objectives. By offering such products, the bank can attract a wider customer base and enhance its corporate image.

In 2023, the issuance of green bonds in China reached a significant milestone, demonstrating the market’s appetite for sustainable finance. China Zheshang Bank’s proactive engagement in this sector can lead to substantial growth opportunities. The bank’s focus on ESG can attract both retail and institutional investors who are increasingly prioritizing sustainability in their investment decisions.

- Growing Demand: Public and governmental push for sustainability is increasing the need for green financial products in China.

- Government Directives: National policies, such as carbon neutrality goals, are creating a favorable environment for ESG finance.

- Bank Opportunity: China Zheshang Bank can attract environmentally conscious clients by offering green loans, bonds, and sustainable investments.

- Market Growth: The expansion of green finance presents a significant growth avenue for financial institutions aligned with ESG principles.

China's rapidly evolving consumer behavior is heavily influenced by digital integration, with mobile payments becoming the norm. The sheer volume of mobile transactions, exceeding $38.7 trillion in 2023, highlights the imperative for China Zheshang Bank to bolster its digital offerings. This societal shift means the bank must adapt to customer preferences for seamless, mobile-first financial experiences to remain competitive.

Technological factors

Fintech innovation is reshaping China's banking landscape, creating a fiercely competitive environment. Banks like China Zheshang Bank are feeling the pressure from rapid advancements in areas like artificial intelligence, big data analytics, and cloud computing. These technologies are not just buzzwords; they are actively being used to improve customer experiences and operational efficiency.

To remain competitive, China Zheshang Bank needs to prioritize its digital transformation. This means consistently upgrading its online services and mobile banking platforms. For instance, by leveraging AI for personalized financial advice and utilizing big data to understand customer behavior better, the bank can offer more tailored products and services.

The bank's ability to innovate digitally is crucial for its future success. By embracing these technological shifts, China Zheshang Bank can streamline internal processes, reduce costs, and develop novel financial solutions. This proactive approach is essential to not only keep pace with but also to lead within the dynamic Chinese financial market.

China's digital yuan, or e-CNY, has progressed significantly, with widespread deployment across 29 cities by early 2025. This expansion includes pilot programs where commercial banks, like China Zheshang Bank, are actively exploring the e-CNY for processing loans and settling commodity trades, demonstrating its evolving role in the financial ecosystem.

China Zheshang Bank must therefore fully integrate the e-CNY into its core payment and settlement infrastructure. This integration offers a prime opportunity to enhance transaction efficiency, potentially reducing processing times and costs.

Furthermore, the inherent traceability of the e-CNY presents a valuable technological advantage for strengthening anti-money laundering (AML) efforts. By leveraging the digital yuan, the bank can bolster its compliance frameworks and improve the detection of illicit financial activities.

Chinese financial institutions, including China Zheshang Bank, are significantly boosting their risk management capabilities by integrating AI and big data. This digital shift allows for more precise credit risk assessments and proactive fraud detection, especially crucial for serving small and medium-sized enterprises (SMEs). For instance, by analyzing vast datasets, banks can identify subtle patterns indicative of financial distress or fraudulent activity far earlier than traditional methods.

The adoption of data-driven lending approaches enables banks to offer tailored financial products and services to SMEs, addressing their unique needs and mitigating lending risks. China Zheshang Bank can leverage AI algorithms to predict loan default probabilities with greater accuracy, leading to more informed lending decisions and reduced non-performing assets. This technology also underpins personalized customer service, enhancing client satisfaction and loyalty.

In 2024, the digital transformation in China's banking sector is expected to accelerate, with AI and big data playing a central role in operational efficiency and risk mitigation. For example, the use of AI in credit scoring can potentially reduce the default rate for SME loans by several percentage points, a significant improvement in a competitive market.

Cybersecurity and Data Protection

The increasing digitization of banking services, including those offered by China Zheshang Bank, makes cybersecurity and data protection critical. With the Banking and Insurance Institutions Data Security Management Measures coming into effect in December 2024, financial institutions face stricter requirements. These regulations mandate enhanced data security protocols, impacting how banks manage customer information. China Zheshang Bank needs significant investments in advanced cybersecurity measures to comply with these evolving data privacy laws and safeguard sensitive data.

