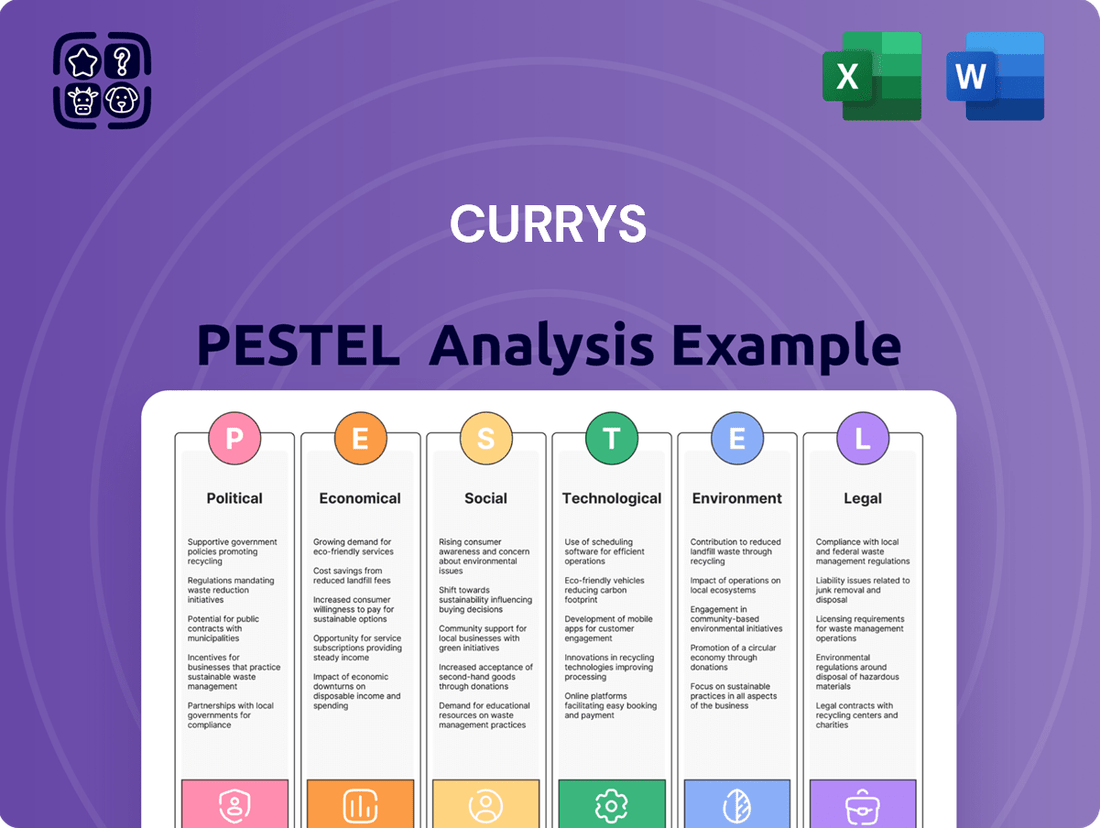

Currys PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Currys Bundle

Currys operates within a dynamic landscape shaped by evolving political regulations, economic fluctuations, and rapid technological advancements. Understanding these external forces is crucial for forecasting their future performance and identifying strategic opportunities. Our comprehensive PESTLE analysis dives deep into these factors, offering actionable intelligence for your business planning. Download the full version now and gain a significant competitive edge.

Political factors

Government regulations surrounding electronic waste (e-waste) directly affect Currys' operations, especially its service division. These policies dictate how the company handles product disposal and recycling, influencing operational costs and compliance requirements.

Currys has voiced apprehension regarding potential shifts in e-waste reforms, suggesting that certain proposals might inadvertently reduce recycling rates and escalate expenses for both consumers and businesses. This highlights the delicate balance between environmental mandates and economic feasibility.

For instance, the UK's Extended Producer Responsibility (EPR) for waste electrical and electronic equipment (WEEE) aims to shift the financial burden of e-waste management onto producers. In 2023, the UK government consulted on changes to WEEE regulations, with potential impacts on collection targets and producer fees that Currys, as a major retailer, must monitor closely.

Effectively adapting to these evolving regulatory landscapes is paramount for Currys’ sustained profitability and its demonstrated commitment to environmental stewardship. The company's ability to navigate these complexities will be a key determinant of its long-term success and reputation.

