China Yangtze Power Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

China Yangtze Power Bundle

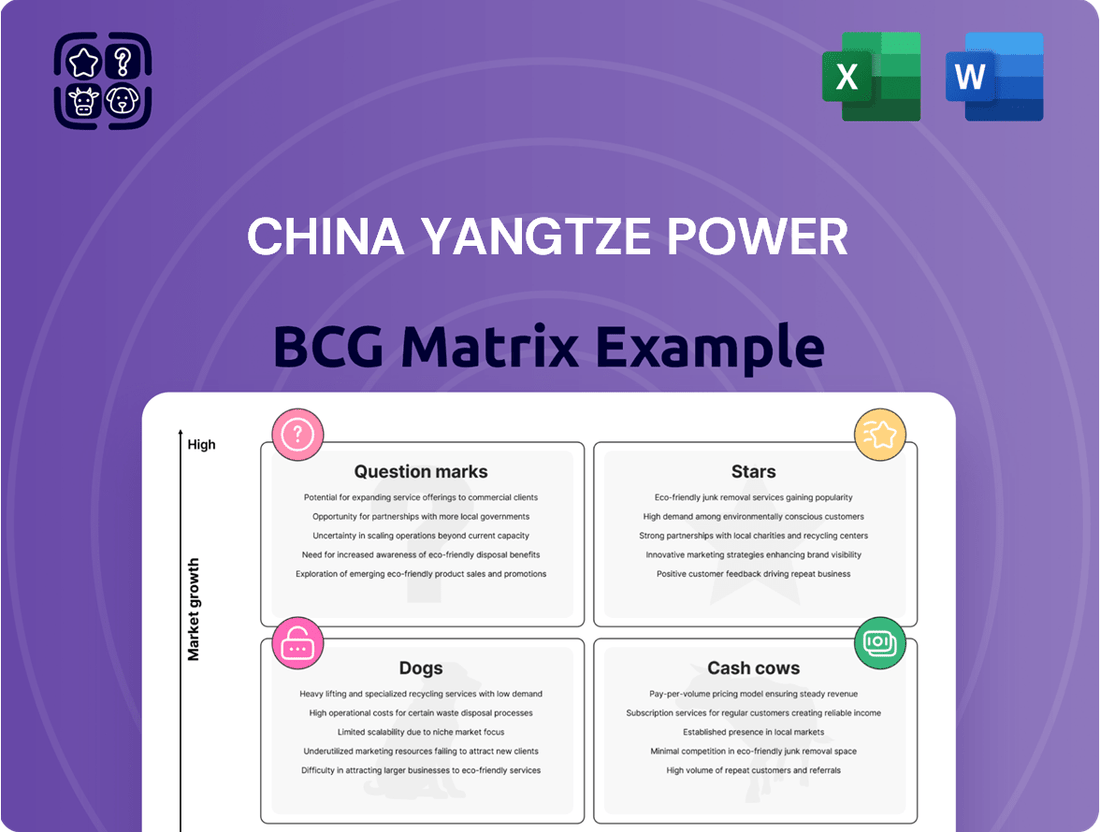

Curious about China Yangtze Power's strategic positioning? This preview offers a glimpse into their product portfolio's potential, highlighting areas of growth and stability. To fully grasp their competitive advantage and identify key investment opportunities, dive deeper into the complete BCG Matrix.

Unlock the full strategic potential of China Yangtze Power by purchasing the complete BCG Matrix. Gain a comprehensive understanding of their "Stars," "Cash Cows," "Dogs," and "Question Marks" to make informed decisions and drive future success.

Don't miss out on critical insights into China Yangtze Power's market performance. The full BCG Matrix provides a detailed breakdown, enabling you to pinpoint areas for resource allocation and strategic development. Secure your copy for actionable intelligence.

Stars

China Yangtze Power is expanding its pumped storage hydropower (PSH) portfolio, exemplified by the HouSihe Pumped Storage Power Station in Henan Province. This project, with an approved investment of RMB 8.264 billion (USD 1.14 billion), is slated for full commercial operation by Q2 2030, highlighting significant future capacity additions.

