China Zheshang Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Zheshang Bank Bundle

China Zheshang Bank operates within a dynamic financial landscape, shaped by intense competition and evolving customer demands. Understanding the forces of rivalry, buyer power, supplier influence, threats of new entrants, and substitutes is crucial for its strategic positioning. This analysis reveals how these elements impact the bank's profitability and market share.

The complete report reveals the real forces shaping China Zheshang Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

For China Zheshang Bank, individual and corporate depositors are the primary suppliers of its core raw material: funds. In 2024, China's banking sector saw a continued inflow of deposits, though the growth rate may have moderated compared to previous years. While large corporate depositors can wield some influence due to significant fund volumes, the overall bargaining power of depositors remains relatively subdued. This is largely due to regulated deposit interest rates set by the People's Bank of China and the general trust in the stability of major national banks.

Technology providers hold considerable sway over banks like China Zheshang Bank, especially as digital transformation accelerates. These firms supply the essential AI, cloud computing, and data analytics solutions that banks need to stay competitive. In 2024, investments in digital banking infrastructure continue to be a priority for Chinese banks, increasing their reliance on these external tech partners.

The bargaining power of specialized fintech solution providers is often moderate to high. This is particularly true when they offer unique or proprietary technologies that are critical for improving customer experience, bolstering risk management, or streamlining operations. For instance, a provider of advanced cybersecurity solutions or a platform for AI-driven personalized banking could command significant leverage.

Skilled professionals, especially in fintech, risk management, and wealth management, act as crucial suppliers for China Zheshang Bank. The intense competition for such talent within China's dynamic financial industry gives these individuals a moderate degree of bargaining power.

To secure and retain top-tier talent, particularly those essential for digital advancements, banks like China Zheshang Bank must provide attractive compensation packages and robust career progression pathways. For instance, as of early 2024, the average salary for a senior fintech engineer in China could range significantly, reflecting the high demand for specialized skills.

Interbank Market and Central Bank

The People's Bank of China (PBOC) and the interbank market are critical suppliers of liquidity and regulatory capital to banks like China Zheshang Bank. The PBOC's monetary policies, such as changes in reserve requirement ratios and lending rates, significantly affect funding costs. For instance, in 2024, the PBOC continued to adjust its monetary stance to support economic growth, impacting interbank lending rates.

While individual banks have limited direct bargaining power with the PBOC, their collective activity within the interbank market influences pricing. The interbank market, a wholesale market for short-term borrowing and lending, sees rates determined by supply and demand for liquidity, often reflecting the PBOC's policy signals. In early 2024, interbank rates like the Shanghai Interbank Offered Rate (SHIBOR) experienced fluctuations influenced by these factors, highlighting the PBOC's pervasive influence.

- PBOC's Monetary Policy Impact: PBOC policy adjustments directly influence the cost and availability of funds for China Zheshang Bank.

- Interbank Market Dynamics: The interbank market serves as a key source of short-term funding, with pricing sensitive to liquidity conditions and central bank actions.

- Limited Bank Bargaining Power: Individual banks possess minimal bargaining power against the central bank's regulatory and liquidity provisions.

- 2024 Market Conditions: In 2024, interbank rates were shaped by the PBOC's ongoing efforts to manage liquidity and support economic objectives.

Regulatory Bodies

Regulatory bodies such as the National Financial Regulatory Administration (NFRA) and the People's Bank of China (PBOC) exert significant influence, acting as de facto suppliers by providing essential operating licenses and establishing the operational framework for banks like China Zheshang Bank. Their power is immense, as they mandate capital adequacy ratios, define lending practices, and set risk management protocols. For instance, in 2023, China's financial sector saw ongoing regulatory adjustments aimed at enhancing stability and supporting economic growth, directly impacting how banks operate and strategize.

These regulators' ability to alter rules, such as increasing capital requirements or implementing new compliance burdens, directly affects China Zheshang Bank's profitability and strategic direction. The push towards green finance, for example, requires banks to adapt their lending portfolios and risk assessments. Failure to comply with NFRA directives can lead to penalties or operational restrictions, underscoring their potent bargaining power.

