China Yangtze Power Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Yangtze Power Bundle

China Yangtze Power's marketing strategy is a fascinating case study in leveraging a powerful product – clean, reliable hydropower – within a dynamic energy market. Their approach to pricing, distribution, and promotion is meticulously crafted to maintain market leadership and foster sustainable growth.

Uncover the strategic brilliance behind China Yangtze Power's product offerings, pricing architecture, distribution channels, and communication mix. This comprehensive analysis provides actionable insights and ready-to-use formatting, perfect for anyone seeking to understand and replicate their success.

Product

China Yangtze Power's core offering is electricity generation from its vast hydropower infrastructure, notably the Three Gorges and Gezhouba Dams. This involves comprehensive water resource management and the efficient conversion of water's kinetic energy into electrical power.

The company's primary goal is to optimize the electricity output from these colossal renewable energy assets, fulfilling significant national energy requirements. In 2023, China Yangtze Power reported a total power generation of 222.1 billion kilowatt-hours, with hydropower accounting for the majority of this output.

China Yangtze Power's clean energy offering is a cornerstone of its marketing mix, directly addressing China's ambitious decarbonization targets. This critical product, primarily hydropower, offers a vital alternative to fossil fuels, supporting the nation's push towards carbon neutrality.

In 2024, the company's clean energy corridor demonstrated its impact, generating a record 295.9 billion kWh. This output is equivalent to saving approximately 89.24 million tons of standard coal, significantly reducing carbon emissions by over 240 million tons.

China Yangtze Power's stable power supply is a fundamental product feature, ensuring consistent electricity delivery across diverse Chinese regions. Its extensive network of hydropower stations, particularly the six on the Yangtze River operating in cascade, underpins this reliability.

This large-scale hydropower infrastructure enables consistent base-load power generation, a critical element for maintaining grid stability and meeting the unwavering energy needs of a vast economy. For instance, in 2023, China Yangtze Power reported a total installed capacity of 72,765.69 MW, with hydropower comprising a significant portion, contributing to its dependable output.

Grid Support and Ancillary Services

China Yangtze Power's extensive hydropower portfolio is a crucial provider of grid support and ancillary services, going beyond simple electricity generation. These services, including frequency regulation and voltage support, are becoming increasingly vital for grid stability, especially as China rapidly expands its renewable energy capacity. For instance, by the end of 2023, China's installed renewable energy capacity reached 1.46 billion kilowatts, a significant increase that demands flexible resources like hydropower.

The inherent flexibility of hydropower allows China Yangtze Power to quickly adjust output, acting as a buffer against the variability of solar and wind power. This capability is essential for maintaining grid balance. In 2024, China's national grid is undergoing significant reforms to better integrate and compensate for these ancillary services, recognizing their growing importance in a decarbonizing energy landscape.

- Frequency Regulation: Hydropower's rapid response capabilities help stabilize grid frequency, a critical service as renewable intermittency increases.

- Voltage Support: Maintaining stable voltage levels across the grid is another key ancillary service provided by these large-scale hydro assets.

- Black Start Capabilities: In the event of a grid outage, hydropower plants can restart themselves and supply power to other parts of the grid, a vital emergency function.

- Market Value: As China's ancillary services markets mature, these capabilities represent a growing revenue stream beyond energy sales.

Water Resource Management

China Yangtze Power's dams, particularly the Three Gorges, are pivotal for water resource management, extending its product value beyond mere electricity generation. These structures offer critical flood control capabilities, safeguarding downstream regions. In 2023, the Three Gorges Project played a crucial role in managing floodwaters, a testament to its ongoing importance in disaster prevention along the Yangtze River.

Beyond flood mitigation, the company's operations significantly improve navigation on the Yangtze River, facilitating trade and economic activity. This enhancement of the waterway directly supports the logistics and supply chains of numerous industries. The improved navigability contributes to reduced transportation costs and increased efficiency for businesses operating within the Yangtze economic belt.

Furthermore, the dams contribute to water supply for agricultural and industrial use, especially during drier periods. This reliable water source is essential for maintaining agricultural productivity and supporting industrial processes in the basin. The project's role in water resource utilization underscores its contribution to regional economic stability and development.