The broader Chinese market shows robust growth in PSH, with 2024 seeing 14.4 GW of new hydropower capacity added, more than half of which is PSH. This trend underscores the strategic importance of PSH for grid stability and renewable energy integration, positioning new projects like HouSihe as key contributors to this expanding sector.

China Yangtze Power (CYPC) is actively pursuing a 'water-wind-electricity integration' strategy through its subsidiary, China Yangtze Power New Energy Co., Ltd., established in 2021. This initiative is central to CYPC's renewable energy development, aiming to synergize hydropower with wind power in dedicated energy bases.

This strategic focus aligns with China's ambitious green transition goals, a commitment underscored by its leading role in global renewable energy. In 2024, China's renewable energy capacity represented over 40% of the world's total, demonstrating substantial investment and progress in this sector.

China Yangtze Power is strategically investing in advanced hydropower technologies, evidenced by its increased R&D spending. This focus is crucial for maintaining its dominant position in hydropower while also identifying new avenues for growth. For instance, in 2023, the company's R&D expenditure saw a significant uptick, reflecting its commitment to innovation.

Expansion into High-Growth International Renewable Markets

China Yangtze Power (CYPC) is actively pursuing expansion into high-growth international renewable energy markets, positioning these ventures as potential Stars in its BCG Matrix. This strategy is evident in its ongoing exploration of new overseas hydropower opportunities, building on its existing international presence. For instance, while CYPC acquired Peru's largest electricity distribution company in 2020, its forward-looking statements highlight a continued drive for international growth.

These international ventures are characterized by significant investment and a focus on establishing or expanding market share in regions with strong renewable energy demand. The company's commitment to these markets suggests a belief in their future profitability and growth potential. CYPC's approach indicates a proactive strategy to diversify its revenue streams and capitalize on global trends towards sustainable energy sources.

- International Focus: CYPC's stated intention to explore new overseas hydropower business opportunities underscores its strategic move into international markets.

- Growth Potential: These ventures are targeted at high-growth renewable energy markets, suggesting a strong potential for market share expansion.

- Strategic Investment: The company's acquisition of Peru's largest electricity distributor in 2020 demonstrates a tangible commitment to international energy infrastructure.

Digitalization and Smart Integrated Energy Solutions

China Yangtze Power (CYPC) is actively expanding its presence in the burgeoning integrated smart energy market. This strategic move involves innovating urban green integrated energy management systems, exemplified by the deployment of an industrial Internet platform across its cascade hydropower stations. This initiative positions CYPC to capitalize on the rapid evolution of the energy sector, particularly in areas like energy management and efficiency services, which are experiencing significant growth.

The company's focus on digitalization and smart solutions is a key driver for future revenue streams. By integrating advanced technologies into its operations, CYPC aims to enhance operational efficiency and unlock new service offerings. For instance, the industrial Internet platform facilitates real-time data analysis and predictive maintenance for its hydropower assets, leading to optimized energy generation and reduced downtime. This technological advancement is crucial for CYPC to maintain its competitive edge in a dynamic market.

CYPC's investment in smart integrated energy solutions aligns with global trends toward decarbonization and grid modernization. The company's efforts to develop innovative urban green energy models are particularly noteworthy. In 2023, China's renewable energy sector saw substantial growth, with smart grid technologies playing an increasingly vital role in integrating these sources. CYPC's strategy directly taps into this trend, aiming to become a leader in providing comprehensive energy solutions that are both efficient and environmentally sustainable.

The integrated smart energy market presents significant growth opportunities for CYPC:

- Market Expansion: CYPC is pushing for broader adoption of integrated smart energy solutions.

- Innovation in Models: Development of urban green integrated energy housekeeping services is a key focus.

- Digital Infrastructure: Deployment of an industrial Internet platform across hydropower stations enhances operational intelligence.

- Growth Capture: The rapidly evolving smart energy market offers substantial potential for growth in energy management and efficiency services.

