Currys Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Currys Bundle

Currys faces intense competition, with the threat of new entrants and the bargaining power of buyers significantly shaping its market landscape. Understanding these dynamics is crucial for navigating the electronics retail sector.

The full Porter's Five Forces Analysis reveals the real forces shaping Currys’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Currys faces a concentrated supplier base for consumer electronics and appliances, with major global manufacturers like Apple, Samsung, Sony, and LG dominating the market. This limited number of powerful suppliers can exert significant influence over pricing and product availability for retailers.

The strong brand loyalty consumers have for these manufacturers further amplifies supplier bargaining power. For instance, in 2024, Samsung continued to hold a substantial share of the global smartphone market, approximately 20%, giving them considerable leverage in negotiations with retailers like Currys.

Currys faces significant supplier power due to the strong brand differentiation of many products it sells. For instance, consumers frequently demand specific brands like Apple for smartphones or Samsung for televisions, limiting Currys' flexibility in product selection and pricing. This brand loyalty means suppliers can exert considerable influence over terms and conditions.

The inability for Currys to easily substitute these popular branded items without alienating its customer base further strengthens supplier leverage. While Currys does offer its own brands, such as Logik and Sandstrom, these private labels provide only a partial offset to the power wielded by major electronics manufacturers. In 2024, the continued dominance of a few key tech brands in the consumer electronics market underscores this dynamic.

Currys faces moderate switching costs when changing suppliers, impacting the bargaining power of those suppliers. These costs involve adapting inventory management systems and retraining staff on new product specifications, which can be time-consuming and expensive. For instance, in 2024, significant IT system overhauls for inventory tracking could cost hundreds of thousands of pounds, making a swift supplier change impractical.

Furthermore, the established efficiencies and deep integration within Currys’ current supply chain with major partners create inertia against frequent vendor changes. The company's long-standing relationships have likely led to optimized logistics and favorable payment terms, which would need to be re-negotiated and re-established with new suppliers, adding another layer of complexity and cost.

Forward Integration Threat by Suppliers

The threat of suppliers engaging in forward integration directly impacts Currys' negotiating strength. Major electronics brands like Apple and Samsung increasingly operate their own direct-to-consumer (DTC) sales channels, both online and through physical stores. This allows them to bypass traditional retailers if they find terms unfavorable, potentially reducing Currys' leverage.

This dynamic forces Currys to continually enhance its value proposition beyond just product availability. Offering specialized services, expert advice, and a seamless customer experience becomes crucial for retaining supplier partnerships and customer loyalty. For instance, in 2024, the electronics retail sector saw continued investment in omnichannel strategies to counter the growing influence of DTC models.

- Supplier DTC Channels: Major electronics manufacturers are expanding their direct sales operations, diminishing reliance on traditional retail partners.

- Currys' Response: Retailers like Currys must differentiate through superior customer service and added value to maintain supplier relationships.

- Market Trend: The ongoing growth of e-commerce and brand-owned DTC platforms in 2024 underscores this evolving supplier power.

Importance of Volume to Suppliers

Currys' position as a major omnichannel retailer in the UK and Nordics makes it a highly valuable sales channel for its suppliers. The sheer volume of products Currys purchases gives it considerable leverage, meaning suppliers are keen to maintain a relationship for access to its broad market reach and substantial customer base. This scale allows Currys to negotiate more favorable terms than smaller competitors might achieve.

For instance, in the fiscal year ending April 2024, Currys reported total revenue of approximately £8.5 billion. This significant revenue underscores the substantial purchasing power Currys wields, which directly translates into a stronger bargaining position with its suppliers. Suppliers recognize that being part of Currys' distribution network is crucial for achieving significant sales volumes.

The importance of volume to Currys' suppliers can be seen in how they prioritize partnerships that offer consistent and large-scale orders. This dynamic can lead to:

- Favorable pricing: Suppliers may offer lower unit costs to secure large, ongoing orders from Currys.

- Preferential product allocation: Currys' high order volumes can ensure it receives priority for new product launches or limited stock.

