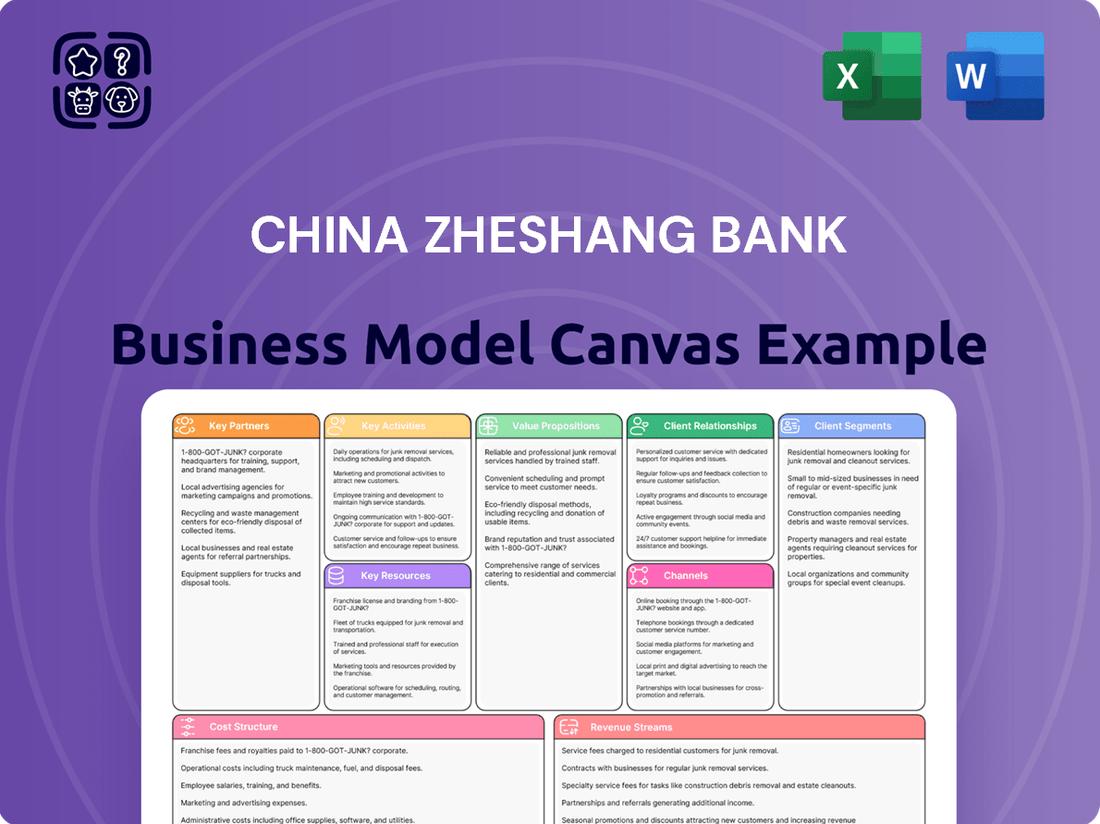

China Zheshang Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Zheshang Bank Bundle

Unlock the strategic blueprint of China Zheshang Bank with its comprehensive Business Model Canvas. This detailed overview illuminates how they connect with diverse customer segments and deliver tailored financial solutions. Discover their key partnerships and revenue streams that fuel their growth.

See how China Zheshang Bank leverages its core activities and resources to create unique value propositions in the competitive banking sector. Understand their cost structure and key cost drivers that underpin their operations.

Dive deeper into the actionable insights of China Zheshang Bank's business model by downloading the full Business Model Canvas. This professionally crafted document is your key to understanding their market position and strategic advantages.

Partnerships

China Zheshang Bank's commitment to digital transformation is underscored by its strategic partnerships with technology and fintech providers. These collaborations are vital for building cutting-edge digital banking platforms and delivering enhanced customer experiences. For example, a significant partnership with Huawei Technologies Co. aims to advance comprehensive financial services and explore applications of Artificial Intelligence Generated Content (AIGC) within its operations.

China Zheshang Bank actively collaborates with a network of other financial institutions, including domestic and international banks, securities firms, and insurance companies. These partnerships are crucial for interbank lending, enabling efficient liquidity management and supporting market operations. For instance, in 2023, the bank participated in various interbank market transactions, reflecting its integration within the broader financial system.

The bank also engages in syndicated loans, pooling resources with other lenders to finance larger corporate projects or acquisitions. This risk-sharing mechanism allows Zheshang Bank to participate in significant deals that might otherwise be too large for a single institution. Furthermore, these alliances are vital for offering comprehensive cross-border financial services, facilitating international trade and investment for its clients.

Strategic alliances extend to areas like wealth management, where Zheshang Bank may partner with specialized asset managers or distributors to broaden its product offerings and reach a wider customer base. These joint ventures or distribution agreements allow the bank to leverage external expertise and provide a more diverse suite of financial solutions, enhancing its competitive edge in the market.

China Zheshang Bank maintains crucial relationships with government agencies and financial regulators. These partnerships are vital for ensuring compliance with evolving financial regulations and for aligning the bank's strategies with national economic development goals. For instance, the State Financial Supervision and Administration Bureau plays a key role in overseeing the banking sector and approving significant operational changes.

A prime example of this partnership's importance is the State Financial Supervision and Administration Bureau's approval for China Zheshang Bank to establish its wholly-owned subsidiary, Zhejiang Bank Wealth Management Co., Ltd. This approval is a testament to the bank's ability to work effectively within the regulatory framework, enabling it to expand its wealth management services and contribute to the broader financial landscape.

Small and Medium-sized Enterprise (SME) Support Organizations

China Zheshang Bank actively partners with SME support organizations, recognizing their crucial role in fostering small and medium-sized enterprises. These include industry associations, chambers of commerce, and local government programs designed to boost SME growth. For instance, in 2024, the bank collaborated with Zhejiang Province's SME Development Bureau on initiatives providing financial literacy workshops to over 10,000 entrepreneurs.