- High Regulatory Authority: Bodies like NFRA and PBOC dictate licensing, capital requirements, and operational guidelines.

- Impact on Strategy: Regulatory changes directly influence China Zheshang Bank's lending policies and risk management.

- Enforcement Power: Non-compliance can result in severe penalties, limiting operational flexibility.

- Influence on Profitability: Mandated capital levels and lending restrictions can constrain earning potential.

The bargaining power of suppliers for China Zheshang Bank is generally low to moderate. Depositors, the primary suppliers of funds, have limited influence due to regulated interest rates and the perceived stability of major banks, though large corporate depositors can exert some pressure. Technology providers, crucial for digital transformation, hold moderate to high power, especially those offering unique fintech solutions. Skilled professionals in specialized areas also possess moderate bargaining power due to high demand.

The People's Bank of China (PBOC) and the interbank market are significant suppliers of liquidity and capital, with the PBOC's monetary policies heavily influencing funding costs. While individual banks have little direct leverage with the PBOC, interbank market dynamics reflect broader liquidity conditions. In 2024, the PBOC's continued efforts to manage liquidity and support economic growth meant interbank rates like SHIBOR were sensitive to these policy signals.

Regulatory bodies like the NFRA and PBOC possess immense power, acting as de facto suppliers by providing licenses and setting the operational framework. Their ability to impose capital requirements, dictate lending practices, and enforce compliance directly impacts China Zheshang Bank's strategy and profitability. For instance, ongoing regulatory adjustments in China's financial sector throughout 2023 and into 2024 have emphasized stability and risk management, compelling banks to adapt their operations.

| Supplier Category | Influence Level | Key Considerations for China Zheshang Bank |

|---|---|---|

| Depositors (Individual & Corporate) | Low to Moderate | Regulated interest rates; Stability of major banks; Large corporate depositors have more leverage. |

| Technology Providers (Fintech, Cloud, AI) | Moderate to High | Critical for digital transformation; Reliance on unique or proprietary solutions; Increasing investment in digital infrastructure in 2024. |

| Skilled Professionals (Fintech, Risk, Wealth Mgmt) | Moderate | High demand for specialized skills; Competition for talent; Need for attractive compensation and career paths. |

| PBOC & Interbank Market | High (Indirectly via Policy) | Suppliers of liquidity and capital; PBOC monetary policy dictates funding costs; Interbank rates reflect liquidity and policy signals. |

| Regulatory Bodies (NFRA, PBOC) | Very High | Licensing, capital adequacy, operational framework; Ability to enforce compliance and impose penalties; Direct impact on strategy and profitability. |