China Yangtze Power's international ventures, particularly in overseas hydropower, are positioned as Stars within its BCG Matrix. These initiatives are characterized by significant investment and a focus on expanding market share in high-growth renewable energy markets globally. The company's acquisition of Peru's largest electricity distributor in 2020 exemplifies this strategic international push, indicating a strong belief in the future profitability and growth potential of these ventures.

These international operations are expected to drive future revenue and contribute significantly to CYPC's overall growth trajectory. By diversifying its geographical footprint and capitalizing on global renewable energy demand, CYPC aims to solidify its position as a leading international energy player.

The company's strategic intent to explore new overseas hydropower business opportunities, coupled with its existing international presence, highlights its commitment to these high-potential markets.

The global renewable energy market continues to expand, with significant opportunities for companies like CYPC to invest and grow. For example, in 2023, global renewable energy capacity additions reached record levels, underscoring the favorable market conditions for such investments.

What is included in the product

This BCG Matrix analysis categorizes China Yangtze Power's business units, guiding investment and divestment decisions.

China Yangtze Power's BCG Matrix offers a clear, visual roadmap, simplifying complex portfolio decisions for executives.

Cash Cows

The Three Gorges Dam, a colossal feat of engineering and the world's largest hydropower project, has been a consistent powerhouse for China Yangtze Power (CYPC). By December 2024, it had generated an astounding over 1.7 trillion kilowatt-hours (kWh) of electricity, a testament to its enduring operational capacity. This mature asset represents a significant and stable source of revenue for CYPC, embodying the characteristics of a cash cow within the company's portfolio.

The Gezhouba Dam, China's pioneering large-scale water control project on the Yangtze River, has demonstrated remarkable operational longevity, safely functioning for over four decades. By 2021, it had already produced an impressive 600 billion kilowatt-hours of electricity. This sustained and dependable performance solidifies its status as a consistent revenue generator and a vital cash cow for China Yangtze Power.

China Yangtze Power's (CYPC) established hydropower stations, such as Xiluodu, Xiangjiaba, Wudongde, and Baihetan, function as significant cash cows. These facilities, forming the world's largest clean energy corridor, boast a combined installed capacity of 71.695 million kilowatts.

The consistent, large-scale power generation from these mature assets translates into robust and reliable cash flows for CYPC. This operational stability makes them a foundational element of the company's financial strength.

Stable Domestic Hydropower Generation and Sales

China Yangtze Power Company (CYPC) firmly anchors its operations in the stable generation and sale of electricity from its significant domestic hydropower assets. This segment represents a cornerstone of their business, providing consistent revenue streams.

In the first half of 2025, CYPC reported a notable 5.01% year-on-year increase in gross electricity generation from its domestic cascade hydropower projects. This growth underscores the operational efficiency and continued productivity of these mature assets, solidifying their status as a cash cow.

- Stable Revenue Generation: Hydropower projects offer predictable cash flows due to long-term power purchase agreements and relatively stable operational costs.

- Operational Efficiency: The 5.01% increase in generation in H1 2025 highlights effective management and optimal utilization of existing infrastructure.

- Market Dominance: CYPC's extensive domestic hydropower portfolio positions it as a key player in China's energy market, ensuring consistent demand for its output.

- Low Marginal Costs: Once established, hydropower plants have very low operating costs, contributing to high profit margins and strong cash generation.

Consistent High Dividend Payouts

China Yangtze Power's consistent high dividend payouts are a hallmark of its Cash Cow status. The company announced its 2024 annual profit distribution, proposing a final cash dividend of RMB 7.33 per 10 shares. This translates to a substantial total payout of RMB 17,935,203,585.83, scheduled for distribution in July 2025.

These robust and regular dividend distributions underscore the company's ability to generate strong, consistent cash flow. This financial strength is a direct result of its mature, highly profitable assets, which reliably contribute to its bottom line.

- Consistent Profitability: The proposed RMB 7.33 per 10 shares dividend for 2024 reflects a stable and predictable earnings stream.