- Extended payment terms: The retailer's financial strength and volume can allow for negotiation of longer payment cycles, improving cash flow.

- Collaborative marketing support: Suppliers may invest in joint marketing initiatives to leverage Currys' customer reach.

The bargaining power of suppliers for Currys is significant, primarily driven by the concentrated nature of the consumer electronics market. Major global brands like Apple and Samsung hold considerable sway due to strong consumer demand and brand loyalty, limiting Currys' flexibility in pricing and product selection.

While Currys' substantial revenue, around £8.5 billion in the fiscal year ending April 2024, grants it significant purchasing power, this is somewhat counterbalanced by suppliers' expanding direct-to-consumer (DTC) channels. This DTC trend, evident in 2024, allows brands to bypass retailers, reducing Currys' leverage and necessitating a focus on service differentiation.

The inability to easily substitute dominant brands without impacting customer loyalty further strengthens supplier power. Although Currys offers private labels, these provide only partial mitigation against the influence of key electronics manufacturers, whose market dominance remained pronounced throughout 2024.

| Factor | Impact on Currys | 2024 Relevance |

|---|---|---|

| Supplier Concentration | High power for dominant brands (Apple, Samsung) | Continued market share dominance by key players |

| Brand Loyalty | Limits product substitution, increases supplier leverage | Strong consumer demand for specific brands |

| Supplier DTC Channels | Reduces retailer reliance, shifts power | Expansion of brand-owned online and physical stores |

| Currys' Revenue Scale | Provides counter-leverage through purchasing volume | £8.5 billion annual revenue (FY ending April 2024) |