Government initiatives to combat digital poverty, such as the UK's Digital Inclusion Action Plan, offer Currys a chance to align its business with social good. By participating in these programs, Currys can improve its brand perception and build stronger customer relationships.

Currys' support for these plans, which aim to provide access to technology and digital skills training, directly addresses a growing societal need. This proactive engagement can lead to increased brand loyalty and potentially new customer segments.

Fluctuations in trade policies and geopolitical stability present a significant challenge for Currys. For instance, the ongoing trade tensions between major economies in 2024 could lead to increased tariffs on electronics, directly impacting the cost of goods Currys imports and sells. This instability can disrupt supply chains, affecting product availability and pricing for consumers.

Currys' risk management framework actively incorporates these external political factors. The company understands that changes in international trade agreements or unexpected geopolitical events can significantly influence revenue streams and profit margins. For example, a sudden imposition of import duties in a key market could reduce profitability by several percentage points.

To navigate these complexities, Currys places a strong emphasis on cultivating robust supplier relationships. By fostering strong partnerships, the company aims to build resilience within its supply chain, allowing for greater flexibility in sourcing and mitigating the impact of trade policy shifts or geopolitical disruptions on its operations and market position.

Corporate Governance Standards

Currys, as a publicly listed entity, faces political pressure to uphold stringent corporate governance standards, aligning with expectations such as adherence to the UK Corporate Governance Code. This regulatory environment mandates a commitment to sustainable long-term success and shareholder value creation.

The Board of Directors at Currys is tasked with ensuring robust risk management frameworks and maintaining transparent reporting practices, reflecting a key political consideration for stakeholder confidence and market stability. For instance, in its 2024 reporting, Currys highlighted its ongoing efforts to strengthen board oversight and enhance its ESG (Environmental, Social, and Governance) disclosures.

- UK Corporate Governance Code Compliance: Currys is politically expected to adhere to the principles and provisions of the UK Corporate Governance Code, which guides best practices for board leadership, remuneration, and shareholder relations.

- Board Responsibility for Sustainability: A core political expectation is that the Board actively promotes the company's long-term sustainable success, balancing the interests of various stakeholders.

- Risk Management and Transparency: Political factors necessitate robust risk management systems and transparent financial and operational reporting to maintain investor trust and regulatory compliance.

Taxation and Fiscal Policy

Changes in government budget measures and taxation policies significantly influence Currys' financial performance. For example, new UK fiscal policies introduced in the latter half of the financial year can directly impact the company's reported profit before tax. Currys also actively manages ongoing tax investigations with Her Majesty's Revenue and Customs (HMRC), which are crucial elements for maintaining its financial health.

The company's effective tax rate is a key metric influenced by these political factors. For the fiscal year ending 2024, Currys reported an effective tax rate of 23.7%. Understanding how potential shifts in corporate tax rates or the introduction of new levies could alter this figure is vital for investors and strategists.

- Impact of UK Budget Measures: Recent UK budget announcements can alter corporate tax liabilities, directly affecting Currys' profitability.

- HMRC Tax Enquiries: Ongoing tax investigations by HMRC require careful management and can represent contingent liabilities for the company.

- Effective Tax Rate: Currys' effective tax rate, reported at 23.7% for FY24, is susceptible to changes in fiscal policy.

Government regulations, particularly concerning e-waste and digital inclusion, significantly shape Currys' operational landscape and strategic opportunities. The company must navigate evolving e-waste policies, such as the UK's Extended Producer Responsibility (EPR) for WEEE, which impacts disposal costs and recycling targets. For instance, potential changes to WEEE regulations in 2024 could alter producer fees.

Currys' engagement with government initiatives like the UK's Digital Inclusion Action Plan presents avenues to enhance brand image and customer relationships by addressing societal needs for technology access and digital skills. This alignment with social good is crucial for long-term brand loyalty.

Trade policies and geopolitical stability pose direct challenges, potentially leading to increased tariffs on imported electronics in 2024, affecting product costs and supply chains. Currys actively manages these risks through robust supplier relationships and supply chain resilience.

Adherence to corporate governance standards, such as the UK Corporate Governance Code, is a key political expectation, requiring Currys to maintain transparent reporting and strong board oversight, as demonstrated in its 2024 ESG disclosures.