- Strong Cash Generation: The total proposed payout of over RMB 17.9 billion highlights the company's significant cash-generating capabilities from its core operations.

- Mature Asset Base: Yangtze Power's established and efficient infrastructure, primarily hydropower, supports its ability to consistently return value to shareholders.

- Shareholder Returns: The commitment to high dividend payouts demonstrates a focus on rewarding investors, a key characteristic of a Cash Cow.

China Yangtze Power's (CYPC) established hydropower stations, including the Three Gorges Dam, Gezhouba Dam, Xiluodu, Xiangjiaba, Wudongde, and Baihetan, are its core cash cows. These mature, highly efficient assets provide stable and substantial revenue streams for the company.

The consistent, large-scale power generation from these facilities translates into robust and reliable cash flows, solidifying their position as foundational elements of CYPC's financial strength and market dominance.

This strong cash generation is further evidenced by CYPC's commitment to shareholder returns, with a proposed 2024 final cash dividend of RMB 7.33 per 10 shares, totaling over RMB 17.9 billion, scheduled for July 2025.

| Asset | Operational Status | Contribution to Cash Flow |

| Three Gorges Dam | Mature, High Capacity | Significant & Stable |

| Gezhouba Dam | Long-standing, Reliable | Consistent Revenue |

| Xiluodu, Xiangjiaba, Wudongde, Baihetan | Established, High Capacity | Robust Cash Generation |

What You’re Viewing Is Included

China Yangtze Power BCG Matrix

The China Yangtze Power BCG Matrix preview you are viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently expect to download the complete BCG Matrix, optimized for immediate application in your business planning and decision-making processes.

Dogs

Within China Yangtze Power's portfolio, less efficient older minor assets would likely fall into the 'Dogs' category of the BCG Matrix. These are typically smaller, older hydropower facilities that are not part of the main, highly productive cascade systems. They may demand significant upkeep relative to their limited electricity generation, making them less profitable.

Such assets would exhibit a low market share in terms of power output and contribute very little to the company's overall profitability. For instance, if a facility generates only a fraction of a percent of China Yangtze Power's total output and requires substantial ongoing investment, it fits the 'dog' profile. These can become cash traps, consuming resources without generating adequate returns.

Underperforming Non-Core Legacy Investments within China Yangtze Power's (CYPC) portfolio would represent ventures outside its core hydropower business that have struggled to gain traction. These might include historical investments in sectors where CYPC lacked competitive advantage or faced intense market competition. For instance, if CYPC had invested in a technology startup in the early 2000s that never reached critical mass, it would fit here.

Such assets are characterized by low market share and minimal profitability, acting as a drag on overall company performance. They consume management attention and capital without generating substantial returns, hindering CYPC's ability to focus on its more promising business segments. For example, if these investments collectively represented 5% of CYPC's total assets but contributed less than 1% to its net profit in 2024, it would highlight their underperformance.

Divested non-strategic assets, like China Yangtze Power's (CYPC) sale of its stake in Hubei Qingneng Investment and Development Group Co., Ltd., often represent 'Dogs' in the BCG matrix. These are typically businesses with low market share and limited growth potential. CYPC's divestment of its 42.99% stake in Hubei Qingneng in 2024 exemplifies this strategy.

Smaller, Isolated Regional Distribution Networks with Low Growth

China Yangtze Power's (CYPC) smaller, isolated regional distribution networks, such as those listed in Wanzhou, Fuling, and Qianjiang in 2020, represent a segment with potential challenges.

These networks, operating in localized areas, may exhibit low growth potential and limited market penetration, impacting their ability to generate substantial returns. For instance, while CYPC’s overall revenue from power distribution and sales has seen growth, the specific performance of these smaller, isolated networks can lag.

If these segments consistently underperform against projections or industry benchmarks, they could be categorized as Dogs within the BCG Matrix. Specific financial data detailing the underperformance of these individual networks is not publicly available in recent reports, making precise quantification difficult.

- Limited Market Share: These regional networks often serve a small, geographically constrained customer base.