What is included in the product

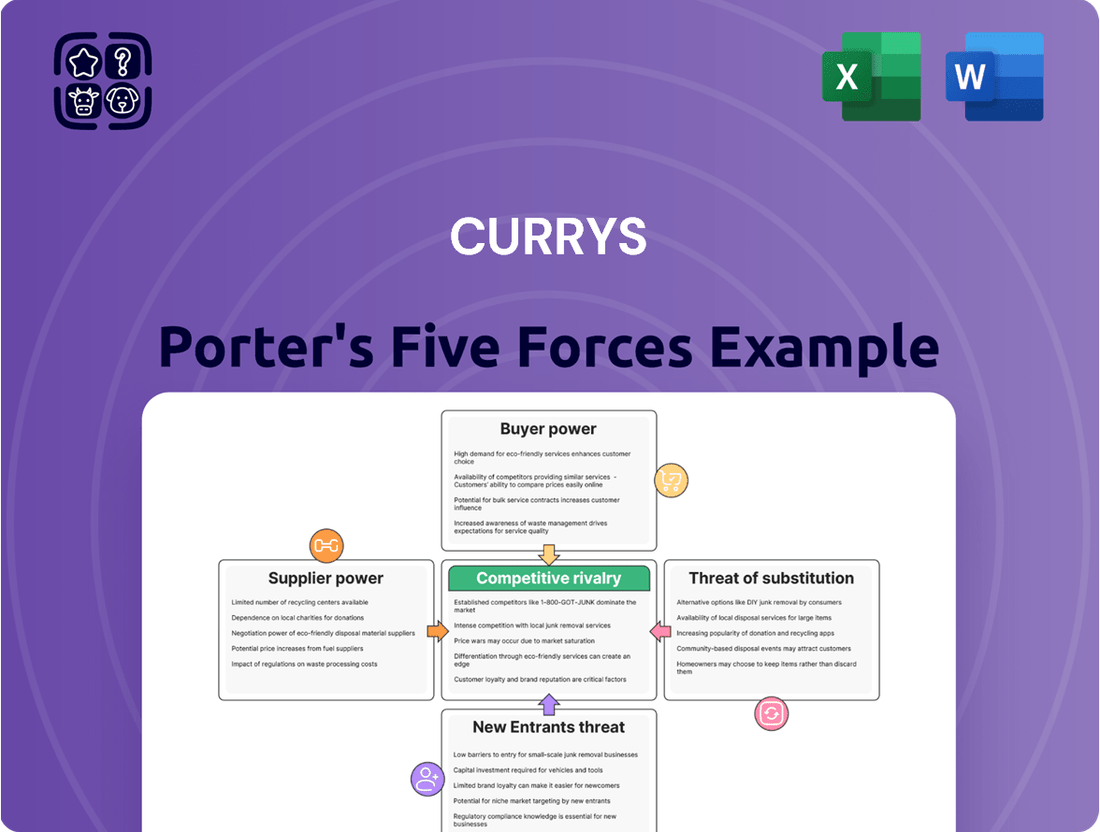

This analysis dissects the competitive forces impacting Currys, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the electronics retail sector.

Effortlessly assess competitive intensity and identify strategic vulnerabilities with a visual, easy-to-understand Porter's Five Forces analysis.

Customers Bargaining Power

Customers in the consumer electronics sector exhibit significant price sensitivity. This is amplified by the ease with which they can compare prices across numerous retailers online. For instance, in 2024, a significant portion of consumer electronics purchases were influenced by price comparisons, with over 70% of shoppers reportedly checking prices on at least three different websites before buying.

The proliferation of price comparison websites and readily available product information online significantly bolsters customer bargaining power. This transparency means customers can easily identify the lowest prices available, compelling retailers like Currys to adopt more competitive pricing strategies to remain attractive in the market.

Customers can easily switch between retailers for most consumer electronics, meaning Currys faces low switching costs. For instance, a customer looking for a new television can readily compare prices and features across Currys, Amazon, Argos, and other high-street or online stores without significant effort or expense. This ease of comparison directly impacts customer loyalty and bargaining power.

The ability to switch retailers effortlessly means customers will gravitate towards the best deals, convenience, or service. In 2023, the UK online retail market saw significant growth, with consumers increasingly accustomed to price-checking and switching between platforms. This trend amplifies the bargaining power of customers, as they are not locked into any single retailer.

The sheer volume of brands and product varieties available in the electronics and home appliance market significantly bolsters customer bargaining power. If Currys' selection or pricing isn't satisfactory, consumers can readily turn to a multitude of other retailers, both online and brick-and-mortar, or even explore direct-to-consumer brands.

This abundance extends beyond new products; the growing market for refurbished and second-hand electronics provides even more cost-effective alternatives, further intensifying pressure on Currys to remain competitive and meet customer expectations. For instance, the UK's refurbished electronics market saw substantial growth in 2023, with many consumers actively seeking out these more affordable options.

Omnichannel Expectations and Service Demands

Customers increasingly expect a seamless omnichannel experience, blending online ease with in-store engagement and support. Currys' extensive after-sales services, such as installation, repairs, and technical assistance, are designed to satisfy these expectations. However, if these services are not seen as valuable or are easily accessible from competitors, customers retain significant bargaining power.

In 2024, the retail sector saw a continued surge in omnichannel adoption. For instance, a significant portion of consumers, estimated to be over 60% according to recent retail analytics, now research products online before purchasing in-store or vice-versa. This behavior directly amplifies customer bargaining power as they can easily compare prices and service offerings across different retailers. Currys' ability to differentiate its after-sales support, which is a key component of its value proposition, becomes critical in mitigating this power.

The bargaining power of customers is further influenced by the perceived value of ancillary services. For Currys, services like:

- Product installation and setup

- Extended warranties and repair services

- Technical support and troubleshooting

If these services are not perceived as superior or are readily available from other electronics retailers or independent providers, customers can easily switch, thereby increasing their leverage. For example, if a competitor offers a similar repair service at a lower cost or with faster turnaround times, customers are likely to shift their loyalty.

Influence of Online Reviews and Social Media

Customer reviews and social media have become powerful tools that significantly influence purchasing decisions. Negative feedback shared online can rapidly damage a retailer's reputation and, consequently, its sales figures. This collective customer voice grants buyers substantial power to shape Currys' operational practices and customer service expectations.