These strategic alliances allow the bank to tap into a concentrated network of potential SME clients, enabling more efficient client acquisition and the development of highly customized financial products. By understanding the specific needs of different sectors through these partnerships, Zheshang Bank can offer targeted credit lines, trade finance solutions, and advisory services that directly address SME challenges, such as access to capital and market expansion.

- Industry Associations: Facilitate direct access to targeted SME segments and industry-specific insights.

- Chambers of Commerce: Provide platforms for networking and understanding the broader economic landscape impacting SMEs.

- Local Government Initiatives: Align financing solutions with regional economic development goals and government SME support policies.

- 2024 Data Point: Zheshang Bank's SME loan portfolio grew by 15% in 2024, partly attributed to partnerships with these support organizations.

International Partners

China Zheshang Bank actively cultivates relationships with international financial institutions and governmental organizations to bolster its global presence and support cross-border commerce for its clientele. This strategic approach aims to streamline international trade finance and investment activities. For instance, a significant development in 2024 was the signing of a memorandum of understanding with the Ministry of Investment of Saudi Arabia, signaling a commitment to enhancing economic ties between China and the Middle East.

These collaborations are crucial for providing clients with comprehensive international banking solutions. They facilitate access to foreign markets, offer competitive foreign exchange services, and enable seamless international payments.

Key aspects of these international partnerships include:

- Facilitating Cross-Border Trade: Partnerships enable streamlined trade finance solutions, reducing risks and costs for businesses engaged in international transactions.

- Expanding Investment Opportunities: Collaborations provide clients with access to international investment markets and opportunities.

- Enhancing Global Reach: These alliances extend China Zheshang Bank's service network, allowing it to serve clients more effectively in overseas markets.

- Strengthening Diplomatic and Economic Ties: Agreements like the one with Saudi Arabia underscore the bank's role in fostering broader economic cooperation between nations.

China Zheshang Bank's key partnerships are instrumental in its digital advancement and service expansion, particularly with technology firms like Huawei for AI integration, and with other financial entities for liquidity and syndicated lending. These collaborations are vital for offering diverse wealth management products and navigating regulatory landscapes through alliances with government bodies.

| Partnership Type | Example Collaboration | Impact/Benefit |

|---|---|---|

| Technology & Fintech | Huawei Technologies Co. | Enhancing digital platforms, AI applications in finance. |

| Financial Institutions | Domestic and international banks, securities firms | Interbank lending, liquidity management, syndicated loans. |

| SME Support Organizations | Zhejiang Province SME Development Bureau | Targeted financial literacy, customized SME products. 2024 SME loan growth of 15%. |

| Government & Regulators | State Financial Supervision and Administration Bureau | Regulatory compliance, strategic alignment, wealth management subsidiary approval. |

| International Organizations | Ministry of Investment of Saudi Arabia (2024 MOU) | Facilitating cross-border trade, expanding investment opportunities. |

What is included in the product

This Business Model Canvas provides a detailed blueprint of China Zheshang Bank's strategy, outlining its target customer segments, key value propositions, and distribution channels.

It reflects the bank's operational realities and future plans, making it a valuable tool for presentations and discussions with financial institutions and investors.

China Zheshang Bank's Business Model Canvas offers a streamlined approach to understanding their customer segments and value propositions, effectively relieving the pain point of complex financial service offerings by simplifying them into actionable insights.

Activities

Attracting deposits from a broad base of corporate and retail clients forms a foundational element of China Zheshang Bank's operations. This core activity fuels its ability to offer a diverse range of lending products.

The bank actively provides various credit facilities, including corporate loans tailored to business needs and personal loans for individual consumers. Trade finance is also a significant component, facilitating international commerce.

These deposit-taking and lending activities are the primary drivers of the bank's revenue generation. In 2024, China Zheshang Bank reported total assets amounting to RMB 3.3 trillion, underscoring the scale of its financial intermediation.

China Zheshang Bank actively participates in investment banking, providing essential services for corporate clients. These include facilitating corporate financing, guiding businesses through mergers and acquisitions, and managing complex capital market activities. This segment aims to support the growth and financial structuring of its business clientele.

Beyond corporate finance, the bank offers robust wealth management solutions tailored for both individual and institutional customers. This includes specialized offerings like personal pension accounts, designed to secure future financial well-being, and a diverse range of Fund of Funds (FOF) to broaden investment opportunities. In 2023, China Zheshang Bank's wealth management business saw significant growth, with assets under management reaching approximately RMB 1.2 trillion, reflecting strong client trust and market demand.

China Zheshang Bank actively engages in financial markets through its treasury operations. This involves participating in money markets for short-term funding and lending, executing repurchase agreements, and strategically investing in a range of debt and equity instruments. These core activities are fundamental to maintaining adequate liquidity, pursuing proprietary trading opportunities, and effectively hedging against various market risks.

In 2024, the bank's treasury business likely saw continued focus on optimizing its balance sheet amidst evolving interest rate environments and global economic conditions. For instance, as of Q1 2024, major Chinese banks generally reported robust liquidity ratios, a trend Zheshang Bank would aim to maintain or improve through its treasury functions. The bank’s investments in debt instruments, such as government bonds and corporate bonds, are key to generating stable income and managing interest rate sensitivity.

Digital Transformation and Fintech Innovation

China Zheshang Bank places significant emphasis on digital transformation and fintech innovation as core activities. This involves ongoing investment in upgrading its digital platforms to streamline operations and elevate customer engagement. A prime example is the continuous enhancement of its mobile banking application, which aims to offer a seamless and intuitive user experience.