What is included in the product

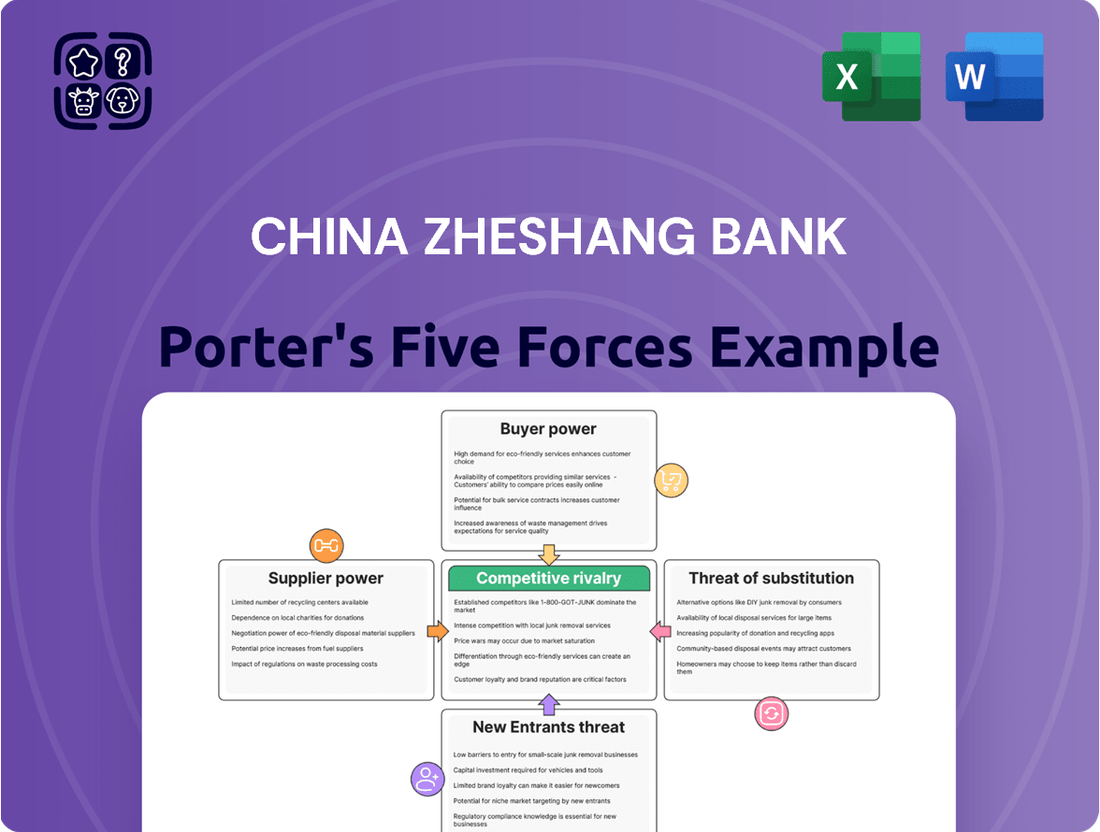

This Porter's Five Forces analysis provides a comprehensive examination of the competitive landscape for China Zheshang Bank, dissecting threats from new entrants, the power of buyers and suppliers, the intensity of rivalry, and the availability of substitutes.

Effortlessly identify and mitigate competitive threats to China Zheshang Bank's market position with a clear, actionable overview of Porter's Five Forces.

Customers Bargaining Power

Retail customers, encompassing individuals and small businesses, typically wield limited individual bargaining power. This is largely due to the standardized offerings prevalent in retail banking. However, their collective strength is substantial, fueled by low switching costs for fundamental banking services and a wide array of available banking providers.

The proliferation of digital banking and mobile payment systems has amplified customer convenience and choice. This trend indirectly bolsters the collective influence of retail customers, pushing banks to enhance service quality and digital functionalities to remain competitive.

In 2024, the digital transformation in banking is accelerating, with a significant portion of retail transactions moving online. For instance, data from Statista suggests that over 70% of retail banking activities in major markets are now initiated digitally, underscoring the growing leverage of digitally active customers.

China Zheshang Bank's strategic focus on Small and Medium-sized Enterprises (SMEs) means its customer base is heavily concentrated in this segment. While SMEs as a group represent a significant market, their individual bargaining power against a large institution like Zheshang Bank is typically moderate.

SMEs often have limited resources and may depend on banks for crucial financing, including credit lines and working capital solutions, which somewhat reduces their leverage. For instance, in 2023, the average loan size for SMEs in China often remained relatively small, highlighting their reliance on consistent banking support.

However, the landscape for SME financing is evolving. The rise of fintech platforms and alternative lending options provides SMEs with more choices, incrementally increasing their ability to negotiate terms or seek financing elsewhere. Government initiatives aimed at boosting SME access to capital, such as tax incentives for lenders or direct subsidies, also empower these businesses.

This growing availability of alternatives compels banks like Zheshang Bank to remain competitive, offering attractive interest rates, flexible repayment schedules, and specialized advisory services to retain and attract SME clients. The bank's ability to offer tailored solutions, such as supply chain finance or industry-specific lending products, becomes a key differentiator in managing customer power.

Large corporate clients and institutional investors wield considerable bargaining power. Their substantial transaction volumes mean they can negotiate for more favorable terms, including better interest rates and reduced fees. For instance, in 2024, major corporations often secure preferential pricing on loans and other banking services by leveraging their significant deposit balances and loan needs.