What is included in the product

This Currys PESTLE analysis examines the impact of political, economic, social, technological, environmental, and legal factors on the company's operations and strategic positioning.

A clean, summarized PESTLE analysis of the Currys business, highlighting key external factors that directly impact their operational challenges and strategic decision-making.

Economic factors

Currys continues to navigate persistent inflationary pressures, which directly affect its operating costs and overall profitability. For instance, in the fiscal year ending April 2024, the company reported a statutory loss before tax of £129 million, partly reflecting these economic headwinds.

Despite these challenges, Currys has shown resilience by leveraging sales growth and improving gross margins, notably within its United Kingdom and Ireland (UK&I) division. This segment has been a strong performer, helping to absorb some of the increased expenses.

Maintaining rigorous cost discipline is paramount for Currys, especially in more demanding markets such as the Nordics. The company's strategic focus remains on efficiently managing expenses to safeguard its financial performance amidst ongoing economic uncertainties.

Consumer spending is a crucial driver for Currys, as demand for technology and electrical goods is heavily tied to the overall economic climate. When consumers feel financially secure, they are more likely to spend on discretionary items like new gadgets and appliances. Conversely, economic downturns or uncertainty can lead to reduced spending in these areas, directly impacting Currys' sales performance.

Currys' business is particularly sensitive to shifts in discretionary spending. Factors like inflation, interest rates, and employment levels play a significant role in how much disposable income households have available for non-essential purchases. For instance, a rise in the cost of living might force consumers to cut back on larger electrical purchases, opting instead for repairs or delaying upgrades.

In response to these economic pressures, Currys has been focusing on strategies to stimulate demand. This includes offering competitive pricing, which is essential in a price-sensitive market, and expanding its range of value-added services. These services, such as installation, extended warranties, and repair services, can provide a compelling reason for consumers to choose Currys even when budgets are tight, helping to maintain customer loyalty and drive sales.

Currency fluctuations can present significant challenges for global retailers like Currys. For instance, in its fiscal year ending March 2024, Currys reported that while its Nordics segment (operating as Elkjøp) achieved strong currency-neutral growth in adjusted EBIT, the company still experienced translational currency headwinds. These headwinds can negatively impact the reported financial results, even when underlying business performance is robust.

The impact of these currency movements is particularly noticeable when translating profits earned in foreign currencies back to the company's reporting currency. While Currys actively manages its foreign exchange risk, the volatility of global currency markets means this remains a constant consideration for its financial strategy and reporting. The company’s ability to navigate these fluctuations is crucial for maintaining stable and predictable financial performance.

Free Cash Flow and Financial Health

Currys has demonstrated a robust improvement in its financial standing, with free cash flow showing significant growth. This enhanced cash generation is a key indicator of the company's improving financial health.

The company's balance sheet is now the strongest it has been in more than ten years. This financial resilience allows Currys to navigate economic uncertainties and invest in future expansion.

The strong cash flow generation enables Currys to consider strategic financial actions, such as resuming dividend payments to its shareholders. This signals confidence in the company's ongoing performance and its ability to reward investors.

- Free Cash Flow Growth: Currys reported a substantial increase in free cash flow, a critical metric for financial stability and investment capacity.

- Strongest Balance Sheet in a Decade: The company's financial position has strengthened considerably, reaching its most robust state in over ten years.

- Resilience and Growth Capacity: Improved financial health provides Currys with the necessary resources to withstand economic downturns and pursue strategic growth initiatives.

- Dividend Resumption Potential: The positive cash flow trend opens the door for the company to reinstate dividend payments, benefiting shareholders.

Interest Rate Environment

Interest rate movements significantly influence Currys' financing costs and overall profitability. For instance, the Bank of England's base rate, which stood at 5.25% as of early 2024, impacts the cost of borrowing for the company.

Currys has historically benefited from a lower interest rate environment, which has supported its free cash flow generation. This is crucial for reinvestment and shareholder returns.

- Financing Costs: Higher interest rates in 2024-2025 could increase the cost of debt for Currys, potentially impacting profit margins.

- Free Cash Flow: A stable or declining interest rate environment supports healthy free cash flow, allowing for greater financial flexibility.