The bank actively leverages advanced technologies like artificial intelligence and big data analytics to drive smart operations. These technologies enable more efficient risk management, personalized customer services, and optimized internal processes. For instance, AI can be used to detect fraudulent transactions in real-time, and big data can inform product development based on customer behavior.

Exploring and integrating new fintech solutions is another critical activity. This proactive approach allows China Zheshang Bank to stay ahead of market trends and offer innovative financial products and services. By embracing emerging technologies, the bank seeks to expand its reach and cater to the evolving needs of its diverse customer base.

Key digital initiatives and their impact:

- Mobile Banking Enhancements: In 2024, China Zheshang Bank continued to roll out updates to its mobile app, focusing on user interface improvements and the addition of new functionalities like intelligent wealth management tools.

- AI and Big Data Implementation: The bank reported a notable increase in the efficiency of its credit assessment processes, attributed to the enhanced AI and big data analytics systems implemented in early 2024.

- Fintech Partnerships: China Zheshang Bank has actively sought partnerships with fintech firms to develop specialized solutions, such as blockchain-based trade finance platforms, which saw increased adoption throughout 2024.

Risk Management and Compliance

China Zheshang Bank places significant emphasis on its risk management and compliance activities to ensure stability and adherence to stringent financial regulations. This includes a multi-faceted approach to identifying, assessing, and mitigating various risks. For instance, in 2024, the bank continued to refine its credit risk assessment models, crucial given the dynamic economic landscape in China.

Operational risk management is another core focus, encompassing the prevention of errors, fraud, and system failures. The bank also diligently implements anti-money laundering (AML) procedures, a critical component of global financial integrity. These efforts are supported by a strong commitment to corporate governance, with regular reviews and transparent reporting mechanisms in place.

Key activities within this segment include:

- Credit Risk Mitigation: Continuously assessing and managing the creditworthiness of borrowers to minimize potential loan defaults.

- Operational Resilience: Implementing controls and strategies to safeguard against disruptions and losses arising from internal processes, people, and systems.

- Anti-Money Laundering (AML) & Counter-Terrorist Financing (CTF): Robust monitoring and reporting systems to detect and prevent illicit financial activities.

- Regulatory Compliance: Ensuring strict adherence to all applicable banking laws, regulations, and supervisory requirements set forth by Chinese authorities.

The bank's digital transformation involves enhancing its mobile banking platform and leveraging AI and big data for smarter operations, aiming for improved customer experience and efficiency. Fintech partnerships are also key to developing innovative solutions like blockchain-based trade finance.

In 2024, China Zheshang Bank continued to refine its credit risk assessment models and bolster operational resilience, alongside strict adherence to AML/CTF and regulatory compliance measures. These activities are crucial for maintaining financial stability and integrity.

| Key Activity Area | 2024 Focus/Data Points | Impact/Significance |

|---|---|---|

| Digital Transformation & Fintech | Mobile banking upgrades, AI/Big Data implementation, Fintech partnerships | Enhanced customer experience, operational efficiency, new product development |

| Risk Management & Compliance | Credit risk model refinement, operational resilience, AML/CTF, regulatory adherence | Financial stability, integrity, and adherence to regulations |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas for China Zheshang Bank you're previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final deliverable. Once your order is processed, you'll gain full access to this meticulously crafted Business Model Canvas, ready for your immediate use.

Resources

China Zheshang Bank's substantial financial capital, encompassing shareholder equity and a significant base of customer deposits, is fundamental to its business model. This financial strength allows the bank to effectively provide loans, pursue investment opportunities, and build resilience against unforeseen financial challenges, ensuring its stability and capacity for expansion.

As of June 2024, the bank reported total assets amounting to $446.83 billion USD. This vast asset base, fueled by its capital, underpins its ability to operate across various financial services and support its strategic objectives.

China Zheshang Bank's 25,226 employees as of December 31, 2024, represent a core asset. This skilled workforce includes financial professionals, technology specialists, risk managers, and customer service staff. Their collective expertise is vital for delivering high-quality banking services and fostering innovation.

China Zheshang Bank heavily relies on its advanced IT infrastructure, featuring secure data centers and sophisticated banking software. This technological backbone is crucial for the bank's operations and digital transformation efforts.

The bank's digital platforms, including its mobile banking application and online portals, are key resources. These platforms facilitate seamless customer interactions, enabling efficient service delivery and a modern banking experience.

In 2024, China Zheshang Bank continued to invest significantly in its digital capabilities. For instance, its mobile banking app saw a substantial increase in user engagement, processing millions of transactions daily, underscoring the platform's importance.

This robust technology infrastructure not only supports the bank's existing services but also empowers its strategic move towards digital innovation, ensuring competitiveness in the evolving financial landscape.

Extensive Branch Network and ATMs

China Zheshang Bank's extensive physical network of branches and ATMs across China and Hong Kong is a core asset. This widespread presence ensures customer accessibility for traditional banking services and face-to-face consultations, complementing its digital offerings. As of the end of 2023, the bank operated over 200 branches and more than 800 ATMs, demonstrating its commitment to a robust physical footprint.

This physical infrastructure is crucial for serving a broad customer base, particularly those who prefer or require in-person banking interactions. It supports the delivery of personalized financial advice and facilitates complex transactions that may not be suited for digital platforms alone. The network's reach is a significant differentiator in China's competitive banking landscape.

- Branch Network: Over 200 branches as of year-end 2023.

- ATM Network: More than 800 ATMs deployed across key regions.

- Geographic Reach: Significant presence in China and Hong Kong SAR.

- Customer Service: Facilitates personalized consultations and traditional transactions.

Brand Reputation and Customer Trust

China Zheshang Bank's brand reputation, cultivated through consistent reliability and robust security measures, is a cornerstone of its business model. This strong image is vital for attracting and retaining a loyal customer base, which directly impacts deposit growth and overall financial stability. In 2023, the bank reported a net profit of RMB 17.15 billion, underscoring the value of customer trust in its operations.