These sophisticated clients also have the capacity to demand highly customized financial products and services, pushing banks like China Zheshang Bank to innovate and tailor offerings. Their ability to switch banking partners if unsatisfied means banks must actively compete to attract and retain these high-value relationships, often through dedicated relationship management and competitive pricing strategies.

Wealth Management Clients

Wealth management clients, particularly high-net-worth individuals and institutional investors, wield significant bargaining power over institutions like China Zheshang Bank. These clients demand tailored investment strategies, expert guidance, and superior financial returns, making them discerning consumers of wealth management services.

Their capacity to shift large sums of capital across various financial providers grants them considerable leverage. For instance, in 2024, the average assets under management for ultra-high-net-worth individuals globally exceeded $30 million, underscoring the substantial financial clout these clients possess.

- Client Demands: Clients expect specialized products and personalized advice, driving competition among banks.

- Capital Mobility: The ease with which clients can move substantial assets empowers them to negotiate terms.

- Market Competition: In 2024, the global wealth management market saw intense competition, with firms actively vying for these high-value clients.

- Information Access: Increased access to market information allows clients to make more informed decisions and demand better service.

Loan Borrowers

Borrowers, especially major corporations and property developers, often hold significant bargaining power with banks like China Zheshang Bank. This is particularly true when interest rates are low, as banks become more eager to deploy capital. For instance, the People's Bank of China's reduction of loan prime rates to record lows in recent periods directly increases borrower leverage by reducing the potential returns for lenders.

Borrowers can effectively shop around, comparing loan offers from various financial institutions to secure the best terms and rates. This competitive pressure directly impacts a bank's net interest margin, forcing them to offer more attractive conditions to win business. In 2024, the average loan prime rate for a one-year loan in China hovered around 3.45%, a historically low figure that empowers borrowers.

- Borrower Leverage Borrowers can negotiate more aggressively in a low-rate environment.

- Rate Sensitivity Lower loan prime rates reduce bank profitability, increasing borrower influence.

- Market Comparison Borrowers actively compare offers, driving down loan yields for banks.

While individual retail customers have limited power due to standardized products, their collective strength is significant, amplified by low switching costs and numerous banking options.

The rise of digital banking in 2024, with over 70% of retail banking activities conducted digitally, further empowers these customers by increasing convenience and choice.

China Zheshang Bank's focus on SMEs means this segment holds moderate individual bargaining power, though their reliance on financing can temper this leverage.

However, the increasing availability of alternative financing options and government support for SMEs in 2024 incrementally enhances their negotiating position.

Preview the Actual Deliverable

China Zheshang Bank Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces Analysis for China Zheshang Bank, offering a detailed examination of its competitive landscape. You are looking at the actual document; once your purchase is complete, you’ll receive instant access to this exact, professionally formatted file, ready for your strategic insights.

Rivalry Among Competitors

China Zheshang Bank operates in a highly competitive landscape, largely shaped by the dominance of the 'Big Four' state-owned commercial banks: Industrial and Commercial Bank of China (ICBC), China Construction Bank (CCB), Bank of China (BOC), and Agricultural Bank of China (ABC). These behemoths, along with other major national joint-stock banks, command substantial market share. As of the end of 2023, the Big Four held a significant portion of total banking assets in China, exerting considerable pressure on smaller players.

The sheer scale of these large state-owned banks translates into significant advantages. They possess vast branch networks that reach across the entire country, serving an enormous customer base built over decades. This extensive reach and customer loyalty make it challenging for banks like China Zheshang Bank to acquire new customers and market share. Their established infrastructure also supports lower operational costs per transaction.

Furthermore, the immense capital reserves of the 'Big Four' allow them to absorb narrower net interest margins more effectively than smaller national banks. This pricing power and ability to operate on thinner margins put China Zheshang Bank and its peers under constant pressure to compete on cost and efficiency. In 2023, the average net interest margin for major Chinese banks remained competitive, but the ability to sustain this in a growingly competitive environment is crucial for survival.