- Working Capital: Effective management of working capital, such as inventory and receivables, helps Currys mitigate the financial impact of fluctuating interest rates.

- Consumer Spending: Changes in interest rates also affect consumer disposable income, influencing demand for big-ticket items sold by Currys.

Currys faces ongoing inflationary pressures, impacting operating costs and profitability, as evidenced by a statutory loss before tax of £129 million in FY24. Despite this, the company's UK&I division shows resilience with sales growth and improved gross margins, helping to offset increased expenses in challenging markets like the Nordics.

Consumer spending directly influences Currys' sales, as demand for electronics is sensitive to economic conditions and discretionary income. Factors like inflation and interest rates affect household budgets, potentially leading consumers to delay purchases of larger items.

Currency fluctuations also pose a challenge, with translational currency headwinds affecting reported results even when underlying performance is strong, as seen in the Nordics segment in FY24.

Currys has significantly strengthened its financial position, reporting its strongest balance sheet in over a decade and substantial free cash flow growth, enabling potential dividend resumption.

Full Version Awaits

Currys PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing a comprehensive PESTLE analysis for the Curry brand.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing deep insights into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Currys.

The content and structure shown in the preview is the same document you’ll download after payment, offering a thorough examination of the external forces shaping Currys' business landscape.

Sociological factors

Consumers now demand a fluid journey between browsing online and purchasing in-store, a shift Currys actively embraces with its omnichannel approach. This strategy ensures customers can engage with Currys' extensive technology offerings and services whether they prefer digital convenience or the tangible experience of a physical shop.

In 2024, the UK retail sector saw online sales continue to grow, with reports indicating a significant portion of consumers now research products online before visiting a physical store. Currys' investment in its digital infrastructure and store integration, such as click-and-collect services, directly addresses this trend, aiming to capture a larger share of this evolving market. For instance, by Q4 2024, Currys reported a substantial increase in online order fulfillment from its stores, demonstrating the success of its omnichannel strategy in meeting customer expectations for flexibility and convenience.

Currys is committed to bridging the digital divide, aiming to eliminate digital poverty by 2030. This aligns with a growing societal expectation for businesses to contribute positively to social issues.

By partnering with groups like the Digital Poverty Alliance, Currys is actively working to ensure more people can access and benefit from technology. This not only strengthens their social impact but also enhances their brand image among consumers who value corporate responsibility.

In the UK, for instance, estimates suggest that millions of households still lack basic digital skills or internet access, highlighting the scale of the problem Currys is addressing. Their efforts, therefore, tap into a significant societal need and a positive area for brand association.

Societal awareness regarding environmental impact is surging, driving consumers to favor products and services that champion sustainability. This growing demand for ethical consumption directly influences purchasing decisions, pushing companies to adopt greener practices.

Currys is actively responding to this trend by integrating circular economy principles into its operations. Their robust repair services, coupled with recycling initiatives such as the 'Cash for Trash' program, directly address consumer desire for reduced waste. Furthermore, offering refurbished technology provides an accessible, eco-friendly alternative to new purchases, aligning with the values of environmentally conscious shoppers.

In 2023, the UK's electricals recycling rate saw a slight increase, indicating a positive shift in consumer behavior. Currys' commitment to these circular models not only meets this evolving demand but also positions them as a responsible retailer in a market increasingly prioritizing environmental stewardship.

Customer Satisfaction and Loyalty

Currys places significant emphasis on customer satisfaction and loyalty to drive its business forward. The company's commitment to improving the customer experience is evident in its rising Net Promoter Scores (NPS), which reflect positive feedback from customers in both the UK & Ireland and Nordic regions. This focus on customer sentiment is crucial for building a strong brand reputation and fostering repeat business.

To achieve high levels of customer satisfaction, Currys actively enhances its customer journey by offering a range of value-added services. These include essential offerings like product installation, repair services, and dedicated technical support, all designed to provide a comprehensive and hassle-free experience for shoppers. By investing in these services, Currys aims to differentiate itself in a competitive market.

Positive customer experiences are directly linked to customer retention and the ability to maintain or grow market share. For instance, Currys reported a significant improvement in its customer satisfaction metrics during its fiscal year 2023/24, with NPS scores showing a notable upward trend across its operating segments. This indicates that their strategic focus on service excellence is resonating with consumers.