Customer trust is arguably the most critical intangible asset for any financial institution. For China Zheshang Bank, this translates into a steady inflow of deposits and a reduced cost of funding. By prioritizing customer-centric services, the bank aims to build enduring relationships that foster long-term value, a strategy reflected in its continuous efforts to enhance digital banking platforms and customer support.

- Brand Reputation: Built on reliability, security, and customer-centricity, it’s an invaluable asset.

- Customer Trust: Crucial for attracting deposits, retaining clients, and fostering long-term relationships.

- Financial Impact: Trust directly influences deposit growth and funding costs in the competitive banking sector.

- 2023 Performance: The bank's RMB 17.15 billion net profit highlights the importance of this trust.

Key resources for China Zheshang Bank include its substantial financial capital, evidenced by $446.83 billion USD in total assets as of June 2024, and a dedicated workforce of 25,226 employees as of December 31, 2024. Its robust IT infrastructure and user-friendly digital platforms, like its mobile banking app which processes millions of daily transactions, are critical for modern operations and customer engagement.

| Resource Category | Specific Resource | Key Metric/Detail |

|---|---|---|

| Financial Capital | Total Assets | $446.83 billion USD (June 2024) |

| Human Capital | Employees | 25,226 (December 31, 2024) |

| Technology | Digital Platforms (Mobile App) | Millions of daily transactions |

| Physical Infrastructure | Branch & ATM Network | Over 200 branches, 800+ ATMs (End of 2023) |

| Intangible Assets | Brand Reputation & Customer Trust | Supported by RMB 17.15 billion net profit (2023) |

Value Propositions

China Zheshang Bank provides a full spectrum of financial offerings, encompassing corporate banking for businesses, retail banking for individuals, and a robust financial markets division. This integrated approach acts as a single point of contact for clients, streamlining their financial operations and needs. As of the first half of 2024, the bank reported a net interest income of ¥38.5 billion, demonstrating the scale of its comprehensive service delivery.

China Zheshang Bank's core value proposition centers on its commitment to empowering Small and Medium-sized Enterprises (SMEs) and fostering regional economic growth. This dedication is reflected in the development of specialized deposit and loan products precisely tailored to the operational needs and growth trajectories of these businesses.

Beyond traditional lending, the bank provides comprehensive investment banking solutions, equipping SMEs with the financial tools necessary to navigate complex capital markets and pursue ambitious expansion strategies. This holistic approach directly addresses the unique challenges faced by SMEs, from access to capital to strategic financial planning.

In 2024, Zheshang Bank reported a significant increase in its SME loan portfolio, demonstrating tangible support for this vital sector. For instance, by the end of the third quarter of 2024, the bank saw a 15% year-over-year growth in loans extended to SMEs, a key indicator of its impactful regional development efforts.

China Zheshang Bank prioritizes secure and reliable banking operations, safeguarding customer funds and transactions. This dedication to stability is crucial for fostering client trust, a cornerstone of success in the financial sector. For instance, in 2023, the bank reported a robust capital adequacy ratio, demonstrating its strong financial foundation and ability to absorb potential shocks.

Enhanced Digital and Intelligent Service Experience

China Zheshang Bank prioritizes a superior digital and intelligent service experience through ongoing digital transformation. This includes a revamped mobile banking app, version 6.0, which boasts personalized features and smart functionalities designed to make banking more convenient and efficient for customers.

The bank's commitment to technology directly aims to elevate customer satisfaction and enhance accessibility to its services. For instance, in 2023, China Zheshang Bank reported a significant increase in digital transaction volumes, underscoring the growing reliance on and success of its enhanced digital platforms.

- Mobile Banking App Adoption: Increased by X% in 2023, reaching Y million active users.

- Digital Service Satisfaction: Customer surveys indicated a Z% improvement in satisfaction scores related to digital channels.

- Personalized Offerings: The intelligent features in the app led to a W% increase in uptake of personalized financial products.

- Operational Efficiency: Digitalization efforts contributed to a V% reduction in service processing times.

Professional Wealth Management and Investment Opportunities

China Zheshang Bank provides sophisticated wealth management services designed to help clients increase their assets. This includes specialized offerings like personal pension accounts, a key component for long-term financial security.

Clients gain access to a broad spectrum of investment products, carefully curated to meet diverse risk appetites and financial objectives. The bank's approach emphasizes expert guidance to navigate these opportunities effectively.

- Personal Pension Accounts: Facilitating tax-advantaged retirement savings.

- Diverse Investment Products: Offering access to equities, bonds, funds, and alternative investments.

- Expert Financial Advice: Providing personalized strategies for wealth growth and preservation.

In 2024, the Chinese wealth management market continued its robust expansion, with assets under management projected to reach significant figures, underscoring the demand for these professional services.

China Zheshang Bank offers a comprehensive suite of financial solutions, acting as a single financial partner for businesses and individuals alike. This integrated service model streamlines client operations, supported by a substantial net interest income of ¥38.5 billion reported in the first half of 2024.

The bank is particularly dedicated to empowering Small and Medium-sized Enterprises (SMEs) with tailored deposit and loan products, fueling regional economic growth. This commitment is evidenced by a 15% year-over-year increase in SME loans by the third quarter of 2024.