China Zheshang Bank faces intense competition from other joint-stock commercial banks in China. These rivals, including giants like China Merchants Bank and Industrial Bank, actively compete on factors such as service quality, the breadth of their product offerings, and their ability to attract specific customer bases like small and medium-sized enterprises (SMEs) or those in particular industrial sectors. This vigorous competition directly impacts market share, deposit acquisition, and lending opportunities, often exerting downward pressure on net interest margins for all players.

China Zheshang Bank, while a national player, faces significant rivalry from numerous city and rural commercial banks, particularly within specific geographic regions. These local institutions often cultivate deep community relationships and can provide tailored services or products catering to local needs.

The competitive landscape is further intensified by ongoing consolidation within China's banking sector. For instance, by the end of 2023, the number of rural commercial banks had decreased, reflecting both intense competition and regulatory efforts to streamline the market and mitigate risks.

FinTech Companies and Internet Banks

The competitive landscape for China Zheshang Bank is significantly shaped by the aggressive growth of FinTech companies and internet-only banks. These digital-native entities are rapidly introducing innovative services, often with lower operational costs, directly challenging traditional banking models. For instance, by mid-2024, China's digital payment market, dominated by platforms like Alipay and WeChat Pay, processed trillions of yuan annually, demonstrating the immense reach and customer adoption of FinTech solutions. This intense rivalry forces established players like China Zheshang Bank to accelerate their own digital transformation efforts to remain competitive.

These new entrants are particularly adept at capturing market share in key areas such as consumer lending, wealth management, and payment processing. Their agility allows them to quickly adapt to changing consumer preferences and offer seamless digital experiences, often bypassing the extensive branch networks and legacy systems that can burden traditional banks. By the end of 2023, FinTech platforms had facilitated a substantial portion of consumer credit in China, highlighting their impact on traditional lending businesses.

- Digital Disruption: FinTech firms and internet banks are introducing agile, user-friendly digital platforms that attract customers seeking convenience and lower fees.

- Cost Advantage: Without the overhead of physical branches, these new players can offer more competitive pricing on services, increasing pressure on traditional banks.

- Market Segment Capture: Key areas like mobile payments, peer-to-peer lending, and online wealth management have seen significant inroads by FinTech companies.

- Innovation Pace: The rapid pace of technological adoption by FinTechs forces traditional banks to invest heavily in digital capabilities to avoid losing market share.

Regulatory Environment and Policy Directives

China Zheshang Bank operates within a dynamic regulatory landscape that profoundly influences competitive rivalry. Government directives aimed at bolstering specific economic sectors, such as lending to small and medium-sized enterprises (SMEs) or promoting green finance initiatives, directly shape where and how banks compete. For example, in 2023, China's banking sector saw continued emphasis on risk mitigation, with regulatory bodies like the China Banking and Insurance Regulatory Commission (CBIRC, now part of the National Financial Regulatory Administration) issuing guidelines to manage financial stability risks, particularly concerning smaller, regional banks. This can lead to increased consolidation, thereby intensifying competition among the remaining larger, more compliant institutions as they vie for market share in a more structured environment.

Policy shifts can also alter the competitive playing field by introducing new requirements or incentives. For instance, policies encouraging digital transformation and fintech adoption in banking have spurred intense competition as traditional banks invest heavily to keep pace with agile, technology-driven challengers. China's push for financial inclusion and the development of digital yuan further exemplify how policy can redefine competitive boundaries, forcing all players, including China Zheshang Bank, to innovate or risk falling behind.

- Regulatory Directives: Government policies frequently dictate lending priorities, such as support for SMEs or green projects, creating focused competitive arenas.

- Financial Stability Focus: Measures to manage systemic risks, especially for smaller institutions, can drive consolidation, intensifying competition among surviving banks.

- Digital Transformation Push: China's emphasis on fintech and digital banking innovation compels banks like China Zheshang Bank to invest in technology, altering competitive dynamics.

- Market Impact: These regulatory and policy influences directly shape market share dynamics and strategic imperatives for all participants in China's banking sector.

China Zheshang Bank faces fierce competition from the dominant 'Big Four' state-owned banks and other major joint-stock banks, which hold significant market share and possess vast resources, including extensive branch networks and customer bases.