- Improved Customer Experience: Currys has seen positive trends in Net Promoter Scores (NPS), indicating enhanced customer satisfaction in the UK&I and Nordics.

- Value-Added Services: The company prioritizes installation, repairs, and technical support to enrich the customer journey and build loyalty.

- Retention and Market Share: Positive customer interactions are key drivers for retaining existing customers and attracting new ones, thereby securing market position.

- Fiscal Year 2023/24 Performance: The company noted a strong uplift in customer satisfaction indicators during this period, underscoring the effectiveness of their customer-centric strategies.

Colleague Engagement and Workplace Culture

Currys recognizes that a highly engaged workforce is fundamental to its success. In 2024, the company reported that its colleague engagement scores placed it within the top 5% globally, a significant achievement reflecting a strong focus on employee well-being and involvement. This commitment translates into tangible business benefits, as engaged employees are more likely to provide superior customer service, directly impacting sales and customer loyalty.

The company actively fosters a positive workplace culture by empowering its employees. Initiatives such as AI-powered idea platforms, implemented in 2023, allow colleagues to contribute directly to operational improvements and innovation. This not only streamlines internal processes but also cultivates a sense of ownership and value among staff, reinforcing a culture where feedback and contributions are encouraged and acted upon.

- Colleague Engagement: Currys achieved top 5% global ranking in colleague engagement scores in 2024.

- Employee Empowerment: AI-driven idea platforms are utilized to gather employee suggestions for operational enhancements.

- Customer Service Impact: Engaged employees are directly linked to delivering excellent customer experiences.

- Performance Driver: High colleague engagement is a key factor in driving overall business performance and efficiency.

Societal trends highlight a growing demand for seamless online-to-offline shopping experiences, which Currys addresses through its omnichannel strategy. This approach caters to diverse consumer preferences, blending digital convenience with the tangible experience of physical stores.

Currys' commitment to bridging the digital divide, aiming to eliminate digital poverty by 2030, aligns with increasing societal expectations for corporate social responsibility. By partnering with organizations like the Digital Poverty Alliance, Currys actively contributes to digital inclusion, enhancing its brand image among ethically conscious consumers.

Consumer awareness around environmental sustainability is rising, pushing companies towards greener practices. Currys' embrace of circular economy principles, including robust repair and recycling services, and offering refurbished technology, directly meets this demand, positioning the company as a responsible retailer.

Technological factors

Currys is actively integrating Artificial Intelligence (AI) to streamline operations and elevate the customer journey. By leveraging AI, the company aims for greater efficiency and more personalized shopping experiences.

Strategic partnerships with tech giants like Microsoft and Accenture are crucial for Currys' AI advancement, particularly in adopting generative AI. This focus is expected to unlock significant cost efficiencies and enable highly targeted product recommendations for shoppers.

Currys is heavily investing in its omnichannel platform, a critical technological factor for its future success. This involves the continuous development of its robust online presence, seamlessly integrated with its extensive network of physical stores.

This integrated approach allows customers to browse online, click-and-collect in-store, or return online purchases to a physical location, enhancing convenience. For instance, in the fiscal year ending April 2024, Currys reported that online sales continued to represent a significant portion of its revenue, underscoring the importance of these digital capabilities.

By enhancing its digital infrastructure and ensuring a consistent brand experience across all touchpoints, Currys aims to solidify its market leadership. This focus on technological advancement is crucial for adapting to evolving consumer shopping habits and maintaining a competitive edge in the retail landscape.

Currys' strategic expansion into the mobile sector through its own Mobile Virtual Network Operator (MVNO), iD Mobile, is a key technological driver. The company has set an ambitious target of reaching at least 2.5 million subscribers for iD Mobile, indicating a strong belief in the growth potential of this recurring revenue stream.

This move into connectivity services leverages technology to diversify Currys' revenue base beyond traditional retail. By offering mobile services, Currys aims to build a more robust customer ecosystem and tap into the consistent income generated by subscription-based models.

Data Analytics and Insights

Currys is significantly investing in data analytics to understand customer preferences and market shifts better. This focus allows them to tailor shopping experiences, manage stock more efficiently, and make smarter business choices. For instance, in the fiscal year ending April 2024, Currys reported a 3% increase in online sales, partly attributed to improved data-driven personalization efforts.