- Low Growth Prospects: The economic development and electricity demand in these specific regions might be stagnant or declining.

- Potential for Divestment: Underperforming Dog assets may be considered for divestment or restructuring to reallocate resources to more promising ventures.

Phased-Out or Stagnant Pilot Projects

Phased-out or stagnant pilot projects for China Yangtze Power would represent ventures that, despite initial investment, failed to achieve traction or economic viability. These are akin to question marks that never transitioned into stars or cash cows, instead becoming drains on resources. For instance, an experimental foray into a new renewable energy technology that proved too costly to scale or faced regulatory hurdles would fit here.

These projects, by definition, consumed cash without generating significant returns, impacting the company's overall profitability. While specific discontinued pilot projects for China Yangtze Power are not publicly detailed, the principle applies to any past experimental ventures that did not scale successfully or were deemed economically unviable, leading to their discontinuation. Such initiatives represent investments that yielded low returns and were subsequently de-prioritized.

- Hypothetical Example: A pilot project testing advanced tidal energy conversion technology in a specific coastal region of China, which, after initial trials, was found to have a high cost per megawatt-hour compared to existing sources.

- Resource Drain: This type of project would have consumed capital for research, development, and initial infrastructure, but without a clear path to profitability or market acceptance, it would be categorized as a cash user with low return potential.

- Strategic Re-evaluation: The decision to phase out such a project would stem from a strategic re-evaluation of its economic feasibility and alignment with the company's core competencies and market opportunities.

China Yangtze Power's 'Dogs' in the BCG Matrix likely encompass older, less efficient hydropower assets and underperforming legacy investments outside its core business. These segments have a low market share and contribute minimally to profitability, often acting as cash drains. For example, if a smaller regional distribution network consistently underperforms against industry benchmarks, it would fit this category.

Divested non-strategic assets, such as CYPC's sale of its stake in Hubei Qingneng Investment and Development Group Co., Ltd. in 2024, also represent 'Dogs'. These are typically businesses with low market share and limited growth prospects. Stagnant pilot projects that failed to achieve economic viability would also be classified here, consuming resources without generating significant returns.

These 'Dog' assets, while not generating substantial returns, might still require ongoing operational or maintenance expenditures. Their presence can dilute overall company performance and divert management attention from more lucrative ventures. CYPC's strategy likely involves identifying and managing these underperforming segments, potentially through divestment or restructuring.

For instance, while specific financial breakdowns for individual 'Dog' assets are not always public, the overall impact of such segments can be inferred from broader company performance metrics. If these segments collectively represent a notable portion of assets but contribute disproportionately little to net profit, their 'Dog' status is evident.

Question Marks

China Yangtze Power Company (CYPC) established its new energy business in 2021, specifically targeting the development of integrated 'water-wind-electricity' renewable energy bases. These projects represent a forward-looking strategy to capitalize on China's booming renewable energy sector.

Given that these integrated projects are relatively new, CYPC's market share within this niche is likely modest. The company is positioned to invest heavily to expand its footprint and achieve economies of scale, characteristic of early-stage ventures in a high-growth market.

China Yangtze Power (CYPC) is eyeing new overseas markets for renewable energy, particularly in hydropower and broader energy ventures. This strategic move goes beyond its existing Peruvian distribution asset, aiming to tap into high-growth international markets where its current presence is minimal.

These new market entries are inherently speculative, demanding significant capital investment to build a competitive foothold. For instance, as of early 2024, many emerging markets in Southeast Asia and Africa are seeing substantial growth in renewable energy infrastructure development, presenting both opportunities and challenges for new entrants.

China Yangtze Power is heavily investing in R&D for next-generation energy solutions, aiming to lead in areas like advanced hydropower efficiency and next-gen renewable integration. These ventures are characterized by significant upfront costs and a long road to potential profitability, embodying the high-risk, high-reward nature of Question Marks.

For instance, in 2024, the company allocated a substantial portion of its capital expenditure towards exploring novel energy storage technologies and advanced grid management systems. While these initiatives hold the promise of substantial future returns and market disruption, their commercial viability and market acceptance remain uncertain, placing them squarely in the Question Mark quadrant of the BCG matrix.