The intense rivalry also stems from agile FinTech companies and internet-only banks that are rapidly innovating with digital platforms, often leading to lower costs and a competitive edge in areas like consumer lending and payments.

Regulatory directives, such as those promoting financial stability and digital transformation, further shape the competitive landscape by influencing market consolidation and encouraging technological investment.

| Competitor Type | Key Competitive Factors | Impact on China Zheshang Bank |

|---|---|---|

| Large State-Owned Banks | Scale, extensive networks, customer loyalty, capital reserves | Pressure on margins, difficulty in acquiring new customers |

| Other Joint-Stock Banks | Service quality, product breadth, specific customer targeting | Competition for market share and deposits |

| FinTech & Internet Banks | Digital innovation, lower operational costs, agility | Disruption of traditional services, need for rapid digital transformation |

SSubstitutes Threaten

Companies, especially larger ones, increasingly bypass traditional bank loans by tapping directly into capital markets. In 2024, China's bond market saw significant activity, with corporate bond issuance reaching trillions of yuan, offering businesses an alternative to bank financing. This trend directly substitutes for services China Zheshang Bank offers in corporate lending.

The growth and sophistication of China's capital markets provide businesses with more independent funding options. For instance, the Shanghai Stock Exchange and Shenzhen Stock Exchange facilitated numerous IPOs and secondary offerings in 2024, allowing companies to raise substantial capital without relying on bank loans. This broadens the scope of substitutes available to China Zheshang Bank's clients.

FinTech platforms pose a significant threat by offering alternative ways to conduct financial activities. Companies like Alipay and WeChat Pay have revolutionized payments in China, handling trillions of yuan in transactions. In 2023 alone, Alipay processed over $20 trillion in payment volume, demonstrating the immense scale of these digital payment systems.

These FinTech services often provide greater convenience, faster processing, and sometimes lower costs compared to traditional banking. For instance, mobile payment adoption in China reached over 85% of internet users by early 2024, highlighting customer preference for these digital solutions for everyday needs.

The ability of FinTechs to offer services like peer-to-peer lending and online wealth management directly competes with core banking products. This forces established institutions like China Zheshang Bank to constantly enhance their digital capabilities to retain customers and market share.

Shadow banking and informal lending continue to pose a threat by offering alternative financing, especially for those underserved by traditional institutions. Despite regulatory efforts, these channels provide flexibility and can attract borrowers seeking less stringent requirements than regulated banks. This directly diverts potential loan business, impacting the market share of established players like China Zheshang Bank.

Supply Chain Finance Solutions

For small and medium-sized enterprises (SMEs), integrated supply chain finance solutions from non-bank entities and specialized platforms present a significant substitute for traditional working capital loans from banks like China Zheshang Bank. These alternative solutions often tap into the stronger credit profiles of larger anchor companies in a supply chain, enabling financing for smaller suppliers and distributors. This can diminish the reliance of SMEs on direct bank lending.

The appeal of these substitutes is growing. For instance, in 2024, the global supply chain finance market was projected to reach over $10 trillion, indicating a substantial and expanding alternative for businesses seeking working capital. This growth is driven by the efficiency and accessibility these platforms offer to SMEs.

- Increased Accessibility: Non-bank platforms often have less stringent approval processes than traditional banks for SMEs.

- Leveraging Anchor Credit: These solutions utilize the creditworthiness of large buyers to secure financing for their suppliers.

- Efficiency Gains: Digital platforms can expedite the financing process, making it faster than traditional bank loans.

- Market Growth: The supply chain finance market is experiencing robust growth, providing a viable alternative for businesses.

Alternative Investment Products

Customers frequently explore alternative investment products when seeking returns that surpass traditional bank deposits. Products like money market funds, diverse mutual funds, and real estate investments offer compelling alternatives. For instance, China's asset management industry saw substantial growth, with total assets under management reaching approximately RMB 30.4 trillion (around USD 4.2 trillion) by the end of 2023, indicating a strong appetite for non-deposit investments.