The integrated approach to water management creates a clean energy corridor that benefits:

- Flood Control: Mitigating risks and protecting communities and infrastructure.

- Navigation Improvement: Enhancing shipping capacity and reducing transit times.

- Water Resource Utilization: Ensuring supply for agriculture and industry.

- Ecological Security: Supporting the health and sustainability of the Yangtze River ecosystem.

China Yangtze Power's product is multifaceted, extending beyond electricity generation to encompass crucial water resource management services. Its core offering of clean hydropower, totaling 222.1 billion kWh in 2023 and a record 295.9 billion kWh in 2024, directly supports China's decarbonization goals. This clean energy is complemented by essential grid support services like frequency and voltage regulation, vital for integrating China's growing renewable capacity, which reached 1.46 billion kilowatts by the end of 2023.

The company's extensive hydropower infrastructure, including the Three Gorges Dam, provides significant flood control, protecting downstream areas. In 2023, the Three Gorges Project demonstrated its critical role in flood management. Furthermore, operations enhance Yangtze River navigation, boosting trade, and ensure water supply for agriculture and industry, underscoring the broad economic and societal value of its product portfolio.

| Product Aspect | Description | 2023 Data Point | 2024 Data Point | Key Benefit |

|---|---|---|---|---|

| Clean Electricity Generation | Hydropower output | 222.1 billion kWh | 295.9 billion kWh | Supports decarbonization targets |

| Grid Support Services | Ancillary services (frequency, voltage regulation) | Integral to grid stability | Increasingly vital with renewable integration | Enhances grid reliability |

| Water Resource Management | Flood control, navigation, water supply | Three Gorges Dam managed floodwaters | Improved navigation benefits trade | Mitigates disaster risk, facilitates commerce |