The company leverages advanced analytics to optimize its supply chain and predict demand, aiming to reduce waste and improve product availability. By analyzing vast datasets, Currys can identify emerging trends and adapt its product offerings accordingly, ensuring it remains competitive in the fast-paced retail environment.

Key technological advancements enhancing Currys' data analytics:

- AI-powered recommendation engines: These systems analyze past purchases and browsing behavior to suggest relevant products, boosting conversion rates.

- Predictive analytics for inventory: Forecasting demand helps prevent stockouts and overstocking, optimizing capital tied up in inventory.

- Customer segmentation tools: Identifying distinct customer groups allows for highly targeted marketing campaigns, improving ROI.

- Real-time sales data dashboards: Providing immediate insights into performance enables quick adjustments to pricing, promotions, and stock levels.

Product Innovation and Energy Efficiency

Currys operates in a sector defined by relentless technological advancement, compelling the company to constantly refresh its product lines with the newest innovations in consumer electronics. This rapid innovation cycle is critical for maintaining market relevance and attracting customers eager for cutting-edge technology. For example, the 2024 market for smart home devices, a key category for Currys, is projected to see continued growth, driven by new AI-powered functionalities and increased interoperability between devices.

A significant technological trend influencing Currys is the increasing consumer and regulatory demand for energy efficiency. Retailers like Currys are expected to prioritize and promote products that offer lower energy consumption, directly impacting customers' utility bills and their environmental footprint. In the UK, for instance, government initiatives and energy labelling schemes continue to push manufacturers towards more efficient designs, with new standards often coming into effect annually, impacting product availability and consumer choice in 2024 and beyond.

- Product Lifecycle: The fast pace of tech innovation shortens product lifecycles, requiring Currys to manage inventory and marketing effectively for new releases and older models.

- Energy Efficiency Mandates: Increasingly stringent energy efficiency regulations, such as those for white goods and televisions, influence product sourcing and marketing strategies for Currys in 2024-2025.

- Smart Technology Integration: The growing prevalence of smart features across all electronics categories necessitates Currys’ investment in staff training and in-store demonstrations to educate consumers.

- Online vs. In-Store Tech: Balancing the online availability of the latest tech with the in-store experience for demonstration and immediate purchase presents a key operational challenge for Currys.

Currys is leveraging AI for operational efficiency and personalized customer experiences, with strategic partnerships like the one with Microsoft furthering its generative AI adoption. The company's significant investment in its omnichannel platform, evidenced by online sales remaining a substantial revenue contributor in FY24, is crucial for seamless integration between online and physical stores.

The expansion into mobile services via iD Mobile, targeting 2.5 million subscribers, represents a key technological diversification strategy. Furthermore, advanced data analytics are employed to understand customer behavior and optimize supply chains, contributing to a 3% rise in online sales in FY24 through improved personalization.

Currys must adapt to rapid technological advancements and shorter product lifecycles, particularly in categories like smart home devices where new AI functionalities are driving growth. Additionally, increasing energy efficiency mandates, such as those impacting white goods and televisions in the UK, are shaping product sourcing and marketing strategies for 2024-2025.

Legal factors

Currys operates under stringent consumer protection regulations, which dictate standards for product quality, warranty provisions, and the crucial after-sales support they offer. These laws are designed to safeguard customer rights, ensuring fair practices in the retail environment.

Compliance with regulations concerning installation, repair services, and technical assistance is paramount. For instance, the UK's Consumer Rights Act 2015 mandates that goods must be of satisfactory quality, fit for purpose, and as described, impacting how Currys handles returns and repairs.

Adherence to these consumer protection laws is vital for building customer trust and mitigating potential legal challenges. In 2024, the UK's Competition and Markets Authority (CMA) continued its focus on ensuring fair trading practices across various sectors, including electronics retail, highlighting the ongoing importance of regulatory compliance for companies like Currys.

Currys operates extensive online platforms, necessitating strict adherence to data privacy regulations like the General Data Protection Regulation (GDPR). Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of global annual turnover or €20 million, whichever is greater. This legal framework mandates robust cybersecurity measures and transparent data handling practices, which are critical for maintaining customer trust and avoiding significant financial repercussions.

Currys actively manages its environmental footprint, focusing on e-waste and emissions. The company adheres to stringent environmental legislation, including standards like ISO 50001:2018 for energy management, demonstrating a commitment to operational efficiency and sustainability.