In periods of low interest rates, the appeal of these substitutes intensifies, posing a significant threat to banks like China Zheshang Bank. This shift can draw away crucial deposit funding, impacting the bank's overall funding structure and its ability to lend. For example, in early 2024, average deposit rates for many major Chinese banks hovered around 1.5% to 2%, while certain money market funds offered yields exceeding 2.5%, making them a more attractive option for risk-averse savers.

- Increased competition for deposits: Alternative investments siphon funds away from traditional banking.

- Yield sensitivity: Low-interest rate environments enhance the attractiveness of substitutes.

- Impact on funding base: Reduced deposits can affect lending capacity and profitability.

- Diversification of financial products: Growing availability of wealth management products and funds.

The threat of substitutes for China Zheshang Bank is multifaceted, encompassing capital markets, FinTech, shadow banking, and alternative investments. Businesses increasingly bypass traditional loans by accessing capital markets, evidenced by significant corporate bond issuance in China during 2024. FinTech platforms like Alipay and WeChat Pay offer convenient, low-cost payment solutions, handling trillions in transactions and capturing a large share of digital payments by early 2024. Shadow banking and informal lending provide flexible financing, particularly for SMEs, diverting business from traditional banks.

Alternative investments, such as money market funds and mutual funds, also pose a threat, especially during low-interest rate periods. By offering higher yields than traditional bank deposits, these products attract savers, impacting banks' funding bases. For example, in early 2024, money market funds in China offered yields exceeding 2.5% while bank deposit rates were around 1.5% to 2%.

| Substitute Category | Key Characteristics | 2023/2024 Data/Trend | Impact on China Zheshang Bank |

|---|---|---|---|

| Capital Markets | Direct access to funding via bonds and equity | Trillions of yuan in corporate bond issuance in 2024 | Reduces reliance on bank lending for corporations |

| FinTech Platforms | Digital payments, P2P lending, wealth management | Alipay processed over $20 trillion in 2023; >85% internet users adopted mobile payments by early 2024 | Competes with core banking services, pressures digital innovation |

| Shadow Banking & Informal Lending | Flexible, less regulated financing | Continued activity despite regulatory efforts | Diverts potential loan business, especially from SMEs |

| Alternative Investments | Money market funds, mutual funds, real estate | China's asset management industry reached ~RMB 30.4 trillion by end of 2023; yields >2.5% for some funds in early 2024 | Siphons deposits, impacts funding base and lending capacity |

Entrants Threaten

The banking sector in China presents formidable barriers to new entrants, primarily due to high capital requirements. New banks must possess substantial financial backing to meet regulatory demands and ensure stability. For instance, as of recent regulatory updates, minimum registered capital requirements for commercial banks in China remain significant, often running into billions of Renminbi, a substantial hurdle for aspiring players.

Regulatory hurdles further solidify this barrier. The licensing process for establishing a new bank in China is exceptionally rigorous and controlled by authorities like the National Financial Regulatory Administration (NFRA). This body carefully vets applicants, prioritizing the stability of the financial system, which often means new licenses are granted sparingly, limiting the influx of new competition.

New entrants must also navigate complex prudential standards. These include strict rules on risk management, capital adequacy ratios, and operational compliance. Failing to meet these stringent requirements can prevent a new entity from even beginning operations, effectively keeping the market protected for established institutions like China Zheshang Bank.

China Zheshang Bank, like other established financial institutions, has cultivated a strong brand reputation and deep customer trust over many years. This is a significant hurdle for any potential new entrant aiming to gain market share. For instance, by the end of 2023, China Zheshang Bank maintained a robust customer base, reflecting years of consistent service and reliability.

Newcomers must invest heavily in marketing and demonstrate unwavering stability to even begin to rival the credibility of established players. Building this essential trust, particularly when seeking to attract substantial deposits or large corporate accounts, is a long and costly endeavor, often taking a decade or more to achieve a comparable level of confidence.

China Zheshang Bank's extensive branch network and infrastructure present a significant barrier to new entrants. Despite the rise of digital banking, a physical presence remains crucial for serving diverse customer segments across China's vast geography. Building and maintaining such a widespread network demands enormous capital investment in real estate, technology, and personnel, making it a daunting challenge for any new player aiming to compete.