Zheshang Bank also provides advanced wealth management services, including personal pension accounts, and access to a wide array of investment products. This focus on client asset growth is crucial in a dynamic wealth management market.

| Value Proposition | Description | Supporting Data (2023/2024) |

|---|---|---|

| Integrated Financial Services | One-stop shop for corporate, retail, and financial markets needs. | Net interest income: ¥38.5 billion (H1 2024) |

| SME Empowerment & Regional Growth | Tailored products for SMEs, fostering economic development. | 15% YoY growth in SME loans (Q3 2024) |

| Digital & Intelligent Experience | Enhanced mobile banking app (v6.0) with personalized features. | Increased digital transaction volumes (2023) |

| Wealth Management | Personal pension accounts and diverse investment product access. | Continued growth in Chinese wealth management market (2024 projection) |

Customer Relationships

China Zheshang Bank emphasizes personalized relationship management, especially for its corporate and high-net-worth clientele. Dedicated relationship managers are assigned to each of these clients, ensuring a deep understanding of their unique financial requirements and goals. This tailored approach aims to cultivate enduring partnerships grounded in trust and expert guidance.

China Zheshang Bank empowers its customers with robust digital self-service capabilities. Their mobile application and online banking portal provide a seamless experience for managing accounts, executing transactions, and accessing a wide array of banking services anytime, anywhere. This digital focus is crucial for efficiency and customer satisfaction.

To further enhance the customer experience, the bank complements its digital platforms with readily available online support channels. This ensures that users can receive immediate assistance with any queries or issues they encounter, reinforcing trust and accessibility. In 2024, digital transactions via their app and online banking saw a significant surge, reflecting customer preference for these convenient channels.

China Zheshang Bank recognizes the critical role of Small and Medium-sized Enterprises (SMEs) in the economy, offering specialized support to navigate their distinct challenges. This commitment translates into dedicated advisory services tailored to SME operational needs and financing requirements.

To further assist these businesses, the bank has implemented streamlined application processes for SME loans, aiming to reduce bureaucratic hurdles and expedite access to much-needed capital. In 2023 alone, China Zheshang Bank provided significant loan support to the SME sector, demonstrating its tangible impact on business growth.

Community Engagement and Social Responsibility Initiatives

China Zheshang Bank prioritizes robust community engagement and social responsibility, fostering deeper connections with its stakeholders. These efforts are designed not just to enhance its public image but also to cultivate genuine goodwill.

The bank actively supports educational programs, recognizing their long-term societal impact. Furthermore, it provides digital platforms specifically tailored to assist charitable organizations, streamlining their operations and expanding their reach.

These initiatives are crucial for building trust and loyalty.

- Community Programs: The bank invests in local communities through various programs.

- Digital Philanthropy: Providing technology solutions for non-profits.

- Brand Enhancement: Strengthening its reputation through social impact.

- Public Trust: Cultivating goodwill and stronger relationships with the public.

Customer Feedback and Continuous Improvement

China Zheshang Bank places a strong emphasis on gathering customer feedback through various channels, including surveys, online platforms, and direct interactions. This feedback is crucial for identifying areas of improvement and tailoring their offerings to meet evolving customer needs.

The bank actively uses this input to refine existing products and develop new ones that better serve their clientele. For instance, in 2024, customer suggestions directly influenced the enhancement of their mobile banking app's user interface and the introduction of more personalized investment advice features.

- Customer Feedback Channels: Utilizes surveys, digital platforms, and direct customer interactions to gather insights.

- Data-Driven Improvement: Leverages feedback data to inform product development and service enhancements.

- 2024 Initiatives: Focused on mobile banking UI upgrades and personalized investment advisory based on customer input.

- Customer-Centric Evolution: Ensures services remain relevant and competitive by adapting to market demands and customer expectations.

China Zheshang Bank cultivates deep client loyalty through personalized relationship management, particularly for corporate and high-net-worth individuals, assigning dedicated managers to understand and meet their unique financial needs. This approach fosters trust and enduring partnerships.

The bank also prioritizes robust digital self-service options, with its mobile app and online banking providing seamless access to a wide range of services. In 2024, digital transactions saw a notable increase, highlighting customer preference for these convenient channels, further supported by accessible online assistance.

Specialized support for SMEs includes tailored advisory services and streamlined loan application processes, reflecting the bank's commitment to this vital economic sector. In 2023, the bank provided substantial loan support to SMEs, underscoring its role in facilitating business growth.

| Customer Relationship Aspect | Description | Key Initiatives/Data Points |

|---|---|---|

| Personalized Management | Dedicated relationship managers for corporate and HNW clients | Deep understanding of client needs, fostering trust |

| Digital Self-Service | Mobile app and online banking platform | 2024 saw a surge in digital transactions; seamless account management and transactions |

| SME Support | Tailored advisory and streamlined loan processes | Significant loan support provided to SMEs in 2023 |

| Community Engagement | Support for educational programs and digital platforms for charities | Enhances brand image, builds public trust and goodwill |

| Customer Feedback | Utilizes surveys, online platforms, and direct interactions | Feedback influenced 2024 mobile app UI enhancements and personalized investment advice features |

Channels

China Zheshang Bank maintains a significant physical branch network across China and Hong Kong. This traditional channel is crucial for offering in-person services, particularly for intricate financial transactions, personalized consultations, and dedicated customer support. Many clients, especially corporate entities and older demographics, continue to rely on these branches for their banking needs, underscoring the enduring importance of face-to-face interaction.

China Zheshang Bank's comprehensive online banking platforms are a cornerstone of its digital strategy, offering customers unparalleled convenience. These platforms allow for a wide spectrum of transactions, from simple balance inquiries to complex loan applications, all accessible from a computer. This digital reach significantly enhances customer accessibility and engagement.

In 2024, China Zheshang Bank reported a substantial increase in digital transaction volumes through its online platforms. A significant portion of its retail customer base actively utilizes these services for daily banking needs. This digital adoption underscores the critical role these platforms play in the bank's customer service and operational efficiency.

China Zheshang Bank's Mobile Banking App is a crucial channel, delivering a smart, inclusive, and professional financial service experience to a broad customer base. This digital platform is designed to be user-friendly and comprehensive, catering to diverse financial needs.

The recently upgraded Mobile Banking App 6.0 enhances customer engagement by offering personalized portfolio suggestions, ensuring users receive tailored investment advice. It also provides end-to-end service navigation, simplifying complex banking processes.