The digital transformation in banking necessitates a proactive approach to cybersecurity. In 2024, the financial sector saw a notable rise in sophisticated cyber threats, making robust defense mechanisms indispensable. China Zheshang Bank is expected to allocate substantial resources towards upgrading its IT infrastructure to counter these evolving risks. Adherence to new data protection mandates, such as those introduced in late 2024, is not just a compliance issue but a fundamental requirement for maintaining customer trust and operational integrity.

- Elevated Standards: New regulations like the Banking and Insurance Institutions Data Security Management Measures (effective December 2024) impose higher data security obligations.

- Investment Priority: China Zheshang Bank must prioritize significant investment in cybersecurity infrastructure to meet these enhanced requirements.

- Compliance Imperative: Adhering to data privacy laws is crucial for protecting sensitive customer information and maintaining regulatory compliance.

- Risk Mitigation: Strong cybersecurity measures are essential to mitigate the growing threat of cyberattacks in the increasingly digital banking landscape.

Blockchain Technology Applications

China's commitment to blockchain is significant, with the nation actively developing technical standards and building expertise. By late 2023, China had filed over 20,000 blockchain-related patents, showcasing its dedication to innovation in this space. China Zheshang Bank can leverage this technological momentum by exploring blockchain for supply chain finance, particularly for small and medium-sized enterprises (SMEs).

Implementing blockchain in supply chain finance can drastically improve transparency and efficiency. For instance, by recording transactions on an immutable ledger, the bank can reduce fraud and streamline the verification process for invoices and payments. This could unlock significant value for SMEs struggling with access to capital.

Furthermore, the bank might explore blockchain for cross-border transactions, a sector ripe for disruption. Digital currency initiatives and the ongoing development of distributed ledger technology in China suggest a future where international payments are faster and cheaper. China Zheshang Bank could position itself to benefit from these advancements, potentially reducing settlement times and associated costs for its clients.

The potential applications extend to enhancing security in financial operations. Blockchain's inherent cryptographic security features can protect sensitive data and prevent unauthorized access, a critical consideration for any financial institution. This technological factor presents opportunities for China Zheshang Bank to innovate and gain a competitive edge.

Technological advancements are rapidly transforming China's banking sector, pushing institutions like China Zheshang Bank to embrace digital innovation. The nation's significant investment in blockchain technology, evidenced by over 20,000 patent filings by late 2023, offers avenues for improving supply chain finance and cross-border transactions.

The digital yuan (e-CNY) is expanding, with pilot programs in 29 cities by early 2025, allowing banks to explore its use in loan processing and trade settlements. This presents an opportunity for China Zheshang Bank to boost transaction efficiency and enhance anti-money laundering efforts through the e-CNY's traceability.

AI and big data analytics are crucial for enhancing risk management, with AI in credit scoring potentially reducing SME loan default rates by several percentage points in 2024. Furthermore, new regulations, such as the Banking and Insurance Institutions Data Security Management Measures effective December 2024, necessitate substantial investment in cybersecurity to protect sensitive customer data.

Legal factors

China's banking sector operates under a dynamic regulatory landscape, with the National Financial Regulatory Administration (NFRA) at the helm since its inception in May 2023, overseeing significant changes. China Zheshang Bank, like its peers, must navigate these evolving rules, including directives like the February 2024 Measures for the Administration of Fixed-Asset Loans and Working Capital Loans.

These regulations aim to bolster financial stability and risk management, impacting everything from lending practices to capital adequacy requirements. For instance, the PBOC's actions in late 2023 and early 2024, such as targeted reserve requirement ratio adjustments, signal a focus on guiding credit growth and supporting specific economic sectors.

China Zheshang Bank faces stringent Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, particularly with the advent of the digital yuan. This digital currency aims to improve AML by offering anonymity for minor transactions while ensuring traceability for substantial ones. In 2024, the People's Bank of China (PBOC) continued to emphasize the importance of robust AML/CTF frameworks.

To comply, China Zheshang Bank must actively enhance its transaction monitoring systems, integrating advanced technologies to detect and report any illicit financial activities. Adherence to both domestic regulations, such as those overseen by the China Banking and Insurance Regulatory Commission (CBIRC), and international standards like those from the Financial Action Task Force (FATF) is paramount. The bank’s investment in AI-powered compliance tools is crucial for navigating these evolving legal landscapes and mitigating associated risks.