What is included in the product

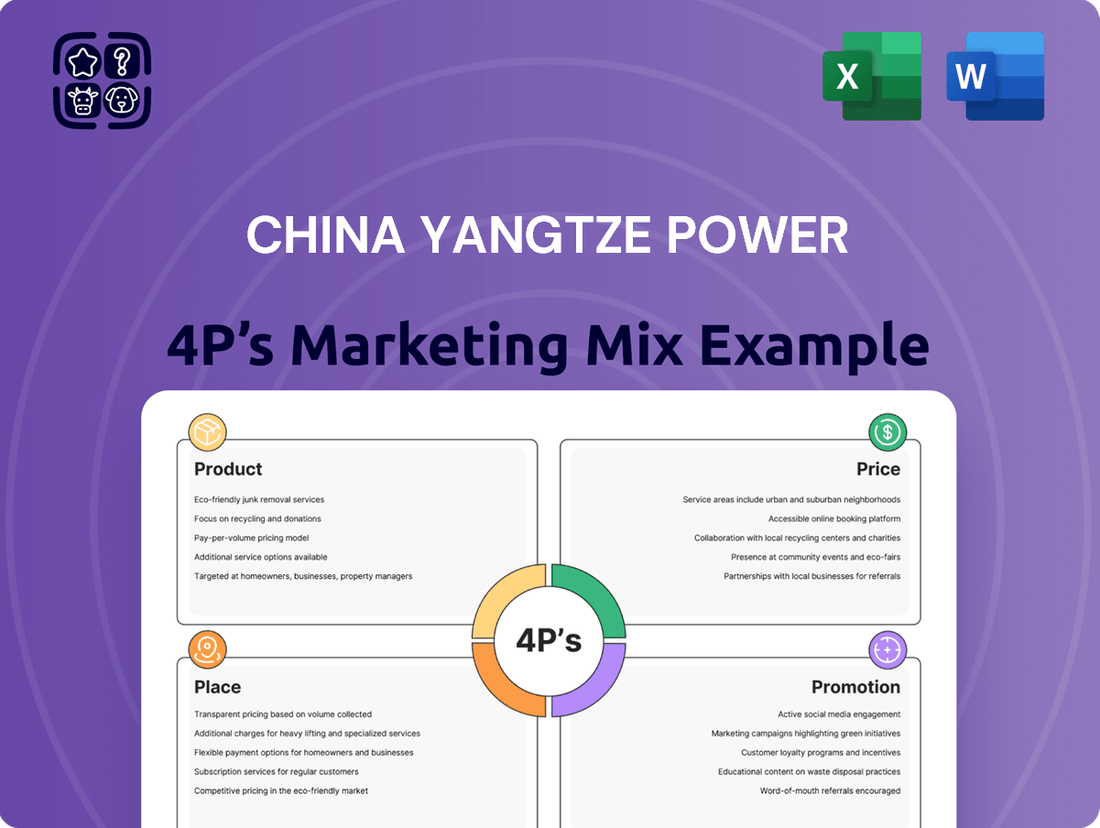

This analysis provides a comprehensive 4P marketing mix overview for China Yangtze Power, examining its product offerings, pricing strategies, distribution channels, and promotional activities within the competitive energy market.

This analysis simplifies China Yangtze Power's 4Ps marketing strategy, addressing the pain point of complex market positioning by offering a clear, actionable framework.

Place

China Yangtze Power's electricity primarily flows through China's extensive national grid, managed by the State Grid Corporation of China (SGCC) and China Southern Power Grid. This vast network is crucial for delivering power from its significant hydropower facilities to a wide consumer base. In 2023, SGCC continued its substantial investments, aiming to improve grid stability and integrate more renewable energy sources, which directly benefits China Yangtze Power's distribution capabilities.

China Yangtze Power's 'Place' in its marketing mix is the direct sale of electricity to the national grid. This business-to-business (B2B) approach bypasses retail channels, with the company's primary transaction points being national electricity dispatch and trading centers. These centers then manage the distribution to provincial grids and end consumers.

By the close of 2025, China aims to establish a unified national power trading market. This significant development is designed to modernize the country's electricity sector, fostering greater transparency and encouraging competition among power generators and distributors.

China Yangtze Power's strategic placement of its hydropower stations on the Yangtze River's main current is a cornerstone of its 'place' strategy. This includes major facilities like the Three Gorges and Gezhouba dams, which leverage ideal hydrological conditions for substantial power output.

These prime locations also ensure efficient electricity transmission to key consumption hubs across China. The company has developed a significant 'clean energy corridor' by consolidating six massive hydropower stations along this vital waterway, optimizing its operational reach and market access.

Ultra-High Voltage (UHV) Transmission Lines

China Yangtze Power's distribution strategy is heavily underpinned by ultra-high voltage (UHV) transmission lines. These lines are essential for moving substantial amounts of electricity across vast distances, significantly reducing energy loss. This focus on UHV infrastructure ensures efficient power delivery to meet growing demand.

The State Grid is a key player, driving investment in UHV network expansion. Their efforts aim to boost grid capacity and facilitate the integration of renewable energy sources. This strategic development is vital for modernizing China's power infrastructure and supporting a cleaner energy future.

- UHV Lines Crucial for Long-Distance, Low-Loss Transmission

- State Grid Investing Heavily in UHV Network Expansion

- Goal: Enhance Grid Capacity and Renewable Energy Integration

- In 2024, State Grid Completed 3 New UHV Lines, Reaching a Total of 38

Inter-Provincial and Regional Dispatch

China Yangtze Power's 'place' in its marketing mix extends to sophisticated inter-provincial and regional dispatch systems. These mechanisms are crucial for balancing electricity supply and demand across China's vast geography, ensuring power generated in surplus regions reaches areas with higher demand. This optimizes the utilization of resources and enhances overall grid efficiency.

Inter-provincial power transactions are set to continue operating under established policies. However, a significant shift is coming for intra-provincial transactions involving new energy electricity. Starting June 1, 2025, these new energy sources will fully integrate into and participate within the power market framework.

- Inter-Provincial Dispatch: Balances supply and demand across different Chinese provinces, optimizing resource allocation.

- Grid Efficiency: Ensures power generated in one region can be effectively utilized in another.

- Policy Continuity: Inter-provincial transactions will continue under existing policies.

- New Market Participation: From June 1, 2025, intra-provincial new energy electricity will fully participate in the power market.

China Yangtze Power's 'Place' strategy centers on its strategically located hydropower stations along the Yangtze River, including the Three Gorges Dam, optimizing power generation and transmission. Its primary sales channel is direct to the national grid, managed by entities like State Grid Corporation of China (SGCC). By 2025, China aims for a unified national power trading market, enhancing transparency and competition.