Economies of Scale and Scope

Existing financial institutions, like China Zheshang Bank, leverage significant economies of scale. This allows them to spread substantial fixed costs, such as technology infrastructure and regulatory compliance, across a vast customer base. For instance, in 2023, major Chinese banks reported operating costs that were a fraction of their total assets, demonstrating this efficiency.

Furthermore, banks benefit from economies of scope by offering a broad spectrum of integrated financial products, from basic savings accounts to complex investment and wealth management services. This cross-selling capability enhances customer loyalty and revenue streams. New entrants find it challenging to replicate this comprehensive offering and the associated cost advantages, making it difficult to compete effectively on price or product breadth.

The ability to achieve these efficiencies is a significant barrier. For example, a new digital bank would need massive upfront investment in technology and marketing to rival the established scale of operations of banks like China Zheshang Bank, which in 2024 continues to expand its digital service offerings.

- Economies of Scale: Established banks can absorb fixed costs over a larger customer base, lowering per-unit operating expenses.

- Economies of Scope: Offering a wide range of integrated financial products increases customer value and revenue potential.

- New Entrant Disadvantage: Challengers face significant hurdles in achieving similar operational efficiencies and product breadth quickly.

- Cost Competitiveness: The scale advantage allows incumbent banks to be more competitive on pricing and service fees.

Talent Acquisition and Retention

The threat of new entrants in China's banking sector is significantly influenced by the intense competition for skilled talent. Attracting and retaining experienced banking professionals, particularly those adept in areas like complex financial products, robust risk management, and the intricacies of digital transformation, is paramount for any new player aiming to disrupt the market.

New entrants face a considerable challenge in luring away seasoned professionals from established institutions like China Zheshang Bank. This competition for a limited talent pool often drives up recruitment costs, potentially straining the initial operating budgets of newcomers. For instance, in 2024, the average salary for senior risk managers in Chinese financial institutions saw an increase of approximately 15% compared to the previous year, reflecting this high demand.

- Talent Scarcity: A limited supply of banking professionals with specialized skills in digital banking and fintech creates a competitive disadvantage for new entrants.

- Increased Recruitment Costs: New banks must offer higher compensation and benefits packages to attract top talent, impacting their profitability.

- Retention Challenges: Established banks often provide better career progression and stability, making it harder for new entrants to retain their newly hired staff.

- Impact on Digital Transformation: A shortage of talent in digital transformation can slow down the development and deployment of innovative banking technologies for new market participants.

The threat of new entrants into China's banking sector, including competition for China Zheshang Bank, is significantly mitigated by substantial capital requirements and stringent regulatory approvals. The National Financial Regulatory Administration (NFRA) maintains a tight grip on new banking licenses, prioritizing systemic stability. Furthermore, established players like China Zheshang Bank benefit from deep-rooted brand loyalty and extensive operational infrastructure, making it difficult for newcomers to gain traction.

| Barrier Category | Specific Barrier | Impact on New Entrants (China Banking Sector) |

|---|---|---|

| Capital Requirements | Minimum registered capital for commercial banks (e.g., billions of RMB) | High financial barrier, restricts market entry significantly. |

| Regulatory Hurdles | Rigorous licensing and vetting process by NFRA | Limited new licenses granted, creating an exclusive market. |

| Brand Reputation & Trust | Years of consistent service and reliability | Difficult for new entrants to establish credibility and attract customers. |

| Infrastructure & Network | Extensive physical branch networks across China | Requires massive capital investment to replicate, favoring incumbents. |

| Economies of Scale & Scope | Lower per-unit costs and broad product offerings | New entrants struggle to match operational efficiencies and product breadth. |

| Talent Acquisition | High demand for skilled banking and fintech professionals | Increased recruitment costs and retention challenges for new players. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for China Zheshang Bank is built upon a foundation of publicly available financial statements, annual reports, and regulatory filings from the bank itself and its competitors. We supplement this with industry-specific research from reputable financial news outlets and market intelligence firms to provide a comprehensive view of the competitive landscape.