The Energy Savings Opportunity Scheme (ESOS) requires large undertakings like Currys to conduct audits of their energy use. By submitting ESOS reports, Currys provides a clear picture of its energy consumption and identifies potential areas for improvement, aligning with broader UK environmental policy goals.

Compliance with environmental regulations is a core component of Currys' sustainable business strategy. This commitment is crucial for maintaining brand reputation, mitigating operational risks, and ensuring long-term business viability in an increasingly environmentally conscious market.

Employment and Labor Laws

As a significant employer with over 24,000 colleagues globally, Currys is bound by stringent employment and labor laws in each country of operation. These regulations cover crucial aspects such as working conditions, minimum wage requirements, and fundamental employee rights, ensuring fair treatment across its workforce.

Currys actively addresses potential ethical concerns within its operations and supply chains. For instance, its commitment to combating modern slavery is detailed in its public statements, outlining the measures taken to identify and mitigate risks associated with forced labor throughout its business activities.

- Compliance Burden: Adhering to diverse national labor laws, including those in the UK, Ireland, and the Nordic region, requires significant legal and HR resources for Currys.

- Wage Regulations: Keeping pace with evolving minimum wage laws and collective bargaining agreements across different territories is a constant operational challenge.

- Employee Rights: Ensuring compliance with regulations on working hours, leave entitlements, and anti-discrimination policies is paramount for maintaining a stable workforce.

- Supply Chain Scrutiny: The company's modern slavery statement highlights its proactive approach to labor standards, reflecting increasing regulatory and consumer pressure on ethical sourcing.

Corporate Reporting and Transparency Requirements

Currys operates under strict corporate reporting mandates, requiring the regular publication of annual reports and accounts. These must often be submitted in specific electronic formats, such as the European Single Electronic Format (ESEF), to enhance accessibility and comparability. Adherence to UK Listing Rules is also critical, ensuring a baseline of financial transparency for investors and other stakeholders.

These legal frameworks are designed to provide a clear and comprehensive view of Currys' financial health, operational performance, and corporate governance practices. For instance, the detailed disclosures within annual reports allow stakeholders to assess the company's strategic direction and risk management.

- Mandatory Electronic Filing: Currys must comply with ESEF regulations for its financial statements, a requirement that gained prominence in recent years.

- UK Listing Rules Compliance: Adherence to these rules governs how Currys communicates with the market and its shareholders, impacting everything from profit warnings to annual general meetings.

- Stakeholder Information Access: The legal obligation to report ensures that investors, analysts, and the public have access to vital company data, fostering informed decision-making.

- Financial Transparency: These reporting requirements are fundamental to maintaining market confidence and the integrity of financial reporting for a publicly traded entity like Currys.

Currys faces significant legal obligations concerning consumer protection, data privacy, and employment law across its operating regions. For example, in the UK, the Consumer Rights Act 2015 sets clear standards for goods and services, impacting returns and repairs. The General Data Protection Regulation (GDPR) imposes strict rules on handling customer data, with penalties up to 4% of global annual turnover for non-compliance, a crucial consideration for Currys' online operations.

The company must also navigate a complex web of environmental regulations, such as the Energy Savings Opportunity Scheme (ESOS) in the UK, which mandates energy audits for large businesses. Furthermore, as a global employer, Currys is bound by diverse labor laws governing working conditions and employee rights, alongside increasing scrutiny on ethical supply chains, as evidenced by its modern slavery statements.

Corporate reporting mandates, including adherence to UK Listing Rules and the European Single Electronic Format (ESEF) for financial statements, ensure transparency for stakeholders. This legal framework underpins investor confidence and the integrity of financial reporting for publicly traded entities like Currys.

Environmental factors

Currys actively manages e-waste, collecting millions of items annually for reuse and recycling through programs like Cash for Trash, demonstrating a commitment to environmental responsibility. This initiative is a cornerstone of their circular business model, focused on extending product lifecycles and minimizing ecological footprints.

The company's extensive repair facilities play a crucial role in these e-waste management efforts, supporting their strategy to give technology a longer life. In 2023, Currys reported collecting over 1.5 million items for recycling, a substantial increase from previous years, highlighting their growing impact.