The company leverages ultra-high voltage (UHV) transmission lines for efficient, long-distance power delivery, a network actively expanded by SGCC. In 2024, SGCC completed 3 new UHV lines, bringing their total to 38, supporting grid capacity and renewable energy integration.

Sophisticated inter-provincial and regional dispatch systems balance supply and demand across China, ensuring optimal resource utilization. While inter-provincial transactions continue under existing policies, new energy electricity within provinces will fully integrate into the power market framework from June 1, 2025.

| Key Infrastructure | 2024 UHV Lines (SGCC) | Market Integration Date |

|---|---|---|

| Yangtze River Hydropower Stations | 3 New Lines Completed | June 1, 2025 (New Energy) |

| UHV Transmission Network | Total 38 Lines | Unified National Market by 2025 |

| National Grid Dispatch | Supports Renewable Integration | Inter-Provincial Policy Continuity |

Full Version Awaits

China Yangtze Power 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of China Yangtze Power's 4P's Marketing Mix is fully prepared and ready for your immediate use.

Promotion

China Yangtze Power (CYPC) leverages corporate communications and public relations to reinforce its image as a key player in China's national development, particularly focusing on its significant contributions to clean energy generation. In 2024, the company continued to emphasize its role in environmental protection and economic stability through transparent official announcements and proactive media engagement, aiming to build trust with stakeholders.

The company's public relations efforts in 2024 highlighted its commitment to sustainable development, showcasing its hydropower projects' environmental benefits and its role in ensuring energy security. CYPC actively communicated its investments in technological advancements for cleaner energy production, underscoring its dedication to a greener future.

Furthermore, CYPC's engagement in social welfare undertakings and community development initiatives in 2024 was a prominent aspect of its public relations strategy. These activities, often highlighted through corporate social responsibility reports and local media outreach, demonstrated the company's commitment to contributing positively to the communities where it operates, fostering goodwill and strengthening its social license.

China Yangtze Power actively engages the financial community through robust investor relations, encompassing detailed annual reports, timely financial disclosures, and informative investor briefings. These initiatives are designed to foster investor confidence and attract capital by showcasing strong financial results, operational excellence, and a commitment to corporate governance.

The company's dedication to transparency was evident with the release of its 2024 annual report on April 30, 2025. This report highlighted a significant achievement: a 19.36% year-over-year increase in net profit attributable to shareholders for the fiscal year 2024, underscoring the company's consistent growth and financial health.

China Yangtze Power's promotional activities are deeply integrated with national energy strategies, particularly China's ambitious goals for carbon peaking by 2030 and carbon neutrality by 2060. The company actively promotes the benefits of large-scale hydropower and clean energy, aligning its messaging with the government's push for a greener energy mix.

The company's advocacy efforts focus on shaping policies that support the growth of hydropower and other renewable energy sources, solidifying its role in China's ongoing energy transition. This strategic alignment ensures its business objectives resonate with national priorities, fostering a supportive regulatory environment.

With China's new Energy Law coming into effect on January 1, 2025, which champions renewable energy and strengthens energy security, China Yangtze Power is well-positioned to leverage these policy shifts. This legal framework provides a favorable backdrop for the company's continued expansion and promotion of clean energy solutions, reinforcing its market leadership.

Showcasing Technological Advancements

China Yangtze Power actively showcases its technological prowess in large-scale hydropower, emphasizing advancements in dam construction and generation efficiency. This promotion positions them as a leader in innovative energy solutions. For instance, their commitment to smart grid integration was evident in their ongoing projects, aiming to enhance operational intelligence and reliability.

The company vigorously advances technological innovation as a core strategic pillar. This focus is crucial for maintaining their competitive edge in the evolving energy landscape. Their investments in research and development are geared towards improving power generation efficiency and exploring new sustainable energy technologies.

- Technological Leadership: Highlighting expertise in large-scale hydropower, dam construction, and generation efficiency.

- Smart Grid Integration: Showcasing advancements in smart grid technology for enhanced operational intelligence.

- Strategic Innovation: Vigorously pursuing technological innovation as a key strategic objective.

- Reliable Provider: Positioning as a technologically advanced and dependable energy provider.