The rise of platforms like Trustpilot and social media channels means that a single negative experience can be amplified, directly impacting potential customers. For instance, as of early 2024, many electronics retailers, including those similar to Currys, face scrutiny on review sites where average ratings can fluctuate based on recent customer feedback, directly affecting consumer trust.

- Customer Empowerment: Online reviews and social media give customers a collective voice, increasing their bargaining power against retailers like Currys.

- Reputational Risk: Negative feedback can quickly erode brand image and deter new customers, forcing companies to prioritize customer satisfaction.

- Engagement Strategy: Currys' efforts to engage younger audiences on social media highlight the acknowledgment of this shift in customer influence.

Customers possess significant bargaining power due to the high price sensitivity in the consumer electronics market. With numerous online retailers and comparison sites, consumers can easily find the best deals, forcing retailers like Currys to maintain competitive pricing. For example, in 2024, over 70% of electronics shoppers checked prices across multiple websites before purchasing.

The ease of switching between retailers for electronics, with low switching costs, further empowers customers. If Currys' offerings aren't satisfactory, consumers can readily turn to competitors, both online and physical stores, or even direct-to-consumer brands. The growing market for refurbished electronics in 2023 also provides cost-effective alternatives, intensifying pressure on retailers.

Customer reviews and social media significantly amplify their bargaining power. Negative feedback shared online can quickly damage a retailer's reputation, compelling companies to prioritize customer satisfaction. By early 2024, many electronics retailers faced scrutiny on review sites, directly impacting consumer trust and influencing purchasing decisions.

Full Version Awaits

Currys Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for the Currys business, offering an in-depth examination of competitive rivalry, buyer power, supplier power, threat of new entrants, and threat of substitutes. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises and full immediate access to valuable strategic insights.

Rivalry Among Competitors

The UK consumer electronics retail sector is a crowded space, with a diverse array of competitors vying for market share. This includes large, established omnichannel retailers, agile online-only businesses, and niche specialty stores, all contributing to a highly fragmented market.

Currys contends with significant rivalry from dominant players such as Amazon, Argos, and AO.com, who leverage extensive online platforms and logistics networks. Furthermore, direct competition from brand-specific retailers, like Apple stores, directly targets consumer loyalty and product preference.

Price is a constant battleground in the retail electronics sector, forcing companies like Currys to frequently offer promotions and engage in price matching to win over consumers. This intense pricing pressure directly impacts profitability, squeezing margins for all involved.

In 2024, the UK electricals market saw significant promotional activity. For instance, during key sales periods like Black Friday, average discounts across major retailers, including Currys, often reached 20-30% on popular product categories, further intensifying the price competition.

Competitive rivalry at Currys is intense, extending well beyond just price. The strength of a company's omnichannel approach, seamlessly blending physical stores with online capabilities, is a key differentiator. Currys leverages its significant footprint of physical stores alongside its robust online presence to offer a comprehensive customer experience.

Currys' strategy focuses on differentiating itself through a complete service offering. This includes not only the sale of products but also crucial after-sales support such as installation, repairs, and technical assistance. This comprehensive approach aims to build strong customer loyalty in a competitive market.

For the fiscal year ending March 2024, Currys reported a revenue of £7.9 billion, highlighting the scale of its operations amidst fierce competition. Their omnichannel strategy is designed to capture market share by offering convenience and reliable support across all customer touchpoints.

Technological Advancements and Product Innovation

The consumer electronics sector, a core market for Currys, is defined by its relentless technological evolution. Retailers must continuously refresh their product lines to incorporate the latest innovations, from evolving smartphone capabilities to the burgeoning smart home market. This dynamic environment necessitates substantial capital outlay for inventory management and staff upskilling to effectively market and support these new technologies.

Currys, like its competitors, faces intense pressure to adapt. For instance, the rapid adoption of AI-powered devices and the expansion of the Internet of Things (IoT) require retailers to not only stock these items but also to understand and communicate their benefits to consumers. Staying ahead means significant investment in supply chain agility and employee training, as demonstrated by the ongoing need to educate sales staff on complex smart home ecosystems and the latest advancements in wearable technology.