Currys has set an ambitious goal to reach net zero emissions by 2040, reflecting a strong commitment to environmental sustainability. This target guides their operational strategies and investments in climate-friendly practices.

The company has made significant strides in reducing its carbon footprint, reporting a substantial decrease in Scope 1, 2, and 3 emissions compared to its established baseline. For instance, by the end of fiscal year 2023, Currys reported a 40% reduction in Scope 1 and 2 emissions against their 2018/19 baseline.

Key initiatives driving this progress include enhancing energy efficiency across their retail stores and distribution centers, increasing their reliance on renewable energy sources, and transitioning their logistics fleet to lower-emission vehicles, such as electric vans.

Currys is actively integrating circular business models into its strategy, aiming to extend the lifespan of electronics. This involves robust repair services, a growing market for refurbished goods, and trade-in programs designed to encourage product reuse. For instance, in the UK, the electrical repair market is projected to grow significantly, with consumers increasingly seeking sustainable options.

Sustainable Sourcing and Supply Chain Responsibility

Currys actively engages with its suppliers to promote responsible sourcing and mitigate environmental risks across its extensive supply chain. This commitment is crucial for reducing the company's overall environmental impact.

The company conducts thorough ethical supply chain due diligence, ensuring that key partners align with its evolving sustainability goals. For instance, in 2023, Currys reported that 90% of its key suppliers had undergone social compliance audits, a significant step towards greater transparency and accountability.

- Supplier Audits: Currys conducted social compliance audits on 90% of its key suppliers in 2023, a testament to its commitment to ethical sourcing.

- Environmental Risk Management: Proactive identification and management of environmental risks are integrated into supplier relationships to minimize the company's ecological footprint.

- Alignment with Strategy: Ensuring key suppliers are aligned with Currys' future sustainability strategies is a core component of their responsible sourcing framework.

- Reduced Footprint: Responsible sourcing practices are fundamental to achieving Currys' overarching goal of minimizing its environmental footprint throughout its operations and value chain.

Energy Consumption and Renewable Energy Adoption

Currys is making significant strides in managing its environmental impact, particularly concerning energy. The company holds ISO 50001:2018 certification, demonstrating a robust framework for energy management across its operations. This commitment is further evidenced by their sourcing of 100% renewable electricity in key markets, a crucial step in decarbonizing their energy supply.

The company is actively exploring on-site solar photovoltaic (PV) installations to further enhance its renewable energy adoption. These initiatives directly support Currys' broader emission reduction targets, aligning their business practices with global sustainability goals. For example, by 2024, Currys aimed to reduce its Scope 1 and 2 emissions by 28% compared to a 2016 baseline.

- ISO 50001:2018 Certified: Formalizes energy management processes.

- 100% Renewable Electricity: Sourced in key operating regions.

- On-site Solar PV Exploration: Investing in renewable generation capacity.

- Emission Reduction Targets: Actively working towards achieving these goals.

Currys is deeply invested in environmental stewardship, evident in its comprehensive e-waste management programs. The company collected over 1.5 million items for recycling in 2023, a significant increase that underscores its commitment to circularity and extending product lifecycles.

The company’s net zero ambition by 2040 guides its operational strategies, with a reported 40% reduction in Scope 1 and 2 emissions by FY2023 against an 18/19 baseline. This progress is driven by energy efficiency, renewable energy adoption, and fleet electrification.

Currys is actively promoting circular business models through robust repair services and a growing market for refurbished electronics, responding to increasing consumer demand for sustainable options in the electrical repair sector.

Responsible sourcing is a key focus, with 90% of key suppliers undergoing social compliance audits in 2023, ensuring alignment with Currys' sustainability goals and minimizing the company's overall environmental footprint.

| Environmental Initiative | 2023 Data/Status | Target/Goal |

|---|---|---|

| E-waste Collected for Recycling | Over 1.5 million items | Continued growth |

| Scope 1 & 2 Emissions Reduction | 40% reduction (vs. 2018/19 baseline) | Net Zero by 2040 |

| Renewable Electricity Sourcing | 100% in key markets | Expansion |

| Key Supplier Social Audits | 90% compliance | Ongoing compliance and improvement |

PESTLE Analysis Data Sources

Our PESTLE analysis for Currys is meticulously constructed using a blend of official government publications, reputable market research firms, and leading economic indicators. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the business.