Sustainability and ESG Reporting

China Yangtze Power is increasingly highlighting its dedication to sustainability and ESG principles. This focus aims to attract stakeholders who prioritize responsible corporate behavior by transparently reporting on environmental impact, social contributions, and governance. For instance, in 2023, the company reported a significant reduction in carbon emissions intensity, contributing to China's broader green energy goals.

The company's strategy integrates its own growth with societal sustainable development, placing a strong emphasis on low-carbon initiatives and environmental stewardship. This commitment is reflected in their ongoing investments in renewable energy projects, which are crucial for achieving national climate targets.

Key aspects of China Yangtze Power's sustainability efforts include:

- Investment in Hydropower: Continuing to leverage its core strength in hydropower, a renewable energy source, contributing to a lower carbon footprint.

- Environmental Protection Measures: Implementing robust measures to minimize the environmental impact of its operations, including biodiversity protection around its facilities.

- Social Responsibility Programs: Engaging in community development initiatives and ensuring fair labor practices throughout its value chain.

- Transparent ESG Reporting: Adhering to international ESG reporting standards to provide stakeholders with clear and comprehensive data on its performance.

China Yangtze Power actively promotes its role in national energy security and the transition to cleaner energy sources. The company highlights its significant contributions to China's carbon reduction goals, aligning its messaging with national policy. Their promotional efforts emphasize technological innovation in hydropower and smart grid integration, positioning them as a reliable and advanced energy provider.

The company's commitment to sustainability and ESG principles is a key promotional focus, aiming to attract environmentally conscious investors. By reporting on reduced carbon emissions intensity and investing in renewable projects, CYPC demonstrates its dedication to responsible corporate behavior and societal development. These efforts underscore their alignment with national climate targets and a greener energy future.

China Yangtze Power leverages its financial performance, such as the 19.36% year-over-year increase in net profit for 2024, to bolster investor confidence. Through transparent reporting and investor briefings, they showcase operational excellence and strong corporate governance, attracting capital and reinforcing their market leadership.

The company's promotional strategy is deeply intertwined with China's energy policies, particularly the new Energy Law effective January 1, 2025, which champions renewables. This advocacy for hydropower and clean energy growth solidifies their position within the evolving energy landscape and fosters a supportive regulatory environment.

| Key Promotional Focus | Supporting Data/Initiatives (2024/2025) | Impact/Objective |

| National Energy Security & Clean Energy Transition | Alignment with China's carbon peaking (2030) and neutrality (2060) goals; emphasis on hydropower's role. | Reinforce national development contribution; attract stakeholders supporting green initiatives. |

| Technological Innovation & Smart Grid | Showcasing advancements in hydropower efficiency and smart grid integration projects. | Position as a leader in advanced, reliable energy solutions. |

| Sustainability & ESG Principles | Reporting reduced carbon emissions intensity (e.g., 2023 data); investments in renewable projects. | Attract ESG-focused investors; demonstrate commitment to responsible corporate behavior. |

| Financial Performance & Investor Relations | 19.36% YoY net profit increase (FY2024); transparent annual reports and investor briefings. | Foster investor confidence; attract capital; showcase operational excellence. |

Price

China Yangtze Power's electricity pricing is significantly shaped by government-regulated tariffs, a common practice for essential utilities in China. These tariffs are typically set by national and provincial authorities, aiming to balance energy security with consumer affordability. For instance, in 2023, the average on-grid electricity price for thermal power in China was around 0.45 RMB per kWh, though this varies by region and fuel type.

While historical pricing has been heavily influenced by these regulations, China is progressively moving towards a more market-oriented system for new energy sources. This shift aims to incorporate market dynamics into pricing for renewables like hydropower, potentially leading to greater price flexibility in the future. The state's role in setting benchmarks, however, is expected to persist, particularly for ensuring grid stability and managing the transition.

China's shift towards market-based pricing for new energy electricity, beginning June 1, 2025, is a significant development for China Yangtze Power. This means that all electricity from new energy sources, including hydropower, will generally enter power market trading, with prices dictated by supply and demand dynamics. This transition is expected to increase price volatility but also offer opportunities for more competitive revenue generation.