Development of AI-Powered Grid Dispatch Systems

China Yangtze Power (CYPC) is actively integrating AI-powered grid dispatch systems into its operations, exemplified by their use in new projects such as the HouSihe pumped storage station. This strategic move into advanced grid management technology positions CYPC within a rapidly evolving smart grid sector. The company has also established an industrial Internet platform to enhance efficiency across its cascade power stations, underscoring its commitment to digital transformation.

While this AI-driven dispatch technology represents a high-growth segment within the smart grid landscape, CYPC's specific market share in this niche area of software and system integration is likely still in its nascent stages. This focus on AI-powered dispatch aligns with broader industry trends toward more intelligent and responsive energy infrastructure.

- AI Integration: CYPC is deploying AI-powered dispatch systems in new developments like the HouSihe pumped storage station.

- Industrial Internet Platform: An industrial Internet platform has been implemented across CYPC's cascade power stations for improved operational efficiency.

- Market Position: CYPC is entering a high-growth area of smart grid technology, but its specific market share in AI dispatch systems is still developing.

- Strategic Focus: This development reflects CYPC's commitment to leveraging advanced technology for grid management and operational excellence.

Uncertain Outcomes of Broader Diversification Efforts

While China Yangtze Power's (CYPC) core hydropower business remains a stable cash cow, venturing into broader diversification, particularly in non-hydro renewables like direct solar or wind farm development, presents uncertain outcomes.

These new areas, though experiencing growth, are highly competitive, demanding significant capital investment and specialized expertise that CYPC may not yet possess. For instance, the global renewable energy market saw substantial growth in 2023, with solar PV capacity additions alone reaching record levels, but this also means established players and new entrants are vying for market share. CYPC's success in these new ventures would hinge on its ability to quickly acquire or develop this expertise and secure a competitive edge.

- Market Entry Challenges: Entering nascent or rapidly evolving renewable sectors outside their core competency requires navigating complex regulatory landscapes and establishing new supply chains.

- Competitive Landscape: The solar and wind sectors are already populated by numerous global and domestic players, making it difficult for a new entrant to gain traction without a clear differentiation strategy.

- Capital Intensity: Developing large-scale solar or wind farms demands substantial upfront capital, which could strain financial resources if not managed effectively, impacting overall profitability.

China Yangtze Power's (CYPC) investments in new energy bases, such as integrated 'water-wind-electricity' projects initiated in 2021, and its exploration of overseas renewable energy markets, particularly in Asia and Africa, represent classic Question Mark characteristics. These ventures require substantial capital and are in high-growth sectors, but their market share and profitability are yet to be firmly established. For example, by early 2024, many Southeast Asian nations were significantly increasing their renewable energy targets, creating a dynamic but uncertain environment for new entrants like CYPC.

The company's push into AI-powered grid dispatch systems and industrial Internet platforms, exemplified by their deployment in projects like the HouSihe pumped storage station, also falls into the Question Mark category. While these technologies are crucial for the future of smart grids and offer high growth potential, CYPC's specific market penetration and the ultimate commercial success of these integrated solutions are still developing. In 2024, significant R&D spending was directed towards these advanced energy solutions, highlighting the speculative nature and long-term investment horizon.

CYPC's diversification into non-hydro renewables like solar and wind farms, while targeting a growing market, presents similar Question Mark challenges. These sectors are highly competitive, demanding new expertise and substantial capital, with uncertain returns. The global renewable energy market continued its rapid expansion in 2023, with solar PV alone seeing record capacity additions, underscoring the intense competition CYPC faces in establishing a significant foothold outside its core hydropower business.

These ventures are characterized by high investment needs and uncertain future market shares, demanding careful strategic management to convert potential into established market positions.

BCG Matrix Data Sources

Our China Yangtze Power BCG Matrix is built on a foundation of robust data, integrating financial disclosures, industry growth forecasts, and official company reports to provide a clear strategic view.