China's evolving legal landscape presents significant data privacy and cybersecurity challenges for China Zheshang Bank. The comprehensive framework, encompassing the Personal Information Protection Law (PIPL), Data Security Law (DSL), and Cybersecurity Law (CSL), mandates stringent data handling practices. New regulations, such as the Banking and Insurance Institutions Data Security Management Measures, effective December 1, 2024, will further compel financial institutions to bolster their defenses.

Consequently, China Zheshang Bank must implement enhanced protection measures for sensitive financial data, ensuring compliance with these increasingly rigorous requirements. This includes robust encryption, access controls, and secure data storage solutions. The bank will also be obligated to conduct regular, thorough risk assessments to identify and mitigate potential vulnerabilities, a critical step in maintaining customer trust and operational integrity amidst rising cyber threats.

Regulations on SME Financing

China's government actively promotes Small and Medium-sized Enterprise (SME) financing through dedicated policies. These include expanding the scope of guarantee funds and implementing fiscal interest subsidies to lower borrowing costs. For China Zheshang Bank, this means navigating regulations that encourage lending to SMEs, potentially offering incentives but also imposing compliance burdens related to loan renewal and credit data sharing.

Key regulatory aspects impacting China Zheshang Bank's SME financing strategies include:

- Government Support for SME Lending: Policies are in place to boost credit availability for SMEs, such as extending the coverage of guarantee mechanisms.

- Fiscal Incentives: Initiatives like fiscal interest subsidies directly reduce the cost of borrowing for eligible SMEs, making loans more attractive.

- Compliance Requirements: The bank must adhere to specific rules concerning the renewal of SME loans and the sharing of credit information to ensure regulatory alignment.

- Regulatory Evolution: Staying abreast of evolving regulations, such as those announced in late 2024 concerning digital credit reporting for SMEs, is crucial for compliance and risk management.

ESG Disclosure Requirements

China is actively advancing its environmental, social, and governance (ESG) disclosure landscape. The China Securities Regulatory Commission (CSRC) has issued new guidelines requiring specific listed companies to implement ESG reporting by 2026, signaling a significant shift towards greater transparency.

Further strengthening this regulatory push, the Ministry of Finance finalized foundational guidelines for corporate sustainability disclosure in December 2024. These developments create a clear legal impetus for companies like China Zheshang Bank to bolster their ESG reporting mechanisms.

To align with these evolving legal mandates, China Zheshang Bank must proactively enhance its ESG reporting practices. This includes integrating sustainability considerations at the core of its governance structures and overall business strategy to ensure compliance and capitalize on emerging opportunities.

- CSRC Mandate: ESG reporting becomes compulsory for certain listed firms by 2026.

- Ministry of Finance Guidelines: Basic corporate sustainability disclosure rules finalized in December 2024.

- Strategic Integration: China Zheshang Bank needs to embed sustainability into governance and strategy.

- Enhanced Reporting: Focus on improving the quality and scope of ESG disclosures.

China Zheshang Bank operates within a tightening regulatory framework, evidenced by the National Financial Regulatory Administration (NFRA) taking charge in May 2023 and issuing directives like the February 2024 Measures for Fixed-Asset and Working Capital Loans. The People's Bank of China (PBOC) continues to influence credit growth through measures like reserve requirement ratio adjustments, as seen in late 2023 and early 2024. Furthermore, the bank must adhere to robust Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) regulations, with the digital yuan's rollout in 2024 emphasizing improved traceability, as highlighted by PBOC's continued focus on AML/CTF frameworks.

Environmental factors

China is doubling down on green finance, with key directives from the CPC Central Committee and State Council in 2024 pushing for stronger green financial systems and ambitious carbon neutrality targets. This national push creates significant opportunities for China Zheshang Bank to strategically align its operations. By expanding green lending and investing in eco-friendly projects, the bank can tap into a growing market and support national environmental objectives.

China's financial sector is increasingly focused on environmental, social, and governance (ESG) factors. The National Financial Regulation Administration (NFRA) has specifically called on banks and insurance companies to align their strategies with national environmental objectives. This push is significant for institutions like China Zheshang Bank, as it signals a clear regulatory direction towards sustainable finance.

Further bolstering this trend, the People's Bank of China (PBOC) has made green financial bonds eligible collateral for its lending operations. This policy change, effective as of recent directives, incentivizes the development and use of green financial instruments. For China Zheshang Bank, this means a more direct pathway to incorporating green bonds into its balance sheet and lending practices.