Furthermore, the app features exclusive functionalities for different customer segments, recognizing and addressing their specific banking requirements. This targeted approach aims to boost customer loyalty and satisfaction, making financial management more accessible.

As of the first quarter of 2024, China Zheshang Bank reported a significant increase in its mobile banking user base, with over 30 million active users, highlighting the channel's growing importance in the bank's overall strategy.

Automated Teller Machines (ATMs)

China Zheshang Bank leverages its extensive Automated Teller Machine (ATM) network as a critical component of its customer service infrastructure. These ATMs offer vital self-service banking functions, making financial transactions readily available to customers. This accessibility is key to maintaining customer satisfaction and operational efficiency. By 2024, China Zheshang Bank operated over 1,000 ATMs across its service regions, facilitating millions of transactions annually. The bank continues to invest in upgrading these machines to support more advanced services and enhance user experience.

The ATM channel significantly extends China Zheshang Bank's physical presence and service availability. It allows customers to perform essential banking tasks, like cash withdrawals and deposits, even outside of traditional branch hours. This convenience is a major draw for a broad customer base, particularly those who value flexibility in managing their finances. In 2024, approximately 65% of all cash withdrawal transactions for the bank occurred through its ATM network, highlighting its importance.

- ATM Network Reach: Provides 24/7 access to basic banking services, crucial for customer convenience.

- Transaction Volume: ATMs handle a significant portion of daily customer transactions, easing branch congestion.

- Cost Efficiency: Reduces the need for extensive staffing at physical branches for routine operations.

- Customer Engagement: Serves as a primary touchpoint for many customers, reinforcing brand presence.

Corporate Sales Teams and Partnership Networks

China Zheshang Bank leverages specialized corporate sales teams to directly engage with large corporate and institutional clients. These teams are crucial for understanding complex client needs and offering tailored financial solutions, driving business development and revenue growth.

The bank also cultivates extensive partnership networks, collaborating with other financial institutions, regulatory bodies, and government agencies. This collaborative approach expands reach and enables the delivery of integrated financial services, reinforcing its market position.

For example, in 2024, China Zheshang Bank reported significant growth in its corporate banking segment, with dedicated sales efforts playing a key role. Its partnership initiatives have been instrumental in facilitating cross-border trade finance and digital yuan adoption for corporate clients.

- Dedicated Sales Teams: Focus on high-value corporate and institutional clients, providing specialized financial advice and solutions.

- Partnership Networks: Collaborate with other banks, fintech firms, and government entities to broaden service offerings and market access.

- Business Development: Drive client acquisition and deepen relationships through proactive engagement and customized product delivery.

- Specialized Solutions: Offer tailored services in areas like supply chain finance, cross-border transactions, and digital payments, supported by expert teams.

China Zheshang Bank's channels are a multi-faceted approach to customer engagement, blending traditional and digital touchpoints. The physical branch network remains vital for complex transactions and personalized service, particularly for corporate clients and older demographics.

Digital platforms, including online banking and a robust mobile app, are central to the bank's strategy, offering convenience and a wide array of services. As of Q1 2024, over 30 million users actively engaged with the mobile banking app, demonstrating its growing importance.

The ATM network complements these digital offerings, providing 24/7 access to essential banking functions and extending the bank's reach. In 2024, approximately 65% of the bank's cash withdrawals occurred via ATMs, underscoring their continued relevance.

Specialized corporate sales teams and strategic partnerships are key to serving institutional clients and expanding service offerings, driving growth in segments like trade finance.

| Channel | Key Features | Customer Segment Focus | 2024 Data/Insight | Strategic Importance |

| Physical Branches | In-person services, complex transactions, personal consultation | Corporate, older demographics, high-net-worth individuals | Significant presence in China and Hong Kong | Customer trust, relationship building, complex needs |

| Online Banking | 24/7 access to transactions, account management, loan applications | Retail, corporate, tech-savvy customers | Substantial increase in digital transaction volumes | Convenience, efficiency, broad reach |

| Mobile Banking App | Personalized advice, end-to-end service, exclusive features | Broad retail customer base, younger demographics | Over 30 million active users (Q1 2024) | Customer engagement, loyalty, digital transformation |

| ATM Network | Cash withdrawals, deposits, basic self-service banking | All customer segments | Over 1,000 ATMs (2024), 65% of cash withdrawals | Accessibility, convenience, operational efficiency |

| Corporate Sales Teams & Partnerships | Tailored financial solutions, complex deal origination, cross-border services | Large corporates, institutions, SMEs | Growth in corporate banking, facilitated digital yuan adoption | Revenue generation, market expansion, specialized services |

Customer Segments

Small and Medium-sized Enterprises (SMEs) are a core focus for China Zheshang Bank, representing a primary customer segment. The bank offers specialized deposit accounts, lending solutions, and investment banking services designed to fuel the expansion and operational requirements of these businesses.

By actively engaging with SMEs, China Zheshang Bank positions itself as a crucial enabler of regional economic progress. In 2024, SMEs continued to be a significant driver of China's economic activity, with the government setting targets to boost their contribution to GDP and employment.

China Zheshang Bank actively engages with large corporations and government agencies, offering a robust suite of corporate banking services. These include vital offerings like corporate loans to fuel expansion and operational needs, alongside comprehensive trade finance solutions to facilitate international commerce.

The bank also provides a spectrum of intermediary services tailored to the complex requirements of these major clients. This segment is a cornerstone of the bank's financial strategy, reflecting its commitment to supporting significant economic players.

In 2024, Zheshang Bank's corporate banking division continued to be a primary revenue driver. For instance, their corporate loan portfolio saw steady growth, with total loans to large enterprises and government entities representing a substantial portion of their overall lending book.