The competitive landscape is further intensified by the constant introduction of new product categories. This rapid innovation cycle means retailers must be adept at forecasting demand for emerging technologies and managing the lifecycle of existing products. For example, the shift towards more sustainable and energy-efficient appliances, driven by both consumer preference and regulatory changes, adds another layer of complexity to inventory and product development strategies for companies like Currys.

- Rapid Product Obsolescence: The fast pace of technological change means products can become outdated quickly, requiring retailers to manage inventory risk effectively.

- Investment in New Technologies: Significant capital is needed to invest in stocking and promoting emerging tech categories like AI-driven assistants and advanced home automation.

- Staff Training and Expertise: Employees require ongoing training to understand and effectively sell complex new products, such as the latest smart home integrated systems.

- Evolving Consumer Demands: Retailers must anticipate and respond to shifts in consumer preferences, such as the growing demand for personalized tech experiences and connected devices.

International and Online Retailer Threat

The competitive landscape for Currys is significantly shaped by the escalating threat from international and online-only retailers. These players, unburdened by extensive physical store networks, often leverage lower operational costs to offer more aggressive pricing. For instance, global e-commerce giants like Amazon continue to expand their electronics and appliance offerings, directly challenging Currys’ market share.

Currys needs to emphasize its unique selling propositions, such as in-store expertise, immediate product availability, and installation services, to counter the price-driven advantage of online competitors. In 2024, the online retail sector continued its robust growth, with global e-commerce sales projected to reach trillions of dollars, underscoring the persistent pressure from digital-first businesses.

- Price Competition: Online retailers often operate with lower overheads, enabling them to undercut traditional brick-and-mortar stores on price, a key factor for consumers in the electronics market.

- Global Reach: International online retailers can serve a wider customer base without the need for a physical presence in every market, increasing competitive intensity.

- Direct-to-Consumer (DTC) Models: Manufacturers increasingly adopting DTC strategies bypass traditional retailers like Currys, capturing more of the value chain and offering direct sales to consumers.

- Currys' Value Proposition: To remain competitive, Currys must highlight its strengths in customer service, expert advice, installation, and the tangible experience of its physical stores, differentiating itself from purely online offerings.

Competitive rivalry within the UK consumer electronics sector is exceptionally fierce, driven by a diverse mix of large omnichannel retailers, agile online-only players, and specialized niche stores. Currys faces direct competition from giants like Amazon and AO.com, who benefit from extensive online platforms and efficient logistics. Brand-specific retailers, such as Apple stores, also exert significant pressure by cultivating direct customer loyalty.

Price remains a critical battleground, compelling retailers like Currys to engage in frequent promotions and price matching, which directly impacts profit margins. In 2024, major sales events like Black Friday saw average discounts of 20-30% across popular electronics categories, intensifying this price war.

Beyond price, differentiation hinges on a robust omnichannel strategy, blending physical store experiences with seamless online capabilities. Currys leverages its store network and online presence to offer a comprehensive customer journey, further enhanced by value-added services like installation and repairs. For the fiscal year ending March 2024, Currys reported £7.9 billion in revenue, underscoring the scale of its operations amidst this intense competitive environment.

SSubstitutes Threaten

The refurbished and second-hand market presents a significant threat to Currys. As of early 2024, the global refurbished electronics market is projected to reach over $100 billion, driven by consumers seeking value and environmental benefits. This trend means customers may bypass new purchases at Currys for more budget-friendly, pre-owned alternatives that still meet their needs.

The rise of multi-functional devices presents a significant threat of substitutes for traditional electronics sold at Currys. Smartphones, for instance, are increasingly capable of replacing dedicated devices like digital cameras and portable music players. In 2023, smartphone penetration in the UK was over 80%, meaning a vast majority of potential customers already possess devices that can perform many functions previously requiring separate purchases.

The rise of DIY repairs and the growing emphasis on extending product lifespans present a significant substitute threat to Currys. With readily available online tutorials and affordable replacement parts, consumers are more empowered than ever to fix their own electronics, bypassing the need for new purchases. This trend directly impacts Currys' new product sales by reducing the frequency of upgrades.