A substantial part of China Yangtze Power's electricity is sold through long-term power purchase agreements (PPAs) with grid companies, ensuring steady revenue. These PPAs offer a buffer against market volatility, though recent policy shifts encourage more direct market engagement.

Projects operational before June 1, 2025, will continue under existing PPA terms. However, newer projects will face annual competition for their place within this pricing mechanism, reflecting a move towards market-based pricing for future capacity.

Cost-Plus and Investment Recovery Considerations

China Yangtze Power's pricing strategy inherently incorporates cost-plus and investment recovery, acknowledging the immense capital required for hydropower infrastructure. The company must generate revenue to cover operational expenses, manage debt obligations, and secure a fair return on its substantial investments.

This approach is crucial for the long-term sustainability and expansion of its power generation capabilities. For context, the State Grid Corporation of China, a major player in the energy sector, is projected to invest a record-breaking 650 billion yuan (approximately $89 billion) in 2025, underscoring the significant capital demands in the industry.

- Capital Intensive Operations: Hydropower projects require massive upfront investment in construction and ongoing maintenance.

- Revenue Generation Focus: Pricing must ensure recovery of operational costs, debt servicing, and investor returns.

- Future Development Funding: Adequate returns are essential for reinvestment in new projects and asset upgrades.

- Industry Investment Trends: State Grid's planned 2025 investment of over 650 billion yuan highlights the sector's capital needs.

Influence of National Energy Policies

National energy policies are a significant driver of electricity pricing for companies like China Yangtze Power. Government directives prioritizing clean energy and grid upgrades directly shape how electricity is valued and sold.

Policies designed to curb energy use and carbon emissions, while boosting renewable sources, often translate into favorable pricing structures for clean energy producers. For instance, China's commitment to increasing non-fossil energy consumption to 20% by 2025, as outlined in its 2024-2025 action plan for energy saving and carbon reduction, signals a market environment that rewards companies like China Yangtze Power for their clean energy generation.

- Clean Energy Incentives: Policies favoring renewable energy sources can lead to higher tariffs or subsidies for clean power generators.

- Grid Modernization: Investments in grid infrastructure can impact the cost of transmitting and distributing electricity, influencing overall pricing.

- Carbon Reduction Goals: National targets for CO2 intensity reduction often include mechanisms that make fossil fuel-based generation more expensive, indirectly benefiting cleaner alternatives.

- Energy Efficiency Measures: Mandates for energy efficiency can reduce overall demand, potentially affecting the price dynamics for all energy providers.

China Yangtze Power's pricing is evolving from regulated tariffs to market-based mechanisms for new energy sources starting June 1, 2025. This transition, driven by national policies, means hydropower will increasingly be traded based on supply and demand, potentially increasing revenue opportunities and price volatility.

Existing long-term power purchase agreements (PPAs) provide revenue stability for older projects, while newer ones will face annual market competition. The company’s pricing must also ensure recovery of significant capital investments, with the sector seeing substantial investment, like State Grid's planned 650 billion yuan in 2025.

National policies supporting clean energy, such as the goal for non-fossil energy to reach 20% by 2025, create a favorable environment for hydropower. These policies can lead to better pricing structures for renewable energy generation.

| Pricing Factor | 2023/2024 Context | 2025 Outlook |

|---|---|---|

| Regulated Tariffs | Dominant for existing capacity, average thermal power around 0.45 RMB/kWh. | Continues for pre-June 1, 2025 projects. |

| Market Trading | Emerging for new energy sources. | Mandatory for all new energy sources from June 1, 2025, based on supply/demand. |

| Power Purchase Agreements (PPAs) | Provide steady revenue for operational projects. | Continue for pre-June 1, 2025 projects; newer projects face annual market competition. |

| Capital Recovery | Essential due to high infrastructure costs. | Pricing must support continued investment, with sector investments like State Grid's 650 billion yuan in 2025. |

| Policy Influence | Incentives for clean energy, e.g., non-fossil energy target of 20% by 2025. | Continued policy support for renewables expected to influence pricing favorably. |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for China Yangtze Power leverages official company reports, investor relations disclosures, and industry-specific publications to detail product offerings, pricing strategies, distribution networks, and promotional activities. We also incorporate data from energy market analyses and regulatory filings to ensure a comprehensive view.