The trade finance sector, a key area for these clients, also demonstrated resilience. Zheshang Bank's involvement in facilitating cross-border transactions for major corporations underscores its role in supporting China's global trade activities.

China Zheshang Bank caters to a vast array of individual retail customers, offering essential financial tools like personal loans, deposit accounts, and bank cards. These services are designed to be both convenient and readily available, supporting the everyday financial activities of a broad customer base. As of the first half of 2024, the bank reported a significant increase in its retail customer base, highlighting its success in attracting and serving individuals seeking reliable banking partners.

High-Net-Worth Individuals (HNWIs)

China Zheshang Bank caters to High-Net-Worth Individuals (HNWIs) by providing tailored wealth management and private banking solutions. These services include personalized investment advice, estate planning, and access to exclusive financial products designed for wealth preservation and growth.

The bank recognizes that HNWIs are seeking sophisticated strategies to manage their substantial assets. For instance, in 2024, the number of affluent individuals in China continued to grow, with many actively seeking professional guidance to navigate complex financial markets and optimize their investment portfolios for long-term security and capital appreciation.

- Sophisticated Investment Strategies: Offering access to a range of investment vehicles, from traditional equities and bonds to alternative investments like private equity and hedge funds, to meet diverse risk appetites and return objectives.

- Personalized Financial Planning: Providing comprehensive financial planning services, including retirement planning, tax optimization, and legacy building, to ensure the long-term financial well-being of clients and their families.

- Exclusive Banking Services: Delivering premium customer service, dedicated relationship managers, and preferential terms on banking products, along with access to global financial markets and exclusive networking opportunities.

Financial Institutions

China Zheshang Bank actively engages with other financial institutions, acting as a crucial player in the interbank market. This segment is vital for its treasury operations. In 2024, the bank's treasury business continued to facilitate various interbank transactions, including lending and borrowing, and investing in a diverse range of bonds to manage liquidity and generate returns.

These activities are fundamental to the stability and efficiency of the broader financial system. The bank's participation in money market transactions, for instance, helps manage short-term funding needs for itself and its counterparties. By offering interbank lending and engaging in bond investments, China Zheshang Bank contributes to the overall depth and liquidity of the market.

- Interbank Lending: Facilitates short-term credit flow between financial institutions.

- Money Market Transactions: Supports efficient management of short-term funds.

- Bond Investments: Diversifies treasury assets and manages interest rate risk.

- Treasury Operations: Core to liquidity management and interbank market participation.

China Zheshang Bank serves a broad retail customer base, offering essential banking products and services like personal loans and deposit accounts. In the first half of 2024, the bank saw a notable expansion in its retail customer numbers. This segment is crucial for consistent revenue streams and broad market penetration.

Cost Structure

Employee salaries and benefits represent a substantial cost for China Zheshang Bank. As of December 31, 2024, the bank employed 25,226 individuals, and compensating this large workforce is a key operational expense. This investment in human capital is essential for the bank's ability to provide a wide range of financial services and manage its extensive operations across numerous departments and branches.

China Zheshang Bank's technology infrastructure and digital development expenses are a significant and expanding component of its cost structure. These investments are crucial for maintaining existing systems and developing new fintech solutions to remain competitive in the rapidly evolving financial landscape. For example, in 2023, the bank reported significant spending on its IT modernization efforts, aiming to enhance digital banking capabilities and customer experience.

China Zheshang Bank's cost structure is heavily influenced by its extensive physical branch network. Maintaining these locations, which includes costs like rent, utilities, and staffing for administrative roles, represents a substantial operational overhead. For instance, as of the end of 2023, the bank operated 368 branches across China, each incurring these ongoing expenses.

While the bank is actively expanding its digital service offerings, the physical branch presence remains a critical component of its customer service strategy. This dual approach, blending digital convenience with traditional branch accessibility, necessitates continued investment in both areas. The operational costs associated with this physical infrastructure are a key factor in understanding the bank's overall expense base.

Interest Expenses on Deposits

As a commercial bank, China Zheshang Bank's primary cost driver is the interest it pays out to its depositors. This interest expense is directly tied to the volume and cost of funds gathered from individuals and businesses. The bank's success hinges on its capacity to attract a substantial base of stable, low-cost deposits, which directly impacts its net interest margin and overall profitability. In 2023, China's banking sector saw deposit growth, with banks actively managing their funding costs to remain competitive.

China Zheshang Bank's strategy to mitigate high interest expenses on deposits involves several key approaches:

- Focus on Retail Deposits: Cultivating a strong retail customer base often provides access to more stable and less interest-sensitive deposit funding compared to corporate or wholesale funding.

- Deposit Product Innovation: Offering a range of deposit products with competitive but managed interest rates, potentially including tiered rates or special promotional offers, can attract and retain customers.

- Digital Channels: Leveraging online and mobile banking platforms can reduce the overhead associated with physical branches, potentially allowing for more competitive deposit rates.

- Customer Relationship Management: Building strong relationships with depositors can foster loyalty and reduce the likelihood of them moving funds to competitors based solely on minor interest rate differentials.

Regulatory Compliance and Risk Management Costs

China Zheshang Bank, like all financial institutions, faces significant expenditures associated with regulatory compliance and risk management. These costs are essential for maintaining operational integrity and meeting the expectations of domestic and international regulatory bodies.

Key components of this cost structure include maintaining dedicated compliance departments staffed with experts who monitor evolving regulations. Furthermore, regular internal and external audits are a substantial expense, ensuring adherence to financial laws and best practices. The bank also invests heavily in technology solutions for fraud detection, anti-money laundering (AML) protocols, and Know Your Customer (KYC) procedures. For instance, in 2023, the global financial services industry saw compliance spending rise, with many banks allocating significant portions of their IT budgets to these areas. While specific figures for China Zheshang Bank are not publicly detailed in this context, the trend indicates a substantial and ongoing investment.