For instance, a 2024 report indicated that over 60% of consumers would consider a repair before replacing an electronic device, a notable increase from previous years. This shift means fewer customers are walking through Currys' doors for the latest gadgets, opting instead to keep their current ones functional for longer.

However, Currys is not without its own defense against this threat. By offering in-house repair services, the company can capture a portion of this market, turning a potential substitute into a revenue stream. This strategy allows Currys to maintain customer relationships and generate income from product maintenance rather than just new sales.

Rental and Subscription Models

Emerging rental and subscription models for electronics, such as mobile phones, gaming consoles, and large appliances, pose a threat to Currys' traditional sales model. These alternatives offer consumers flexibility and access to the latest technology without the commitment of outright ownership.

If these rental or subscription services become more prevalent, they could significantly diminish the demand for new product purchases from retailers like Currys. For instance, the UK's consumer electronics rental market has seen steady growth, with many consumers appreciating the lower upfront costs and upgrade options.

- Growing popularity of "as-a-service" models across various consumer sectors.

- Potential for reduced long-term demand for outright electronics purchases.

- Impact on Currys' revenue streams if a substantial portion of the market shifts to rentals.

Shift in Consumer Priorities and Discretionary Spending

During periods of economic strain, such as the high inflation experienced in 2023 and continuing into 2024, consumers often re-evaluate their spending. Discretionary purchases, like new electronics, become secondary to essential needs. This shift directly impacts retailers like Currys, as people may choose to hold onto existing devices longer or opt for more budget-friendly alternatives.

For instance, a significant portion of consumers might delay upgrading their smartphones or home appliances if they perceive current economic uncertainty. This behavioral change means that the threat of substitutes, in this case, the continued use of older products or foregoing a purchase altogether, becomes more pronounced. Data from early 2024 suggests that consumer confidence remains somewhat fragile, reinforcing this trend.

- Reduced Discretionary Spending: Economic pressures in 2023-2024 led many households to cut back on non-essential electronics.

- Extended Product Lifecycles: Consumers are increasingly opting to repair or continue using older electronic devices rather than purchasing new ones.

- Substitution with Alternatives: Lower-cost brands or refurbished products can also serve as substitutes for premium electronics, especially when budgets are tight.

- Impact on Sales: This trend directly affects sales volumes for retailers like Currys, as demand for new, higher-margin products may soften.

The threat of substitutes for Currys is multifaceted, encompassing refurbished goods, multi-functional devices, DIY repairs, and rental models. Economic pressures in 2023-2024 amplified these threats as consumers prioritized value and extended product lifecycles, impacting discretionary spending on new electronics.

The refurbished market is a significant substitute, with the global sector projected to exceed $100 billion by early 2024. Simultaneously, smartphones now replace many single-function devices, with over 80% UK penetration in 2023. Furthermore, a 2024 report indicated over 60% of consumers would consider repairs before replacement, highlighting a shift away from new purchases.

| Substitute Category | Key Driver | Impact on Currys |

|---|---|---|

| Refurbished/Second-hand Market | Value and environmental consciousness | Direct competition for new product sales |

| Multi-functional Devices (e.g., Smartphones) | Convenience and consolidation | Reduces demand for dedicated electronics |

| DIY Repairs & Extended Lifecycles | Cost savings and sustainability | Decreases upgrade frequency |

| Rental/Subscription Models | Flexibility and lower upfront cost | Potential shift from ownership to access |

Entrants Threaten

Establishing a physical retail presence akin to Currys' extensive network demands significant capital. This includes substantial outlays for prime real estate, vast inventory management, and the underlying infrastructure to support operations. For instance, acquiring or leasing large format retail spaces in desirable locations, as Currys often does, can easily run into millions of pounds per store.

This considerable financial commitment acts as a potent deterrent for many aspiring competitors, especially those looking to replicate Currys' integrated omnichannel strategy. New entrants without deep pockets find it exceptionally challenging to compete on a scale that offers the same accessibility and customer experience as an established player with a widespread physical footprint.