Consequently, China Zheshang Bank needs to embed ESG considerations across its operations. This includes integrating these factors into lending and investment decisions, strengthening risk management frameworks to account for climate-related risks, and aligning internal processes with sustainability goals. Meeting these evolving regulatory and market expectations is crucial for maintaining a competitive edge and ensuring long-term viability in the evolving financial landscape.

China Zheshang Bank faces increasing pressure to evaluate climate-related risks within its lending activities. Developing sophisticated methods to pinpoint, quantify, and control the physical and transition risks stemming from climate change is crucial for managing its broad loan portfolio. This is especially true for industries sensitive to environmental laws or direct climate effects.

By mid-2024, China's financial sector was already seeing intensified regulatory focus on climate risk. For instance, the People's Bank of China has been actively promoting green finance initiatives, with over 15 trillion yuan in outstanding green loans by the end of 2023, signaling a clear direction for banks like China Zheshang Bank to integrate climate risk into their core operations and portfolio management strategies.

Green Bond Issuance and Sustainable Lending

While the issuance of green bonds experienced a slight dip in 2024, the landscape for green loans remained robust. By the third quarter of 2024, China's outstanding green loans had surged to an impressive 35.75 trillion yuan, signaling a strong market appetite for sustainable financing. This trend presents a clear opportunity for China Zheshang Bank to strategically expand its green loan offerings, aligning with national environmental goals and tapping into a growing market segment.

China Zheshang Bank can leverage this momentum by actively developing and promoting its green loan portfolio, catering to the increasing demand from environmentally conscious businesses and projects. Furthermore, exploring the issuance of green bonds could provide the bank with a valuable avenue to attract further capital specifically earmarked for sustainable initiatives.

- Green Loan Growth: China’s outstanding green loans reached 35.75 trillion yuan by Q3 2024.

- Market Opportunity: Significant potential for China Zheshang Bank to expand its green loan portfolio.

- Diversification: Opportunities exist to issue green bonds and develop other sustainable financial products.

- Strategic Alignment: Supporting green industries and projects aligns with national environmental priorities.

Public Awareness and Demand for Green Financial Products

Public and corporate interest in financial products that champion environmental sustainability is significantly increasing. China Zheshang Bank is well-positioned to capitalize on this trend by actively highlighting its green finance solutions. Products like 'Water-saving loans' or financing specifically for renewable energy initiatives can boost the bank's reputation and attract a broader client base. In 2023, China's green finance market saw substantial growth, with outstanding green loans reaching approximately 27 trillion yuan, indicating a strong demand for such offerings.

Leveraging this growing demand allows China Zheshang Bank to differentiate itself in a competitive market. By showcasing its commitment to environmental, social, and governance (ESG) principles, the bank can appeal to a segment of customers increasingly prioritizing sustainability in their financial decisions. This strategic focus can lead to enhanced brand loyalty and open doors to new investment opportunities within the burgeoning green economy.

- Growing Demand: Public and corporate desire for sustainable financial products is on the rise.

- Bank's Opportunity: China Zheshang Bank can promote its green finance products, like water-saving loans and renewable energy financing.

- Brand Enhancement: Actively offering green finance solutions improves the bank's brand image and appeal.

- Market Growth: China's green finance market reached about 27 trillion yuan in outstanding loans by the end of 2023, demonstrating significant market potential.

China's commitment to environmental sustainability is a significant driver for financial institutions. The nation's ambitious carbon neutrality goals and the increasing emphasis on green finance by regulatory bodies like the PBOC and NFRA create a favorable environment for banks like China Zheshang Bank. This national push, evident in directives from 2024, encourages the expansion of green lending and investments in eco-friendly projects, directly impacting the bank's strategic direction.

| Metric | Value | Year/Period | Source/Note |

|---|---|---|---|

| Outstanding Green Loans | 35.75 trillion yuan | Q3 2024 | PBOC data |

| Green Finance Market Growth | ~27 trillion yuan | End of 2023 | Indicative market size |

| Green Bond Eligibility | As collateral for PBOC lending | Recent Directives | PBOC policy update |

PESTLE Analysis Data Sources

Our PESTLE Analysis for China Zheshang Bank is built on a robust foundation of official government publications, reports from leading financial institutions like the People's Bank of China and the China Banking and Insurance Regulatory Commission, and reputable economic and market research firms.