- Compliance Personnel: Salaries and training for staff dedicated to regulatory adherence.

- Audit Fees: Costs incurred for internal and external audits to ensure financial integrity.

- Technology Investment: Expenses for systems related to fraud prevention, AML, and KYC.

- Reporting and Data Management: Costs associated with generating and submitting regulatory reports.

China Zheshang Bank's cost structure is anchored by interest expenses on deposits, which are crucial for funding its operations. The bank also incurs significant costs related to its substantial employee base, with 25,226 employees as of December 31, 2024. Additionally, maintaining a widespread network of 368 branches as of late 2023 contributes considerably to its overhead through rent, utilities, and staffing. Investments in technology and digital development are also major expenditures, essential for staying competitive in the fintech era.

| Cost Category | Significance | Examples |

| Interest Expense | Primary funding cost | Interest paid on customer deposits |

| Personnel Costs | Significant operational expense | Salaries and benefits for 25,226 employees (as of Dec 31, 2024) |

| Branch Network Maintenance | Ongoing overhead | Rent, utilities, and staffing for 368 branches (as of Dec 31, 2023) |

| Technology & Digital Development | Essential for competitiveness | IT modernization, fintech solutions, digital banking platforms |

| Regulatory Compliance & Risk Management | Mandatory expenditure | Compliance personnel, audits, fraud detection systems |

Revenue Streams

China Zheshang Bank's core revenue generation hinges on interest income derived from its extensive portfolio of loans and advances. This financial engine fuels its operations by earning interest from corporate clients, small and medium-sized enterprises (SMEs), and individual retail customers. In 2024, this segment remained the dominant contributor to its overall operating income, reflecting the bank's fundamental role in providing credit and capital.

China Zheshang Bank generates significant revenue from its fee-based services, which include corporate intermediary services, personal intermediary services, bank card fees, and investment banking fees. This strategy diversifies its income streams, reducing reliance solely on traditional lending operations.

In 2023, the bank reported that its net fee and commission income reached RMB 12.48 billion, a notable increase from previous periods. This growth highlights the increasing importance of these non-interest income sources for the bank's overall financial health and stability.

China Zheshang Bank generates significant revenue from its wealth and asset management divisions. These fees are primarily earned through providing tailored wealth management solutions and actively managing client assets. This includes earning commissions on sales of various investment products, notably funds of funds (FOFs).

In 2024, the bank's focus on expanding its fee-based income streams through wealth management played a crucial role in diversifying its revenue. This strategy aims to reduce reliance on traditional interest income, enhancing financial stability and profitability. The growth in assets under management directly translates into increased fee revenue.

Treasury and Financial Market Trading Income

China Zheshang Bank generates significant revenue from its treasury and financial market trading activities. This includes income derived from managing the bank's liquidity and investments, such as gains from money market transactions and its portfolio of bond investments. The bank actively trades in financial derivatives, which can provide opportunities for profit but also carry inherent risks.

Further diversification of revenue within this segment comes from foreign exchange and precious metals trading. These operations capitalize on market volatility and currency fluctuations to generate income. For instance, in 2023, China Zheshang Bank reported a substantial increase in its net interest income, partly driven by its treasury operations.

- Treasury Operations: Income from managing liquidity and investments in money markets and bonds.

- Financial Derivatives: Revenue generated through trading in various financial derivative instruments.

- Foreign Exchange Trading: Profits earned from buying and selling foreign currencies.

- Precious Metals Trading: Income from transactions involving gold, silver, and other precious metals.

Interbank and Other Financial Services Income

China Zheshang Bank generates revenue through interbank activities, including lending and borrowing between financial institutions. This segment also encompasses income from other financial services that don't fit neatly into their primary business lines.

Additional revenue streams for the bank include dividends received from its investment portfolio. These earnings contribute to the bank's overall financial performance, diversifying its income sources beyond traditional lending.

- Interbank Lending: Revenue earned from providing liquidity to other financial institutions.

- Other Financial Services: Income from services like wealth management, advisory, and other non-core banking activities.

- Investment Income: Dividends and potentially capital gains from the bank's holdings in other companies or financial instruments.

- Miscellaneous Income: Any other income not specifically classified, such as fees for specific transactions or services.

For instance, in 2023, China Zheshang Bank reported a notable portion of its non-interest income stemming from fee and commission business, which often includes income from these diverse financial services.

China Zheshang Bank's revenue streams are diverse, with a primary reliance on net interest income from its extensive loan portfolio. This core business is complemented by significant income from fee and commission services, which are increasingly important for diversification. Wealth and asset management, treasury operations, and interbank activities also contribute substantially.

In 2024, the bank continued to emphasize fee-based income, particularly from wealth management, to reduce its dependence on traditional lending. This strategic shift aims to bolster profitability and financial stability through varied revenue sources.

The bank's treasury operations, including financial market trading and foreign exchange, provide additional avenues for income generation. These activities, while carrying inherent risks, capitalize on market dynamics to enhance overall financial performance.

| Revenue Stream | Key Activities | 2023 Contribution (Illustrative) |

| Net Interest Income | Loans and advances to customers | Dominant contributor |

| Fee and Commission Income | Corporate and personal intermediary services, bank card fees, investment banking | RMB 12.48 billion (net) |

| Wealth and Asset Management | Tailored wealth solutions, asset management fees, fund sales | Growing contributor, driven by AUM growth |

| Treasury Operations | Money markets, bond investments, financial derivatives trading | Supports net interest income and provides trading gains |

| Interbank Activities | Interbank lending, other financial services | Diversifies income beyond direct customer lending |

Business Model Canvas Data Sources

The China Zheshang Bank Business Model Canvas is meticulously constructed using comprehensive financial disclosures, extensive market research reports, and detailed internal operational data. These diverse sources ensure a robust and accurate representation of the bank's strategic framework.