Currys has cultivated significant brand recognition and customer loyalty over its long history in the UK and Ireland. This established presence means new competitors must invest heavily in marketing to even begin matching Currys' brand awareness and the trust consumers place in it.

Currys leverages significant economies of scale, particularly in purchasing and logistics. Its sheer size allows for bulk discounts from global suppliers, a benefit new entrants would find hard to match. For instance, in the UK, Currys' extensive store network and online presence enable highly efficient distribution, a costly infrastructure for newcomers to replicate.

New entrants face a substantial hurdle in building comparable supply chain relationships. Currys' long-standing partnerships provide preferential terms and reliable stock availability, which are crucial for competitive pricing and customer satisfaction. Without this established network, new businesses would likely face higher procurement costs and potential stock shortages, hindering their ability to compete effectively on price or product availability.

Regulatory and Compliance Hurdles

Regulatory and compliance hurdles represent a significant barrier to entry for new players in the consumer electronics retail space. Companies must adhere to a complex web of rules covering product safety, consumer credit practices, and environmental standards, such as those related to electronic waste disposal. For instance, in the UK, the WEEE (Waste Electrical and Electronic Equipment) regulations place obligations on producers and retailers to manage the collection and recycling of old electrical goods. Navigating these requirements demands substantial investment in compliance systems and expertise, thereby increasing the initial cost and operational complexity for potential entrants.

The financial implications of these regulations are considerable. New entrants must factor in the costs associated with obtaining necessary certifications, implementing robust safety protocols, and establishing compliant waste management processes. For example, compliance with GDPR (General Data Protection Regulation) in Europe, which affects how customer data is handled, adds another layer of operational and financial consideration. Failure to comply can result in hefty fines, as seen in various sectors where non-compliance has led to significant penalties, deterring smaller or less capitalized businesses from entering the market.

- Product Safety Standards: New entrants must ensure all products meet stringent safety certifications, adding to upfront product sourcing and testing costs.

- Consumer Credit Regulations: If offering financing, compliance with consumer credit laws, such as the Consumer Credit Act in the UK, is mandatory and requires specific licensing and operational frameworks.

- Environmental Compliance (E-waste): Adhering to e-waste directives, like the EU's WEEE Directive, necessitates investment in collection, recycling infrastructure, or producer responsibility schemes.

- Data Protection Laws: Compliance with data privacy regulations like GDPR impacts how customer information is collected, stored, and used, requiring investment in secure IT systems and compliance training.

Expertise in After-Sales Services and Omnichannel Operations

Currys' established expertise in after-sales services, including installation, repairs, and technical support, presents a substantial barrier for potential new entrants. This integrated offering creates a complex operational model that requires significant investment and logistical capability to replicate.

New competitors would need to build comparable service infrastructure or forge strategic partnerships, a process that can be both time-consuming and capital-intensive. For instance, in 2024, the ongoing demand for reliable appliance repair and smart home setup services highlights the value customers place on these offerings, making it difficult for new players to gain traction without similar capabilities.

- High Capital Investment: Replicating Currys' extensive service network requires substantial upfront investment in logistics, trained technicians, and parts inventory.

- Operational Complexity: Managing a seamless omnichannel experience that integrates sales with comprehensive after-sales support is operationally challenging.

- Customer Trust and Loyalty: Currys has cultivated customer trust through years of reliable service, a factor that is difficult for new entrants to quickly establish.

The threat of new entrants for Currys is moderate. While the brand has strong recognition and economies of scale, the high capital investment required for physical retail, coupled with regulatory hurdles and the need for established supply chains, deters many potential newcomers. However, the growing online retail space offers lower entry barriers for digitally native competitors.

Porter's Five Forces Analysis Data Sources

Our Currys Porter's Five Forces analysis is built upon a robust foundation of data, drawing from Currys' annual reports, investor presentations, and competitor financial statements. We also incorporate insights from reputable industry analysis firms and market research reports to provide a comprehensive view of the competitive landscape.